Finance

What IRS Forms Can Be Signed Electronically?

Published: October 30, 2023

Discover which IRS forms in the field of finance can be signed electronically. Streamline your tax process with digital signatures.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Benefits of Electronic Signature

- Overview of IRS Forms

- Forms That Can Be Signed Electronically

- Form 8879, IRS e-file Signature Authorization

- Form 8878, IRS e-file Signature Authorization for Form 4868 or Form 2350

- Form 8453, U.S. Individual Income Tax Declaration for an IRS e-file Return

- Form 8879-PE, IRS e-file Signature Authorization for Form 1120-PE

- Form 8879-C, IRS e-file Signature Authorization for Form 1120

- Form 8879-S, IRS e-file Signature Authorization for Form 1120S

- Form 8879-F, IRS e-file Signature Authorization for Form 1120-F

- Conclusion

Introduction

Welcome to the digital era, where technology has revolutionized the way we handle paperwork. Gone are the days of printing, signing, and mailing documents. With the advent of electronic signature technology, individuals and businesses can now sign important forms and contracts with just a few clicks.

One area where the use of electronic signatures has gained significant traction is in the realm of financial transactions, particularly when it comes to dealing with the Internal Revenue Service (IRS). The IRS, recognizing the convenience and efficiency of electronic signatures, has provided guidelines on which forms can be signed electronically.

In this article, we will explore the benefits of electronic signatures and provide an overview of the IRS forms that can be signed electronically. Whether you’re an individual taxpayer or a business owner, understanding these forms will help streamline your tax filing process and save you valuable time and resources.

So, let’s delve into the world of electronic signatures and discover how they can simplify your interactions with the IRS.

Benefits of Electronic Signature

Electronic signatures offer numerous advantages over traditional paper-based signatures. Here are some key benefits:

- Convenience: Gone are the days of printing, signing, and mailing physical documents. With electronic signatures, you can sign forms from anywhere, at any time, using any device with internet access. This eliminates the need for in-person meetings or having to wait for documents to be delivered through regular mail.

- Efficiency: With electronic signatures, you can sign documents with just a few clicks. This saves a significant amount of time compared to traditional methods, where physical signatures would need to be obtained and documents would have to be processed manually.

- Cost Savings: Electronic signatures eliminate the need for printing, paper, ink, and postage. This not only reduces costs but also helps the environment by minimizing paper wastage.

- Security: Electronic signatures offer advanced security measures to ensure the integrity and authenticity of the signed documents. Encryption technologies and audit trails provide robust protection against unauthorized tampering or alterations.

- Legally Binding: Electronic signatures are legally recognized in many countries, including the United States under the Electronic Signatures in Global and National Commerce Act (ESIGN Act) and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures hold the same legal weight as handwritten signatures, making them a valid and enforceable means of signing important documents.

Overall, electronic signatures provide a seamless and streamlined signing process, enabling individuals and businesses to save time, resources, and effort. With their convenience, efficiency, cost savings, security, and legal validity, it’s no wonder that they have become the preferred method of signing forms and contracts.

