Finance

What IRS Letters Come From Ogden, Utah, 2022

Published: October 31, 2023

Learn about the IRS letters coming from Ogden, Utah in 2022, regarding finance matters. Get informed about important updates and understand the implications for your financial situation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Background of IRS Letters from Ogden, Utah

- Importance of Understanding IRS Letters

- Common Types of IRS Letters from Ogden, Utah

- Explanation of IRS Letter Codes

- Examples of IRS Letters from Ogden, Utah

- How to Respond to IRS Letters from Ogden, Utah

- Tips for Communicating with the IRS

- Resources and Support for Dealing with IRS Letters from Ogden, Utah

- Conclusion

Introduction

Welcome to the world of IRS letters from Ogden, Utah! If you’ve ever received a letter from the Internal Revenue Service (IRS), you may have noticed that many of them are sent from the IRS campus in Ogden, Utah. But what do these letters mean? Why are they coming from Utah? And most importantly, how should you respond to them?

In this article, we will explore the background of IRS letters from Ogden, Utah, and the importance of understanding them. We’ll delve into the common types of letters you may receive and decode the letter codes so that you can decipher their meaning. Additionally, we’ll provide you with examples of IRS letters from Ogden, Utah, and offer guidance on how to respond effectively.

Dealing with IRS letters can be intimidating and stressful, but having the knowledge and understanding of what they mean can empower you to take the necessary actions. Whether it’s a notice about a potential error on your tax return, a request for additional information, or a reminder about an unpaid balance, each letter serves a specific purpose in the IRS’s effort to ensure compliance with tax laws.

By familiarizing yourself with the different types of letters, their codes, and how to respond, you can navigate the IRS letter process with confidence and minimize any potential negative consequences. So, let’s embark on this journey to demystify IRS letters from Ogden, Utah, and empower you to effectively address any communication from the IRS.

Background of IRS Letters from Ogden, Utah

The choice of Ogden, Utah as a central location for handling IRS correspondence dates back to the early 20th century. In 1918, a mail-processing center was established in Ogden to facilitate communication between the IRS and taxpayers across the country. Over the years, the Ogden location expanded its operations and became a hub for various IRS functions, including handling tax returns, processing payments, and issuing letters.

Ogden’s strategic location played a significant role in its selection as an IRS center. Situated in the western part of the United States, Ogden provides convenient access to taxpayers from multiple states, ensuring efficient and timely processing of correspondence. This centralized approach allows the IRS to streamline its operations and provide consistent communication to taxpayers across the country.

The IRS campus in Ogden, Utah is home to a large workforce dedicated to managing a wide range of tax-related activities. From customer service representatives to tax examiners and support staff, the employees in Ogden play a crucial role in handling the enormous volume of IRS correspondence. Their expertise and dedication contribute to the smooth functioning of the IRS and ensure that taxpayers receive accurate and timely information.

As the IRS has embraced digital transformation, the Ogden campus has also taken steps to modernize its operations. With the advancements in technology, the processing and issuance of IRS letters have become more streamlined. However, despite the digital shift, Ogden, Utah remains a vital center for IRS letter processing and serves as a critical link between the IRS and taxpayers.

Understanding the background of IRS letters from Ogden, Utah underscores the importance of treating them with the seriousness they deserve. Each letter serves a specific purpose and contains valuable information regarding your tax obligations. By recognizing the significance of these letters, you can proactively address any issues, respond appropriately, and maintain compliance with tax laws.

Importance of Understanding IRS Letters

Receiving a letter from the IRS can be quite unsettling, but it’s important to remember that the IRS communicates through letters to address various tax-related matters. Understanding the significance of these letters is crucial for several reasons:

- Compliance: IRS letters provide essential information about your tax situation and any necessary actions you need to take to remain compliant with tax laws. Ignoring or misinterpreting these letters can lead to penalties, interest charges, or even legal consequences.

- Timely Response: IRS letters often come with specific deadlines for response or action. By understanding the content and instructions in the letter, you can ensure that you provide the necessary information or take the required steps within the given timeframe. Responding promptly can help resolve issues efficiently and prevent further complications.

- Error Detection: Sometimes, IRS letters alert you to potential errors or discrepancies in your tax filings. By carefully reviewing the letter and understanding its contents, you can identify any mistakes and take corrective action. This proactive approach can prevent future headaches and help maintain accurate tax records.

- Information Verification: IRS letters may request additional information or documentation to support your tax return. Understanding the nature of the request and providing the requested information allows the IRS to verify the accuracy of your tax filings. Providing prompt and accurate information can help resolve any discrepancies and minimize the potential for further audits or investigations.

