Finance

What Is A Credit Invoice

Modified: February 21, 2024

Learn what a credit invoice is and how it impacts your finances. Discover how credit invoices can help manage your financial transactions efficiently.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Definition of a Credit Invoice

- Purpose of a Credit Invoice

- When to Use a Credit Invoice

- Components of a Credit Invoice

- Difference between a Credit Invoice and a Regular Invoice

- How to Create a Credit Invoice

- Example of a Credit Invoice

- Importance of a Credit Invoice

- Benefits of Using a Credit Invoice

- Common Mistakes to Avoid when Using a Credit Invoice

- Conclusion

Definition of a Credit Invoice

A credit invoice, also known as a credit memo or credit note, is a document used in finance and accounting to record a reduction in the amount owed by a customer to a business. It is a form of adjustment made to correct an error or resolve a dispute related to a previous invoice.

When a credit invoice is issued, it indicates that the customer’s account will be credited with a specific amount, reducing the outstanding balance owed to the business. The credit is typically applied towards future purchases or can be refunded to the customer if applicable.

Credit invoices play a crucial role in maintaining accurate financial records and ensuring proper accounting practices. They provide a transparent and systematic way of handling adjustments and resolving any issues that may arise between a business and its customers regarding invoices and payments.

When a credit invoice is issued, it serves as a written acknowledgment of the adjustment made to the customer’s account. It includes details such as the customer’s name, the invoice number being credited, the reason for the credit, the date of issuance, and the amount credited.

These documents are generated and sent by the business’s finance or accounts receivable department to the customer. They serve as official records of the credit and should be retained for future reference.

Credit invoices can be used in various industries, including retail, wholesale, and services, whenever there is a need to correct a billing error, adjust a pricing discrepancy, process refunds, or resolve disputes over returned goods or services not rendered as agreed.

Purpose of a Credit Invoice

The purpose of a credit invoice is multifaceted and serves several essential functions for both businesses and customers. Here are the primary purposes of a credit invoice:

- Adjusting Errors: One of the primary purposes of a credit invoice is to correct any errors or discrepancies that may have occurred in a previous invoice. It allows businesses to rectify mistakes such as incorrect pricing, quantity discrepancies, or billing errors in a transparent and organized manner. By issuing a credit invoice, businesses can accurately reflect the correct amount owed by the customer.

- Resolving Disputes: Another crucial purpose of a credit invoice is to address and resolve disputes between a business and a customer. If there is a disagreement regarding products or services, a credit invoice can be used to reconcile the issue and adjust the invoice amount accordingly. This helps to maintain good customer relationships by providing a clear resolution and demonstrating the business’s commitment to fair and accurate billing.

- Processing Returns and Refunds: Credit invoices are commonly used when customers return products or request refunds. When a customer returns a defective item or is dissatisfied with a purchase, the business may issue a credit invoice to deduct the amount from the original invoice. This allows for an efficient and straightforward process of managing returns and issuing refunds.

- Accounting and Financial Reporting: Credit invoices serve an integral role in accounting and financial reporting. They ensure that all adjustments made to a customer’s account are accurately recorded and reflected in the business’s financial statements. By maintaining proper documentation of credit invoices, businesses can maintain accurate records and provide an audit trail for future reference.

- Customer Relationship Management: A credit invoice can also contribute to effective customer relationship management. By promptly addressing billing errors or discrepancies, businesses can demonstrate their commitment to providing excellent customer service. It helps build trust and loyalty, as customers appreciate the business’s commitment to resolving issues in a fair and transparent manner.

Overall, the purpose of a credit invoice is to ensure accuracy in billing, resolve disputes, process returns and refunds, and maintain strong customer relationships. By utilizing credit invoices effectively, businesses can streamline their financial processes and build trust with their customers.

When to Use a Credit Invoice

A credit invoice is used in various situations where adjustments need to be made to a customer’s account or a billing error needs to be corrected. Here are some common scenarios when a credit invoice is used:

- Billing Errors: If there is a mistake in the original invoice, such as incorrect pricing, quantity discrepancies, or calculation errors, a credit invoice is used to rectify the error. It adjusts the customer’s account to reflect the correct amount owed.