Overview of IRS Forms

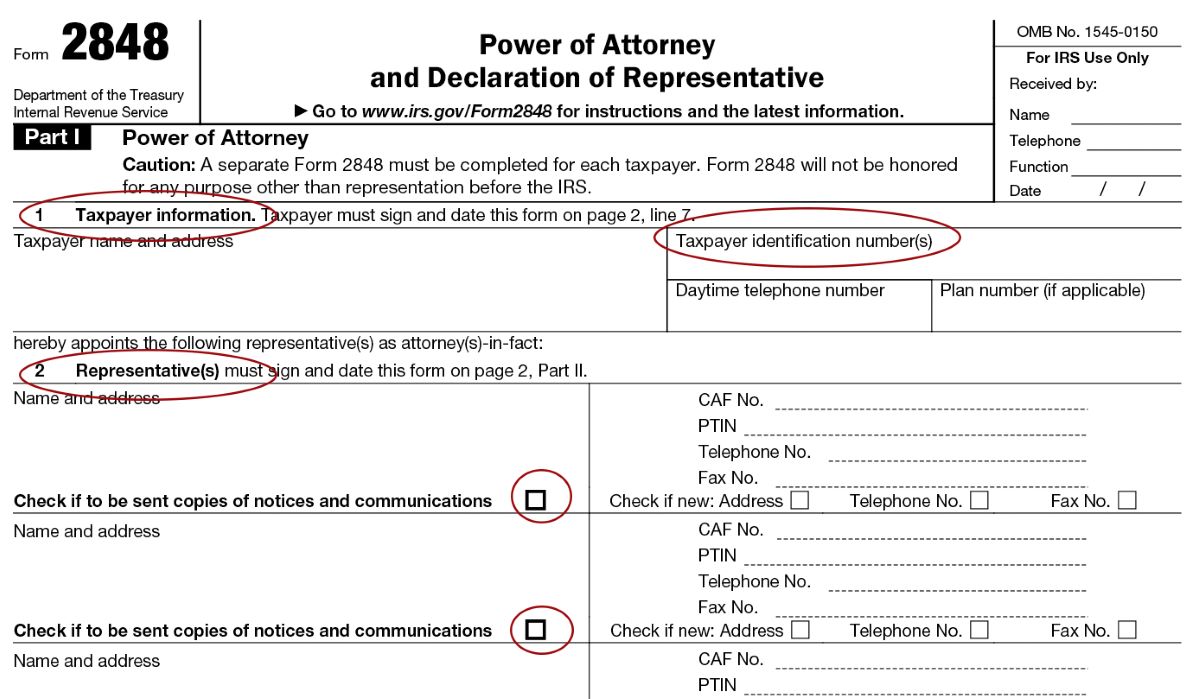

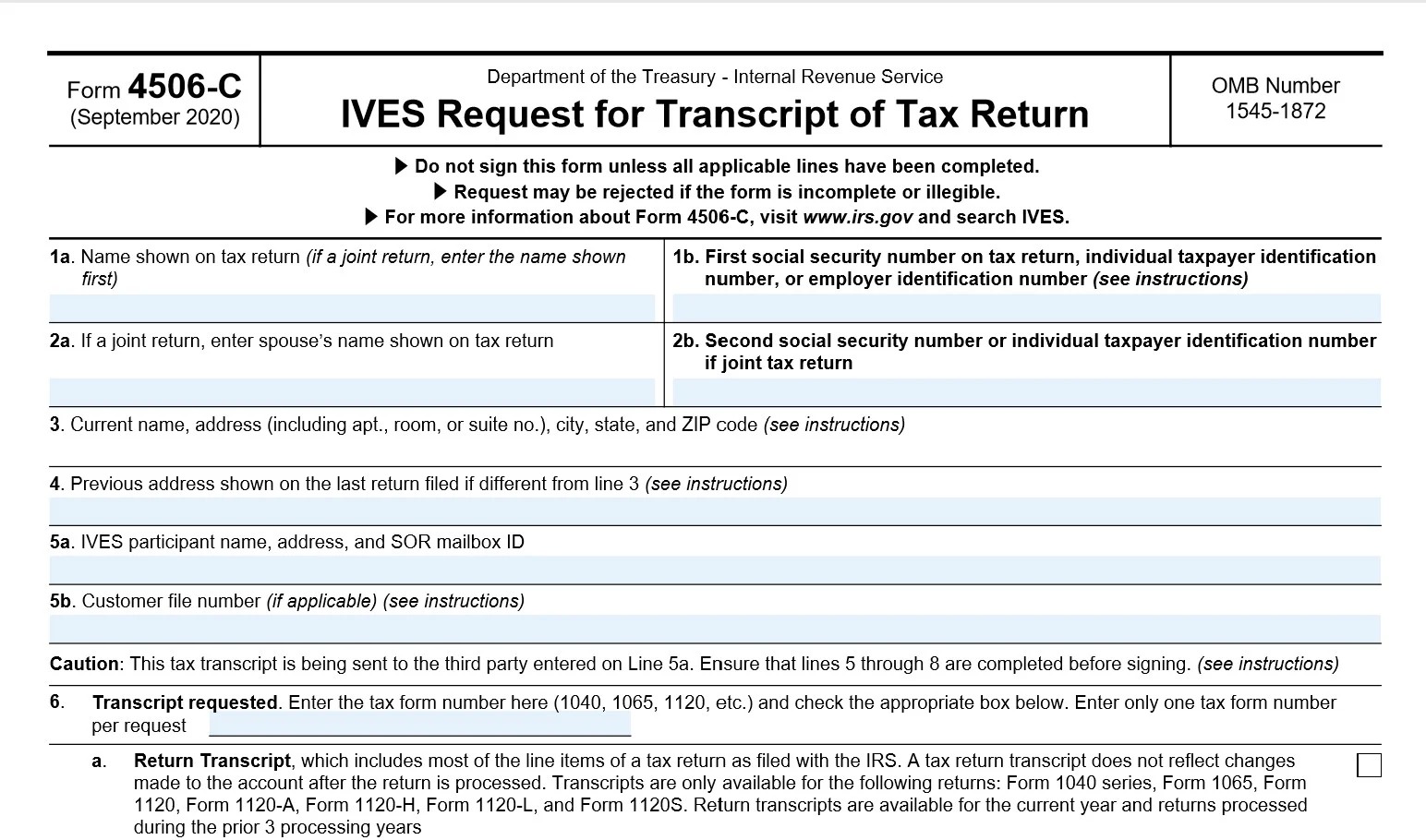

The Internal Revenue Service (IRS) requires taxpayers to file various forms to report their income, claim deductions, and fulfill their tax obligations. These forms serve as official documentation and play a crucial role in the tax filing process. It is important to understand the different forms and their requirements to ensure compliance with the IRS regulations.

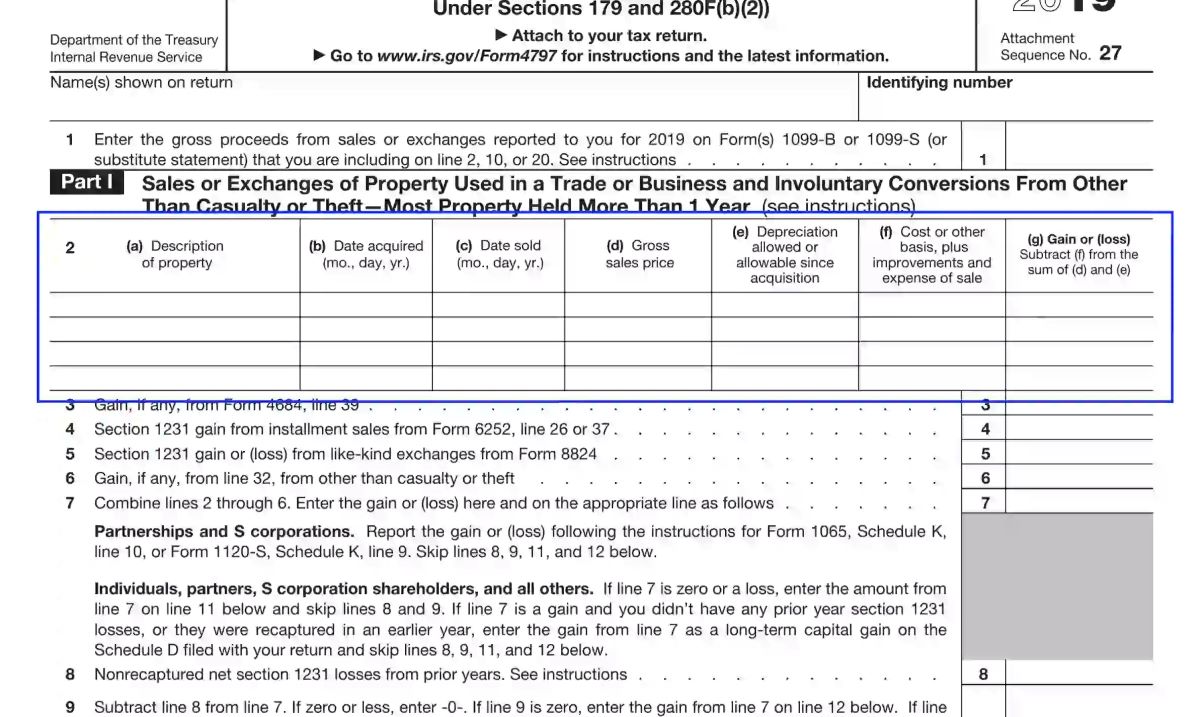

IRS forms cover a wide range of tax-related matters, from individual income taxes to corporate tax filings. Some common IRS forms include:

- Form 1040: This is the main form used by individuals to report their annual income and calculate their tax liability. It includes sections for reporting income, claiming deductions, and calculating credits.

- Form 1065: Partnerships use this form to report their income, deductions, and losses. It provides information about the partnership’s financial activities and each partner’s share of the profits or losses.

