Finance

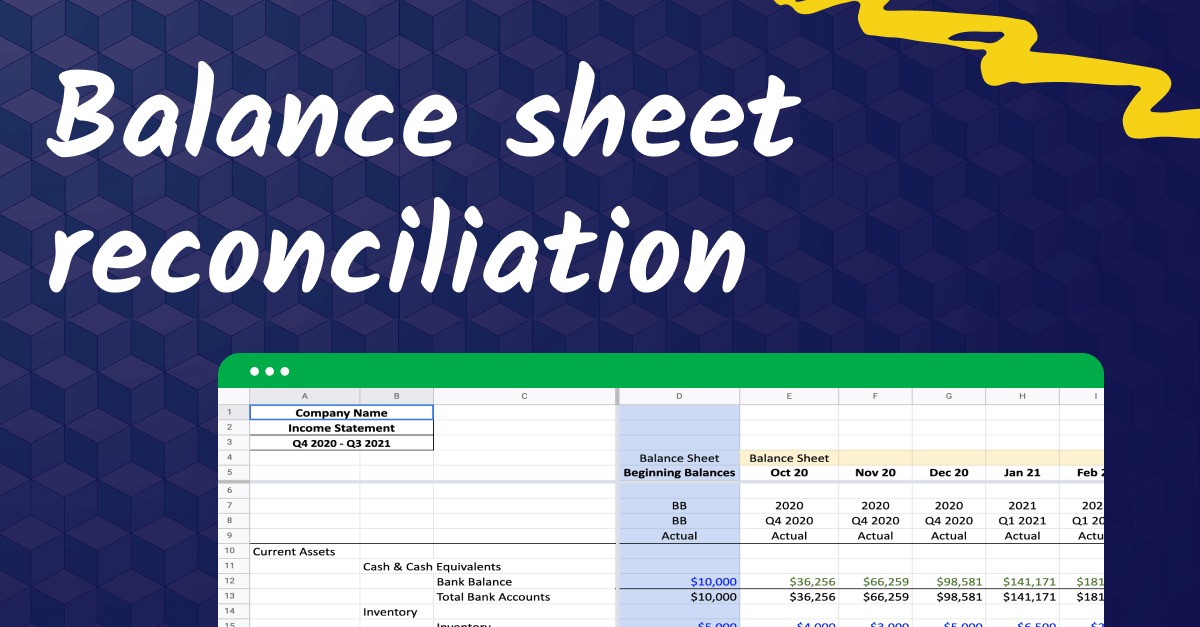

What Is Reconciliation In Accounting

Published: October 12, 2023

Discover the importance of reconciliation in accounting and its impact on finance. Gain insights into the process and best practices for accurate financial reporting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Reconciliation in Accounting

- Importance of Reconciliation in Accounting

- Process of Reconciliation in Accounting

- Types of Reconciliation in Accounting

- Benefits of Reconciliation in Accounting

- Challenges in Reconciliation in Accounting

- Best Practices for Reconciliation in Accounting

- Conclusion

Introduction

Accounting is an integral part of any organization, ensuring that financial transactions are accurately recorded and reported. One crucial aspect of accounting is reconciliation, which plays a fundamental role in maintaining the integrity of financial data and ensuring its accuracy. Reconciliation in accounting refers to the process of comparing two sets of records to ensure that they are consistent and in agreement.

In a business context, reconciliation involves matching individual transactions, balances, or statements between different sources. This process allows accounting professionals to identify any discrepancies or errors that may have occurred throughout the accounting cycle. By doing so, reconciliation not only helps maintain the accuracy of financial records but also provides valuable insights into the financial health of an organization.

In today’s fast-paced and complex financial landscape, reconciliation has become more critical than ever. With the increasing volume and complexity of financial transactions, organizations face a higher risk of discrepancies and errors. Therefore, thorough and regular reconciliation is essential to mitigate risks, detect fraud, and maintain the trust of stakeholders.

This article aims to explore the concept of reconciliation in accounting, highlighting its importance, process, types, benefits, challenges, and best practices. By understanding the fundamental aspects of reconciliation, accountants, finance professionals, and business owners can ensure accurate financial reporting and make informed decisions based on reliable financial data.

