Finance

What Is The Cash Flow 101 System

Published: December 21, 2023

Learn how the Cash Flow 101 System can improve your financial knowledge and skills. Explore the world of finance and gain valuable insights with this educational tool.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of personal finance and wealth building! If you are looking for a comprehensive system that can help you understand the fundamentals of finance and provide you with the tools to achieve financial independence, then the Cash Flow 101 system is for you.

Designed by renowned investor and author, Robert Kiyosaki, the Cash Flow 101 system offers a unique approach to learning about money and investing. It is not just a game, but an interactive experience that teaches you how to manage your finances, make smart investment decisions, and ultimately achieve financial freedom.

In today’s fast-paced and ever-changing financial landscape, it is more important than ever to have a solid understanding of how money works. Whether you are a student, a professional, or someone looking to retire comfortably, the Cash Flow 101 system provides a valuable education that can help you navigate the complexities of the financial world.

In this article, we will explore the basics of the Cash Flow 101 system, including how it works, its key concepts and terminology, and strategies for building wealth. We will also discuss common mistakes to avoid and the importance of financial education in today’s society.

So, get ready to embark on a journey of financial enlightenment as we delve into the world of the Cash Flow 101 system.

Overview of the Cash Flow 101 System

The Cash Flow 101 system is a financial education tool created by Robert Kiyosaki as a way to teach individuals the principles of wealth creation and financial independence. It is designed to help players gain a deep understanding of financial concepts such as cash flow, assets, liabilities, and investing.

At its core, the Cash Flow 101 system is a board game that simulates real-life financial scenarios. Players start with a predetermined occupation and a fixed salary that represents their primary source of income. They then navigate through the game by making financial decisions and investments.

The main objective of the Cash Flow 101 game is to transition from the “Rat Race” to the “Fast Track” quadrant of the game board. The Rat Race quadrant represents the cycle where individuals work for money, often relying on a single source of income and struggling to make ends meet. The Fast Track quadrant, on the other hand, symbolizes financial freedom achieved through passive income and smart investments.

By playing the Cash Flow 101 game, participants learn the importance of generating passive income through investments rather than solely relying on earned income. They gain an understanding of the difference between assets and liabilities, and how to use debt strategically to build wealth.

One of the unique aspects of the Cash Flow 101 system is its ability to mimic real-life financial situations. Players encounter unexpected expenses, market fluctuations, and investment opportunities, forcing them to make calculated decisions to overcome challenges and maximize their financial gain.

Moreover, the Cash Flow 101 system fosters a mindset shift when it comes to money and investing. It encourages players to think long-term, focus on building assets, and seek financial opportunities that generate passive income. This shift in mindset is crucial for individuals looking to break free from the cycle of living paycheck to paycheck and create a solid financial foundation for themselves.

Now that we have a general understanding of the Cash Flow 101 system, let’s delve deeper into the key concepts and terminology used in the game.

Understanding the Cash Flow Quadrant

The Cash Flow Quadrant is a fundamental concept in the Cash Flow 101 system that categorizes individuals into four distinct groups based on their primary source of income and their approach to wealth creation.

On the left side of the quadrant, we have the E and the S, which represent the Employee and the Self-Employed categories. These individuals primarily earn money by exchanging their time and skills for a paycheck. They typically have a linear income, meaning they only earn money when they are actively working.

On the right side of the quadrant, we have the B and the I, which stand for the Business Owner and the Investor. These individuals generate income through assets, businesses, and investments. They focus on building systems and leveraging their resources to generate passive income and wealth.

The Cash Flow Quadrant illustrates the different mindsets and approaches to wealth creation. Those in the E and S categories often have a limited ability to control their income and are more dependent on working actively to generate money. They often face time constraints and may struggle to achieve financial freedom.

In contrast, those in the B and I categories have the potential to build wealth more effectively. Business Owners can create systems and leverage the efforts of others to generate income, while Investors can grow their wealth through strategic investments that provide passive income streams.

