Home>Finance>When Is It Too Late To Buy Whole Life Insurance?

Finance

When Is It Too Late To Buy Whole Life Insurance?

Published: October 15, 2023

Discover when it's too late to secure whole life insurance and make informed financial decisions to protect your future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to financial planning, having a robust insurance strategy is crucial. Life insurance can provide a safety net for your loved ones in the event of your untimely demise. Among the various types of life insurance available, whole life insurance offers a unique blend of protection, savings, and lifelong coverage. However, choosing the right time to invest in whole life insurance can be a critical decision.

In this article, we’ll explore when it might be too late to buy whole life insurance and discuss important factors to consider before making this financial commitment. But first, let’s understand what whole life insurance entails.

Understanding Whole Life Insurance

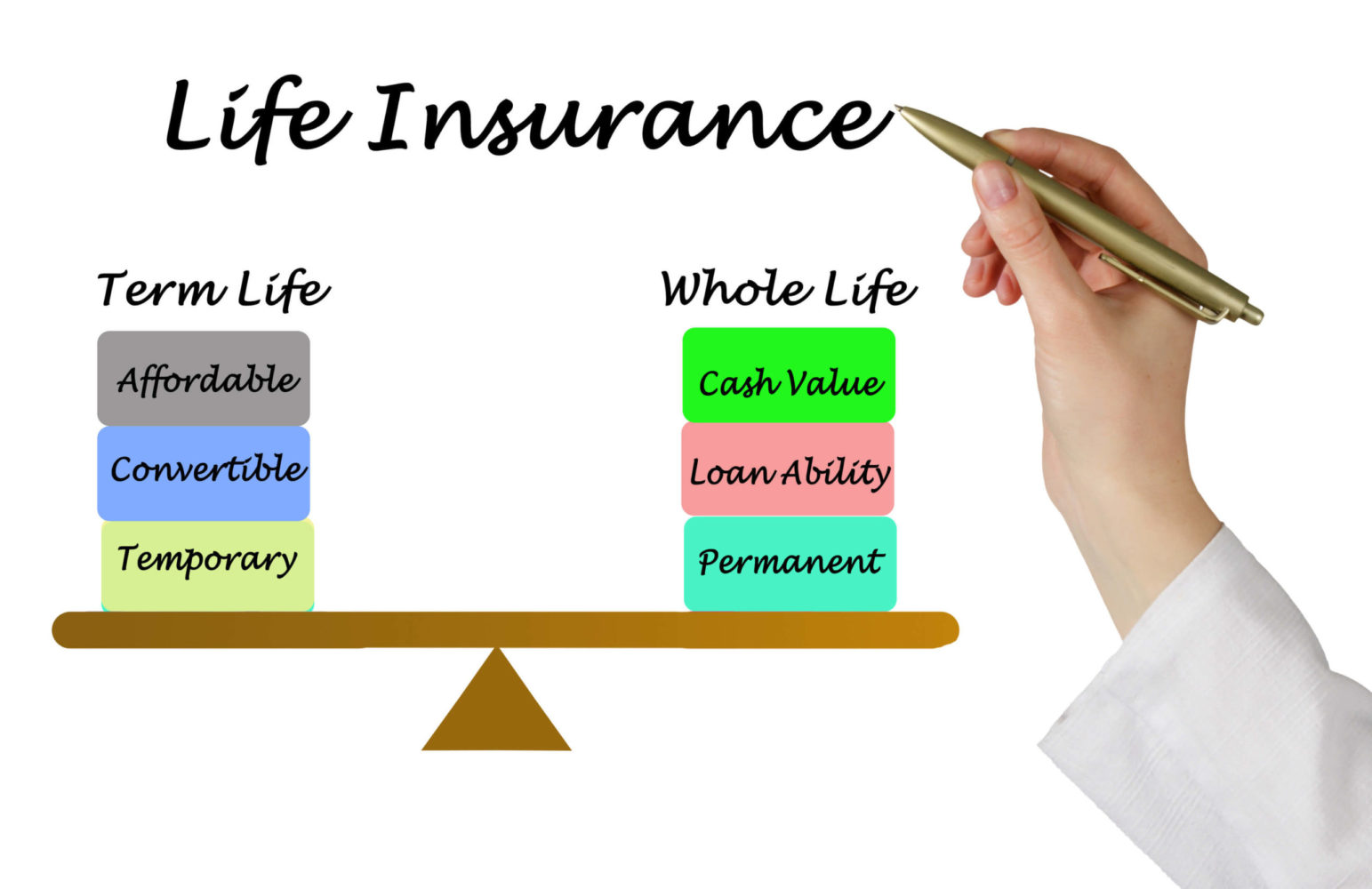

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as the policy is active. Unlike term life insurance, which provides coverage for a specific period (e.g., 10, 20, or 30 years), whole life insurance offers lifelong protection.

One of the key features of whole life insurance is the cash value component. A portion of your premium payments is set aside and grows tax-deferred over time. This cash value can be accessed through policy loans or withdrawals and can serve as a source of emergency funds or even a supplement to your retirement income.

Benefits of Whole Life Insurance

Whole life insurance offers several benefits that make it an attractive option for those looking for long-term financial security:

- Permanent coverage: Whole life insurance guarantees coverage for your entire lifetime, ensuring that your loved ones are protected no matter when you pass away.

- Fixed premiums: With whole life insurance, your premiums remain the same throughout the life of the policy, providing predictability and stability in your financial planning.

- Cash value accumulation: The cash value component of whole life insurance grows over time, allowing you to accumulate savings that can be accessed when needed.

- Tax advantages: The cash value growth is tax-deferred, meaning you won’t pay taxes on the gains until you withdraw them.

These benefits make whole life insurance an attractive option for individuals who want lifelong coverage and the opportunity to build cash value.

Understanding Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as the policy is active. Unlike term life insurance, which provides coverage for a specific period (e.g., 10, 20, or 30 years), whole life insurance offers lifelong protection.

