Finance

What Is 30% Of A $300 Credit Limit

Modified: March 6, 2024

Learn how to calculate 30% of a $300 credit limit in finance. Discover the importance of understanding credit limits and managing your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on understanding credit limits and how to calculate 30% of a credit limit. Credit limits play a crucial role in managing your finances and maintaining a healthy credit score. Whether you’re applying for a credit card or already have one, understanding credit limits is essential to make informed financial decisions.

A credit limit is the maximum amount of credit that a lender or financial institution is willing to extend to a borrower. It represents the upper threshold of spending that is allowed on a credit card or line of credit. The credit limit is typically determined by factors such as an individual’s credit history, income level, and the lender’s assessment of the borrower’s ability to repay the debt.

Calculating 30% of a credit limit is crucial because it is often considered a benchmark for maintaining good credit utilization. Credit utilization is the ratio of your outstanding credit card balances to your total credit limits, and it is a significant factor in calculating your credit score. By keeping your credit utilization at or below 30%, you demonstrate responsible credit management, which can positively impact your credit score.

In this guide, we will walk you through the process of determining 30% of a $300 credit limit. By understanding this calculation, you will be equipped with the knowledge to effectively manage your credit and make informed decisions regarding your spending and repayment habits.

So, let’s dive in and explore the world of credit limits and how to calculate 30% of a credit limit. Understanding these concepts will empower you to take control of your financial well-being and build a strong foundation for a successful financial future.

Understanding Credit Limits

Before we delve into calculating 30% of a credit limit, let’s first understand what credit limits are and why they matter. A credit limit is the maximum amount of money that a lender or credit card issuer is willing to lend to you. It represents the upper limit of your spending on a credit card or line of credit.

When you apply for a credit card or any form of credit, the lender evaluates your financial information to determine your creditworthiness. They take into account factors such as your credit score, income, employment history, and existing debts. Based on this assessment, they assign you a credit limit, which can range from a few hundred dollars to several thousand dollars.

Your credit limit serves as a safeguard for lenders, ensuring that you don’t borrow more than you can responsibly repay. It also helps prevent you from accumulating excessive debt and potentially damaging your credit score.

It’s important to note that your credit limit is not a measure of your affordability. Just because you have a high credit limit doesn’t mean you should max it out. In fact, experts recommend utilizing only a fraction of your available credit limit to maintain a healthy credit profile.

By understanding your credit limit, you can make informed decisions regarding your spending and borrowing habits. It’s crucial to keep your credit utilization ratio in mind, which is the percentage of your credit limit that you are currently using. To maintain a good credit score, it’s generally advised to keep your credit utilization below 30%.

Now that we have a clear understanding of credit limits, let’s move on to the next section and explore how to calculate 30% of a credit limit.

Calculating 30% of a Credit Limit

Calculating 30% of a credit limit is a simple process that can help you manage your credit utilization effectively. By keeping your credit utilization below 30%, you can demonstrate responsible credit usage, which can contribute to a positive credit score. Here’s how to calculate 30% of a credit limit:

- Step 1: Determine your credit limit

First, identify the specific credit limit that you want to calculate 30% of. This could be the credit limit on a credit card or a line of credit. - Step 2: Convert the credit limit to a decimal

To convert a percentage to a decimal, simply divide the percentage by 100. For example, 30% can be converted to 0.30. - Step 3: Multiply the credit limit by the decimal

Take the credit limit and multiply it by the decimal form of the percentage. For example, if your credit limit is $1,000, multiplying it by 0.30 will give you a result of $300

By following these steps, you can calculate 30% of any credit limit. This figure represents the ideal maximum amount you should utilize to maintain a healthy credit utilization ratio and positively impact your credit score.

It’s important to note that while 30% is often recommended as a benchmark, it is not a strict rule. Different credit agencies and lenders may have varying guidelines. Some may consider credit utilization ratios below 20% even more favorable, while others may factor in other aspects of your credit history as well.

Nevertheless, aiming to keep your credit utilization below 30% is generally a good practice. It allows you to demonstrate responsible credit management and minimize the risk of accumulating too much debt.

Now that you know how to calculate 30% of a credit limit, let’s apply this concept to a specific scenario of a $300 credit limit. Move on to the next section to find out more.

