Finance

What Is Quantitative Risk Assessment

Published: January 15, 2024

Gain insights into quantitative risk assessment in finance. Understand how this approach helps in analyzing and managing financial risks for informed decision-making.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Quantitative Risk Assessment

- Purpose of Quantitative Risk Assessment

- Steps in Quantitative Risk Assessment

- Data Collection for Quantitative Risk Assessment

- Data Analysis for Quantitative Risk Assessment

- Interpretation of Quantitative Risk Assessment Results

- Limitations of Quantitative Risk Assessment

- Benefits of Quantitative Risk Assessment

- Conclusion

Introduction

Welcome to the world of quantitative risk assessment! In today’s dynamic and uncertain business environment, understanding and managing risk is crucial for the success and sustainability of any organization. Whether you are a financial institution, a manufacturing company, or an individual investor, the ability to quantitatively assess risk is a valuable skill.

Quantitative risk assessment is a systematic approach to evaluating and measuring risk using numerical data and statistical analysis. It provides a structured framework for objectively assessing the likelihood and impact of potential risks, enabling informed decision-making and the allocation of resources towards risk mitigation.

Traditionally, risk assessment primarily focused on qualitative methods, relying on subjective judgments and expert opinions. While qualitative assessments provide valuable insights and are still widely used, they can be limited by the inherent biases and inconsistencies of human judgment.

Quantitative risk assessment, on the other hand, brings a more objective and data-driven approach to the table. By leveraging historical data, market trends, and advanced statistical models, it enables organizations to quantify risk in a meaningful and actionable way. This allows for a more accurate understanding of the potential consequences of various risks and the ability to prioritize risk mitigation efforts.

In this article, we will delve deeper into the world of quantitative risk assessment, exploring its definition, purpose, steps, data collection and analysis methods, interpretation of results, limitations, and benefits. By the end, you will have a comprehensive understanding of how quantitative risk assessment can enhance decision-making and enable effective risk management strategies.

Definition of Quantitative Risk Assessment

Quantitative risk assessment (QRA) is a systematic and quantitative approach to analyzing and evaluating risks in a structured and objective manner. It involves the use of mathematical models, statistical analysis, and historical data to estimate the likelihood and consequences of potential risks.