- Understanding Rights and Options: IRS letters often outline your rights as a taxpayer and provide information on available options for resolving tax issues. By comprehending these rights and options, you can make informed decisions about how to handle the situation and choose the best course of action.

Overall, understanding IRS letters allows you to navigate the complex tax landscape with confidence. By being aware of the implications of each letter and taking appropriate action, you can effectively address any concerns raised by the IRS and ensure compliance with tax laws. It’s crucial to approach each letter with attentiveness and seek professional guidance if needed.

Common Types of IRS Letters from Ogden, Utah

IRS letters from Ogden, Utah can cover a wide range of tax-related issues. Here are some common types of letters that you may receive:

- Notice of Tax Due: This type of letter informs you that you have an outstanding balance of taxes owed to the IRS. It will specify the amount due, any penalties or interest accrued, and provide instructions on how to make payment.

- Notice of Underreported Income: If the IRS identifies discrepancies between the income reported on your tax return and the information they have received from other sources (such as employers or financial institutions), they may send a letter notifying you of the underreported income. It will outline the adjustments made to your return and any resulting changes in your tax liability.

- Notice of Tax Return Examination: This letter indicates that your tax return has been selected for examination or audit. It will provide details on the specific items or areas of your return that the IRS intends to review and request supporting documentation or information to verify the accuracy of the reported figures.

- Notice of Proposed Changes: If the IRS finds discrepancies or errors during an examination or audit, they may send a letter proposing changes to your tax return. The letter will outline the adjustments made, the resulting tax liability, and provide instructions on how to respond or contest the proposed changes if you disagree.

- Notice of Intent to Levy: If you have unpaid taxes and have not responded to previous notices, the IRS may send a letter notifying you of their intent to levy your assets, such as bank accounts or wages. This letter serves as a final warning before the IRS takes specific collection actions.

- Verification Request: The IRS may send a letter requesting verification of specific information reported on your tax return. This can include documentation related to income, deductions, or credits claimed. Providing the requested information accurately and promptly is crucial to resolve any discrepancies.

- Identity Verification Request: To prevent identity theft and fraudulent filings, the IRS may send a letter requesting verification of your identity. This typically requires providing copies of identification documents, such as a driver’s license or passport, to confirm your identity.

These are just a few examples of the various types of letters you may receive from the IRS. Each letter serves a specific purpose and requires careful attention and appropriate action. Understanding the type of letter you have received is essential in determining the necessary steps to take in response.

In the next section, we will explain the letter codes used in IRS correspondence, which can further help you decipher the purpose of the letter and how to address it.

Explanation of IRS Letter Codes

IRS letters often include letter codes that provide additional information about the purpose or type of letter. Understanding these letter codes can help you decipher the meaning behind the IRS correspondence. Here are some common letter codes and their explanations:

- CP: CP stands for “Computer Paragraph.” These letters are often generated automatically by the IRS computer systems and cover a wide range of topics, such as changes to your tax return, requests for information, or notices of a balance due. It’s important to carefully read the content of the letter to understand the specific issue or request.

- LTR: LTR refers to “Letter.” These letters are typically manually generated by IRS employees and cover a variety of topics. They can include notices of examination, proposed adjustments, or requests for additional information. The content of the letter will provide details on the specific issue being addressed.

- CPA: CPA stands for “Certified Public Accountant.” This type of letter is sent specifically to tax professionals representing clients. It may provide information on tax law updates, changes in procedures, or reminders of filing deadlines. It’s important for tax professionals to stay updated on any CPA letters to ensure they are providing accurate and timely guidance to their clients.

- LTRCP: LTRCP combines both the “Letter” and “Computer Paragraph” components. These letters are a combination of computer-generated content with additional manually written paragraphs. They can cover a range of topics, including proposed adjustments, requests for documentation, and balance due notices.

- CPAR: CPAR stands for “Computer Paragraph and Account Response.” These letters are specifically used in response to an inquiry or documentation provided by the taxpayer. They acknowledge receipt of the information and may provide additional instructions or requests.

- LTRE: LTRE indicates a “Letter Examination.” These letters are typically sent after a tax return has undergone examination or audit. They outline the results of the examination, proposed changes to the return, and any resulting adjustments in tax liability. It’s important to review these letters carefully and respond within the specified timeframe if you disagree with the proposed changes.

These are just a few examples of the letter codes you may encounter in IRS correspondence. Each code provides valuable insights into the nature of the letter and can help guide your response. Regardless of the letter code, it’s crucial to read the letter in its entirety to understand the specific issue being addressed and take appropriate action.

