Home>Finance>How To Get A Profit And Loss Statement In HDFC Securities

Finance

How To Get A Profit And Loss Statement In HDFC Securities

Published: January 22, 2024

Learn how to generate a profit and loss statement in HDFC Securities to track your financial performance. Gain insights into your finance with this step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where every decision holds the potential to shape your financial future. As an investor, it's crucial to have access to comprehensive financial statements that provide insights into the performance of your investments. One such essential financial document is the Profit and Loss Statement, which serves as a vital tool for evaluating the profitability of your investments.

In the realm of HDFC Securities, understanding and accessing the Profit and Loss Statement is integral to gaining a clear understanding of your investment portfolio's performance. Whether you're a seasoned investor or just embarking on your investment journey, mastering the art of interpreting and obtaining a Profit and Loss Statement in HDFC Securities is paramount.

In this article, we will delve into the intricacies of the Profit and Loss Statement, explore its significance within the context of HDFC Securities, and provide a comprehensive guide on how to obtain this critical financial document. By the end of this journey, you will be equipped with the knowledge and confidence to navigate the realm of Profit and Loss Statements in HDFC Securities, empowering you to make informed investment decisions and steer your financial endeavors toward success.

What is a Profit and Loss Statement?

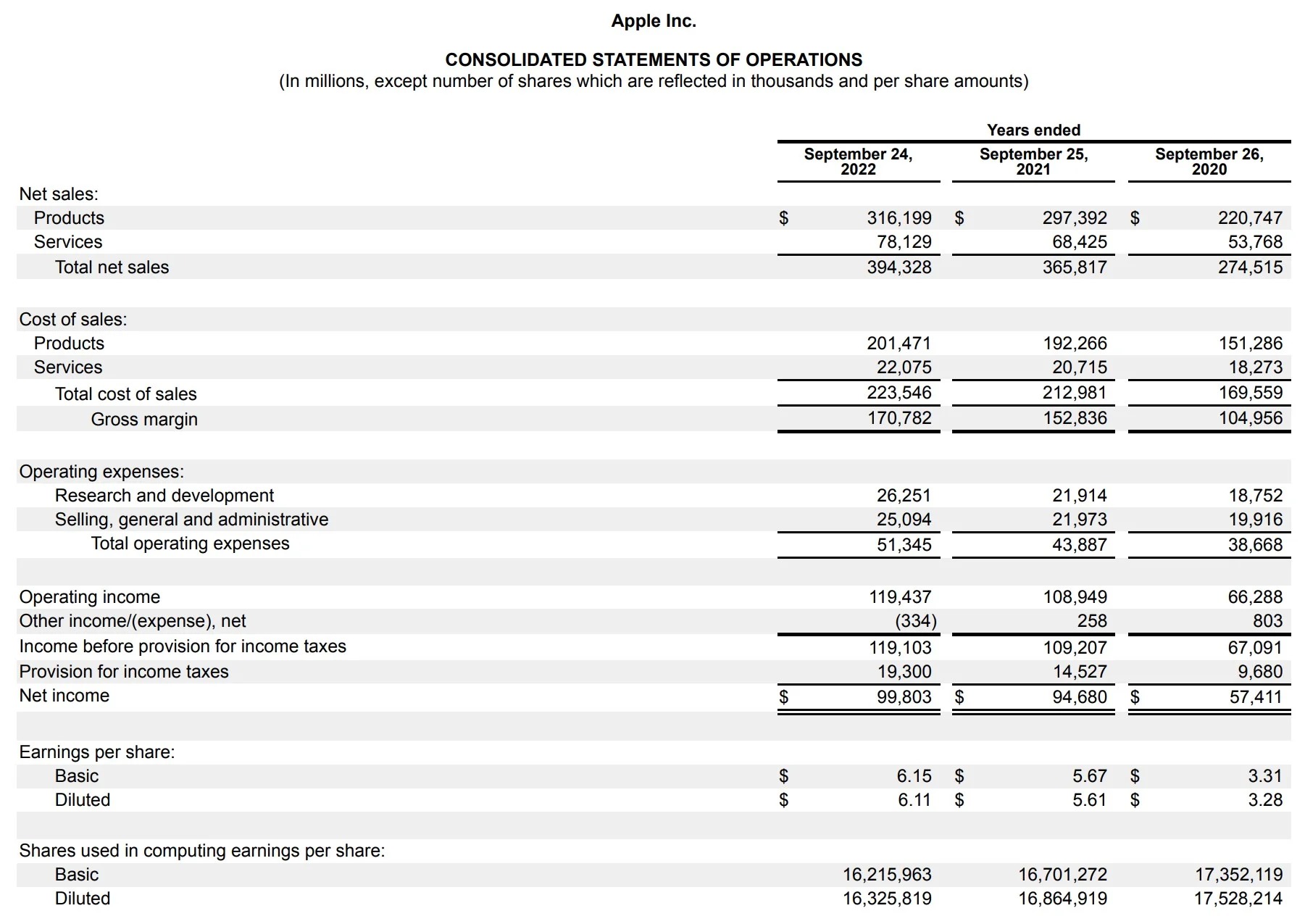

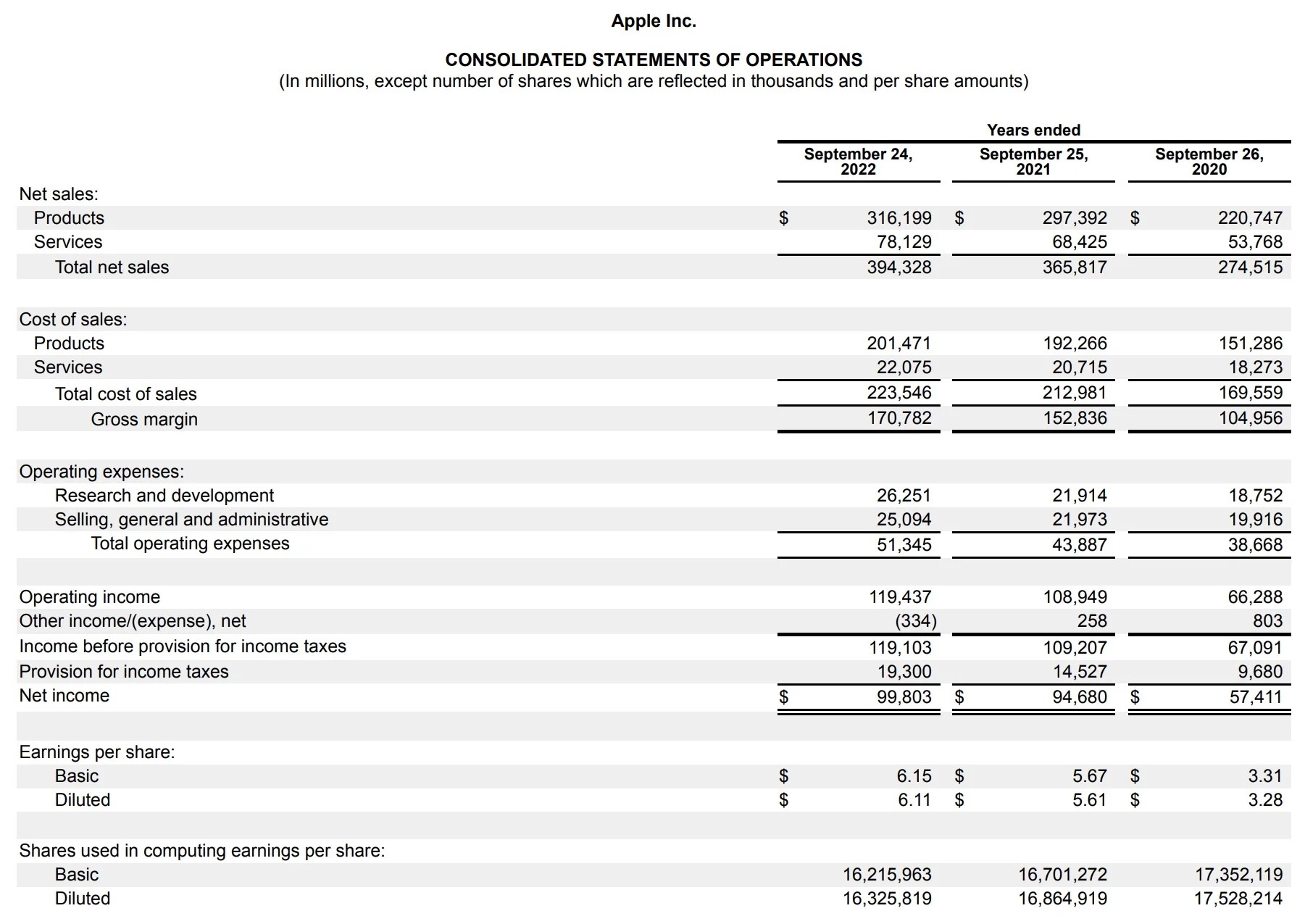

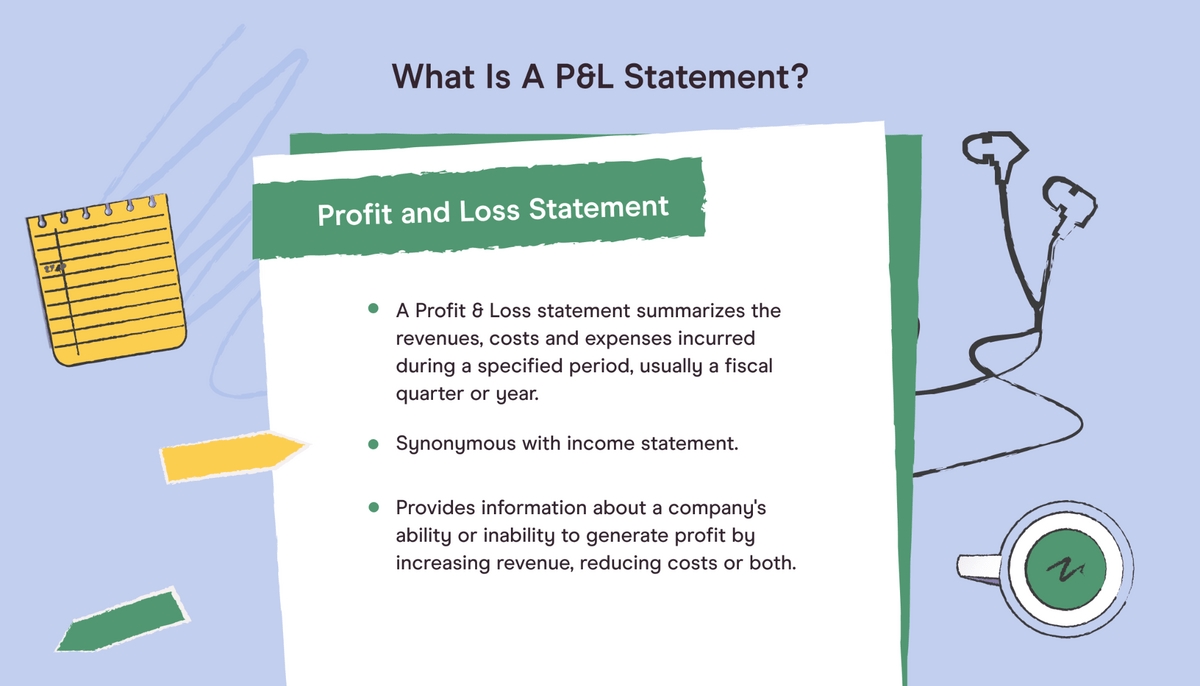

Before delving into the specifics of obtaining a Profit and Loss Statement in HDFC Securities, it’s essential to grasp the fundamental concept of this financial document. Commonly referred to as an income statement, the Profit and Loss Statement is a key financial report that provides a snapshot of a company’s financial performance over a specific period.

At its core, the Profit and Loss Statement encapsulates the revenue, expenses, and resulting profits or losses generated by a business or investment portfolio. It serves as a dynamic indicator of an entity’s ability to generate profits and manage expenses, offering valuable insights into its operational efficiency and financial health.

Within the context of investment portfolios managed through HDFC Securities, the Profit and Loss Statement serves as a critical tool for evaluating the performance of individual securities, mutual funds, or other investment vehicles. By analyzing this statement, investors can gauge the profitability of their investments, identify trends in financial performance, and make informed decisions regarding their portfolio management strategies.

Furthermore, the Profit and Loss Statement plays a pivotal role in facilitating comparisons between different investment avenues, enabling investors to assess the relative performance and profitability of various securities or funds within their portfolio. This comparative analysis is instrumental in identifying high-performing assets and optimizing the overall investment mix to align with specific financial goals and risk tolerance levels.

