Finance

When Is The S-Corp Tax Return Due?

Published: October 28, 2023

Discover the deadline for filing your S-Corp tax return and ensure you stay compliant with Finance regulations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to running a successful business, understanding and meeting tax obligations are essential. For entrepreneurs who have structured their business as an S-Corporation (S-Corp), knowing the deadlines for filing tax returns is crucial. The S-Corp tax return is a key document that must be filed annually to report the company’s income, expenses, deductions, and credits to the Internal Revenue Service (IRS).

While tax compliance can be complex, especially for those who are new to the world of business finance, familiarizing yourself with the deadlines and requirements for filing an S-Corp tax return is vital. This article aims to provide a comprehensive overview of the deadlines associated with S-Corp tax returns and highlight the importance of timely compliance.

This guide will delve into the filing deadlines for S-Corp tax returns, explore extension options that may be available to business owners, discuss estimated tax payments for S-Corps, and outline the penalties that can arise from late filing. By gaining a clear understanding of these topics, S-Corp owners can navigate their tax obligations with confidence and ensure that they meet all the necessary deadlines.

Whether you are a new business owner or have been operating as an S-Corp for some time, this article will serve as a valuable resource in clarifying the requirements and timelines for filing your S-Corp tax return. Remember, staying compliant with tax laws is not only a legal obligation but also a way to protect your business’s financial health and reputation.

Understanding S-Corp Tax Returns

Before delving into the filing deadlines for S-Corp tax returns, it’s important to have a clear understanding of what these returns entail. An S-Corp is a type of company that elects to pass its corporate income, losses, deductions, and credits through to its shareholders for federal tax purposes. What sets S-Corps apart from other business entities is that they are not subject to double taxation.