When you purchase a whole life insurance policy, a portion of your premium payments goes towards the cost of insurance, while the remaining amount goes into a cash value account. This cash value component is what sets whole life insurance apart from other types of life insurance.

The cash value component of a whole life insurance policy accumulates over time. It grows on a tax-deferred basis, meaning you won’t have to pay taxes on the growth until you withdraw the funds. This cash value can be accessed through policy loans or withdrawals, providing you with financial flexibility if the need arises.

The death benefit of a whole life insurance policy is typically tax-free for your beneficiaries. This means that when you pass away, the beneficiaries named in the policy will receive the full death benefit amount without having to pay income taxes on it.

Whole life insurance policies also offer the option to participate in the company’s dividends. If the insurance company performs well and declares dividends, policyholders may have the opportunity to receive a share of those dividends. Dividends can be used to increase the policy’s cash value, pay premiums, or be taken as cash.

It’s important to note that whole life insurance policies tend to have higher premiums compared to term life insurance policies. This is because whole life insurance not only provides a death benefit but also builds cash value and offers lifelong coverage.

Whole life insurance policies come in different variations, including traditional whole life, universal life, and variable life. Each has its own unique features and may be suitable for different individuals based on their financial goals and risk tolerance.

When considering whole life insurance, it’s important to carefully evaluate your financial situation, long-term financial goals, and insurance needs. Consulting with a financial advisor or insurance professional can help you determine if whole life insurance is the right choice for you.

Benefits of Whole Life Insurance

Whole life insurance offers several benefits that make it an attractive option for individuals seeking long-term financial security:

- Permanent coverage: One of the primary advantages of whole life insurance is that it provides coverage for your entire lifetime. As long as you pay the premiums, the policy remains in force. This guarantees that your loved ones will receive a death benefit regardless of when you pass away. It provides peace of mind knowing that your family will be financially protected.

- Fixed premiums: Whole life insurance comes with fixed premiums that stay the same throughout the life of the policy. This means that you won’t have to worry about premium increases as you age or if your health condition changes. Fixed premiums provide stability and predictability in your financial planning, making it easier to budget for insurance costs in the long run.

