Finance

What Is The IRS Per Diem Rate For 2016?

Published: November 1, 2023

Get to know the IRS per diem rate for 2016 and stay updated on the latest finance regulations and guidelines.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Per Diem

- Purpose of Per Diem Rates

- How the IRS Determines Per Diem Rates

- Per Diem Rates for Different Locations

- Per Diem Rates for Meals and Incidentals

- Per Diem Rates for Lodging

- Per Diem Rates for High-Cost Areas

- How to Use Per Diem Rates for Tax Deductions

- Changes to the IRS Per Diem Rates for 2016

- Conclusion

Introduction

Are you curious about the IRS per diem rate for 2016? Per diem is a Latin term that means “per day.” It is used to refer to the daily allowance provided to employees for expenses incurred during business trips. This allowance covers meals, lodging, and incidental expenses. The IRS sets specific per diem rates that employers can use as a guideline for reimbursing their employees.

Understanding the IRS per diem rate for 2016 is essential for both employers and employees to ensure proper reimbursement and tax deductions. In this article, we will explore what per diem is, why per diem rates exist, and how the IRS determines these rates.

Additionally, we will examine the specific per diem rates for different locations and expenses, including meals and incidentals, lodging, and high-cost areas. We will also explain how taxpayers can utilize per diem rates for tax deductions.

Lastly, we will touch on any changes to the IRS per diem rates for 2016 to ensure that you have the most up-to-date information.

Definition of Per Diem

Per diem is a term used to describe the daily allowance provided to employees for expenses incurred during business trips. It is an all-inclusive amount that covers meals, lodging, and incidental expenses. Employers use per diem rates as a guideline to reimburse their employees for these expenses.

The per diem rate is usually calculated on a daily basis and varies depending on the location and the purpose of the trip. It takes into account the average cost of meals, lodging, and incidental expenses in a specific area. Per diem rates are designed to simplify the reimbursement process by providing a fixed amount that employees can claim without needing to submit individual receipts.

Per diem rates can vary significantly depending on the location and the local cost of living. Areas with higher costs, such as major cities or popular tourist destinations, typically have higher per diem rates to account for the increased expenses.

It’s important to note that per diem rates are set by the General Services Administration (GSA) for federal government employees. However, the Internal Revenue Service (IRS) sets separate per diem rates for tax purposes. These IRS per diem rates determine the amount that can be deducted as a business expense on an individual’s tax return.

By understanding the definition and purpose of per diem, employees and employers can ensure proper reimbursement and take advantage of potential tax deductions when it comes to business travel expenses.

Purpose of Per Diem Rates

The purpose of per diem rates is to provide a simplified and standardized method for reimbursing employees for their business travel expenses. By using per diem rates, employers can streamline the reimbursement process and ensure that employees are adequately compensated for their out-of-pocket expenses.

Here are a few key reasons why per diem rates are established:

- Simplicity: Per diem rates eliminate the need for employees to keep track of and submit individual receipts for every meal or incidental expense. Instead, they receive a fixed daily allowance that covers all eligible expenses.

- Fairness: Per diem rates are determined based on average costs in a specific location. This means that employees will receive a consistent reimbursement amount, regardless of their personal spending habits or preferences.

- Efficiency: By providing a predetermined per diem rate, employers can expedite the reimbursement process. This helps to reduce administrative burdens and ensures that employees receive their reimbursements in a timely manner.

- Tax Compliance: The IRS per diem rates serve an additional purpose – they establish guidelines for claiming tax deductions on business travel expenses. By adhering to these rates, taxpayers can maximize their deductions and remain compliant with IRS regulations.

- Cost Control: Per diem rates help employers manage their travel expenses effectively. By setting a consistent allowance, employers can budget for travel expenses more accurately and avoid potential abuse or excessive spending.

Overall, per diem rates provide a fair and standardized approach to reimbursing employees for business travel expenses. They simplify the reimbursement process, ensure compliance with IRS guidelines, and help employers maintain cost control. By understanding the purpose behind per diem rates, both employers and employees can navigate the complexities of business travel expenses with ease.

How the IRS Determines Per Diem Rates

The Internal Revenue Service (IRS) determines per diem rates based on the average costs of meals, lodging, and incidental expenses in various locations. These rates are used to calculate the deductible expenses for business trips and provide a guideline for employers to reimburse their employees.

