Home>Finance>What Is Not A Benefit Of Having A Good Credit Score

Finance

What Is Not A Benefit Of Having A Good Credit Score

Published: October 22, 2023

A good credit score is essential for finance, but it does not guarantee financial success. Find out the limitations and misconceptions of credit scores.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

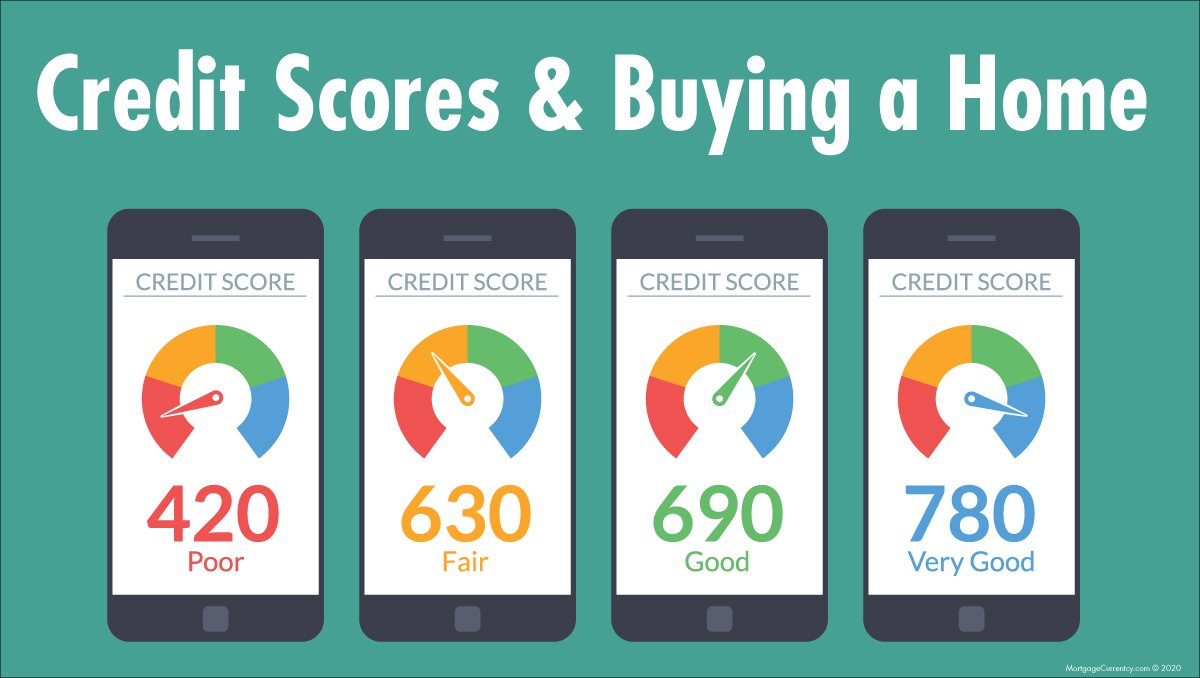

Having a good credit score is often touted as a crucial financial goal. With a good credit score, individuals can access a wide range of benefits, such as lower interest rates, better loan options, and increased financial opportunities. However, it is equally important to understand that there are also disadvantages associated with having a less than stellar credit history. In this article, we will explore the flip side of having a good credit score by highlighting what is not a benefit of maintaining excellent credit.

While a good credit score undoubtedly opens doors to various financial opportunities, it is essential to recognize that it is not a guaranteed solution to all financial challenges. There are certain drawbacks that individuals with good credit must also navigate. By understanding these potential downsides, individuals can make informed decisions and develop a well-rounded approach to managing their personal finances.

In the following sections, we will delve into the specific disadvantages that individuals may encounter despite having a good credit score. It is important to note that these drawbacks may not directly affect every person with a good credit score, as the severity and impact can vary depending on individual circumstances. Nonetheless, it is essential to be aware of these potential challenges and take steps to mitigate their impact on your financial well-being.

Difficulty in Obtaining Loans

Contrary to popular belief, having a good credit score does not guarantee automatic approval for loans. Lenders consider various factors when assessing loan applications, including income, debt-to-income ratio, employment history, and credit history. While a good credit score is certainly a positive factor, other aspects of your financial profile also come into play.

If you have a good credit score but a low income or a high debt-to-income ratio, lenders may still hesitate to approve your loan application. This is because they want assurance that you have the financial capability to repay the loan. Similarly, if you have a limited credit history, even with a good score, lenders may view you as more of a risk compared to someone with a longer credit history.

