Home>Finance>What Does The Ownership Clause In A Life Insurance Policy State?

Finance

What Does The Ownership Clause In A Life Insurance Policy State?

Published: October 16, 2023

Learn what the ownership clause in a life insurance policy entails and how it can impact your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Ownership Clause

- Key Elements of the Ownership Clause

- Rights and Responsibilities of the Policy Owner

- Transferring Ownership of a Life Insurance Policy

- Update and Change of Ownership

- Effect of Ownership on Policy Proceeds

- Beneficiary Designation and Ownership

- Tax Implications and Ownership of Life Insurance Policies

- Conclusion

Introduction

When purchasing a life insurance policy, it is important to understand the various clauses and provisions that govern the policy. One such clause that holds significant importance is the ownership clause. The ownership clause defines the legal rights and responsibilities of the policy owner, including the ability to control the policy’s terms and make decisions regarding its beneficiaries.

The ownership clause is a fundamental aspect of a life insurance policy, as it determines who has the authority to exercise control and make modifications to the policy. This clause plays a crucial role in shaping the policy’s overall flexibility and adaptability to the policy owner’s changing needs and circumstances.

Understanding the ownership clause is vital, as it empowers policyholders to make informed decisions about their life insurance coverage. It also has implications for aspects such as tax planning, policy loans, and the ability to transfer ownership in the future. In this article, we will delve into the intricacies of the ownership clause in a life insurance policy, exploring its key elements, rights and responsibilities of the policy owner, transferring ownership, and its effect on policy proceeds.

By gaining a deep understanding of the ownership clause and its implications, policyholders can maximize the benefits of their life insurance policies and ensure that their coverage aligns with their long-term financial goals.

Understanding the Ownership Clause

The ownership clause is a provision within a life insurance policy that determines who has legal ownership and control over the policy. It outlines the rights and responsibilities of the policy owner, including the ability to modify the policy, select beneficiaries, and make decisions regarding policy proceeds. The ownership clause is a critical component of a life insurance policy, as it establishes the framework for how the policy operates.

Under the ownership clause, the policy owner is typically the individual who purchases the policy or someone to whom the ownership has been transferred. The policy owner holds the power to make changes and decisions regarding the policy, including beneficiaries, premium payments, and policy loans.

It’s important to note that the policy owner and the insured individual are not always the same person. For example, someone may purchase a life insurance policy on behalf of their child, in which case they would be the policy owner, and the child would be the insured individual.

The ownership clause also establishes the policy owner’s rights and responsibilities regarding premium payments. The policy owner is responsible for ensuring timely premium payments, as failure to do so may result in the policy lapsing or losing certain benefits.

Furthermore, the ownership clause may specify restrictions on the minimum age a person must reach to own a policy, as well as any limitations on transferring ownership. This clause is essential to protect the interests of all parties involved and maintain the integrity of the policy.

By clearly understanding the ownership clause, policyholders can make informed decisions about their life insurance coverage. They can exercise control over the policy, select beneficiaries based on their evolving needs, and make adjustments to better align with their long-term financial goals.

Key Elements of the Ownership Clause

The ownership clause of a life insurance policy contains several key elements that define the rights and responsibilities of the policy owner. Understanding these elements is crucial for policyholders to make informed decisions and effectively manage their life insurance coverage. Let’s explore the key elements of the ownership clause:

- Policy Owner: The ownership clause specifies who has legal ownership and control over the life insurance policy. The policy owner can be an individual or an entity, such as a trust or corporation.

- Ownership Transfer Restrictions: The clause may outline any limitations or conditions on transferring ownership of the policy. Transferring ownership often requires the consent of the insurance company and may involve completing specific forms and documentation.

- Change of Ownership: The ownership clause may specify the process and requirements for changing ownership of the policy. This could include completing a change of ownership form or obtaining written consent from the current policy owner.

- Beneficiary Designation: The ownership clause typically addresses beneficiary designation. It outlines the policy owner’s right to select and change beneficiaries, including primary and contingent beneficiaries. The policy owner has the authority to designate who will receive the death benefit upon their passing.