- Returned Merchandise: When customers return products due to defects, dissatisfaction, or any other valid reason, a credit invoice is used to process the return. The invoice deducts the value of the returned items from the original invoice, ensuring accurate accounting and proper refund processing.

- Refunds: In cases where customers request refunds for overpayments or cancellations, a credit invoice is used to adjust the original invoice and initiate the refund process. It ensures that the refunded amount is accurately recorded and reflects the correct balance owed by the customer.

- Discounts and Adjustments: Businesses may issue credit invoices to provide discounts or adjustments to customers for various reasons, such as loyalty rewards, promotional offers, or goodwill gestures. These credit invoices deduct a specific amount from the customer’s account, reflecting the discount or adjustment provided.

- Dispute Resolution: If there is a dispute between the business and the customer regarding the amount owed or the quality of the products or services provided, a credit invoice can be used to resolve the dispute. It adjusts the invoice amount to reflect the agreed-upon resolution between the parties and ensures a fair and transparent outcome.

It’s important to use credit invoices correctly and in a timely manner to maintain accurate financial records and facilitate efficient customer interactions. By utilizing credit invoices in the appropriate situations, businesses can ensure transparent billing processes and maintain positive customer relationships.

Components of a Credit Invoice

A credit invoice consists of several key components that provide important information about the adjustment made to the customer’s account. Here are the essential components typically included in a credit invoice:

- Header: The header of a credit invoice contains the business’s name, address, contact information, and logo. It helps identify the business issuing the credit invoice.

- Invoice Number: Each credit invoice is assigned a unique invoice number for easy reference and tracking. The invoice number helps both the business and the customer identify the specific credit invoice and associate it with the relevant transaction or dispute.

- Date: The date of issuance is included on the credit invoice, indicating when the adjustment was made. This helps with record-keeping and provides a chronological reference for future auditing and reconciliation purposes.

- Customer Information: The credit invoice includes details about the customer, such as their name, address, and contact information. This ensures that the credit is applied to the correct customer’s account and facilitates easy communication between the business and the customer.

- Original Invoice Details: To provide clarity and reference, the credit invoice should reference the original invoice being credited. This includes the original invoice number, date, and amount. This information helps both the business and the customer track the adjustment made in relation to the original invoice.

- Reason for Credit: It is important to specify the reason for issuing the credit invoice. This could be a billing error, product return, refund request, or any other valid reason for adjusting the invoice amount. Clearly stating the reason helps both the business and the customer understand the purpose of the credit invoice.

- Amount Credited: The credit invoice indicates the specific amount credited to the customer’s account. It reflects the adjustment made to the original invoice and reduces the outstanding balance owed by the customer. The amount credited should be clearly stated in a prominent location on the credit invoice.

- Payment Instructions: If the customer is entitled to a refund or the credited amount can be used towards future purchases, the credit invoice should provide clear instructions on how to proceed. This can include details about refund processing, credit availability, or any other relevant instructions related to the adjustment.

- Terms and Conditions: The credit invoice may include any necessary terms and conditions related to the adjustment, such as expiration dates for credit usage or any limitations or restrictions on refunds. These terms and conditions ensure that both the business and the customer are aware of any specific requirements or guidelines related to the adjustment.

By including these key components, a credit invoice provides a comprehensive and detailed record of the adjustment made to the customer’s account. It ensures transparency, facilitates accurate accounting, and helps maintain effective communication between the business and the customer.

Difference between a Credit Invoice and a Regular Invoice

While both credit invoices and regular invoices are used in financial transactions, they serve contrasting purposes and contain different information. Here are the key differences between a credit invoice and a regular invoice:

- Purpose: The primary purpose of a regular invoice is to request payment from a customer for goods or services rendered. It represents an obligation or debt owed by the customer to the business. On the other hand, a credit invoice is used to adjust the amount owed by the customer, either by reducing it due to an error, refund, or discount or by indicating the return of goods.

- Direction of Flow: A regular invoice is sent from the business to the customer to request payment, while a credit invoice is typically sent from the business to the customer to document a reduction in the amount owed.