Definition of Reconciliation in Accounting

Reconciliation in accounting refers to the process of comparing and matching financial records from different sources to ensure their accuracy and consistency. It involves verifying that the balances, transactions, and statements in one set of records align with those in another set of records.

Accounting reconciliation is essential to identify any discrepancies or errors that may have occurred during the accounting cycle. It ensures that the financial data reflects the actual financial position of an organization and aids in detecting and correcting any inaccuracies.

The process of reconciliation involves comparing various financial records, such as bank statements, cash flow statements, general ledger accounts, and other financial documents. By conducting a thorough comparison, accountants can reconcile differences and bring the records into alignment.

Reconciliation in accounting can also involve matching individual transactions, such as purchases, sales, and expenses, to ensure that they are accurately recorded. This process helps detect any missing or duplicate transactions, ensuring that financial statements present an accurate depiction of the organization’s activities.

Overall, reconciliation in accounting serves as a critical control mechanism to ensure the accuracy, integrity, and reliability of financial records. It allows organizations to identify and resolve errors, discrepancies, or fraudulent activities, and ensures that the financial data presented to stakeholders is trustworthy and transparent.

Importance of Reconciliation in Accounting

Reconciliation in accounting is of utmost importance for several reasons. It ensures accuracy, integrity, and transparency in financial reporting, provides insights into an organization’s financial health, and aids in identifying errors, discrepancies, and fraudulent activities. The following are some key reasons why reconciliation is crucial in accounting:

- Accuracy of Financial Data: Reconciliation ensures that the financial data recorded in different sets of records align with each other. By comparing and matching transactions, balances, and statements, accountants can identify and correct any discrepancies or errors, ensuring that the financial records accurately reflect the organization’s financial position.

- Identifying Errors and Fraudulent Activities: Reconciliation plays a vital role in detecting errors, discrepancies, or fraudulent activities that may have occurred during the accounting cycle. It allows accountants to identify missing or duplicate transactions, spot unauthorized transactions, and address any irregularities promptly.

- Financial Reporting Compliance: Reconciliation is essential for complying with accounting standards and regulations. Accurate financial reporting is crucial for organizations to maintain the trust of stakeholders, such as investors, lenders, and regulatory bodies. Reconciliation ensures that financial statements are reliable, transparent, and in line with the applicable accounting principles.

- Budgeting and Financial Analysis: Reconciliation provides a solid foundation for budgeting and financial analysis. By ensuring the accuracy and consistency of financial data, organizations can make informed decisions, develop realistic budgets, and conduct meaningful financial analysis. Reconciliation also helps highlight trends, patterns, and areas that require further attention or improvement.

- Risk Management: Reconciliation helps mitigate financial risks by ensuring that all financial transactions and activities are properly recorded and accounted for. It aids in early detection of errors, discrepancies, or fraudulent activities, reducing the chances of financial losses or reputational damage. Regular reconciliation is particularly crucial for organizations that handle large volumes of transactions and have complex financial operations.

In summary, reconciliation in accounting is crucial for maintaining the accuracy, integrity, and transparency of financial records. It is essential for compliance, risk management, decision-making, and ensuring the trust of stakeholders. By embracing robust reconciliation practices, organizations can enhance their financial management processes and make data-driven decisions based on reliable financial information.

Process of Reconciliation in Accounting

The process of reconciliation in accounting involves several steps to ensure the accuracy and consistency of financial records. While the specific process may vary depending on the organization’s size, industry, and complexity of financial transactions, the following are the general steps involved in the reconciliation process:

- Gather Financial Records: Collect all the relevant financial records that need to be reconciled. This may include bank statements, cash flow statements, general ledger accounts, credit card statements, and other supporting documents.

- Compare Transactions: Match and compare individual transactions across the various financial records. Ensure that the amounts, dates, and descriptions of transactions are consistent across all records. Identify any missing or duplicate transactions that need to be investigated and resolved.

- Check Balances: Verify the balances in different accounts or statements. This includes bank account balances, cash balances, accounts receivable, accounts payable, and any other relevant balances. Ensure that the balances recorded in the financial records match the actual balances in the corresponding accounts.

