Finance

What Is Code 846 On An IRS Transcript

Published: October 31, 2023

Discover what code 846 on an IRS transcript means and how it relates to your finances. Unravel the mystery behind this important tax code.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Dealing with taxes can be a complex and overwhelming process, especially when it comes to understanding the codes and indicators used by the Internal Revenue Service (IRS). One such code that may appear on an IRS transcript is code 846. In this article, we will delve into what code 846 means and its implications for taxpayers.

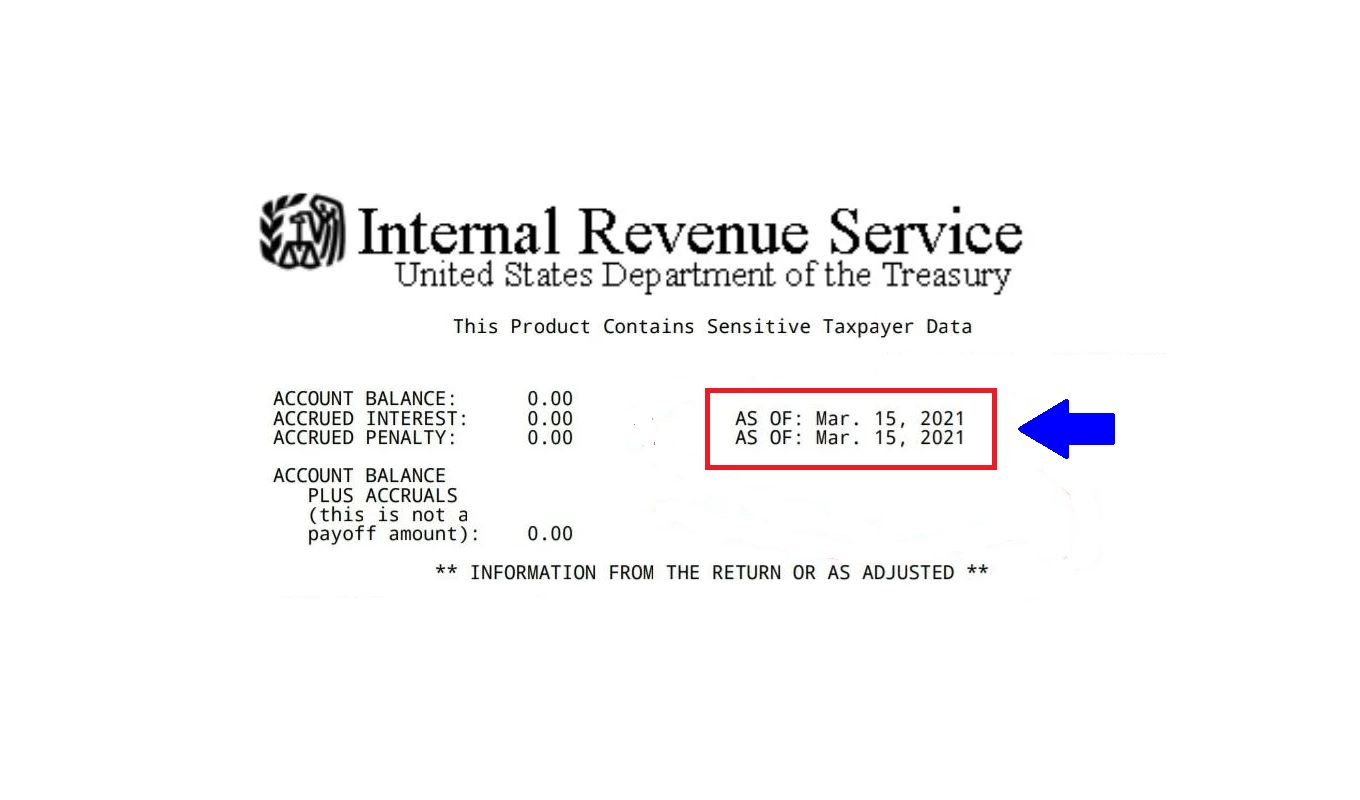

Before we dive into the specifics of code 846, let’s first gain a basic understanding of IRS transcripts. An IRS transcript is a record of a taxpayer’s tax-related activities, including filings, payments, and any adjustments made to their tax account. It provides valuable information for taxpayers, tax professionals, and the IRS to review and assess the taxpayer’s financial history.

