Finance

What Is A 780 Credit Score

Published: October 22, 2023

Learn what a 780 credit score means and how it can affect your finances. Discover the benefits of maintaining a high credit score and make wiser financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

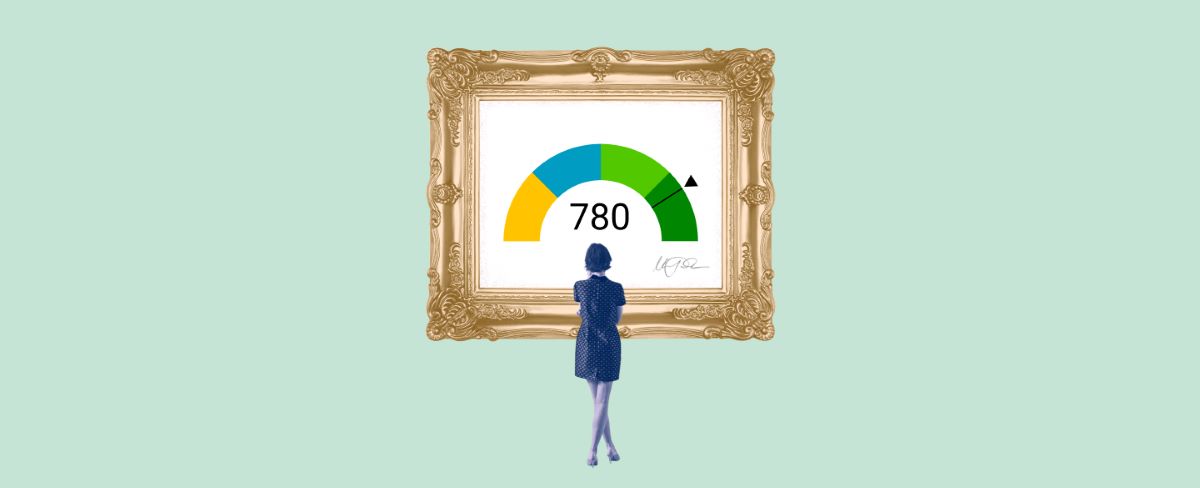

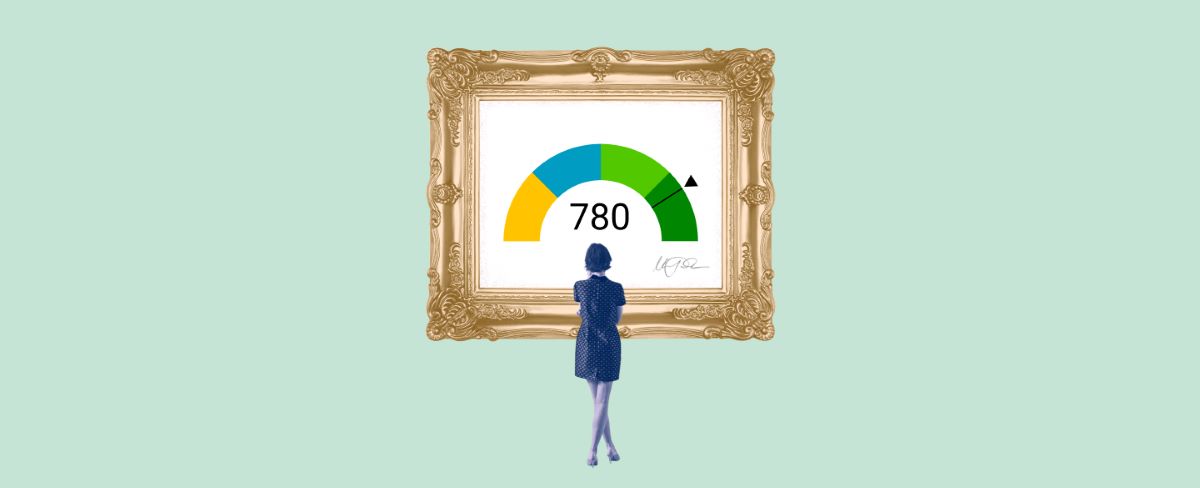

A credit score is a three-digit number, ranging from 300 to 850, that indicates an individual’s creditworthiness. It is an important factor that lenders and financial institutions use to determine whether to approve a loan or credit application. A high credit score indicates responsible financial behavior and a low credit risk, while a low credit score suggests a higher risk of defaulting on loans.

