Finance

What Does ODFI Mean In Banking

Modified: March 1, 2024

Discover the meaning of ODFI in banking and its significance in the world of finance. Explore the role and impact of ODFI in the financial industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of banking and financial transactions, there are numerous acronyms and terms that can leave people feeling confused and overwhelmed. One such term is ODFI, which stands for Originating Depository Financial Institution. Understanding the role and significance of an ODFI is essential for anyone involved in the banking industry or conducting electronic transactions.

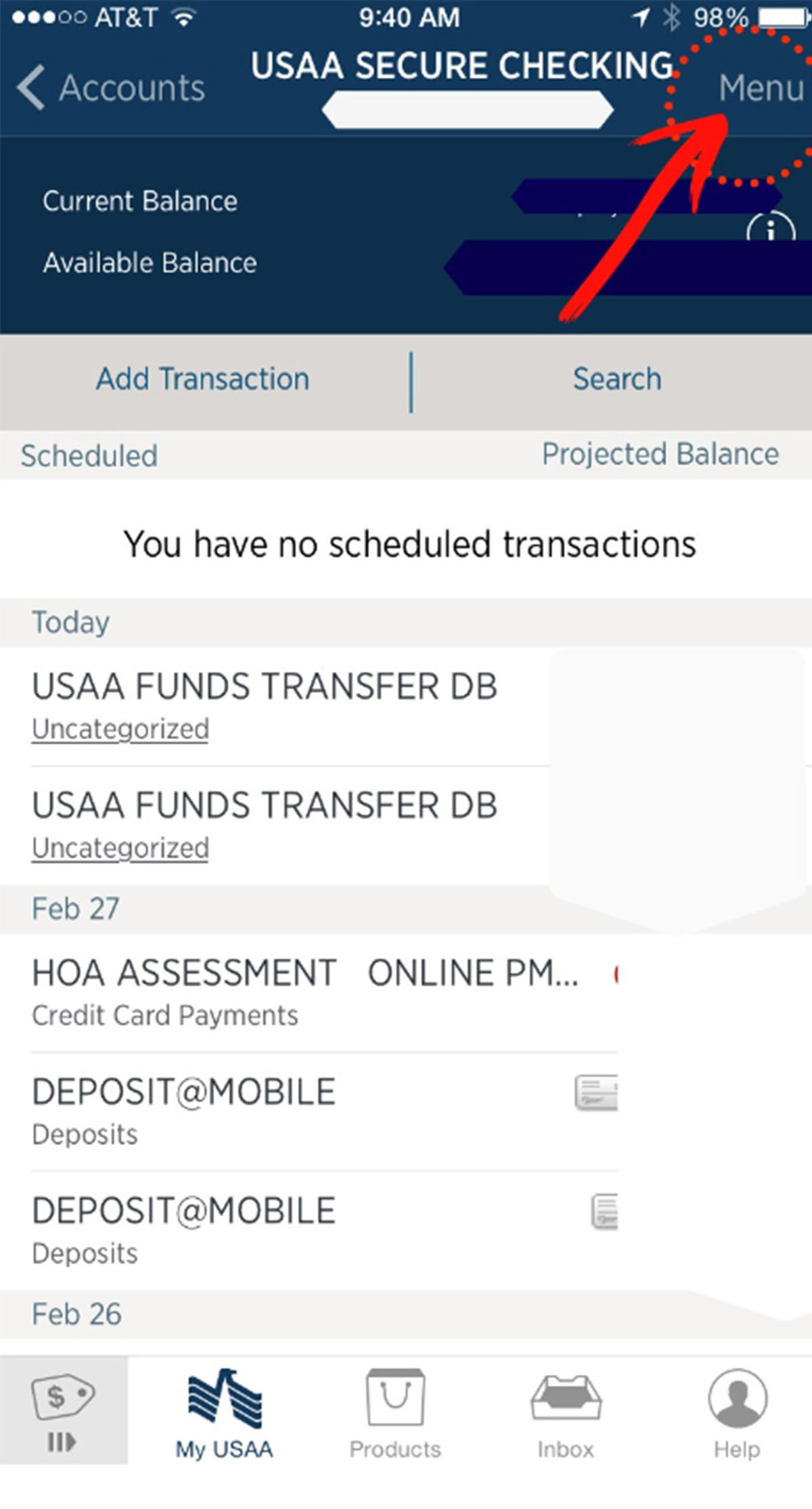

In simple terms, an ODFI can be described as the financial institution that initiates and sends Automated Clearing House (ACH) transactions. These transactions involve the movement of funds electronically between banks, allowing for quick and efficient transfers.

