Finance

What Is Smart Credit

Published: January 12, 2024

Learn about smart credit and how it can help you manage your finances effectively. Gain insights into the benefits and features of smart credit for better financial control.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of smart credit, where technology meets finance to revolutionize the way we manage our financial lives. In this digital era, traditional credit systems are being transformed by the emergence of smart credit solutions, offering individuals and businesses innovative ways to access and utilize credit.

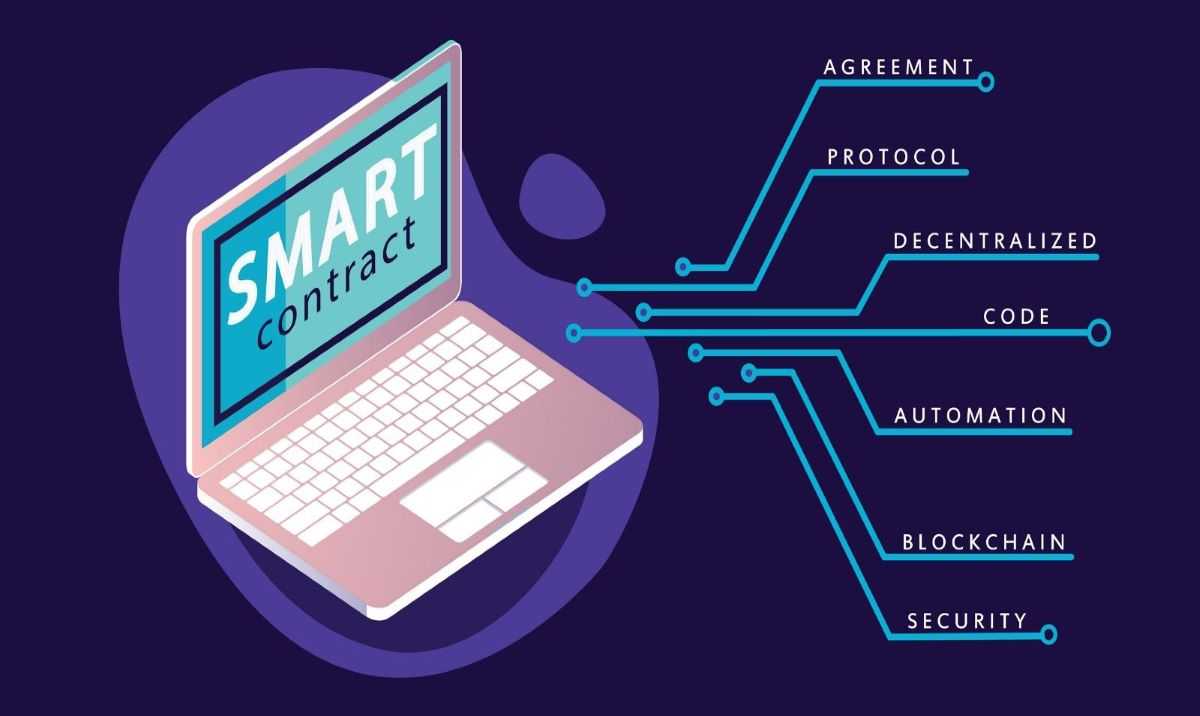

So, what exactly is smart credit? In its simplest form, smart credit refers to the integration of advanced technology and data analysis techniques into the credit process. It aims to provide users with tailored credit solutions, improved efficiency, and enhanced user experiences.

Gone are the days of filling out lengthy paper applications and waiting weeks for a response. Smart credit leverages the power of automation, artificial intelligence, and big data to streamline and expedite the credit application and approval process.

Whether you are looking for a personal loan, a credit card, or financing for your business, smart credit offers a range of benefits that go beyond traditional credit systems.

Throughout this article, we will delve into the world of smart credit, exploring how it works, its advantages over traditional credit, examples of smart credit services, as well as potential risks and challenges involved.

So, fasten your seatbelt as we embark on this journey to discover the exciting innovations in the realm of smart credit and explore how it can transform the way we access and manage credit.

Definition of Smart Credit

Smart credit can be broadly defined as the utilization of technology and advanced algorithms to optimize the credit process, making it more efficient and personalized. It involves the integration of diverse data sources, such as financial records, transaction history, and alternative data points, to make informed lending decisions and offer customized credit solutions.