- Policy Modifications: The ownership clause grants the policy owner the ability to modify certain policy details, such as the coverage amount, premium payment frequency, and policy riders. This allows policyholders to adjust their coverage to meet changing financial and personal circumstances.

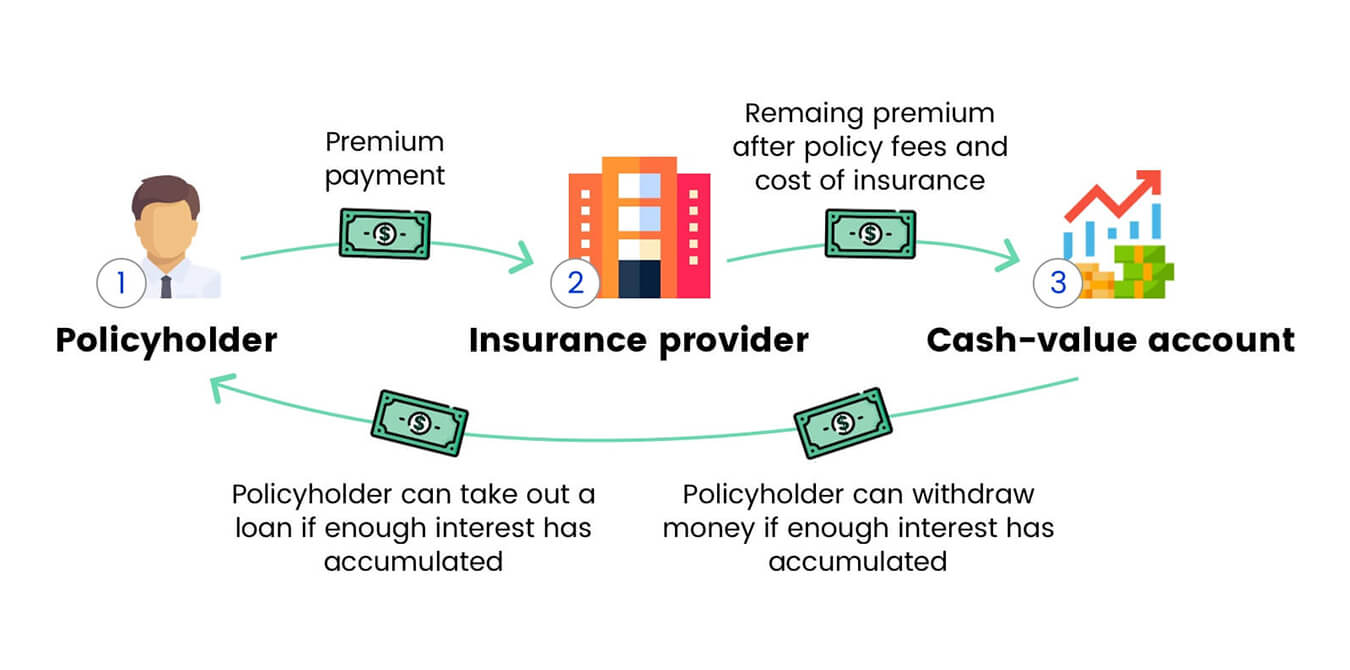

- Policy Loans: The clause may include provisions regarding the policy owner’s ability to take out loans against the cash value of the policy. Policy loans can provide access to funds for various purposes, with the policy’s cash value serving as collateral.

- Policy Surrender: The ownership clause details the policy owner’s rights to surrender the policy in exchange for the cash value. Surrendering the policy terminates coverage and may result in taxation on any gains.

- Policy Lapse: The ownership clause outlines the consequences of failure to pay premiums, which may result in the policy lapsing or losing certain benefits. It is the policy owner’s responsibility to ensure timely premium payments to maintain coverage.

Understanding these key elements of the ownership clause empowers policyholders to make informed decisions about their life insurance coverage. It provides flexibility and control over the policy’s terms and conditions, allowing for adjustments that align with the policy owner’s evolving needs and goals.

