Finance

What Is Terminal Cash Flow

Modified: February 21, 2024

Learn about terminal cash flow in finance and its importance. Understand how it impacts investment decisions and future profitability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Terminal Cash Flow

- Importance of Terminal Cash Flow

- Components of Terminal Cash Flow

- Calculation of Terminal Cash Flow

- Factors Affecting Terminal Cash Flow

- Terminal Cash Flow in Financial Analysis

- Limitations of Terminal Cash Flow Analysis

- Examples of Terminal Cash Flow Calculation

- Conclusion

Introduction

When it comes to financial analysis and investment evaluation, understanding the concept of terminal cash flow is crucial. Terminal cash flow refers to the estimated cash flow that is expected to occur at the end of a project, investment, or business venture. It represents the cash inflows or outflows that will be generated beyond the forecast horizon.

The terminal cash flow is a significant consideration in financial decision-making as it affects the valuation and profitability of an investment. By estimating the terminal cash flow, investors and analysts can determine the long-term value or viability of a project and make informed decisions about its implementation or continuation.

Terminal cash flow is particularly relevant in capital budgeting decisions, mergers and acquisitions, and other investment scenarios where investors need to assess the potential returns and risks associated with an investment over its entire lifespan.

In this article, we will delve deeper into the concept of terminal cash flow, its importance, the components involved, methods of calculation, factors affecting it, and its role in financial analysis. We will also discuss the limitations of terminal cash flow analysis and provide examples to illustrate its application in real-world scenarios.

Definition of Terminal Cash Flow

The terminal cash flow is the estimated amount of cash inflows or outflows that is projected to occur at the end of a project, investment, or business venture. It represents the cash flows that will be generated beyond the forecast period or the expected life of the investment.

This cash flow is often referred to as the “terminal value” because it indicates the long-term value or profitability of the investment. It takes into account the future cash flows that are expected to be generated beyond the period covered by the financial projections.

The terminal cash flow is crucial in financial analysis as it helps determine the overall value or viability of an investment. It allows investors and analysts to assess the long-term returns, potential risks, and future prospects of a project or investment opportunity.

Terminal cash flow can be either positive or negative, depending on the nature of the investment. In a positive scenario, where the cash inflows exceed the outflows, the terminal cash flow represents the net positive cash flow that will be generated in the future. Conversely, in a negative scenario, where the cash outflows exceed the inflows, the terminal cash flow represents the net negative cash flow that will be incurred.

It is important to note that the terminal cash flow is typically based on estimates and projections, as it involves forecasting the financial performance of the investment beyond the available data and information. These estimates are based on assumptions and factors such as future market conditions, growth rates, competitive dynamics, and other relevant variables.

By considering the terminal cash flow, investors and analysts can have a more comprehensive understanding of the long-term financial prospects and sustainability of an investment. This allows for more informed decision-making and evaluation of the investment’s potential profitability.

Importance of Terminal Cash Flow

The terminal cash flow holds significant importance in financial analysis and investment evaluation for several reasons:

- Estimating Long-Term Value: The terminal cash flow allows investors and analysts to estimate the long-term value or profitability of an investment beyond the forecast period. It provides insight into the potential returns that can be generated in the future, helping to assess the overall value of the investment.

- Considering Future Cash Flows: By incorporating the terminal cash flow, investors can consider the cash inflows or outflows that will occur beyond the available data and projections. This helps in gaining a holistic understanding of the investment’s financial performance and future prospects.

- Assessing Investment Viability: The terminal cash flow helps determine the viability of an investment by considering its long-term financial sustainability. It helps evaluate whether the investment will generate sufficient cash flows to cover costs, provide a return on investment, or achieve profitability over the lifespan of the project.

- Setting Investment Objectives: The terminal cash flow plays a pivotal role in setting investment objectives. It helps investors define their financial goals and expectations for the investment, as it provides insights into the potential long-term cash flows and value creation opportunities.

- Comparing Investment Opportunities: When evaluating multiple investment opportunities, the terminal cash flow allows for a more comprehensive comparison. By considering the estimated cash flows beyond the forecast period, investors can assess and compare the long-term potential returns and risks of different investment options.

- Facilitating Decision-making: The terminal cash flow provides valuable information for decision-making. It assists investors and analysts in making informed choices about whether to proceed with an investment, discontinue it, or modify the strategy to enhance long-term value creation.

