Home>Finance>What Is The Main Disadvantage Of Having Whole Life Insurance?

Finance

What Is The Main Disadvantage Of Having Whole Life Insurance?

Published: October 15, 2023

Discover the main drawback of whole life insurance in the realm of finance. Find out why it may not be the most advantageous option for your financial needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

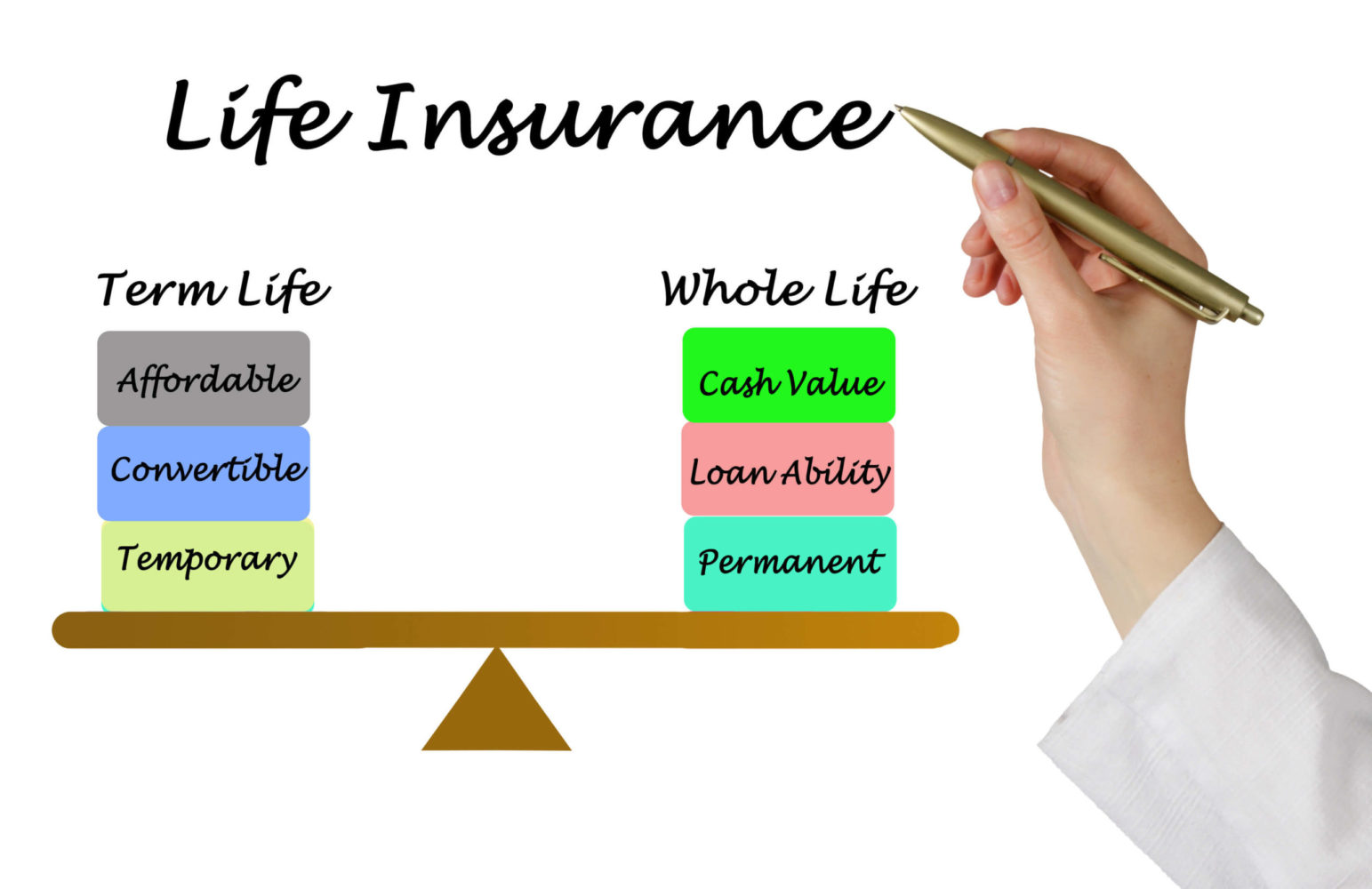

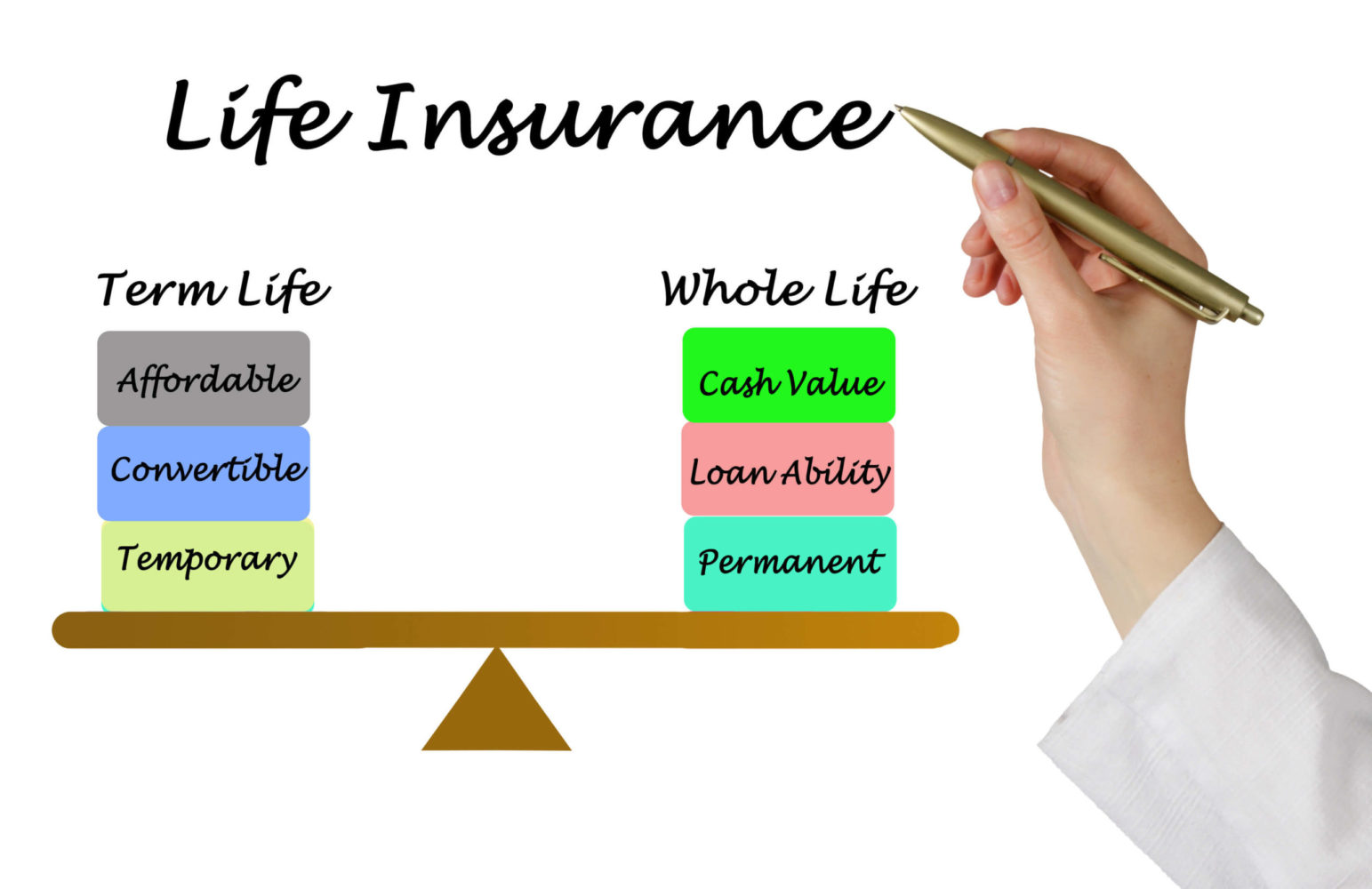

Whole life insurance is a type of permanent life insurance that offers both a death benefit and a cash value accumulation component. While it provides lifelong coverage, there are certain disadvantages to consider. As with any financial product, it’s important to carefully evaluate the pros and cons before making a decision. This article will focus on the main disadvantage of having whole life insurance.

Whole life insurance is often considered as a long-term investment and protection tool. It guarantees a death benefit to the policyholder’s beneficiaries upon their passing and accumulates cash value over time. However, the main disadvantage of having whole life insurance is the lack of flexibility it presents.

Unlike term life insurance, which offers coverage for a specified period of time, whole life insurance is designed to last a lifetime. This means you are committed to paying premiums as long as you hold the policy. This lack of flexibility can be a disadvantage if your financial situation changes or if you find yourself unable to afford the premiums in the future.