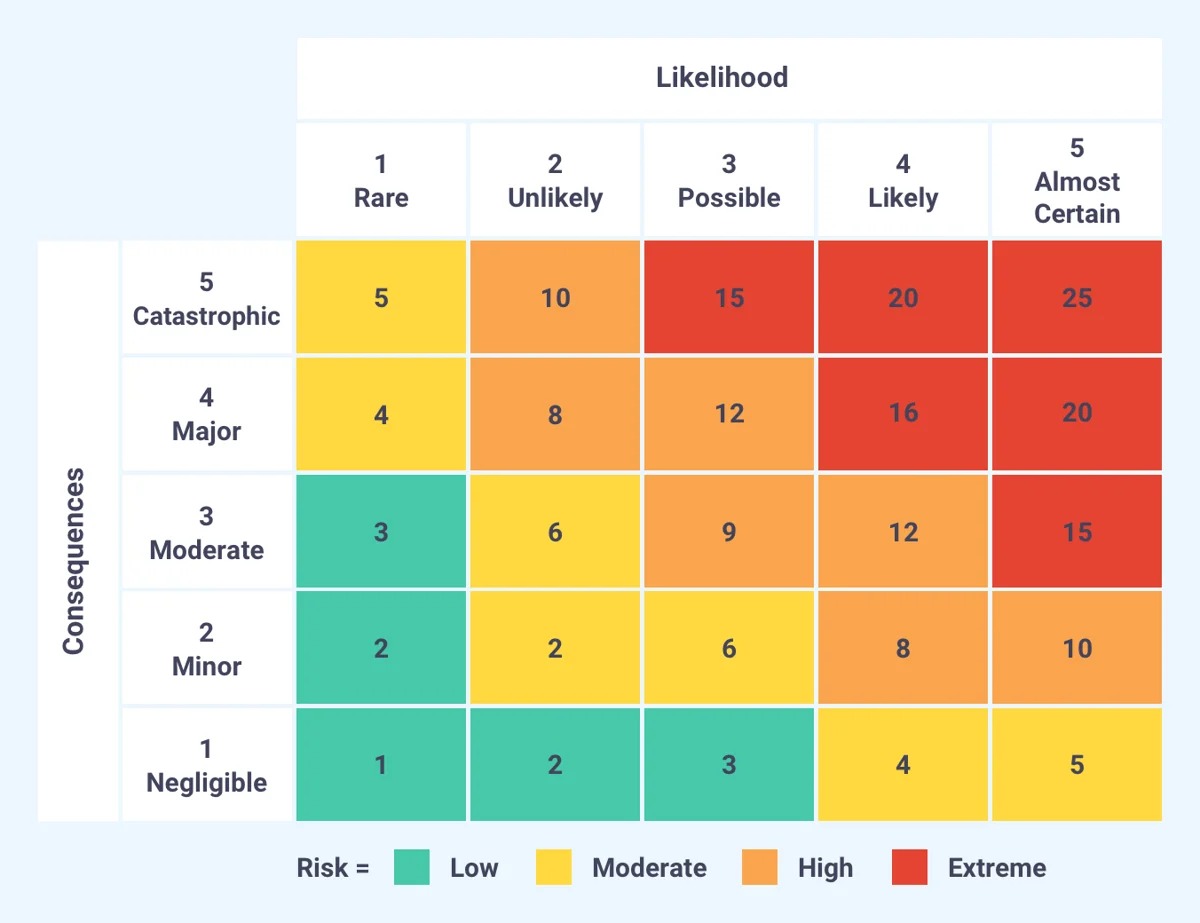

At its core, QRA aims to assign numerical values to different aspects of risk, such as probability and impact, in order to provide a more precise and measurable understanding of risk. It goes beyond qualitative risk assessment methods by quantifying the uncertainties and enabling comparisons between different risks.

QRA involves the development of mathematical models to simulate and predict the behavior of risk factors and their potential impact on an organization. It takes into account various elements such as financial analysis, operational processes, market conditions, and external factors that could influence risk.

A key aspect of QRA is the use of probability distributions to represent uncertainties in the assessment. By utilizing statistical techniques, such as Monte Carlo simulation, QRA can generate a range of possible outcomes based on different sets of scenarios and assumptions.

These quantitative assessments provide decision-makers with valuable insights into the level of risk exposure and the potential impacts on various performance metrics, such as revenue, profitability, or asset value. The results of QRA can be used to inform risk management strategies, support resource allocation decisions, and prioritize risk mitigation efforts.

It’s important to note that while QRA provides a more objective and quantitative approach to risk assessment, it is not a crystal ball that can predict the future with certainty. The results of QRA are based on historical data and assumptions, and they are subject to the inherent limitations and uncertainties present in any quantitative analysis.

Overall, QRA is a powerful tool that brings a scientific and data-driven approach to risk assessment. It allows organizations to make more informed decisions, allocate resources effectively, and ultimately enhance their ability to manage and mitigate risks.

Purpose of Quantitative Risk Assessment

The purpose of quantitative risk assessment (QRA) is to provide organizations with a quantitative understanding of the potential risks they face and their potential impacts. It serves several key purposes in the realm of risk management:

- Identifying and prioritizing risks: QRA helps organizations identify and prioritize risks by quantifying their likelihood and potential consequences. By assigning numerical values to risks, organizations can objectively compare and rank them, allowing for more effective risk mitigation and resource allocation.

- Quantifying risk exposure: QRA provides organizations with a quantitative measure of their exposure to different types of risks. This allows decision-makers to understand the potential negative impact on key performance metrics, such as financial results, operational efficiency, reputation, and regulatory compliance.

- Evaluating risk management strategies: QRA enables organizations to evaluate the effectiveness of their risk management strategies. By simulating different scenarios and assessing the potential outcomes, organizations can assess the impact of different risk mitigation measures and identify the most appropriate strategies to reduce risk.

- Supporting informed decision-making: QRA provides decision-makers with valuable insights into the potential risks associated with different courses of action. By incorporating quantitative risk analysis into the decision-making process, organizations can make more informed decisions, weighing the potential risks against the expected benefits.

- Facilitating communication and stakeholder engagement: QRA provides a common language for discussing and communicating risks both internally and externally. By presenting risk in a quantitative format, organizations can effectively communicate the potential impacts and facilitate discussions with stakeholders, including senior management, board members, regulators, and customers.