By incorporating the terminal cash flow, investors and analysts can make more accurate and informed investment decisions. It provides a clearer view of the long-term financial prospects of an investment, enabling stakeholders to evaluate its attractiveness and potential for generating sustained returns.

Components of Terminal Cash Flow

The terminal cash flow consists of various components that contribute to the overall estimation of the cash flows beyond the forecasted period. These components are:

- Net Cash Flows: The net cash flows represent the difference between the cash inflows and outflows in the terminal period. It takes into account all the revenues, expenses, and taxes that will occur at the end of the investment or project.

- Working Capital Adjustments: Working capital adjustments consider the changes in current assets and liabilities that are expected to happen in the terminal period. It includes adjustments for accounts receivable, inventory, accounts payable, and other working capital items.

- Capital Expenditures: Capital expenditures (CapEx) refer to the investments made in fixed assets, such as property, plant, and equipment, in the terminal period. It includes the cash outflows required for maintaining or expanding the productive capacity of the investment.

- Depreciation: Depreciation represents the reduction in the value of fixed assets over time. In the terminal cash flow, depreciation is considered as a non-cash expense that is added back to the net cash flows, as it does not involve actual cash outflows.

- Tax Provisions: Tax provisions account for the taxes that will be incurred in the terminal period. It takes into consideration the applicable tax rates and regulations to calculate the cash outflows associated with tax payments.

- Discounting Factor: The discounting factor is used to adjust the cash flows occurring in the terminal period to their present value. It takes into account the time value of money and reflects the risk and uncertainty associated with future cash flows.

These components collectively determine the magnitude and nature of the terminal cash flow. While the specific components may vary depending on the nature of the investment or project, analyzing and incorporating these factors is essential for accurately estimating the terminal cash flow.

It is important to note that the estimation of these components involves making assumptions and projections based on available information and industry trends. These estimates may be subject to uncertainties and should be evaluated with caution.

By considering these components, investors and analysts can create a comprehensive picture of the terminal cash flow, allowing them to assess the long-term financial prospects and value creation potential of the investment.