The Cash Flow 101 system emphasizes the importance of moving from the left side of the quadrant to the right side. By transitioning from being an Employee or Self-Employed individual to becoming a Business Owner or Investor, one can break free from the limitations of active income and achieve financial independence.

This shift requires a change in mindset and a commitment to learning and implementing sound financial strategies. The Cash Flow 101 system provides players with the tools and knowledge they need to make this transition by challenging them to make strategic financial decisions that align with the principles of the right side of the quadrant.

By gaining a deep understanding of the Cash Flow Quadrant and the advantages of being on the right side, players can develop a roadmap to financial freedom and start making meaningful changes in their financial lives.

Now that we have explored the Cash Flow Quadrant, let’s discuss the importance of financial education in the pursuit of wealth creation.

The Importance of Financial Education

Financial education is the foundation for building a solid financial future. It empowers individuals with the knowledge and skills necessary to make informed decisions about money, investments, and wealth creation. In the context of the Cash Flow 101 system, financial education plays a crucial role in helping players navigate the game effectively and develop a winning strategy.

One of the key reasons why financial education is important is because it provides individuals with a deeper understanding of how money works. Many people grow up without receiving formal education on personal finance, leading to a lack of knowledge about basic financial concepts such as budgeting, saving, and investing. This knowledge gap can result in poor financial decisions and a cycle of financial struggle.

By investing in financial education, individuals can gain the knowledge they need to make informed financial decisions. They can learn the importance of budgeting, saving for emergencies, and investing for the future. This knowledge can empower them to take control of their finances, reduce financial stress, and work towards their long-term financial goals.

Financial education also helps individuals avoid common financial pitfalls and scams. With the rise of fraudulent investment schemes and misleading financial advice, it is crucial to be equipped with the knowledge to discern between legitimate opportunities and fraudulent schemes. Financial education provides individuals with the tools to protect themselves and their hard-earned money.

In addition, financial education fosters a mindset shift when it comes to money. It encourages individuals to adopt a proactive and goal-oriented approach to their finances. Instead of simply earning and spending money, individuals with financial education understand the importance of building assets, generating passive income, and working towards long-term financial security.

The Cash Flow 101 system recognizes the significance of financial education by immersing players in a learning experience that goes beyond traditional textbooks. It provides a hands-on, interactive environment where players can learn through practice and experience. This approach allows players to develop practical skills and gain a deeper understanding of financial concepts that they can apply in real life.

Ultimately, financial education is not just about playing the Cash Flow 101 game or acquiring knowledge for the sake of it. It is about empowering individuals to take control of their financial lives, make informed decisions, and work towards achieving financial independence. It is an investment that has the potential to provide lifelong benefits and open doors to a brighter financial future.

Now that we understand the importance of financial education, let’s explore how the Cash Flow 101 system works and its key components.

How the Cash Flow 101 System Works

The Cash Flow 101 system is a unique and interactive tool designed to teach financial concepts and strategies through gameplay. It provides players with a hands-on experience that simulates real-life financial scenarios, allowing them to learn and apply financial principles in a practical and engaging manner.

The game consists of a game board, playing cards, and play money. Players start by selecting a profession and receiving a set amount of income from that profession. The objective is to increase their cash flow and move from the “Rat Race” quadrant to the “Fast Track” quadrant on the game board.

Players take turns rolling the dice and moving their game piece around the board. They encounter various spaces that represent different financial events and decisions. Players draw cards that present opportunities such as investments, expenses, or passive income streams.

