Finance

What Is The Tax Rate On Dividends For 2016

Published: January 3, 2024

Learn about the tax rate on dividends for 2016 in the finance industry. Stay informed and make the most of your investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing, one of the most attractive features for many investors is the potential to receive dividends. Dividends are payments made by corporations to their shareholders as a reward for owning their stock. Not only do dividends provide a stream of income, but they can also be a valuable component of a well-diversified investment portfolio.

However, it’s important for investors to understand that receiving dividends may come with tax implications. The tax rate on dividends for 2016 can vary depending on various factors, such as the type of dividend and the investor’s tax bracket.

In this article, we will explore the tax rate on dividends for 2016 and provide a comprehensive overview of the different types of dividends and how they are taxed. We will also discuss the impact of other factors, such as the investor’s tax bracket and the holding period, on dividend taxation. Lastly, we will provide some strategies that investors can use to minimize their dividend taxes.

By understanding the tax implications of dividends, investors can make informed decisions and maximize their after-tax returns.

Understanding Dividends

Before delving into the tax rate on dividends for 2016, it’s crucial to have a solid understanding of what dividends are. Dividends are cash payments or additional shares of stock that a company distributes to its shareholders as a way to share its profits.

Dividends are typically paid out on a regular schedule, such as quarterly or annually, and are declared by the company’s board of directors. Companies that consistently generate profits and have a strong financial position are more likely to pay dividends.

Investors can receive dividends from various types of investments, including stocks, mutual funds, and exchange-traded funds (ETFs). Dividends can be a significant source of income for investors, particularly those who rely on their investments for retirement or other financial goals.

It’s important to note that not all companies pay dividends. Some companies, especially smaller ones or those in growth industries, may reinvest their profits back into the business to fund expansion or research and development.

Investors should also be aware that dividend payments are not guaranteed. Companies can decide to reduce or eliminate their dividends based on various factors, such as financial performance or economic conditions.

Overall, dividends play a crucial role in generating income from investment portfolios. Understanding how dividends work is the first step in comprehending how they are taxed.

Different Types of Dividends

When it comes to dividends, it’s important to differentiate between the different types that exist. The tax treatment of dividends depends on the classification of the dividend. Here are the main types:

- Cash Dividends: Cash dividends are the most common type of dividend. As the name suggests, these dividends are paid out in cash to shareholders. Investors can either choose to receive the cash or reinvest it back into the company by purchasing more shares.

- Stock Dividends: Rather than paying out cash, some companies choose to distribute additional shares of their stock as dividends. For example, an investor who owns 100 shares of a company might receive 5 additional shares as a stock dividend. These additional shares increase the investor’s ownership stake in the company, but the total value of their investment remains the same.

- Property Dividends: In some cases, companies may distribute assets or property to shareholders as dividends. For example, a real estate investment trust (REIT) might distribute rental properties to its shareholders as a property dividend. The value of the distributed property is usually based on its fair market value.

- Special Dividends: Special dividends are one-time payments that are not part of the company’s regular dividend policy. These dividends are usually declared when a company has excess cash or profits that they want to distribute to shareholders. Special dividends can be in the form of cash, stock, or property.

It’s important for investors to understand the type of dividend they receive, as the tax treatment can vary depending on the classification. The tax rate on dividends for 2016 is contingent upon the classification of the dividend and the investor’s individual circumstances, which we will discuss in later sections.