Calculation of Terminal Cash Flow

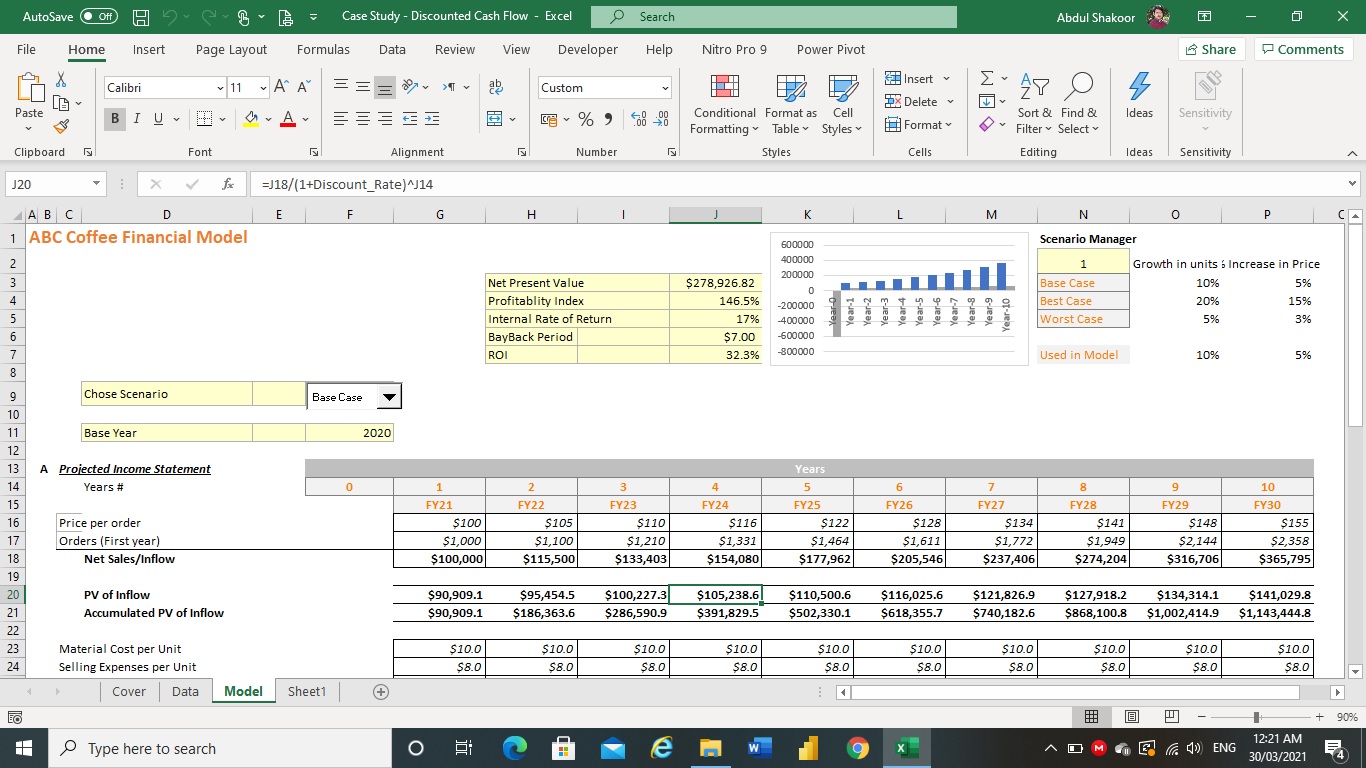

The calculation of the terminal cash flow involves estimating the cash inflows or outflows that will occur at the end of the project or investment. While there are various methods to calculate the terminal cash flow, two commonly used approaches are the perpetuity method and the exit multiple method.

Perpetuity Method: The perpetuity method assumes that the cash flows beyond the forecast period will continue indefinitely at a constant rate. The formula for calculating the terminal cash flow using the perpetuity method is:

Terminal Cash Flow = Cash Flow in Year (n+1) / (Discount Rate – Long-Term Growth Rate)

In this formula, the cash flow in year (n+1) represents the cash flow projected for the first year beyond the forecast period. The discount rate is the required rate of return or the cost of capital, and the long-term growth rate represents the expected growth rate of the cash flows in the perpetuity stage.

Exit Multiple Method: The exit multiple method involves applying a multiple to a relevant financial metric (such as EBITDA, net income, or free cash flow) to estimate the terminal value. The formula for calculating the terminal cash flow using the exit multiple method is:

Terminal Cash Flow = Terminal Value x (1 – Tax Rate)

In this formula, the terminal value is calculated by multiplying the projected financial metric (EBITDA, net income, or free cash flow) by the exit multiple. The tax rate is applied to the terminal value to account for the taxes that will be incurred.

It is essential to determine appropriate assumptions for the cash flow projection, discount rate, long-term growth rate, and exit multiple to ensure accurate calculation of the terminal cash flow. These assumptions are based on factors such as industry trends, market conditions, competitive dynamics, and the specific characteristics of the investment or project.

By using suitable methodologies and making realistic assumptions, investors and analysts can estimate the terminal cash flow effectively. This allows for a more comprehensive evaluation of the investment’s long-term value and profitability.

Factors Affecting Terminal Cash Flow

Several key factors influence the estimation of the terminal cash flow. Understanding these factors is essential for accurately assessing the long-term financial prospects and value creation potential of an investment. The factors that affect the terminal cash flow include:

- Market Conditions: The state of the overall market has a significant impact on the terminal cash flow. Factors such as economic growth, interest rates, inflation, and industry trends can affect the cash flows beyond the forecasted period. A favorable market environment may lead to higher growth rates and more significant cash inflows in the terminal stage.

- Industry Dynamics: The dynamics of the specific industry in which the investment operates can influence the terminal cash flow. Factors such as competition, regulatory changes, technological advancements, and consumer demand can impact the projected cash flows and profitability over the long term.

- Growth Rate: The projected growth rate of the investment is a crucial factor in estimating the terminal cash flow. The growth rate represents the expected increase or decrease in future cash flows beyond the forecasted period. It can be influenced by factors such as market demand, industry trends, and competitive advantages of the investment.

- Cost of Capital: The discount rate or cost of capital used to calculate the present value of the terminal cash flow is an important factor. It reflects the risk associated with the investment and the required rate of return expected by investors. A higher cost of capital can reduce the present value of the terminal cash flow, while a lower cost of capital can increase its value.

