Finance

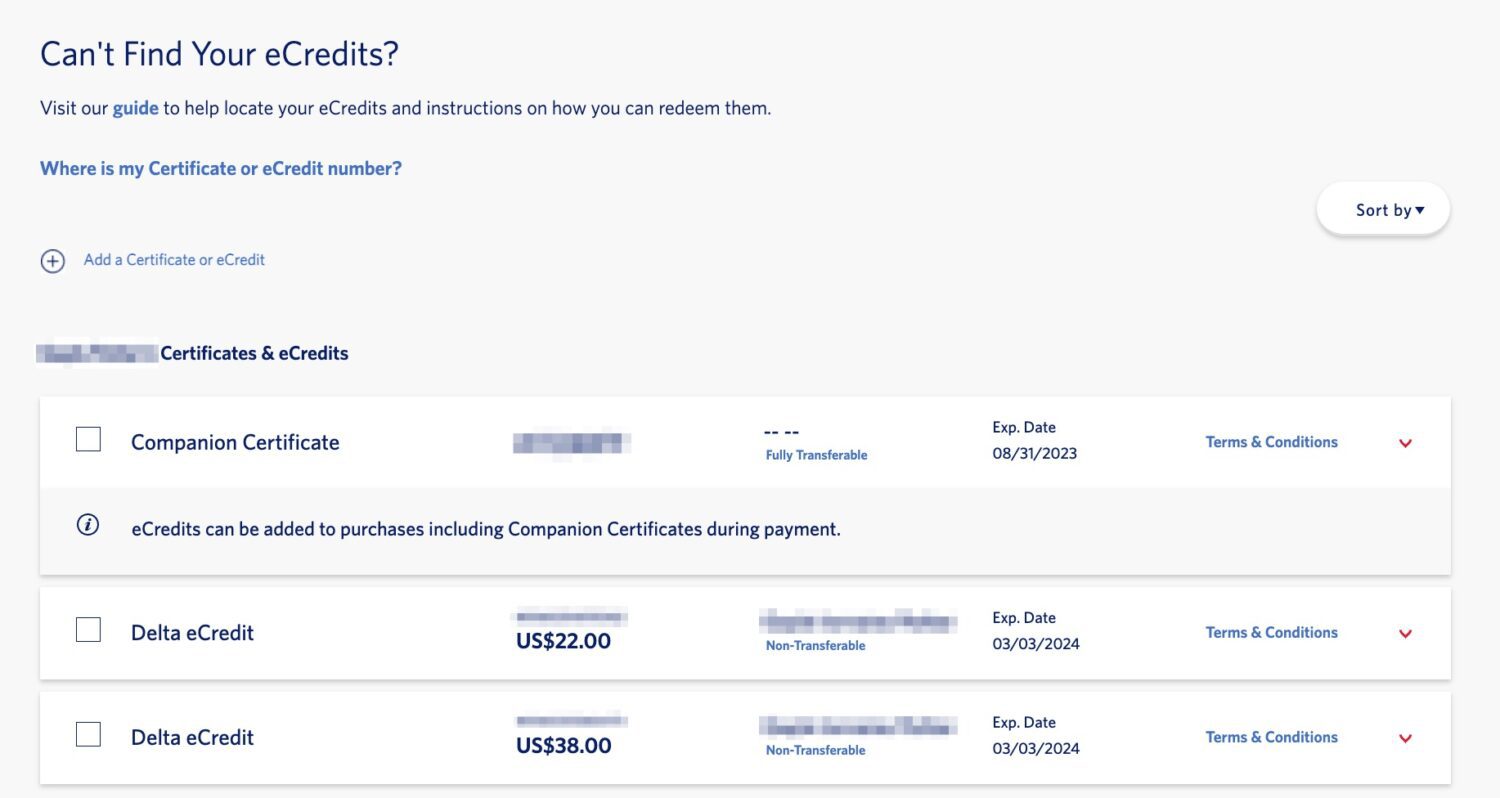

What Is A Delta In Accounting

Published: October 13, 2023

Learn what a delta is in accounting and how it relates to finance. Gain a deeper understanding of financial analysis and decision-making with this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Accounting is a fundamental aspect of managing and analyzing financial information for individuals, businesses, and organizations. It involves recording, summarizing, and interpreting financial transactions to determine the financial health and performance of an entity.

