Finance

What Are Capital Markets In Real Estate

Modified: December 30, 2023

Learn about capital markets in real estate and how they play a crucial role in financing property transactions. Explore the intersection of finance and real estate.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Capital Markets

- Importance of Capital Markets in Real Estate

- Components of Capital Markets in Real Estate

- Role of Investors in Capital Markets

- Role of Financial Institutions in Capital Markets

- Role of Regulatory Bodies in Capital Markets

- Benefits and Risks of Capital Markets in Real Estate

- Case Studies of Capital Market Transactions in Real Estate

- Future Trends in Capital Markets in Real Estate

- Conclusion

Introduction

Welcome to the world of capital markets in real estate. In this article, we will explore the fascinating realm of finance and investments within the real estate industry. Capital markets play a pivotal role in facilitating the flow of funds from investors to real estate projects, enabling growth, development, and wealth creation.

But what exactly are capital markets? How do they operate in the context of real estate? And why are they so important? These are the questions we will delve into and answer in the following sections.

At their core, capital markets are platforms that enable the buying and selling of financial instruments such as stocks, bonds, and derivatives. In the realm of real estate, the capital market serves as a marketplace for investors and participants to raise and deploy capital for real estate projects.

Real estate is a significant asset class that offers numerous investment opportunities. From residential properties to commercial buildings, the real estate market represents a vast and diverse landscape in terms of investment options. Capital markets provide the means to finance the acquisition, development, and operation of these properties.

Real estate capital markets operate on a global scale, bridging the gap between investors and real estate developers. They facilitate the allocation of funds, enabling the conversion of savings into productive investments. By connecting investors with projects that match their risk appetite and return expectations, capital markets create a dynamic ecosystem that drives growth and economic activity.

The importance of capital markets in real estate cannot be overstated. They play a pivotal role in fulfilling the financial needs of developers, allowing them to undertake large-scale projects that contribute to urban development and economic growth. Additionally, they provide opportunities for individual and institutional investors to diversify their portfolios and generate returns through real estate investments.

In the following sections, we will explore the various components of capital markets in real estate, the roles of different stakeholders, the benefits and risks associated with these markets, and the future trends that are shaping the industry. So, let’s dive in and unravel the world of capital markets in real estate.

Definition of Capital Markets

Capital markets refer to the financial platforms or exchanges where individuals, corporations, and governments can buy and sell various financial instruments, including stocks, bonds, and derivatives. These markets provide a framework for raising capital and investing in different asset classes such as real estate.

In the context of real estate, capital markets are specifically focused on facilitating the flow of funds between investors and real estate developers. They enable investors to allocate their capital into real estate projects, either through direct investments or indirect investments via real estate securities.

The key characteristic of capital markets is the presence of primary and secondary markets. The primary market deals with the issuance and sale of new financial instruments, while the secondary market enables the trading of previously issued instruments among investors.