Rights and Responsibilities of the Policy Owner

The ownership clause in a life insurance policy grants specific rights and responsibilities to the policy owner. These rights and responsibilities play a pivotal role in managing the policy effectively. Let’s explore the key rights and responsibilities of the policy owner:

1. Control over Policy: As the policy owner, you have the right to make decisions regarding the policy. This includes selecting beneficiaries, modifying coverage and premium payments, and accessing policy details and statements. You have the power to shape and tailor the policy to meet your changing financial goals and circumstances.

2. Premium Payments: The policy owner is responsible for ensuring timely premium payments. It is your duty to keep your policy in force by paying premiums regularly. Failure to do so may result in the policy lapsing or losing certain benefits. Understand your payment obligations and make necessary arrangements to meet them.

3. Beneficiary Designation: The ownership clause allows the policy owner to designate primary and contingent beneficiaries. This means you have the authority to decide who will receive the death benefit upon your passing. Review and update your beneficiary designation periodically to ensure it aligns with your wishes and any changes in your personal circumstances.

4. Policy Modifications: You have the right to modify certain aspects of the policy, such as the coverage amount, premium payment frequency, and policy riders. This gives you the flexibility to adjust the policy to meet your evolving needs. However, be mindful of any costs, restrictions, or potential impact on the policy’s performance when making modifications.

5. Access to Policy Loans: Depending on the policy type, you may have the right to access policy loans. Policy loans allow you to borrow against the cash value of the policy for various purposes, such as emergency expenses, education, or retirement planning. Be aware of the terms, interest rates, and potential impact on the policy’s performance before pursuing a policy loan.

6. Policy Surrender: The policy owner has the right to surrender the policy in exchange for the cash value. Surrendering the policy terminates the coverage and may result in taxation on any gains. Consider the financial implications and assess alternatives before deciding to surrender the policy.

7. Estate Planning: As the policy owner, you have the opportunity to incorporate the life insurance policy into your estate planning strategy. This may involve placing the policy in a trust, designating specific beneficiaries, or considering tax implications. Consult with an estate planning professional to maximize the benefits of your life insurance policy within your overall estate planning framework.

Understanding and exercising these rights and responsibilities as the policy owner empowers you to manage your life insurance policy effectively. It ensures your coverage remains aligned with your financial goals, provides protection for your loved ones, and secures a solid foundation for your future.

Transferring Ownership of a Life Insurance Policy

The ownership of a life insurance policy can be transferred from one party to another under certain circumstances. Transferring policy ownership involves transferring the rights and responsibilities of the policy owner to a new individual or entity. Let’s explore the process, requirements, and considerations when transferring ownership of a life insurance policy:

1. Consent and Documentation: Generally, transferring ownership requires the consent of the insurance company. The policy owner must complete the necessary forms and provide the required documentation to initiate the transfer process.

2. Policy Assignment: The most common method of transferring ownership is through a policy assignment. The policy owner assigns their rights and interests in the policy to another individual or entity. This can be done through a written agreement and by submitting a formal assignment form to the insurance company.

3. Assignee Qualifications: The assignee, or the new policy owner, must meet the qualifications set by the insurance company. These qualifications can include minimum age requirements, insurable interest, and ability to assume the responsibilities of ownership.

4. Tax Implications: Transferring ownership of a life insurance policy may have tax implications. Consult with a tax professional to understand any potential tax consequences, such as gift taxes or capital gains taxes, and ensure compliance with applicable regulations.

5. Policy Loans and Outstanding Obligations: Before transferring ownership, consider any outstanding policy loans or obligations associated with the policy. Both the current policy owner and the assignee should review and address any outstanding loans or obligations to ensure a smooth transfer process.

6. Beneficiary Designation: Transferring ownership does not automatically alter the beneficiary designation. The new policy owner can choose to maintain the existing beneficiaries or make changes as necessary. It is important to review and update the beneficiary designation to reflect the new ownership.