Overview of the Tax Rate on Dividends for 2016

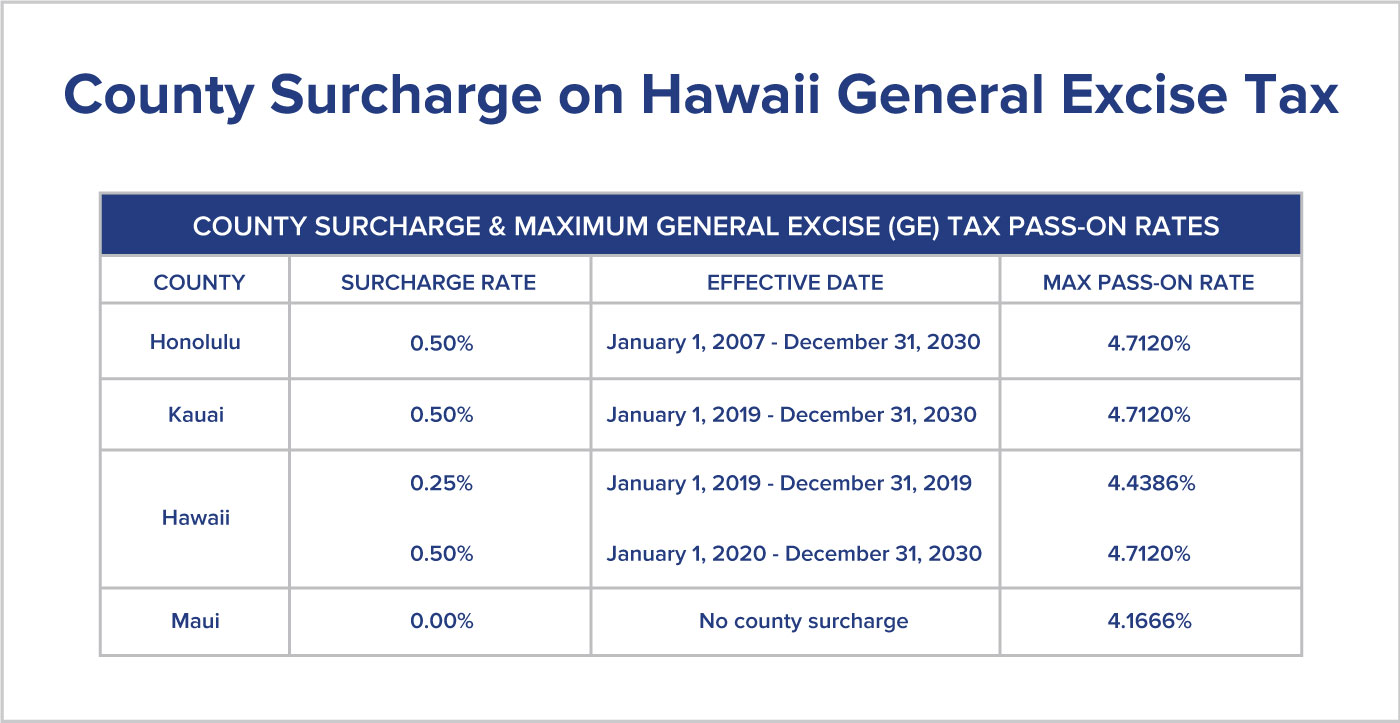

The tax rate on dividends for 2016 is determined by several factors, including the investor’s taxable income, filing status, and the classification of the dividend. The tax rates on dividends can differ between qualified dividends and non-qualified dividends.

For most taxpayers, qualified dividends are taxed at a lower rate than ordinary income. In 2016, the tax rates on qualified dividends for individuals are as follows:

- 0%: For individuals in the 10% and 15% income tax brackets.

- 15%: For individuals in the 25%, 28%, 33%, and 35% income tax brackets.

- 20%: For individuals in the highest income tax bracket of 39.6%.

It’s worth noting that these tax rates are subject to change, and it’s essential for taxpayers to consult the current tax laws or seek advice from a tax professional.

On the other hand, non-qualified dividends are taxed at the individual’s ordinary income tax rate. These dividends do not meet the eligibility criteria for the lower tax rates applied to qualified dividends. Non-qualified dividends may include dividends received from real estate investment trusts (REITs), certain foreign companies, and dividends on employee stock options.

Understanding the classification of dividends and the corresponding tax rates is crucial for investors to accurately calculate their potential tax liability.

Qualified Dividends

Qualified dividends are a specific type of dividend that meets certain criteria to qualify for preferential tax treatment. These dividends are subject to lower tax rates than ordinary income, making them more appealing for investors. To be classified as qualified dividends, the following requirements must be met:

- The dividends must be paid by a U.S. corporation or a qualified foreign corporation. Typically, dividends received from domestic companies and companies incorporated in eligible foreign countries are considered qualified dividends.

