Finance

What Is A Profit And Loss Write Off

Published: January 22, 2024

Learn about profit and loss write-offs in finance, including their impact on businesses and how they are recorded in financial statements. Understand the significance of these write-offs for your company's financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

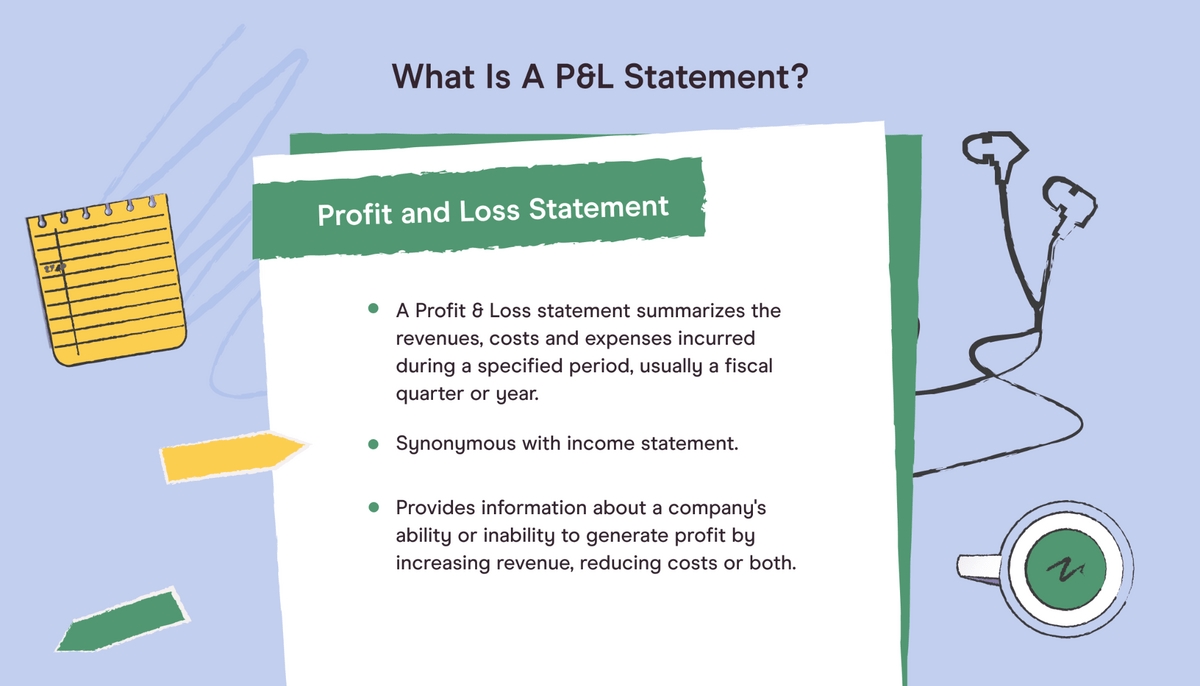

In the dynamic landscape of finance and business, the concept of profit and loss write offs holds significant importance. These write offs play a pivotal role in the financial management of companies, influencing their profitability and overall financial health. Understanding the nuances of profit and loss write offs is essential for businesses and individuals alike, as it directly impacts financial statements and tax obligations.

Profit and loss write offs encompass a range of financial activities that involve the reduction of taxable income by recognizing certain expenses or losses. These write offs are crucial for businesses to accurately reflect their financial performance and ensure compliance with tax regulations. By comprehending the intricacies of profit and loss write offs, individuals and organizations can make informed decisions regarding their financial strategies and tax planning.

This article aims to delve into the fundamentals of profit and loss write offs, exploring their various types, significance, and the accounting practices associated with them. By gaining a comprehensive understanding of profit and loss write offs, readers will be equipped with valuable insights to navigate the complexities of financial management and optimize their tax positions.

Understanding Profit and Loss Write Offs

Profit and loss write offs are integral components of financial management, representing the recognition of expenses or losses to accurately depict the financial performance of an entity. These write offs serve as a mechanism to align financial statements with the economic reality of business operations, ensuring transparency and accountability in reporting.

At their core, profit and loss write offs involve the deduction of certain expenses or losses from the revenue generated, ultimately arriving at the net income or loss for a specific period. By recognizing these write offs, businesses can present a more accurate representation of their financial standing, which is crucial for stakeholders, investors, and regulatory compliance.

