Home>Finance>What Is The Credit Limit Worksheet For Form 8863

Finance

What Is The Credit Limit Worksheet For Form 8863

Published: January 7, 2024

Discover how to use the credit limit worksheet on Form 8863 to manage your finances effectively. Gain insights on calculating and maximizing your credit limit.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Purpose of the Credit Limit Worksheet

- Overview of Form 8863

- Understanding the Credit Limit Worksheet

- Step-by-Step Instructions for Completing the Credit Limit Worksheet

- Important Points to Consider when Filling out the Worksheet

- Common Mistakes to Avoid while Using the Credit Limit Worksheet

- Frequently Asked Questions about the Credit Limit Worksheet

- Conclusion

Introduction

Welcome to the world of personal finance where understanding the intricacies of credit limits and tax forms is crucial. If you’ve ever claimed education-related tax credits, you might be familiar with Form 8863 and its accompanying Credit Limit Worksheet. This worksheet plays a vital role in determining the maximum amount of education tax credits you can claim.

Whether you’re a student, a parent, or a taxpayer looking to maximize your tax savings, navigating the complexities of Form 8863 and the Credit Limit Worksheet can be daunting. But fear not! In this comprehensive guide, we’ll walk you through the ins and outs of the Credit Limit Worksheet for Form 8863, providing valuable insights and instructions along the way.

Understanding how to utilize the Credit Limit Worksheet effectively is important because it can directly impact the amount of tax credits you’re eligible for. By carefully following the instructions and avoiding common mistakes, you can make the most of this valuable tool and potentially save a significant amount of money on your taxes.

Whether you’re a seasoned taxpayer or just starting your financial journey, this guide will provide you with a clear understanding of the purpose of the Credit Limit Worksheet, its components, and how to navigate through it with ease. So, let’s dive in and unravel the mystery of the Credit Limit Worksheet for Form 8863!

Purpose of the Credit Limit Worksheet

The Credit Limit Worksheet is a crucial component of Form 8863, which is used to claim education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. The purpose of the Credit Limit Worksheet is to determine the maximum amount of tax credit that you can claim based on your eligible education expenses.

Education tax credits are designed to provide financial relief to individuals who are pursuing higher education or paying for qualified educational expenses. These credits can help offset the costs of tuition, fees, and other necessary expenses, making education more affordable for students and their families.

However, it’s important to note that these tax credits have certain limitations and restrictions. This is where the Credit Limit Worksheet comes into play. It calculates the allowable credit amount based on your modified adjusted gross income (MAGI) and adjusted qualified education expenses.

The purpose of the Credit Limit Worksheet is twofold:

- To determine if you are eligible for any education tax credits.

- To calculate the maximum amount of credit you can claim based on your income and expenses.

By going through this worksheet, you can ensure that you are accurately claiming the tax credits you are entitled to while staying within the limits set by the Internal Revenue Service (IRS).

It’s important to note that the Credit Limit Worksheet is specific to Form 8863 and is not used for other types of tax credits or deductions related to education. Each credit has its own set of rules and requirements, so it’s essential to carefully review the instructions provided by the IRS or consult a tax professional to determine which credits you qualify for and how to fill out the Credit Limit Worksheet correctly.

Now that we understand the purpose of the Credit Limit Worksheet, let’s delve into the details of Form 8863 and gain a better understanding of how it all fits together.