- The investor must hold the stock for a specific holding period. For most stocks, this holding period requirement is 60 days within the 121-day period that begins 60 days before the ex-dividend date. Preferred stock has a different holding period requirement of 90 days within a 181-day period that begins 90 days before the ex-dividend date.

- The dividends must not be listed as non-qualified dividends or dividends that do not meet the necessary criteria.

It’s worth noting that not all dividends qualify for the preferential tax treatment. Dividends received from certain sources, such as interest on savings accounts, money market funds, or dividends derived from investments in tax-exempt accounts like individual retirement accounts (IRAs), do not meet the criteria for qualified dividends.

For individuals, qualified dividends are subject to the tax rates mentioned earlier: 0%, 15%, or 20%, based on their income tax bracket. The lower tax rates on qualified dividends are aimed at incentivizing long-term investment in corporations and rewarding shareholders for their commitment.

Investors should review their investment portfolios and consult with a tax professional to determine whether their dividends qualify for the preferential tax treatment of qualified dividends. Maximizing the use of qualified dividends can significantly reduce an investor’s tax liability.

Non-Qualified Dividends

Non-qualified dividends are dividends that do not meet the specific requirements to be classified as qualified dividends. Unlike qualified dividends, non-qualified dividends are taxed at the individual’s ordinary income tax rate.

There are several situations where dividends may be considered non-qualified:

- Dividends from certain investments: Certain types of investments, such as real estate investment trusts (REITs), often distribute dividends that are classified as non-qualified. These dividends do not meet the criteria set by the Internal Revenue Service (IRS) to qualify for preferential tax treatment.

- Dividends on employee stock options: Dividends received from employee stock options are generally treated as compensation rather than as qualified dividends. As a result, they are taxed at the individual’s ordinary income tax rate.

- Dividends from certain foreign companies: Dividends received from foreign companies that are not classified as qualified foreign corporations may be considered non-qualified dividends.

Non-qualified dividends are taxed at the individual’s ordinary income tax rate, which means they are subject to the same tax brackets that apply to wages, salaries, and other types of income. The specific tax rate an individual will pay on their non-qualified dividends depends on their taxable income and filing status.

It’s important for investors to be aware of the potential tax implications of non-qualified dividends as they may impact one’s overall tax liability. Reviewing investment portfolios and understanding which dividends are classified as non-qualified is essential for accurate tax planning and reporting.

Taxation of Dividends for Different Taxpayers

The tax treatment of dividends can vary based on an individual’s filing status and taxable income. Let’s explore how dividends are taxed for different types of taxpayers:

- Single taxpayers: Single individuals, who file their taxes as single, head of household, or qualifying widow(er), will be subject to the tax rates for qualified and non-qualified dividends based on their taxable income.

- Married taxpayers filing jointly: For married couples who file their taxes jointly, the tax rates for qualified and non-qualified dividends are the same as for single taxpayers. However, the income thresholds at which the tax rates apply are higher. It’s important to note that if one spouse receives dividends and the other does not, special rules may apply.

- Married taxpayers filing separately: Married individuals who choose to file their taxes separately will generally have higher tax rates for their dividends. They may also face limitations on qualifying for the lower tax rates on qualified dividends.

- Dividend earning children: Children who have dividend income may be subject to different tax rates and rules. If the child’s total income, including dividends, is below certain thresholds, their dividends may be taxed at a lower rate or even tax-free.

It’s important for taxpayers to understand their filing status, consult the current tax laws, and determine their taxable income in order to accurately calculate the tax rate on their dividends. Utilizing tax software or consulting with a tax professional can be helpful in navigating the complexities of dividend taxation for different types of taxpayers.

Impact of Other Factors on Dividend Taxation

In addition to the type of dividend and the taxpayer’s filing status, there are several other factors that can impact the taxation of dividends. Understanding these factors can help investors better plan their dividend income and minimize their tax liability. Here are some key factors to consider:

- Tax Bracket: The tax bracket in which an individual falls will have a significant impact on the taxation of dividends. Higher-income individuals generally face higher tax rates on both qualified and non-qualified dividends.