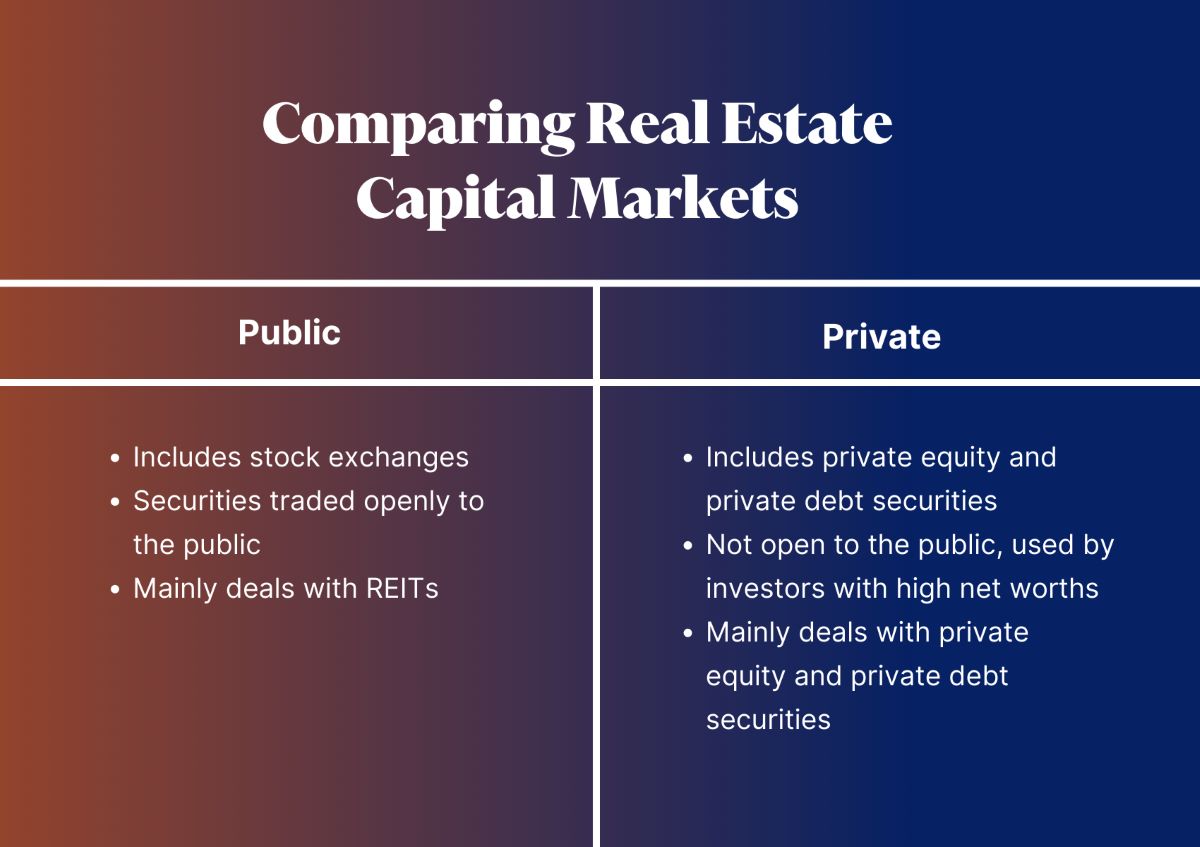

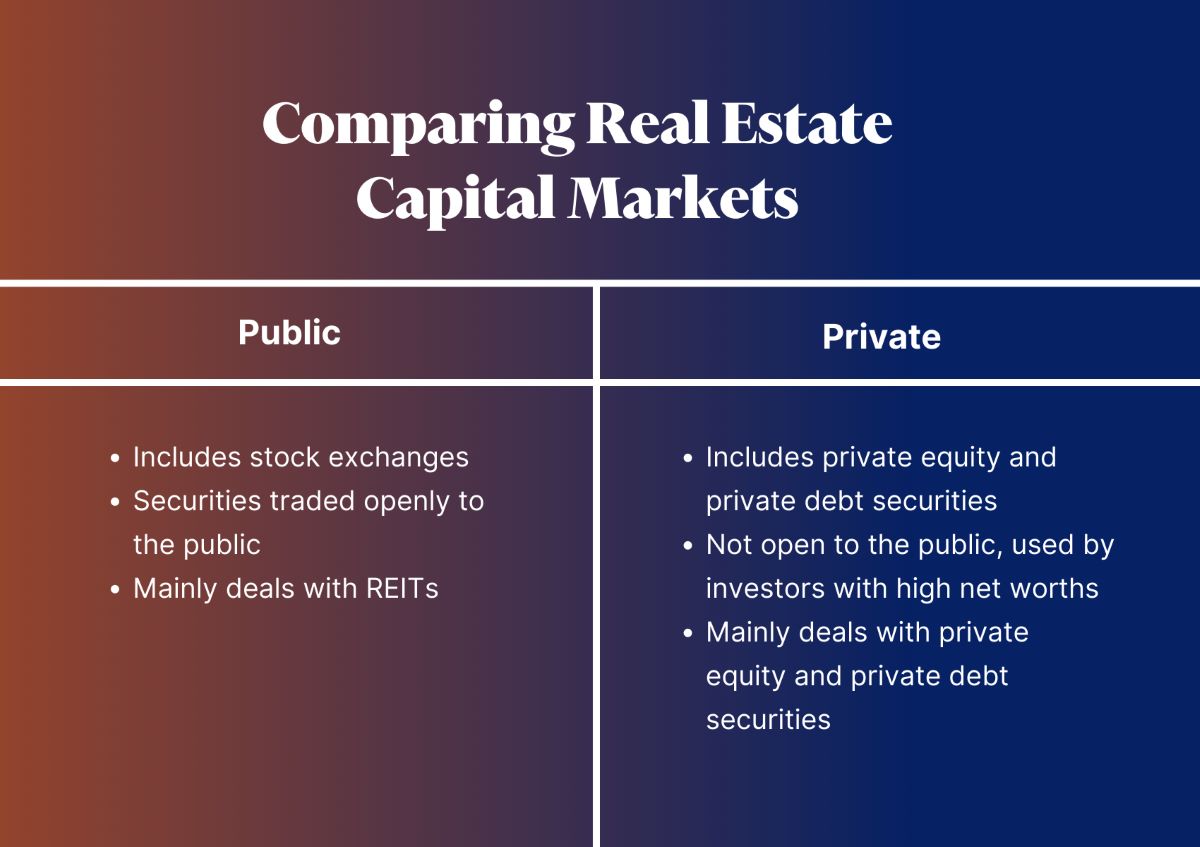

Capital markets in real estate can be divided into two primary segments:

- Equity Market: This segment involves the buying and selling of ownership interests in real estate assets. Investors can participate through direct ownership, such as purchasing shares in a real estate investment trust (REIT) or limited partnership, or through indirect ownership of publicly traded real estate companies.

- Debt Market: The debt market focuses on the issuance and trading of real estate debt instruments, such as mortgages, bonds, and commercial paper. Investors lend money to real estate developers or property owners in exchange for regular interest payments and the return of principal over time.

Capital markets in real estate operate under specific regulatory frameworks and are subject to oversight by governing bodies, such as financial regulators and securities commissions. These regulations are in place to promote transparency, protect investors, and maintain the integrity of the market.

Overall, capital markets in real estate provide a mechanism for investors to access investment opportunities in the real estate sector, while allowing developers to secure the necessary capital for their projects. They play a vital role in the efficient allocation of capital, driving economic growth and supporting the development of vibrant and sustainable cities.

Importance of Capital Markets in Real Estate

Capital markets play a crucial role in the real estate industry, providing a vital source of financing for developers and offering investment opportunities for individuals and institutions. Here are some key reasons why capital markets are important in the context of real estate:

- Access to Capital: Capital markets enable real estate developers to access the funds needed for property acquisition, development, and operation. Through the issuance of equity or debt instruments, developers can tap into a wide pool of investors, raising the necessary capital for their projects. This access to capital allows for the development of large-scale real estate projects that may have a positive impact on urban development and economic growth.

- Diversification of Investment Portfolios: For individual and institutional investors, capital markets provide an avenue to diversify their investment portfolios. Real estate investments can offer stable income streams, potential capital appreciation, and a hedge against inflation, creating a diversified asset allocation strategy. By participating in real estate capital markets, investors can allocate funds to different types of properties and locations, reducing their exposure to risk while potentially earning attractive returns.

- Liquidity: Real estate investments are typically long-term commitments, as properties are illiquid assets that require time to sell. However, through the use of real estate securities traded in capital markets, investors gain the benefit of liquidity. By buying and selling shares of real estate investment trusts (REITs) or other publicly traded real estate companies, investors can easily enter or exit their positions, providing flexibility and access to their invested capital.

