Finance

What Is IRS Letter 2645C?

Published: October 31, 2023

Discover what IRS Letter 2645C means and how it impacts your finances. Gain clarity on this important document and its implications for tax obligations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of taxes and finance! We all know that dealing with the Internal Revenue Service (IRS) can be a daunting task. Tax forms, audits, and letters from the IRS can cause anxiety and confusion for many taxpayers. One such letter that often raises questions is IRS Letter 2645C.

IRS Letter 2645C is a correspondence sent by the IRS to taxpayers to address specific issues or seek additional information regarding their tax return or financial situation. It is important to understand the purpose and content of this letter to ensure compliance with IRS regulations and avoid potential penalties or fines.

In this article, we will delve into the background, purpose, and key information included in IRS Letter 2645C. We will also discuss the actions required by the recipient of this letter and address some common issues that can be resolved through this correspondence. Additionally, we will provide answers to some frequently asked questions about IRS Letter 2645C to help you navigate through this process smoothly.

So, let’s dive in and unravel the mysteries of IRS Letter 2645C!

Background of IRS Letter 2645C

To understand the significance of IRS Letter 2645C, it is important to grasp the context in which it is issued. The IRS is responsible for enforcing tax laws and regulations in the United States, ensuring that taxpayers are compliant and fulfilling their tax obligations. As part of their oversight, the IRS conducts audits and reviews the information provided on tax returns to identify discrepancies or potential issues.

IRS Letter 2645C is a specific type of correspondence that the IRS uses to communicate with taxpayers when they require additional information or clarification regarding their tax return. This letter is not a cause for alarm but rather a means for the IRS to gather necessary details to complete their review and ensure accuracy in the taxpayer’s filing.

It is important to note that the IRS generates Letter 2645C through an automated system, which means that not all taxpayers will receive this letter. The issuance of this letter typically follows a review or audit of the taxpayer’s return that has identified discrepancies or missing information that needs to be addressed.

By providing this background information, individuals who receive IRS Letter 2645C can better understand its purpose and approach it with confidence. It is crucial to respond to this letter in a timely manner and provide the requested information to avoid further scrutiny or potential penalties from the IRS.

Purpose of IRS Letter 2645C

The primary purpose of IRS Letter 2645C is to request additional information or clarification from the taxpayer regarding their tax return. When the IRS identifies discrepancies or missing information during their review or audit process, they will issue this letter to gather the necessary details to complete their assessment.

IRS Letter 2645C serves as a formal communication tool, enabling the IRS to obtain accurate and complete information from the taxpayer. The requested information typically relates to specific items on the tax return that require further explanation or documentation. By requesting this additional information, the IRS can ensure that the taxpayer’s return is evaluated correctly and in accordance with applicable tax laws and regulations.

It is important to understand that receiving IRS Letter 2645C does not imply wrongdoing or indicate that the taxpayer is under investigation. Instead, it is a routine step in the IRS’s review process to gather the necessary details to finalize the assessment of the taxpayer’s return.

Responding to IRS Letter 2645C in a timely and accurate manner is crucial. Ignoring or delaying a response can lead to further scrutiny from the IRS and potential penalties for non-compliance. By promptly providing the requested information, taxpayers can facilitate the review process and ensure that their tax return is resolved accurately and efficiently.

It is essential to note that communication with the IRS should be handled cautiously and professionally. If the recipient of IRS Letter 2645C is unsure about the requested information or how to respond, seeking professional tax advice or consulting with a tax professional is recommended.

