Finance

What Number Do I Fax To The IRS?

Published: October 31, 2023

Find out the correct fax number to securely send your financial documents to the IRS. Ensure smooth communication and compliance with our easy-to-follow instructions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction:

Welcome to the world of taxes and bureaucracy! Dealing with the Internal Revenue Service (IRS) can be a daunting task, and in certain situations, you may need to submit documents via fax. But what fax number should you use? This article aims to guide you through the process of finding the correct fax number to send your documents to the IRS.

The IRS is the United States government agency responsible for collecting taxes and enforcing tax laws. Often, individuals and businesses need to correspond with the IRS to resolve tax-related issues, submit important documents, or inquire about their tax status. While many transactions can be done electronically or through traditional mail, faxing documents to the IRS remains a common and necessary method.

Understanding the IRS’s fax system is crucial for ensuring that your documents reach the right department and are processed in a timely manner. The IRS has different fax numbers for various purposes, such as filing tax returns, requesting transcripts, or responding to notices.

When it comes to submitting documents to the IRS via fax, it’s important to find the correct fax number to ensure that your information reaches the appropriate department. Using the wrong fax number can lead to delays in processing or, even worse, your documents getting lost in the vast sea of paperwork.

In the next sections, we will delve into the process of finding the correct fax number for your specific needs, the best practices for faxing documents to the IRS, and some useful tips to ensure a smooth and successful fax submission process. So, let’s dive in and demystify the IRS faxing process!

Understanding IRS Fax Numbers:

Before we dive into the details of finding the correct fax number for the IRS, it’s important to understand how their fax number system works. The IRS has multiple fax numbers, each serving a specific purpose or department within the organization.

Here are some common types of fax numbers used by the IRS:

- General Fax Numbers: These are the main fax numbers used for general inquiries or to submit certain documents like Form 8283 (Noncash Charitable Contributions) or Form 8822 (Change of Address). These general fax numbers are usually used when there is not a specific department or form designation required.

- Departmental Fax Numbers: The IRS has different departments for various purposes like income tax, estate and gift tax, or international tax. Each department may have its own dedicated fax number. These departmental fax numbers are specific to particular sections within the IRS and should be used when corresponding with a specific department.

- Tax Return Fax Numbers: If you need to fax your tax return to the IRS, there are separate fax numbers depending on the type of return you are filing. For example, individual tax returns have different fax numbers than business tax returns. Make sure to use the correct tax return fax number to ensure timely processing of your return.

It’s important to note that the IRS periodically updates their fax numbers, so it’s crucial to verify the current fax numbers before sending any documents. The IRS website is the most reliable source for obtaining the correct fax numbers. Alternatively, you can contact the IRS directly for the most up-to-date information.

Now that we have a basic understanding of the different types of fax numbers used by the IRS, let’s move on to the next section where we will explore how to find the correct fax number for your specific needs.

Finding the Correct Fax Number:

When it comes to finding the correct fax number for the IRS, there are a few reliable sources you can turn to. Here are some methods to help you find the correct fax number:

- IRS Website: The IRS website is the primary resource for obtaining the most up-to-date fax numbers. Visit the official IRS website and navigate to the specific section or department you need to contact. Look for their contact information or forms page, where you may find the fax number relevant to your needs.

