Finance

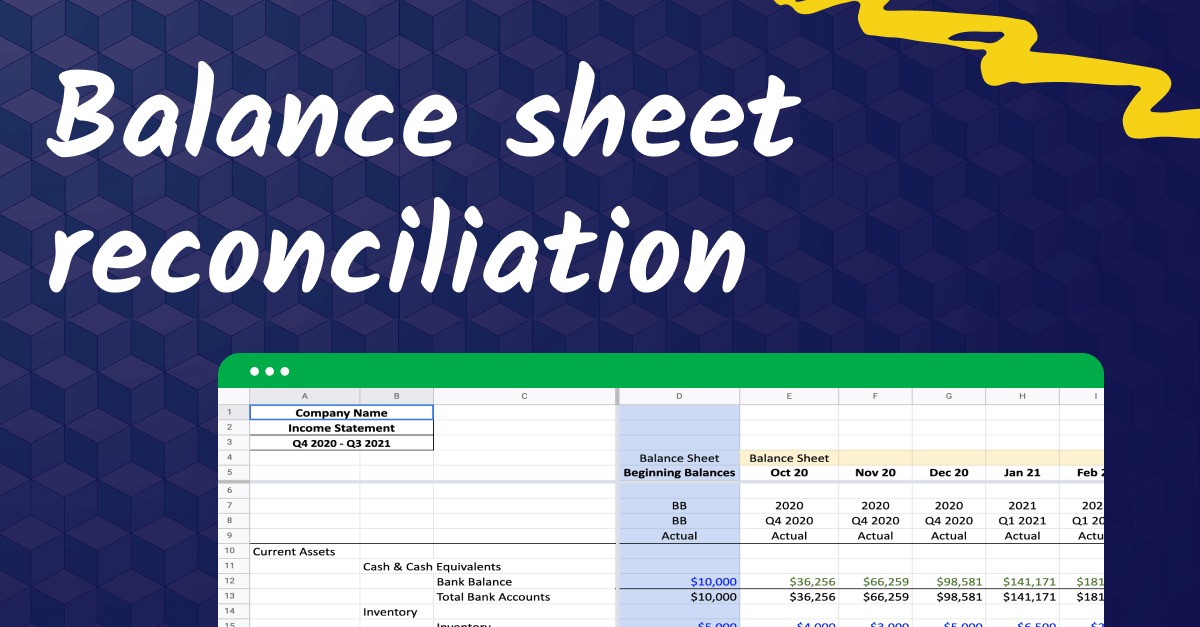

What Is Balance Sheet Reconciliation

Modified: February 21, 2024

Learn about finance and the importance of balance sheet reconciliation. Gain insights on managing financial statements and improving accuracy in financial reporting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where numbers rule and accuracy is paramount. In the complex realm of financial management, keeping track of an organization’s assets, liabilities, and equity is crucial. This is where balance sheet reconciliation comes into play.

Balance sheet reconciliation is a fundamental process in financial accounting that ensures the accuracy and reliability of an organization’s financial statements. It involves comparing and aligning the balances of various accounts in the balance sheet with supporting documents and records. This reconciliation process is essential for identifying discrepancies, correcting errors, and ensuring that the financial statements reflect the true financial position of the company.

As businesses grow and financial transactions become more complex, the need for effective balance sheet reconciliation becomes even more critical. Without proper reconciliation, businesses may face risks such as misstated financial statements, inappropriate decision-making, regulatory compliance issues, and potential financial losses.

In this article, we will delve deeper into the world of balance sheet reconciliation, exploring its definition, importance, process, key components, and best practices. We will also discuss common challenges and issues in this process, along with potential solutions. By the end of this article, you will have a comprehensive understanding of the significance of balance sheet reconciliation and how it can benefit your organization.

Definition of Balance Sheet Reconciliation

Balance sheet reconciliation can be defined as the process of comparing the balances of the various accounts in an organization’s balance sheet with the corresponding supporting documents and records to ensure accuracy and integrity. It involves verifying that the balances in the general ledger match the actual amounts recorded in external documents, such as bank statements, vendor invoices, and customer receipts.

This reconciliation process is vital for identifying any discrepancies or errors in the financial statements. It helps to ensure that all assets, liabilities, and equity are accurately reported, providing a true and fair reflection of the financial health of the organization.

Balance sheet reconciliation typically involves comparing the ending balances in the general ledger with the balances shown on external statements and records. This includes verifying cash and bank account balances, accounts receivable and payable, inventory figures, investment valuations, and other key components of the balance sheet.

It is important to note that balance sheet reconciliation is not limited to just comparing numbers. It also involves a deeper analysis of the underlying transactions and events that contribute to the balances. This includes examining transaction details, verifying supporting documents, and investigating any discrepancies to ensure that the reported balances are accurate and reliable.