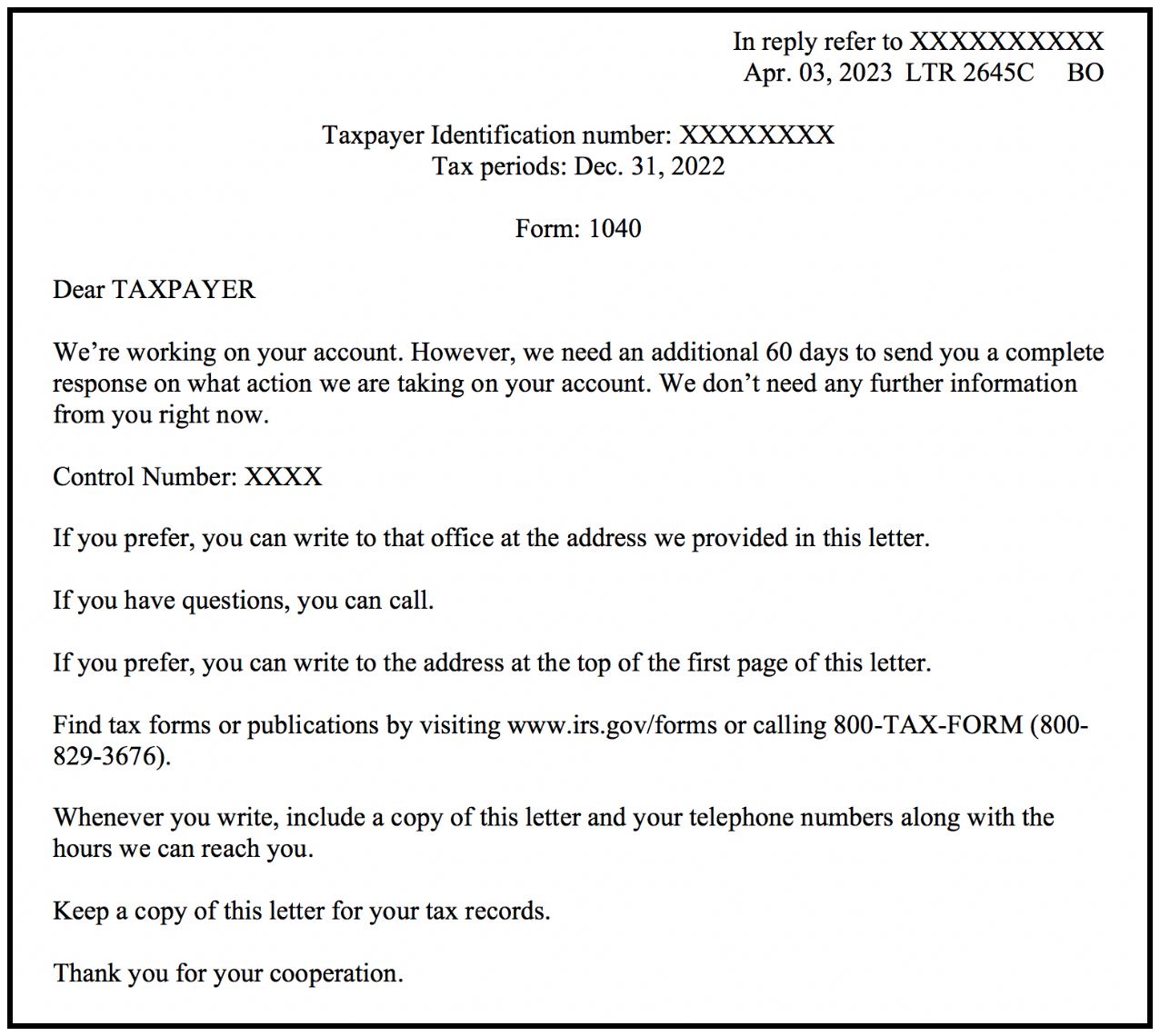

Key Information Included in IRS Letter 2645C

When you receive IRS Letter 2645C, it is important to carefully read and understand the information provided. The letter contains specific details that will help you respond appropriately and address the concerns raised by the IRS. Here are some key pieces of information typically included in IRS Letter 2645C:

- Reference number: The letter will have a reference number, usually indicated at the top or bottom of the page. This reference number is unique to your case and should be used in any correspondence with the IRS regarding the letter.