- Content: A regular invoice includes details such as the itemized list of products or services, quantity, unit price, total amount due, payment terms, and any applicable taxes or discounts. It provides a clear breakdown of what the customer is being billed for. In contrast, a credit invoice includes information on the original invoice being credited, the reason for the credit, the amount credited, and any necessary payment instructions or terms and conditions related to the adjustment.

- Effect on Account Balances: A regular invoice increases the accounts receivable balance for the business, as it represents money owed to the company. Conversely, a credit invoice reduces the accounts receivable balance since it indicates a credit or adjustment made to the customer’s account, reducing the amount owed.

- Timing: Regular invoices are typically issued when products or services are delivered or rendered, indicating the due date by which the payment should be made. Credit invoices, on the other hand, are issued after the original invoice has been generated to correct an error, process a return, issue a refund, or provide a credit.

- Financial Impact: Regular invoices contribute to the business’s revenue and cash flow when payments are received. Credit invoices, however, do not directly impact revenue as they represent adjustments or reductions in the amount owed. Credit invoices may result in a decrease in revenue if refunds are issued or adjustments are made to the sales amount.

- Legal and Tax Considerations: Regular invoices are crucial for legal and tax purposes as they serve as supporting documentation for revenue recognition and tax filings. Credit invoices also have legal and tax implications as they help in accurate accounting and can affect returns or refunds in the business’s financial statements.

Understanding the differences between a credit invoice and a regular invoice is essential for businesses to maintain accurate financial records, provide transparency to customers, and ensure compliance with legal and tax requirements.