Now, let’s move on to the main focus of this article: code 846. Code 846 on an IRS transcript is associated with the issuance of a refund. It indicates that the IRS has reviewed the taxpayer’s return, determined that they are owed a refund, and subsequently applied the necessary adjustments to process the refund.

### Writing Style: casual

Understanding IRS Transcripts

To have a greater understanding of code 846, it’s essential to familiarize ourselves with IRS transcripts and how they work. An IRS transcript is a summary of a taxpayer’s tax return and includes important information about their filing status, income, deductions, and any financial transactions related to their tax account.

IRS transcripts serve as a historical record, providing a chronological overview of the taxpayer’s tax activities. They are often used by taxpayers, tax professionals, and the IRS itself to verify income, resolve tax-related issues, and monitor changes made to a taxpayer’s account.

Obtaining an IRS transcript can be done online through the IRS website or by requesting a physical copy by mail. There are different types of transcripts available, including the most common ones such as the tax return transcript, which provides a summary of the taxpayer’s original tax return, and the account transcript, which shows any adjustments made to the taxpayer’s tax account.

Transcripts can reveal a variety of information, including wages reported by employers, interest earned from financial institutions, and any credits or deductions claimed by the taxpayer. They can also indicate if the taxpayer has any outstanding tax liabilities, penalties, or interest owed to the IRS.

Overall, understanding IRS transcripts is crucial when it comes to interpreting the information they contain and identifying any codes or indicators that may appear, such as code 846. By obtaining and reviewing their IRS transcripts, taxpayers can gain a clear understanding of their tax situation and effectively navigate any tax-related challenges they may face.