- Issue or concern: The letter will clearly state the specific issue or concern identified by the IRS during their review or audit of your tax return. This could be related to deductions, income reporting, or any other aspect of your return that requires further explanation or documentation.

- Requested information: IRS Letter 2645C will specify the exact information or documentation that the IRS is seeking from you. It could be copies of specific documents, explanations for certain entries on your return, or any other details necessary to resolve the issue indicated in the letter.

- Response deadline: The letter will also include a deadline by which you must provide the requested information to the IRS. It is crucial to adhere to this deadline to avoid further complications or penalties. If you need more time, it is advisable to contact the IRS and request an extension.

- Contact information: The letter will provide contact information, such as a phone number or address, where you can reach the IRS representative handling your case. If you have any questions or need clarification about the requested information, this is the contact information you should use.

- Consequences of non-compliance: Lastly, IRS Letter 2645C may also outline the potential consequences of not providing the requested information by the deadline. This could include penalties, further review of your return, or other actions that the IRS may take to resolve the issue.

By carefully reviewing and understanding the key information provided in IRS Letter 2645C, you can ensure that you respond appropriately and address the concerns raised by the IRS. If you have any doubts or require assistance, don’t hesitate to reach out to the IRS representative designated in the letter or consult with a tax professional for guidance.

Actions Required by the Recipient of IRS Letter 2645C

Receiving IRS Letter 2645C indicates that the IRS requires additional information or clarification regarding your tax return. It is important to take prompt action and fulfill the IRS’s requests to ensure compliance and resolve any outstanding issues. Here are the actions typically required by the recipient of IRS Letter 2645C:

- Read the letter carefully: Start by reading the letter thoroughly to understand the specific issue or concern raised by the IRS. Take note of the requested information, the deadline to respond, and any consequences mentioned if the requested information is not provided on time.

- Gather the requested information: Next, gather all the requested information specified in the letter. This could include supporting documents, explanations for specific entries on your tax return, or any other evidence that will help address the concerns raised by the IRS.

- Prepare a comprehensive response: Draft a clear and concise response that addresses each point raised in IRS Letter 2645C. Provide the requested information, explanations, or any other documentation that will help the IRS understand and evaluate your tax return accurately.

- Respond within the given deadline: It is crucial to respond to IRS Letter 2645C within the timeframe given. Failing to respond on time can lead to further complications and potential penalties. If you require more time due to exceptional circumstances, contact the IRS and request an extension.

- Keep copies of all correspondence: Make copies of all documents, letters, and any other communication related to IRS Letter 2645C. This will serve as a record of your communication with the IRS and can be useful for future reference.

- Send your response via certified mail: When sending your response to the IRS, it is recommended to use certified mail with a return receipt. This provides proof of delivery and ensures that your response reaches the IRS within the specified deadline.

- Follow up if needed: After submitting your response, it is advisable to follow up with the IRS to confirm receipt and inquire about the status of your case. This can help ensure that your response has been received and is being processed.

By taking these necessary actions, you can effectively address the concerns raised by the IRS in IRS Letter 2645C. Remember to be thorough, accurate, and timely in your response to minimize any potential complications and maintain compliance with IRS regulations.

Common Issues Addressed by IRS Letter 2645C

IRS Letter 2645C can address a variety of issues related to your tax return. Here are some common issues that this letter may seek to address:

- Missing or incomplete information: The IRS may have identified missing or incomplete information on your tax return. This could include omitted income, deductions, or credits that require further explanation or documentation.

- Data entry errors: IRS Letter 2645C may be issued if the IRS identified errors in the data entry on your tax return. These errors could include incorrect Social Security numbers, misreported income figures, or other input mistakes.

- Discrepancies with third-party information: If the information reported on your tax return does not match the data received from third parties, such as employers, financial institutions, or other sources, the IRS may issue Letter 2645C to seek clarification and resolve any discrepancies.

- Validation of claimed deductions or credits: If you claimed certain deductions or credits on your tax return that require substantiation or further documentation, the IRS may request additional information to verify their eligibility and ensure proper compliance.