The ODFI plays a crucial role in the ACH network, serving as the link between the originator, the receiver, and the ACH operator. This article will delve deeper into the responsibilities of an ODFI, its relationship with other parties, and the compliance and regulatory requirements it must adhere to.

So, if you’ve ever wondered what exactly an ODFI is and how it fits into the world of banking, read on to gain a comprehensive understanding of this important component of the financial industry.

Definition of ODFI

An Originating Depository Financial Institution (ODFI) is a term used in the banking industry to refer to the financial institution that initiates and sends Automated Clearing House (ACH) transactions. ACH transactions are electronic transfers of funds between banks, allowing for secure and efficient movement of money.

The ODFI typically acts as the sender or originator of the transaction, initiating the transfer of funds from a customer’s account to the recipient’s account. It can be a bank, credit union, or any other financial institution that is eligible to participate in the ACH network.

ODFIs play a critical role in the ACH system by facilitating the movement of funds between parties. They are responsible for collecting the necessary payment information from the originators, verifying the authenticity and accuracy of the transactions, and initiating the transfer of funds through the ACH network.

One important aspect to note is that an ODFI can also serve as an RDFI (Receiving Depository Financial Institution) in other transactions. This means that they can receive ACH transactions initiated by other ODFIs for their own customers.

In summary, an ODFI is a financial institution that acts as the originator and sender of ACH transactions. They play a crucial role in facilitating the electronic movement of funds, providing a secure and efficient means of transferring money between accounts.

Role of ODFI in Banking

The Originating Depository Financial Institution (ODFI) plays a vital role in the banking industry, especially in the realm of electronic transactions. Being responsible for initiating and sending Automated Clearing House (ACH) transactions, the ODFI facilitates the movement of funds between different financial institutions.

One of the primary roles of an ODFI is to act as the bridge between the originator of the transaction, the receiver, and the ACH operator. They collect the necessary payment information from the originator, verify its accuracy, and initiate the ACH transfer on behalf of the originator.

ODFIs enable individuals, businesses, and other organizations to conveniently and securely transfer funds electronically. This eliminates the need for time-consuming and costly paper-based transactions, providing a more efficient payment mechanism.

By utilizing the services of an ODFI, banks can offer their customers a wide range of electronic payment options. This includes direct deposits, bill payments, business-to-business payments, vendor payments, and more.

Furthermore, ODFIs play a critical role in supporting businesses and streamlining their operations. They enable companies to automate their payment processes, ensuring timely and accurate transactions. This can lead to improved cash flow management and enhanced efficiency for businesses of all sizes.

In addition to facilitating transactions, ODFIs also provide value-added services to their customers. These may include fraud prevention measures, risk management solutions, and reporting capabilities to monitor and track payments.

Overall, the role of the ODFI in banking is crucial for promoting the growth of electronic transactions and facilitating the secure movement of funds. By providing reliable and efficient ACH services, ODFIs contribute to the development of a modern and interconnected financial ecosystem.

Responsibilities of an ODFI

The Originating Depository Financial Institution (ODFI) has a range of responsibilities when it comes to facilitating Automated Clearing House (ACH) transactions and ensuring the smooth flow of funds between financial institutions.

Here are the key responsibilities of an ODFI:

- Originator Verification: The ODFI is responsible for verifying the authenticity and accuracy of the payment information provided by the originator. This includes confirming the account details, ensuring the availability of funds, and performing necessary fraud prevention checks.

- Transaction Authorization: Before initiating the ACH transfer, the ODFI must obtain proper authorization from the originator. This authorization can be in the form of a signed agreement, an electronic consent, or any other legally accepted form of permission.

- Funds Transfer: Once the payment information has been verified and the transaction is authorized, the ODFI initiates the ACH transfer. They are responsible for securely transmitting the funds from the originator’s account to the receiver’s account through the ACH network.

- Compliance with ACH Rules: ODFIs must adhere to the rules and regulations set by National Automated Clearing House Association (NACHA) to ensure compliance with industry standards. This includes following ACH operating rules, transaction formatting guidelines, and maintaining the necessary security protocols.

- Transaction Reporting: ODFIs are responsible for providing transaction reports to the originators, detailing the details of each ACH transaction. These reports may include information such as transaction status, date and time, transaction code, and amount transferred.

- Credit and Debit Management: ODFIs must accurately credit the receiver’s account when funds are received through the ACH network. Likewise, they are responsible for debiting the originator’s account when initiating ACH transactions.