- Holding Period: The holding period of the stock can affect the taxation of dividends. To qualify for the lower tax rates on qualified dividends, the investor must hold the stock for a specific period of time. If the holding period is not met, the dividends will be treated as non-qualified and subject to higher tax rates.

- Investment Accounts: The type of investment account can affect the taxation of dividends. Dividends received in tax-advantaged accounts like individual retirement accounts (IRAs) or 401(k) plans are typically tax-deferred or tax-free until withdrawn. Conversely, dividends received in regular brokerage accounts are subject to taxation in the year they are received.

- Foreign Dividends: Dividends received from foreign companies may be subject to different tax rules and international tax treaties. Investors receiving foreign dividends should check the specific tax agreements between their country of residence and the country from which the dividends are received.

- Capital Gains and Losses: When an investor sells a stock at a profit (capital gain) or a loss (capital loss), it can affect the overall tax liability on dividends. Capital gains can push an investor into a higher tax bracket, potentially increasing the tax rate on their dividends. Conversely, capital losses can offset capital gains and potentially reduce the tax liability on dividends.

It’s important for investors to consider these factors and consult with a tax professional to fully understand their individual tax situation and develop strategies to optimize dividend taxation.

Strategies to Minimize Dividend Taxes

While dividends are subject to taxation, there are several strategies that investors can employ to minimize their dividend taxes. By implementing these strategies, investors can potentially reduce their tax liability and maximize their after-tax returns. Here are some effective strategies to consider:

- Invest in tax-advantaged accounts: One of the most effective ways to minimize dividend taxes is to invest in tax-advantaged accounts such as individual retirement accounts (IRAs) or 401(k) plans. Dividends earned within these accounts are either tax-deferred or tax-free until withdrawal, allowing for potential tax savings.

- Focus on tax-efficient investments: Some investments, such as index funds or exchange-traded funds (ETFs), tend to generate fewer taxable dividends compared to actively managed funds. By investing in these tax-efficient options, investors can potentially reduce their tax liability on dividends.

- Consider tax-loss harvesting: Tax-loss harvesting involves selling investments that have experienced losses to offset gains from dividends or capital gains. By strategically realizing capital losses, investors can potentially reduce their overall tax liability.

- Hold investments for the long term: By holding investments for longer periods, investors may qualify for the lower tax rates on qualified dividends. This can result in significant tax savings compared to short-term investments, which are subject to higher ordinary income tax rates.

- Optimize asset location: Asset location refers to the strategic placement of different asset classes across various investment accounts. By allocating high-dividend investments, such as bonds or real estate investment trusts (REITs), to tax-advantaged accounts and low-dividend or tax-efficient investments to taxable accounts, investors can minimize their overall tax liability on dividends.

- Consider tax-managed funds: Tax-managed funds are mutual funds or ETFs that aim to minimize taxable income and capital gains distributions. These funds employ strategies such as selective trading and tax-loss harvesting to reduce tax implications for investors.

It’s important for investors to evaluate their individual circumstances and consult with a tax professional or financial advisor to determine which strategies are most suitable for their specific needs and goals. By implementing these strategies, investors can potentially optimize their dividend income and minimize their tax burden.

Conclusion

Understanding the tax rate on dividends for 2016 and how dividends are taxed is essential for investors seeking to optimize their investment returns. Different types of dividends, such as qualified and non-qualified dividends, have varying tax treatment. Qualified dividends are subject to lower tax rates, while non-qualified dividends are taxed at ordinary income tax rates.

Several factors can impact the taxation of dividends, including an individual’s tax bracket, holding period, investment accounts, and the type of dividend received. By considering these factors and implementing strategies such as investing in tax-advantaged accounts, focusing on tax-efficient investments, and optimizing asset location, investors can potentially minimize their dividend taxes and maximize their after-tax returns.

It’s important for investors to stay informed about current tax laws and consult with tax professionals or financial advisors to ensure they are taking advantage of the applicable tax breaks and strategies available to them.

By effectively managing dividend taxes, investors can enhance their overall investment performance and work towards achieving their financial goals.