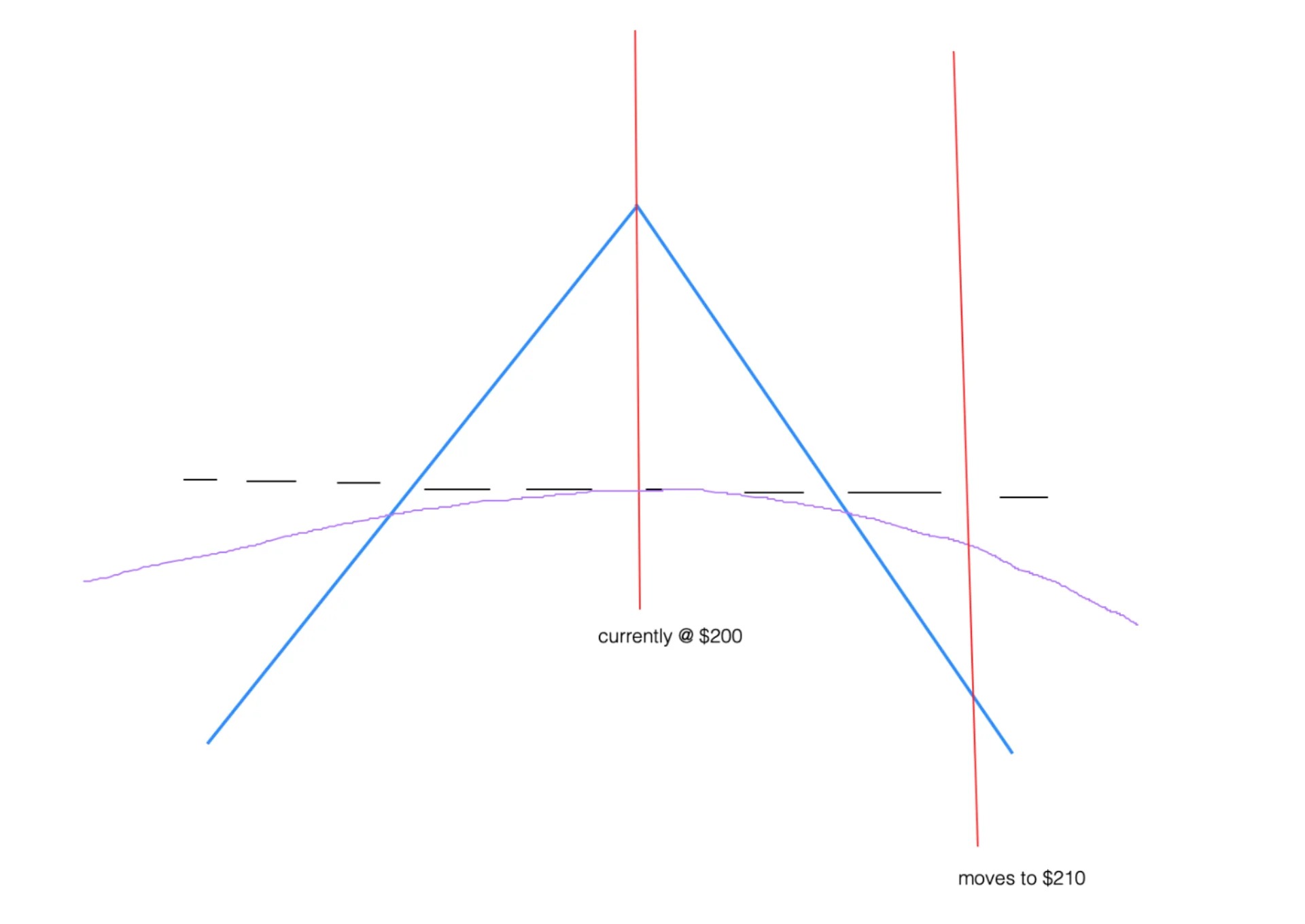

One essential tool in the field of accounting is the concept of a delta. A delta, in accounting, refers to the change or difference between two values or periods. It provides valuable insights into the trends, variations, and shifts in financial data over time.

In this article, we will delve into the definition and types of deltas in accounting, as well as their importance and application in financial analysis. We will explore how deltas are calculated, interpreted, and how they can be used to assess the performance and financial position of an entity. Additionally, we will examine examples of deltas in financial statements and discuss the limitations and considerations when working with deltas in accounting.

Understanding the concept of deltas and their role in accounting can significantly enhance your ability to analyze financial data and make informed decisions. So, let’s dive into the world of deltas in accounting and explore their significance in financial analysis.