Ultimately, the Profit and Loss Statement serves as a compass for investors, guiding them through the intricate landscape of financial performance and empowering them to navigate the complexities of investment management with clarity and confidence.

Importance of Profit and Loss Statement in HDFC Securities

The Profit and Loss Statement holds immense significance within the realm of HDFC Securities, playing a pivotal role in shaping investment decisions and fostering a deep understanding of portfolio performance. Its importance can be delineated across several key facets that underscore its critical relevance to investors utilizing the services of HDFC Securities.

- Evaluating Investment Performance: The Profit and Loss Statement serves as a compass for investors, offering a comprehensive overview of the financial performance of their investment portfolio. By assessing the revenue, expenses, and resulting profits or losses, investors can gauge the effectiveness of their investment strategies and identify areas for potential optimization.

- Facilitating Informed Decision-Making: With access to detailed Profit and Loss Statements, investors can make well-informed decisions regarding portfolio rebalancing, asset allocation, and the inclusion or exclusion of specific securities or funds. This empowers investors to align their investment choices with their financial objectives and risk tolerance, fostering a strategic and informed approach to wealth management.

- Identifying Trends and Patterns: The Profit and Loss Statement serves as a window into the financial dynamics of individual securities and investment vehicles. By analyzing trends in revenue generation and expense management, investors can identify patterns that illuminate the performance trajectory of their investments, enabling them to adapt their strategies in response to evolving market conditions.

- Enabling Comparative Analysis: Through the lens of the Profit and Loss Statement, investors can compare the performance of different securities and funds within their portfolio. This comparative analysis empowers investors to discern the relative profitability and efficiency of their investment holdings, facilitating strategic decision-making and the optimization of their overall investment mix.

Embracing the intrinsic importance of the Profit and Loss Statement within HDFC Securities empowers investors to navigate the complexities of investment management with clarity and precision, fostering a proactive and informed approach to optimizing their financial portfolios.

Steps to Get a Profit and Loss Statement in HDFC Securities

Obtaining a Profit and Loss Statement in HDFC Securities is a streamlined process that empowers investors to gain valuable insights into the financial performance of their investment portfolio. The following steps elucidate the process of accessing this critical financial document, enabling investors to navigate the realm of investment analysis with confidence and clarity.