Overview of Form 8863

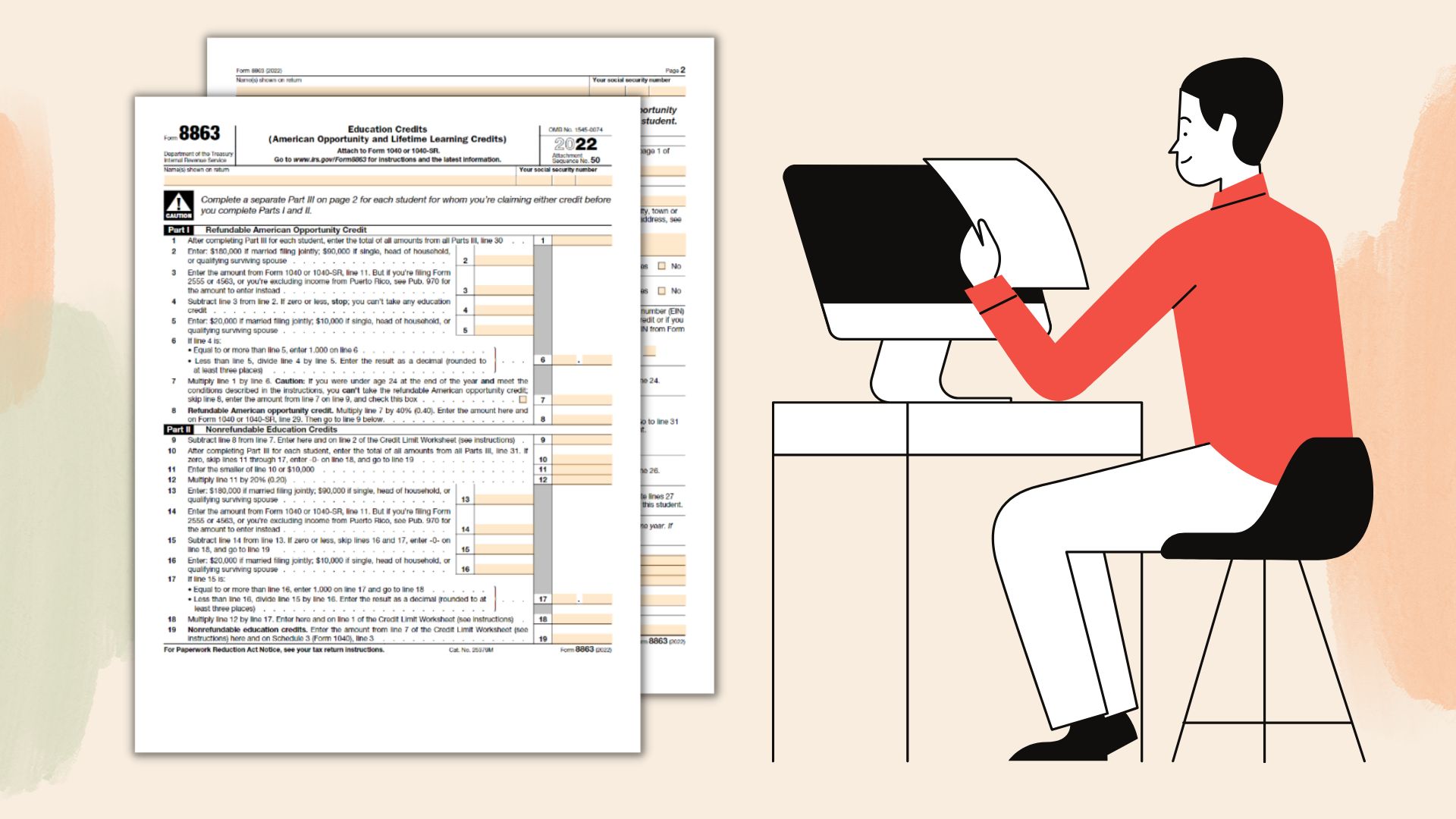

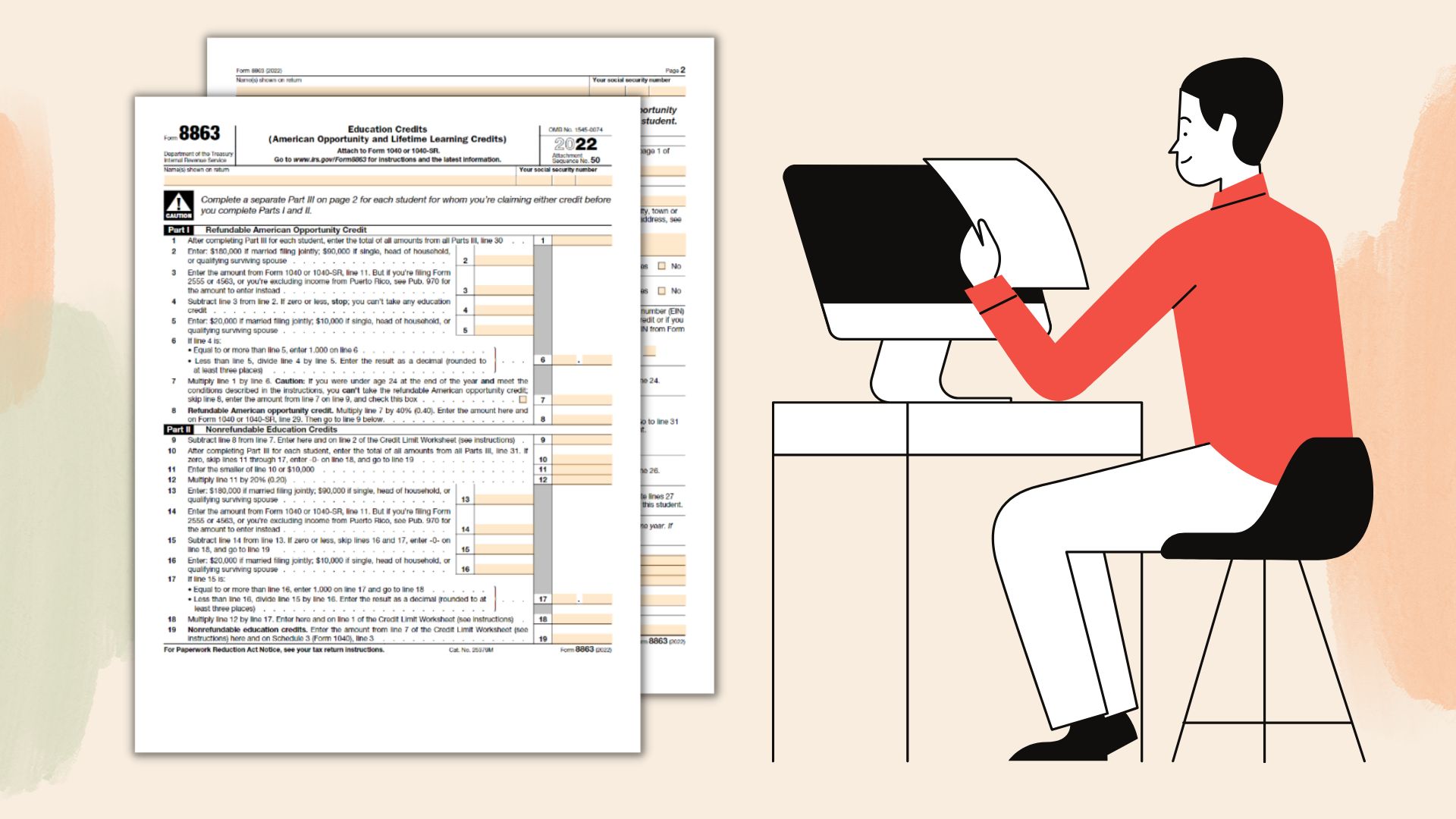

Form 8863, officially known as the “Education Credits (American Opportunity and Lifetime Learning Credits)” form, is used to claim education-related tax credits on your federal income tax return. This form is submitted along with your Form 1040 or Form 1040A.

Form 8863 consists of several sections, each designed to gather specific information about your educational expenses and eligibility for education tax credits. Here’s an overview of the main sections of Form 8863:

- Part I: Information About the Student: In this section, you provide personal details about the student, including their name, Social Security number, and the educational institution they attended during the tax year.

- Part II: Information About the Educational Institutions: Here, you provide the name, address, and taxpayer identification number (TIN) of the educational institutions attended by the student. This section is essential for verifying the eligible expenses.

- Part III: Limit on Exclusions: If you received tax-free educational assistance, scholarships, or grants, you need to provide the details in this section. These amounts may limit the education credits you can claim.

- Part IV: Figuring the Credit: This is where the Credit Limit Worksheet comes into play. Depending on your eligibility and expenses, you will complete the appropriate worksheet to calculate the education credits you can claim.

- Part V: Additional Tax Credits and Payments: If you qualify for other tax credits or have made certain payments, such as tuition and fees deductions, you need to provide the relevant information in this section.

- Part VI: Refundable Education Credits: If you are eligible for a refundable credit, such as the American Opportunity Credit, you provide the necessary details here.

- Part VII: Certification: This section requires your signature, indicating that the information provided is accurate and true to the best of your knowledge.