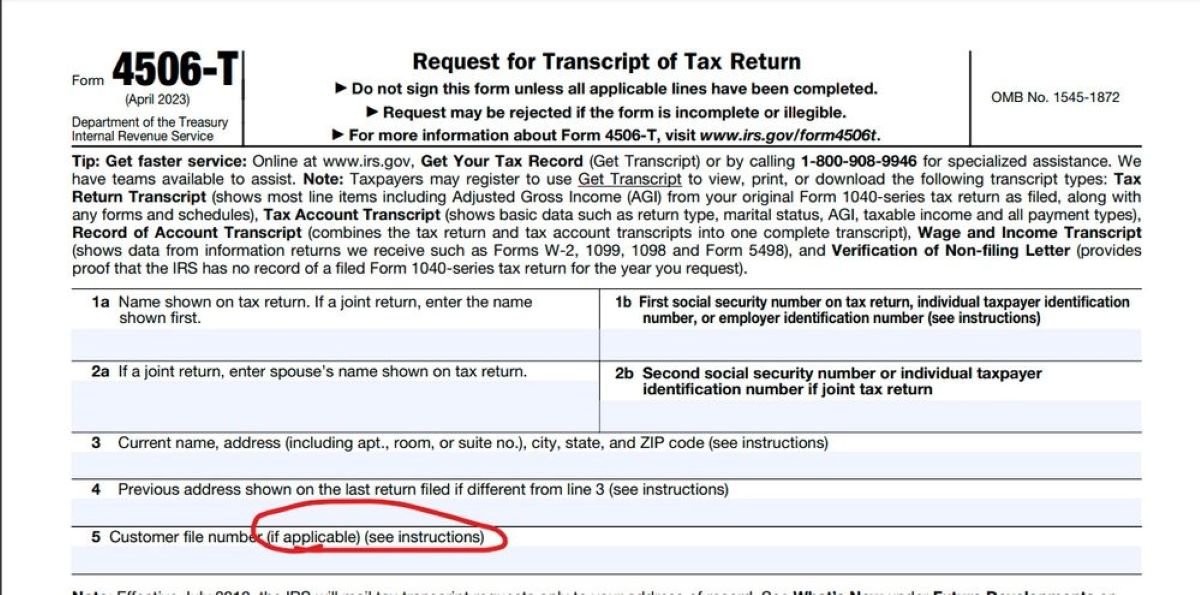

- Tax Forms and Publications: If you’re using a specific tax form or publication, check the instructions or contact information included with the document. Often, the IRS will provide the relevant fax number for submitting related documents.

- IRS Correspondence: If you have received a notice or letter from the IRS, it may contain the fax number to use when responding to their request. Make sure to carefully read through any communication received from the IRS to find the correct fax number.

- IRS Phone Support: If you’re unable to find the appropriate fax number online or through other sources, you can contact the IRS directly by phone. Their customer support representatives should be able to provide you with the correct fax number based on your specific needs.

It’s important to note that some departments or specific forms may have different fax numbers. Therefore, it’s crucial to verify that you have the correct fax number for your specific situation. Using the wrong fax number can lead to delays in processing or misrouting of your documents.

Once you have the correct fax number, it’s time to proceed with faxing your documents to the IRS. The next section will provide you with some valuable tips to ensure a successful fax submission process. So, let’s continue!

Faxing Documents to the IRS:

Now that you have the correct fax number for the IRS, it’s time to prepare and send your documents. Here’s a step-by-step guide on how to fax documents to the IRS:

- Prepare your documents: Ensure that your documents are complete, accurate, and legible. Make sure to include any relevant forms, supporting documentation, or cover sheets as required by the IRS.

- Organize your fax: Arrange your documents in the order specified by the IRS. Use paper clips or staples to keep multiple pages together. If you are sending multiple documents, clearly label and separate them to avoid confusion.

- Create a fax cover sheet: In many cases, it’s essential to include a cover sheet with your fax. The cover sheet should contain your contact information, the recipient’s information, a brief description of the documents being faxed, and any other relevant details specified by the IRS. You can create a simple cover sheet using a word processing program or use one provided by the IRS if available.

- Enter the fax number: Use a fax machine or an online fax service to enter the correct fax number for the IRS. Double-check the number to ensure accuracy and avoid any potential errors.

- Send the fax: Initiate the fax transmission and wait for the process to complete. Ensure that the entire document is successfully transmitted before concluding the process.

It’s important to keep a record of your fax transmission, including the date, time, and confirmation of successful transmission. This record will serve as proof of submission in case any issues arise later.