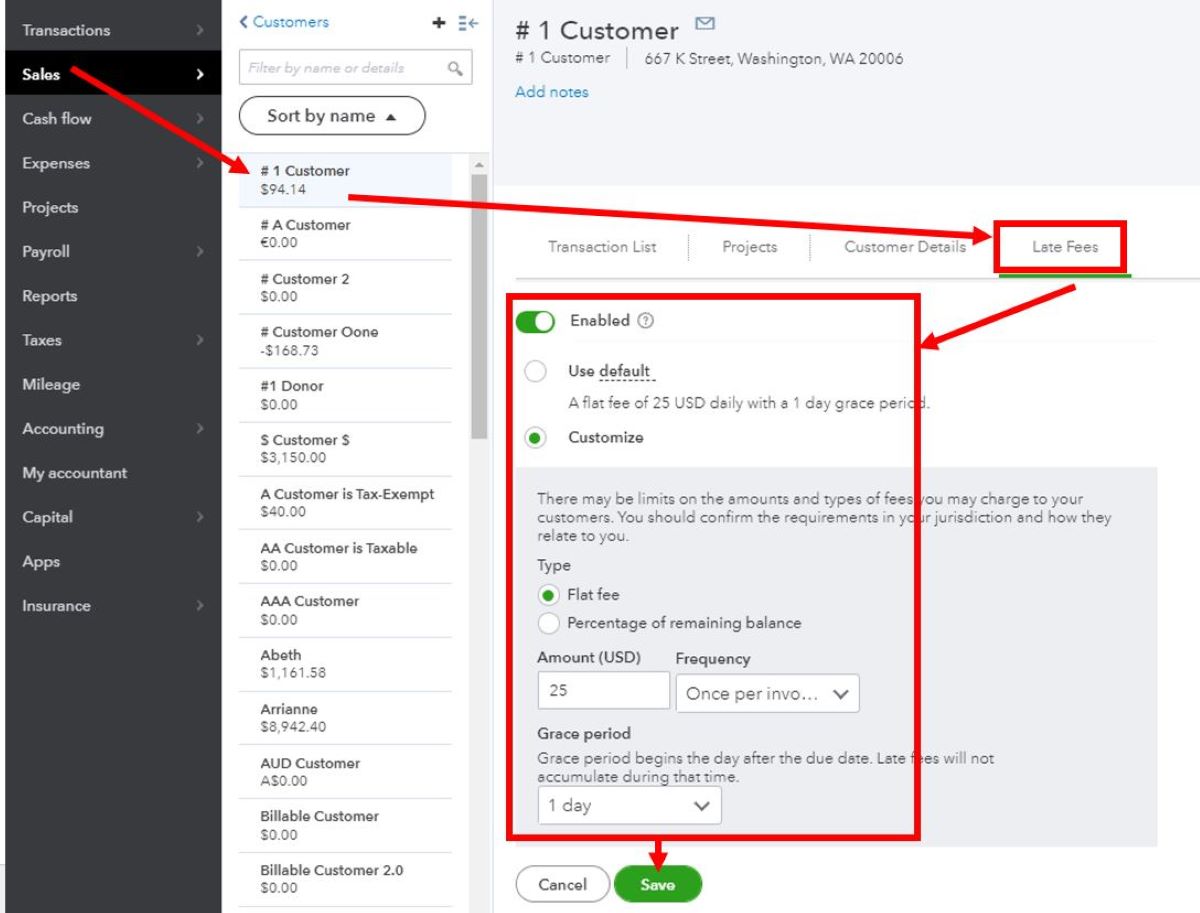

How to Create a Credit Invoice

Creating a credit invoice requires careful attention to detail to ensure accuracy and proper documentation of the adjustment being made. Here are the steps to create a credit invoice:

- Gather Information: Collect all the necessary information for the credit invoice, including the customer’s details, the original invoice number, the reason for the credit, and the amount to be credited.

- Use a Template or Software: Utilize an invoice template or accounting software to create the credit invoice. These tools often have pre-designed formats and fields to input the required information.

- Include Business Details: Add your business’s name, address, contact information, and logo at the top of the credit invoice. This helps identify your business and provides a professional touch.

- Label it as a Credit Invoice: Clearly indicate that the document is a credit invoice or credit memo. This helps distinguish it from a regular invoice and ensures the customer understands the purpose of the document.

- Input Customer Details: Include the customer’s name, address, and contact information to clearly identify who the credit invoice is for.

- Reference the Original Invoice: Specify the details of the original invoice being credited. This includes the original invoice number, date, and amount. This information helps both you and the customer track the adjustment made in relation to the original invoice.

- State the Reason for Credit: Clearly explain the reason for issuing the credit invoice. Whether it is a billing error, product return, refund, or discount, it is important to provide a clear and concise explanation.

- Specify the Amount Credited: Clearly state the amount being credited to the customer’s account. This should be prominently displayed on the credit invoice to avoid any confusion.

- Include Payment Instructions: If applicable, provide clear instructions on how the customer can utilize the credited amount or process a refund. This may include information on how to apply the credit to future purchases or details on the refund process.

- Add Terms and Conditions: Include any necessary terms and conditions related to the adjustment being made. This may include details on expiration dates for credit usage, limitations on refunds, or any other relevant guidelines or restrictions.

- Review and Send: Review the credit invoice to ensure accuracy and completeness. Once satisfied, send the credit invoice to the customer through the chosen communication channel (email, mail, etc.). Retain a copy for your own records.

By following these steps, you can create a credit invoice that accurately reflects the adjustment being made and facilitates clear communication between your business and the customer.

Example of a Credit Invoice

To better understand how a credit invoice is structured, here is an example of a credit invoice:

[Your Company Logo]

[Your Company Name]

[Your Company Address]

[City, State, ZIP]

[Phone Number]

[Email Address]

[Website]

Credit Invoice

Invoice Number: [Credit Invoice Number]

Date: [Date of Issuance]

Customer:

Name: [Customer Name]

Address: [Customer Address]

Email: [Customer Email]

Phone: [Customer Phone]

Original Invoice Details:

Invoice Number: [Original Invoice Number]

Date: [Date of Original Invoice]

Amount: [Original Invoice Amount]

Reason for Credit:

[Provide a concise explanation of the reason for issuing the credit invoice]

Amount Credited:

[Specify the amount credited to the customer’s account]

Payment Instructions:

[Provide clear instructions on how the customer can utilize the credited amount or request a refund if applicable]

Terms and Conditions:

[Include any relevant terms and conditions related to the adjustment, such as expiration dates for credit usage or limitations on refunds]

Thank you for your cooperation. Please feel free to contact us if you have any questions or concerns.

Sincerely,

[Your Name]

[Your Position]

This example includes the necessary components of a credit invoice, such as the business details, customer details, original invoice information, reason for credit, amount credited, payment instructions, terms and conditions, and a closing message.

Remember to customize the credit invoice with your own company’s logo, information, and formatting to align with your brand identity.