7. Comprehend the Consequences: Understand the implications of transferring ownership. Once the transfer is complete, the new policy owner assumes all rights, responsibilities, and decision-making authority over the policy. Carefully consider the impact on policy terms, premium payments, and future modifications.

8. Seek Professional Guidance: Transferring ownership of a life insurance policy can be complex, and it is advisable to seek the guidance of a financial advisor or an insurance professional throughout the process. They can provide specific insights and ensure that all necessary steps are taken with accordance to relevant regulations and requirements.

Transferring ownership of a life insurance policy can be beneficial in certain situations, such as estate planning, business succession, or changing personal circumstances. By following the necessary procedures and seeking professional guidance, policyholders can navigate the transfer process smoothly and ensure the policy continues to serve its intended purpose.

Update and Change of Ownership

Life circumstances and financial needs can change over time, prompting policyholders to consider updating or changing the ownership of their life insurance policies. Whether it’s a change in marital status, the birth of a child, or a desire to pass on the policy to a loved one, understanding the process of updating and changing ownership is essential. Let’s explore the key considerations and steps involved in updating or changing the ownership of a life insurance policy:

1. Review Policy Terms: Start by reviewing the terms and conditions of your life insurance policy. Understand any restrictions or provisions related to updating or changing ownership. Familiarize yourself with the requirements set by the insurance company.

2. Consult with the Insurance Company: Contact your insurance company and inform them of your intent to update or change the policy ownership. They will guide you through the necessary steps and provide the required forms and documentation.

3. Complete Ownership Change Forms: Fill out the appropriate ownership change forms provided by the insurance company. These forms typically require details of the new policy owner and may require signatures from both the current policy owner and the new owner.

4. Consent of Current Owner: If there is a change in policy ownership, the current policy owner must consent to the transfer. This consent is typically documented through signatures on the ownership change forms.

5. Submission of Documentation: Submit the completed ownership change forms along with any supporting documentation required by the insurance company. This may include identification documents and proof of relationship for the new policy owner.

6. Beneficiary Designation: Consider reviewing and updating the beneficiary designation on the policy. Changing ownership does not automatically alter the beneficiaries. Ensure the new policy owner reviews and updates the beneficiary designation as desired.

7. Assess Tax Implications: Understand the potential tax implications of updating or changing ownership. Depending on the specific circumstances, tax consequences such as gift taxes or capital gains taxes may arise. Consult with a tax professional to minimize any adverse tax consequences.

8. Seek Professional Guidance: It’s advisable to seek guidance from a financial advisor or insurance professional throughout the process of updating or changing ownership. They can provide personalized advice, ensure compliance with all requirements, and help maximize the benefits of the life insurance policy.

Updating or changing the ownership of a life insurance policy allows policyholders to reflect their current financial and personal circumstances. By following the appropriate procedures and seeking professional guidance, policyholders can ensure a seamless transition while maintaining the intended purpose and benefits of the life insurance coverage.

Effect of Ownership on Policy Proceeds

The ownership of a life insurance policy has a significant impact on how the policy proceeds are distributed upon the insured individual’s death. Understanding the effect of ownership on policy proceeds is crucial for both the policy owner and the beneficiaries. Let’s explore how ownership can affect the distribution of policy proceeds:

1. Beneficiary Designation: The policy owner has the authority to designate the primary and contingent beneficiaries of the life insurance policy. These are the individuals or entities who will receive the death benefit upon the insured individual’s passing. The ownership of the policy does not typically impact the chosen beneficiaries.

2. Policy Ownership and Beneficiary: In some cases, the same person may be the policy owner and the designated beneficiary. In this case, the policy owner can simply name themselves as the beneficiary to receive the policy proceeds. The ownership and beneficiary designation can be aligned.

3. Policy Ownership and Estate Planning: When a policy owner passes away, the policy proceeds may become part of their estate. If the policy is owned by the insured individual, it may be subject to probate and potential estate taxes. Proper estate planning can help minimize these effects and ensure smooth distribution to the intended beneficiaries.