In addition, some lenders have specific criteria or requirements that go beyond just a good credit score. For example, certain mortgage lenders may require a minimum down payment or a specific debt-to-income ratio, regardless of your credit score. Therefore, it is essential to understand that while a good credit score is beneficial, it does not guarantee automatic loan approval.

In some cases, individuals with good credit scores may face difficulties obtaining loans simply due to external factors. For instance, during economic downturns or financial crises, lenders may tighten their lending criteria, making it more challenging for even those with good credit scores to secure loans.

To overcome this hurdle, it is important to have a comprehensive understanding of your financial situation. Work on improving other aspects of your financial profile, such as increasing your income or reducing your debt-to-income ratio. Additionally, consider approaching lenders who specialize in working with individuals with good credit scores but may have unique circumstances that make traditional lending institutions hesitant.

Higher Interest Rates

While having a good credit score can generally result in lower interest rates on loans and credit cards, it is not a guarantee that you will always receive the best rates available. Lenders still consider other factors when determining the interest rates they offer to borrowers.

If your credit score is good but not excellent, lenders may still view you as slightly riskier compared to individuals with impeccable credit histories. As a result, they may offer you a slightly higher interest rate to mitigate their perceived risk. Even a small difference in interest rates can add up over time, significantly increasing the total cost of borrowing.

It’s important to understand that interest rates are not solely based on credit scores. Lenders also take into account factors such as current market conditions, loan terms, and the type of loan for which you are applying. So, even if you have an excellent credit score, if market conditions are unfavorable or you are applying for a high-risk loan, you may still be offered higher interest rates.

In some cases, individuals with good credit scores may also be subject to predatory lending practices, where unscrupulous lenders take advantage of their perceived creditworthiness to charge exorbitant interest rates. It is essential to be cautious and thoroughly research any lender or loan offer before committing to avoid falling victim to such practices.

To mitigate the potential impact of higher interest rates, shop around and compare loan offers from different lenders. Even with a good credit score, different lenders may have varying criteria and may offer different interest rates. By exploring multiple options, you can increase your chances of finding lenders who offer competitive rates based on your creditworthiness.

Additionally, you should continue to work on improving your credit score over time. As your score improves, you may become eligible for even better interest rates in the future. Paying bills on time, minimizing debt, and maintaining a healthy credit utilization ratio are all good practices that can help gradually increase your creditworthiness.

Limited Credit Options

Despite having a good credit score, individuals may still face limitations when it comes to accessing certain credit options. While a good credit score opens doors to a wide range of borrowing opportunities, there may be specific types of credit that are only available to those with higher credit scores or specific financial profiles.

For example, individuals with excellent credit scores may have access to exclusive credit cards with high credit limits, attractive rewards programs, and low-interest rates. On the other hand, those with good credit scores may have access to a more limited selection of credit cards or may not qualify for premium credit card offers.

In addition, certain credit products, such as specialized loans or lines of credit, may require an even higher credit score or specific financial criteria that go beyond simply having a good credit score. These credit options may offer more favorable terms or features that cater to specific needs, such as business loans, medical financing, or high-value mortgages.

Furthermore, individuals with good credit scores may still encounter limitations when seeking credit from certain lenders. Some lenders have stricter borrowing criteria and may only be willing to extend credit to individuals with excellent credit scores or extensive credit histories. This can make it challenging for those with good credit scores to access credit from these specific lenders.

To overcome these limitations, it is crucial to continue building your credit history and improving your credit score. Consistently practicing good credit habits, such as making timely payments, maintaining a low credit utilization ratio, and keeping a diverse mix of credit accounts, can help enhance your creditworthiness over time.

Additionally, consider exploring alternative lending options or specialized lenders that cater to individuals with good credit scores but may have unique circumstances that traditional lenders may overlook. These lenders may have more flexible lending criteria or offer credit products specifically designed for those with good credit but limited options.

Difficulty in Renting a Home or Apartment

Having a good credit score is often considered a crucial factor when renting a home or apartment. Landlords and property management companies typically run credit checks on potential tenants to assess their financial responsibility and ability to pay rent on time. While a good credit score can certainly improve your chances of securing a rental, it does not guarantee a seamless process.

Landlords may have specific criteria or rental policies that go beyond credit scores alone. They may consider other factors such as income, rental history, employment stability, and references. Even with a good credit score, if you have a low income or a history of late rent payments, landlords may still be hesitant to approve your rental application.

In some cases, landlords may require a higher security deposit or co-signer if they perceive any risk associated with your financial situation. They may also impose stricter terms, such as shorter lease agreements, to mitigate potential risks. This can make it more challenging to find suitable rental options, especially in competitive housing markets.