By referring to this example, you can create your own credit invoice that accurately reflects the adjustment being made and effectively communicates with your customers.

Importance of a Credit Invoice

A credit invoice holds significant importance for both businesses and customers. Here are some reasons why credit invoices are crucial in financial transactions:

- Accurate Financial Records: Credit invoices play a vital role in maintaining accurate financial records. They provide a transparent and systematic way to document adjustments, ensuring that the customer’s account reflects the correct amount owed. This helps businesses maintain accurate accounting practices and facilitates proper financial reporting.

- Resolving Billing Discrepancies: Credit invoices are instrumental in resolving billing errors or disputes. They offer a mechanism to address issues such as incorrect pricing, quantity discrepancies, or other mistakes made in the original invoice. By issuing a credit invoice, businesses can rectify errors and provide a fair resolution to customers, maintaining trust and preventing potential conflicts.

- Efficient Return and Refund Processes: When products are returned or customers request refunds, credit invoices streamline the process. They allow businesses to adjust the original invoice amount accordingly, accurately reflecting the returned items or requested refunds. Credit invoices facilitate efficient inventory management, financial reconciliation, and timely refund processing.

- Clear Communication: Credit invoices provide clear communication between the business and the customer. They serve as formal documentation that acknowledges the adjustment made to the customer’s account. By specifying the reason for the credit and the amount credited, credit invoices ensure transparency and maintain open lines of communication between both parties.

- Audit Trail and Compliance: Credit invoices serve as important documents for auditing purposes. They provide a clear trail of adjustments made to customer accounts and are crucial for compliance with financial regulations. Properly documenting credit invoices ensures that all adjustments and accounting entries are traceable, facilitating audits and maintaining regulatory compliance.

- Customer Satisfaction and Retention: By promptly issuing credit invoices and addressing billing errors or disputes, businesses can enhance customer satisfaction. Clear and transparent handling of adjustments and refunds demonstrates a commitment to fair business practices, builds trust, and fosters long-term customer relationships. Satisfied customers are more likely to remain loyal and recommend the business to others.

Overall, credit invoices are vital components of financial transactions, ensuring accuracy, resolving disputes, facilitating returns and refunds, and maintaining strong customer relationships. By recognizing the importance of credit invoices, businesses can effectively manage adjustments, maintain financial integrity, and foster a positive customer experience.

Benefits of Using a Credit Invoice

Using a credit invoice offers several benefits for businesses and customers. Here are some notable advantages of incorporating credit invoices in financial transactions:

- Accuracy in Billing: Credit invoices ensure accurate billing by providing a systematic method for adjusting invoice amounts. They allow businesses to rectify errors and provide proper documentation of adjustments made, resulting in precise financial records.

- Dispute Resolution: Credit invoices help resolve billing disputes with customers in a transparent manner. They provide a clear and documented record of adjustments made, allowing both parties to review and agree upon the credit applied to the customer’s account, helping to alleviate disputes and maintain positive customer relationships.

- Efficient Refund Processing: Credit invoices streamline the refund process for businesses. By using credit invoices to accurately document and track refunded amounts, businesses can process refunds promptly and accurately, improving customer satisfaction and efficient financial management.

- Improved Financial Reporting: Credit invoices contribute to accurate financial reporting and auditing. They provide a clear trail of adjustments made to customer accounts, helping businesses maintain compliance with financial regulations. Proper documentation of credit invoices enhances transparency and facilitates reliable reporting.

- Enhanced Customer Experience: Using credit invoices demonstrates a commitment to excellent customer service. Addressing billing errors promptly and providing clear communication with credit invoices helps build trust and improve the overall customer experience. Customers appreciate the transparency and efficient handling of adjustments, impacting their perception of the business.

- Streamlined Inventory Management: Credit invoices play a crucial role in managing returned products. By using credit invoices to adjust inventory and accounting figures, businesses can accurately track returned goods, update stock levels, and maintain efficient inventory management processes.

- Improved Cash Flow: Credit invoices contribute to better cash flow management for businesses. Timely issuance of credit invoices ensures that adjustments are accounted for, taking the necessary steps to reduce outstanding balances owed by customers. This allows businesses to have a clearer financial position and optimize their cash flow.

