Finance

What Is Ach Credit SSA Treas

Modified: January 15, 2024

Discover what Ach Credit SSA Treas is and how it impacts your finances. Uncover important details about this payment method and its significance in your financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Are you curious about what Ach Credit SSA Treas means? If you’ve come across this term while managing your finances, you might be wondering how it relates to your transactions. Ach Credit SSA Treas refers to an electronic payment system that delivers Social Security and government benefit payments directly to recipients. Understanding how ACH credit works with SSA Treas can help you effectively manage your finances and ensure a seamless payment experience.

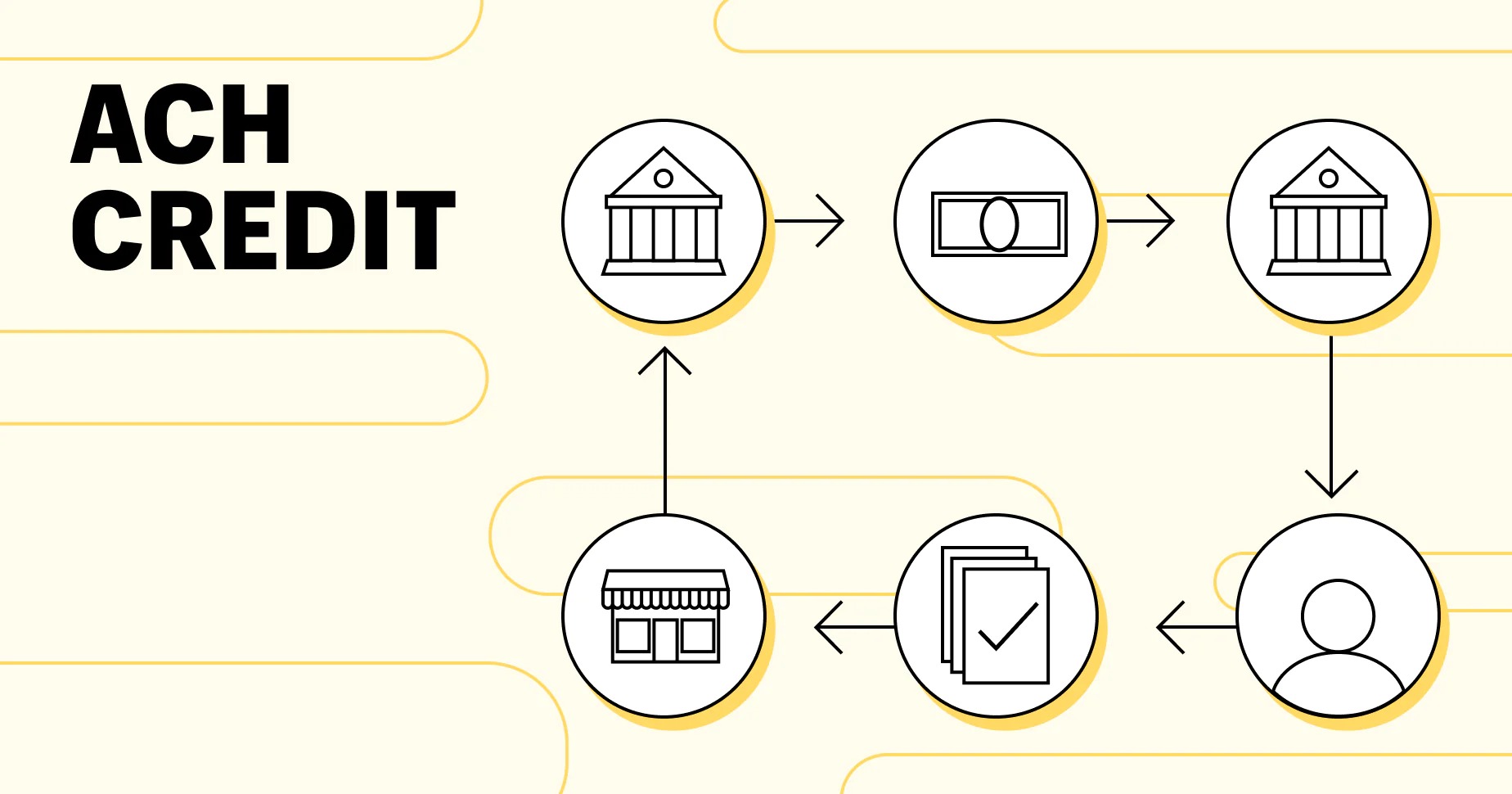

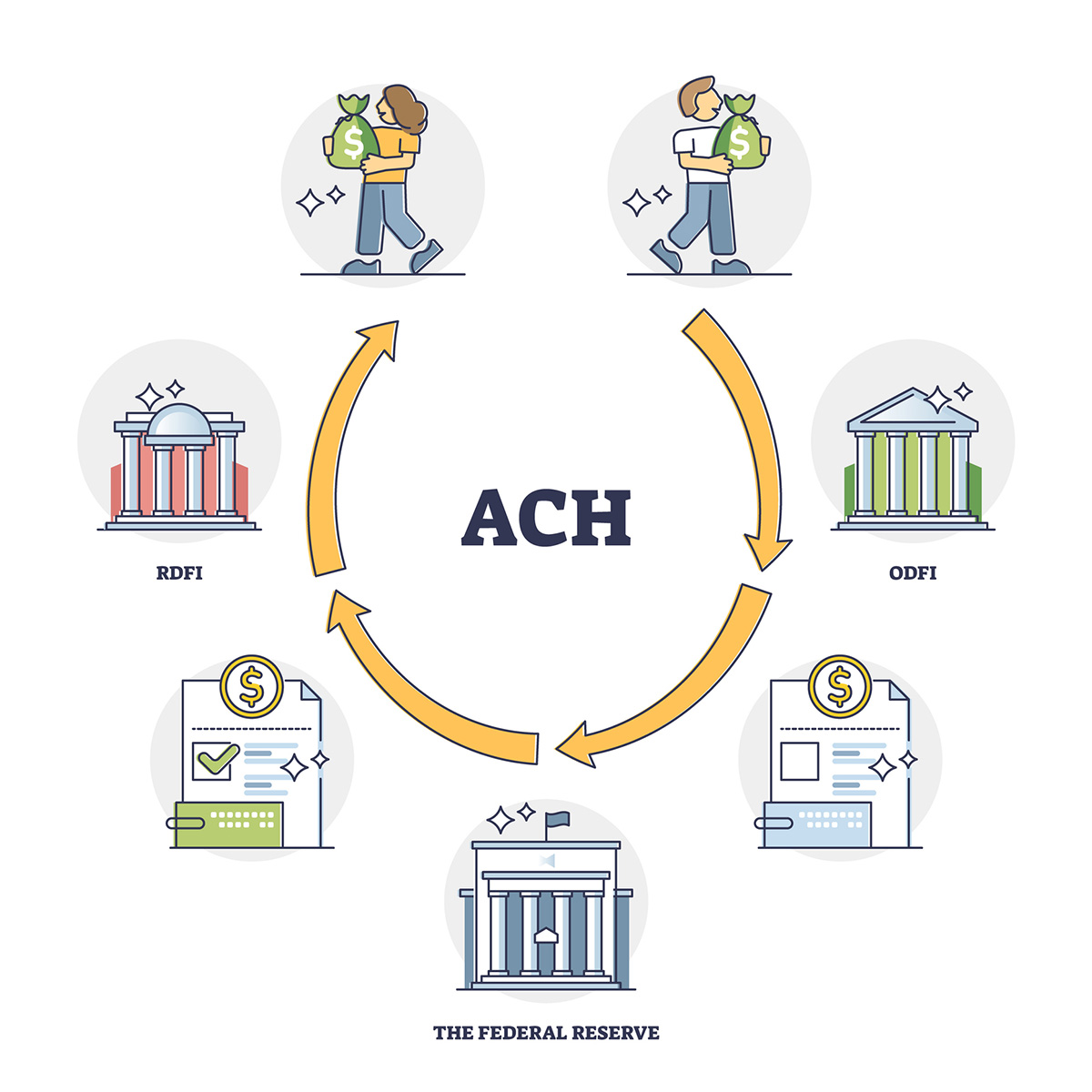

ACH, which stands for Automated Clearing House, is a network that facilitates electronic money transfers. It enables businesses, individuals, and government entities to send and receive funds electronically, eliminating the need for paper checks or physical cash. By utilizing the ACH network, the Social Security Administration (SSA) is able to disburse benefits efficiently and securely.

SSA Treas, short for the Social Security Administration Treasury, is the department responsible for managing and distributing Social Security payments. It works in conjunction with ACH credit to provide beneficiaries with a convenient and reliable method of receiving their benefits. By setting up ACH credit with SSA Treas, you can have your Social Security payments deposited directly into your bank account.

But what are the specific advantages of using ACH credit SSA Treas? How can you apply for this service? In this article, we’ll explore the benefits of ACH credit SSA Treas and guide you through the process of setting it up. Whether you’re already receiving Social Security payments or looking to enroll for the first time, understanding the ins and outs of ACH credit SSA Treas will help you streamline your financial management.