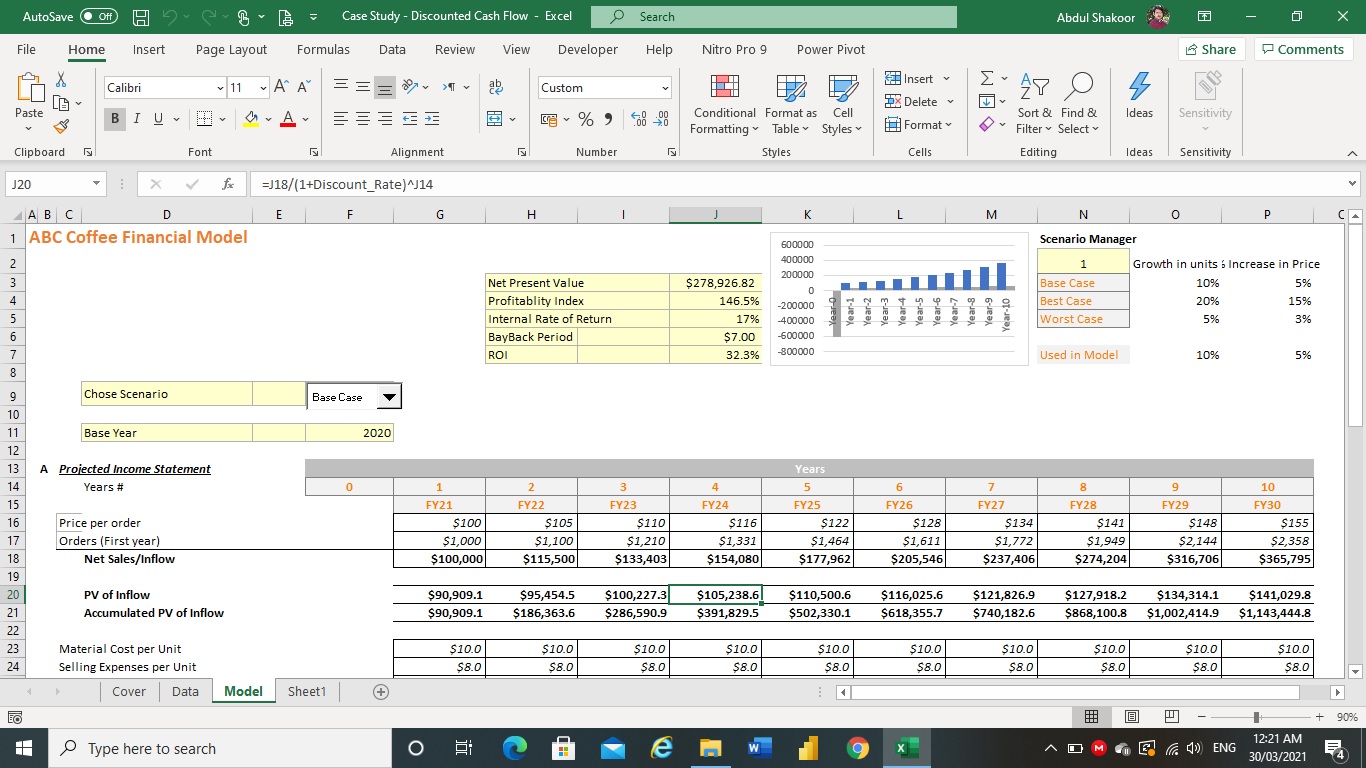

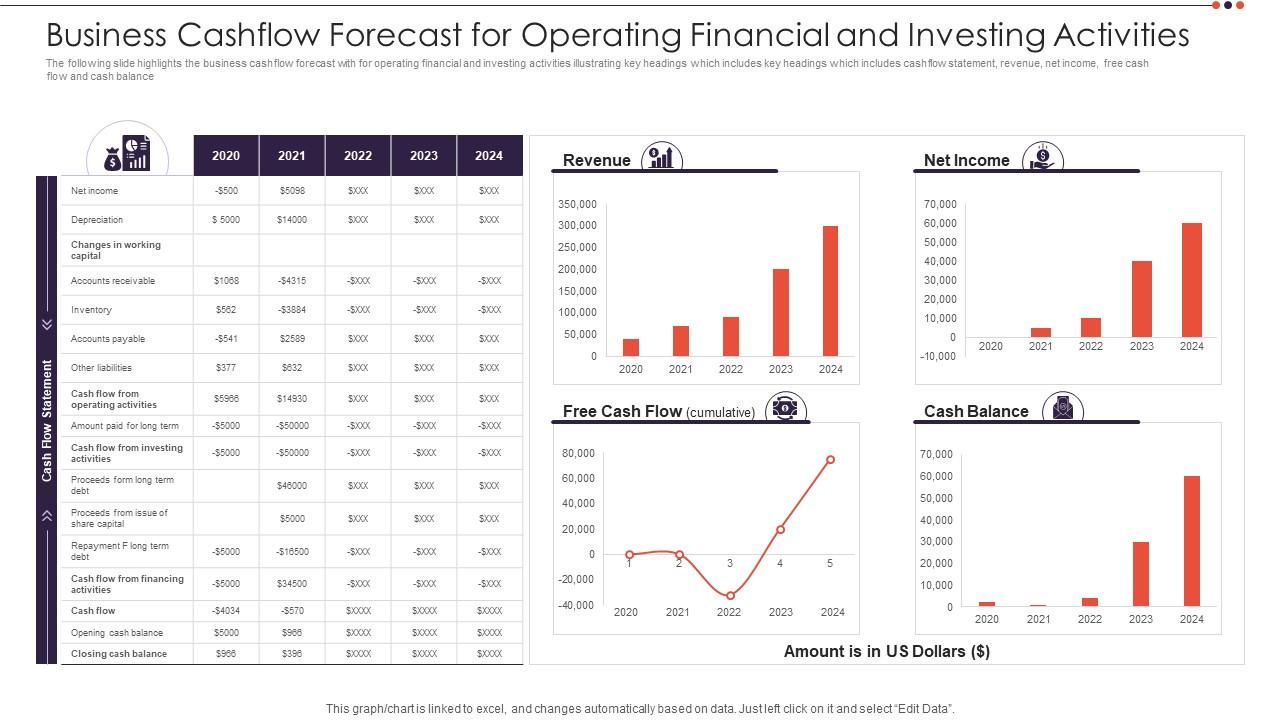

Throughout the game, players learn important financial concepts such as cash flow, assets, liabilities, and investing. They become familiar with terms like passive income, capital gains, and financial statements. This immersive gameplay experience helps players develop financial literacy and gain a deeper understanding of how money works in the real world.

The Cash Flow 101 system also emphasizes the importance of strategic decision-making and critical thinking. Players must analyze their financial situation, evaluate the risks and rewards of different opportunities, and make choices that will maximize their cash flow and wealth accumulation.

One of the key components of the Cash Flow 101 system is the concept of passive income. Players learn that relying solely on earned income from their profession may limit their financial growth and independence. Instead, they are encouraged to invest in assets that generate passive income, such as rental properties, stocks, or businesses. This shifts their focus from trading time for money to creating multiple streams of income.

Another important aspect of the Cash Flow 101 system is the concept of managing cash flow effectively. Players learn how to budget, save, and prioritize expenses. They also learn the importance of managing debt strategically and distinguishing between good debt (that can generate income) and bad debt (that drains financial resources).

Overall, the Cash Flow 101 system provides a dynamic and engaging learning experience that allows players to develop the skills and knowledge necessary for financial success. It encourages players to adopt a proactive approach to personal finance, understand the power of passive income, and make informed decisions that align with their long-term financial goals.

Now that we understand how the Cash Flow 101 system works, let’s delve deeper into some of the key concepts and terminology used in the game.

Key Concepts and Terminology

The Cash Flow 101 system introduces players to a variety of key concepts and terminology that are fundamental to understanding and navigating the world of personal finance. These concepts provide the foundation for making sound financial decisions and building wealth. Let’s explore some of the key concepts and terminology used in the Cash Flow 101 game:

- Cash Flow: Cash flow refers to the movement of money into and out of one’s financial accounts. It represents the net income or loss generated from all income sources and expenses.

- Assets: Assets are resources or investments that have value and can generate income. Examples include real estate, stocks, businesses, and intellectual property.