Unlike traditional credit systems that rely heavily on credit scores and historical data, smart credit takes a more holistic approach to assessing creditworthiness. It leverages artificial intelligence and machine learning algorithms to analyze a wide range of factors, including income, spending patterns, social media activity, and even educational background.

By considering a comprehensive set of data points, smart credit providers can offer personalized credit products and tailored interest rates based on an individual’s unique financial situation and borrowing needs.

One key characteristic of smart credit is its ability to provide real-time credit decisions. Instead of waiting days or weeks for approval, smart credit platforms can evaluate loan applications within minutes, thanks to the automation of processes and sophisticated risk assessment models.

Additionally, smart credit often includes features that encourage responsible borrowing and help individuals improve their financial well-being. For instance, it may offer personalized recommendations and financial management tools to help users better understand their spending habits and establish a healthy credit profile.

Overall, the primary objective of smart credit is to make credit more accessible, flexible, and personalized, offering individuals and businesses the financial tools they need to thrive in today’s fast-paced digital economy.

How Smart Credit Works

Smart credit harnesses the power of technology and data analytics to transform the traditional credit process into a more efficient and user-friendly experience. Here’s a breakdown of how smart credit works:

- Data Collection: Smart credit platforms collect a vast amount of data from various sources. This includes financial records, transaction history, employment information, credit reports, and even non-traditional data sources like social media and online behavior.

- Data Analysis: Once the data is collected, advanced algorithms are used to analyze and interpret it. Machine learning and artificial intelligence models crunch the data to gain insights into an individual’s financial behavior, patterns, and creditworthiness.

- Credit Assessment: Using the insights gained from data analysis, smart credit systems assess the creditworthiness of an individual or business. This assessment goes beyond traditional credit scores and incorporates a broader set of factors to make informed lending decisions.

- Customized Credit Solutions: Smart credit providers offer personalized credit solutions based on the credit assessment. These solutions can range from personal loans, credit cards, lines of credit, to business financing. Interest rates and loan terms are often tailored to the individual’s risk profile and borrowing needs.

- Real-time Credit Decisions: One of the key advantages of smart credit is the ability to provide real-time credit decisions. Instead of waiting for days or weeks, applicants receive instant feedback on their loan applications, allowing them to make quick financial decisions.

- Accessible and Convenient: Smart credit platforms are designed to be user-friendly and accessible. They usually have intuitive user interfaces, enabling users to apply for credit and manage their accounts online or through mobile applications.

- Financial Management Tools: Many smart credit platforms offer additional financial management tools to help users better understand their finances and improve their credit profiles. These tools may include budgeting features, credit monitoring, and recommendations for building credit.

Overall, smart credit simplifies and expedites the credit process by leveraging technology and advanced analytics. It offers customized credit solutions based on a comprehensive assessment of an individual’s financial information, allowing for faster, more accurate, and personalized lending decisions.

Benefits of Smart Credit

Smart credit brings numerous benefits to individuals and businesses, transforming the way credit is accessed and utilized. Here are some key advantages of smart credit:

- Faster Approval Process: One of the primary benefits of smart credit is the speed at which credit decisions are made. Traditional credit systems can take days or even weeks to process loan applications, whereas smart credit platforms can provide instant approvals, allowing individuals to access funds quickly.

- Personalized Credit Solutions: Smart credit takes into account a wide range of data points when assessing creditworthiness. This enables lenders to offer personalized credit solutions tailored to an individual’s unique financial situation and needs. Whether it’s a specific loan amount, favorable interest rates, or flexible repayment terms, smart credit ensures borrowers receive the most suitable options.

- Expanded Access to Credit: Smart credit opens up access to credit for individuals who may have limited or no credit history. By considering alternative data sources such as educational background, employment history, and social media activity, smart credit provides opportunities for those who were previously excluded from traditional credit systems.

- Improved User Experience: Smart credit platforms are designed to provide a seamless and user-friendly experience. Applications can be completed online or through mobile apps, eliminating the need for lengthy paperwork and in-person visits to financial institutions. This convenience enhances the overall user experience and makes managing credit more accessible and efficient.

- Better Risk Assessment: Smart credit leverages advanced algorithms and machine learning to analyze a broad set of data points. This allows for a more accurate assessment of creditworthiness, minimizing the risk of default and enabling lenders to make smarter lending decisions. As a result, lenders can offer credit to a wider range of individuals while managing their risk effectively.