By fulfilling these purposes, QRA empowers organizations to proactively manage risks, optimize resource allocation, and make informed business decisions. It enhances the overall risk management process by providing a quantitative framework that evaluates risk exposure and guides the development of targeted risk mitigation strategies.

Steps in Quantitative Risk Assessment

Quantitative risk assessment (QRA) follows a systematic process that involves several key steps to ensure a comprehensive and accurate assessment of risk. Here are the typical steps involved in conducting QRA:

- Identify the scope and objectives: Clearly define the scope and objectives of the risk assessment. Determine what risks will be assessed, the desired level of detail, and the specific goals to be achieved through the assessment.

- Identify risk factors: Identify the key risk factors that are relevant to the scope of the assessment. This may include market conditions, regulatory changes, operational processes, financial factors, or external events that could potentially impact the organization.

- Collect data: Gather relevant data to analyze and quantify the identified risk factors. This may involve data from internal sources, such as historical records, financial statements, or operational reports, as well as external data, such as market trends, industry benchmarks, or economic indicators.

- Analyze the data: Apply statistical analysis and modeling techniques to analyze the collected data. This may involve calculating probabilities, estimating parameters, and developing mathematical models to simulate the behavior of the identified risk factors.

- Quantify risk: Assign numerical values to the identified risks based on the analysis of data and modeling results. This may involve determining the probabilities of different outcomes and measuring the potential impact of those outcomes on key performance indicators or financial metrics.

- Assess the risk: Assess the overall level of risk based on the quantified values. This may involve comparing the calculated risk values against predefined risk tolerance thresholds or benchmarks to determine the significance of the identified risks.

- Interpret the results: Interpret the results of the risk assessment to understand the implications and potential consequences of the identified risks. This step involves examining the quantitative outputs in the context of the organization’s goals and objectives, as well as considering any qualitative factors that may influence the decision-making process.

- Communicate the findings: Communicate the results of the risk assessment to relevant stakeholders in a clear and understandable manner. This includes presenting the quantitative risk values, discussing the implications, and making recommendations for risk mitigation strategies or further actions.

- Update and review: Regularly update and review the quantitative risk assessment to reflect changes in the internal and external environment. Risks are not static, and new risks may emerge or existing risks may evolve over time, requiring ongoing monitoring and analysis.

By following these steps, organizations can ensure a systematic and thorough approach to quantitative risk assessment, enabling them to make informed decisions and effectively manage risks.

Data Collection for Quantitative Risk Assessment

In quantitative risk assessment (QRA), data collection is a crucial step in obtaining the necessary information to analyze and quantify risks. Collecting relevant and reliable data is essential to ensure accuracy and validity in the assessment process. Here are the key considerations for data collection in QRA:

- Identify required data: Determine the specific data requirements for the risk assessment. This includes identifying the risk factors, variables, and parameters that need to be considered. For example, financial data, market data, operational data, historical records, and industry-specific metrics may be necessary depending on the scope of the assessment.

- Collect internal data: Gather data from internal sources within the organization, such as financial statements, operational reports, incident logs, and performance metrics. Internal data provides valuable insights into the organization’s past performance and can help assess the impact of risks on key business functions.

- Access external data sources: Explore external sources of data relevant to the risk assessment. This may include market trends, economic indicators, industry benchmarks, regulatory reports, and data from reputable sources such as government agencies, industry associations, or research institutions.

- Evaluate data quality: Assess the quality and reliability of the collected data. Ensure that the data is accurate, up-to-date, and relevant to the risk assessment. Scrutinize the data for any inconsistencies, errors, or biases that may affect the analysis and the validity of the assessment results.

- Standardize and organize data: Standardize the collected data to ensure consistency and compatibility for analysis. This may involve converting data formats, normalizing units of measurement, or applying data cleansing techniques to remove any outliers or errors. Organize the data in a structured manner to facilitate efficient data analysis.

- Fill data gaps: Identify any gaps in the available data and address them appropriately. This may involve conducting additional research, gathering supplementary data, or estimating missing data points using interpolation or other statistical techniques. Care should be taken to ensure that the methods used to fill data gaps are appropriate and do not introduce biases or inaccuracies.

- Consider data limitations: Be aware of the limitations and assumptions associated with the collected data. Recognize that data alone may not provide a complete picture of the risks, and additional qualitative information or expert judgment may be necessary to complement the quantitative analysis.