- Customer Support: ODFIs are the primary point of contact for their customers in relation to ACH transactions. They must provide efficient and reliable customer support, addressing any inquiries or issues raised by originators or receivers.

- Regulatory Compliance: ODFIs must comply with all federal and state regulations governing electronic transactions and money transfers. This includes abiding by anti-money laundering (AML) laws, data privacy regulations, and other relevant financial regulations.

By fulfilling these responsibilities, ODFIs play a critical role in ensuring the secure and efficient movement of funds, allowing for seamless electronic transactions between financial institutions.

ODFI’s Relationship with Other Parties

As the facilitator of ACH transactions, an Originating Depository Financial Institution (ODFI) has important relationships with various parties involved in the payment process. These relationships are crucial for the smooth movement of funds and the successful completion of transactions.

Here are the key relationships that an ODFI has:

- Originators: The ODFI works closely with originators, who are the individuals or businesses initiating the ACH transactions. They collect payment information, verify its accuracy, and obtain the necessary authorization to initiate the transfer. The ODFI acts as a trusted partner for originators, ensuring their transactions are processed securely and efficiently.

- Receiving Depository Financial Institution (RDFI): In certain transactions, an ODFI may also act as an RDFI. In this case, they receive ACH transactions initiated by other ODFIs on behalf of their customers. The ODFI acts as the recipient’s bank, ensuring the proper crediting of funds and facilitating the receipt of electronic payments.

- Automated Clearing House Operator: The ODFI maintains a relationship with the ACH operator, which is responsible for overseeing and managing the ACH network. They collaborate with the operator to initiate and transmit ACH transactions, ensuring compliance with operating rules and guidelines. The ODFI relies on the ACH operator’s infrastructure to securely move funds between financial institutions.

- Receiving Customers: The ODFI’s relationship with receiving customers is indirect but still significant. The successful completion of ACH transactions relies on the ODFI’s ability to accurately transfer funds to the receiving customers’ accounts. The ODFI ensures that funds are directed to the appropriate accounts, allowing receiving customers to access their funds in a timely manner.

- Regulatory Agencies: ODFIs interact with regulatory agencies, such as the National Automated Clearing House Association (NACHA), to ensure compliance with industry regulations and guidelines. They stay up-to-date with any changes in rules or standards set by the regulatory bodies, following best practices to maintain a secure and compliant ACH operation.

- Other Financial Institutions: ODFIs maintain connections with other financial institutions within the ACH network. They engage in inter-bank partnerships to facilitate the electronic movement of funds, collaborating on initiatives to improve ACH processing and enhance the overall efficiency of the payment system.

These relationships are built on trust, collaboration, and a commitment to providing secure and reliable ACH services. By cultivating these relationships, the ODFI ensures the seamless transfer of funds while fostering a strong and interconnected financial ecosystem.

ODFI Responsibilities in ACH Transactions

As the Originating Depository Financial Institution (ODFI) plays a critical role in facilitating Automated Clearing House (ACH) transactions, they have specific responsibilities at each stage of the process. These responsibilities ensure the secure and efficient movement of funds between financial institutions.

Here are the key ODFI responsibilities in ACH transactions:

- Collecting and Verifying Payment Information: The ODFI is responsible for collecting the necessary payment information from the originator. This includes details such as the receiver’s bank account number, routing number, transaction amount, and transaction type. The ODFI must verify the accuracy of this information to ensure a successful transaction.

- Authorization and Consent: Before initiating an ACH transaction, the ODFI must obtain proper authorization and consent from the originator. This can be in the form of a signed agreement, electronic consent, or any other legally accepted means. The ODFI ensures that the originator has given permission for the transaction to take place.

- Transaction Formatting: The ODFI is responsible for formatting the transaction according to the rules and guidelines set by the National Automated Clearing House Association (NACHA). This involves using the appropriate transaction codes, adding relevant payment information, and adhering to formatting standards for the ACH network.

- Initiating the ACH Transfer: Once the payment information is verified and the transaction is properly formatted, the ODFI initiates the ACH transfer. They securely transmit the payment information to the ACH operator, who facilitates the movement of funds between financial institutions.

- Payment Settlement: The ODFI ensures that funds are debited from the originator’s account on the agreed-upon date and time. They must accurately calculate the transaction amount and correctly debit the funds to complete the payment settlement process.

- Transaction Monitoring and Reporting: ODFIs monitor the status of ACH transactions to ensure their successful completion. They track the progress of each transaction and provide reports to the originators, detailing the status, date, and amount of the transaction. This enables originators to maintain accurate records and reconcile their accounts.

