Finance

What Is A 660 Credit Score

Modified: March 6, 2024

Learn about the importance of a 660 credit score in finance and how it can impact your financial decisions. Start building your credit today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

A credit score is a three-digit number that plays a crucial role in financial matters. It provides lenders, landlords, and even insurance companies with a snapshot of an individual’s creditworthiness. Whether you’re applying for a mortgage, car loan, or credit card, your credit score will be a determining factor in the outcome of your application.

Having a good credit score is essential for various reasons. It showcases your financial responsibility, increases your chances of getting approved for loans at favorable interest rates, and can even impact your ability to secure employment or rent a home. On the other hand, a poor credit score can make it challenging to access credit and may result in higher interest rates.

The FICO credit score is the most widely used scoring model in the United States. It ranges from 300 to 850, with higher scores indicating better creditworthiness. While a credit score of 660 may not be considered excellent or perfect, it falls within a range that can still provide access to certain financial opportunities.

In this article, we will delve into the details of a 660 credit score, exploring what it means, its advantages and disadvantages, and provide tips on how to improve and maintain a good credit score.

What is a Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness based on their credit history and financial behavior. It is used by lenders, banks, and other financial institutions to assess the risk of extending credit to a borrower.

Credit scores are calculated by credit bureaus, such as Equifax, Experian, and TransUnion, using various factors such as payment history, credit utilization, length of credit history, new credit accounts, and credit mix. The most commonly used credit scoring model is the FICO score, developed by the Fair Isaac Corporation.

The FICO credit scoring system ranges from 300 to 850, with higher scores indicating better creditworthiness. A credit score above 700 is generally considered good, while a score above 800 is considered excellent. On the other hand, scores below 600 are typically considered fair to poor.

Credit scores are important because they determine whether a lender will approve an individual’s loan application and what terms and interest rates will be offered. Higher credit scores often result in more favorable loan terms and lower interest rates, while lower scores may lead to higher interest rates or outright loan denial.

It is crucial to note that credit scores are dynamic and can change over time based on individual financial behavior. Late payments, high credit card balances, and collections can negatively impact a credit score, while timely payments and responsible credit management can improve it.

Regularly monitoring your credit score and understanding how it is calculated can help you make informed financial decisions, improve your creditworthiness, and secure better loan terms in the future.

Importance of Credit Scores

Credit scores play a vital role in financial matters and have a significant impact on an individual’s financial well-being. Here are some key reasons why credit scores are important:

- Access to Credit: A good credit score is crucial for obtaining credit. Whether you’re applying for a mortgage, car loan, or credit card, lenders often rely on credit scores to assess your creditworthiness. A higher credit score increases your chances of being approved for credit and helps you secure better loan terms and interest rates.

- Loan Approval: When you apply for a loan, lenders evaluate your creditworthiness to determine if they should extend credit to you. A high credit score indicates to lenders that you are responsible with credit and have a lower risk of defaulting on loan payments. This increases the likelihood of loan approval.

- Interest Rates: Credit scores also impact the interest rates you are offered on loans and credit cards. A higher credit score often translates to lower interest rates, resulting in significant savings over the life of a loan. Conversely, borrowers with lower credit scores may face higher interest rates, which can increase the overall cost of borrowing.

- Housing and Rental Applications: Landlords and property managers often consider credit scores when assessing rental applications. A higher credit score demonstrates financial responsibility and increases the chances of being approved for a rental property. It can also result in lower security deposits or rental fees.

- Employment Opportunities: Certain employers may check credit scores as part of the hiring process, particularly for roles that involve financial responsibilities. A poor credit score may raise concerns about an individual’s financial stability or ability to handle money, potentially impacting their chances of securing employment.

- Insurance Premiums: Insurance companies may use credit scores to assess an individual’s risk profile. A lower credit score could lead to higher premiums for auto, home, or other types of insurance coverage. Maintaining a good credit score can help you secure more affordable insurance rates.

Given the wide-ranging impact credit scores have on various aspects of personal finance, it is important to understand your creditworthiness, work on improving your credit score, and maintain responsible credit habits to secure better financial opportunities.