Definition of a Delta in Accounting

In accounting, a delta represents the change or difference between two values or periods. It measures the extent of the variation or movement between two financial data points, such as revenues, expenses, assets, liabilities, or equity, over a specific period of time.

Delta is a Greek letter symbol (∆) used to represent change. It is derived from the mathematical concept of “difference” or “increment.” In accounting, the delta is utilized to quantify and analyze the fluctuations and trends in financial information, enabling stakeholders to make informed decisions based on these changes.

A delta can be expressed as an absolute value, indicating the exact difference between two values, or as a percentage, representing the relative change in percentage terms. Depending on the context and purpose, different formulas and approaches may be used to calculate deltas in accounting.

The concept of deltas is widely employed in various areas of accounting, including financial statement analysis, budgeting, forecasting, and performance evaluation. By examining the deltas, analysts and stakeholders can gain insights into the financial health, trends, and patterns of an entity.

It is important to note that deltas can be positive or negative, depending on whether the change reflects an increase or decrease in the corresponding financial data points. Positive deltas indicate growth or improvement, while negative deltas signify decline or deterioration.

To effectively utilize deltas in accounting, it is crucial to understand the specific financial metrics and context under consideration. Different financial indicators, such as revenue deltas, expense deltas, or asset deltas, can provide valuable information to analyze the financial performance and position of an entity.

In the next section, we will explore the different types of deltas in accounting and how they contribute to financial analysis.

Types of Deltas in Accounting

In accounting, there are several types of deltas that are commonly used to analyze financial data. These types of deltas provide insights into different aspects of an entity’s financial performance and position. Let’s explore some of the key types:

- Revenue Deltas: Revenue deltas measure the change in a company’s sales or income over a specific period of time. Positive revenue deltas indicate an increase in revenue, which can be attributed to factors such as increased sales volumes, higher prices, or new product offerings. Negative revenue deltas, on the other hand, signify a decline in revenue, which might be caused by factors such as lower sales volumes, decreased prices, or changing market conditions.

- Expense Deltas: Expense deltas capture the variations in a company’s expenses over time. They provide insights into the changing cost structure and efficiency of the business. Positive expense deltas indicate an increase in expenses, which could be due to factors such as inflation, higher production costs, or increased investment in marketing or research. Negative expense deltas, on the other hand, represent a decrease in expenses, signaling potential cost savings or improved efficiency.

- Asset Deltas: Asset deltas focus on changes in a company’s assets. This includes tangible assets such as property, equipment, and inventory, as well as intangible assets like patents and trademarks. Positive asset deltas indicate an increase in the value of assets, which could be the result of acquisitions, investments, or appreciation in asset prices. Negative asset deltas, conversely, depict a decrease in asset value, which might be due to impairment, depreciation, or sale of assets.

- Liability Deltas: Liability deltas measure changes in a company’s debts and obligations. This encompasses short-term liabilities such as accounts payable and accrued expenses, as well as long-term liabilities like bonds and loans. Positive liability deltas indicate an increase in debt, potentially resulting from borrowing or the accrual of new obligations. Negative liability deltas, on the other hand, denote a reduction in liabilities, which could include debt repayments or the settlement of outstanding obligations.

- Equity Deltas: Equity deltas assess variations in a company’s shareholders’ equity, which represents the residual interest in the assets of the entity. Positive equity deltas indicate an increase in equity, which can be attributed to factors such as retained earnings, additional capital contributions, or favorable changes in the fair value of investments. Negative equity deltas reflect a decrease in equity, which might be due to losses, dividends, or capital distributions.

These are just a few examples of the types of deltas commonly used in accounting. Depending on the specific analysis and context, other types of deltas may also be relevant. By examining these deltas, stakeholders can gain a comprehensive understanding of the dynamics and trends within an entity’s financial statements.

In the next section, we will explore the importance of deltas in financial analysis and decision-making.

Importance of Deltas in Financial Analysis

Deltas play a vital role in financial analysis as they provide valuable insights into the trends, variations, and shifts in financial data over time. They enable analysts, investors, and stakeholders to assess the financial performance, position, and trajectory of an entity. Here are some key reasons why deltas are important in financial analysis:

- Identifying Trends and Patterns: Deltas help identify patterns and trends within financial statements. By examining the changes in revenue, expenses, assets, liabilities, and equity over multiple periods, analysts can identify consistent upward or downward trends. This knowledge is crucial in understanding an entity’s financial health and making informed decisions.