It is important to be proactive and transparent with potential landlords about your credit history and any relevant circumstances that may have impacted it. Providing supporting documentation, such as proof of income or references, can help strengthen your rental application and demonstrate your ability to be a responsible tenant.

If you are facing difficulties in renting due to credit-related issues, consider offering a higher security deposit or seeking out private landlords who may be more flexible in their criteria. Additionally, you can work on improving your credit by making timely payments, reducing debt, and addressing any negative items on your credit report.

Remember that rental challenges based on credit are not permanent. As you continue to demonstrate responsible financial habits and improve your creditworthiness, future rental applications may become easier to navigate.

Higher Insurance Premiums

When it comes to insurance, having a good credit score can play a significant role in determining the premiums you are charged. Insurance companies utilize credit-based insurance scores to assess the risk level of policyholders. These scores are based on factors such as payment history, credit utilization, length of credit history, and number of open accounts.

Individuals with good credit scores are generally considered lower-risk policyholders, as they are seen as more financially responsible and less likely to file insurance claims. As a result, they may qualify for lower insurance premiums. However, it is important to note that a good credit score is just one of many factors considered by insurance companies.

If you have a good credit score but other risk factors come into play, such as a poor driving record or high-risk occupation, insurance companies may still charge higher premiums to compensate for the perceived increased risk. Similarly, depending on the insurance provider, the impact of credit on premiums may vary. Some insurers may heavily weigh credit scores, while others may place less emphasis on them.

In some cases, individuals with good credit scores may face challenges in finding affordable insurance coverage if they have a limited credit history or a recent negative credit event, such as bankruptcy or foreclosure. Insurance companies may view these factors as indications of higher risk and adjust premiums accordingly.

To mitigate potential increases in insurance premiums, it is crucial to maintain a good credit score and continue practicing responsible financial habits. Pay bills on time, keep credit utilization low, and regularly review your credit reports for any errors or discrepancies that could negatively impact your creditworthiness.

Additionally, it can be beneficial to shop around and compare insurance quotes from multiple providers. Each insurance company has its own underwriting criteria, which means premiums can vary significantly. By obtaining quotes from different insurers, you can find the coverage that meets your needs at a more competitive rate.

Lastly, consider discussing your credit history and its impact on premiums directly with insurance providers. Some companies may offer discounts or alternative rating factors that can help offset any potential increases due to credit-related factors. It is worth exploring these options to ensure you are getting the most affordable coverage available.

Inability to Qualify for Certain Jobs

In today’s competitive job market, having a good credit score has become increasingly important for certain professions. Some employers use credit checks as part of their pre-employment screening process, especially for positions that handle sensitive financial information or have fiduciary responsibilities.

While a good credit score is not the sole determinant of job eligibility, it can have an impact on the employer’s perception of your financial responsibility and trustworthiness. If you have a low credit score or a history of financial mismanagement, employers may question your ability to handle monetary matters or make sound decisions, potentially affecting your chances of securing certain jobs.

It is important to note that specific regulations and laws vary by jurisdiction, and not all employers are allowed to consider credit scores in their hiring decisions. However, for positions that involve financial transactions, access to sensitive data, or a high level of responsibility, credit checks may be permissible in some jurisdictions.

To mitigate potential challenges, it is crucial to be proactive in managing your credit and addressing any negative items on your credit report. Make sure to review your credit report regularly for accuracy and contact the credit bureaus to dispute any erroneous information. Paying bills on time, reducing debt, and practicing responsible financial habits can also positively impact your credit score over time.

If you are applying for a job that may require a credit check, it can be helpful to provide context or explanations for any negative credit history. This can be done during the application or interview process, highlighting any extenuating circumstances or steps you have taken to rectify past financial challenges.

Regardless of whether credit checks are a part of the hiring process, it is important to maintain overall financial stability and responsibility. Being organized, demonstrating strong budgeting skills, and showcasing your ability to handle financial responsibilities in other areas of your life can help create a positive impression with potential employers.

Remember, while a good credit score may be a consideration for certain job applications, it is not the sole indicator of your qualifications or worth as a candidate. Focus on highlighting your skills, experience, and achievements relevant to the job requirements to maximize your chances of success.

Limited Utility Options

When setting up essential utilities such as electricity, water, and gas, individuals with good credit scores generally have more options and flexibility. Utility companies often conduct credit checks to assess the likelihood of timely bill payments. While a good credit score is advantageous, it does not guarantee access to all utility providers or favorable terms.