- Financial Management Tools: Many smart credit platforms offer additional resources to help individuals better manage their finances. These tools may include budgeting features, credit score monitoring, and personalized recommendations for improving financial health. This holistic approach to credit empowers borrowers to make informed financial decisions and build stronger credit profiles.

In summary, smart credit offers numerous benefits, including faster approvals, personalized credit solutions, expanded access to credit, improved user experience, better risk assessment, and additional financial management tools. By revolutionizing the credit landscape, smart credit empowers individuals and businesses to confidently navigate their financial journeys and make the most of their credit opportunities.

Smart Credit vs Traditional Credit

Smart credit and traditional credit systems differ in several key aspects, revolutionizing the way individuals and businesses access and utilize credit. Let’s explore the main differences between these two approaches:

- Credit Assessment: Traditional credit systems primarily rely on credit scores and historical data to assess creditworthiness. Smart credit, on the other hand, considers a broader set of factors, including alternative data sources such as social media activity, educational background, and transaction history. This more comprehensive assessment allows smart credit providers to offer tailored credit solutions based on a more holistic understanding of an individual’s financial behavior.

- Approval Process: Traditional credit systems often involve lengthy paperwork and manual review processes, leading to time-consuming approval processes. In contrast, smart credit platforms automate and streamline the credit application and approval process, resulting in faster decision-making. Applicants can receive instant approvals, allowing them to access funds quickly.

- Personalization: Traditional credit systems typically offer standardized credit products with predetermined interest rates and loan terms. Smart credit, however, emphasizes personalization. It tailors credit solutions to the individual’s unique financial situation, allowing for more flexible interest rates, loan amounts, and repayment terms that align with the borrower’s needs.

- Accessibility: Traditional credit systems often place significant emphasis on credit history and require a lengthy credit history to access credit. This can limit access for individuals with little to no credit history. Smart credit, in contrast, considers alternative data points beyond credit history, providing opportunities for individuals who may have been excluded by traditional credit systems. This increased accessibility opens up credit options to a wider range of individuals.

- Risk Assessment: While traditional credit systems rely on historical data and credit scores as the primary indicators of creditworthiness, smart credit employs advanced algorithms and machine learning models to assess risk. By considering a broader range of data points, such as income, spending patterns, and employment history, smart credit providers can make more accurate risk assessments, reducing the chances of defaults and better managing potential risks.

- User Experience: Traditional credit systems often involve in-person visits to banks or financial institutions and manual paperwork. Smart credit platforms, on the other hand, prioritize a streamlined and user-friendly experience. Applications can be completed online or through mobile apps, offering convenience and ease of use. This improved user experience enhances accessibility and encourages more individuals to actively engage with and manage their credit.

In summary, smart credit differs from traditional credit systems in terms of credit assessment, approval process, personalization, accessibility, risk assessment, and user experience. By leveraging advanced technology and data analysis, smart credit offers a more personalized, efficient, and inclusive approach to accessing and managing credit.

Examples of Smart Credit Services

Smart credit services have emerged across various sectors, offering innovative credit solutions that utilize advanced technology and data analysis. Here are some examples of smart credit services:

- Peer-to-Peer Lending Platforms: Peer-to-peer (P2P) lending platforms connect borrowers directly with investors, eliminating the need for traditional financial institutions. These platforms use smart credit techniques to assess borrower creditworthiness and determine interest rates. By leveraging technology to match borrowers with lenders, P2P lending platforms offer more accessible and flexible credit options.

- Alternative Credit Scoring Companies: Alternative credit scoring companies utilize non-traditional data sources, such as utility bill payments, rental history, and mobile phone usage, to assess creditworthiness. By incorporating these alternative data points into their credit assessment models, these companies can provide credit options to individuals with limited or no credit history.

- Digital Wallets and Buy Now, Pay Later Services: Digital wallets and buy now, pay later (BNPL) services offer convenient payment solutions that leverage smart credit capabilities. These platforms analyze an individual’s transaction history, spending patterns, and payment behavior to provide instant credit approvals at the point of sale. Digital wallets also offer financial management tools and budgeting features to help users stay on top of their payments.

- Online Lenders: Online lenders have revolutionized the lending landscape by integrating smart credit technology into their platforms. Using automated processes and advanced algorithms, online lenders can evaluate loan applications in real-time, offering fast approvals and personalized loan options.