In this article, we will focus on the 780 credit score, which is considered an excellent score by most standards. Achieving and maintaining a 780 credit score demonstrates a high level of financial responsibility and can provide numerous benefits in the world of personal finance.

Understanding what a 780 credit score entails, how it is calculated, and the factors that influence it is vital for anyone looking to improve their credit health or secure favorable lending terms. We will explore the key aspects of a 780 credit score, the benefits it offers, and strategies for achieving and maintaining it.

Whether you are looking to buy a home, finance a car, or apply for a credit card with attractive rewards, a 780 credit score can open doors to better financial opportunities. Let’s dive into the specifics of what makes a 780 credit score so desirable and how you can take steps to reach this elite status.

What Is a Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness. It serves as a measure of their ability to manage and repay debts. Lenders, banks, and other financial institutions use credit scores to assess the risk of lending money to a borrower. The higher the credit score, the more financially trustworthy an individual is considered.

Credit scores are calculated using various algorithms and data from credit reports, which include information about one’s credit history, payment patterns, outstanding debts, and more. The most common credit scoring models used are the FICO Score and the VantageScore.

The FICO Score, developed by the Fair Isaac Corporation, is the most widely used credit scoring system in the United States. It ranges from 300 to 850, with higher scores indicating better creditworthiness. The VantageScore, on the other hand, ranges from 300 to 850 as well, but follows a slightly different scoring formula.

Credit scores are categorized into different ranges to help lenders assess an individual’s creditworthiness. These ranges may vary slightly depending on the credit reporting agency or scoring model being used. Generally, the ranges are as follows:

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Excellent: 800-850

A credit score is not a permanent number; it can change over time based on one’s financial habits and actions. By understanding how credit scores are calculated and taking steps to improve them, individuals can work towards achieving higher credit scores and reaping the benefits that come with them.

Understanding the 780 Credit Score

A 780 credit score is considered excellent and puts individuals in a favorable position when it comes to borrowing and accessing credit. With a 780 credit score, borrowers are viewed as low-risk borrowers by lenders and are likely to qualify for loans with competitive interest rates and favorable terms.

Having a 780 credit score indicates a strong credit history and responsible financial behavior. It reflects a track record of consistently making payments on time, keeping credit utilization low, and managing debts effectively. Lenders trust individuals with a 780 credit score to handle credit responsibly and are more likely to offer them better loan options and higher credit limits.

Moreover, a 780 credit score can provide individuals with a sense of financial security and peace of mind. It opens up opportunities for accessing credit cards with excellent rewards programs and perks, such as cash-back incentives, travel benefits, and low-interest rates. Individuals with a 780 credit score may also have an easier time renting an apartment, obtaining insurance policies, or even landing a job.

While a 780 credit score is excellent, it’s important to note that credit scores can still vary slightly depending on the credit scoring model used. Different lenders may also have their own criteria and scoring thresholds. However, the general consensus is that a 780 credit score is a strong indicator of financial health and responsible credit management.

It’s worth mentioning that even with a 780 credit score, individuals should continue to monitor their credit report regularly and maintain healthy financial habits. Building and maintaining a high credit score is an ongoing process. By staying vigilant and proactively managing their credit, individuals with a 780 credit score can ensure they continue to enjoy the benefits and opportunities that come with it.

Factors Influencing a 780 Credit Score

Several key factors determine a credit score, including payment history, credit utilization, length of credit history, credit mix, and new credit. Understanding how these factors contribute to a 780 credit score can help individuals maintain and improve their credit standing.

1. Payment History: The most significant factor in determining a credit score is payment history. Consistently making on-time payments for credit cards, loans, and other debts demonstrates responsible financial behavior and contributes to a higher credit score.