Examples of IRS Letters from Ogden, Utah

IRS letters from Ogden, Utah cover a wide range of tax-related matters and serve as an important means of communication between the IRS and taxpayers. Here are a few examples of the types of letters you may receive from Ogden:

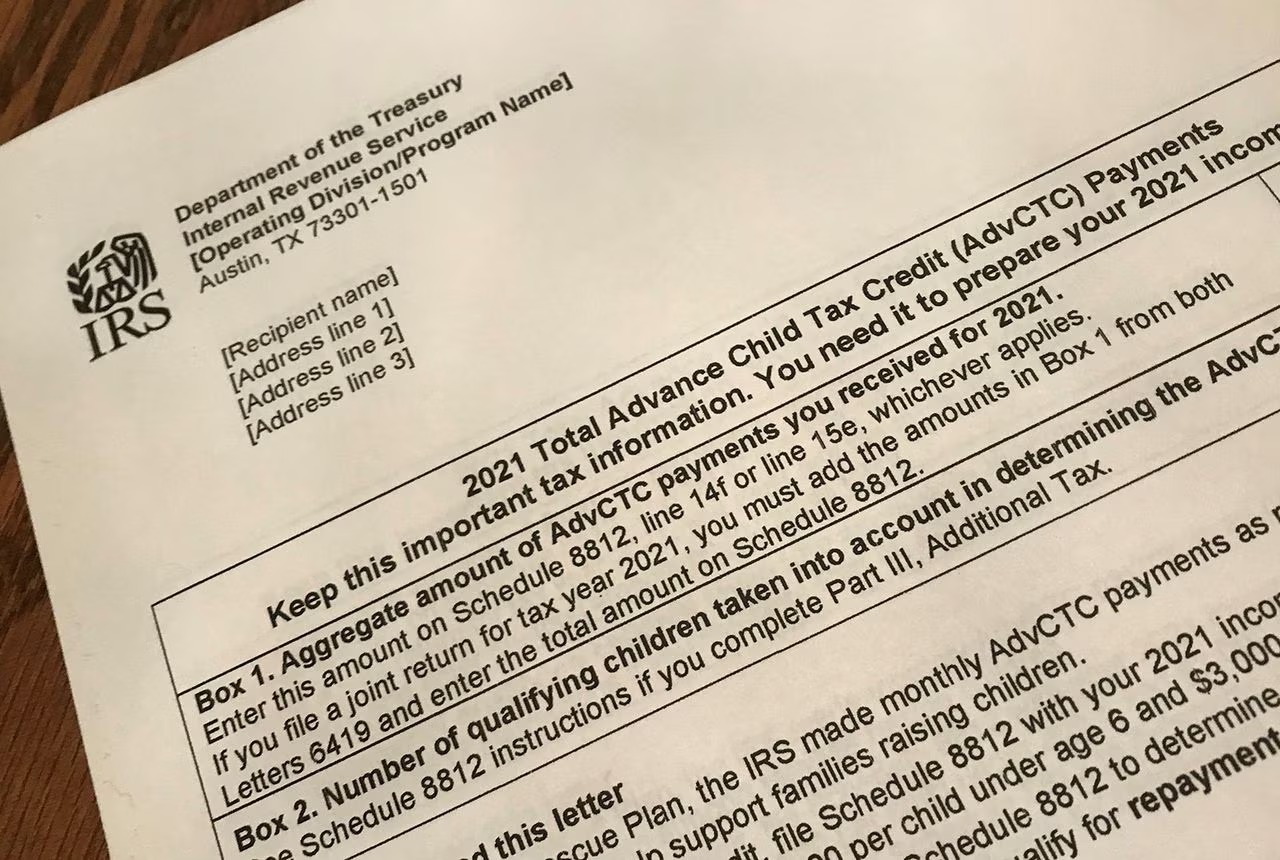

- CP2000: This letter, also known as the Notice of Proposed Adjustment, is a common correspondence sent from Ogden. It typically addresses discrepancies found between the income and deductions reported on your tax return and the information received from third-party sources, such as employers or financial institutions. The CP2000 outlines proposed changes and provides instructions on how to respond.

- Letter 226J: If the IRS determines that an employer has potentially failed to comply with the Affordable Care Act (ACA) requirements, they may send Letter 226J. This letter from Ogden outlines the proposed employer shared responsibility penalty and provides details on how to respond and dispute the penalty calculation if necessary.

- Letter 1058: Letter 1058, also known as Final Notice of Intent to Levy, is sent from Ogden to notify taxpayers of the IRS’s intent to levy their assets to collect unpaid taxes. It serves as a final warning before the IRS takes specific collection actions, and it includes instructions on how to resolve the unpaid tax debt.