- Form 1120: Corporations, including C corporations, use this form to report their income, deductions, and tax liability. It provides detailed information about the corporation’s financial activities and helps determine its tax liability.

- Form 990: Non-profit organizations, such as charitable and educational institutions, use this form to report their financial information and ensure compliance with tax-exempt status requirements.

- Form W-2: Employers use this form to report wages, tips, and other compensation paid to their employees. Employees use this form to report their earnings and withholdings when filing their personal income tax returns.

- Form 1099: Various types of income, such as interest, dividends, and self-employment income, are reported on different versions of Form 1099. These forms are issued by payers to report income earned by individuals or businesses.

It is important to note that not all IRS forms can be signed electronically. The IRS provides specific guidelines and requirements for electronic signatures on certain forms, which we will explore in the next section.

Now that we have an understanding of the different IRS forms, let’s delve into the specific forms that can be signed electronically.

Forms That Can Be Signed Electronically

The IRS recognizes the benefits of electronic signatures and allows certain forms to be signed electronically. By embracing electronic signature technology, taxpayers can save time, reduce paper wastage, and streamline their filing process. Here are some IRS forms that can be signed electronically:

- Form 8879, IRS e-file Signature Authorization: This form is used to authorize the electronic filing of individual tax returns. It enables taxpayers to sign and authorize their tax return electronically, eliminating the need for physical signatures.

- Form 8878, IRS e-file Signature Authorization for Form 4868 or Form 2350: Taxpayers who need additional time to file their individual tax returns can use either Form 4868 or Form 2350 to request an extension. The Form 8878 allows taxpayers to electronically sign and authorize the extension request.

- Form 8453, U.S. Individual Income Tax Declaration for an IRS e-file Return: This form is used to verify the accuracy of electronically filed individual tax returns. Taxpayers who electronically file their returns may be required to sign and submit Form 8453 electronically as well.

- Form 8879-PE, IRS e-file Signature Authorization for Form 1120-PE: Partnerships that choose to electronically file their Form 1120-PE use Form 8879-PE to authorize the electronic submission of their partnership return. This form can be signed electronically by the authorized partner or the designated tax professional.

- Form 8879-C, IRS e-file Signature Authorization for Form 1120: Corporations can electronically sign and authorize the electronic filing of their Form 1120 using Form 8879-C. This form streamlines the filing process for corporate tax returns.

- Form 8879-S, IRS e-file Signature Authorization for Form 1120S: S corporations can utilize Form 8879-S to electronically sign and authorize the electronic filing of their Form 1120S. This form simplifies the process of filing tax returns for S corporations.

- Form 8879-F, IRS e-file Signature Authorization for Form 1120-F: Foreign corporations that need to electronically sign and authorize the electronic filing of their Form 1120-F can use Form 8879-F. This form facilitates the electronic submission of tax returns for foreign corporations.

These are just a few examples of the IRS forms that can be signed electronically. It is important to note that each form has specific requirements and guidelines for electronic signatures, so it is crucial to follow the IRS instructions and use approved electronic signature platforms to ensure compliance.

By taking advantage of electronic signature technology for these specific forms, taxpayers can expedite their filing process and reduce the administrative burden associated with traditional paper-based methods.

Now that we have explored the IRS forms that can be signed electronically, let’s summarize what we have learned.

Form 8879, IRS e-file Signature Authorization

Form 8879, IRS e-file Signature Authorization, is a crucial form for individual taxpayers who choose to electronically file their tax returns. This form serves as authorization for the electronic submission of their tax return, eliminating the need for a physical signature.

When using electronic filing methods, such as e-filing software or engaging the services of a tax professional, taxpayers must complete and sign Form 8879 to provide their consent. The form includes important information, including the taxpayer’s name, Social Security Number (SSN), and the tax year for which the return is being filed.

The electronic signature on Form 8879 acts as a legally binding authorization, indicating the taxpayer’s acceptance of the information contained in the tax return and their acknowledgment of its accuracy. By signing this form electronically, taxpayers confirm their commitment to the accuracy of the return and agree to be responsible for any penalties or liabilities associated with the filing.

It is important to note that the IRS has specific requirements for electronic signatures on Form 8879. Taxpayers must use approved electronic signature methods or software that comply with the IRS guidelines. The IRS provides a list of approved software providers and platforms that meet the necessary security and authentication requirements.