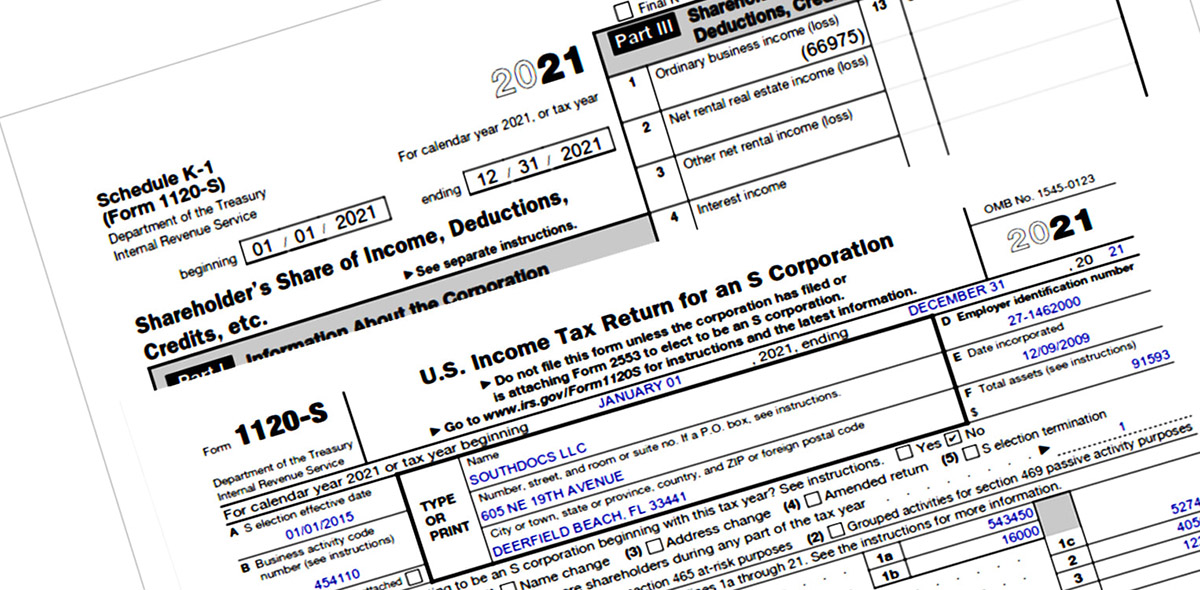

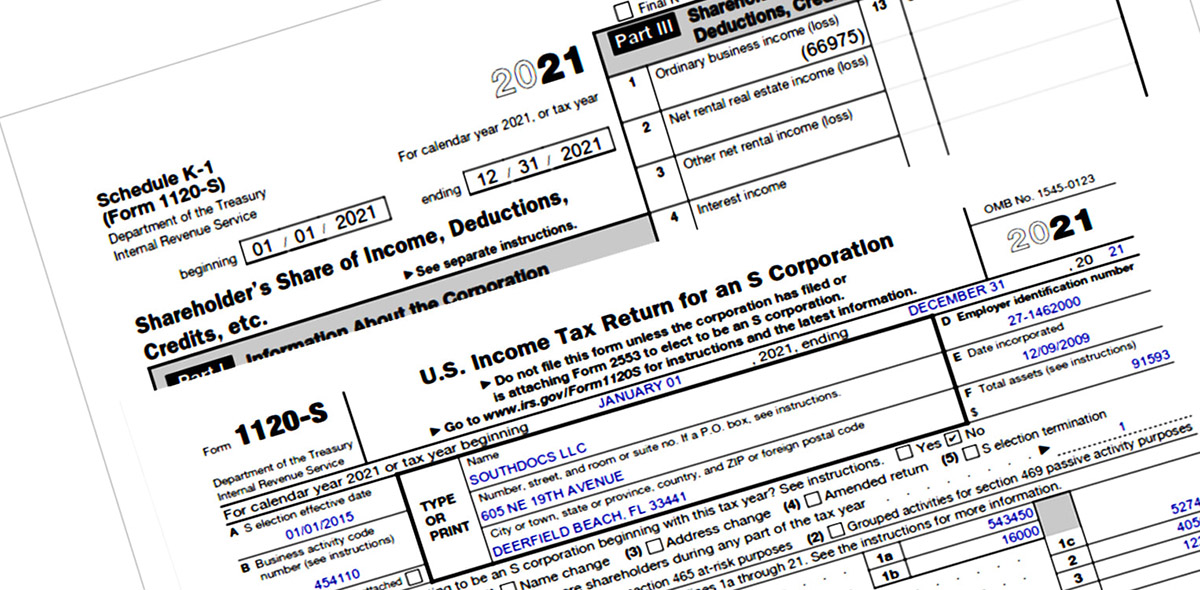

Unlike C-Corporations, which must file their own separate tax returns and are subject to corporate tax rates, S-Corps are deemed “pass-through” entities. This means that the shareholders report their share of the company’s profits and losses on their individual tax returns. S-Corp tax returns, also known as Form 1120S, are informational returns that provide the IRS with an overview of the company’s financial activity for the year.

When completing an S-Corp tax return, the business owner or their designated tax professional must report the company’s revenue, expenses, deductions, and credits. It’s important to maintain accurate and thorough financial records throughout the year to ensure the accuracy of the tax return.

Additionally, S-Corp shareholders must also receive a copy of Schedule K-1, which outlines their share of the company’s income, deductions, and credits. This information is then used on the individual shareholder’s personal tax return.

Understanding the nuances of S-Corp tax returns is critical to ensure compliance with tax laws and maximize tax efficiency. By maintaining accurate records and partnering with a knowledgeable tax professional, S-Corp owners can navigate this process smoothly and effectively.

In the next section, we will delve into the specific deadlines for filing S-Corp tax returns.

Filing Deadlines for S-Corp Tax Returns

As an S-Corp owner, it is crucial to be aware of the filing deadlines for your tax returns to avoid penalties and ensure timely compliance. The deadline for filing S-Corp tax returns is generally on or around March 15th, which falls on the 15th day of the third month following the end of the S-Corp’s tax year.

However, it’s important to note that the filing deadline can vary slightly depending on certain factors, such as weekends, holidays, or if the S-Corp has requested an extension. If the regular due date falls on a weekend or holiday, the IRS will generally extend the deadline to the next business day.

For example, if your S-Corp’s tax year ends on December 31st, the deadline for filing the corresponding tax return is typically March 15th. If March 15th falls on a weekend or holiday, the deadline will be moved to the next business day.

It’s worth noting that if your S-Corp operates on a fiscal year basis, meaning the tax year does not match the calendar year, the filing deadline may be different. In this case, it is crucial to consult the IRS guidelines or seek guidance from a tax professional to determine the appropriate filing deadline for your specific situation.

To ensure timely filing, it is highly recommended to start preparing your S-Corp tax return well in advance. Gathering all necessary financial documents, ensuring accurate record-keeping, and partnering with a qualified tax professional can streamline the process and minimize stress leading up to the deadline.

While March 15th is the general deadline for filing S-Corp tax returns, it’s essential to recognize that extensions may be available in certain circumstances. In the next section, we will explore the extension options for S-Corp tax returns.

Extension Options for S-Corp Tax Returns

Life can be unpredictable, and sometimes circumstances arise that make it challenging to meet the original deadline for filing your S-Corp tax return. In such cases, the IRS provides options for obtaining an extension, allowing you additional time to submit your tax return without incurring penalties.

The standard extension period for filing an S-Corp tax return is six months, meaning that if you are granted an extension, you will have until September 15th to submit your return. However, it’s important to note that the extension only grants additional time for filing the return, not for paying any taxes owed.

To request an extension, S-Corp owners must file Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, with the IRS. This form must be submitted by the original due date of the S-Corp tax return, typically March 15th.

It’s important to keep in mind that while an extension can provide temporary relief from the filing deadline, any taxes owed must still be paid by the original due date. If you fail to pay the taxes owed by the deadline, you may incur penalties and interest on the outstanding balance.

Obtaining an extension can be a valuable resource for S-Corp owners who need additional time to gather all necessary financial information or who are experiencing unforeseen circumstances that prevent them from filing by the original due date. However, it’s important to remember that an extension does not exempt you from the responsibility of properly filing your tax return and paying any taxes owed in a timely manner.