- Tax Considerations: Tax provisions play a role in determining the terminal cash flow. The applicable tax rates, tax laws, and tax planning strategies can impact the cash outflows associated with taxes in the terminal stage. It is important to consider the tax implications when estimating the terminal cash flow.

- Competition: The competitive landscape and market positioning of the investment can affect the terminal cash flow. Factors such as market share, pricing power, and competitive advantages can impact the long-term cash flows and profitability of the investment.

- Operational Efficiency: The operational efficiency of the investment or project can impact the terminal cash flow. Factors such as cost management, productivity improvements, and operational optimization can contribute to higher cash flows and profitability in the long term.

- External Factors: External factors such as government policies, geopolitical risks, and environmental regulations can also influence the terminal cash flow. These factors can introduce uncertainties and impact the sustainability and profitability of the investment over the long term.

When estimating the terminal cash flow, it is crucial to carefully analyze and consider these factors. By doing so, investors and analysts can make more accurate projections and evaluations of the investment’s long-term financial performance.

Terminal Cash Flow in Financial Analysis

Terminal cash flow plays a significant role in financial analysis as it provides insights into the long-term value and viability of an investment. It helps investors and analysts assess the potential returns, risks, and sustainability of an investment beyond the forecasted period. Here’s how terminal cash flow is used in financial analysis:

Valuation of Investments: Terminal cash flow is crucial in determining the valuation of an investment. By estimating the cash flows that will occur beyond the forecasted period and discounting them to their present value, investors can assess the overall value and attractiveness of the investment.

Decision-Making: The terminal cash flow assists in making informed investment decisions. By incorporating the estimated cash flows beyond the forecasted period, investors can evaluate the long-term financial prospects and potential risks associated with the investment. This information enables stakeholders to make well-informed choices about whether to proceed with the investment, modify the strategy, or explore alternative options.

Risk Management: Terminal cash flow analysis allows for a more comprehensive evaluation of the risk associated with an investment. By considering the long-term cash flows, investors can assess the potential risks that may arise in the future and incorporate appropriate risk management strategies into their investment decisions.

Comparative Analysis: Terminal cash flow facilitates comparative analysis among different investment opportunities. By considering the estimated cash flows beyond the forecasted period, investors can compare the long-term potential returns, risks, and value creation opportunities of various investment options. This helps in choosing the most promising investment among alternatives.

Assessing Profitability: By incorporating the terminal cash flow, financial analysts can assess the profitability of an investment over its entire lifespan. It helps calculate metrics such as net present value (NPV) and internal rate of return (IRR), which provide insights into the potential returns and profitability of the investment.

Long-Term Planning: Terminal cash flow analysis supports long-term planning and strategic decision-making. By considering the estimated cash flows beyond the forecasted period, investors and analysts can develop robust strategic plans and identify investment opportunities with sustainable long-term growth potential.

Overall, terminal cash flow analysis is a critical component of financial analysis. It provides valuable insights into the long-term value, profitability, and viability of an investment. By considering the cash flows that will occur beyond the forecasted period, investors and analysts can make informed decisions, assess risks, and plan for long-term financial success.

Limitations of Terminal Cash Flow Analysis

While terminal cash flow analysis is a valuable tool in financial analysis, it is important to recognize its limitations. These limitations should be considered when interpreting the results and making investment decisions. Here are some key limitations to keep in mind:

- Uncertainty of Projections: Terminal cash flow analysis relies on assumptions and projections about future cash flows, growth rates, and market conditions. These projections are inherently uncertain and subject to change. Therefore, the accuracy of the terminal cash flow estimate can be affected by unforeseen events or changes in market dynamics.

- Dependency on Assumptions: The accuracy of the terminal cash flow calculation heavily relies on the assumptions made about factors such as growth rates, discount rates, and operating margins. Small variations in these assumptions can significantly impact the estimated terminal cash flow, potentially leading to inaccurate valuations or decisions.

- Market Volatility: Terminal cash flow analysis assumes that market conditions will remain relatively stable over the long term. However, markets can be highly volatile, and unexpected events or economic downturns can significantly impact the projected cash flows and valuations. It is essential to consider the potential impact of market volatility on the terminal cash flow estimate.