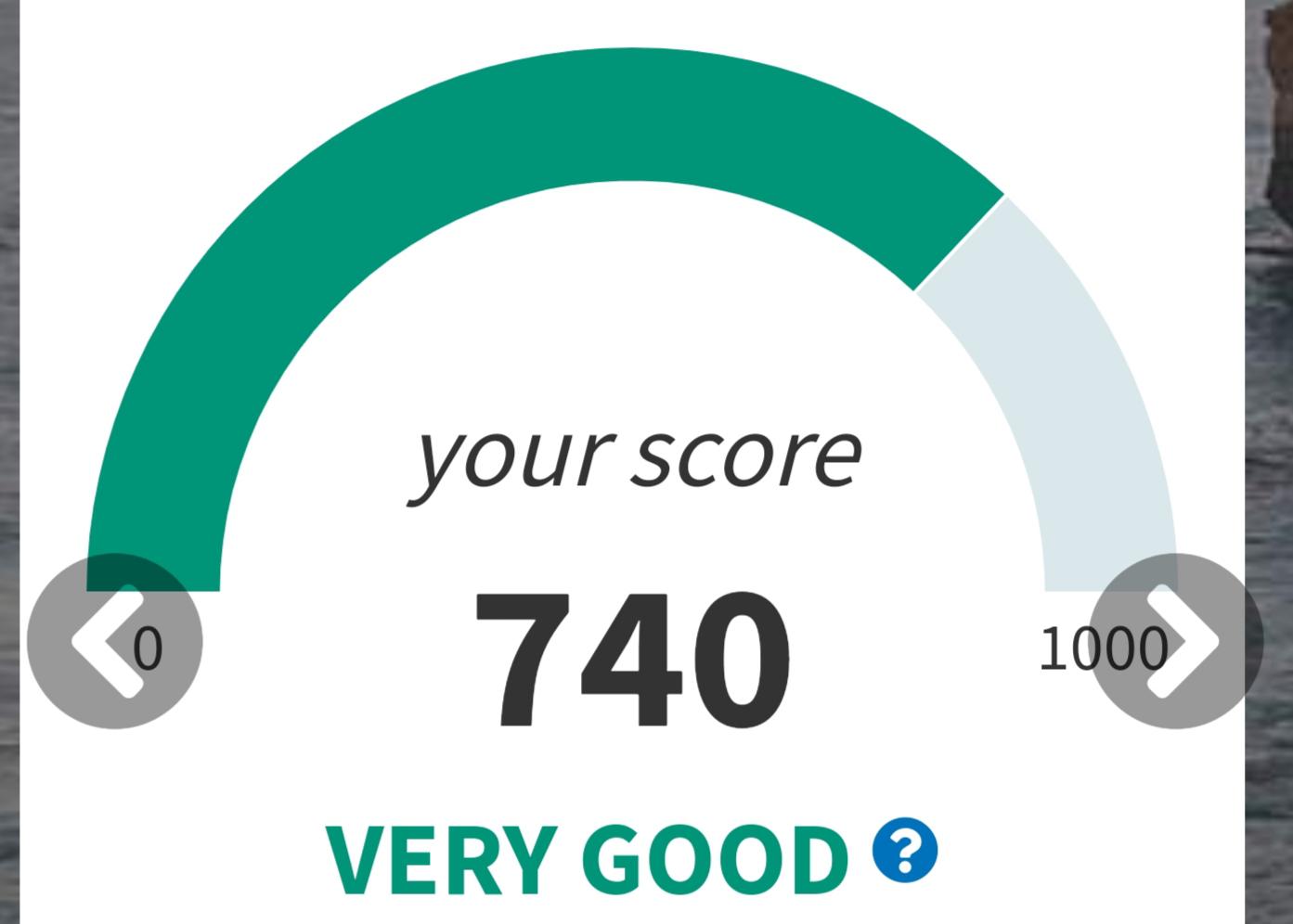

Understanding the FICO Credit Score Range

The FICO credit score range is commonly used by lenders to evaluate an individual’s creditworthiness. Understanding this range can help you gauge where your credit score falls and what it signifies. Here is a breakdown of the FICO credit score range:

- Exceptional (800-850): Individuals in this range have excellent credit and are likely to qualify for the best loan terms and interest rates. They have a demonstrated history of responsible credit management and low credit risk.

- Very Good (740-799): This range indicates a strong credit profile. Borrowers in this range are considered low-risk and are likely to receive favorable loan terms and competitive interest rates.

- Good (670-739): Falling within this range signifies a fairly good credit score. Borrowers in this range are still considered creditworthy, but may not qualify for the most favorable loan terms and may face slightly higher interest rates.

- Fair (580-669): Credit scores in this range indicate some degree of credit risk. While borrowers may still access credit, they might encounter challenges in obtaining credit approval or may be offered less favorable loan terms and higher interest rates.