One of the key aspects of understanding profit and loss write offs is their impact on taxable income. By incorporating allowable expenses and losses as write offs, businesses can lower their taxable income, thereby reducing their tax liability. This underscores the strategic importance of effectively leveraging these write offs to optimize tax planning and enhance overall financial performance.

Furthermore, profit and loss write offs are not solely confined to expenses incurred during regular business operations. They also encompass non-cash expenses such as depreciation and amortization, which reflect the gradual consumption of assets over time. Understanding the diverse nature of these write offs empowers businesses to make informed decisions regarding asset management and financial planning.

By grasping the underlying principles of profit and loss write offs, individuals and organizations can gain clarity on the intricacies of financial reporting and tax implications. This knowledge forms the foundation for prudent financial decision-making and fosters a deeper appreciation of the interconnectedness between operational activities and financial outcomes.

Types of Profit and Loss Write Offs

Profit and loss write offs encompass a diverse array of categories, each representing specific expenses or losses that impact the financial performance of an entity. Understanding the various types of write offs is essential for comprehensive financial management and accurate reporting. The following are key types of profit and loss write offs:

- Operating Expenses: These write offs include day-to-day operational costs such as rent, utilities, salaries, and marketing expenses. By recognizing these expenses, businesses can accurately reflect the true cost of conducting their operations and determine their operational efficiency.

- Bad Debts: When a business is unable to collect payment for goods or services provided, it incurs a bad debt. Recognizing bad debts as write offs allows businesses to adjust their financial statements to reflect the realistic value of accounts receivable.

- Depreciation and Amortization: Non-cash expenses, such as the depreciation of tangible assets and the amortization of intangible assets, are essential components of profit and loss write offs. These write offs acknowledge the gradual consumption of assets over time, aligning with the matching principle in accounting.

- Impairment Losses: When the carrying amount of an asset exceeds its recoverable amount, an impairment loss is recognized. This write off reflects the reduction in the value of assets and is crucial for maintaining accuracy in financial reporting.

- Restructuring Costs: Expenses incurred during organizational restructuring, including severance payments and asset write downs, are recognized as write offs. These costs impact the overall profitability and financial position of a business.

By comprehending the distinct types of profit and loss write offs, businesses can effectively manage their financial resources, optimize tax planning, and present transparent and reliable financial statements to stakeholders and regulatory authorities.

Importance of Profit and Loss Write Offs

The significance of profit and loss write offs cannot be overstated, as they play a pivotal role in shaping the financial landscape of businesses and individuals. Understanding the importance of these write offs is essential for prudent financial management and strategic decision-making. The following factors underscore the critical importance of profit and loss write offs:

- Accurate Financial Reporting: Profit and loss write offs enable businesses to present accurate and transparent financial statements, reflecting the true economic reality of their operations. By recognizing expenses and losses, companies can provide stakeholders and investors with reliable information for assessing performance and making informed decisions.

- Tax Optimization: Leveraging allowable write offs is instrumental in optimizing tax planning and minimizing tax liabilities. By strategically incorporating eligible expenses and losses, businesses can effectively reduce their taxable income, thereby enhancing their financial position and preserving capital for growth and investment.

- Operational Efficiency: Recognizing operating expenses and other write offs allows businesses to evaluate their operational efficiency and cost management. By identifying and addressing areas of excessive expenditure, companies can streamline operations and improve overall profitability.

- Asset Management: Non-cash expenses such as depreciation and amortization write offs facilitate prudent asset management. These write offs acknowledge the gradual consumption of assets over time, guiding businesses in making informed decisions regarding asset utilization and replacement.

- Financial Prudence: By acknowledging impairment losses and restructuring costs as write offs, businesses demonstrate financial prudence and transparency. This fosters trust and confidence among stakeholders, contributing to a positive reputation and sustainable growth.

Ultimately, the importance of profit and loss write offs lies in their ability to align financial reporting with economic realities, facilitate tax efficiency, and empower businesses to make sound financial decisions. By recognizing and embracing the significance of these write offs, individuals and organizations can navigate the complexities of financial management with clarity and confidence.