It is important to fill out each section accurately and completely, ensuring that all the necessary information is provided and any applicable worksheets are completed. Failing to do so could lead to delays in processing your tax return or receiving your tax credits.

Understanding the different sections and their purposes is essential for correctly filling out Form 8863. However, the Credit Limit Worksheet, found in Part IV, deserves special attention as it determines the maximum amount of education credits you can claim. In the next section, we will take a closer look at the specifics of the Credit Limit Worksheet and how to navigate through it.

Understanding the Credit Limit Worksheet

The Credit Limit Worksheet is a crucial part of Form 8863 that helps determine the maximum amount of education tax credits you can claim. This worksheet is designed to calculate the allowable credit based on your modified adjusted gross income (MAGI) and adjusted qualified education expenses.

When filling out the Credit Limit Worksheet, there are a few key terms you need to understand:

- Modified Adjusted Gross Income (MAGI): This is your adjusted gross income (AGI) with certain deductions added back. Your MAGI helps determine your eligibility for education tax credits.

- Adjusted Qualified Education Expenses (AQEE): These refer to the qualified education expenses, such as tuition, fees, and course materials, that are eligible for tax credits.

- Maximum Credit Limit: The maximum credit limit is the highest amount of education tax credits you are eligible to claim.

- Percentage Reduction: This is a reduction in the maximum credit limit based on your MAGI and filing status. The higher your income, the smaller the credit you can claim.

The Credit Limit Worksheet consists of multiple sections, each requiring specific calculations and information. Here is a general breakdown of the sections:

- Part I: Determining the Maximum Credit: This section guides you through the calculation of the maximum credit you are eligible for based on your AQEE and filing status.

- Part II: Determining the Tentative Credit: Here, you calculate the tentative credit by multiplying the appropriate percentage by your AQEE.

- Part III: Applying the Percentage Reduction: This section helps determine the final credit amount by applying the percentage reduction based on your MAGI.

- Part IV: Enter Your Education Credits: In this section, you report the final credit amount determined based on the calculations in the previous sections.

It’s important to carefully follow the instructions provided on the Credit Limit Worksheet to ensure accuracy when completing each section. Keep in mind that the calculations may vary depending on your filing status, income level, and specific circumstances.

Understanding the components of the Credit Limit Worksheet is vital for accurately determining the education tax credits you can claim. In the next section, we will provide step-by-step instructions on how to complete the Credit Limit Worksheet to streamline the process and maximize your tax savings.

Step-by-Step Instructions for Completing the Credit Limit Worksheet

Filling out the Credit Limit Worksheet doesn’t have to be a daunting task. By carefully following these step-by-step instructions, you can navigate through the worksheet with ease:

- Review the instructions: Begin by carefully reading the instructions provided on the Credit Limit Worksheet. Make sure you understand the terms, calculations, and requirements outlined in the worksheet.

- Gather your necessary documents: Collect all the relevant documents, including your Form 8863, Form 1098-T (Tuition Statement) from your educational institution(s), and any other records of qualified education expenses you incurred during the tax year.

- Start with Part I: Begin by entering the required personal information about the student, such as their name, Social Security number, and the educational institution they attended.

- Proceed to Part II: In this section, provide the necessary information about the educational institutions attended by the student, including their names, addresses, and taxpayer identification numbers (TINs).

- Move on to Part III: If you received any tax-free educational assistance, scholarships, or grants, disclose the amounts in this section as they may affect the education credits you can claim.

- Calculate the maximum credit: In Part I of the Credit Limit Worksheet, follow the instructions to calculate the maximum credit you are eligible for based on your adjusted qualified education expenses (AQEE) and filing status.

- Determine the tentative credit: Use Part II of the worksheet to calculate the tentative credit by multiplying the appropriate percentage by your AQEE.

- Apply the percentage reduction: Move on to Part III and apply the percentage reduction based on your modified adjusted gross income (MAGI) to determine the final credit amount.

- Report your education credits: In Part IV, enter the final credit amount determined in the previous sections. This is the education credit you can claim on your tax return.

- Double-check for accuracy: Before submitting your tax return, review the completed Credit Limit Worksheet to ensure that all calculations and information are accurate. Mistakes or omissions could lead to delays in processing your return or incorrect tax credits.