- Poor (300-579): This range reflects significant credit issues and poses higher credit risk. Borrowers with scores in this range may struggle to secure credit, and if approved, they may face limited options and higher interest rates.

It’s important to note that while FICO is the most widely used credit scoring model, there are alternative scoring models utilized by some lenders. These models may have different credit score ranges and criteria for assessing creditworthiness.

Monitoring your credit score regularly allows you to track your progress and identify areas for improvement. If your credit score falls below the desired range, there are steps you can take to improve it, such as making timely payments, reducing credit card balances, and maintaining a healthy credit utilization ratio.

Understanding the FICO credit score range gives you a better perspective on how lenders view your creditworthiness. By striving for a higher credit score, you can position yourself for better financial opportunities and more favorable loan terms.

What Does a 660 Credit Score Indicate?

A credit score of 660 falls within the “fair” range of the FICO credit score scale. While it may not be considered excellent or perfect, a 660 credit score still offers certain advantages and indicates a moderate level of creditworthiness.

Here’s what a 660 credit score generally indicates:

- Access to Credit: With a credit score of 660, you can typically access credit, including loans and credit cards. However, your options may be more limited compared to those with higher credit scores. Lenders may offer you credit at higher interest rates or with more stringent terms to account for the perceived risk.

- Moderate Credit Risk: A 660 credit score suggests that you have a moderate level of credit risk. Lenders may view you as someone who has the potential to make payments on time but may have some past credit issues or inconsistencies in your credit history.

- Some Derogatory Marks: A credit score of 660 may indicate the presence of some derogatory marks on your credit report, such as late payments, collections, or high credit utilization. It is essential to review your credit report regularly to identify and address any negative items that could be impacting your credit score.

- Room for Improvement: While a 660 credit score is not terrible, there is still room for improvement. By focusing on improving your credit habits, such as making timely payments, reducing debt, and maintaining a low credit utilization ratio, you can gradually increase your credit score over time.

It’s crucial to remember that credit scores are just one aspect that lenders consider when evaluating your creditworthiness. They also take into account other factors such as income, employment history, and overall financial stability.

Although a 660 credit score may not provide access to the most favorable loan terms and interest rates, it is still possible to build and improve your credit from this point. By practicing responsible credit habits and demonstrating consistent financial behavior, you can work towards achieving a higher credit score in the future.

Pros and Cons of a 660 Credit Score

A credit score of 660 comes with both advantages and disadvantages. Understanding the pros and cons can help you navigate your financial decisions more effectively. Let’s explore:

Pros:

- Access to Credit: With a credit score of 660, you can typically access credit, including loans and credit cards. While you may not have access to the most favorable terms and interest rates, it still provides you with opportunities to obtain credit.

- Building Credit: A credit score of 660 allows you to continue building your credit history. By making timely payments and responsibly managing your credit, you have the chance to improve your score over time.

- Gradual Improvement: A 660 credit score indicates room for improvement. By following good credit practices, such as paying bills on time and keeping credit card balances low, you can gradually increase your credit score and move towards a higher credit range.

- Qualifying for Certain Loans: While a 660 credit score may not grant you access to the most competitive loan terms, it can still qualify you for certain types of loans, such as personal loans or auto loans. This can help you meet your financing needs when necessary.

Cons:

- Higher Interest Rates: With a credit score of 660, you are likely to be offered loans and credit cards with higher interest rates compared to borrowers with better credit scores. This can result in increased borrowing costs over time.

- Limited Options: Some lenders may impose stricter requirements or provide limited options for borrowers with a 660 credit score. You may encounter fewer choices when it comes to credit cards or loans, limiting your ability to secure the most favorable terms.

- Difficulty Securing Housing: Renting a home or apartment can be more challenging with a 660 credit score. Landlords often consider credit scores when assessing rental applications, and a lower score may lead to higher security deposits or rental fees, or even rejection of your application.

- Harder to Obtain Certain Benefits: Some financial institutions and service providers offer perks or benefits to customers with higher credit scores. With a 660 credit score, you may not qualify for these advantageous offerings.

It is important to note that a credit score is not static and can change over time. By consistently practicing responsible credit habits, you can work towards improving your credit score and enjoy more advantages associated with higher creditworthiness.

How to Improve a 660 Credit Score

If you have a credit score of 660 and want to improve it, there are several steps you can take to enhance your creditworthiness. Here are some effective strategies to help you improve your credit score:

- Pay Bills on Time: Consistently making timely payments is crucial for improving your credit score. Set up payment reminders or automatic payments to ensure you never miss a due date.