Understanding ACH Credit

Before we delve into the specifics of ACH credit SSA Treas, it’s important to have a clear understanding of how ACH credit works. ACH credit is a method of transferring funds electronically from one bank account to another. Instead of using paper checks or physical cash, ACH credit allows for direct deposits into the recipient’s bank account.

When it comes to government benefit payments, such as Social Security, ACH credit provides a secure and efficient way to distribute funds to beneficiaries. With ACH credit, recipients no longer need to worry about lost or stolen paper checks, delays in mail delivery, or the inconvenience of cashing physical checks.

ACH credit transactions are typically initiated by the organization or government agency responsible for disbursing funds. In this case, the Social Security Administration (SSA) utilizes ACH credit to deliver benefit payments directly to recipients. Upon enrollment in ACH credit SSA Treas, the recipient’s bank account information is securely stored and used to initiate automated transfers.

One key advantage of ACH credit is the speed at which funds are deposited. Unlike traditional paper checks, which can take days or even weeks to clear, ACH credit payments are typically deposited into the recipient’s bank account within one to two business days. This ensures that beneficiaries have timely access to their funds and can promptly meet their financial obligations.

It’s worth noting that ACH credit transactions require the recipient to have a valid bank account. This is because ACH credits are initiated as direct deposits to the recipient’s account. If you don’t currently have a bank account, it’s important to open one before applying for ACH credit SSA Treas to ensure a smooth and seamless payment process.

In summary, ACH credit is an electronic money transfer system that enables funds to be deposited directly into a recipient’s bank account. This method facilitates secure and efficient payments, eliminating the need for paper checks and providing timely access to funds. By embracing ACH credit, the Social Security Administration can deliver benefits seamlessly to recipients through SSA Treas.

Overview of SSA Treas

SSA Treas, or the Social Security Administration Treasury, is the department responsible for managing and distributing Social Security payments. The SSA Treas collaborates with the Treasury Department and utilizes the ACH credit system to electronically transfer funds to beneficiaries.

When you receive Social Security benefits, the funds are sent directly from the SSA Treas to your designated bank account through ACH credit. This ensures a hassle-free and secure method of receiving payments.

The SSA Treas is committed to ensuring that beneficiaries receive their Social Security payments promptly and accurately. Through their partnership with the Treasury Department and use of ACH credit, they have streamlined the payment process and eliminated the need for paper checks.

One key advantage of receiving Social Security payments through SSA Treas is the convenience it offers. Instead of waiting for a physical check to arrive in the mail and then having to deposit or cash it, ACH credit allows the funds to be deposited directly into your bank account. This means no more trips to the bank or worries about lost or stolen checks.

Moreover, by utilizing ACH credit and removing paper checks from the equation, the SSA Treas promotes sustainability and reduces the environmental impact associated with paper-based payment methods.

Additionally, receiving your Social Security payments through SSA Treas provides a level of security. With ACH credit, there is a reduced risk of fraud, as the funds are transferred electronically and deposited directly into your bank account. This eliminates the need for physical checks that can be lost, stolen, or tampered with.

In summary, SSA Treas is the department within the Social Security Administration responsible for managing and distributing Social Security payments. Through their collaboration with the Treasury Department and implementation of ACH credit, beneficiaries can enjoy the convenience, security, and efficiency of receiving their payments directly into their bank accounts.

Benefits of ACH Credit SSA Treas

Enrolling in ACH credit SSA Treas offers several advantages for recipients of Social Security benefits. Let’s explore some of the key benefits:

- Convenience: ACH credit SSA Treas eliminates the need for physical checks, making the payment process convenient and hassle-free. Recipients no longer need to visit the bank to deposit or cash their checks, saving time and effort.

- Security: By utilizing ACH credit, funds are securely deposited directly into the recipient’s bank account. This minimizes the risk of lost or stolen checks and reduces the likelihood of fraud associated with paper-based payments.

- Timely Access to Funds: ACH credit payments are typically deposited into the recipient’s bank account within one to two business days. This ensures timely access to funds and allows beneficiaries to meet their financial obligations without delays.

- Reduced Environmental Impact: By eliminating the use of paper checks, ACH credit SSA Treas promotes sustainability and reduces the environmental impact associated with printing, processing, and transporting physical checks.

- Automatic Deposits: Once enrolled in ACH credit SSA Treas, recipients no longer need to worry about manually depositing their checks. The funds will be automatically deposited into their designated bank account, providing peace of mind and eliminating the risk of forgetting to deposit or losing a check.

- Easy Management: With ACH credit, managing your Social Security payments becomes simpler. You can easily track and monitor your deposits through your bank account, making it convenient to keep tabs on your finances.

Overall, ACH credit SSA Treas offers numerous benefits that enhance the payment experience for Social Security recipients. From convenience and security to timely access to funds and simplified management, enrolling in ACH credit can significantly improve your financial well-being.