- Verification of claimed dependents: IRS Letter 2645C may address concerns related to the claimed dependents on your tax return. The IRS may request proof of the dependents’ relationship to you, such as birth certificates or adoption papers.

- Resolution of math errors: In some cases, the IRS may identify math errors or miscalculations on your tax return. Letter 2645C may be issued to request clarification or correction of these errors.

These are just a few examples of the common issues that IRS Letter 2645C can address. It is important to carefully review the letter to understand the specific issue raised by the IRS and provide the necessary information to resolve it. If you are unsure about how to address the issue or require further clarification, seeking professional tax advice or consulting with a tax professional is advisable.

Frequently Asked Questions about IRS Letter 2645C

Receiving IRS Letter 2645C can bring about numerous questions and concerns. To help address them, here are some frequently asked questions about this letter:

- What should I do if I receive IRS Letter 2645C?

- What happens if I don’t respond to IRS Letter 2645C?

- Can I request an extension to respond to IRS Letter 2645C?

- What if I don’t have the requested information?

- Will receiving IRS Letter 2645C trigger an audit?

- Can I seek professional help when responding to IRS Letter 2645C?

- What if I disagree with the issue raised in IRS Letter 2645C?

- How long does it take for the IRS to resolve my case after I respond to IRS Letter 2645C?

If you receive this letter, carefully read it and understand the issue raised by the IRS. Gather the requested information and respond within the given deadline, providing a comprehensive and accurate explanation.

Failure to respond to IRS Letter 2645C can lead to further complications and potential penalties. It is crucial to address the concerns raised by the IRS and provide the requested information within the given deadline.

Yes, if you need more time to gather the requested information or encounter exceptional circumstances, you can contact the IRS and request an extension. It is advisable to do so before the original deadline mentioned in the letter.

If you don’t have the requested information, consider reaching out to the IRS representative mentioned in the letter to explain the situation. They may be able to provide guidance or offer alternative solutions.

Receiving this letter does not necessarily mean that you are being audited. It is often a routine step in the IRS’s review process to gather additional information or clarification regarding your tax return.

Absolutely. If you have any doubts, concerns, or need assistance in responding to IRS Letter 2645C, it is advisable to seek professional tax advice or consult with a tax professional. They can provide guidance and ensure that your response is accurate and compliant.

If you believe there is an error or misunderstanding regarding the issue raised by the IRS, it is important to respond to the letter and provide a detailed explanation of your position. Supporting documentation or evidence can be included to substantiate your claims.

The timeframe for resolving your case after responding to IRS Letter 2645C can vary depending on various factors. It is best to follow up with the IRS representative mentioned in the letter to inquire about the expected timeline and any further steps required.

It is important to note that while these FAQs cover common concerns, each situation can differ. If you have specific questions or unique circumstances related to IRS Letter 2645C, consulting with a tax professional or directly contacting the IRS for guidance is recommended.

Conclusion

IRS Letter 2645C can initially cause concern and confusion for taxpayers. However, understanding its purpose, key information, and necessary actions can help navigate this process with confidence.

Remember, receiving IRS Letter 2645C does not imply wrongdoing or an audit. It is merely a request for additional information or clarification regarding your tax return. By promptly and accurately responding to the letter, you can ensure compliance with IRS regulations and resolve any outstanding issues effectively.

Take the time to carefully read the letter, gather the requested information, and provide a comprehensive response by the given deadline. Seek professional tax advice or consult with a tax professional if you need guidance or have specific concerns.

Addressing the concerns raised by the IRS in a timely and accurate manner will help minimize potential penalties and ensure that your tax return is evaluated accurately. Remember to maintain copies of all correspondence and follow up with the IRS as needed to stay informed about the status of your case.

Dealing with the IRS can be intimidating, but by understanding the process and taking the necessary actions, you can navigate through IRS Letter 2645C and resolve any outstanding issues. Stay proactive, stay compliant, and reach out for help when needed to ensure a smooth resolution.