Electronic signatures on Form 8879 offer several advantages. They streamline the tax filing process, eliminating the need for physical signatures and the delays associated with traditional mailing methods. Electronic signatures also provide enhanced security measures, ensuring the integrity and authenticity of the signed document. Additionally, electronic signatures on Form 8879 help reduce paper wastage, contributing to environmental sustainability.

By understanding the significance of Form 8879 and its electronic signature requirements, taxpayers can confidently embrace the convenience and efficiency of electronic filing. It is crucial to follow the IRS guidelines and utilize approved electronic signature methods to ensure compliance and a smooth tax filing process.

Now that we have explored Form 8879, let’s proceed to the next IRS form that can be signed electronically.

Form 8878, IRS e-file Signature Authorization for Form 4868 or Form 2350

Form 8878, IRS e-file Signature Authorization for Form 4868 or Form 2350, is an essential form for taxpayers who need additional time to file their individual tax returns. This form allows taxpayers to electronically sign and authorize the extension request using an electronic signature.

When individuals require extra time beyond the tax filing deadline, they can file either Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, or Form 2350, Application for Extension of Time to File U.S. Income Tax Return for U.S. Citizens and Resident Aliens Abroad. These forms grant an extension of time to file, but it is important to note that they do not extend the time to pay any taxes owed.

To authorize the electronic filing of these extension requests, taxpayers must complete and sign Form 8878. This form includes important information such as the taxpayer’s name, Social Security Number (SSN), the tax year for which the extension is being requested, and the estimated tax liability.

Electronic signatures on Form 8878 serve as legally binding authorization, indicating the taxpayer’s acceptance of the information provided and their agreement to be responsible for any taxes owed. By signing electronically, taxpayers confirm their commitment to filing the extension request accurately and in a timely manner.

It is essential to follow the specific requirements set forth by the IRS for electronic signatures on Form 8878. Taxpayers must use approved electronic signature methods or software that meet the necessary security and authentication standards outlined by the IRS.

By utilizing electronic signatures on Form 8878, taxpayers can enjoy the convenience and efficiency of submitting extension requests electronically. This eliminates the need for physical signatures and the delays associated with traditional mailing methods. Additionally, electronic signatures on Form 8878 help in reducing paper wastage and contribute to environmental sustainability.

Understanding the importance of Form 8878 and its electronic signature requirements empowers taxpayers to navigate the process of requesting an extension smoothly and efficiently. Compliance with the IRS guidelines ensures the proper submission of extension requests and reduces the risk of penalties or late filings.

Now that we have explored Form 8878, let’s move on to the next IRS form that can be signed electronically.

Form 8453, U.S. Individual Income Tax Declaration for an IRS e-file Return

Form 8453, U.S. Individual Income Tax Declaration for an IRS e-file Return, is a critical form for taxpayers who choose to electronically file their individual income tax returns. This form is used to verify the accuracy of electronically filed returns and is typically required when certain attachments, such as paper documents or schedules, need to be included with the return.

When taxpayers e-file their returns, they may need to provide additional supporting documentation to validate certain deductions, credits, or income reported. Instead of physically attaching these documents to the electronic file, taxpayers can use Form 8453 to declare that the required supporting documents are being retained and can be produced if requested by the IRS.

Form 8453 includes the taxpayer’s name, Social Security Number (SSN), and the tax year for which the return is being filed. Additionally, taxpayers must provide a declaration stating that they have retained the required documentation and will provide it upon request by the IRS.

The IRS allows taxpayers to sign and submit Form 8453 electronically in conjunction with the electronically filed tax return. This eliminates the need for physical signatures and the delays associated with mailing paper documents.

It is crucial to adhere to the IRS guidelines and requirements for electronic signatures on Form 8453. Taxpayers must use approved electronic signature methods or software that meet the necessary security and authentication standards outlined by the IRS.

By utilizing electronic signatures on Form 8453, taxpayers can streamline the e-filing process and eliminate the need for physical attachments. This saves time, reduces administrative burdens, and contributes to a more efficient and environmentally friendly tax filing experience.

Understanding the significance of Form 8453 and its electronic signature requirements empowers taxpayers to confidently e-file their individual income tax returns. Compliance with the IRS guidelines ensures accurate filing and reduces the risk of penalties or delays in processing.

Now that we have explored Form 8453, let’s proceed to the next IRS form that can be signed electronically.