- Evaluating Growth and Profitability: Revenue deltas help evaluate a company’s growth rate. Positive revenue deltas indicate revenue growth, highlighting the success of sales strategies, market expansion, or product innovation. Analyzing expense deltas in relation to revenue deltas provides insights into the company’s ability to control costs and maintain profitability.

- Detecting Financial Red Flags: Negative deltas can act as warning signs of potential financial problems. For example, a significant negative asset delta may indicate a decline in the value of the company’s assets, suggesting impairment or inadequate management. Negative equity deltas might indicate declining ownership value or potential financial distress.

- Assessing Financial Stability: Deltas help assess a company’s financial stability and ability to meet its obligations. By examining liability deltas, analysts can evaluate the company’s debt levels and its capacity to repay or service its debts. Negative liability deltas might indicate successful debt reduction efforts or improved liquidity.

- Supporting Financial Planning and Decision-making: Deltas provide valuable information for financial planning and decision-making processes. By analyzing past deltas and projecting future ones, businesses can create more accurate budgets, forecasts, and financial models. They can also use deltas to assess the potential impact of strategic decisions, such as expanding operations, acquiring assets, or implementing cost-cutting measures.

Overall, deltas serve as important tools in financial analysis, helping stakeholders understand the dynamics and trends within an entity’s financial data. They enable better decision-making, risk assessment, and strategic planning, ultimately contributing to the financial success and stability of the entity. But it’s important to consider the limitations and context when interpreting and using deltas in financial analysis, which we will discuss further in the next section.

How to Calculate and Interpret Deltas in Accounting

Calculating and interpreting deltas in accounting involves several steps to accurately measure the change or difference between two financial data points. Here is a general process for calculating and interpreting deltas:

- Select the Relevant Financial Metrics: Determine the specific financial metrics you want to analyze. This could include revenue, expenses, assets, liabilities, or equity.

- Identify the Baseline and Comparison Periods: Select the baseline period (starting point) and the comparison period (ending point) for the delta calculation. These periods should be of equal length to ensure accurate comparisons.

- Calculate the Absolute Delta: Subtract the value of the financial metric in the baseline period from the value in the comparison period to obtain the absolute delta. This will give you the exact difference between the two periods.

- Calculate the Relative Delta: To calculate the relative delta, divide the absolute delta by the value in the baseline period and multiply by 100 to express it as a percentage. This percentage represents the relative change in the financial metric between the two periods.

- Interpret the Delta: The interpretation of a delta depends on the context and the financial metric being analyzed. A positive delta indicates an increase or improvement, while a negative delta signifies a decrease or deterioration. The magnitude of the delta can also provide insights into the extent of the change.

- Consider External Factors: When interpreting deltas, it is important to consider any external factors that may have influenced the change. External factors can include economic conditions, industry trends, regulatory changes, or specific events that impact the financial metrics under analysis.

- Compare with Industry Benchmarks or Historical Data: To gain a better understanding of the significance of the delta, compare it with industry benchmarks or historical data. This will provide context and help assess whether the change is in line with expectations or if it deviates significantly.

- Monitor and Analyze Trends: Deltas are most meaningful when analyzed over multiple periods. By monitoring and analyzing trends in deltas, you can identify patterns, evaluate the direction of change, and make more informed decisions.

By following these steps, you can calculate and interpret deltas accurately in accounting. Remember to consider the specific financial metrics, select appropriate baseline and comparison periods, calculate both the absolute and relative deltas, and take into account external factors and industry benchmarks to gain a comprehensive understanding of the changes.

In the next section, we will illustrate the concept of deltas in accounting through examples of their application in financial statements.

Examples of Deltas in Financial Statements

Financial statements, including the income statement, balance sheet, and statement of cash flows, provide valuable information for calculating and analyzing deltas in accounting. Here are a few examples of how deltas can be applied to financial statements:

- Revenue Deltas: By comparing the revenue figures from one period to another, we can calculate the revenue delta. For example, if a company had $100,000 in revenue in the previous year and $150,000 in revenue in the current year, the revenue delta would be $50,000 or a 50% increase.

- Expense Deltas: Analyzing the variations in expenses over time helps assess cost management and efficiency. For instance, if a company had $50,000 in operating expenses in the previous quarter and $45,000 in the current quarter, the expense delta would be -$5,000 or a 10% decrease.