- Maintain data security and privacy: Adhere to data security and privacy regulations when collecting and handling sensitive data. Ensure that data is stored securely and access is limited to authorized individuals. Safeguard confidentiality and protect against any potential data breaches or unauthorized disclosures.

By following these data collection practices, organizations can ensure the availability of accurate and reliable data to support the quantitative analysis in risk assessment. The quality of the data collected directly impacts the accuracy and validity of the assessment results, enabling informed decision-making and effective risk management strategies.

Data Analysis for Quantitative Risk Assessment

In quantitative risk assessment (QRA), data analysis plays a critical role in interpreting the collected data and deriving meaningful insights about the potential risks. It involves applying statistical techniques, mathematical models, and analytical tools to analyze and interpret the data. Here are the key components of data analysis in QRA:

- Data validation and cleaning: Validate and clean the collected data to ensure its accuracy and integrity. This involves identifying and resolving any inconsistencies, errors, or outliers that may impact the analysis. Data cleaning techniques may include data transformation, outlier detection, and missing data imputation.

- Descriptive analysis: Conduct descriptive analysis to summarize and describe the data. This includes calculating measures of central tendency such as mean, median, and mode, as well as measures of dispersion such as standard deviation and range. Descriptive analysis provides a basic understanding of the data distribution and key characteristics.

- Probability distribution fitting: Fit probability distributions to the data to model the behavior of risk factors. This involves analyzing the data distribution and selecting an appropriate probability distribution that best represents the observed data. Common distributions used in QRA include Gaussian (normal), exponential, Weibull, and lognormal distributions.

- Histograms and frequency analysis: Create histograms and conduct frequency analysis to visualize the distribution of data and identify any patterns or trends. Histograms provide a graphical representation of the data distribution, highlighting the frequencies of different values or ranges. Frequency analysis helps in understanding the likelihood of different outcomes and potential risk levels.

- Correlation and regression analysis: Analyze the relationship between different variables using correlation and regression analysis. Correlation analysis measures the strength and direction of the relationship between two variables, while regression analysis helps quantify the dependence of one variable on one or more independent variables. These analyses provide insights into how changes in one variable may affect the risk associated with another.

- Sensitivity analysis: Conduct sensitivity analysis to assess the impact of changes in key variables on the overall risk assessment. This involves varying the values of input parameters to assess how sensitive the risk outcomes are to different assumptions or scenarios. Sensitivity analysis allows organizations to understand which variables have a significant influence on the assessment results and prioritize their focus accordingly.

- Scenario analysis and simulation: Perform scenario analysis and simulation to assess the potential outcomes and impacts of different risk scenarios. This involves developing mathematical models and using simulation techniques, such as Monte Carlo simulation, to generate multiple iterations of possible outcomes based on the defined scenarios and input parameters.

- Risk aggregation and quantification: Aggregate and quantify the assessed risks based on the outcomes of the data analysis. This involves combining the individual risk factors, their probabilities, and potential impacts to estimate the overall level of risk. The quantification may be expressed in various ways, such as numerical values, risk scores, or qualitative ratings.

- Interpretation and reporting: Interpret the results of the data analysis and prepare clear and concise reports that communicate the findings. The interpretation should provide insights and implications of the assessed risks, highlighting areas of concern and potential mitigation strategies. Effective reporting ensures that key stakeholders can understand and act upon the risk assessment results.

By conducting thorough data analysis in QRA, organizations can gain a deeper understanding of the risks they face, quantify the potential impacts, and make informed decisions to effectively manage and mitigate those risks.

Interpretation of Quantitative Risk Assessment Results

Interpreting the results of a quantitative risk assessment (QRA) is crucial for deriving meaningful insights and making informed decisions. The interpretation process involves analyzing the quantified risks and understanding their implications. Here are key considerations for interpreting QRA results:

- Understanding risk levels: Review the quantified risk values to understand the level of risk associated with different scenarios or variables. Assess whether the risks fall within acceptable thresholds or if they exceed predefined risk tolerance levels. This helps in prioritizing risk mitigation efforts and allocating resources appropriately.