Furthermore, whole life insurance comes with higher premiums compared to term life insurance. The premiums for whole life insurance are calculated to cover both the cost of insurance and the cash value accumulation within the policy. This can result in significantly higher premiums, making it less affordable for some individuals or families.

Another disadvantage of whole life insurance is the limited investment options it offers. Unlike other investment vehicles, such as mutual funds or individual stocks, the cash value component of a whole life insurance policy is usually invested in a conservative manner. This can restrict your ability to achieve higher returns on your investment and may not align with your risk appetite or investment goals.

Moreover, the cash value growth in a whole life insurance policy may not meet your expectations. While the cash value generally grows over time, the rate of growth may be lower than other investment options or even fail to keep pace with inflation. This can lead to a diminished return on investment and may not provide the level of financial security you initially expected.

Lack of Flexibility

One of the main disadvantages of having whole life insurance is the lack of flexibility it offers. Unlike term life insurance, which allows you to adjust the length of coverage based on your specific needs, whole life insurance is designed to last for your entire lifetime. This means that once you commit to a whole life insurance policy, you are obligated to pay the premiums for the duration of the policy.

This lack of flexibility can be problematic if your financial situation changes. For example, if you experience a significant decrease in income or unexpected financial expenses, you may find it challenging to keep up with the high premiums associated with whole life insurance. This could force you to either reduce the coverage amount or terminate the policy altogether, resulting in a loss of the investment and potential financial protection.

In addition, whole life insurance may not provide the flexibility to meet changing financial goals. As your financial priorities evolve over time, you may find that you need to allocate your funds differently. However, with whole life insurance, your premium payments are fixed, and you have limited options to modify the policy to align with new financial objectives.

Another aspect of flexibility that can be lacking in whole life insurance is the inability to surrender the policy for cash value. While whole life insurance policies do accumulate cash value over time, accessing this cash value can be challenging and may come with penalties or restrictions. If you find yourself in need of immediate funds, you may be limited in your options to tap into the cash value of your policy.

Overall, the lack of flexibility in whole life insurance can be a significant disadvantage. It limits your ability to adjust the coverage or premiums to align with changing financial circumstances and goals. Before committing to a whole life insurance policy, it’s crucial to carefully consider your long-term financial needs and determine if the lack of flexibility associated with this type of insurance is a risk you are willing to take.

Higher Premiums

When it comes to whole life insurance, one of the main disadvantages that individuals need to consider is the higher premiums associated with this type of policy. Whole life insurance is generally more expensive than term life insurance due to its permanent nature and the cash value component it offers.