The reconciliation process is carried out on a periodic basis, such as monthly, quarterly, or annually, depending on the organization’s accounting practices and requirements. It is typically performed by accountants or finance professionals who have a thorough understanding of the organization’s chart of accounts, financial transactions, and internal controls.

Overall, balance sheet reconciliation is a critical process for maintaining the integrity of an organization’s financial statements. It provides assurance to stakeholders, including investors, lenders, and regulators, that the reported financial information is accurate and reliable. By reconciling the balances on the balance sheet, organizations can identify and rectify any errors or discrepancies, ensuring transparency and instilling trust in the financial reporting process.

Importance of Balance Sheet Reconciliation

Balance sheet reconciliation is a fundamental practice in financial accounting that holds great importance for organizations of all sizes and industries. Here are some key reasons why balance sheet reconciliation is crucial:

- Accuracy of Financial Statements: Balance sheet reconciliation plays a vital role in ensuring the accuracy and reliability of an organization’s financial statements. By comparing the balances on the balance sheet with supporting documents and records, organizations can identify any discrepancies or errors that may exist. This helps in presenting a true and fair view of the organization’s financial position to stakeholders, such as investors, lenders, and regulators.

- Compliance with Accounting Standards: Reconciliation is essential for ensuring compliance with accounting standards and regulations. In many jurisdictions, organizations are required to follow specific accounting principles, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Balance sheet reconciliation helps in verifying that the reported balances adhere to these standards, reducing the risk of non-compliance and potential legal and regulatory penalties.

- Detection of Errors and Fraud: By reconciling the balances on the balance sheet, organizations can identify errors, discrepancies, or potentially fraudulent activities. These could include misposting of transactions, double entries, unauthorized journal entries, or embezzlement. Early detection of such issues allows organizations to rectify the errors, strengthen internal controls, and prevent future occurrences of fraud.

- Effective Decision Making: Accurate financial information is vital for making informed business decisions. The reconciliation process ensures that the information presented in the financial statements is reliable, enabling management to make effective decisions based on a clear understanding of the organization’s financial health. It provides insights into the liquidity, profitability, and financial stability of the business, supporting strategic planning and resource allocation.

- Risk Mitigation: Identifying and rectifying errors in the balance sheet through reconciliation helps to mitigate financial risks. Inaccurate financial statements can lead to incorrect forecasting, incorrect tax returns, delayed regulatory filings, and financial losses. By regularly reconciling the balance sheet, organizations can proactively address risks and maintain financial stability.

In summary, balance sheet reconciliation is essential for ensuring the accuracy, compliance, and integrity of an organization’s financial statements. It contributes to the overall transparency and trustworthiness of the financial reporting process, enabling informed decision-making and effective risk management. Implementing robust balance sheet reconciliation practices is crucial for organizations to maintain financial health, meet regulatory requirements, and build trust with stakeholders.

Process of Balance Sheet Reconciliation

The process of balance sheet reconciliation involves several steps to ensure the accuracy and integrity of an organization’s financial statements. While specific procedures may vary depending on the organization’s size and complexity, here are the general steps involved in the reconciliation process:

- Gather Supporting Documents: The first step is to gather all relevant supporting documents and records that correspond to the accounts in the balance sheet. These may include bank statements, vendor invoices, customer receipts, loan agreements, and other financial documents. These documents serve as evidence to verify the balances reported in the balance sheet.

- Compare Balances: Once the supporting documents are gathered, the next step is to compare the balances reported in the balance sheet with the balances shown in the supporting documents. This involves matching the ending balance of each account in the general ledger with the corresponding balance on the external statement or record.

- Analyze and Investigate Discrepancies: If discrepancies are found during the comparison, the next step is to analyze and investigate the differences. This involves examining the underlying transactions and events that contributed to the balances. It may require reviewing transaction details, contacting financial institutions or vendors for clarifications, or conducting further research to identify the cause of the discrepancy.

- Rectify Errors: Once the discrepancies are identified and the cause is determined, the errors need to be rectified. This may involve adjusting the balances in the general ledger to align with the correct amounts. It is important to maintain proper documentation of the adjustments made and ensure that they are appropriately reflected in the financial statements.

- Reconcile Subsidiary Ledgers: In addition to the general ledger, organizations may also need to reconcile subsidiary ledgers, such as accounts receivable and accounts payable. This involves verifying the balances in these subsidiary ledgers with supporting documents, such as invoices and payment records, to ensure accuracy.

- Review and Approval: Once the reconciliation process is complete, the next step is to review and approve the reconciliations. This is typically done by the finance department or management to ensure that the process has been carried out accurately and that any necessary adjustments have been made.

- Document and Retain Records: Lastly, it is crucial to properly document and retain all records related to the balance sheet reconciliation process. This includes the supporting documents, reconciliations, adjustments, and any communication or research conducted during the investigation. Proper documentation helps in future audits, compliance checks, and historical reference.