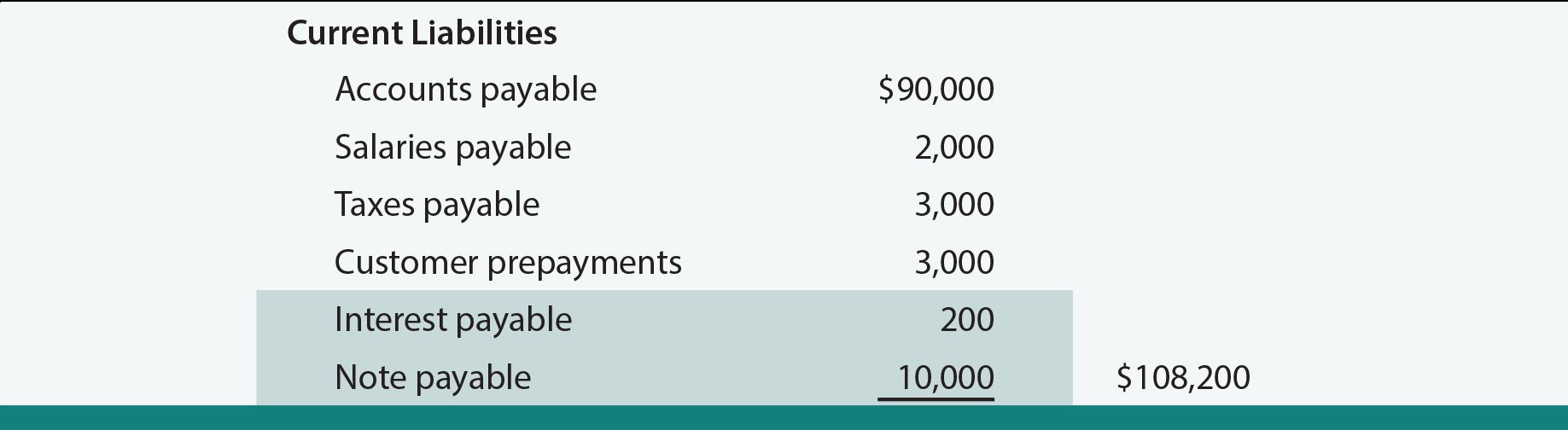

- Liabilities: Liabilities are financial obligations or debts that one owes to others. Examples include mortgages, credit card debt, and loans.

- Passive Income: Passive income is income that is generated from investments or business activities in which one does not need to actively work. It is earned on an ongoing basis with minimal effort.

- Active Income: Active income refers to income that is earned through active work or employment. This includes salaries, wages, and earnings from self-employment.

- Cash Flow Quadrant: The Cash Flow Quadrant categorizes individuals into four groups based on their primary source of income and approach to wealth creation – Employee (E), Self-Employed (S), Business Owner (B), and Investor (I).

- Capital Gains: Capital gains refer to the profits generated from the sale of an asset (e.g., stocks, real estate) at a higher price than its original cost. It is the difference between the purchase price and the selling price.

- Financial Statement: A financial statement is a document that provides information about an individual’s or a company’s financial status. It includes elements such as income, expenses, assets, and liabilities.

- Dividends: Dividends are a portion of a company’s profits that are distributed to its shareholders as a form of income. They are typically paid out regularly and can be received by investors who hold stocks in that company.

- Good Debt: Good debt refers to debt that is utilized to acquire assets or investments that have the potential to generate income or appreciate in value. It can be seen as an investment in one’s financial future.

These are just a few of the key concepts and terminology that players will encounter and learn in the Cash Flow 101 game. Understanding these concepts is crucial for making informed financial decisions and developing a solid foundation for wealth building.

Now, let’s explore how players can actively engage with the Cash Flow 101 system by playing the game and applying the strategies for building wealth.

Playing the Cash Flow 101 Game

Playing the Cash Flow 101 game is an immersive and interactive experience that allows players to apply financial concepts and strategies in a simulated real-life setting. It provides a hands-on approach to learning and mastering the principles of wealth creation. Here’s how you can actively engage with the Cash Flow 101 system:

1. Set up the game: Gather the game board, playing cards, play money, and game pieces. Assign each player a profession and starting income. Ensure that all players have a clear understanding of the game rules and objectives.