Unlike term life insurance, which provides coverage for a specific period of time, whole life insurance is designed to provide lifelong protection. This means that the insurance company is taking on a greater risk by guaranteeing a death benefit regardless of when the policyholder passes away. To account for this increased risk, the premiums for whole life insurance are typically significantly higher.

Higher premiums can make whole life insurance less affordable, especially for individuals or families on a tight budget. The premium payments can be a substantial financial commitment, particularly if you have other financial obligations such as mortgage payments, school fees, or saving for retirement. The higher costs associated with whole life insurance may make it difficult to allocate funds towards other important financial goals.

Furthermore, the high premiums for whole life insurance can make it challenging for younger individuals to obtain adequate coverage. Since the premiums are based on the age and health of the insured at the time the policy is purchased, obtaining whole life insurance at a younger age may require significantly higher premium payments. This can be a deterrent for young individuals who are looking to secure long-term financial protection but may be unable or unwilling to allocate the necessary funds for such high premiums.

It’s worth noting that the premiums for whole life insurance are usually fixed throughout the duration of the policy. While this can provide stability and predictability in terms of budgeting, it also means that you will be locked into paying the same high premiums for the entirety of your policy. As your financial situation evolves, you may find it challenging to afford the premiums, which can lead to lapses in coverage or the need to reduce the coverage amount.

Considering the higher premiums associated with whole life insurance is essential when evaluating whether it aligns with your financial goals and budget. It’s crucial to carefully assess your financial situation and determine if the cost of premiums is justified by the lifelong coverage and cash value accumulation benefits that whole life insurance offers.

Limited Investment Options

One of the key disadvantages of whole life insurance is the limited investment options it offers. Unlike other forms of investment, such as mutual funds or individual stocks, the cash value component of a whole life insurance policy is typically invested in a conservative manner.

Insurance companies typically invest the cash value of whole life insurance policies in low-risk assets such as government bonds, corporate bonds, or other fixed-income instruments. While these investments provide stability and may offer a guaranteed return, they generally offer lower potential for growth compared to riskier investment options with higher returns.

This limited investment scope can be a disadvantage for individuals seeking higher returns on their investments. If you have a higher risk tolerance or are well-versed in investment strategies, the conservative nature of whole life insurance investments may not align with your financial goals or provide the level of growth you desire.

Furthermore, the limited investment options in whole life insurance can restrict your ability to diversify your portfolio. Diversification is a common investment technique that helps reduce risk by spreading investments across different asset classes. With whole life insurance, you are essentially putting a significant portion of your investment in one basket, which can limit your ability to mitigate risks associated with market fluctuations or changes in economic conditions.

It is important to note that the primary purpose of whole life insurance is to provide lifelong protection rather than serve as a primary investment vehicle. The cash value component is meant to accumulate over time and can be utilized for various purposes, such as supplementing retirement income or covering unexpected expenses. However, if your primary goal is to achieve substantial investment growth, alternative investment options outside of whole life insurance may be more suitable.

Before opting for whole life insurance, it is crucial to evaluate your investment objectives and risk tolerance. If you are looking for more diverse investment options with the potential for higher returns, it might be worth exploring other investment avenues outside of a whole life insurance policy.

Cash Value May Not Meet Expectations

While whole life insurance policies offer a cash value component that can grow over time, it’s important to recognize that the cash value may not meet your initial expectations. The growth of the cash value in a whole life insurance policy is influenced by various factors, including the policy’s expenses, fees, and the performance of the underlying investments.

One of the potential reasons that the cash value may not meet expectations is the conservative investment approach taken by insurance companies. The cash value of whole life insurance policies is typically invested in low-risk assets, such as bonds, to provide stability and security. As a result, the potential for substantial growth may be limited compared to other investment options with higher risk and potential returns.

In addition, the insurance company may deduct fees and expenses from the cash value, which can impact its overall growth. These fees can include administrative expenses, mortality charges, and charges associated with the guaranteed death benefit. It’s important to carefully review the policy documents and understand the fees associated with the policy to gauge the potential impact on the cash value growth.