- Price Discovery: Capital markets facilitate price discovery by providing a transparent platform for the trading of real estate securities. Through the interaction of buyers and sellers, market prices are determined, reflecting the supply and demand dynamics of different real estate assets. This price discovery mechanism helps investors assess the value of their investments and make informed decisions based on market trends and conditions.

- Risk Mitigation: Investors in the real estate market are exposed to various risks, including property market fluctuations, interest rate changes, and economic downturns. Capital markets offer risk mitigation tools such as real estate derivatives and hedging strategies. These instruments allow investors to manage their exposure to specific risks and protect their investment portfolios from adverse market conditions.

Overall, capital markets in real estate are vital for the growth and development of the industry. They bridge the gap between investors and developers, providing access to capital, promoting diversification, offering liquidity, facilitating price discovery, and helping mitigate risks. By fostering a well-functioning capital market ecosystem, the real estate industry can thrive and contribute to the overall economic prosperity of a region.

Components of Capital Markets in Real Estate

The capital markets in real estate encompass various components that work together to facilitate the flow of funds and investments. These components include:

- Real Estate Investment Trusts (REITs): REITs are publicly traded companies that own, operate, or finance income-generating real estate properties. By investing in REITs, individuals can gain exposure to a diversified portfolio of real estate assets without directly owning the properties themselves. REITs allow investors to access income-producing assets, such as commercial buildings, residential complexes, and retail spaces.

- Real Estate Private Equity Funds: Private equity funds focused on real estate invest in properties or development projects with the aim of generating attractive returns. These funds pool capital from institutional and high-net-worth investors and use it to acquire and manage real estate assets. Investors in private equity real estate funds benefit from professional management expertise and the potential for higher returns, albeit with longer investment horizons compared to public markets.

- Commercial Mortgage-Backed Securities (CMBS): CMBS are investment securities backed by pools of commercial real estate loans. These securities represent ownership interests in the mortgage payments on income-generating properties, such as office buildings, shopping centers, and hotels. CMBS allow investors to indirectly invest in a diversified portfolio of commercial real estate loans, providing income and potential capital appreciation.

- Real Estate Crowdfunding Platforms: Crowdfunding platforms have emerged as a popular component of real estate capital markets, allowing individual investors to participate in real estate projects with smaller investment amounts. These platforms pool funds from multiple investors to finance real estate transactions, ranging from residential properties to commercial developments. Real estate crowdfunding offers investors the opportunity to diversify their portfolios and gain exposure to properties that may not be accessible through traditional investment channels.

- Real Estate Exchanges: Similar to stock exchanges, real estate exchanges provide a marketplace for the trading of real estate assets, allowing buyers and sellers to come together and transact. These exchanges may facilitate the trading of both direct ownership interests in properties and real estate securities, such as shares of REITs or real estate funds. Real estate exchanges enhance liquidity and transparency, enabling investors to buy and sell assets easily.

- Real Estate Investment Managers: Investment managers specializing in real estate play a critical role in the capital markets. These professionals raise capital from investors, identify investment opportunities, manage properties, and strive to generate attractive returns. Real estate investment managers possess expertise in asset analysis, property valuation, and risk management, providing valuable services to both investors and developers.

These components collectively form the infrastructure of capital markets in real estate, providing investors with a range of investment options and developers with access to diverse funding sources. They create opportunities for individuals, institutions, and developers alike to participate in the real estate market, driving economic growth and wealth creation.

Role of Investors in Capital Markets

Investors play a crucial role in capital markets, including those focused on real estate. Their participation and allocation of capital are integral to the functioning and growth of these markets. Here are key roles that investors fulfill in capital markets:

- Supplying Capital: Investors are the providers of capital in capital markets. They allocate their funds towards various investment opportunities, including real estate projects. Through direct investments or participation in real estate investment vehicles such as REITs, private equity funds, or crowdfunding platforms, investors supply the necessary capital for real estate development and investment activities.