By following these steps, organizations can ensure the accuracy, reliability, and compliance of their financial statements. The balance sheet reconciliation process enables organizations to identify and rectify errors, maintain internal controls, and provide stakeholders with transparent and trustworthy financial information.

Key Components of Balance Sheet Reconciliation

Balance sheet reconciliation involves the evaluation and alignment of various components within an organization’s balance sheet to ensure accuracy and reliability. Here are the key components of balance sheet reconciliation:

- Cash and Bank Accounts: Cash and bank accounts are crucial components of the balance sheet as they represent the organization’s liquidity. Reconciliation involves comparing the ending balances of these accounts in the general ledger with the corresponding balances on bank statements and other supporting documents.

- Accounts Receivable and Payable: Accounts receivable represents the amounts owed to the organization by its customers, while accounts payable represents the amounts owed by the organization to its suppliers and vendors. Reconciliation involves verifying the balances of these accounts against supporting documents such as invoices, receipts, and payment confirmations.

- Inventory: If the organization holds inventory, reconciliation ensures that the inventory valuation reported on the balance sheet matches the actual inventory count and the cost assigned to it. It involves reconciling the inventory balances with physical counts, purchase orders, sales records, and cost calculations.

- Investments and Securities: Organizations that hold investments, such as stocks, bonds, and mutual funds, need to reconcile the balances of these investments with brokerage statements or statements from the investment custodian. This ensures that the reported values in the balance sheet align with the actual market values of the investments.

- Fixed Assets: Fixed assets, such as property, equipment, and vehicles, are important components of the balance sheet. Reconciliation involves verifying the balances of these fixed assets against supporting documents such as purchase agreements, depreciation schedules, and maintenance records.

- Accrued Liabilities and Prepaid Expenses: Accrued liabilities represent expenses that the organization has incurred but has not yet paid, while prepaid expenses represent expenses that the organization has paid in advance. Reconciliation involves reviewing the balances of these accounts and ensuring that they are accurately recorded and classified in the balance sheet.

- Equity: The equity section of the balance sheet represents the ownership interest in the organization. Reconciliation involves examining the balances of equity accounts, such as retained earnings and shareholders’ equity, and ensuring that they align with the organization’s financial transactions, including dividends, capital contributions, and profit or loss allocations.

These key components form the foundation of the balance sheet reconciliation process. By thoroughly examining and aligning these components with supporting documents and records, organizations can ensure the accuracy, reliability, and integrity of their financial statements.

Best Practices for Balance Sheet Reconciliation

Implementing best practices for balance sheet reconciliation is crucial to ensure accuracy, integrity, and efficiency in the financial reporting process. Here are some key best practices that organizations should consider:

- Establish Clear Reconciliation Policies and Procedures: Develop comprehensive policies and procedures that outline the steps and guidelines for balance sheet reconciliation. Documenting these processes ensures consistency and provides a clear framework for the reconciliation process to be followed by all finance personnel involved.

- Segregate Duties: Implement segregation of duties by assigning different individuals to perform and review the reconciliation process. This helps to reduce the risk of errors or fraudulent activities and enhances the independence and integrity of the reconciliation function.

- Regular and Timely Reconciliation: Perform balance sheet reconciliation on a regular basis, such as monthly or quarterly, to ensure timely identification and resolution of discrepancies. Timely reconciliation helps to maintain the accuracy and reliability of the financial statements and provides management with up-to-date information for decision-making.

- Utilize Technology: Leverage accounting software or reconciliation tools to streamline the reconciliation process. These tools can automate tasks, provide built-in checks and controls, and generate reports to facilitate the identification and resolution of discrepancies. Automation reduces manual errors and enhances efficiency in the reconciliation process.

- Document and Validate Reconciliation Adjustments: Maintain proper documentation for any adjustments made during the reconciliation process. Clearly explain the reason for the adjustment, the supporting calculations, and any approvals obtained. Additionally, ensure that these adjustments are validated and reviewed by appropriate personnel to maintain accuracy and transparency.

- Perform Adequate Analysis and Investigation: Thoroughly analyze and investigate any discrepancies or variances that are identified during the reconciliation process. Understand the root cause of the discrepancy and implement corrective actions to prevent future occurrences. In-depth analysis helps to maintain the accuracy and reliability of financial statements.

- Implement Reconciliation Review Process: Establish a review process where reconciliations are reviewed by a higher-level authority or an independent party. This helps to ensure the accuracy and quality of the reconciliation process and provides an additional layer of control and oversight.

- Provide Training and Development: Offer regular training and development programs to finance personnel involved in the reconciliation process. Ensuring that employees have the necessary knowledge and skills enhances their ability to perform accurate and effective reconciliations. Stay updated with changes to accounting standards and regulations to ensure compliance.