### Writing Style: casual

Code 846 Explained

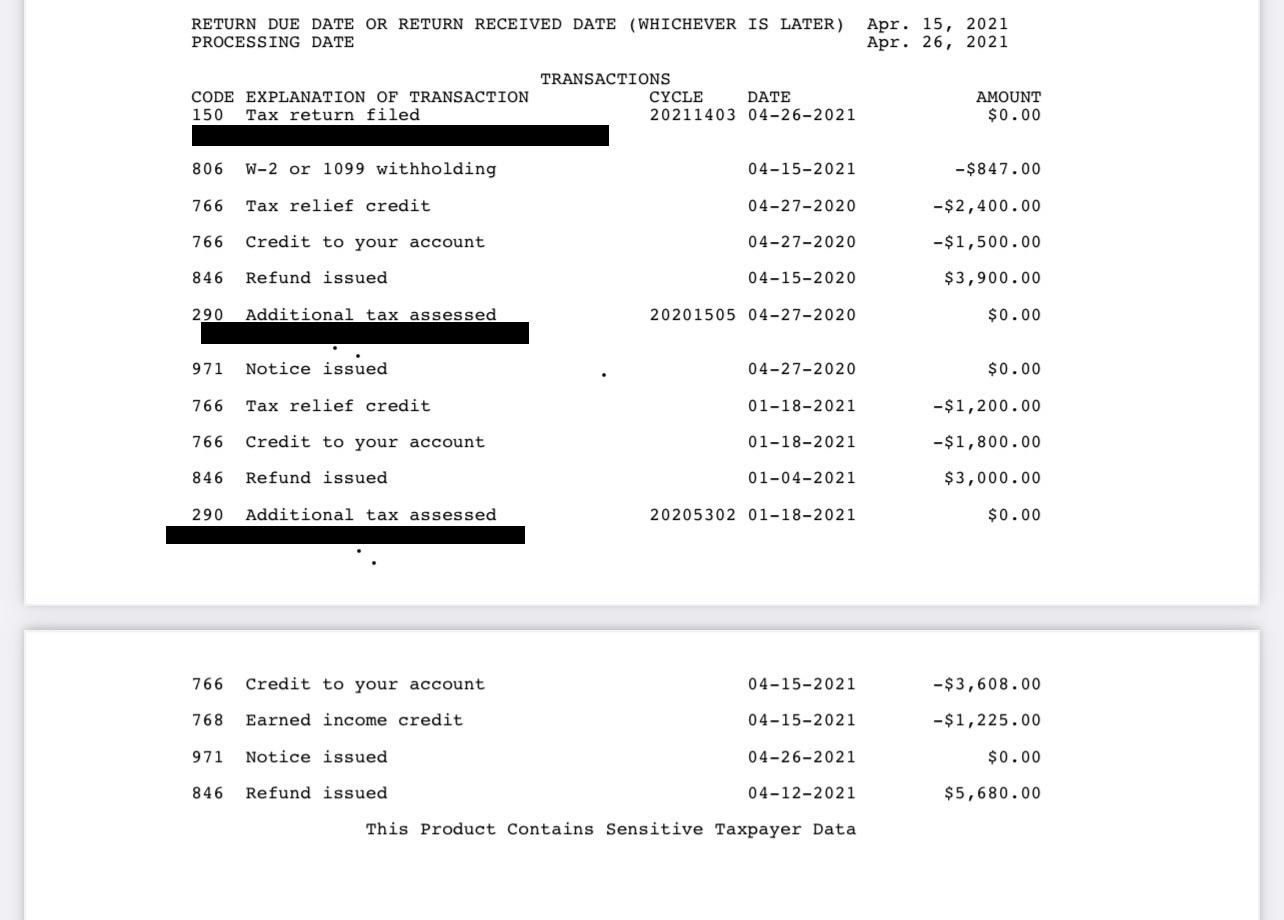

Code 846 on an IRS transcript signifies a refund issued to the taxpayer. When the IRS reviews a taxpayer’s return and determines that they have overpaid their taxes or are eligible for a refund for any other reasons, code 846 is assigned. This code indicates that the IRS has approved the refund and initiated the process to issue it to the taxpayer.

It’s important to note that code 846 does not provide specific details about the refund amount or the reason for the refund. Instead, it serves as a general indicator that a refund has been approved and is being processed. To obtain more information about the refund, taxpayers can refer to their tax return or contact the IRS directly.

In some cases, the refund associated with code 846 may not be the full amount the taxpayer anticipated. The refund could be reduced if the taxpayer has outstanding debts or obligations, such as unpaid taxes, student loan payments, or child support. The IRS has the authority to offset the refund against these obligations, resulting in a smaller refund amount or no refund at all.

It’s also worth mentioning that code 846 may appear multiple times on an IRS transcript if the taxpayer has filed amended returns or made changes to their original return. Each occurrence of code 846 represents a separate refund associated with the changes made to the taxpayer’s tax account.

While code 846 generally denotes a refund, it’s essential for taxpayers to review their IRS transcripts carefully and seek professional advice if they have any concerns or questions about the information provided. Understanding the implications of code 846 can help taxpayers manage their expectations and ensure they receive the appropriate refund owed to them.

### Writing Style: casual

Possible Reasons for Code 846

There are several reasons why code 846 may appear on an IRS transcript. Let’s explore some of the possible scenarios:

- Overpayment of Taxes: One common reason for code 846 is when a taxpayer has overpaid their taxes for the year. This could be due to excess withholdings from their paychecks, overestimated estimated tax payments, or additional tax credits and deductions that reduce their tax liability.

- Errors in Tax Return: If the IRS identifies errors or discrepancies in the taxpayer’s original tax return and makes corrections, they may issue a refund using code 846. These corrections could include adjustments to income, deductions, or credits that result in a change to the taxpayer’s tax liability.

- Amended Returns: When a taxpayer files an amended return to correct errors or claim additional deductions or credits, the IRS may process the amended return and issue a refund if it is determined that the taxpayer is owed additional money.

- Tax Credits and Deductions: Taxpayers who are eligible for refundable tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit, may receive a refund if the credits exceed their tax liability. Code 846 may be applied in these cases to indicate the issuance of the refund.

- Disputes and Audit Adjustments: In some instances, a taxpayer may have gone through an audit or had a dispute with the IRS that resulted in an adjustment to their tax liability. If the outcome of the audit or dispute favors the taxpayer and reduces their tax liability, a refund may be issued using code 846.

These are just a few possible reasons for the appearance of code 846 on an IRS transcript. It’s important for taxpayers to review their tax returns and transcripts carefully to understand the specific circumstances behind the issuance of a refund and ensure that it aligns with their expectations and tax situation.

### Writing Style: casual

Impact of Code 846 on Taxpayers

When taxpayers see code 846 on their IRS transcript, it generally indicates a positive outcome – the issuance of a refund. This can have a significant impact on their financial situation and provide a much-needed boost to their budget. Here are some ways in which code 846 can impact taxpayers:

- Financial Relief: A refund issued through code 846 can provide taxpayers with financial relief. Whether it’s a small amount or a substantial sum, it can be used to pay off debts, cover essential expenses, save for the future, or treat themselves to something special.