- Legal Compliance: Utilizing credit invoices ensures compliance with legal and regulatory requirements. They serve as documented evidence of adjustments made to customer accounts, supporting financial audits and maintaining proper accounting practices.

Overall, the use of credit invoices brings numerous benefits, including accurate billing, efficient dispute resolution, streamlined refund processes, improved financial reporting, enhanced customer satisfaction, effective inventory management, optimized cash flow, and legal compliance. Incorporating credit invoices into financial processes is essential for businesses aiming to operate transparently and efficiently.

Common Mistakes to Avoid when Using a Credit Invoice

While credit invoices are essential for accurate accounting and transparent billing processes, there are common mistakes that businesses should avoid to ensure their effectiveness. Here are some common mistakes to watch out for when using a credit invoice:

- Inaccurate Details: One of the most common mistakes is providing inaccurate information on the credit invoice. This includes errors in the customer’s name, original invoice details, reason for credit, or amount credited. It is crucial to double-check and verify all information before issuing the credit invoice to avoid confusion and potential disputes.

- Missing Original Invoice References: Failing to reference the original invoice being credited is another common mistake. It is important to include the original invoice number, date, and amount on the credit invoice to provide a clear connection between the credit and the original transaction. This ensures proper tracking and helps both the business and the customer understand the context of the credit.

- Lack of Clear Explanations: Not providing a clear and concise explanation for the credit can lead to confusion or misunderstandings. It is essential to specify the reason for the credit, whether it be a billing error, return, or discount, to ensure transparency and avoid any potential disputes or customer dissatisfaction.

- Omitting Payment Instructions: Failing to include clear payment instructions or refund procedures can cause delays or difficulties for customers. Whether it is applying the credited amount towards future purchases or providing details on refund processes, businesses should provide explicit payment instructions to facilitate efficient resolution and improve the overall customer experience.

- Ignoring Terms and Conditions: Neglecting to include relevant terms and conditions related to the credit can lead to misunderstandings or non-compliance with established policies. It is important to specify any expiration dates for credit usage, limitations on refund eligibility, or any other relevant terms and conditions to avoid confusion and ensure that both the business and the customer are aware of the guidelines and restrictions associated with the credit.

- Delayed Issuance: Delaying the issuance of a credit invoice can not only impact the accuracy of financial records but also result in customer dissatisfaction. It is important to promptly address billing errors or adjustments by issuing the credit invoice in a timely manner. This helps maintain transparency, facilitates efficient refunds or adjustments, and demonstrates a commitment to providing excellent customer service.

- Poor Record-Keeping: Failing to maintain accurate records of credit invoices can lead to confusion and difficulties in the future. It is essential to keep a copy of each credit invoice issued, along with any supporting documentation, for proper record-keeping and easy reference. This facilitates auditing, ensures compliance, and helps businesses maintain accurate financial records.

By being mindful of these common mistakes and proactively addressing them, businesses can ensure the effective use of credit invoices, maintain accurate financial records, and provide a positive experience for their customers.

Conclusion

Credit invoices are an essential tool in finance and accounting, serving to rectify errors, process returns and refunds, and maintain accurate financial records. By understanding the definition, purpose, components, and benefits of credit invoices, businesses can effectively utilize them in their operations, ensuring transparent billing processes and maintaining strong customer relationships.

Creating a credit invoice involves gathering accurate information, using templates or software, and including key components such as the customer details, original invoice references, reason for credit, and payment instructions. It is important to avoid common mistakes like inaccurate information, missing references, unclear explanations, and delayed issuance to ensure the integrity and effectiveness of credit invoices.

The significance of credit invoices lies in their role in accurate financial reporting, resolving billing disputes, facilitating efficient refund processing, maintaining compliance, and improving customer satisfaction. By effectively using credit invoices, businesses can enhance their financial processes, mitigate billing errors, and foster trust with their customers.

In conclusion, credit invoices are vital tools that contribute to accurate accounting, effective dispute resolution, streamlined refund processes, improved financial reporting, enhanced customer experiences, efficient inventory management, optimized cash flow, and legal compliance. By recognizing their importance and avoiding common mistakes, businesses can effectively utilize credit invoices and achieve financial clarity and customer satisfaction.