While these step-by-step instructions provide a general guideline for completing the Credit Limit Worksheet, it’s important to remember that each taxpayer’s situation may differ. Consulting the instructions provided by the IRS or seeking professional assistance is recommended to ensure compliance and accuracy when completing the worksheet.

Now that you have a clear understanding of the step-by-step process for completing the Credit Limit Worksheet, let’s explore some important points to consider to avoid common mistakes and optimize your use of the worksheet.

Important Points to Consider when Filling out the Worksheet

Completing the Credit Limit Worksheet accurately is crucial to ensure that you claim the correct education tax credits and maximize your tax savings. Here are some important points to consider when filling out the worksheet:

- Understand the eligibility requirements: Before filling out the Credit Limit Worksheet, make sure you meet the eligibility criteria for the education tax credits. Each credit has specific requirements regarding enrollment status, educational expenses, and income limits. Review the IRS guidelines or consult a tax professional to ensure you qualify for the credits.

- Keep meticulous records: It’s essential to maintain detailed records of your qualified education expenses, such as tuition bills, receipts, and Form 1098-T from your educational institution(s). These documents will help you accurately fill out the worksheet and provide substantiation if audited.

- Include only qualified expenses: When calculating the Adjusted Qualified Education Expenses (AQEE), ensure that you only include expenses that meet the IRS’s definition of qualified education expenses. This typically includes tuition, fees, and required course materials. Expenses like room and board, transportation, and personal living expenses are generally not considered qualified expenses.

- Double-check calculations: Accuracy is critical when calculating the maximum credit, tentative credit, and applying the percentage reduction. Take your time and double-check all calculations to avoid errors that could result in incorrect credit amounts.

- Verify MAGI and filing status: The percentage reduction applied in the Credit Limit Worksheet is based on your modified adjusted gross income (MAGI) and filing status. Ensure that you accurately report your MAGI and select the correct filing status to determine the correct reduction percentage.

- Use the correct version of the worksheet: The Credit Limit Worksheet may be updated annually by the IRS. Always use the most recent version of the worksheet available on the IRS website to ensure compliance with current tax regulations.

- Consult a tax professional if unsure: If you are uncertain about any aspect of completing the Credit Limit Worksheet or have complex tax situations, it’s advisable to seek assistance from a qualified tax professional. They can provide expert guidance, answer your questions, and help you optimize your education tax credits.

By keeping these important points in mind, you can confidently complete the Credit Limit Worksheet and ensure accurate reporting of your education tax credits. Avoiding common mistakes will help streamline the tax filing process and maximize your potential tax savings.

Now that we’ve covered the important points to consider when filling out the worksheet, let’s explore some common mistakes to avoid to ensure a smooth experience with the Credit Limit Worksheet.

Common Mistakes to Avoid while Using the Credit Limit Worksheet

When completing the Credit Limit Worksheet for Form 8863, it’s important to be aware of common mistakes that can lead to errors, delays, or even missed opportunities for education tax credits. By avoiding these mistakes, you can ensure a smooth and accurate experience. Here are some common mistakes to watch out for:

- Incorrectly reporting qualified education expenses: One of the most common errors is including expenses that are not considered qualified education expenses, such as room and board or personal expenses. Make sure to exclude these non-qualifying expenses when calculating your adjusted qualified education expenses (AQEE).

- Failure to accurately calculate the maximum credit: Failing to properly calculate the maximum credit based on filing status and AQEE can result in claiming an incorrect credit amount. Take the time to carefully follow the instructions and double-check your calculations.

- Using the wrong filing status or income information: Incorrectly entering your filing status or modified adjusted gross income (MAGI) can lead to errors in determining the percentage reduction and final credit amount. Verify the accuracy of these details to ensure you apply the correct reduction.

- Misunderstanding eligibility requirements: Each education tax credit has specific eligibility requirements, such as enrollment status and income limits. Failing to meet these requirements can result in ineligible credit claims. Review the IRS guidelines or consult a tax professional to ensure you qualify for the credits.

- Not keeping accurate records: Proper record-keeping is essential when claiming education tax credits. Failing to maintain accurate and organized records of your qualified education expenses, including tuition statements and receipts, can make it difficult to substantiate your claims if audited.