2. Roll the dice: Players take turns rolling the dice and moving their game pieces along the board. The spaces they land on will present different financial events, opportunities, or expenses.

3. Make financial decisions: As players progress through the game, they will encounter various opportunities to invest, make purchases, or engage in business ventures. These decisions require careful analysis of risks, rewards, and potential cash flow impact.

4. Manage income and expenses: Players must keep track of their income and expenses throughout the game. They need to budget wisely, ensure they have enough cash flow to cover expenses, and constantly evaluate their financial situation.

5. Focus on cash flow and assets: The game emphasizes the importance of generating passive income and acquiring assets. Players should actively seek opportunities to increase their cash flow and invest in assets that can generate long-term wealth.

6. Adapt to changing circumstances: Players will encounter unexpected events, market fluctuations, and financial challenges. It is important to adapt and make strategic decisions to overcome these obstacles and minimize their impact on cash flow.

7. Learn from the game: The Cash Flow 101 game provides valuable insights and lessons about money, finance, and investing. Actively reflect on the decisions made during the game and identify strategies that were successful or could be improved upon.

8. Apply the knowledge in real life: The ultimate goal of playing the Cash Flow 101 game is to apply the knowledge and strategies learned in real life. Take what you’ve learned about cash flow management, asset acquisition, and generating passive income, and apply it to your personal financial journey.

Playing the Cash Flow 101 game is not just about winning or losing; it’s about gaining practical skills, knowledge, and a new mindset toward money and wealth. By actively engaging with the game and applying the strategies, players can develop financial literacy, make more informed financial decisions, and work towards achieving financial independence.

Now, let’s delve into some effective strategies for building wealth that can be applied both in the Cash Flow 101 game and in real life.

Strategies for Building Wealth

Building wealth requires a combination of sound financial strategies, disciplined planning, and a long-term perspective. In the Cash Flow 101 game and in real life, implementing effective strategies can help set you on the path to financial independence. Here are some key strategies for building wealth:

1. Increase cash flow: Focus on increasing your cash flow by exploring opportunities for additional income streams. This could include investing in assets that generate passive income, starting a side business, or acquiring new skills to increase your earning potential.

2. Prioritize saving and investing: Develop a habit of saving a portion of your income and investing it wisely. Set aside a percentage of your earnings each month and allocate it towards investments that have the potential to grow over time.

3. Diversify your investments: Spread your investments across different asset classes to reduce risks and optimize returns. Consider investing in stocks, real estate, bonds, and mutual funds to create a well-rounded investment portfolio.

4. Minimize debt: Manage your debt effectively by paying down high-interest debts and avoiding unnecessary borrowing. Focus on reducing outstanding balances and utilize low-interest debt strategically, such as leveraging it for investment opportunities.

5. Educate yourself: Continuously improve your financial literacy by reading books, attending seminars, and seeking out educational resources. The more you know about personal finance, investing, and wealth creation, the better equipped you’ll be to make informed decisions.

6. Embrace long-term thinking: Building wealth is a marathon, not a sprint. Develop a long-term mindset and resist the temptation for short-term gains or get-rich-quick schemes. Stay committed to your financial goals and be patient as your investments grow over time.

7. Seek professional guidance: Consider consulting with a financial advisor or wealth management expert who can provide personalized advice and help you develop a comprehensive wealth-building plan. They can assist in devising strategies tailored to your specific financial situation and goals.

8. Continuously evaluate and adjust: Regularly review your financial progress and reassess your strategies. As your circumstances change and market conditions fluctuate, it’s essential to adapt your approach to ensure it remains aligned with your long-term objectives.

Implementing these strategies can set you on a path to building wealth in the Cash Flow 101 game and in real life. By focusing on increasing cash flow, saving and investing, managing debt, and continually educating yourself, you can pave the way for long-term financial success.

Now, let’s discuss some common mistakes to avoid as you embark on your journey toward wealth creation.