- Evaluating worst-case scenarios: Identify the worst-case scenarios or extreme events that pose the most significant risks. These scenarios may have high probabilities of occurrence or severe consequences. Understanding these worst-case scenarios allows organizations to develop contingency plans and implement robust risk mitigation strategies.

- Considering risk interdependencies: Assess the interdependencies and correlations between different risks. Evaluate how changes in one risk factor may impact other risks. This understanding helps in evaluating the combined effect of multiple risks and identifying potential cascading effects or systemic risks that may arise from interconnected risk factors.

- Assessing risk drivers and root causes: Analyze the factors that contribute to the risks and identify their root causes. Understanding the underlying drivers of the risks helps in formulating effective risk mitigation strategies. By addressing the root causes, organizations can reduce the likelihood or severity of potential risks.

- Considering risk impacts: Evaluate the potential impacts of the identified risks on various aspects of the organization, such as financial performance, operational efficiency, reputation, and stakeholder relationships. Assess the magnitude and duration of the impacts to determine the significance of the risks in relation to the organization’s goals and objectives.

- Communicating risk findings: Prepare clear and concise reports that communicate the risk assessment findings to relevant stakeholders. Use visual aids, such as charts, graphs, and diagrams, to present the results in an understandable format. Highlight the key risk factors, their probabilities, and potential impacts. Tailor the communication to the audience, providing the necessary level of detail and context.

- Identifying risk mitigation strategies: Based on the interpretation of the results, identify and prioritize risk mitigation strategies. Determine the most effective approaches for reducing the likelihood or impact of the identified risks. Consider both preventive measures to minimize the likelihood of risks occurring and contingency plans to mitigate their potential impacts if they do occur.

- Monitoring and reviewing: Continuously monitor and review the results of the QRA to account for changes in the internal and external environment. Risks evolve over time, and new risks may emerge. Regularly evaluate the effectiveness of risk mitigation strategies and update the assessment as needed.

Effective interpretation of QRA results empowers organizations to make informed decisions, implement appropriate risk mitigation measures, and enhance their overall risk management practices. By understanding the implications of the assessed risks, organizations can proactively address potential threats and seize opportunities for growth and resilience.

Limitations of Quantitative Risk Assessment

While quantitative risk assessment (QRA) is a valuable tool for analyzing and quantifying risks, it is important to recognize its limitations. Understanding these limitations helps organizations make informed decisions and utilize QRA effectively. Here are some key limitations of QRA:

- Data limitations: QRA heavily relies on historical data and assumptions. The availability and quality of data can impact the accuracy and reliability of the assessment. Incomplete or biased data may lead to inaccurate risk estimates and limit the validity of the results.

- Assumptions and simplifications: QRA involves making assumptions and simplifications to model complex systems and processes. However, these assumptions may not always accurately reflect real-world scenarios, and simplifications may overlook important factors or interactions. The results of QRA should be interpreted with caution, considering the limitations of the underlying assumptions.

- Uncertainty: QRA cannot eliminate uncertainty. The future is inherently uncertain, and QRA is based on historical data and assumptions about the future. The calculated risk probabilities are estimates, and there is always a degree of uncertainty associated with the assessed risks. This uncertainty should be acknowledged and considered in decision-making processes.

- Human factors: QRA assumes that human behavior and factors can be accurately captured and modeled. However, human factors, such as psychology, individual decision-making, and external influences, often introduce complexities and uncertainty. These factors can significantly affect the occurrence and impact of risks, making it challenging to predict and quantify them accurately.

- Complexity: QRA may struggle to capture the full complexity of interconnected and dynamic systems. Many real-world scenarios involve complex interdependencies and feedback loops that are difficult to model accurately. Simplified models may not fully capture the potential interactions and cascading effects, leading to limitations in risk assessment accuracy.

- Subjectivity: Although QRA aims to provide objective and quantitative results, there is still a subjective component involved. The selection of risk factors, probability distributions, and modeling approaches involves subjective judgment. Different analysts may make different decisions, leading to variations in the results. Consequently, it is important to validate and review the results by involving multiple perspectives.

- Limited forward-looking capacity: QRA relies on historical data to inform future risk assessments. While it can provide insights into trends and patterns, it may not fully capture emerging risks or anticipate unprecedented events. Forward-looking risk assessment requires additional methods, such as scenario planning and expert judgment, to complement QRA.