Form 8879-PE, IRS e-file Signature Authorization for Form 1120-PE

Form 8879-PE, IRS e-file Signature Authorization for Form 1120-PE, is a crucial form for partnerships that choose to electronically file their Form 1120-PE, also known as the U.S. Return of Partnership Income. This form allows partnerships to authorize the electronic submission of their partnership tax return using an electronic signature.

When partnerships opt for electronic filing methods, they must complete and sign Form 8879-PE to provide their consent. The form includes important information such as the partnership’s name, Employer Identification Number (EIN), the tax year for which the return is being filed, and the name and title of the authorized partner signing the form.

The electronic signature on Form 8879-PE serves as a legally binding authorization, indicating the partnership’s acceptance of the information contained in the tax return and its acknowledgment of the accuracy of the filing. By signing electronically, the partnership confirms its commitment to comply with tax laws and be responsible for any penalties or liabilities associated with the filing.

The IRS has specific requirements for electronic signatures on Form 8879-PE. Partnerships must use approved electronic signature methods or software that comply with the necessary security and authentication requirements outlined by the IRS. The IRS provides a list of approved software providers and platforms that meet these standards.

Electronic signatures on Form 8879-PE offer several advantages. They streamline the partnership’s tax filing process, eliminating the need for physical signatures and the delays associated with traditional mailing methods. Electronic signatures also provide enhanced security measures, ensuring the integrity and authenticity of the signed document. Additionally, they help reduce paper wastage, contributing to environmental sustainability.

By understanding the significance of Form 8879-PE and its electronic signature requirements, partnerships can leverage the convenience and efficiency of electronic filing. Partnerships should follow the IRS guidelines and utilize approved electronic signature methods to ensure compliance and a smooth tax filing process.

Now that we have explored Form 8879-PE, let’s proceed to the next IRS form that can be signed electronically.

Form 8879-C, IRS e-file Signature Authorization for Form 1120

Form 8879-C, IRS e-file Signature Authorization for Form 1120, is a vital form for corporations that choose to electronically file their Form 1120, also known as the U.S. Corporation Income Tax Return. This form allows corporations to authorize the electronic submission of their tax return using an electronic signature.

When corporations opt for electronic filing methods, they must complete and sign Form 8879-C to provide their consent and authorization. The form includes important details such as the corporation’s name, Employer Identification Number (EIN), the tax year for which the return is being filed, and the name and title of the authorized individual signing the form.

By signing Form 8879-C electronically, the corporation provides a legally binding authorization, indicating its acceptance of the information contained in the tax return and its acknowledgement of the accuracy of the filing. The electronic signature represents the corporation’s commitment to adhere to tax laws and be responsible for any penalties or liabilities associated with the filing.

The IRS has specific requirements for electronic signatures on Form 8879-C. Corporations must use approved electronic signature methods or software that meet the necessary security and authentication requirements. The IRS provides a list of approved software providers and platforms that comply with these standards.

The use of electronic signatures on Form 8879-C offers several advantages. It streamlines the tax filing process for corporations by eliminating the need for physical signatures and the delays associated with traditional mailing methods. Electronic signatures also provide enhanced security measures, ensuring the integrity and authenticity of the signed document. Additionally, they contribute to reducing paper usage, promoting environmental sustainability.

By understanding the importance of Form 8879-C and its electronic signature requirements, corporations can leverage the convenience and efficiency of electronic filing. Compliance with the IRS guidelines and the use of approved electronic signature methods ensures accurate filing and reduces the risk of penalties or delays in processing.

Now that we have explored Form 8879-C, let’s proceed to the next IRS form that can be signed electronically.

Form 8879-S, IRS e-file Signature Authorization for Form 1120S

Form 8879-S, IRS e-file Signature Authorization for Form 1120S, is a critical form for S corporations that choose to electronically file their Form 1120S, also known as the U.S. Income Tax Return for an S Corporation. This form enables S corporations to authorize the electronic submission of their tax return using an electronic signature.

When S corporations opt for electronic filing methods, they must complete and sign Form 8879-S to provide their consent and authorization. The form includes important information such as the corporation’s name, Employer Identification Number (EIN), the tax year for which the return is being filed, and the name and title of the authorized individual signing the form.

The electronic signature on Form 8879-S acts as a legally binding authorization, indicating the S corporation’s acceptance of the information included in the tax return and its acknowledgement of the accuracy of the filing. By signing electronically, the S corporation confirms its commitment to comply with tax laws and assumes responsibility for any penalties or liabilities associated with the filing.