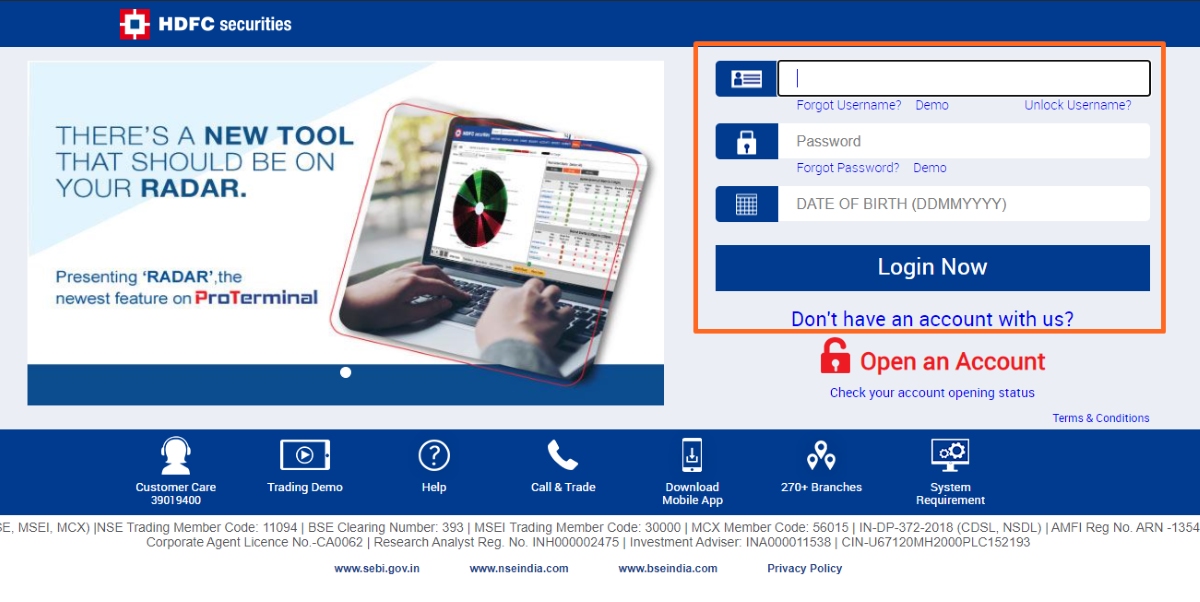

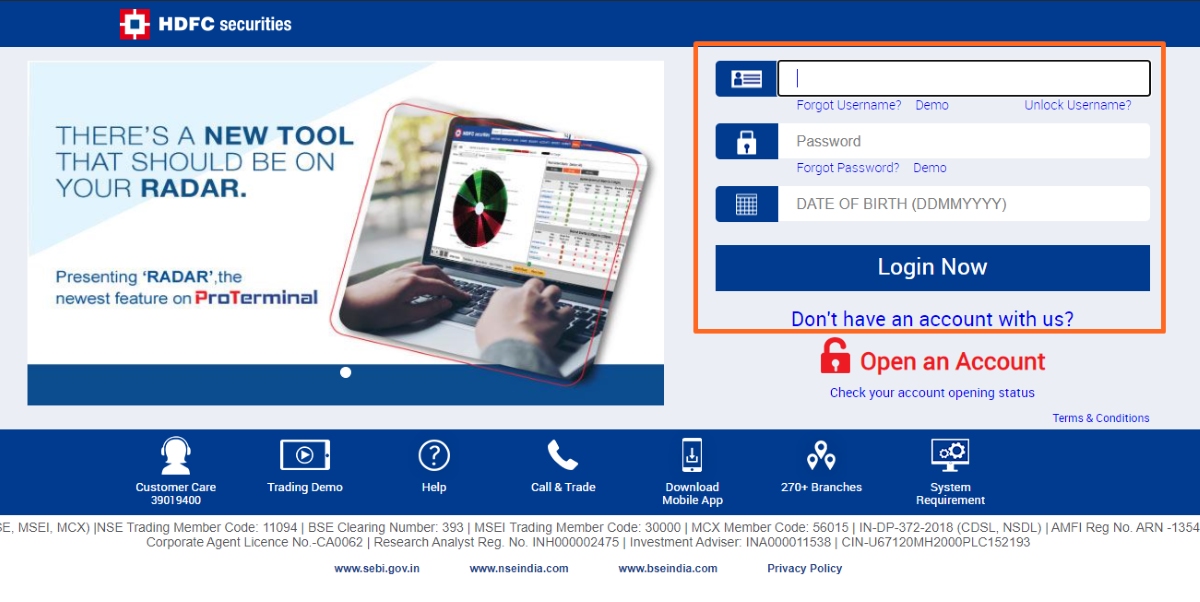

- Log In to Your HDFC Securities Account: Begin by logging in to your HDFC Securities account through the designated online portal or mobile application. This secure access point serves as the gateway to a comprehensive array of investment management tools and financial reports, including the Profit and Loss Statement.

- Navigate to the Reporting Section: Once logged in, navigate to the reporting section or dashboard within your HDFC Securities account. This interface provides access to a diverse range of financial reports and statements, offering a holistic view of your investment portfolio’s performance.