- Letter 4883C: If the IRS identifies potential identity theft or fraud on your tax return, they may send Letter 4883C. This letter requests verification of your identity to ensure that the tax return filed is legitimate. It typically requires you to follow specific steps to verify your identity before the IRS can process your return.

- Letter 525: Letter 525, also known as the General 30-Day Letter, is sent from Ogden to notify you of the IRS’s intent to assess additional taxes. This letter provides an explanation of the proposed assessment and offers an opportunity to respond within 30 days to dispute the proposed changes or provide additional information.

These are just a few examples of the IRS letters that may come from Ogden, Utah. Each letter has a specific purpose and requires attention. When you receive a letter from Ogden, it’s essential to thoroughly read and understand its contents, follow the provided instructions, and take prompt action to address the issues raised.

Understanding the different types of letters and their implications can help you navigate the IRS correspondence more effectively and ensure compliance with tax laws.

How to Respond to IRS Letters from Ogden, Utah

Receiving an IRS letter from Ogden, Utah can be unsettling, but it’s crucial to respond promptly and appropriately. Here are some steps to help you effectively respond to IRS letters:

- Read the letter carefully: Take the time to thoroughly read the letter from the IRS. Pay close attention to the details, including the issue being addressed, any proposed changes, and the deadline for response. Understanding the content of the letter is important for formulating an appropriate response.

- Seek professional help if needed: If the letter is complex or you’re unsure about how to respond, consider seeking assistance from a tax professional, such as an enrolled agent, certified public accountant (CPA), or tax attorney. They can provide expert guidance and help you navigate the IRS correspondence process.

- Gather necessary documentation: If the letter requests additional information or documentation, gather all the necessary documents that support your tax return. Make copies of these documents to include with your response, ensuring that you retain the originals for your records.

- Respond within the given timeframe: It’s important to respond to the IRS letter within the specified timeframe. Failure to respond on time may result in penalties or further collection actions. If you need more time to gather the required information, consider requesting an extension from the IRS in writing.

- Provide a clear and concise response: When drafting your response, be clear, concise, and organized. Address each issue raised in the letter and provide supporting documentation, if necessary. Clearly state your position, provide explanations, and include any relevant calculations or evidence to support your case.

- Keep copies of all correspondence: Make copies of all the correspondence you send to the IRS, including your response and any supporting documents. It’s essential to keep a record of your communication for future reference or in case of any disputes or further inquiries from the IRS.

- Follow up if necessary: After submitting your response, it’s advisable to follow up with the IRS to ensure that they received and processed your information. If you don’t receive a response within a reasonable timeframe, consider reaching out to the IRS to inquire about the status of your case.

- Stay organized and stay informed: Keep all your tax-related documents organized, including copies of your tax returns, correspondence from the IRS, and any other relevant information. Stay informed about changes in tax laws and IRS procedures to ensure compliance and be prepared for any future interactions with the IRS.

Responding to IRS letters from Ogden, Utah requires attention to detail, prompt action, and clear communication. By following these steps and seeking professional advice when necessary, you can effectively address any issues raised by the IRS and work towards a resolution.

Tips for Communicating with the IRS

When communicating with the IRS regarding letters from Ogden, Utah or any other tax-related matters, it’s important to approach the process with care and professionalism. Here are some tips to help facilitate effective communication:

- Be proactive: Address IRS letters promptly and proactively. Ignoring or delaying your response may lead to further complications and potential penalties. Responding in a timely manner demonstrates your willingness to cooperate and resolve any tax issues.

- Be accurate and thorough: When providing information or supporting documentation, ensure accuracy and completeness. Double-check your responses for any errors or omissions. The more thorough and accurate you are, the quicker the IRS can process your case.

- Use clear and concise language: Communicate your points clearly and concisely, using simple and straightforward language. Avoid unnecessary jargon or technical terms that may confuse the reader. Be direct in addressing the specific issues raised in the IRS letter.

- Keep documentation organized: Maintain copies of all correspondence, supporting documents, and any notes from conversations or interactions with the IRS. Organize them in a systematic manner, making it easier to reference them when needed. This documentation can be valuable in case of any discrepancies or disputes in the future.

- Keep a record of dates and deadlines: Note down key dates, such as when you received the IRS letter, the deadline for response, and any subsequent communications. Staying organized and aware of deadlines helps ensure that you respond in a timely manner and avoid any penalties.