Another factor that can affect the growth of the cash value is the policyholder’s premium payments. The premium payments made towards a whole life insurance policy primarily cover the cost of insurance, with a portion allocated towards the cash value. If you fail to consistently make premium payments, or if you elect to pay lower premiums, the accumulation of cash value may be slower and may not meet your initial expectations.

Furthermore, the growth of the cash value may be affected by changes in interest rates. Whole life insurance policies often have a guaranteed minimum rate of return, which provides a level of security. However, if interest rates rise significantly in the market, the return on the cash value portion of the policy may not keep pace, resulting in lower overall growth.

It is essential to approach whole life insurance with realistic expectations regarding the growth of the cash value component. While it can provide a degree of financial security and potential for growth, the conservative nature of investments, associated fees, and other factors can limit the cash value’s growth potential. Understanding and managing your expectations regarding the cash value will allow you to make informed decisions about your financial future.

Possible Loss of Coverage

One of the potential disadvantages of whole life insurance is the risk of a possible loss of coverage. Unlike term life insurance, which provides coverage for a specific period of time, whole life insurance is designed to last for your entire lifetime. However, there are circumstances where you may risk losing your coverage.

If you fail to pay your premiums on time, your whole life insurance policy could lapse, resulting in a loss of coverage. Whole life insurance premiums are typically higher than those of term life insurance, and consistently meeting these premium payments can be a financial strain for some individuals or families. If you miss premium payments or are unable to keep up with the costs, your policy may become inactive, and you will no longer have the protection that the policy provides.

Moreover, if you have taken out a loan against the cash value of your whole life insurance policy and fail to repay it, the outstanding loan balance could lead to a loss of coverage. Unpaid loans against the cash value can erode the policy’s value and potentially result in the insurance company canceling the policy altogether.

Another circumstance where you may risk losing coverage is if you decide to surrender the policy for its cash value. While whole life insurance policies have a cash surrender value that allows you to receive a portion of the accumulated cash value, surrendering the policy means that you will no longer have any life insurance coverage. This may not be a concern if you have alternative life insurance coverage in place, but surrendering the policy without having a backup plan for life insurance could leave you vulnerable and unprotected.

Furthermore, if you have significant changes in your health or engage in high-risk activities that were not disclosed at the time of policy issuance, you may be at risk of losing coverage. Insurance companies typically underwrite policies based on the information provided during the application process. If significant undisclosed risks or changes in health are discovered, the insurance company may choose to cancel the policy or exclude coverage for certain conditions.

To mitigate the risk of a possible loss of coverage, it’s important to carefully review the terms and conditions of your whole life insurance policy. Ensure that you have a clear understanding of the premium payment requirements, loan provisions, surrender value, and any potential exclusions or limitations. By staying informed and diligently meeting your financial obligations, you can minimize the risk of losing the coverage provided by your whole life insurance policy.

Comparatively Low Returns

When considering whole life insurance, it’s important to be aware that it typically offers comparatively low returns compared to other investment options. While whole life insurance policies do accumulate cash value over time, the growth rate may not be as substantial as what you could potentially achieve with other investment vehicles.

One of the reasons for the relatively low returns is the conservative investment strategy employed by insurance companies. The cash value component of whole life insurance policies is usually invested in low-risk assets, such as bonds or other fixed-income instruments. While these investments provide stability and security, they often generate lower returns compared to riskier investment options like stocks or mutual funds.

Another factor contributing to the comparatively low returns of whole life insurance is the fees and expenses associated with the policy. Insurance companies deduct various fees and charges from the cash value, which can impact the overall growth. These expenses include administrative fees, mortality charges, and fees related to the guaranteed death benefit. These fees, although necessary for the administration and operation of the policy, can eat into the potential returns on your investment.