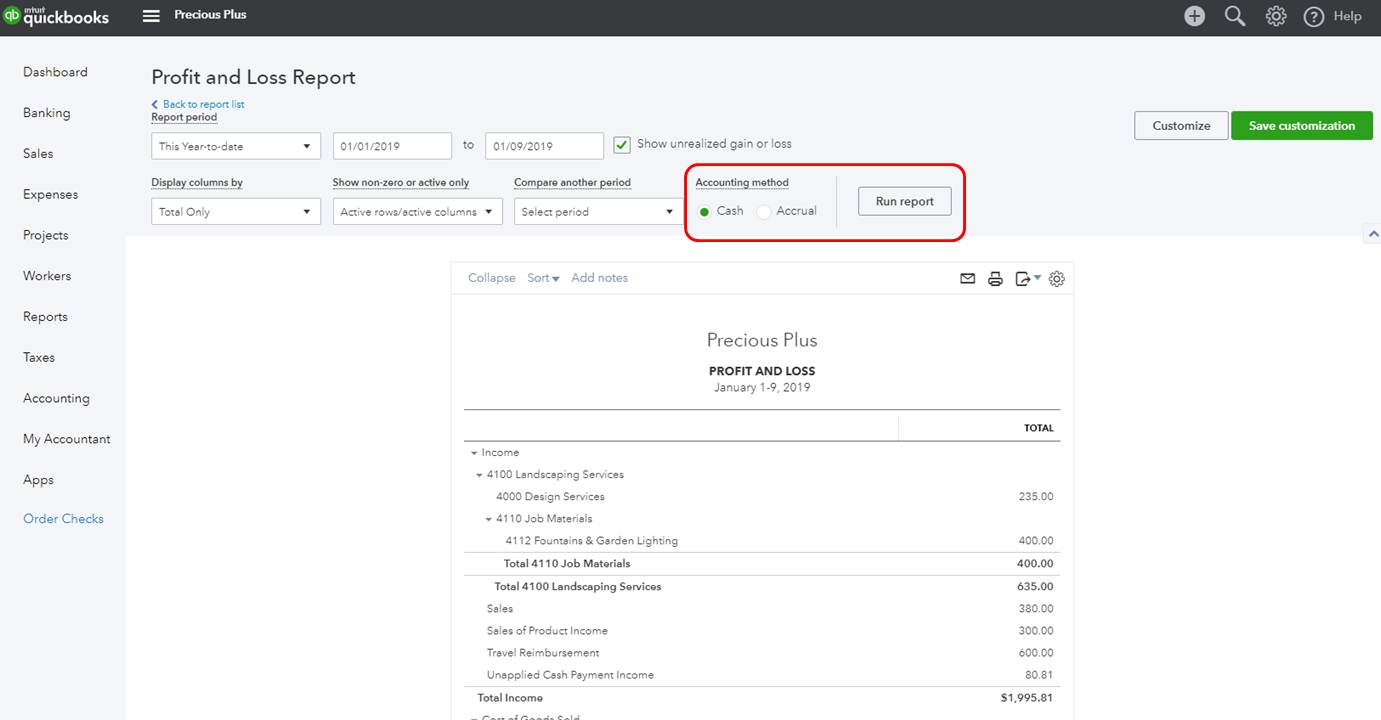

- Select the Profit and Loss Statement Option: Within the reporting section, locate and select the option to generate a Profit and Loss Statement. This intuitive interface empowers investors to specify the desired time frame for the statement, enabling them to capture a comprehensive snapshot of their investment performance over a specific period.