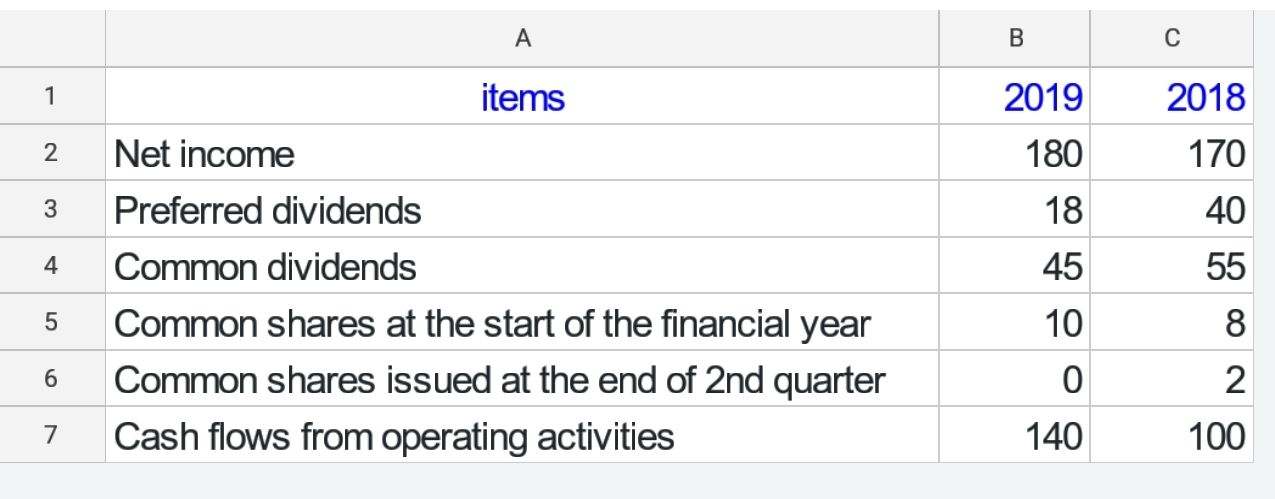

Determining 30% of a $300 Credit Limit

Let’s explore how to determine 30% of a $300 credit limit. This example will help illustrate the calculation process and provide practical insights into managing a specific credit limit.

Step 1: Identify your credit limit

In this scenario, our credit limit is $300. This represents the maximum amount that can be charged to the credit card or utilized as a line of credit.

Step 2: Convert the percentage to a decimal

To calculate 30% of a credit limit, we need to convert the percentage to a decimal. In this case, 30% can be converted to 0.30.

Step 3: Multiply the credit limit by the decimal

Take the credit limit of $300 and multiply it by the decimal form of 30%, which is 0.30. The result is $90. This means that 30% of a $300 credit limit is $90.

Therefore, to maintain a credit utilization ratio of 30% on a $300 credit limit, you should aim to keep your outstanding balance at or below $90. This ensures that you are utilizing an appropriate amount of credit and managing your finances responsibly.

By understanding the calculation process, you can tailor it to your specific credit limit. If you have a higher or lower credit limit, you can adjust the calculation accordingly to determine the ideal credit utilization percentage.

Remember, maintaining a credit utilization ratio of 30% or lower is generally recommended as it shows lenders that you are using credit responsibly. By keeping your outstanding balance within this threshold, you can improve your credit score and demonstrate your ability to manage credit effectively.

Now that we have successfully determined 30% of a $300 credit limit, let’s summarize the key points covered in this article.

Conclusion

Understanding credit limits and how to calculate 30% of a credit limit is essential for maintaining a healthy credit profile. By knowing your credit limit and keeping your credit utilization below 30%, you can showcase responsible credit management and positively impact your credit score.

We explored the concept of credit limits and the significance they hold in managing your finances. Credit limits represent the maximum amount of credit that lenders or credit card issuers are willing to extend to borrowers. They serve as a safeguard against excessive borrowing and help maintain a healthy credit score.

We discussed the process of calculating 30% of a credit limit, which acts as a benchmark for maintaining optimal credit utilization. By converting the percentage to a decimal and multiplying it by the credit limit, you can determine the ideal maximum amount to utilize for responsible credit management.

Specifically, we focused on determining 30% of a $300 credit limit as an illustrative example. By multiplying $300 by 0.30, we found that 30% of a $300 credit limit is $90. This means that, to maintain a credit utilization ratio of 30%, you should strive to keep your outstanding balance at or below $90.

It’s important to note that while 30% is a recommended benchmark, lenders and credit agencies may have their own guidelines. Some financial institutions may view credit utilization ratios below 20% as even more favorable.

In conclusion, understanding credit limits and calculating 30% of a credit limit empowers you to make informed financial decisions. By managing your credit utilization responsibly, you can improve your credit score and pave the way for a solid financial future.

Remember, maintaining a healthy credit score goes beyond just calculating percentages. It’s crucial to make timely payments, minimize debt, and regularly monitor your credit reports to ensure accuracy. With these practices in place, you can achieve financial stability and reap the rewards of responsible credit management.