- Using outdated versions of the worksheet: The Credit Limit Worksheet may be updated annually by the IRS. Using an outdated version can lead to inaccurate calculations or discrepancies. Always use the most recent version available on the IRS website or consult the instructions provided with the current tax year’s Form 8863.

- Rushing through the worksheet: The Credit Limit Worksheet requires careful attention to detail. Rushing through it can lead to mathematical errors or overlooking important information. Take your time, follow the instructions, and double-check your work before submitting your tax return.

Avoiding these common mistakes will help ensure the accuracy of your credit claims and reduce the likelihood of issues with your tax return. When in doubt, it’s always best to consult the instructions provided with the worksheet, seek guidance from a tax professional, or contact the IRS for clarification.

Now that we have covered common mistakes to avoid, let’s address some frequently asked questions about the Credit Limit Worksheet to further enhance your understanding.

Frequently Asked Questions about the Credit Limit Worksheet

As you navigate through the Credit Limit Worksheet for Form 8863, you may come across questions or uncertainties. Here are answers to some frequently asked questions to help clarify any confusion:

- Q: How do I determine my modified adjusted gross income (MAGI)?

A: Your MAGI is calculated by taking your adjusted gross income (AGI) and making certain additions or subtractions, as specified by the IRS. Consult the IRS guidelines or work with a tax professional to accurately determine your MAGI. - Q: Can I claim both the American Opportunity Credit and the Lifetime Learning Credit in the same tax year?

A: No, you cannot claim both credits for the same student in the same tax year. You must choose either the American Opportunity Credit or the Lifetime Learning Credit based on your eligibility and circumstances. - Q: How do I know if my educational institution is eligible for the education tax credits?

A: Eligible educational institutions generally include accredited colleges, universities, vocational schools, and other post-secondary institutions. To confirm eligibility, check if your institution is approved by the U.S. Department of Education or search for it in the IRS’s list of eligible institutions. - Q: Can I claim education tax credits for expenses paid with scholarships or grants?

A: Generally, you cannot claim tax credits for expenses paid with tax-free scholarships or grants. However, you may be able to claim a credit for the portion of expenses that were not covered by scholarships or grants. - Q: What if I made a mistake on the Credit Limit Worksheet?

A: If you discover an error on the Credit Limit Worksheet after filing your tax return, you may need to amend your return using Form 1040X. Consult the IRS guidance or seek assistance from a tax professional to correct any mistakes. - Q: Can I carry forward unused education tax credits to future tax years?

A: No, education tax credits are nonrefundable but can be used to offset your tax liability for the current tax year. Any unused credits cannot be carried forward or refunded.

These are just a few commonly asked questions about the Credit Limit Worksheet. It’s important to further research and familiarize yourself with IRS guidelines and instructions for a comprehensive understanding of the education tax credits and how to properly complete the worksheet.

Now that we have addressed some frequently asked questions, let’s wrap up and summarize the key takeaways from this guide.

Conclusion

Navigating the Credit Limit Worksheet for Form 8863 can seem overwhelming at first, but with the right knowledge and attention to detail, you can successfully claim education tax credits and maximize your savings. Understanding the purpose of the worksheet, the components of Form 8863, and following the step-by-step instructions are key to accurately completing the worksheet.

Remember to consider important points such as eligibility requirements, accurate reporting of qualified education expenses, and keeping meticulous records. By avoiding common mistakes and staying up-to-date with the most recent version of the worksheet, you can ensure the accuracy and validity of your education tax credit claims.

When in doubt, don’t hesitate to consult the IRS guidelines or seek assistance from a qualified tax professional. They can provide valuable insights and help you navigate any uncertainties related to the Credit Limit Worksheet.

By taking the time to understand and complete the Credit Limit Worksheet correctly, you can make the most of the education tax credits available to you, potentially saving a significant amount of money on your taxes.

Remember that tax laws and regulations may change, so it’s important to stay informed and up-to-date with any revisions or updates that may affect your eligibility for education tax credits.

With this comprehensive guide, you now have the knowledge and tools to confidently tackle the Credit Limit Worksheet for Form 8863. By following the instructions, avoiding common mistakes, and seeking assistance whenever necessary, you can optimize your use of the worksheet and reap the benefits of education tax credits.

Happy tax filing and best of luck in your financial journey!