The IRS follows a two-tier system to establish per diem rates:

- GSA Rates: Initially, the IRS adopts the rates published by the General Services Administration (GSA) for federal government employees. The GSA sets per diem rates for different areas within the United States, including standard rates for most locations and higher rates for certain high-cost areas.

- Non-GSA Rates: In some cases, the IRS establishes separate rates for areas where the GSA rates may not accurately reflect the average costs of meals, lodging, and incidental expenses. This could include non-standard areas, remote locations, or popular tourist destinations.

To determine per diem rates, the IRS considers the average costs of meals, lodging, and incidental expenses in each location. It takes into account factors such as the cost of living, availability of lodging options, and restaurant prices. The rates are regularly reviewed and updated to reflect any changes in expenses.

It’s important to note that the per diem rates provided by the IRS are optional and can be used by employers as a guideline for reimbursement. Employers have the flexibility to reimburse employees at these rates or at actual expenses incurred, as long as they maintain adequate records and adhere to IRS regulations.

Additionally, it’s worth mentioning that the IRS provides separate rates for high-cost areas, which have higher-than-average expenses. These rates help ensure that employees are adequately compensated for the increased costs associated with travel to such locations.

By understanding how the IRS determines per diem rates, both employers and employees can utilize these rates effectively for business travel expenses. Employers can use the rates as a guideline for reimbursement, while employees can have a clear understanding of what to expect when it comes to their travel allowances.

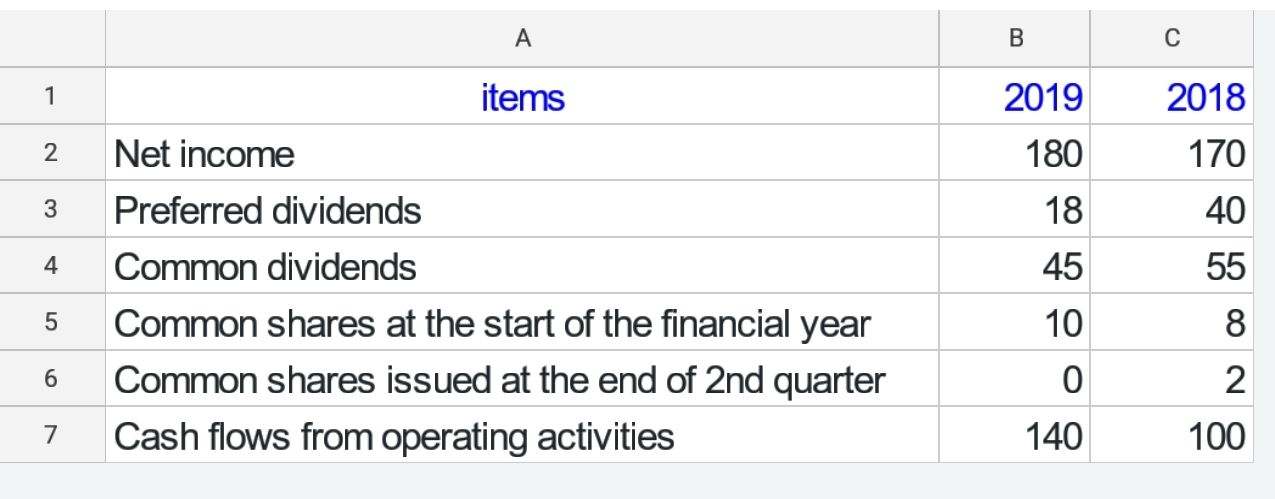

Per Diem Rates for Different Locations

The per diem rates established by the Internal Revenue Service (IRS) vary depending on the location of the business trip. Different areas within the United States have different per diem rates to account for the varying costs of meals, lodging, and incidental expenses. These rates are regularly updated to reflect changes in expenses and ensure accuracy.

The per diem rates are primarily divided into two categories: standard rates and high-cost rates.

Standard Rates:

The standard per diem rates apply to most locations within the country. These rates are established by the General Services Administration (GSA) and adopted by the IRS for tax purposes. They are intended to cover average costs for meals, lodging, and incidental expenses in those areas.