- Risk and Return Assessment: Investors carefully assess the risk and return characteristics of different real estate investment options. They analyze factors such as property location, market conditions, cash flow potential, and exit strategies to make informed investment decisions. By evaluating the risk-reward tradeoff, investors seek to balance their desire for attractive returns with their tolerance for potential risks.

- Portfolio Diversification: Real estate investments offer diversification benefits to investors. By including real estate assets in their investment portfolios, investors can reduce risk and enhance returns by spreading their capital across different asset classes. Real estate’s low correlation with other financial instruments, such as stocks and bonds, allows investors to further diversify their holdings and potentially mitigate overall portfolio volatility.

- Income Generation: Real estate investments can provide investors with a steady stream of rental income. Whether through direct ownership of rental properties or investments in income-focused real estate vehicles such as REITs, investors can earn regular cash flow from leases and distributions. This income component can be particularly attractive for income-oriented investors seeking stable and potentially growing income streams.

- Capital Appreciation: Investors in real estate also seek capital appreciation over the long term. As properties appreciate in value over time, investors can benefit from potential capital gains when they sell their investments. Market dynamics, economic factors, and demand-supply imbalances can contribute to the appreciation of real estate properties, allowing investors to realize capital appreciation and potentially generate significant wealth.

- Active or Passive Role: Investors in real estate capital markets can choose to be actively involved in managing their investments or adopt a passive approach by entrusting their capital to professional managers. Active investors might directly invest in properties, analyze market trends, and make strategic decisions, while passive investors may prefer to invest in real estate funds or REITs, relying on experienced professionals to manage their investments on their behalf.

Ultimately, investors are key participants in capital markets, providing the necessary capital for real estate development and investment activities. They assess risks, seek attractive returns, diversify their portfolios, generate income, and benefit from capital appreciation. Their involvement and decision-making contribute to the overall vitality and growth of capital markets in real estate.

Role of Financial Institutions in Capital Markets

Financial institutions play a vital role in capital markets, acting as intermediaries between investors and borrowers. In the context of capital markets in real estate, they provide essential services and fulfill specific roles that facilitate the flow of funds. Here are the key roles of financial institutions in capital markets:

- Capital Intermediation: Financial institutions, such as banks and mortgage lenders, function as intermediaries by connecting investors with borrowers in the real estate market. They facilitate the lending and borrowing of funds, allowing investors to deploy their capital into profitable real estate projects, and enabling developers to access the necessary funds for property acquisition and development.

- Underwriting and Risk Assessment: Financial institutions conduct thorough risk assessments on real estate projects seeking financing. They evaluate factors such as the creditworthiness of borrowers, property valuations, market conditions, and project feasibility. Through underwriting, financial institutions determine the terms and conditions for lending, such as interest rates, repayment schedules, and collateral requirements.

- Providing Financing Solutions: Financial institutions offer a range of financing solutions to meet the diverse needs of real estate investors and developers. They provide mortgage loans for residential and commercial properties, construction loans for development projects, and bridge loans to facilitate property acquisitions or refinancing. These financing solutions can be tailored to match the specific requirements of investors and borrowers based on their risk profile, cash flow needs, and investment horizon.

- Asset Management: Financial institutions often have specialized real estate asset management divisions that oversee and manage real estate investments on behalf of investors. This includes portfolio management, property valuations, lease negotiations, and property maintenance. Through active management, financial institutions aim to maximize the value and performance of real estate assets, ensuring optimal returns for investors.

- Market Making and Trading: Financial institutions also play a role in facilitating trading activities in the secondary market for real estate securities. They act as market makers, providing liquidity by actively buying and selling these securities. By standing ready to buy or sell real estate securities, financial institutions ensure smooth transactions and foster an efficient secondary market for investors to trade their holdings.