The IRS has specific requirements for electronic signatures on Form 8879-S. S corporations must use approved electronic signature methods or software that meet the necessary security and authentication requirements. The IRS provides a list of approved software providers and platforms that comply with these standards.

The use of electronic signatures on Form 8879-S provides several advantages. It streamlines the tax filing process for S corporations by eliminating the need for physical signatures and the delays associated with traditional mailing methods. Electronic signatures also offer enhanced security measures, ensuring the integrity and authenticity of the signed document. Additionally, they contribute to reducing paper usage, promoting environmental sustainability.

Understanding the significance of Form 8879-S and its electronic signature requirements empowers S corporations to leverage the convenience and efficiency of electronic filing. Compliance with the IRS guidelines and utilizing approved electronic signature methods ensures accurate filing and reduces the risk of penalties or delays in processing.

Now that we have explored Form 8879-S, let’s proceed to the next IRS form that can be signed electronically.

Form 8879-F, IRS e-file Signature Authorization for Form 1120-F

Form 8879-F, IRS e-file Signature Authorization for Form 1120-F, is a crucial form for foreign corporations that choose to electronically file their Form 1120-F, also known as the U.S. Income Tax Return of a Foreign Corporation. This form allows foreign corporations to authorize the electronic submission of their tax return using an electronic signature.

When foreign corporations opt for electronic filing methods, they must complete and sign Form 8879-F to provide their consent and authorization. The form includes important information such as the corporation’s name, Employer Identification Number (EIN), the tax year for which the return is being filed, and the name and title of the authorized individual signing the form.

The electronic signature on Form 8879-F acts as a legally binding authorization, indicating the foreign corporation’s acceptance of the information contained in the tax return and its acknowledgement of the accuracy of the filing. By signing electronically, the foreign corporation confirms its commitment to comply with tax laws and assumes responsibility for any penalties or liabilities associated with the filing.

The IRS has specific requirements for electronic signatures on Form 8879-F. Foreign corporations must use approved electronic signature methods or software that meet the necessary security and authentication requirements. The IRS provides a list of approved software providers and platforms that comply with these standards.

The use of electronic signatures on Form 8879-F offers several advantages. It streamlines the tax filing process for foreign corporations by eliminating the need for physical signatures and the delays associated with traditional mailing methods. Electronic signatures also provide enhanced security measures, ensuring the integrity and authenticity of the signed document. Additionally, they contribute to reducing paper usage, promoting environmental sustainability.

Understanding the significance of Form 8879-F and its electronic signature requirements empowers foreign corporations to leverage the convenience and efficiency of electronic filing. Compliance with the IRS guidelines and utilizing approved electronic signature methods ensures accurate filing and reduces the risk of penalties or delays in processing.

Now that we have explored Form 8879-F, let’s summarize what we have learned about IRS forms that can be signed electronically.

Conclusion

Electronic signatures have revolutionized the way we handle paperwork, offering convenience, efficiency, cost savings, security, and legal validity. The IRS recognizes the benefits of electronic signatures and has made provisions for certain forms to be signed electronically.

In this article, we explored the advantages of electronic signatures and provided an overview of IRS forms that can be signed electronically. We discussed Form 8879, which authorizes the electronic filing of individual tax returns, as well as Form 8878 for extension requests and Form 8453 for verifying electronically filed individual tax returns.

For businesses, we covered Form 8879-PE for partnerships, Form 8879-C for corporations, Form 8879-S for S corporations, and Form 8879-F for foreign corporations. Each form allows for electronic signature authorization, streamlining the tax filing process and eliminating the need for physical signatures.

By understanding these forms and their electronic signature requirements, taxpayers can navigate the tax filing process with greater ease. It is important to follow the IRS guidelines and use approved electronic signature methods or software to ensure compliance and a seamless filing experience.

Incorporating electronic signatures not only saves time but also contributes to environmental sustainability by reducing paper usage. With the convenience, efficiency, and security of electronic signatures, individuals and businesses can streamline their interactions with the IRS and focus on other important aspects of their financial responsibilities.

As technology continues to advance, electronic signatures are set to play an even bigger role in the future of financial documentation. Embracing this digital transformation will further enhance efficiency and simplify administrative processes.

We hope this article has provided valuable insights into the IRS forms that can be signed electronically. By taking advantage of electronic signature capabilities, individuals and businesses can navigate their tax obligations more efficiently, ultimately saving time, reducing costs, and improving overall productivity.