Moreover, the returns on the cash value might be further reduced if you take policy loans or make withdrawals. When you borrow against the cash value of your policy or withdraw money, the insurance company may charge interest or apply penalties, which can further diminish the growth potential of your investment.

It’s important to note that whole life insurance policies are primarily designed to provide lifelong protection rather than serve as a primary investment vehicle. The cash value accumulation is a perk that can be used for various purposes, such as supplementing retirement income or covering unexpected expenses. However, if your primary goal is to generate substantial investment returns, alternative investment options may be more suitable.

Before committing to whole life insurance, it’s important to evaluate your investment objectives holistically. Consider your risk tolerance, desired investment growth, and the level of protection you require. By understanding the relatively lower returns associated with whole life insurance, you can make an informed decision about whether it aligns with your long-term financial goals.

Long-Term Commitment

One of the key disadvantages of whole life insurance is the long-term commitment it requires. Unlike term life insurance, which provides coverage for a specific period of time, whole life insurance is designed to last for the entire duration of your life. This means that once you enter into a whole life insurance policy, you are committed to paying the premiums for the long term.

This long-term commitment can be a disadvantage if your financial circumstances change or if you find it difficult to afford the premium payments in the future. Whole life insurance premiums are generally higher compared to term life insurance because they encompass both the cost of insurance and the cash value accumulation within the policy. Thus, if your financial situation becomes strained, it may be challenging to keep up with the high premium payments associated with whole life insurance.

In addition, the long-term commitment of whole life insurance can be a limiting factor when it comes to adapting to your changing financial needs. Over time, your financial goals and priorities may evolve, requiring adjustments in your insurance coverage. However, with whole life insurance, you have limited options to modify the policy to align with new financial objectives. This lack of flexibility may leave you feeling locked into a policy that no longer meets your current needs.

Furthermore, the long-term commitment of whole life insurance can impact your ability to switch to alternative insurance or investment options. If you discover better insurance or investment products that offer more competitive rates or meet your requirements more effectively, you may find yourself restricted by the commitment you have made to your whole life insurance policy. Terminating the policy prematurely may result in financial penalties or a loss of the cash value built up within the policy.

It’s crucial to carefully evaluate your long-term financial goals and determine if the long-term commitment of whole life insurance aligns with your plans. Consider the financial stability of your income and the potential impact of future financial obligations before committing to a whole life insurance policy. It’s also prudent to regularly review your insurance needs and make adjustments as necessary to ensure that your coverage remains suitable for your changing circumstances.

Conclusion

Whole life insurance can provide lifelong coverage and a cash value accumulation component, making it an attractive option for individuals seeking long-term financial security. However, it’s important to carefully consider the disadvantages of whole life insurance before making a decision.

The lack of flexibility is a significant drawback of whole life insurance. The commitment to pay premiums for the duration of the policy can be challenging if your financial situation changes or if you find it difficult to afford the higher premiums. Additionally, the limited investment options and comparatively low returns may not align with your investment objectives or offer the growth potential you seek.

There is also a possibility of the cash value not meeting your expectations. The conservative investment approach and associated fees can impact the growth of the cash value, potentially leaving you with lower returns than anticipated. Moreover, the risk of losing coverage due to missed premium payments or other circumstances can leave you exposed and unprotected.

Lastly, the long-term commitment of whole life insurance may not be suitable for everyone. Your financial goals and priorities can change over time, and the lack of flexibility in modifying the policy to meet new needs can be limiting. Furthermore, the long-term commitment can hinder your ability to explore alternative insurance or investment options that may better align with your evolving financial circumstances.

In conclusion, whole life insurance can be a valuable tool for long-term financial protection and wealth accumulation. However, it’s crucial to carefully weigh the disadvantages mentioned above against the benefits before making a decision. Consider your financial goals, risk tolerance, and long-term financial plans. Consulting with a qualified financial advisor can also help you navigate the complexities of whole life insurance and determine if it is the right fit for your individual needs.