Awareness of these limitations helps organizations use QRA as a valuable tool within its boundaries. It allows decision-makers to consider the uncertainties, question assumptions, and supplement QRA with qualitative assessments and expert insights to make well-informed risk management decisions.

Benefits of Quantitative Risk Assessment

Quantitative risk assessment (QRA) offers several significant benefits for organizations in managing and mitigating risks. By employing a quantitative approach to risk analysis, organizations can make informed decisions and allocate resources more effectively. Here are the key benefits of QRA:

- Objective risk evaluation: QRA brings objectivity to risk evaluation by utilizing numerical data and statistical analysis. It minimizes subjective bias and provides a standardized framework for assessing risks across different areas of the organization. This objectivity helps in prioritizing risks and aligning risk management strategies with organizational goals.

- Enhanced risk understanding: QRA provides a deeper understanding of risks by quantifying their likelihood and potential impact. It enables organizations to identify and assess risks in a more systematic manner, considering multiple risk factors and their interdependencies. This comprehensive understanding allows for more effective risk response planning and resource allocation.

- Informed decision-making: QRA equips decision-makers with data-driven insights to make informed decisions. It helps weigh the potential benefits and costs associated with different courses of action in light of the assessed risks. By considering the quantitative risk analysis, decision-makers can evaluate alternative strategies and select the ones that offer the best risk-reward profiles.

- Prioritized risk management: QRA enables organizations to prioritize risk management efforts based on the level of risk exposure. By quantifying risks, organizations can identify high-risk areas or processes that require immediate attention and allocate resources accordingly. This targeted approach ensures that risk mitigation efforts are focused where they are most needed, optimizing risk management effectiveness.

- Credible communication: QRA supports effective communication of risks both internally and externally. The use of quantitative data and clear risk metrics makes it easier to communicate the potential impacts and likelihood of risks to stakeholders. This facilitates meaningful discussions, improves risk awareness, and supports transparency in risk reporting to regulatory authorities, investors, and other interested parties.

- Cost-effective risk reduction: QRA helps organizations optimize resource allocation by identifying cost-effective risk reduction strategies. By quantifying risks, organizations can evaluate the cost of risk mitigation measures against the potential benefits. This allows for efficient allocation of resources, ensuring that limited resources are utilized where they can have the most significant impact in reducing risks.

- Continuous improvement: QRA contributes to continuous improvement in risk management practices. It provides a systematic approach to monitor and reassess risks over time. By regularly updating the risk assessment and incorporating new data, organizations can adapt their risk management strategies to emerging risks and evolving market conditions, ensuring ongoing resilience and adaptability.

By leveraging the benefits of QRA, organizations can make more informed decisions, enhance risk management effectiveness, and improve overall organizational resilience. QRA provides a valuable tool for navigating uncertainties and proactively managing risks in today’s dynamic business environment.

Conclusion

Quantitative risk assessment (QRA) offers organizations a powerful framework for systematically assessing and managing risks in a data-driven and objective manner. By leveraging numerical data, statistical analysis, and modeling techniques, QRA provides valuable insights into the likelihood and potential impact of risks, enabling informed decision-making and effective risk mitigation strategies.

In this article, we explored the various aspects of QRA, starting with its definition and purpose. We discussed the steps involved in conducting QRA, including data collection, analysis, and interpretation of the results. Furthermore, we examined the limitations and benefits of QRA, highlighting the importance of understanding its boundaries and leveraging its strengths.

Through QRA, organizations gain a better understanding of their risk exposure, prioritize risks, and allocate resources more effectively. It enables decision-makers to make informed choices based on objective risk assessments, consider potential impacts, and implement targeted risk mitigation strategies. QRA also enhances risk communication, allowing organizations to effectively communicate risks to stakeholders and facilitate meaningful discussions.

However, it is important to recognize the limitations of QRA, such as data constraints, assumptions, and the inherent uncertainty of future events. Organizations should supplement quantitative analyses with qualitative assessments and expert judgment to mitigate these limitations and ensure a more comprehensive risk management approach.

In conclusion, QRA offers organizations a valuable tool to understand, quantify, and manage risks. By harnessing the power of data and statistical analysis, organizations can make informed decisions, enhance risk management practices, and improve overall resilience. As organizations continue to navigate the complex and uncertain business landscape, QRA serves as an indispensable companion in the pursuit of effective risk management and sustainable success.