- Cash value accumulation: One unique feature of whole life insurance is the cash value component. As you make premium payments, a portion of the money goes towards accumulating cash value. This cash value grows on a tax-deferred basis, meaning you won’t have to pay taxes on the growth until you withdraw the funds. The cash value can be accessed through policy loans or withdrawals, providing you with a source of emergency funds or even a supplement to your retirement income.

- Tax advantages: The growth of the cash value component in whole life insurance is tax-deferred. This means that you won’t have to pay taxes on the growth as long as it remains within the policy. In addition, the death benefit is typically received by the beneficiaries tax-free. This can provide significant tax advantages and ensure that your loved ones receive the full amount of the death benefit without tax deductions.

- Asset protection: In certain circumstances, whole life insurance policies offer protection from creditors. The cash value component is considered an asset, and in some states, it may be protected from seizure by creditors or bankruptcy proceedings. This can be an added layer of security for your financial well-being.

These benefits make whole life insurance an attractive option for individuals who want lifelong coverage, the opportunity to build cash value, and the added advantages of fixed premiums and potential asset protection. However, it’s essential to weigh these benefits against the higher premiums associated with whole life insurance and consider if it aligns with your financial goals and objectives.

Factors to Consider

When deciding whether to purchase whole life insurance, there are several key factors to consider. These factors can help you evaluate if whole life insurance aligns with your financial goals and if it is the right choice for your specific circumstances. Here are some important factors to take into account:

- Financial goals: Assess your long-term financial goals, such as providing financial security for your family, creating an estate plan, or leaving a legacy. Whole life insurance can be a valuable tool to achieve these goals, as it offers permanent coverage and the potential to build cash value over time.

- Insurance needs: Determine your insurance needs by evaluating your family’s financial obligations and potential future expenses. Assess the amount of coverage needed to replace your income, pay off debts, cover funeral expenses, and provide for your loved ones’ needs in your absence.

- Risk tolerance: Consider your risk tolerance when it comes to investing and financial planning. Whole life insurance policies offer a guaranteed death benefit and a conservative, low-risk cash value growth. If you prefer a more stable and predictable investment option, whole life insurance can be an attractive choice.

- Affordability: Understand that whole life insurance premiums are typically higher than those of term life insurance. Evaluate your budget and determine if you can comfortably afford the premiums for the duration of the policy.

- Financial stability: Assess your financial stability and ability to commit to long-term premium payments. Whole life insurance is a lifelong commitment, and discontinuing premium payments could lead to the policy’s lapse or reduce the cash value component.

- Add-ons and riders: Consider additional features, add-ons, or riders available with whole life insurance policies. These may include options for accelerated death benefits, long-term care benefits, or other customizable features that can enhance the policy’s value and benefits.

- Estate planning: If you have significant assets or complex estate planning needs, whole life insurance can play a vital role in your estate plan. It can provide liquidity to pay estate taxes, address inheritance equalization among beneficiaries, or fund a trust.

It is essential to carefully evaluate these factors in the context of your unique financial situation and goals. Consulting with a financial advisor or insurance professional can provide valuable insights and guidance to help you make an informed decision about whether whole life insurance is the right fit for you.

Evaluating Your Financial Situation

Before purchasing whole life insurance, it’s crucial to evaluate your financial situation and ensure that it aligns with your insurance needs and long-term goals. Here are key aspects to consider when evaluating your financial situation:

- Income and expenses: Assess your current income and expenses to determine how much you can comfortably allocate towards insurance premiums. Ensure that purchasing whole life insurance won’t strain your budget or hinder your ability to meet other financial obligations.

- Debts and liabilities: Take stock of your outstanding debts, such as mortgages, student loans, and credit card debt. Consider how your passing would impact these financial obligations and whether providing coverage to pay off these debts is a priority for you.

- Emergency fund: Evaluate the status of your emergency fund. It’s important to have a readily accessible stash of savings to cover unexpected expenses. Make sure that purchasing whole life insurance won’t drain your emergency fund or jeopardize your financial security.

- Existing insurance coverage: If you already have life insurance coverage through a term life insurance policy or employer-provided group life insurance, assess whether supplementing it with whole life insurance is necessary. Consider the terms, benefits, and exclusions of your existing coverage to determine if it adequately meets your needs.