- Advisory Services: Financial institutions often provide advisory services to investors and developers in the real estate market. This includes financial planning, investment strategy, risk management, and assistance in structuring real estate transactions. Their expertise and industry knowledge serve as valuable resources, guiding clients in making informed decisions and optimizing their real estate investments.

Financial institutions are integral to the capital markets in real estate, providing capital, managing risk, offering financing solutions, facilitating trading activities, and offering advisory services. By performing these roles, they support the overall functioning, liquidity, and growth of the real estate market, contributing to the success and profitability of investors and developers.

Role of Regulatory Bodies in Capital Markets

Regulatory bodies play a critical role in overseeing and regulating the operations of capital markets, including those focused on real estate. Their role is to protect investors, maintain market integrity, and foster fair and transparent practices. Here are the key roles of regulatory bodies in capital markets:

- Ensuring Investor Protection: Regulatory bodies establish rules and regulations to safeguard the interests of investors. They set standards for financial disclosure, ensuring that investors have access to accurate and timely information about real estate investment opportunities and associated risks. Regulatory bodies also enforce regulations against fraudulent activities, market manipulation, and insider trading, creating a level playing field for all participants.

- Market Oversight: Regulatory bodies are responsible for overseeing the functioning of capital markets. They monitor trading activities, ensure compliance with laws and regulations, and investigate any suspicious or unethical practices. This oversight helps maintain market integrity, transparency, and fairness, fostering investor confidence in the real estate market.

- Licensing and Registration: Regulatory bodies enforce licensing and registration requirements for entities operating in the capital markets. This includes real estate brokers, financial institutions, investment advisors, and other market participants. By ensuring that only qualified and trustworthy individuals and firms are allowed to operate in the market, regulatory bodies protect the interests of investors and maintain the credibility of the industry.

- Setting Standards and Regulations: Regulatory bodies establish standards and regulations for various aspects of capital markets, including real estate investments. These may include requirements for financial reporting, valuation methodologies, risk management, and compliance. By setting these standards, regulatory bodies promote transparency, enhance investor confidence, and promote the stability and efficiency of the capital markets.

- Enforcing Compliance: It is the responsibility of regulatory bodies to enforce compliance with the rules and regulations governing capital markets. They conduct audits, inspections, and investigations to ensure that market participants are adhering to the prescribed standards and practices. Non-compliance can result in penalties, fines, and other disciplinary actions, discouraging fraudulent activities and maintaining market discipline.

- Facilitating Market Development: Regulatory bodies also play a role in supporting the development and growth of capital markets. They may introduce initiatives to encourage innovation, promote market efficiency, and attract investment capital. They may also collaborate with other stakeholders, such as industry associations and government agencies, to create an environment conducive to the growth and development of the real estate market.

The presence of effective regulatory bodies is crucial for the functioning of capital markets in real estate. By ensuring investor protection, market oversight, adherence to standards, and compliance with regulations, regulatory bodies foster trust and confidence in the market. Their role is vital in maintaining a fair, transparent, and well-regulated environment that benefits all participants in the real estate capital markets.

Benefits and Risks of Capital Markets in Real Estate

Capital markets in real estate offer a wide range of benefits for investors and developers. However, they also come with certain risks that need to be carefully considered. Let’s explore the benefits and risks of capital markets in real estate:

- Benefits:

- Access to Capital: Capital markets provide developers with access to a broad pool of investors and funding sources, enabling them to undertake large-scale real estate projects that may otherwise be difficult to finance.

- Portfolio Diversification: Real estate investments allow investors to diversify their portfolios, reducing risk by allocating capital to a different asset class that is not highly correlated with traditional stocks and bonds.

- Liquidity: Through real estate investment vehicles such as REITs, investors can gain liquidity and easily buy or sell their holdings, compared to direct property ownership, which can be more illiquid and time-consuming to sell.

- Income Generation: Real estate investments can provide a steady stream of rental income, offering investors the opportunity for regular cash flow and potentially attractive returns.