Applying for ACH Credit SSA Treas

If you’re interested in receiving your Social Security benefits through ACH credit SSA Treas, the application process is straightforward. Here’s a step-by-step guide to help you apply:

- Ensure you have a bank account: To enroll in ACH credit, you’ll need a valid bank account. If you don’t have one, visit your local bank or credit union to open an account. Make sure to gather all the necessary identification and documentation required by the financial institution.

- Contact the Social Security Administration: Get in touch with the Social Security Administration to inform them of your desire to receive your benefits through ACH credit. You can contact them by phone, visit a local Social Security office, or apply online through the SSA’s official website.

- Provide your bank account information: During the application process, you’ll need to provide your bank account details, including the account number and routing number. This information allows the SSA to initiate the ACH credit payments directly to your account.

- Submit the required documentation: The SSA may require additional documentation to process your application. This can include a copy of your identification, Social Security number, and any other supporting documents requested. Ensure that you submit all the required documents promptly to expedite the enrollment process.

- Wait for confirmation: Once you’ve completed the application and provided all the necessary information, the SSA will review your application and set up the ACH credit for your benefit payments. You will receive a confirmation once the enrollment is successful.

- Monitor your bank account: After enrolling in ACH credit SSA Treas, regularly monitor your bank account to ensure that the funds are being deposited correctly. If you experience any issues or have questions, reach out to the SSA or your bank for assistance.

It’s important to note that the enrollment process for ACH credit SSA Treas may vary slightly depending on your location and individual circumstances. It’s recommended to consult the Social Security Administration or visit their website for specific instructions and guidelines.

By following these steps and applying for ACH credit SSA Treas, you can enjoy the ease, security, and convenience of having your Social Security benefits deposited directly into your bank account.

Frequently Asked Questions

Here are some common questions about ACH credit SSA Treas:

- Can I still receive paper checks for my Social Security benefits?

- How long does it take for ACH credit payments to be deposited into my bank account?

- Can I change my bank account information for ACH credit SSA Treas?

- Is there a fee for receiving Social Security benefits through ACH credit?

- What happens if I close my bank account?

- Can I cancel ACH credit SSA Treas and switch back to receiving paper checks?

No, if you enroll in ACH credit SSA Treas, you will no longer receive paper checks. Your benefit payments will be deposited directly into your designated bank account.

ACH credit payments are typically deposited into your bank account within one to two business days. However, the exact timing may vary depending on your bank’s processing procedures.

Yes, if you need to update or change your bank account information, you can contact the Social Security Administration to provide the new details. They will guide you through the process of updating your account information for ACH credit.

No, there is no fee to receive your benefits through ACH credit SSA Treas. It is a free service provided by the Social Security Administration.

If you close your bank account, it’s important to contact the Social Security Administration and provide them with your new bank account details. This will ensure that your benefit payments continue to be deposited correctly.

Yes, if you wish to stop receiving your benefits through ACH credit and switch back to paper checks, you can contact the Social Security Administration and inform them of your preference. However, keep in mind that paper checks may have processing delays and are generally less secure than ACH credit payments.

If you have any additional questions or concerns about ACH credit SSA Treas, it’s recommended to contact the Social Security Administration directly. They will be able to provide you with the most accurate and up-to-date information regarding your specific situation.

Conclusion

Enrolling in ACH credit SSA Treas can greatly enhance your experience as a recipient of Social Security benefits. By leveraging the convenience, security, and efficiency of electronic payments, you can streamline your financial management and ensure timely access to your funds.

Through ACH credit, the Social Security Administration (SSA) and SSA Treas collaborate to deliver benefit payments directly into your bank account. This eliminates the need for paper checks and offers several advantages, including convenience, security, and reduced environmental impact.

By applying for ACH credit SSA Treas, you can enjoy automatic deposits, easy payment management, and peace of mind knowing that your funds are securely and promptly deposited into your bank account. Moreover, ACH credit eliminates the risk of lost or stolen checks and reduces the likelihood of fraud associated with traditional payment methods.

To apply for ACH credit SSA Treas, ensure you have a bank account and contact the Social Security Administration to initiate the enrollment process. Provide the required documentation and bank account details, and await confirmation of your successful enrollment.

Remember to monitor your bank account after enrolling in ACH credit to ensure that the payments are being deposited correctly. If you have any questions or need assistance, don’t hesitate to reach out to the Social Security Administration or your bank.

In conclusion, ACH credit SSA Treas is a secure and efficient method of receiving your Social Security benefits. Embracing ACH credit offers numerous benefits, including convenience, security, and timely access to funds. Make the switch today and enjoy the convenience of hassle-free electronic payments.