Individuals with poor credit or no credit history may face difficulties in obtaining utility services from traditional providers. Utility companies may require higher deposits or impose stricter payment terms for individuals deemed higher risk due to their credit standing. This can limit the options available to individuals with good credit scores but may still face financial challenges or have a limited credit history.

In some cases, individuals with good credit scores may have the advantage of choosing from multiple utility providers, granting them the ability to compare rates and select the most cost-effective option. However, this is not always the case, as certain geographic areas may have limited utility company options, leaving individuals with fewer choices regardless of their credit score.

Moreover, some utilities, such as cable and internet providers, may offer promotional rates or special packages to customers with excellent credit scores. Individuals with good credit scores may still have access to competitive rates and discounts, though the extent of these offers may vary based on location and service provider.

To ensure access to a variety of utility options and potentially secure better terms, it is important to maintain a good credit score and demonstrate responsible financial behavior. Paying utility bills on time can contribute to a positive credit history, and practicing good credit habits overall can improve your creditworthiness.

If you are facing limitations in utility options due to credit-related factors, consider exploring alternative providers or non-traditional options. Some utility companies specialize in working with individuals with less-than-perfect credit or offer prepaid or pay-as-you-go plans that do not require credit checks.

Lastly, be proactive in researching and comparing utility providers in your area. Look for customer reviews, compare rates, and inquire about any discounts or promotions available. By putting in effort to find the best options, you can mitigate the potential limitations imposed by credit-related factors.

Potential Difficulty in Starting a Business

For aspiring entrepreneurs, starting a business requires careful planning, funding, and strategic decision-making. While having a good credit score is advantageous, it does not guarantee a smooth path to business establishment. The availability of credit and favorable terms can vary depending on various factors, including the individual’s creditworthiness and the nature of the business.

When seeking financing or loans to start a business, lenders often consider both personal and business credit histories. A good personal credit score can positively influence the lender’s decision and potentially secure more favorable loan terms. However, other factors such as business plans, market analysis, and projections also play a crucial role in determining loan approvals.

Individuals with good credit scores may have access to a variety of financing options, including small business loans, lines of credit, and business credit cards. However, even with a good credit score, lenders may still require additional collateral, a solid business plan, or a demonstrated track record of business success.

Moreover, business credit scores, which are separate from personal credit scores, are often considered by lenders and suppliers when assessing the creditworthiness of a business. If the business has no or limited credit history, securing financing or establishing trade credit with suppliers may be more challenging. This can require entrepreneurs to rely on personal credit or personal assets to secure loans or funding.

In addition to credit-related challenges, starting a business may also involve other financial considerations, such as startup costs, equipment purchases, inventory, and operational expenses. Even with a good credit score, entrepreneurs may need to explore alternative funding options or consider bootstrapping techniques to launch their business successfully.

Overall, while a good personal credit score can improve the chances of securing business financing, it is essential to have a comprehensive business plan, a clear understanding of the industry, and a solid financial strategy to navigate the potential hurdles in starting a business.

Consider consulting with business advisors, exploring government-backed loan programs, or seeking guidance from organizations that support small business development. These resources can provide valuable insights, guidance, and potential funding options to help overcome any difficulties in starting a business.

Ultimately, the success of a business depends on various factors beyond credit scores. It requires perseverance, adaptability, and a strong entrepreneurial spirit to navigate the challenges and capitalize on opportunities along the journey of starting and growing a successful business.

Conclusion

While having a good credit score undoubtedly offers numerous benefits, it is important to recognize that it is not a magical solution to all financial challenges. Individuals with good credit scores may still face certain disadvantages that can impact their financial options and opportunities.

In this article, we explored several drawbacks associated with having a good credit score. We discussed the potential difficulties in obtaining loans, the possibility of higher interest rates, limited credit options, challenges in renting a home or apartment, higher insurance premiums, potential job qualification hurdles, limited utility options, and potential difficulties in starting a business.

Understanding these drawbacks helps individuals with good credit scores make informed decisions and take appropriate actions to mitigate any negative impacts. It is important to maintain a comprehensive approach to managing personal finances by focusing on factors beyond just a credit score.

By consistently practicing responsible financial habits, such as paying bills on time, reducing debts, maintaining a diverse credit history, and planning for the future, individuals can improve their overall financial well-being. It is also essential to explore alternative options, research extensively, and communicate openly with lenders, landlords, utility providers, and potential employers to overcome any limitations imposed by credit-related factors.

Remember, a good credit score is just one aspect of your financial profile. It does not define your worth as an individual or dictate your success. By staying informed, adapting to circumstances, and making sound financial decisions, you can navigate the potential disadvantages associated with having a good credit score and achieve long-term financial stability and success.