Common Mistakes to Avoid

As you strive to build wealth, it’s important to be aware of common mistakes that can hinder your progress. Avoiding these pitfalls can help you stay on track and maximize your financial success. Here are some common mistakes to avoid:

1. Neglecting financial education: Failing to invest in your financial education can limit your understanding of key concepts and strategies. Without sufficient knowledge, you may make suboptimal financial decisions and miss out on valuable opportunities.

2. Living beyond your means: Overspending or accumulating unnecessary debt can derail your wealth-building efforts. It’s important to live within your means, create a budget, and resist the temptation of excessive consumerism.

3. Lack of diversification: Putting all your eggs in one basket by investing heavily in a single asset or market sector can increase your exposure to risk. Diversify your investments across different asset classes and industries to reduce your vulnerability to market fluctuations.

4. Timing the market: Trying to predict market movements or timing your investments based on short-term fluctuations is often a losing strategy. Instead, focus on long-term investment goals and employ a disciplined approach rather than speculating on short-term market trends.

5. Failing to plan for emergencies: Unexpected expenses and emergencies can significantly impact your financial well-being if you’re not prepared. Build an emergency fund to cover at least six months’ worth of living expenses to protect yourself from unforeseen circumstances.

6. Neglecting risk management: Failing to adequately assess and manage risk can expose you to unnecessary financial vulnerabilities. Understand the risks associated with your investments and implement appropriate risk-management strategies, such as diversification and asset allocation.

7. Ignoring retirement planning: Neglecting to plan for retirement can leave you financially unprepared in your later years. Start saving for retirement early and take advantage of tax-advantaged retirement accounts to ensure a comfortable and secure retirement.

8. Letting emotions drive financial decisions: Allowing fear, greed, or impatience to dictate your financial decisions can lead to costly mistakes. Maintain a rational and disciplined approach when making financial choices, relying on research and analysis rather than emotional impulses.

9. Overlooking tax optimization: Failing to explore tax optimization strategies can result in missed opportunities to minimize your tax burden. Consult with a tax professional to identify legal ways to optimize your tax situation and maximize your after-tax returns.

10. Neglecting regular evaluation: A static approach to managing your finances without regular evaluation and adjustment can impede your progress. Continuously monitor your financial goals and investment strategies, adjusting them as needed to stay on track.

Avoiding these common mistakes can help you build a solid foundation for long-term wealth creation. By prioritizing financial education, living within your means, diversifying your investments, and being proactive in managing risk, you can navigate the path to financial success more effectively.

Now, let’s conclude our exploration of the Cash Flow 101 system and its potential impact on your financial journey.

Conclusion

The Cash Flow 101 system offers a unique and engaging way to learn about personal finance and wealth creation. Through immersive gameplay, players can gain valuable insights into cash flow management, asset acquisition, and the importance of passive income. By actively participating in the game, players can develop essential financial skills and knowledge that can be applied in real-life situations.

Key concepts such as the Cash Flow Quadrant, assets and liabilities, and the power of financial education are introduced in the Cash Flow 101 game. Players learn to think long-term, prioritize saving and investing, and make strategic decisions to optimize their cash flow and build wealth. The game provides a hands-on experience that allows players to actively engage with financial concepts and learn from both successes and setbacks.

Building wealth is not a one-size-fits-all journey, and the strategies for success may vary from person to person. However, some universal principles include increasing cash flow, diversifying investments, managing debt effectively, and continually educating oneself. By avoiding common mistakes and continuously evaluating and adjusting financial strategies, individuals can enhance their chances of achieving long-term financial independence.

Remember that the Cash Flow 101 system is just a starting point. It provides a solid foundation for understanding financial concepts and developing a wealth-building mindset. To achieve lasting financial success, it is crucial to continue learning, seek professional guidance when needed, and adapt to changing circumstances.

So, are you ready to embark on your financial journey with the knowledge and skills acquired from the Cash Flow 101 system? Take the principles you’ve learned, apply them in your life, and stay committed to your long-term financial goals. With dedication, discipline, and a sound financial plan, you can pave the way to financial freedom and build a secure future for yourself and your loved ones.