- Investigate Discrepancies: If any discrepancies or errors are identified during the comparison process, investigate them thoroughly. This may involve reviewing supporting documents, contacting external parties, or consulting with relevant departments to determine the root cause of the discrepancies.

- Make Adjustments: Once the discrepancies are identified and understood, make the necessary adjustments to correct the errors. This may involve updating the financial records, making journal entries, or reconciling the differences through the appropriate accounting procedures.

- Document Reconciliation: Maintain proper documentation of the reconciliation process, including the steps taken, the adjustments made, and any supporting evidence. This documentation is essential for audit purposes and future reference.

- Review and Finalize: After the reconciliation process is completed, review the reconciled financial records to ensure that all discrepancies have been addressed and the data is accurate and consistent. Obtain any necessary approvals or sign-offs to confirm the completion of the reconciliation process.

Regular reconciliation is crucial to maintain the accuracy and integrity of financial records. The frequency of reconciliation depends on the organization’s specific needs and the volume of financial transactions. Some companies may reconcile on a daily or weekly basis, while others may perform monthly or quarterly reconciliations.

By following a thorough and systematic reconciliation process, organizations can ensure the reliability of financial data, detect and correct errors or discrepancies, and maintain transparency and compliance with accounting standards.

Types of Reconciliation in Accounting

In accounting, there are several types of reconciliation that organizations perform to ensure the accuracy and consistency of financial records. The specific types of reconciliation can vary depending on the nature of the transactions, the industry, and the organization’s specific needs. The following are some common types of reconciliation in accounting:

- Bank Reconciliation: Bank reconciliation is the process of comparing an organization’s internal financial records with the bank statement. It involves matching the transactions recorded in the company’s books with those reported by the bank. This reconciliation helps identify any discrepancies, such as missing transactions or errors in recording, and ensures that the bank balances and cash flows are accurately reflected.

- Accounts Receivable Reconciliation: Accounts receivable reconciliation involves reconciling the outstanding customer balances recorded in the organization’s books with the individual customer statements. This reconciliation helps identify any discrepancies, such as unpaid invoices or incorrect customer balances, and ensures accuracy in the accounts receivable records.

- Accounts Payable Reconciliation: Similar to accounts receivable reconciliation, accounts payable reconciliation involves matching the outstanding supplier invoices and payment records recorded in the organization’s books with the supplier statements. This reconciliation helps identify any discrepancies, such as missing or incorrect invoices, and ensures accuracy in the accounts payable records.

- Inventory Reconciliation: Inventory reconciliation involves comparing the physical inventory count with the inventory records in the accounting system. This reconciliation helps identify any discrepancies, such as theft, damage, or recording errors, and ensures accuracy in the inventory valuation.

- General Ledger Reconciliation: General ledger reconciliation involves reviewing and reconciling the balances in various accounts recorded in the general ledger. This reconciliation ensures that the general ledger balances match the balances reported in the subsidiary ledgers or other supporting documents, such as bank statements or supplier statements.

- Cash Flow Reconciliation: Cash flow reconciliation involves reconciling the cash inflows and outflows recorded in the organization’s cash flow statement with the actual cash transactions. This reconciliation helps identify any discrepancies, such as unrecorded cash receipts or payments, and ensures accuracy in the cash flow statement.

These are just a few examples of the types of reconciliation performed in accounting. Depending on the organization’s specific needs, there may be additional types of reconciliation performed, such as payroll reconciliation, fixed asset reconciliation, or intercompany reconciliation. Each type of reconciliation serves the purpose of ensuring the accuracy and consistency of financial records, providing valuable insights, and supporting financial decision-making.

Benefits of Reconciliation in Accounting

Reconciliation in accounting offers several important benefits that contribute to the accuracy, integrity, and reliability of financial records. By regularly and thoroughly reconciling financial data, organizations can experience the following advantages:

- Accuracy of Financial Reporting: Reconciliation ensures that the financial records accurately reflect the organization’s financial position. By identifying and rectifying discrepancies or errors, organizations can confidently present reliable financial statements to stakeholders, including management, investors, regulators, and lenders.