To ensure a smooth extension process and accurate filing, it is always advisable to work with a qualified tax professional. They can assist you in preparing the necessary documentation, filing the extension request, and meeting all the requirements set forth by the IRS.

Now that we have discussed extension options, let’s move on to the topic of estimated tax payments for S-Corps.

Estimated Tax Payments for S-Corps

As an S-Corp owner, it’s important to understand your obligations regarding estimated tax payments. Unlike employees who have income taxes withheld from their paychecks, S-Corp shareholders are responsible for making quarterly estimated tax payments throughout the year to cover their tax liabilities.

Estimated tax payments are an approximation of the taxes that will be owed at the end of the tax year. These payments help ensure that S-Corp shareholders meet their tax obligations in a timely manner and avoid potential penalties for underpayment of taxes.

The IRS requires S-Corp shareholders to estimate their income, deductions, and credits for the year and make quarterly payments of their share of the expected tax liability. These payments are due by April 15th, June 15th, September 15th, and January 15th of the following year.

Calculating estimated tax payments can be complex, as it involves considering various factors such as projected income, deductible expenses, credits, and changes in tax laws. Working with a knowledgeable tax professional can help ensure accurate estimation and proper compliance with payment requirements.

It’s important to note that underpayment of estimated taxes can result in penalties and interest. The IRS has specific rules regarding the safe harbor provision, which states that if a taxpayer pays at least 90% of the current year’s tax liability or 100% of the previous year’s tax liability (110% for high-income individuals), they will generally avoid penalties for underpayment.

It’s crucial for S-Corp owners to track their income, expenses, and deductions throughout the year to accurately estimate their tax liability and make the appropriate estimated tax payments. Failure to make these payments or underestimating the tax liability can result in financial consequences.

Consulting with a tax professional can provide valuable guidance on calculating and managing estimated tax payments to ensure compliance and minimize the risk of penalties. By staying on top of these payment obligations, S-Corp owners can maintain their tax responsibilities and avoid any unnecessary complications.

In the next section, we will discuss the penalties that can arise from late filing of S-Corp tax returns.

Penalties for Late S-Corp Tax Return Filing

Meeting the deadlines for filing your S-Corp tax returns is crucial to avoid hefty penalties and maintain compliance with IRS regulations. If you fail to file your S-Corp tax return by the due date (including any extensions), you may be subject to some significant penalties.

The penalty for late filing of an S-Corp tax return is calculated based on the number of days the return is overdue. The penalty is generally calculated at a rate of 5% of the unpaid tax liability for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax amount.

For small S-Corporations with average annual gross receipts of $1 million or less in the three preceding tax years, the penalty is generally reduced to $205 per month or part of a month that the return is late, up to a maximum of 12 months.

In addition to the late filing penalty, there is also a separate penalty for late payment of any taxes owed. This penalty is assessed at a rate of 0.5% of the unpaid tax liability per month or part of a month that the tax payment is late. The penalty can increase to 1% per month if the tax remains unpaid after 10 days of the IRS issuing a notice of intent to levy.

It’s important to note that both the late filing penalty and the late payment penalty can accumulate concurrently, making it crucial to file your tax return and pay any taxes owed in a timely manner.

If you have a reasonable cause for filing or paying late, you may be able to request penalty abatement from the IRS. However, it is essential to provide a valid reason and supporting documentation to support your request.

To avoid penalties, it’s highly recommended to stay organized and keep track of important tax deadlines. Utilizing tax software or working with a qualified tax professional can help ensure proper planning, accurate filing, and timely payment of tax obligations.

Remember, paying attention to deadlines and staying compliant with tax regulations is not only a legal requirement but also crucial for maintaining the financial health and reputation of your S-Corp.

Now, let’s summarize the key points discussed in this article.

Conclusion

As an S-Corp owner, understanding the deadlines and requirements for filing your tax returns is essential for maintaining compliance with IRS regulations. By familiarizing yourself with the filing deadlines, extension options, estimated tax payments, and penalties for late filing, you can navigate your tax obligations with confidence.

Remember that the deadline for filing S-Corp tax returns is generally on or around March 15th. However, this date can vary depending on weekends, holidays, and other factors. Extensions may be available, granting an additional six months to file, but taxes owed must still be paid by the original due date.

Estimated tax payments are a crucial aspect of S-Corp tax compliance, allowing shareholders to cover their tax liabilities throughout the year. Failure to make estimated payments or underestimating tax liability can result in penalties and interest.

Late filing of an S-Corp tax return can lead to penalties calculated based on the number of days the return is overdue. Late payment of taxes owed can also result in penalties and interest. It’s important to file and pay on time to avoid these financial consequences.

To ensure accuracy and smooth tax compliance, consider working with a qualified tax professional who can provide guidance and assistance throughout the process.

Remember, understanding and meeting your S-Corp tax obligations is not only a legal responsibility but also essential for the financial health and reputation of your business. Stay organized, keep track of deadlines, and seek professional advice to navigate your tax obligations successfully.

By staying proactive and informed, you can fulfill your tax responsibilities, minimize risks, and focus on the continued growth and success of your S-Corp.