2. Credit Utilization: Credit utilization refers to the percentage of available credit that individuals are using. Keeping credit card balances low in relation to credit limits is crucial for a high credit score. Ideally, individuals should aim to keep their credit utilization below 30%.

3. Length of Credit History: The length of credit history accounts for how long individuals have been using credit. A longer credit history shows a track record of responsible credit management. Individuals with a 780 credit score typically have a well-established credit history.

4. Credit Mix: Lenders also consider the types of credit individuals have, such as credit cards, mortgages, auto loans, and personal loans. Having a diverse range of credit types can positively impact a credit score.

5. New Credit: Opening multiple new credit accounts within a short period can negatively impact a credit score. Lenders interpret this behavior as a sign of financial instability. Individuals with a 780 credit score generally have a minimal number of new credit inquiries and accounts.

It’s important to note that the specific weight given to each factor may vary among credit scoring models. However, focusing on these key factors can help individuals maintain a strong credit score. Regularly checking credit reports for errors or inaccuracies and promptly addressing any issues is also essential in maintaining a 780 credit score.

Benefits of Having a 780 Credit Score

Holding a 780 credit score comes with a wide range of benefits that can significantly impact an individual’s financial well-being. Here are some advantages of having a 780 credit score:

1. Access to Better Loan Terms: With a 780 credit score, individuals are more likely to qualify for loans with lower interest rates, favorable terms, and higher borrowing limits. This can lead to significant savings over time, whether it’s a mortgage, auto loan, or personal loan.

2. Higher Credit Card Limits: Credit card issuers are more inclined to extend higher credit limits to individuals with strong credit scores. A 780 credit score can open doors to credit cards with higher limits, providing greater flexibility for managing expenses and making larger purchases.

3. Lower Interest Rates: Lenders offer better interest rates to borrowers with excellent credit scores. Whether it’s a credit card, personal loan, or mortgage, individuals with a 780 credit score can enjoy lower interest rates, which saves them money in interest payments over the life of the loan.

4. Enhanced Negotiating Power: A high credit score gives individuals greater leverage in negotiating terms with lenders. Whether it’s negotiating a better interest rate or securing a favorable loan agreement, a 780 credit score strengthens an individual’s position.

5. Access to Premium Credit Cards: Some credit card issuers reserve their premium credit cards with exclusive benefits and rewards for individuals with excellent credit scores. These premium cards often offer perks like travel rewards, cash-back programs, airline lounge access, and concierge services.

6. Easier Rental Process: Landlords and property management companies often conduct credit checks on prospective tenants. Having a 780 credit score provides reassurance to landlords, making the rental application process smoother and more favorable.

7. Employment Opportunities: In certain industries, employers may perform credit checks as part of the hiring process. A 780 credit score showcases financial responsibility and can contribute to a positive impression, potentially improving employment prospects.

A 780 credit score reflects a history of responsible financial behavior and opens up a world of opportunities and advantages. By maintaining a high credit score, individuals can enjoy better terms and conditions, save money, and have access to a wide range of financial products and benefits.