- Compliance with Accounting Standards: Reconciliation is crucial for ensuring compliance with accounting standards and regulations. Regular reconciliation helps organizations adhere to the principles of accuracy, consistency, and transparency required by accounting frameworks, reducing the risk of non-compliance and financial penalties.

- Detection of Errors and Fraudulent Activities: Through the reconciliation process, organizations can identify and resolve errors, discrepancies, or fraudulent activities that may have occurred during the accounting cycle. Timely detection helps mitigate the risk of financial losses, improves internal controls, and safeguards the organization’s assets.

- Fraud Prevention: Regular reconciliation acts as a deterrent to fraudulent activities. By requiring a thorough review of financial records, reconciliation increases the likelihood of detecting and preventing fraud, whether it involves unauthorized transactions, fictitious vendors, or embezzlement.

- Improved Financial Management: Reconciliation provides accurate and reliable financial data that supports informed decision-making, budgeting, and financial analysis. By having confidence in the accuracy of financial records, organizations can make data-driven decisions that positively impact profitability, cash flow, and overall financial performance.

- Enhanced Risk Management: Reconciliation helps mitigate financial risks by ensuring the completeness and accuracy of financial records. It facilitates the early detection and resolution of errors, reducing the chances of financial misstatements, compliance breaches, or reputational damage.

- Financial Transparency: Effective reconciliation practices promote financial transparency within an organization. By reconciling various financial records, organizations can provide stakeholders with a clear and accurate picture of their financial health, fostering trust and promoting good corporate governance.

Overall, the benefits of reconciliation in accounting are multifaceted. It ensures accurate financial reporting, aids in compliance, fraud prevention, and risk management. Reconciliation also supports effective financial management, decision-making, and transparency. By incorporating reconciliation as a standard practice, organizations can maintain the integrity of their financial data and build trust with stakeholders.

Challenges in Reconciliation in Accounting

While reconciliation in accounting is essential for ensuring accuracy and reliability of financial records, it can also present several challenges. These challenges arise due to various factors, including the volume and complexity of transactions, disparate systems and data sources, and human error. The following are some common challenges faced in the reconciliation process:

- Manual Processes: Reconciliation often involves manual data entry and comparison, which increases the risk of human errors. Transposing numbers, entering incorrect amounts, or overlooking transactions can lead to discrepancies in the reconciliation process.

- Data Inconsistencies: Different data sources may use different formats, coding structures, or categorizations, making it challenging to match and reconcile the data accurately. Discrepancies in data can arise from variations in terminology, currencies, or units of measurement, leading to difficulties in the reconciliation process.

- Large Volume of Transactions: Organizations that process a high volume of transactions face the challenge of reconciling a significant number of records. The sheer volume of transactions can overwhelm manual reconciliation processes, making it time-consuming and increasing the risk of errors or oversight.

- Complex Financial Operations: Organizations with complex financial operations, such as multiple subsidiaries, intercompany transactions, or complex revenue recognition processes, may face challenges in reconciling transactions and accounts accurately. The complexity adds intricacy to the reconciliation process, requiring detailed analysis and specialized knowledge.

- Discrepancies and Errors: Identifying and resolving discrepancies or errors can be a challenging task. Reconciliation may involve investigating missing or duplicate transactions, identifying the root causes of discrepancies, and implementing corrective measures. This process requires time, attention to detail, and collaboration across departments to achieve accurate reconciliation.

- Timing and Deadlines: Reconciliation must be performed within specific timeframes, often aligning with reporting periods, regulatory requirements, or internal deadlines. The pressure to complete reconciliation within tight deadlines can create additional challenges, potentially compromising the accuracy and thoroughness of the process.

- System and Integration Issues: Reconciliation can be complicated by the presence of disparate systems, data sources, or software applications within an organization. Lack of integration or compatibility between systems can hinder the smooth flow of data, making reconciliation more challenging and prone to errors.

Organizations must address these challenges by implementing effective reconciliation processes, leveraging automation and technology where possible, and ensuring comprehensive training and documentation. By overcoming these challenges, organizations can improve the accuracy, efficiency, and effectiveness of their reconciliation processes.