The standard per diem rates consist of two components: the meals and incidental expenses (M&IE) allowance and the lodging allowance. The M&IE allowance covers expenses such as meals, tips, and any other incidental expenses, while the lodging allowance reimburses the cost of accommodation.

High-Cost Rates:

High-cost areas, such as major cities or popular tourist destinations, have higher per diem rates to account for the increased costs of meals, lodging, and incidental expenses. The IRS provides separate per diem rates for these locations to ensure that employees are adequately compensated for their expenses.

It’s important to note that the high-cost rates are only applicable in specific locations and are generally higher than the standard rates. These rates consider the higher cost of living and higher costs associated with staying in these areas.

Both the standard and high-cost per diem rates are published annually by the IRS and are available on their website. Employers can use these rates as a guideline for reimbursing employees, while individuals can refer to them for tax deductions on their business travel expenses.

It’s crucial to stay updated with the current per diem rates for different locations to ensure accurate reimbursement and maximize potential tax deductions. The IRS provides a reliable resource for accessing the latest per diem rates, making it easier for employers and employees to navigate the reimbursement process and stay compliant with tax regulations.

Per Diem Rates for Meals and Incidentals

When it comes to per diem rates, one important component is the allowance for meals and incidental expenses (M&IE). This portion of the per diem rate covers the cost of meals, tips, and any other incidental expenses that employees may incur during their business trips.

The Internal Revenue Service (IRS) establishes standard per diem rates for M&IE expenses in different locations. These rates are designed to provide a reasonable amount for employees to cover their meal expenses while on business travel.

The M&IE rates are typically structured in two ways:

- Deductible Meals and Incidental Expenses: This is the maximum amount that can be deducted as a business expense when filing taxes. Employees can claim this amount even if their actual expenses are lower.

- Reimbursement Rates: This is the maximum amount that an employer can reimburse employees for these expenses. Employers have the flexibility to reimburse at a lower amount if they choose.

The per diem rates for M&IE vary depending on the location. For example, areas with higher costs of living or tourist destinations generally have higher per diem rates to account for the increased expenses.

It’s important to note that the M&IE rates provided by the IRS are comprehensive. They include the cost of meals, taxes, tips, and any incidental expenses such as parking fees or dry-cleaning services. Therefore, employees do not need to provide detailed receipts for individual expenses in these categories.

It’s also worth mentioning that for partial days of travel, where an employee is not away for a full 24 hours, the per diem rate for meals and incidentals may be prorated. This proration is based on the number of hours spent on travel.

By understanding the per diem rates for meals and incidental expenses, both employers and employees can appropriately reimburse and deduct these expenses according to IRS guidelines. Employers can use these rates as a guide for reimbursement, and employees can maximize their deductions when filing their tax returns.

Per Diem Rates for Lodging

When it comes to business travel, lodging expenses can make up a significant portion of the overall costs. To address this, the Internal Revenue Service (IRS) establishes per diem rates for lodging, which provide guidelines for reimbursing employees for their accommodation expenses during business trips.

The per diem rates for lodging are based on the average cost of lodging in different locations. These rates are set by the General Services Administration (GSA) and adopted by the IRS for tax purposes.

The per diem rates for lodging can vary depending on the location and the time of year, as costs fluctuate due to factors such as local demand and seasonal variations. It’s important to note that the lodging portion of the per diem rate is separate from the meals and incidental expenses (M&IE) allowance.

Employers can use the lodging per diem rates as a guideline for reimbursing employees for their lodging expenses. However, it’s important to remember that employees are not required to spend the entire per diem amount on their lodging. They can choose to book accommodations at a lower cost and keep the remaining amount for other travel-related expenses.

It’s worth mentioning that the IRS per diem rates for lodging do not cover expenses beyond the actual cost of the accommodations. So, if an employee chooses to stay at a higher-end hotel or incur additional costs for services such as room service or laundry, those expenses would not be covered by the per diem rates and would need to be handled separately.

Additionally, if an employee shares lodging expenses with another individual, such as a colleague or family member, the per diem rate for lodging can be divided equally between them.

By utilizing the per diem rates for lodging, employers can ensure fair reimbursement for their employees’ lodging expenses during business travel. Employees, on the other hand, can have a clear understanding of the amount allocated for lodging and make appropriate choices that suit their preferences and needs.