- Open Banking and Credit Aggregation: Open banking and credit aggregation platforms allow users to securely share their financial data with trusted third-party providers. By aggregating data from multiple sources, these platforms utilize smart credit techniques to provide users with a comprehensive view of their financial health, including credit scores, budgeting recommendations, and personalized loan options.

- Artificial Intelligence-powered Credit Underwriting: Some financial institutions are adopting artificial intelligence (AI) and machine learning (ML) for credit underwriting. AI algorithms analyze vast amounts of data to assess creditworthiness, allowing for faster and more accurate risk assessment. These smart credit technologies enable lenders to make data-driven lending decisions with improved efficiency.

These examples illustrate the diverse range of smart credit services available in the market. By leveraging technology, data analysis, and innovative approaches to credit, these services provide individuals and businesses with access to tailored credit solutions, faster approvals, and enhanced user experiences.

Potential Risks and Challenges of Smart Credit

While smart credit offers numerous advantages, it is essential to consider the potential risks and challenges associated with these innovative credit solutions:

- Data Privacy and Security: Smart credit heavily relies on the collection and analysis of vast amounts of personal and financial data. Maintaining the privacy and security of this data is crucial to protect individuals from identity theft, fraud, or unauthorized access. Robust data protection measures are imperative to mitigate these risks.

- Algorithmic Bias: Smart credit systems rely on algorithms and machine learning models to make credit decisions. However, if these algorithms are biased or trained on biased data, it can lead to discriminatory outcomes, perpetuating existing inequalities or excluding certain segments of the population. Ongoing monitoring and testing of algorithms are necessary to ensure fair and unbiased credit assessments.

- Lack of Human Touch: While smart credit brings convenience and efficiency, it may lack the personalized guidance and human touch typically offered by traditional credit systems. Some individuals may prefer the ability to talk to a loan officer or seek advice in person.

- Overreliance on Data: Smart credit heavily relies on data analysis and algorithms. However, not all data points may accurately reflect an individual’s creditworthiness. Overreliance on certain data sources or incomplete data can lead to inaccurate credit assessments and potentially deny credit to deserving individuals.

- Limited Regulatory Framework: As smart credit is a relatively new phenomenon, the regulatory framework to govern these services may still be developing. This can create uncertainties around consumer protections, data privacy, and overall fairness in the credit industry. Regulatory bodies need to adapt and establish appropriate guidelines and rules for smart credit services.

- Inadequate Financial Education: Smart credit platforms often provide access to credit quickly and easily. However, individuals may need proper financial education to make informed borrowing decisions and manage their credit responsibly. Without sufficient financial literacy, individuals may find themselves facing increased debt or other financial challenges.

Addressing these risks and challenges is crucial to ensure the responsible and sustainable growth of smart credit. Continued collaboration between policymakers, financial institutions, and technology providers is essential to establish safeguards, promote transparency, and ensure fair access to credit for all individuals.

Conclusion

Smart credit has transformed the landscape of borrowing and lending, offering innovative solutions that leverage technology and data analysis to improve access to credit and enhance the borrowing experience. By incorporating advanced algorithms, artificial intelligence, and alternative data sources, smart credit has revolutionized the credit assessment process, leading to faster approvals, personalized credit solutions, and increased accessibility.

From peer-to-peer lending platforms and alternative credit scoring companies to digital wallets and online lenders, a wide range of smart credit services have emerged, providing individuals and businesses with tailored credit options based on comprehensive assessments. Real-time credit decisions, intuitive user interfaces, and additional financial management tools have made managing credit more convenient and efficient.

However, it is important to consider potential risks and challenges associated with smart credit, such as data privacy and security concerns, algorithmic bias, and the need for ongoing financial education. Striking a balance between technological advancements and responsible lending practices is crucial to ensure that smart credit benefits all individuals and promotes financial inclusion.

As smart credit continues to evolve, the development of robust regulatory frameworks becomes paramount in protecting consumer rights and ensuring fair access to credit. Continued collaboration between regulators, financial institutions, and technology providers is necessary to establish guidelines that promote transparency, address biases, and safeguard data privacy.

Overall, smart credit presents exciting opportunities for individuals and businesses to access credit in a more personalized, efficient, and inclusive manner. By embracing the power of technology and data analysis, we can look forward to a future where credit is more accessible and tailored to meet the diverse needs of borrowers, ultimately empowering individuals to achieve their financial goals.