- Potential Capital Appreciation: Real estate properties have the potential to appreciate in value over time, allowing investors to benefit from capital gains when they sell their investments.

- Risks:

- Market Volatility: The real estate market is subject to fluctuations and cycles, which can impact property values and investment performance. Economic recessions or changes in market conditions can result in reduced demand and potential declines in property values.

- Interest Rate Risk: Real estate investments can be sensitive to changes in interest rates. Rising interest rates can increase borrowing costs for developers and affect property valuations, potentially impacting investment returns.

- Limited Control: Investors in real estate capital markets have limited control over the management and decision-making of individual properties. Investment performance relies on the competence and effectiveness of the real estate managers and developers.

- Regulatory and Legal Compliance: Real estate investments are subject to various local, regional, and national laws and regulations, which can impact operations, financing, and the ability to generate returns. Non-compliance with these regulations can lead to penalties or legal issues.

- Lack of Transparency: The availability and quality of information in real estate capital markets may vary, making it essential for investors to conduct thorough due diligence to assess investment opportunities and associated risks.

While capital markets in real estate offer significant benefits in terms of access to capital, diversification, liquidity, income generation, and potential capital appreciation, it is important for investors to be aware of the inherent risks involved. By understanding and managing these risks effectively, investors can make informed investment decisions and navigate the dynamic landscape of real estate capital markets.

Case Studies of Capital Market Transactions in Real Estate

Examining real-life case studies of capital market transactions in real estate can provide insights into the dynamics and impact of these markets. Here are a few noteworthy examples:

- Hudson Yards, New York City: One of the largest private real estate developments in the United States, Hudson Yards in New York City serves as an excellent case study of capital market transactions in real estate. This multi-billion-dollar project involved raising capital from numerous investors, including pension funds, private equity firms, and foreign sovereign wealth funds. Through real estate financing vehicles such as commercial mortgage-backed securities (CMBS) and real estate private equity funds, developers secured the necessary capital to transform the area into a vibrant mixed-use development.

- London’s Canary Wharf: Canary Wharf in London is a prominent example of capital market transactions in the real estate sector. This former dockyard area was transformed into a major business and financial district through significant investments from institutional investors and real estate investment trusts (REITs). The issuance of publicly traded REIT securities enabled investors to participate in the project’s development and benefit from rental income and capital appreciation.

- The Dubai Palm Islands: The Dubai Palm Islands project showcases the role of capital markets in financing large-scale real estate developments. This iconic project involved creating a series of artificial islands off the coast of Dubai, complete with residential, commercial, and entertainment facilities. Financial institutions, including local and international banks, provided significant financing for the project through loans, syndicated debt, and structured financing arrangements.

- Real Estate Crowdfunding Platforms: The emergence of real estate crowdfunding platforms provides an interesting case study of capital market transactions in real estate. These platforms connect individual investors with real estate developers for funding smaller-scale projects. Through these platforms, investors can participate in real estate investments with lower minimum investment thresholds, diversify their portfolios, and access property types and locations that may not be traditionally available to individual investors.

- REIT Initial Public Offerings (IPOs): Several REIT IPOs have showcased the successful launch of investment vehicles in the capital markets. These offerings have allowed real estate companies to raise capital and create publicly traded real estate securities. Examples include the IPOs of well-known REITs like Simon Property Group, Prologis, and Equity Residential, which have attracted significant investor interest and provided access to real estate investment opportunities for a wide range of investors.

These case studies illustrate the diverse range of capital market transactions in real estate, ranging from large-scale developments financed by institutional investors and financial institutions to individual investors participating through crowdfunding platforms or publicly traded REITs. They demonstrate the significance of capital markets in mobilizing funds, facilitating real estate projects, and providing investment opportunities to a broad spectrum of investors.