Per Diem Rates for High-Cost Areas

High-cost areas, such as major cities or popular tourist destinations, often come with higher living expenses, including lodging, meals, and other incidental costs. To account for these increased costs, the Internal Revenue Service (IRS) establishes separate per diem rates specifically for high-cost areas.

The per diem rates for high-cost areas are higher than the standard rates and are set to ensure that employees are adequately reimbursed for the increased cost of living and expenses associated with business travel in these locations.

High-cost areas are determined based on factors such as the cost of living, average hotel rates, and other relevant economic indicators. The IRS publishes a list of high-cost areas, specifying the applicable per diem rates for each location.

It’s important to note that the per diem rates for high-cost areas are optional. Employers have the flexibility to use these rates or the standard rates for reimbursement, depending on their policies and the specific circumstances. However, using the high-cost rates is generally recommended for accurate reimbursement in locations with higher expenses.

By providing higher per diem rates for high-cost areas, the IRS ensures that employees traveling to these locations are adequately compensated for their business travel expenses. It helps to address the financial challenges associated with staying and conducting business in expensive areas.

It’s crucial for both employers and employees to be aware of the per diem rates for high-cost areas and incorporate these rates into their reimbursement processes. By doing so, employers can ensure fair compensation, and employees can have peace of mind knowing that their travel expenses in high-cost areas are appropriately covered.