- Industry Changes: Industries are subject to rapid changes, technological advancements, and disruptive innovations. These changes can fundamentally alter market dynamics and render the projected cash flows obsolete. It is crucial to consider the potential impact of industry changes on the terminal cash flow and reassess the estimates periodically.

- Failure to Capture Risks: Terminal cash flow analysis may not fully capture all the risks associated with an investment. It primarily focuses on the long-term cash flows, but it may overlook short-term risks or contingencies that could impact the overall profitability or success of the investment. It is important to supplement terminal cash flow analysis with comprehensive risk assessments.

- Timing Issues: Terminal cash flow analysis assumes that the cash flows beyond the forecast period occur at a specific point in time. However, in practice, these cash flows may materialize gradually over an extended period. The timing of the cash flows can impact the present value calculation and the accuracy of the terminal cash flow estimate.

- Limitations of Discounting: Terminal cash flow analysis relies on discounting future cash flows to their present value. However, the choice of discount rate can be subjective, and different rates can yield different valuations. Additionally, discounting may not adequately reflect the true risk or opportunity cost of capital, introducing potential bias in the terminal cash flow estimate.

It is crucial to be aware of these limitations and exercise caution when relying solely on terminal cash flow analysis. It is recommended to supplement this analysis with other valuation methods, sensitivity analysis, and risk assessments to obtain a more comprehensive understanding of the investment’s potential.

Examples of Terminal Cash Flow Calculation

To illustrate how terminal cash flow is calculated, let’s consider a couple of examples:

Example 1: Perpetuity Method

In this example, a company is estimating the terminal cash flow for a project with a forecasted period of 5 years. The cash flow in year 6 is projected to be $500,000. The discount rate is determined as 10%, and the long-term growth rate is estimated at 3%.

Using the perpetuity method formula, the calculation is as follows:

Terminal Cash Flow = $500,000 / (0.10 – 0.03) = $6,250,000

Therefore, the estimated terminal cash flow for this project is $6,250,000.

Example 2: Exit Multiple Method

In this example, an investor is valuing a company using the exit multiple method. The company’s projected EBITDA in the terminal year is $2,000,000, and the chosen exit multiple is 8x. The tax rate is 25%.

The calculation for the terminal cash flow using the exit multiple method is as follows:

Terminal Value = EBITDA x Exit Multiple = $2,000,000 x 8 = $16,000,000

Terminal Cash Flow = Terminal Value x (1 – Tax Rate) = $16,000,000 x (1-0.25) = $12,000,000

Therefore, the estimated terminal cash flow for this company is $12,000,000.

These examples demonstrate how the terminal cash flow can be calculated using different methods. It is important to note that the assumptions, discount rates, and growth rates used in these calculations may differ depending on the specific circumstances of each investment or project.

It is advisable to conduct thorough research, analysis, and due diligence to ensure that the terminal cash flow calculation accurately reflects the unique characteristics and future prospects of the investment.

Conclusion

Terminal cash flow is a fundamental concept in financial analysis that provides valuable insights into the long-term value, viability, and profitability of an investment. By estimating the cash flows that will occur beyond the forecasted period, investors and analysts can make informed decisions, assess risks, and evaluate the financial prospects of an investment.

In this article, we explored the definition of terminal cash flow, its importance, components, calculation methods, factors affecting it, and its role in financial analysis. The terminal cash flow allows stakeholders to estimate the cash inflows or outflows that will occur at the end of a project, investment, or business venture. It enables investors to assess the long-term value, potential returns, and risks associated with an investment.

It is crucial to recognize the limitations of terminal cash flow analysis, such as uncertainty of projections, dependency on assumptions, market volatility, and timing issues. These limitations should be taken into consideration when interpreting the results and making investment decisions. Additionally, it is recommended to supplement terminal cash flow analysis with other valuation methods, risk assessments, and sensitivity analysis.

By incorporating terminal cash flow analysis into financial evaluations, investors can gain a comprehensive understanding of the long-term financial prospects and value creation potential of an investment. It supports decision-making, risk management, comparative analysis, and long-term planning.

Ultimately, the accurate estimation and analysis of terminal cash flow contribute to informed investment decisions and can enhance the likelihood of achieving long-term financial success.