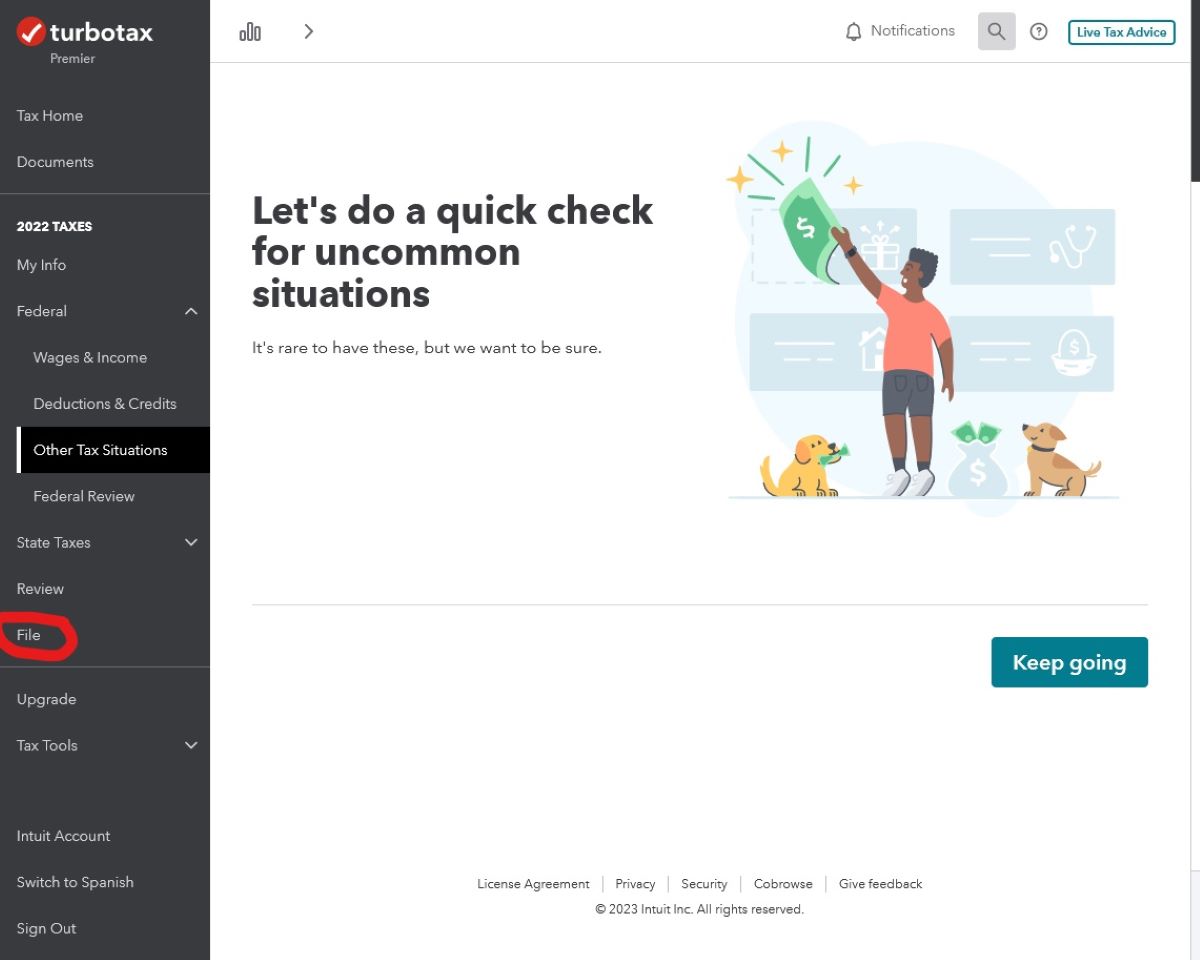

How to Achieve and Maintain a 780 Credit Score

While achieving a 780 credit score may require time and effort, it is an attainable goal for individuals who are committed to practicing responsible credit management. Here are some strategies to help you achieve and maintain a 780 credit score:

1. Establish a Solid Credit History: Start building your credit history early by opening a credit card or a small loan. Make sure to make payments on time and keep your credit utilization low.

2. Pay Bills on Time: Consistently making on-time payments is crucial for achieving a high credit score. Set up automatic payments or reminders to ensure you never miss a due date.

3. Maintain Low Credit Card Balances: Keep your credit card balances well below the credit limit. Aim for a credit utilization ratio of 30% or lower. Paying off balances in full each month is ideal.

4. Diversify Your Credit: Build a healthy mix of credit types, such as credit cards, installment loans, and a mortgage, if applicable. This demonstrates your ability to manage different types of credit responsibly.

5. Avoid Excessive New Credit Inquiries: Limit the number of new credit applications you make within a short period. Each credit inquiry can temporarily lower your credit score.

6. Regularly Check Your Credit Reports: Monitor your credit reports for any errors or fraudulent activity. Dispute any inaccuracies immediately and address any issues promptly.