Remember that faxing documents to the IRS does not guarantee an immediate response. It may take some time for the IRS to process your documents and provide a response or update. If you need urgent assistance or have specific concerns, it’s advisable to contact the IRS directly to ensure your matter receives prompt attention.

Now that you know how to fax your documents to the IRS, let’s move on to the next section where we will explore some valuable tips to ensure a smooth and successful fax submission process. Stay tuned!

Tips for Faxing Documents to the IRS:

Faxing documents to the IRS can be a critical part of resolving tax-related matters or submitting important information. To ensure a smooth and successful fax submission process, here are some valuable tips to keep in mind:

- Double-check the fax number: Before sending your documents, verify that you have entered the correct fax number. Using the wrong fax number can lead to delays or misrouting of your documents. Review the number multiple times to avoid any errors.

- Follow the IRS guidelines: Familiarize yourself with the specific guidelines provided by the IRS for faxing documents. Pay attention to any special instructions, required documentation, or cover sheets that might be necessary for your submission. Adhering to the IRS guidelines will increase the chances of a successful transmission.

- Ensure legibility: Make sure that all the information in your documents is legible. Illegible or unclear documents may lead to processing delays or misinterpretation of important details. If necessary, consider printing or typing the documents instead of handwritten submissions.

- Secure personal information: Protect your personal and sensitive information when faxing documents to the IRS. Be cautious of potential security risks and avoid sending documents via unsecured fax services. If necessary, encrypt your documents or utilize secure fax services to safeguard your data.

- Keep a record: Maintain a record of your fax transmission, including the date, time, and confirmation of successful transmission. This record will serve as proof of submission in case any issues or disputes arise in the future. Additionally, retain copies of the documents you fax for your personal records.

- Follow up if necessary: After faxing your documents, allow some time for the IRS to process your submission. If you haven’t received any acknowledgment or response within a reasonable timeframe, consider contacting the IRS to ensure that your documents were successfully received and are being processed.

- Consider alternative methods: While faxing remains a common method for submitting documents to the IRS, explore alternative options if faxing is not feasible or practical for your specific situation. Electronic submission through the IRS website or traditional mail are other viable options to consider.

By following these tips, you can enhance the efficiency and effectiveness of your fax submissions to the IRS. Remember, attention to detail and adherence to the IRS guidelines are crucial when dealing with tax-related matters. Now, let’s conclude our discussion.

Conclusion:

Dealing with the IRS can be challenging, but understanding how to fax documents to the agency is essential for various tax-related matters and inquiries. In this article, we have explored the process of finding the correct fax number for the IRS and provided helpful tips to ensure a successful fax submission.

When it comes to finding the correct fax number, the IRS website is the most reliable resource. It provides up-to-date fax numbers for different departments, specific forms, and general inquiries. Additionally, tax forms, IRS correspondence, and contacting the IRS directly can help you obtain the correct fax number.

Once you have the correct fax number, it’s crucial to prepare your documents properly. Create a fax cover sheet, organize your documents, and double-check their legibility. When sending the fax, make sure to enter the correct number and keep a record of the transmission for future reference.

Following the IRS guidelines, securing sensitive information, and verifying legibility are important factors for a successful fax submission. Additionally, keeping a record and following up if necessary can help ensure that your documents are received and processed by the IRS in a timely manner.

Remember, faxing documents to the IRS is just one method of submission. Depending on your situation, you may have alternative options such as electronic submission through the IRS website or traditional mail.

By understanding the process of faxing documents to the IRS and implementing the tips provided in this article, you can navigate through the bureaucracy and ensure that your important documents reach the appropriate department for processing.

So, the next time you need to submit documents to the IRS via fax, refer back to this article for a reminder of the correct steps and best practices. Remember, being well-informed and prepared will make your experience with the IRS more efficient and less daunting.