- Perform Regular Internal Audits: Conduct internal audits periodically to assess the effectiveness and adherence to balance sheet reconciliation processes. Internal audits help to identify any gaps or weaknesses in the reconciliation process and provide recommendations for improvement, enhancing overall control and accountability.

By adopting these best practices, organizations can strengthen their balance sheet reconciliation process, mitigate risks, and ensure the integrity and accuracy of their financial statements. Implementing robust reconciliation practices not only enhances financial controls but also instills confidence in stakeholders regarding the organization’s financial reporting.

Common Challenges and Issues in Balance Sheet Reconciliation

While balance sheet reconciliation is a critical process in financial accounting, it is not without its challenges and potential issues. Here are some common challenges and issues that organizations may face during the reconciliation process:

- Data Accuracy and Completeness: Obtaining accurate and complete data for reconciliation can be a major challenge. Incomplete or incorrect data can lead to inaccuracies in the reconciliation process and result in misstated financial statements. Ensuring data integrity requires robust data management processes and regular data validation exercises.

- Timing and Frequency: Timely completion of reconciliations can be a challenge, especially for organizations with high transaction volumes or complex operations. Balancing the need for timely reconciliation with the requirement for thoroughness can result in pressure on finance teams. A well-defined schedule and efficient reconciliation processes can help to address these challenges.

- Account Reconciliation Discrepancies: Discrepancies in account balances are a common issue in the reconciliation process. These discrepancies can arise due to errors in recording transactions, data entry mistakes, timing differences, or other factors. Identifying and resolving these discrepancies requires thorough analysis, investigation, and collaboration across different departments or teams.

- Manual Reconciliation Errors: The manual nature of the reconciliation process leaves room for human errors. Transposition errors, data entry mistakes, and calculation errors can occur during the reconciliation process, leading to inaccurate reconciliations. Automation and the use of reconciliation tools can help minimize manual errors and improve reconciliation accuracy.

- Document Retrieval and Organization: Retrieving and organizing supporting documents for reconciliation can be time-consuming and challenging, particularly for organizations with a large volume of transactions. Failure to find the required documents can delay the reconciliation process and impact accuracy. Implementing proper document management systems or utilizing electronic document storage can help address this challenge.

- Complexity and Volume of Reconciliations: As organizations grow and operations become more complex, the number and complexity of reconciliations increase. Managing multiple reconciliations across various accounts, departments, and subsidiaries can become overwhelming. Adequate resources, proper organization, and prioritization of reconciliations can help tackle this challenge effectively.

- Consistency and Standardization: Maintaining consistency and standardization across the reconciliation process can be difficult, especially in organizations with decentralized accounting functions. Differences in reconciliation methodologies, templates, and practices can lead to inconsistencies and hamper the comparison and analysis of reconciled balances. Setting standardized reconciliation procedures and providing appropriate training can help address this challenge.

- Audit and Regulatory Compliance: Adhering to audit requirements and regulatory compliance is essential during the reconciliation process. Failure to meet these obligations can result in penalties, reputational damage, and loss of investor confidence. Organizations need to stay updated with regulatory changes and maintain proper control documentation to ensure compliance during reconciliations.

These common challenges and issues highlight the complexities and potential roadblocks that organizations may encounter during the balance sheet reconciliation process. By addressing these challenges proactively through process improvements, automation, proper training, and effective communication, organizations can enhance the accuracy, efficiency, and reliability of their reconciliation practices.

Conclusion

Balance sheet reconciliation is an integral process in financial accounting that ensures the accuracy, reliability, and integrity of an organization’s financial statements. By comparing the balances on the balance sheet with supporting documents and records, organizations can identify discrepancies, rectify errors, and present a true and fair view of their financial position.

Throughout this article, we have explored the definition of balance sheet reconciliation, its importance, the process involved, key components, and best practices. We have also discussed common challenges and issues that organizations may face during the reconciliation process.

Effective balance sheet reconciliation practices offer several benefits, including accurate financial reporting, compliance with accounting standards, fraud detection, informed decision-making, risk mitigation, and stakeholder trust. By implementing clear policies, utilizing technology, conducting timely reconciliations, and fostering collaboration, organizations can strengthen their reconciliation process and improve financial controls.

However, organizations must also be aware of the challenges and issues that can arise during the reconciliation process. Managing data accuracy, addressing reconciliation discrepancies, reducing manual errors, and ensuring consistency and compliance require proactive measures and continuous improvement.

In conclusion, balance sheet reconciliation serves as a cornerstone of financial management and reporting. It provides stakeholders with confidence in the accuracy of financial statements and supports informed decision-making. By prioritizing the reconciliation process, organizations can maintain the integrity of their financial information, meet regulatory requirements, and drive financial success.