7. Maintain a Long Credit History: Your credit history’s length is an important factor. Avoid closing old credit accounts unless necessary, as it can shorten your credit history and potentially impact your credit score.

8. Be Cautious with Opening New Accounts: While having a healthy credit mix is important, avoid opening several new accounts within a short period, as it may negatively impact your credit score.

9. Keep an Eye on Your Debt-to-Income Ratio: Your debt-to-income ratio measures your total debt compared to your income. Keeping it low helps maintain a healthy credit score.

10. Manage Your Finances Wisely: Maintain overall financial responsibility by creating a budget, minimizing unnecessary debt, and saving for emergencies. Responsible financial management contributes to a positive credit score.

Remember, building and maintaining a high credit score is a long-term process that requires patience, consistency, and discipline. By following these strategies and practicing responsible financial habits consistently, you can work towards achieving and maintaining a 780 credit score.

Strategies for Improving or Reaching a 780 Credit Score

If your credit score is currently below 780 and you’re looking to improve it or reach that elite status, there are several strategies you can implement. These strategies can help you boost your credit score over time:

1. Pay All Bills on Time: Consistently making on-time payments is crucial for improving your credit score. Set up reminders or automatic payments to ensure you never miss a payment.

2. Reduce Credit Card Balances: Aim to keep your credit card balances as low as possible in relation to your credit limits. Paying down your balances can have a positive impact on your credit utilization ratio.

3. Pay off Debt: Take steps to pay down your existing debts, such as credit cards and loans. This not only reduces your overall debt but also improves your debt-to-income ratio, which is important in credit scoring models.

4. Limit Credit Inquiries: Avoid applying for multiple new credit accounts within a short time frame. Each credit inquiry can temporarily lower your credit score, so be selective and intentional about new credit applications.

5. Check Your Credit Reports: Regularly review your credit reports from the major credit reporting agencies (Equifax, Experian, and TransUnion). Look for any errors or inaccuracies and dispute them to have them corrected.

6. Increase Credit Limits: Request higher credit limits on your existing credit cards. This can help improve your credit utilization ratio, as long as you continue to keep your balances low.

7. Become an Authorized User: If someone you trust has a credit card with a long history of on-time payments and low utilization, ask if they would consider adding you as an authorized user. This can help boost your credit score.

8. Diversify Your Credit: If you only have one type of credit account, such as a credit card, consider adding a different type of credit, such as an installment loan, to diversify your credit mix.

9. Be Patient and Persistent: Improving your credit score takes time and consistent effort. Don’t get discouraged if you don’t see immediate results. Stick to your plan and continue practicing responsible credit habits.

10. Seek Professional Help if Needed: If you’re struggling with your credit or feel overwhelmed, consider consulting with a reputable credit counseling agency or a financial advisor who can provide guidance tailored to your specific situation.

Remember, everyone’s credit journey is unique, and it may take time to reach a 780 credit score. Stay committed to these strategies, monitor your progress, and celebrate each milestone along the way. With patience and determination, you can improve your credit score and achieve your desired financial goals.

Conclusion

In conclusion, a 780 credit score is an excellent score that indicates a high level of creditworthiness and responsible financial management. It opens up a world of benefits, including access to better loan terms, lower interest rates, higher credit limits, and improved financial opportunities. Achieving and maintaining a 780 credit score requires discipline, consistency, and a solid understanding of the factors that contribute to credit scores.

By focusing on making on-time payments, keeping credit card balances low, diversifying credit types, and monitoring your credit reports for errors, you can gradually improve your credit score. Patience is key, as reaching a 780 credit score may take time. However, the long-term benefits and financial freedom that come with a high credit score are well worth the effort.

Remember to regularly review your credit reports, communicate with lenders and credit reporting agencies, and stay committed to responsible financial habits. Building and maintaining a strong credit score is an ongoing process, but the rewards can be significant. With dedication, perseverance, and smart financial decisions, you can achieve and maintain a 780 credit score, opening doors to countless opportunities and financial stability in your life.