- Improved Cash Flow: The refund generated by code 846 injects additional funds into the taxpayer’s bank account, improving their cash flow. This can help ease financial stress and provide flexibility for managing day-to-day expenses.

- Opportunities for Savings: Taxpayers may choose to allocate their refund towards savings or investments. This can create opportunities for building an emergency fund, planning for retirement, or funding other long-term financial goals.

- Debt Repayment: For those carrying debts, such as credit card balances or loans, a refund can be utilized to make substantial payments or even pay off the debt entirely. This can reduce interest charges and improve overall financial health.

- Investments in Education or Career: Taxpayers may use their refund to invest in their education or career advancement. This could involve enrolling in courses, attending conferences, or purchasing resources that enhance their skills and knowledge.

- Supporting Local Economy: Some taxpayers may choose to spend their refund within their local community, supporting local businesses and stimulating economic growth. This can have a positive impact on the local economy and create employment opportunities.

While the impact of code 846 is generally positive, taxpayers should exercise responsible financial management and consider their individual circumstances before making decisions on how to utilize their refunds. Seeking advice from a financial advisor or tax professional can provide valuable guidance tailored to their specific needs.

### Writing Style: casual

Resolving Issues related to Code 846

If taxpayers encounter any issues or have concerns related to code 846 and the associated refund, there are steps they can take to address and resolve them. Here are some strategies to consider:

- Check Refund Status: Taxpayers can use the “Where’s My Refund?” tool on the IRS website or call the IRS refund hotline to check the status of their refund. This will provide information on when the refund was issued and if any issues or delays are present.

- Review Tax Return: It’s important for taxpayers to review their original tax return to ensure its accuracy. Double-checking income, deductions, and credits can help identify any errors or discrepancies that may have led to an incorrect refund amount or delay in processing.

- Contact the IRS: If taxpayers have questions or need additional information regarding their refund issued through code 846, they can contact the IRS directly. The IRS provides various channels for communication, including phone, mail, and online tools.

- Seek Professional Assistance: Taxpayers facing complex issues or disputes related to code 846 may benefit from seeking the guidance of a tax professional or certified public accountant (CPA). These professionals can provide expertise, review the refund situation, and assist in resolving any problems or discrepancies.

- Resolve Outstanding Debts: If the refund amount is less than expected or if there are outstanding debts owed to the IRS, taxpayers should address these issues promptly. Paying off outstanding tax obligations or resolving other debts can help avoid future complications and ensure the taxpayer receives the full refund owed to them.

- Follow-up on Unreceived Refunds: In cases where taxpayers were expecting a refund but have not received it, it is advisable to follow up with the IRS to determine the cause of the delay. This could be due to processing delays, errors in the taxpayer’s information, or other unforeseen circumstances.

By taking these proactive steps, taxpayers can resolve any issues related to code 846 and ensure a smooth and accurate handling of their refund. It’s important to address concerns promptly to avoid unnecessary delays and to make the most of the refund that they are entitled to.

### Writing Style: casual

Conclusion

Understanding the intricacies of the IRS can be challenging, but having knowledge about codes like 846 can provide taxpayers with valuable insights into their tax situation. Code 846 indicates that a refund has been approved and is in the process of being issued.

IRS transcripts play a crucial role in helping taxpayers understand their tax history and any adjustments made to their tax account. By reviewing these transcripts, taxpayers can gain clarity on their financial situation and identify codes and indicators such as code 846.

When code 846 appears on an IRS transcript, taxpayers can anticipate the positive impact it will have on their finances. The refund issuance can provide financial relief, improved cash flow, opportunities for saving and investing, and the ability to pay off debts.

In the event of any concerns or issues related to code 846, taxpayers should take proactive steps to resolve them. Checking the refund status, reviewing the tax return for accuracy, contacting the IRS or seeking professional assistance can all be beneficial in addressing and resolving any problems that may arise.

It is important for taxpayers to be aware that code 846 and the associated refund are subject to certain conditions. The refund amount may not always match expectations, and outstanding debts or obligations can impact the final refund received.

In conclusion, taxpayers can navigate their tax journey with confidence by understanding code 846 and its implications. By staying informed, proactive, and seeking assistance when necessary, taxpayers can effectively manage their refunds and ensure a smooth experience with the IRS.

### Writing Style: casual