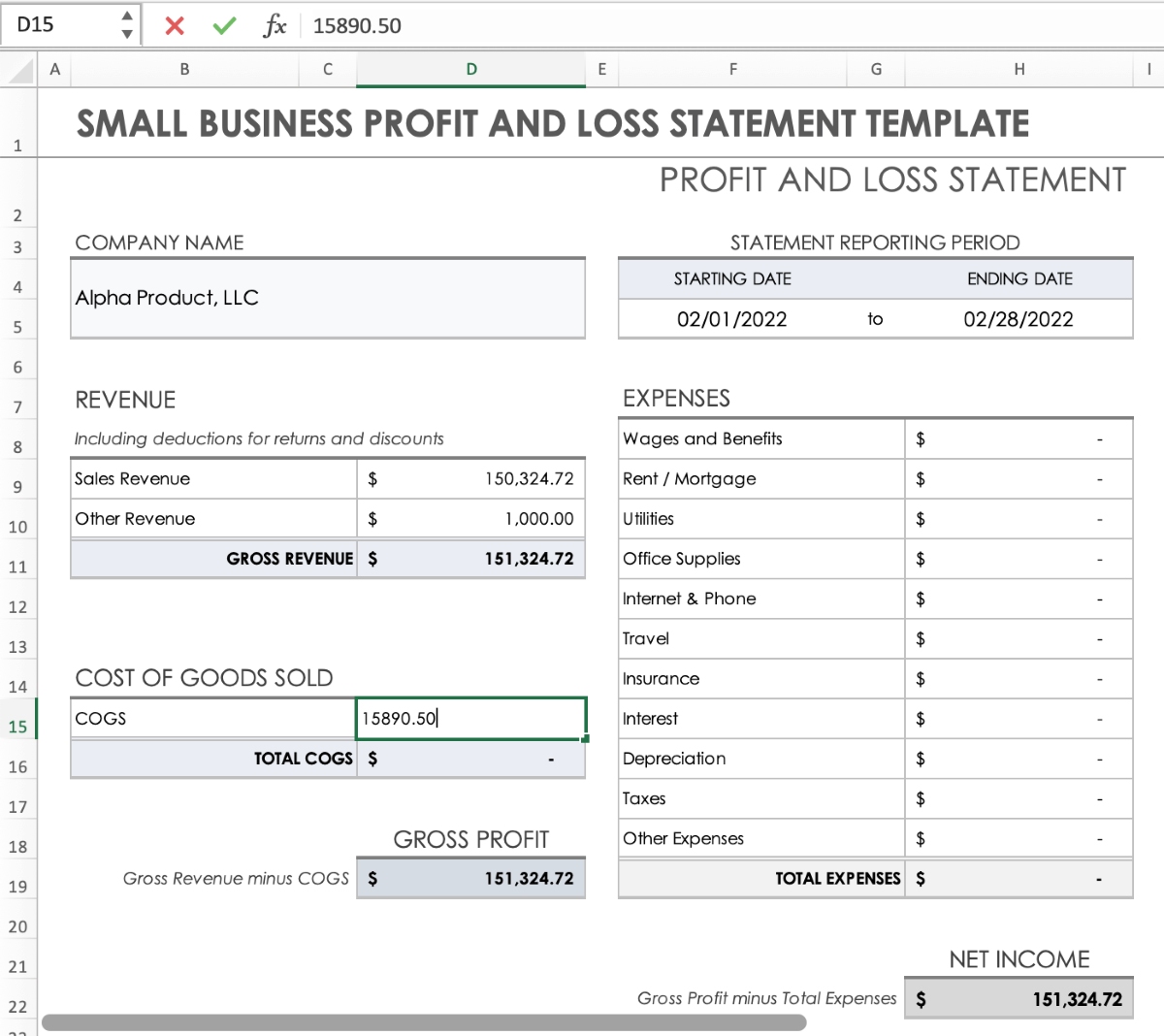

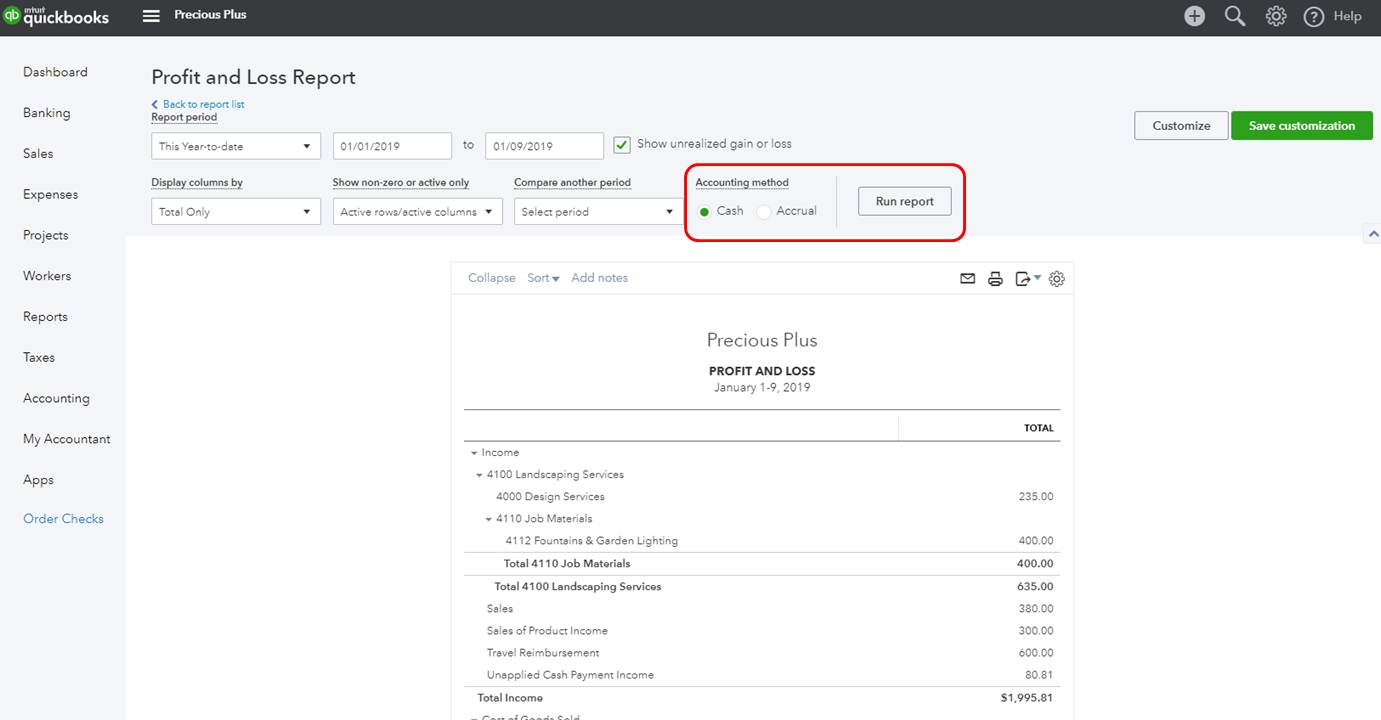

Accounting for Profit and Loss Write Offs

Effective accounting for profit and loss write offs is essential for maintaining accurate financial records and complying with accounting standards. The process of accounting for these write offs involves meticulous attention to detail and adherence to established principles. The following steps outline the fundamental aspects of accounting for profit and loss write offs:

- Identification and Classification: The initial step in accounting for profit and loss write offs entails the identification and classification of eligible expenses and losses. Businesses must distinguish between operating expenses, bad debts, depreciation, impairment losses, and other write offs to ensure accurate recognition.

- Documentation and Substantiation: Proper documentation and substantiation of write offs are imperative for accounting purposes. Supporting evidence, such as invoices, contracts, and impairment assessments, must be maintained to validate the legitimacy of the write offs and withstand potential scrutiny during audits.

- Compliance with Accounting Standards: Accounting for profit and loss write offs necessitates compliance with relevant accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Adhering to these standards ensures consistency and comparability in financial reporting.