4. Transfer of Ownership and Policy Proceeds: Transferring ownership of a life insurance policy does not change the beneficiary designation. The policy proceeds will still be distributed to the designated beneficiaries unless changes are made by the new policy owner.

5. Tax Implications: The ownership of a life insurance policy can have tax implications. In most cases, the death benefit paid to the beneficiary is income tax-free. However, if the policy is owned by a different individual or entity other than the insured, the policy proceeds could potentially be subject to estate taxes, gift taxes, or income taxes. Consult with a tax professional to understand the specific tax implications related to policy ownership and policy proceeds.

6. Estate Equalization: In some cases, a life insurance policy is used as a tool for estate equalization. For example, if one beneficiary is set to inherit a larger portion of the estate, the policy owner can designate another beneficiary as the policy beneficiary to help balance the distribution of assets.

7. Change in Policy Ownership and Proceeds: If the ownership of a policy is changed, it does not affect the distribution of policy proceeds unless the new policy owner makes changes to the beneficiary designation. It is important for the new policy owner to review and update the beneficiary designation if necessary.

Understanding the effect of ownership on policy proceeds is essential for ensuring that the intended beneficiaries receive the life insurance benefits as desired. Consult with a financial advisor or an insurance professional to navigate the complexities of ownership and its impact on the distribution of policy proceeds.

Beneficiary Designation and Ownership

When it comes to life insurance policies, the beneficiary designation is a crucial aspect that works hand in hand with the ownership clause. The beneficiary designation determines who will receive the policy proceeds upon the insured individual’s death. Understanding the relationship between beneficiary designation and ownership is vital in ensuring the effective distribution of the life insurance benefits. Let’s explore how these two elements interrelate:

1. Policy Owner’s Control: As the policy owner, you have the authority to designate the primary and contingent beneficiaries of the life insurance policy. This means that you have the power to choose who will receive the death benefit. The beneficiary designation is a separate provision from the ownership clause, allowing you to specify beneficiaries regardless of the ownership arrangement.

2. Flexibility for Changing Beneficiaries: The ownership clause enables you, as the policy owner, to make changes to the beneficiary designation over time. As your circumstances change, such as marriage, divorce, or the birth of children, you can update the beneficiary designation form to reflect your current wishes. It is important to regularly review and update this information to ensure it aligns with your intentions and any changes in your life.

3. Independent of Ownership: The beneficiary designation is independent of the ownership of the policy. Even if the ownership of the policy changes hands, the beneficiary designation remains as initially selected by the policy owner. It is essential to update the beneficiary designation in the event of a change in policy ownership, if desired, to ensure it aligns with the new policy owner’s intentions.

4. Contingent Beneficiaries: Alongside primary beneficiaries, the policy owner has the option to designate contingent beneficiaries. These individuals or entities will receive the death benefit if the primary beneficiaries predecease the insured individual or are unable to receive the proceeds for any reason. Contingent beneficiaries help ensure a smooth and effective transfer of the policy proceeds to the intended recipients.

5. Policy Proceeds and Beneficiary Designation: When the insured individual passes away, the policy proceeds are paid out to the beneficiaries designated by the policy owner. The ownership of the policy does not impact the distribution of the proceeds to the beneficiaries, as long as the beneficiary designation is properly established and maintained.

6. Review and Update Regularly: Beneficiary designations should be reviewed periodically to ensure they align with your current wishes and circumstances. Life events, such as the birth of a child, marriage, divorce, or the loss of a loved one, may necessitate changes to the beneficiary designation. Regularly reviewing and updating this information helps ensure that the intended beneficiaries receive the life insurance benefits.

7. Seek Professional Advice: It is recommended to consult with a financial advisor or an insurance professional to navigate the intricacies of beneficiary designation and ownership. They can provide valuable insights and assist you in reviewing and updating beneficiary designations, taking into account any legal or tax considerations specific to your situation.

