Home>Finance>What Is The Minimum Payment On A Line Of Credit

Finance

What Is The Minimum Payment On A Line Of Credit

Published: February 25, 2024

Learn about the minimum payment on a line of credit and how it affects your finances. Find out how to manage your line of credit payments effectively. Gain insights into financial planning and budgeting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Basics of Minimum Payments on a Line of Credit

- Exploring the Dynamics of Line of Credit

- Influential Factors in Determining Minimum Payments

- Unveiling the Methodology Behind Minimum Payment Calculation

- Understanding the Significance of Meeting Minimum Payment Obligations

- Empowering Strategies for Effective Line of Credit Management

Introduction

Understanding the Basics of Minimum Payments on a Line of Credit

When it comes to managing your finances, understanding the intricacies of credit and debt is essential. One crucial aspect of this is comprehending the concept of minimum payments on a line of credit. Whether you’re a seasoned borrower or just beginning to navigate the world of credit, knowing what the minimum payment entails is paramount to maintaining a healthy financial profile.

Minimum payments are a fundamental component of managing a line of credit, and they play a pivotal role in your overall financial well-being. In this article, we will delve into the intricacies of minimum payments on a line of credit, exploring the factors that influence them, how they are calculated, and why making these payments is crucial. Additionally, we will provide valuable tips for effectively managing your line of credit payments, empowering you to take control of your financial journey.

By the end of this comprehensive guide, you will have a clear understanding of the significance of minimum payments on a line of credit and the strategies to ensure you manage them effectively, ultimately contributing to your financial stability and peace of mind.

Understanding Line of Credit

Exploring the Dynamics of Line of Credit

Before delving into the specifics of minimum payments, it’s crucial to grasp the concept of a line of credit. A line of credit is a flexible borrowing option extended by financial institutions, allowing individuals to access funds up to a predetermined limit. Unlike a traditional loan, where the borrower receives a lump sum upfront, a line of credit provides the flexibility to withdraw funds as needed, up to the approved limit.

One of the key features of a line of credit is its revolving nature, meaning that as you repay the borrowed amount, the available credit replenishes, providing ongoing access to funds. This dynamic nature offers unparalleled flexibility, making it an attractive option for managing various financial needs, such as home renovations, unexpected expenses, or consolidating higher-interest debt.

Moreover, a line of credit typically comes with a variable interest rate, which means that the interest charged on the outstanding balance can fluctuate based on market conditions. This aspect underscores the importance of prudent financial management when utilizing a line of credit, as it can directly impact the overall cost of borrowing.

Understanding the nuances of a line of credit is essential for making informed decisions regarding its usage and repayment. By comprehending the fundamental characteristics of this financial tool, individuals can leverage it effectively while being mindful of the responsibilities associated with maintaining a healthy financial standing.

Factors Affecting Minimum Payment

Influential Factors in Determining Minimum Payments

Several key factors come into play when determining the minimum payment on a line of credit. Understanding these influences is vital for borrowers to effectively manage their financial obligations and make informed decisions regarding their credit utilization. Below are the primary factors that impact the calculation of minimum payments:

- Outstanding Balance: The amount owed on the line of credit directly influences the minimum payment. Typically, the minimum payment is calculated as a percentage of the outstanding balance, often ranging from 1% to 3% of the total amount owed. As the outstanding balance fluctuates, so does the minimum payment, making it crucial for borrowers to monitor their credit utilization.

- Interest Rate: The interest rate associated with the line of credit significantly affects the minimum payment. A higher interest rate results in increased finance charges, subsequently elevating the minimum payment required to cover the accruing interest and contribute to the principal balance.

- Terms and Conditions: The specific terms and conditions outlined in the line of credit agreement, including any applicable fees or charges, can impact the minimum payment. It is essential for borrowers to review and understand these terms to anticipate the financial obligations associated with their line of credit.

- Credit Utilization: The utilization of available credit relative to the approved limit can influence the minimum payment. Maintaining a high credit utilization ratio, wherein a significant portion of the available credit is utilized, can lead to higher minimum payments and potentially affect the borrower’s credit score.

These factors collectively contribute to the determination of the minimum payment on a line of credit. By recognizing their impact, borrowers can proactively manage their financial responsibilities and make strategic decisions to optimize their credit utilization while maintaining sound financial health.