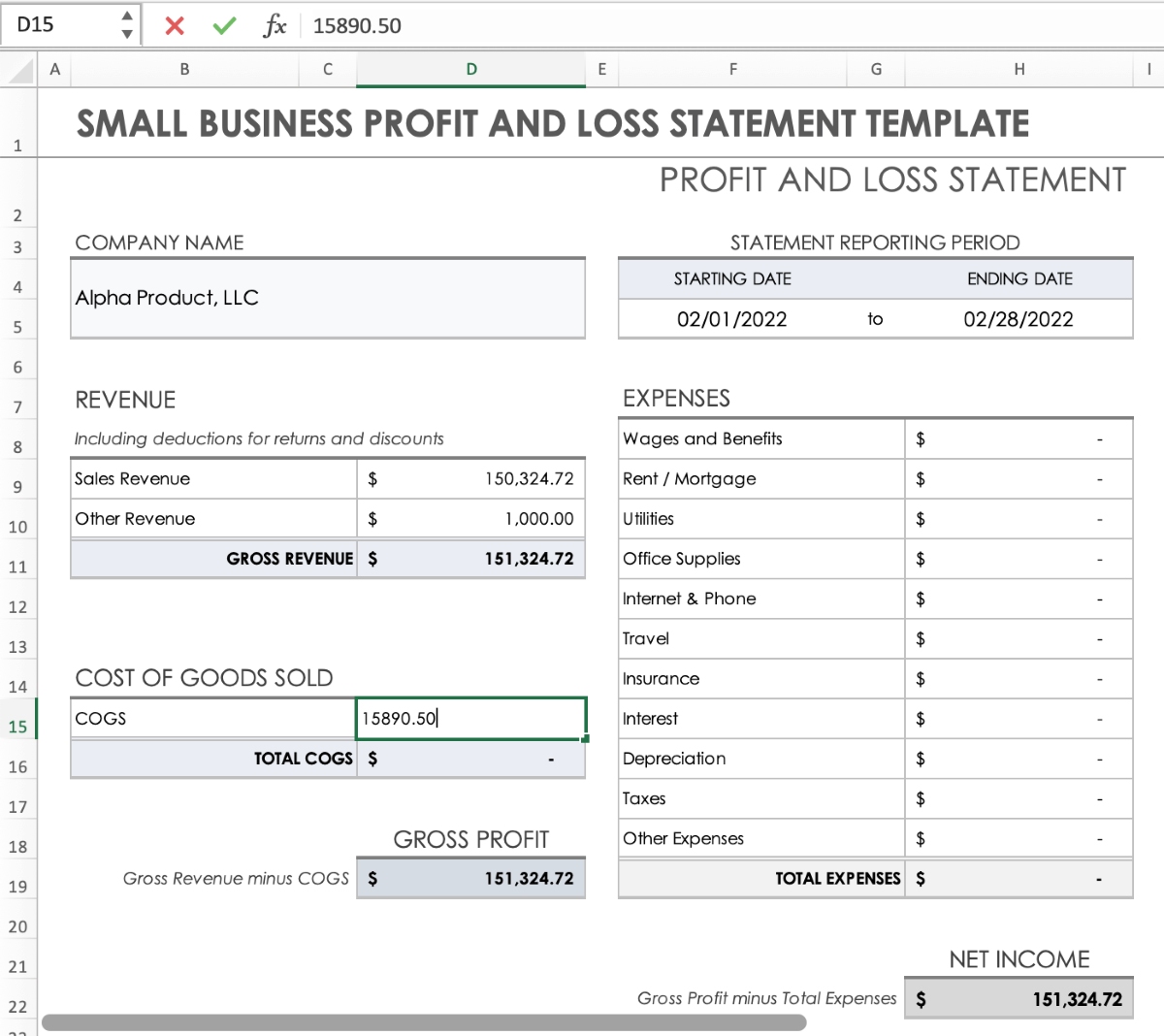

- Customize the Statement Parameters: Tailor the parameters of the Profit and Loss Statement to align with your analytical requirements. This may include selecting specific investment accounts, securities, or funds for inclusion in the statement, as well as specifying the format and presentation preferences to enhance the document’s relevance to your investment analysis endeavors.

- Generate and Review the Statement: Upon customizing the statement parameters, initiate the generation of the Profit and Loss Statement. Once generated, carefully review the document to gain a nuanced understanding of your investment portfolio’s financial performance, revenue streams, expense dynamics, and resulting profitability or losses.

- Utilize the Insights for Informed Decision-Making: Leverage the insights gleaned from the Profit and Loss Statement to inform your investment decisions, portfolio management strategies, and broader wealth optimization initiatives. The comprehensive analysis facilitated by this statement empowers investors to navigate the complexities of investment management with acumen and foresight.

By following these systematic steps, investors can seamlessly obtain a Profit and Loss Statement within the framework of HDFC Securities, harnessing the power of financial insights to steer their investment endeavors toward success.

Conclusion

Embarking on the journey of investment management within HDFC Securities entails a profound appreciation for the pivotal role played by the Profit and Loss Statement. This foundational financial document serves as a beacon of insight, illuminating the performance dynamics of investment portfolios and empowering investors to make informed decisions that resonate with their financial objectives and risk tolerance.

By unraveling the intricacies of the Profit and Loss Statement and understanding its significance within the context of HDFC Securities, investors embark on a transformative path toward financial clarity and strategic acumen. This journey equips them with the tools to evaluate investment performance, identify trends, and leverage comparative analysis to optimize their investment mix with precision and foresight.

Through the seamless process of obtaining a Profit and Loss Statement in HDFC Securities, investors harness the power of financial insights to navigate the complexities of investment management with confidence and clarity. Armed with a comprehensive understanding of their investment portfolio’s profitability and performance dynamics, investors are empowered to steer their financial endeavors toward success, leveraging the intrinsic value of the Profit and Loss Statement as a guiding compass in their wealth optimization journey.

As the financial landscape continues to evolve, the Profit and Loss Statement remains an indispensable ally for investors, offering a dynamic lens through which to interpret investment performance and chart a course toward enduring financial prosperity within the realm of HDFC Securities.