Future Trends in Capital Markets in Real Estate

The capital markets in real estate are constantly evolving, driven by technological advancements, changing investor preferences, and market dynamics. Several emerging trends are expected to shape the future of these markets. Here are some key trends to watch:

- Digital Transformation: The integration of technology is transforming how capital markets operate in the real estate industry. Online platforms, digital marketplaces, and blockchain-based transactions are streamlining processes, increasing market efficiency, and enabling greater transparency. Digitalization also facilitates the democratization of real estate investments, allowing individual investors to access opportunities that were once only available to institutional players.

- Sustainable and Impact Investing: Investors are increasingly focused on sustainable and socially responsible investments. In the real estate sector, this trend is driving capital towards environmentally friendly and socially impactful projects, such as green buildings, renewable energy initiatives, and affordable housing developments. Capital markets are adapting to meet the demand for sustainable real estate investments and incorporating environmental, social, and governance (ESG) factors into investment decision-making processes.

- Real Estate Tokenization: The emergence of blockchain technology is enabling the tokenization of real estate assets, representing ownership in the form of digital tokens. Tokenization offers benefits such as increased liquidity, fractional ownership, and enhanced transparency. It allows investors to access real estate investments with smaller amounts of capital and provides the potential for easier secondary market trading.

- Alternative Financing Models: Non-traditional financing models are gaining traction in the real estate capital markets. Peer-to-peer lending, crowdfunding, and real estate debt funds are offering alternative avenues for raising capital and investing in real estate projects. These models are providing more options and flexibility for both developers and investors, facilitating the funding of smaller projects and reducing reliance on traditional financial institutions.

- Global Capital Flows: Capital markets in real estate are becoming increasingly globalized, with cross-border investments playing a significant role. Global capital flows are facilitated by relaxed regulatory barriers, the growth of real estate investment trusts (REITs), and the increasing participation of institutional investors in international markets. This trend opens up opportunities for diversification and allows investors to access real estate assets in different regions.

- Emerging Market Investments: As investors seek higher yields and diversification, there is a growing interest in emerging market real estate investments. Favorable demographics, urbanization trends, and economic growth in emerging markets attract capital from investors looking for attractive risk-adjusted returns. Capital markets are adapting to accommodate these investments, offering platforms and vehicles that connect investors with real estate opportunities in emerging markets.

These future trends in capital markets indicate a shift towards digitization, sustainability, alternative financing models, global investment opportunities, and increased accessibility for individual investors. As technology continues to advance, regulatory frameworks adapt, and investor preferences evolve, capital markets in real estate are poised to undergo transformative changes, creating new opportunities and shaping the way investments are made and real estate projects are financed.

Conclusion

Capital markets in real estate play a pivotal role in facilitating the flow of funds, connecting investors with developers, and driving economic growth. These markets provide access to capital, enable portfolio diversification, offer liquidity, and create investment opportunities for individuals and institutions alike.

Throughout this article, we have explored the various components of capital markets in real estate, including REITs, private equity funds, crowdfunding platforms, and exchanges. We have also examined the roles of investors, financial institutions, and regulatory bodies in these markets, highlighting their contributions and responsibilities.

The benefits of capital markets in real estate include access to capital for developers, portfolio diversification for investors, income generation, and the potential for capital appreciation. However, it is important to recognize and manage the risks associated with market volatility, interest rate fluctuations, limited control, compliance with regulations, and lack of transparency.

Looking ahead, we anticipate several future trends in capital markets in real estate, such as digital transformation, sustainable and impact investing, real estate tokenization, alternative financing models, global capital flows, and emerging market investments. These trends are likely to reshape the industry, providing opportunities for innovation, increased accessibility, and greater alignment with investors’ preferences.

In conclusion, capital markets in real estate are essential drivers of growth and development. They connect investors with developers, fund large-scale projects, enable portfolio diversification, and offer the potential for attractive returns. While risks exist, capital markets in real estate continue to evolve, adapting to technological advancements and shifting investor demands. By understanding the intricacies of these markets and staying abreast of emerging trends, investors and developers can navigate the complexities of real estate capital markets and capitalize on the opportunities they present.