Calculating Minimum Payment

Unveiling the Methodology Behind Minimum Payment Calculation

Understanding how the minimum payment on a line of credit is calculated is essential for borrowers to navigate their financial obligations effectively. The calculation typically involves a combination of factors, including the outstanding balance, interest rate, and any applicable fees. While specific methodologies may vary among financial institutions, the following general principles are commonly employed in determining the minimum payment:

- Percentage of Outstanding Balance: The most prevalent approach in calculating the minimum payment is based on a percentage of the outstanding balance. This percentage, typically ranging from 1% to 3%, is applied to the total amount owed, ensuring that the minimum payment adjusts in accordance with the fluctuating balance.

- Accrued Interest: The minimum payment encompasses the accrued interest on the outstanding balance. This ensures that borrowers contribute to covering the interest charges, thereby preventing the balance from perpetually accumulating interest without making progress towards repayment.

- Additional Fees and Charges: Depending on the line of credit agreement, certain fees or charges may be included in the minimum payment calculation. These could encompass annual fees, maintenance fees, or any other costs stipulated in the terms and conditions of the credit agreement.

It is important to note that while the minimum payment ensures the borrower meets the basic obligation to the lender, it is advisable to aim for payments exceeding the minimum whenever possible. Doing so can expedite the repayment process and mitigate the long-term interest costs associated with the line of credit.

By gaining insight into the methodology behind minimum payment calculation, borrowers can approach their line of credit obligations with clarity and make informed decisions regarding their repayment strategy, ultimately fostering a more secure financial future.

Importance of Making Minimum Payments

Understanding the Significance of Meeting Minimum Payment Obligations

The act of making minimum payments on a line of credit holds substantial significance in the realm of personal finance. While it may seem routine, fulfilling this obligation carries far-reaching implications that directly impact an individual’s financial well-being. Below are compelling reasons highlighting the importance of consistently meeting minimum payment requirements:

- Preservation of Credit Score: Timely minimum payments are instrumental in preserving and enhancing one’s credit score. Payment history is a critical factor in credit scoring models, and consistently meeting minimum obligations reflects positively on an individual’s creditworthiness.

- Financial Discipline: Adhering to minimum payment requirements fosters financial discipline and responsibility. It instills a habit of meeting financial commitments, which is essential for long-term financial stability and prudent money management.

- Interest Mitigation: Making minimum payments helps mitigate the accumulation of excessive interest on the outstanding balance. While it may not entirely eliminate interest charges, it prevents the balance from growing unchecked, thereby reducing the overall interest cost over time.

- Lender Compliance: By meeting the minimum payment obligations, borrowers fulfill their contractual agreement with the lender. This not only maintains a positive rapport with the financial institution but also ensures compliance with the terms and conditions of the line of credit agreement.

- Debt Repayment Progress: While minimum payments primarily cover interest and a portion of the principal balance, consistently meeting these obligations contributes to the gradual reduction of debt. It signifies a commitment to managing and reducing the outstanding balance over time.

Recognizing the importance of making minimum payments empowers individuals to approach their line of credit responsibilities with clarity and purpose. By acknowledging the broader implications of meeting these obligations, borrowers can proactively steer their financial trajectory towards stability and prosperity.

Tips for Managing Line of Credit Payments

Empowering Strategies for Effective Line of Credit Management

Effectively managing line of credit payments is pivotal in maintaining financial stability and optimizing one’s credit utilization. By implementing strategic approaches and prudent financial habits, individuals can navigate their line of credit obligations with confidence and foresight. The following tips offer actionable guidance for managing line of credit payments efficiently:

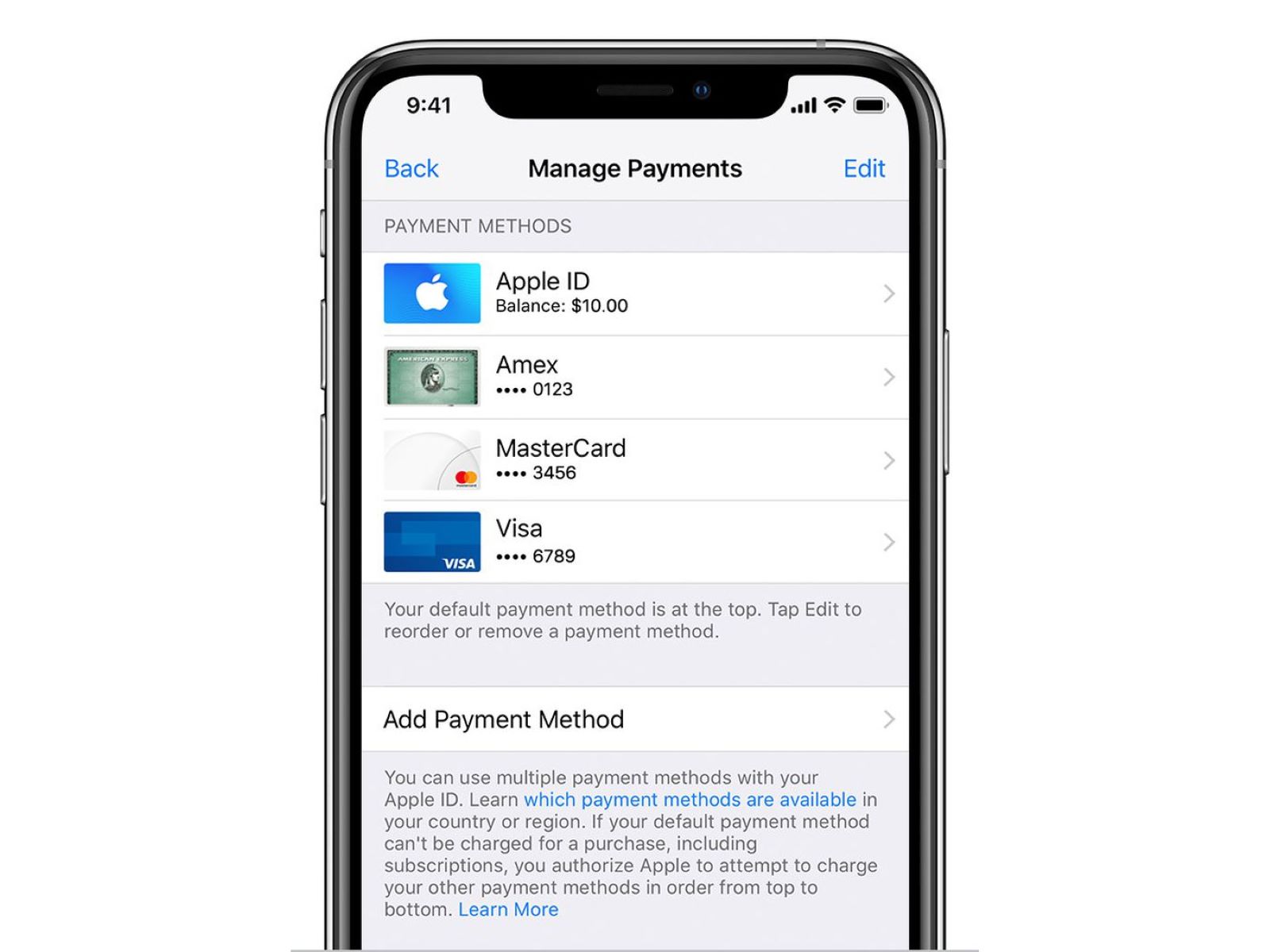

- Regular Monitoring: Routinely monitor your line of credit activity, including balances, transactions, and payment due dates. This proactive approach enables you to stay informed and responsive to any changes in your financial obligations.

- Timely Payments: Strive to make payments on time, if not ahead of schedule, to avoid late fees and maintain a positive payment history. Setting up automatic payments or reminders can help ensure punctual remittance of minimum obligations.

- Payment Beyond Minimum: Whenever feasible, aim to contribute more than the minimum payment to expedite debt reduction and minimize interest costs. Even modest additional payments can yield significant long-term savings.

- Utilize Wisely: Exercise prudence in utilizing your line of credit, borrowing only what is necessary and within your means to repay. Responsible utilization mitigates the risk of excessive debt accumulation and facilitates manageable repayment.

- Review Terms and Conditions: Familiarize yourself with the specific terms and conditions of your line of credit, including interest rates, fees, and repayment requirements. Understanding these details empowers informed decision-making and proactive financial management.

- Limit Credit Utilization: Aim to maintain a conservative credit utilization ratio by refraining from maxing out your available credit. Responsible utilization can positively impact your credit score and minimize the financial burden of high minimum payments.

- Seek Guidance if Needed: If you encounter challenges in managing your line of credit payments or require clarity on financial matters, don’t hesitate to seek guidance from financial advisors or credit counseling services. Professional insights can offer valuable perspectives and solutions.

By integrating these actionable tips into their financial approach, individuals can proactively manage their line of credit payments, mitigate financial stress, and cultivate a sound financial foundation for the future.