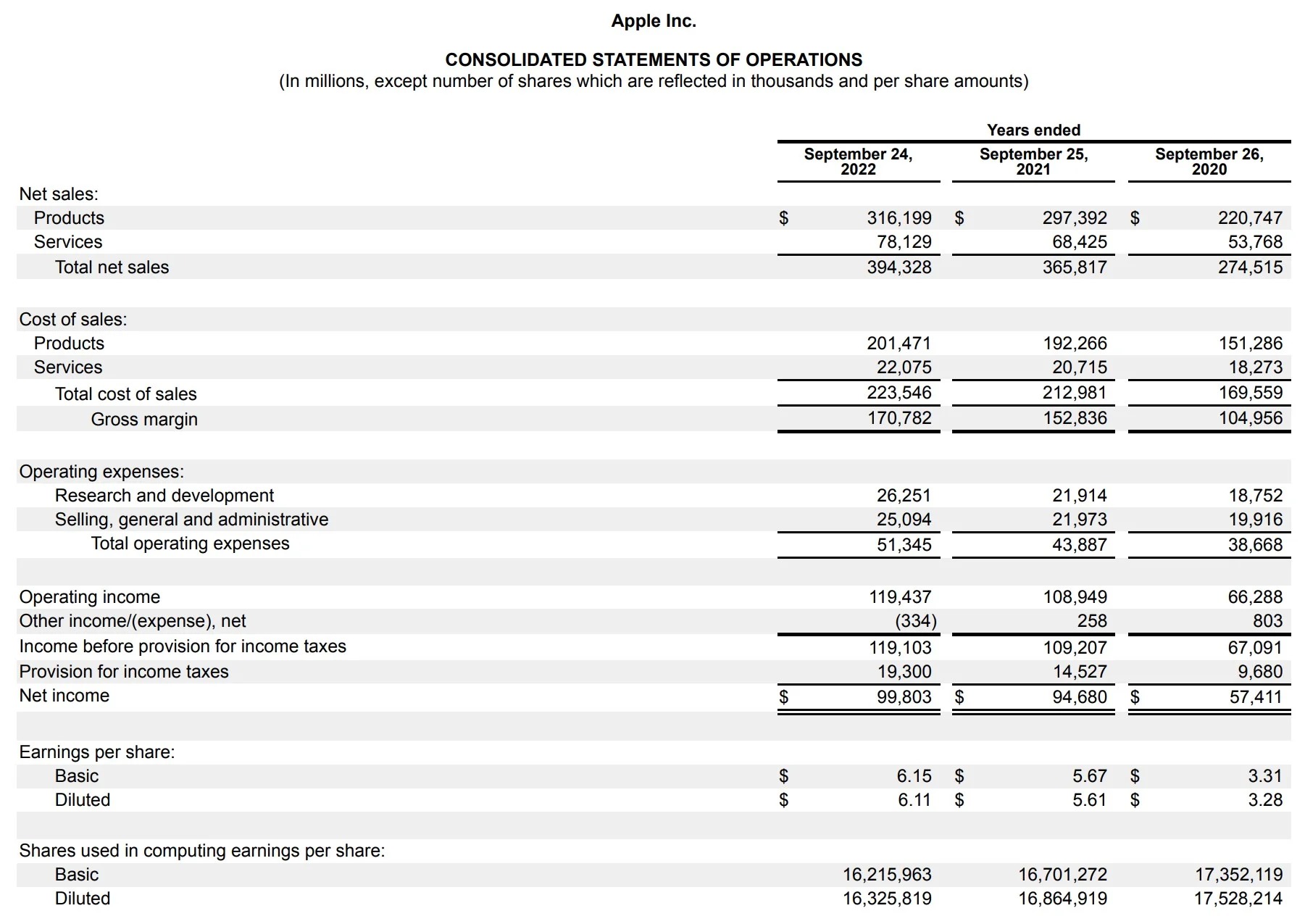

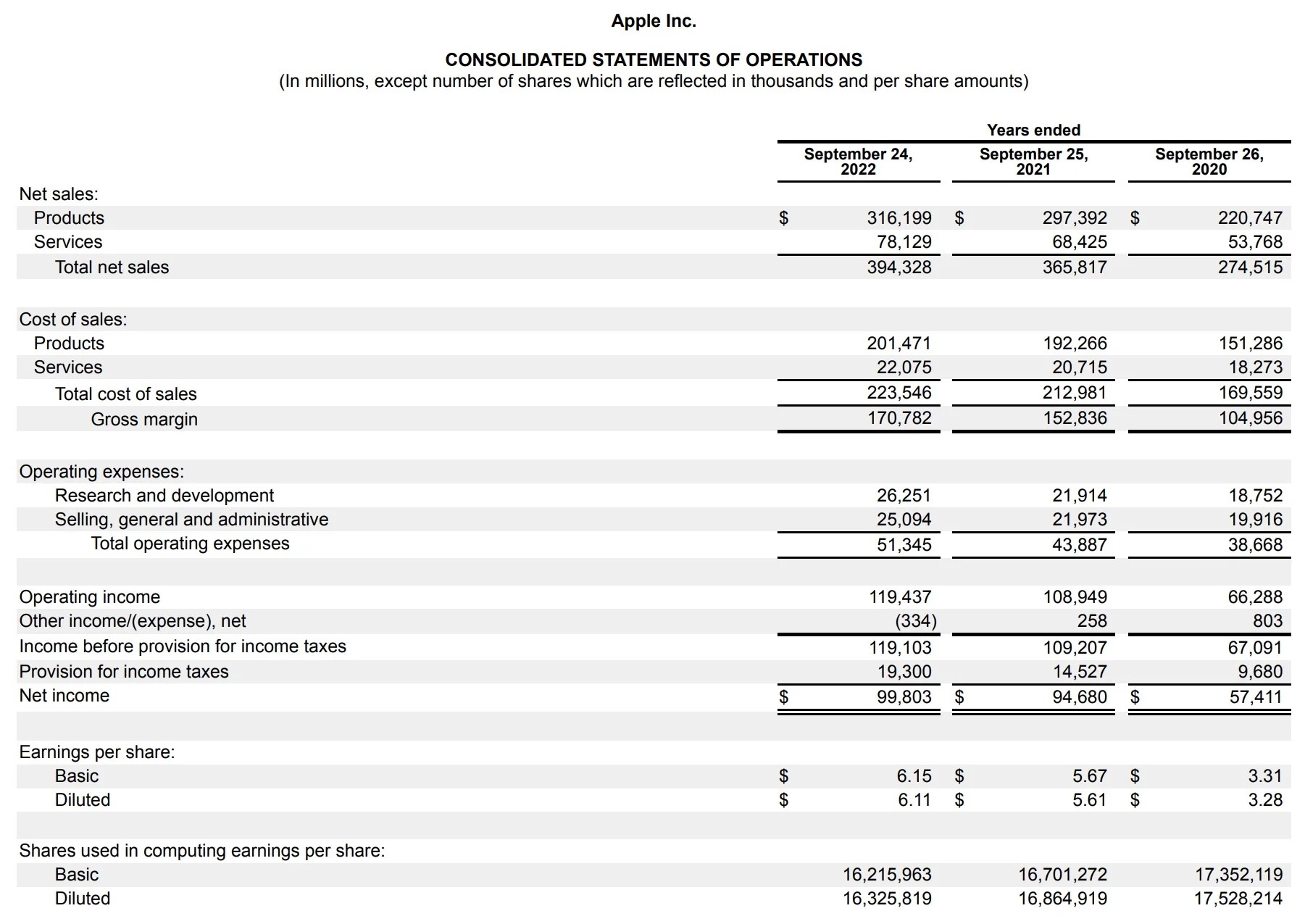

- Impact on Financial Statements: The recognition of profit and loss write offs directly influences the presentation of financial statements. Whether it pertains to the income statement, balance sheet, or cash flow statement, the impact of these write offs must be accurately reflected to convey the true financial position and performance of the business.

- Disclosure and Transparency: Transparent disclosure of profit and loss write offs in financial statements is crucial for providing stakeholders with a comprehensive understanding of the entity’s financial health. Clear and concise disclosures enhance transparency and foster trust among investors, creditors, and regulatory authorities.

By meticulously accounting for profit and loss write offs, businesses uphold the integrity of their financial reporting and demonstrate a commitment to sound accounting practices. This not only enhances the reliability of financial information but also instills confidence in the entity’s management and governance.

Conclusion

Profit and loss write offs form the bedrock of sound financial management, offering businesses and individuals a mechanism to recognize expenses and losses accurately, optimize tax planning, and present transparent financial statements. The comprehensive understanding of these write offs is instrumental in navigating the complexities of financial reporting and tax compliance, empowering entities to make informed decisions and cultivate financial prudence.

By comprehending the diverse types of profit and loss write offs, from operating expenses to impairment losses, businesses can effectively manage their financial resources, enhance operational efficiency, and demonstrate transparency in their financial disclosures. Furthermore, leveraging these write offs for tax optimization enables businesses to minimize their tax liabilities, preserving capital for growth and investment while adhering to regulatory requirements.

Accounting for profit and loss write offs demands meticulous attention to detail, compliance with accounting standards, and transparent disclosure in financial statements. This ensures the reliability and integrity of financial reporting, fostering trust and confidence among stakeholders and regulatory authorities.

In essence, the importance of profit and loss write offs transcends mere financial recognition; it embodies a commitment to accuracy, prudence, and transparency in financial management. By embracing the significance of these write offs, individuals and organizations can navigate the intricacies of financial decision-making with clarity and confidence, laying the foundation for sustainable growth and resilience in an ever-evolving economic landscape.