- Funds Availability: The ODFI is responsible for crediting the receiving financial institution’s account with the transferred funds. They ensure that the funds are made available to the receiver on the agreed-upon date, enabling them to access the funds promptly.

- Dispute Resolution and Customer Support: ODFIs handle customer inquiries, disputes, and issues related to ACH transactions. They provide customer support, offer assistance in resolving any transaction-related problems, and ensure proper communication between all parties involved.

By fulfilling these responsibilities, the ODFI ensures the smooth and secure movement of funds through the ACH network, contributing to the overall efficiency of electronic transactions.

ODFI Compliance and Regulatory Requirements

As an Originating Depository Financial Institution (ODFI), adherence to compliance and regulatory requirements is of utmost importance to maintain the integrity of the ACH system and ensure the secure and efficient movement of funds. ODFIs are subject to various rules and regulations set by regulatory bodies within the financial industry.

Here are the key compliance and regulatory requirements that ODFIs must adhere to:

- NACHA Operating Rules: ODFIs must comply with the operating rules set by the National Automated Clearing House Association (NACHA). These rules define the standards and guidelines for ACH transactions, covering areas such as transaction formatting, settlement timelines, consumer protection, and network security.

- Anti-Money Laundering (AML) Regulations: ODFIs are obligated to comply with applicable anti-money laundering regulations to prevent financial crimes. They must implement robust AML policies and procedures, perform due diligence on originators, and report any suspicious activities to the appropriate authorities.

- Data Privacy Regulations: ODFIs must ensure compliance with data privacy regulations, such as the General Data Protection Regulation (GDPR) in the European Union or the California Consumer Privacy Act (CCPA) in the United States. They must protect the personal and financial information of their customers and implement measures to secure data during ACH transactions.

- Payment Card Industry Data Security Standard (PCI DSS): If handling card-based ACH transactions, ODFIs must comply with the PCI DSS, which sets security requirements to protect cardholder data. They must maintain secure networks, encrypt sensitive information, and regularly monitor and test their IT systems for vulnerabilities.

- Regulatory Reporting: ODFIs are required to submit various reports to regulatory authorities, such as the Federal Reserve, the Office of the Comptroller of the Currency (OCC), or the Consumer Financial Protection Bureau (CFPB). These reports may include transaction data, compliance records, and other relevant information as mandated by the regulatory bodies.

- Record Keeping: ODFIs must maintain accurate and up-to-date records of their ACH transactions, originator authorizations, and compliance activities. These records should be readily accessible for audit purposes and retained for the required period of time as stipulated by regulatory authorities.

- Risk Management: ODFIs must implement effective risk management practices, including fraud prevention measures, transaction monitoring systems, and internal controls. They must have processes in place to identify and mitigate potential risks associated with ACH transactions to ensure the integrity of the payment system.

- Continuing Education: ODFIs are encouraged to stay informed about changes in regulations, standards, and industry best practices. They should invest in training and ongoing education for their staff to keep abreast of evolving compliance requirements and to foster a culture of compliance within the organization.

By adhering to these compliance and regulatory requirements, ODFIs demonstrate their commitment to maintaining the highest standards of security, transparency, and trust within the ACH system.

Conclusion

The Originating Depository Financial Institution (ODFI) plays a crucial role in the world of banking and electronic transactions. As the initiator and sender of Automated Clearing House (ACH) transactions, the ODFI enables the secure and efficient movement of funds between financial institutions.

Throughout this article, we have explored the definition of an ODFI, its responsibilities, its relationship with other parties, and the compliance and regulatory requirements it must adhere to. From collecting and verifying payment information to ensuring transaction authorization, formatting, and settlement, the ODFI plays a pivotal role in facilitating ACH transactions.

Furthermore, ODFIs have important relationships with originators, receiving financial institutions, ACH operators, regulatory agencies, and other financial institutions within the ACH network. These relationships are built on trust, collaboration, and a commitment to providing secure and reliable ACH services.

To uphold the integrity of the ACH system, ODFIs must comply with various regulatory requirements and industry standards. This includes following NACHA operating rules, adhering to anti-money laundering regulations, ensuring data privacy and security, and meeting reporting obligations.

In conclusion, ODFIs are vital participants in the banking industry, facilitating the electronic movement of funds and providing businesses and individuals with convenient and efficient payment options. Their responsibilities, relationships, and compliance efforts contribute to the seamless functioning of the ACH network, benefiting both financial institutions and their customers.

By fulfilling their role with diligence and dedication, ODFIs play a vital part in driving the advancement of electronic transactions, streamlining financial processes, and fostering a secure and interconnected financial ecosystem.