- Reduce Credit Card Balances: High credit card balances can negatively impact your credit score. Work on paying down your balances and aim to keep your credit utilization ratio below 30% of your available credit limit.

- Manage Credit Applications: Limit the number of credit applications you make as multiple inquiries can have a temporary negative impact on your credit score. Only apply for credit when necessary and be selective about the applications you submit.

- Review and Dispute Errors: Regularly review your credit reports from all three major credit bureaus to identify any inaccuracies or errors. If you find any discrepancies, dispute them promptly to have them corrected and potentially improve your credit score.

- Diversify Your Credit Mix: Having a mix of different types of credit, such as credit cards, installment loans, and mortgages, can have a positive impact on your credit score. However, only take on new types of credit if you genuinely need them.

- Keep Old Accounts Open: Closing old credit accounts can shorten your credit history and potentially lower your credit score. Instead, keep those accounts active and occasionally make small transactions to maintain a positive credit history.

- Work with a Credit Counselor: If you’re struggling to manage your credit or have significant debt, consider working with a reputable credit counseling agency. They can provide guidance on managing finances, developing a debt repayment plan, and improving your credit score.

Improving your credit score takes time and requires consistent effort. Stay committed to good credit habits and be patient as you work towards boosting your creditworthiness. Remember, every positive step you take can contribute to a healthier credit profile and potentially lead to a higher credit score over time.

Tips for Maintaining a Good Credit Score

Maintaining a good credit score is essential for long-term financial health. Once you’ve worked hard to improve your credit or if you already have a good credit score, it’s important to continue practicing responsible credit management. Here are some tips to help you maintain a good credit score:

- Pay Bills on Time: Make it a priority to pay all your bills, including credit card bills, loans, and utilities, on time every month. Late payments can have a significant negative impact on your credit score.

- Keep Credit Card Balances Low: Aim to keep your credit card balances low, ideally below 30% of your available credit limit. High credit utilization can negatively affect your credit score. Pay off your credit card balances in full each month to avoid accruing high interest charges.

- Avoid Opening Unnecessary Credit: While it can be tempting to open new credit accounts, only apply for credit that you really need. Opening multiple accounts within a short period can temporarily lower your credit score and increase the risk of accumulating excessive debt.

- Monitor Your Credit: Regularly review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) to ensure the information is accurate and up to date. Monitoring your credit can help you detect and resolve any errors or fraudulent activity promptly.

- Limit Credit Inquiries: Limit the number of times you apply for new credit. Multiple credit inquiries within a short period can signal financial distress to lenders and lower your credit score. Only apply for credit when necessary and do your research beforehand to increase your chances of approval.

- Keep Old Accounts Open: Keeping old accounts open can help boost the length of your credit history, which is a factor in determining your credit score. Even if you don’t use these accounts regularly, keeping them open and in good standing can contribute positively to your credit profile.

- Utilize Credit Monitoring and Alerts: Consider enrolling in credit monitoring services that provide alerts for any changes or updates to your credit report. This can help you stay on top of any potential identity theft or unauthorized activity.

- Practice Patience: Building and maintaining a good credit score takes time. It’s important to be patient and consistent in your credit management habits. Focus on making responsible financial decisions and maintaining good credit behaviors over the long term.

By following these tips, you can maintain a good credit score and strengthen your overall financial well-being. Good credit opens doors to favorable loan terms, lower interest rates, and various financial opportunities. Protect and nurture your credit for a brighter financial future.

Conclusion

Understanding credit scores and their impact on your financial life is crucial for achieving your financial goals. While a credit score of 660 may not be considered excellent, it still provides access to credit and opportunities for improvement.

It’s important to remember that credit scores are dynamic and can change over time based on your financial behavior. By adopting responsible credit habits such as paying bills on time, reducing credit card balances, and limiting credit inquiries, you can gradually improve your credit score.

Maintaining a good credit score requires ongoing effort and discipline. It’s essential to continue monitoring your credit, reviewing your credit reports regularly, and resolving any errors or inaccuracies promptly.

A good credit score opens doors to favorable loan terms, lower interest rates, and various financial opportunities. It can make a significant difference in your ability to access credit, rent a home, secure employment, or obtain affordable insurance premiums.

By following the tips and strategies outlined in this article, you can take control of your credit and work towards achieving and maintaining a good credit score. Remember, every positive step you take towards improving your credit is an investment in your financial future.