- Asset Deltas: Changes in asset values can be measured using deltas. Suppose a company’s total assets were $500,000 in the beginning of the year and increased to $600,000 at the end of the year. The asset delta would be $100,000 or a 20% increase.

- Liability Deltas: Tracking changes in liabilities is crucial for assessing a company’s debt management. For example, if a company had $100,000 in long-term debt at the beginning of the year and reduced it to $80,000 by the end of the year, the liability delta would be -$20,000 or a 20% decrease.

- Equity Deltas: Deltas in equity can be useful in understanding changes in ownership value. If a company had $200,000 in shareholders’ equity at the beginning of the year and generated $50,000 in net income during the year, the equity delta would be $50,000 or a 25% increase.

These examples demonstrate how deltas can be calculated and applied to financial statements to provide insights into the changes in revenue, expenses, assets, liabilities, and equity over time. By examining these deltas, analysts gain a better understanding of the financial performance and position of a company, allowing for more informed decision-making.

In the next section, we will discuss the limitations and considerations when using deltas in accounting.

Limitations and Considerations When Using Deltas in Accounting

While deltas provide valuable insights into the changes in financial data over time, it is important to acknowledge their limitations and consider certain factors when using deltas in accounting. Here are some key limitations and considerations:

- Context and Comparability: Deltas should be analyzed within the appropriate context and compared to relevant benchmarks. Changes in financial metrics need to be evaluated in light of industry norms, company goals, and external factors that may affect performance and comparability.

- Sensitivity to Time Periods: The choice of time periods for evaluating deltas can significantly impact the calculation and interpretation. Using different time intervals can yield different results. Therefore, it is essential to carefully select comparable and relevant time periods.

- Accounting Methods and Policies: Deltas can be influenced by changes in accounting methods or policies. Any changes in measurement techniques or reporting standards can distort the comparison, making it necessary to consider the consistency of accounting methods and policies.

- One-Dimensional Analysis: Deltas provide a snapshot of change and are limited to the variables being measured. They do not provide a comprehensive view of the underlying factors influencing the change. It is important to supplement delta analysis with qualitative insights and a holistic understanding of the business.

- External Factors and Events: Deltas may be influenced by external events or factors beyond the company’s control. Economic conditions, market trends, regulatory changes, or unforeseen events can impact the deltas. Therefore, it is critical to consider the impact of external factors on changes in financial data.

- Interpretation Bias: The interpretation of deltas needs to be done cautiously to avoid bias. Positive or negative deltas may have different implications depending on the company’s objectives, industry norms, or specific circumstances. It is important to consider the broader context and avoid assumptions or premature judgments.

- Data Accuracy and Reliability: The accuracy and reliability of the underlying financial data impact the validity of deltas. Flawed or incomplete data can lead to misleading results. Therefore, it is crucial to ensure the integrity of the data used for calculating deltas.

- Limited Predictive Value: Deltas reflect past changes and may not always accurately predict future trends or outcomes. Market dynamics and business conditions can change, making it important to supplement delta analysis with other forecasting techniques and analytical tools.

By acknowledging these limitations and considering the relevant factors, analysts can utilize deltas effectively while maintaining a balanced and informed approach to financial analysis. It is crucial to approach delta analysis with a critical mindset and augment it with qualitative insights and a comprehensive understanding of the business and industry.

Next, let’s wrap up our discussion on deltas in accounting.

Conclusion

Deltas play a significant role in accounting, providing valuable insights into the changes, trends, and variations in financial data over time. They are essential tools for financial analysis, decision-making, and assessing the performance and position of an entity.

In this article, we explored the definition of a delta in accounting and its various types, including revenue deltas, expense deltas, asset deltas, liability deltas, and equity deltas. We learned how to calculate and interpret deltas, considering the context, external factors, industry benchmarks, and limitations involved.

By analyzing deltas, stakeholders can identify trends, evaluate growth and profitability, detect red flags, assess financial stability, and support financial planning and decision-making. Deltas provide a quantitative measure of changes in financial metrics, allowing for a better understanding of a company’s financial health and performance.

However, it is important to remember the limitations and considerations when using deltas. The context, comparability, accounting methods, external factors, interpretation bias, data accuracy, and limited predictive value are all factors that need to be taken into account to ensure a comprehensive and accurate analysis.

In conclusion, understanding and utilizing deltas in accounting can significantly enhance the ability to analyze financial data, make informed decisions, and navigate the dynamic business landscape. By incorporating deltas into financial analysis, stakeholders can gain valuable insights and drive the financial success and stability of an entity.