- Consider seeking professional assistance: If you’re unsure about how to communicate or handle your case with the IRS, don’t hesitate to seek help from a qualified tax professional. Enrolled agents, CPAs, or tax attorneys can provide expert advice and guide you through the process.

- Remain polite and professional: Maintain a respectful and professional tone in all communications with the IRS. Avoid confrontational language or emotional responses. A courteous and professional approach can help foster better communication and potentially lead to a more favorable resolution.

- Respond in writing whenever possible: While the IRS may provide phone numbers for inquiries, it’s generally advisable to respond in writing whenever possible. Written correspondence provides a clear record of your communication and ensures that all relevant information is documented and properly addressed.

- Follow up if needed: If you don’t receive a response from the IRS within a reasonable timeframe, consider following up politely to inquire about the status of your case. Avoid excessive or frequent follow-ups that may hinder their ability to address your case efficiently.

- Stay informed: Stay updated on changes in tax laws and IRS procedures. The IRS website and other reputable sources provide valuable information to help you understand your tax responsibilities and rights as a taxpayer.

By following these tips, you can navigate the communication process with the IRS more effectively and increase the chances of a successful resolution to any tax-related matters.

Resources and Support for Dealing with IRS Letters from Ogden, Utah

Dealing with IRS letters from Ogden, Utah can be complex and overwhelming. Fortunately, there are resources and support available to help you navigate the process. Here are some valuable resources to consider:

- IRS Website: The official website of the Internal Revenue Service, www.irs.gov, offers a wealth of information and resources for taxpayers. You can find answers to frequently asked questions, access tax forms and publications, and stay updated on changes in tax laws and regulations.

- IRS Online Tools: The IRS provides various online tools and resources to help taxpayers, such as the “Where’s My Refund?” tool, which allows you to track the status of your refund. Other tools include the Interactive Tax Assistant and the Tax Withholding Estimator, which can assist in calculating tax-related figures and providing answers to common tax-related questions.

- Local IRS Office: If you prefer face-to-face assistance, you can locate your local IRS office through the IRS website. Visiting an IRS office allows you to speak with IRS personnel directly and receive personalized guidance. However, it’s advisable to make an appointment in advance to ensure availability.

- Tax Professionals: Enrolled agents, certified public accountants (CPAs), and tax attorneys are professionals experienced in dealing with IRS matters. Seeking their assistance can provide expert advice and guidance specific to your situation. They can help you understand IRS letters, communicate with the IRS on your behalf, and ensure compliance with tax laws.

- IRS Hotlines: The IRS operates various toll-free hotlines that you can contact for specific inquiries or assistance. These hotlines are categorized based on tax topics, such as individual taxes, business taxes, and international taxes. You can find the appropriate hotline number on the IRS website.

- IRS Correspondence: If you need to communicate with the IRS regarding a specific letter or case, ensure that you have the relevant correspondence available. The letter from the IRS will provide contact information, including a specific address or fax number, where you can send your response or request additional information.

Remember, it’s essential to stay informed and seek assistance when needed. Dealing with IRS letters can be complex, and the guidance of professionals or access to reliable resources can greatly simplify the process and help you achieve a resolution.

Lastly, be patient and persistent. Resolving issues with the IRS may take time, but by staying proactive, organized, and utilizing the available resources, you can navigate the process successfully.

Conclusion

Understanding IRS letters from Ogden, Utah, is essential for effectively communicating with the IRS and addressing any tax-related matters. These letters play a vital role in ensuring compliance with tax laws and resolving potential issues. By familiarizing yourself with the different types of letters, their codes, and how to respond, you can navigate the process with confidence and minimize any negative consequences.

Remember that each IRS letter serves a specific purpose, and it’s important to read them carefully to grasp the content and instructions provided. Whether it’s a notice of a tax due, a proposed adjustment, or a request for additional information, each letter requires prompt attention and appropriate action.

Communicating with the IRS requires professionalism, accuracy, and promptness. It’s crucial to respond within the given timeframe, provide accurate information, and maintain clear and concise communication. Seeking assistance from qualified tax professionals can provide invaluable support throughout the process, ensuring that you navigate the complexities of IRS correspondence effectively.

Remember to utilize the resources available to you, such as the IRS website, online tools, and local IRS offices. These resources can provide valuable guidance, answers to frequently asked questions, and access to personalized assistance.

In conclusion, responding to IRS letters from Ogden, Utah, may initially seem overwhelming, but with the right knowledge, preparation, and support, you can effectively address tax-related matters and ensure compliance with tax laws. By proactively understanding the letters, seeking professional guidance as needed, and utilizing available resources, you can navigate the process with confidence and achieve a favorable outcome.