Best Practices for Reconciliation in Accounting

To ensure accurate and efficient reconciliation in accounting, organizations should follow certain best practices. These practices help streamline the reconciliation process, mitigate risks, and maintain the integrity of financial records. The following are some key best practices for reconciliation:

- Establish Standard Operating Procedures (SOPs): Develop and document clear SOPs for reconciliation processes. This includes defining roles and responsibilities, outlining the steps to be followed, and establishing timelines for completing reconciliations. SOPs provide consistency and guidance to the reconciliation process.

- Implement Automation: Leverage technology and automation tools to streamline the reconciliation process. Utilize accounting software or reconciliation software that can automatically match transactions, detect discrepancies, and generate reconciliation reports. Automation reduces the risk of errors and saves time.

- Perform Regular and Timely Reconciliations: Conduct reconciliations on a regular basis, depending on the volume and complexity of transactions. Regular reconciliations help identify and resolve discrepancies in a timely manner, reducing the risk of errors accumulating and improving the accuracy of financial records.

- Segregate Duties: Separate the responsibilities of those who reconcile the accounts from those who have custody or control over the assets. This segregation helps maintain objectivity and reduces the risk of fraudulent activities going undetected.

- Implement Reconciliation Controls: Put in place appropriate controls to validate the accuracy and completeness of reconciliation processes. This may include requiring review and approval of reconciliation reports by a senior employee or implementing periodic independent audits of reconciliation procedures.

- Document Reconciliation Procedures: Maintain detailed documentation of the reconciliation process, including the sources of data, the steps followed, and any adjustments made. This documentation serves as an audit trail and provides a reference for future reconciliations.

- Regularly Review and Update Reconciliation Procedures: Reconciliation procedures should be periodically reviewed and updated to reflect changes in the organization’s processes, systems, or regulations. This ensures that the reconciliation process remains effective and aligned with evolving business needs.

- Implement Training and Knowledge Sharing: Provide comprehensive training to staff involved in the reconciliation process. Keep employees updated on best practices, industry trends, and regulatory requirements. Encourage knowledge sharing and cross-training to ensure continuity and efficiency in reconciliation processes.

- Maintain Communication and Collaboration: Foster open communication and collaboration among the departments involved in the reconciliation process, such as finance, operations, and IT. Effective collaboration ensures that data is accurate, discrepancies are resolved promptly, and the reconciliation process runs smoothly.

By following these best practices, organizations can improve the accuracy, efficiency, and effectiveness of their reconciliation processes. Implementing efficient procedures, leveraging technology, and promoting collaboration contribute to maintaining accurate, reliable, and transparent financial records.

Conclusion

Reconciliation is a critical process in accounting that ensures the accuracy, integrity, and reliability of financial records. By comparing and matching data from various sources, organizations can identify and rectify discrepancies, detect errors or fraudulent activities, and provide stakeholders with accurate financial information. The importance of reconciliation in accounting cannot be overstated, as it supports compliance with accounting standards, facilitates informed decision-making, and enhances financial transparency.

While reconciliation comes with its own set of challenges, such as manual processes, data inconsistencies, and timing constraints, organizations can overcome these challenges by implementing best practices. By establishing standard operating procedures, leveraging automation tools, ensuring regular and timely reconciliations, and promoting collaboration and training, organizations can streamline their reconciliation processes and mitigate risks associated with errors or fraud.

Furthermore, reconciliation is not a one-time activity, but an ongoing process that should be conducted regularly. As businesses evolve and financial transactions increase in complexity, reconciling financial records becomes even more crucial. Regular reconciliation provides accurate and reliable financial data that forms the foundation for sound financial management, compliance, and risk mitigation.

In conclusion, reconciliation in accounting is an indispensable practice for organizations to ensure the accuracy and integrity of financial records. By embracing the concept, understanding its importance, and implementing best practices, organizations can enhance their financial reporting processes, make informed decisions, and maintain the trust of stakeholders. With accurate and reliable financial records, organizations can navigate the dynamic business landscape with confidence and achieve sustainable growth.