- Investment portfolios: Evaluate your investment portfolios and assess your risk tolerance. If you have a well-diversified investment portfolio that aligns with your long-term financial goals, it may be more beneficial to focus on maximizing those investments rather than allocating a significant portion of your funds towards whole life insurance.

- Retirement savings: Consider your retirement savings and how whole life insurance fits into your retirement planning. If you already have robust retirement savings and other investment vehicles in place, purchasing whole life insurance may not be a priority. However, if you have concerns about leaving a financial legacy or need additional retirement income options, whole life insurance may be worth considering.

Evaluating your financial situation requires a comprehensive review of your income, liabilities, savings, and investment goals. It also involves considering how whole life insurance fits into your overall financial plan.

Remember that everyone’s financial situation is unique, and what may be suitable for one person may not be the right choice for another. Seeking guidance from a qualified financial advisor or insurance professional can provide valuable insights tailored to your specific needs and circumstances.

Age and Health Factors

Age and health are significant factors to consider when contemplating the purchase of whole life insurance. These factors can affect your eligibility for coverage, the cost of premiums, and the potential benefits of the policy. Here’s what to consider regarding age and health:

- Age: Generally, the younger you are when you purchase whole life insurance, the more affordable the premiums will be. This is because insurance companies assess the risk of covering individuals based on their age. Purchasing whole life insurance at a younger age allows you to lock in lower premiums and accumulate more years of cash value growth.

- Health: Your health plays a crucial role in determining the cost of premiums and your insurability. Insurance companies typically request a medical examination or ask health-related questions during the underwriting process. Pre-existing health conditions or lifestyle factors, such as smoking, can increase premiums or affect your ability to obtain coverage.

- Medical history: Insurance companies evaluate your medical history to assess the risk of providing coverage. Previous or current health issues may result in higher premiums or the need to provide additional medical records or examinations to validate your insurability.

- Family medical history: In addition to your own health, insurers may consider your family medical history. Certain genetic or familial health conditions can increase the risk associated with providing coverage, potentially affecting the cost of premiums.

- Life expectancy: Assessing your life expectancy is significant when considering whole life insurance. If you have a shorter life expectancy due to health conditions or lifestyle factors, the benefits of whole life insurance may be less compelling. However, if you have a longer life expectancy, whole life insurance can provide comprehensive coverage and the potential for significant cash value accumulation over time.

- Insurability: It’s essential to understand that as you age, your insurability may decline. Health conditions can emerge or worsen as you grow older, making it more difficult to obtain coverage or leading to higher premiums. If you have health concerns or anticipate potential health issues in the future, purchasing whole life insurance at a younger age can provide peace of mind and secure the coverage you need.

Age and health factors are crucial in determining the cost and availability of coverage. As time goes by, the potential benefits and affordability of whole life insurance may diminish. It’s important to consider these factors early on and take advantage of more favorable pricing and eligibility criteria.

Consulting with an insurance professional can help you assess the impact of age and health on your insurance needs and determine the most appropriate time to purchase whole life insurance based on your unique circumstances.

Alternatives to Whole Life Insurance

While whole life insurance offers a range of benefits, it may not be the best fit for everyone. Fortunately, there are alternative options to consider that can provide similar coverage or fulfill your financial goals. Here are some alternatives to whole life insurance:

- Term Life Insurance: Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It offers a death benefit but does not accumulate cash value. Term life insurance is often more affordable than whole life insurance and can be a suitable option for individuals with temporary financial obligations or those seeking affordable coverage for a specific period, such as until their mortgage is paid off or their children reach adulthood.

- Universal Life Insurance: Universal life insurance is a type of permanent life insurance that offers flexibility in premiums and death benefit amounts. It allows policyholders to adjust their coverage and premium payments over time. Universal life insurance also accumulates cash value but typically offers more potential growth than whole life insurance. It can be an alternative for individuals who want lifelong coverage with the ability to modify their policy as their financial situation changes.