Understanding the relationship between beneficiary designation and ownership ensures that your life insurance benefits are distributed according to your wishes. Regularly reviewing and updating your beneficiary designations, along with seeking professional advice, creates a solid foundation for effective estate planning and providing financial protection for your loved ones.

Tax Implications and Ownership of Life Insurance Policies

The ownership of a life insurance policy can have various tax implications that policyholders should be aware of. Understanding the tax considerations associated with policy ownership is crucial for effective financial planning and managing potential tax liabilities. Let’s explore the key tax implications of owning a life insurance policy:

1. Death Benefit: In most cases, the death benefit paid out to the beneficiaries of a life insurance policy is generally not subject to income tax. The proceeds are typically received tax-free by the named beneficiaries.

2. Estate Taxes: If the policy owner is also the insured individual and retains ownership of the policy until death, the death benefit may become part of their taxable estate. Depending on the size of the estate and applicable exemption thresholds, estate taxes may apply. Proper estate planning, such as placing the policy in an irrevocable trust, can help mitigate potential estate tax liabilities.

3. Gift Taxes: Transferring ownership of a life insurance policy for no consideration or to someone other than the policyholder may trigger gift tax implications. The value of the policy at the time of transfer could be considered a gift and may be subject to gift taxes. Consult with a tax professional to ensure compliance with gift tax regulations.

4. Collateral Assignment: In certain situations, a policy owner may assign the policy as collateral for a loan. The assignment of the policy as collateral does not carry tax implications in itself. However, policyholders should be aware that if the loan is not repaid, it could result in taxable income. This typically occurs if the outstanding loan balance exceeds the policy’s cash surrender value when the policy terminates.

5. Policy Loans: Policy loans, when taken against the cash value of a policy, are generally not taxable. The loan proceeds are not considered taxable income as they are borrowed against the policy’s cash value. However, if the policy lapses or is surrendered with an outstanding policy loan balance, the amount of the loan could be treated as taxable income.

6. 1035 Exchanges: A 1035 exchange allows policyholders to transfer the cash value of an existing life insurance policy to a new policy without immediate tax consequences. This exchange is tax-free, provided that certain requirements are met, such as transferring the cash value directly between the insurance companies and maintaining the same insured individual.

7. Premium Payments with Pre-Tax Dollars: In most cases, life insurance premiums are paid with after-tax dollars. However, certain employer-sponsored policies may allow for premium payments with pre-tax dollars. Such policies are typically subject to taxation upon receiving benefits and may have different tax implications. Consult with a tax professional or benefits administrator to clarify the tax treatment of premiums.

It is crucial to consult with a qualified tax professional or financial advisor to understand the specific tax implications of owning a life insurance policy based on your unique circumstances and jurisdiction. They can provide personalized guidance to help minimize tax liabilities, maximize benefits, and ensure compliance with applicable tax laws.

Conclusion

Understanding the ownership clause in a life insurance policy is crucial for policyholders to make informed decisions, exercise control, and maximize the benefits of their coverage. The ownership clause defines the legal rights and responsibilities of the policy owner, including the ability to modify the policy, select beneficiaries, and make decisions regarding policy proceeds.

Throughout this article, we have explored various aspects of the ownership clause, including its key elements, the rights and responsibilities of the policy owner, transferring ownership, the effect of ownership on policy proceeds, beneficiary designation, and tax implications.

By comprehending the ownership clause, policyholders can effectively navigate the complexities of life insurance policies. They can make informed decisions that align with their changing needs, review and update beneficiary designations, and seek professional advice to understand the tax implications associated with policy ownership.

Remember, the ownership clause provides a solid foundation for managing life insurance coverage and ensuring that the intended beneficiaries receive the policy proceeds. Regularly reviewing and updating policy details, consulting with experts, and staying informed about changes in tax laws can help policyholders make the most of their life insurance policies.

Ultimately, a comprehensive understanding of the ownership clause empowers policyholders to protect their loved ones, achieve their financial goals, and secure a solid foundation for the future.