- Variable Life Insurance: Variable life insurance combines a death benefit with investment options. Policyholders have the opportunity to allocate a portion of their premium payments to investment accounts, such as mutual funds, stocks, or bonds. The cash value accumulation in variable life insurance is dependent on the performance of these investment options. This can be an alternative for individuals seeking higher growth potential but with increased investment risk compared to traditional whole life insurance.

- Income Replacement Strategies: Instead of relying solely on life insurance, you may consider other income replacement strategies. This could include creating a comprehensive investment portfolio, maximizing contributions to retirement accounts, or building a diversified portfolio of income-producing assets. These strategies focus on growing your savings, investments, and assets to create a financial cushion for your loved ones in the event of your passing.

- Combination of Policies: Another option is to combine different types of insurance policies for a tailored coverage approach. This might involve purchasing a term life insurance policy to cover specific financial obligations and then supplementing it with a smaller whole life insurance policy to provide lifelong coverage or build cash value.

Consider your specific financial needs, risk tolerance, and long-term goals when evaluating alternatives to whole life insurance. Each alternative has its own advantages and considerations. Seeking guidance from a knowledgeable insurance professional or financial advisor can help you navigate through the options and select the most suitable alternative to meet your individual needs.

When It Might Be Too Late

While there is no definitive age that marks the point where it is “too late” to buy whole life insurance, there are certain circumstances where it may not be the most optimal choice. Here are a few scenarios where it might be considered “too late” to purchase whole life insurance:

- Advanced age: As you get older, the cost of whole life insurance premiums increases significantly. If you are in your 60s or 70s, the affordability of whole life insurance may become a concern. In such cases, other forms of life insurance, like term life insurance, may be more appropriate since they provide coverage for a specific period at a more affordable rate.

- Poor health: If you have pre-existing health conditions or a history of serious illnesses, obtaining whole life insurance can be challenging or prohibitively expensive. Insurers may view your health as high-risk, resulting in higher premiums or even denial of coverage. In such cases, alternative forms of insurance or other financial planning options may be more suitable.

- Financial constraints: If your budget is already stretched thin due to various financial obligations, it might not be feasible to allocate a significant portion of your income towards whole life insurance premiums. In these situations, focusing on building an emergency fund, paying off debts, or maximizing contributions to retirement accounts may take precedence over purchasing whole life insurance.

- Existing coverage: If you already have sufficient life insurance coverage through other policies, such as term life insurance or employer-provided group life insurance, it may not be necessary to add a whole life insurance policy on top of it. Assess your existing coverage and determine if it adequately meets your needs before considering additional policies.

However, it’s important to note that individual circumstances vary, and what might be considered “too late” for some individuals might still be a viable option for others. Every person’s financial situation and goals are unique, and it is crucial to assess your specific circumstances and consult with a financial advisor or insurance professional to determine the best course of action.

Ultimately, the decision to purchase any type of life insurance, including whole life insurance, should be based on careful consideration of your financial goals, needs, and affordability, taking into account factors such as age, health, and existing coverage.

Conclusion

Deciding when it’s the right time to buy whole life insurance requires careful consideration of various factors. Whole life insurance offers permanent coverage, cash value accumulation, and tax advantages that can provide long-term financial stability and peace of mind. However, it may not be the best fit for everyone, and there are alternative options to consider.

Evaluating your financial situation, understanding your insurance needs, and assessing your risk tolerance are essential steps in determining whether whole life insurance aligns with your goals. Factors such as age and health play a significant role in eligibility, premium costs, and potential benefits. It’s important to consider these factors early on to take advantage of more favorable pricing and insurability.

If whole life insurance isn’t the right fit for your circumstances, alternatives like term life insurance, universal life insurance, or exploring other income replacement strategies can provide viable options. Evaluating your financial goals, affordability, and existing coverage can help you make an informed decision.

Remember, every individual’s financial situation is unique, and what works for one person may not be suitable for another. Seeking guidance from a financial advisor or insurance professional can provide valuable insights and help you navigate the complex world of insurance to find the best solution for your specific needs.

Regardless of the path you choose, having some form of life insurance coverage is crucial for protecting your loved ones and providing financial security in the event of your passing. Take the time to assess your needs, explore the options available to you, and make an informed decision that aligns with your long-term financial goals.