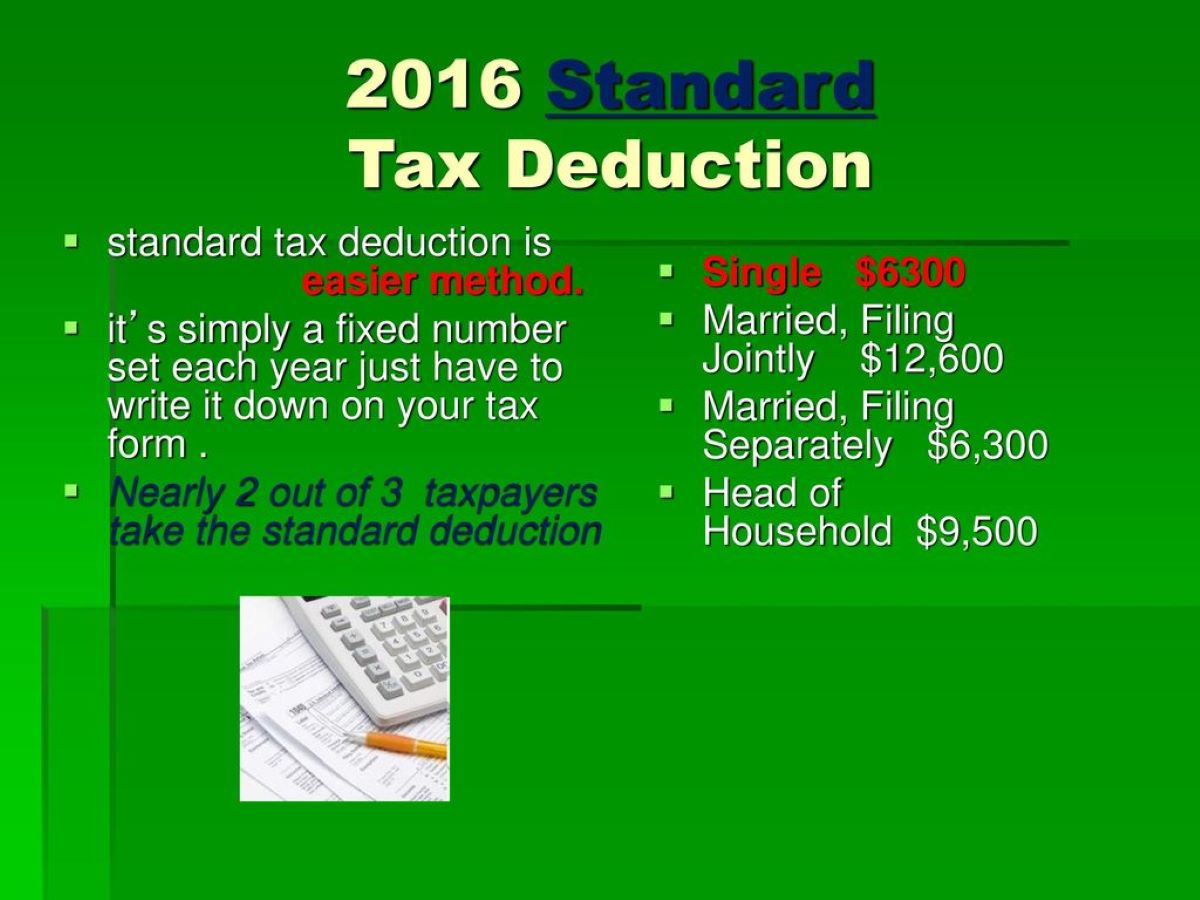

How to Use Per Diem Rates for Tax Deductions

The per diem rates established by the Internal Revenue Service (IRS) not only serve as guidelines for employers to reimburse their employees’ business travel expenses but also play a crucial role in tax deductions for individuals. Understanding how to use per diem rates for tax deductions can help taxpayers maximize their eligible deductions while remaining compliant with IRS regulations.

Here’s how you can utilize per diem rates for tax deductions:

- Using Actual Expenses: Taxpayers have the option to deduct their actual expenses for meals, lodging, and incidental expenses instead of using per diem rates. However, this requires proper record-keeping and the ability to substantiate each expense with receipts or other supporting documentation.

- Choosing the Standard Rate: Instead of tracking and providing detailed records of actual expenses, taxpayers can opt to use the standard per diem rates established by the IRS. This simplifies the process by allowing taxpayers to deduct the predetermined per diem amount for meals and incidental expenses, as well as the lodging allowance specific to the location of their business travel.

- Ensuring Eligibility: To be eligible for tax deductions using per diem rates, taxpayers must meet certain conditions, such as being away from their tax home and traveling on business-related activities. It’s essential to review IRS guidelines and consult with a tax professional to ensure compliance.

- Keeping Detailed Records: Even when using per diem rates, it’s important to maintain detailed records of the dates, locations, and purpose of each business trip. This documentation helps support the tax deductions claimed and provides a clear audit trail if necessary.

- Staying Updated: Per diem rates can change annually or even during the year, so it’s vital to stay informed about any updates or adjustments made by the IRS. The latest rates can be found on the IRS website or by consulting with a tax professional.

By utilizing per diem rates for tax deductions, individuals can simplify the process of claiming business travel expenses on their tax returns. Whether using the standard per diem rates or opting for actual expenses, it’s crucial to maintain accurate records and ensure compliance with IRS regulations.

It’s recommended to consult with a tax professional to understand the specific rules and requirements related to using per diem rates for tax deductions. With proper knowledge and guidance, taxpayers can take full advantage of eligible deductions while minimizing the risk of errors or noncompliance.

Changes to the IRS Per Diem Rates for 2016

Each year, the IRS updates the per diem rates to reflect changes in the cost of living and travel expenses. These updates ensure that employees are adequately reimbursed for their business travel expenses while maintaining compliance with tax regulations. Here are some notable changes to the IRS per diem rates for the year 2016:

- GSA Rates: The IRS adopted the General Services Administration (GSA) per diem rates for the 2016 tax year. These rates determine the maximum allowable per diem rates for federal government employees.

- Standard Rates: The IRS maintained the standard rates for most locations within the United States. These rates cover the cost of meals, lodging, and incidental expenses incurred during business travel. It’s important to note that some individual locations may have slight variations in their rates due to local factors.

- High-Cost Areas: The IRS continued to provide separate per diem rates for high-cost areas to account for the increased expenses associated with business travel in these locations. These rates were generally higher than the standard rates to reflect the higher cost of living and lodging expenses in these areas.

- Transportation Industry Rates: The IRS introduced a special per diem rate category for the transportation industry. This category was established to address the unique travel requirements and expenses faced by workers in the transportation industry.

- Foreign Rates: The IRS maintained the separate per diem rates for international travel. These rates apply to business travel outside of the United States and are published separately from the domestic rates.

It’s important for employers and employees to stay informed about the changes to the IRS per diem rates each year. Being aware of these updates allows for accurate reimbursement, proper tax deductions, and compliance with IRS guidelines.

It’s worth noting that the per diem rates for future years may also change due to fluctuations in economic conditions, living costs, and other factors. Staying up to date with the IRS publications and consulting with a tax professional can help ensure that you are using the most current rates and meeting the requirements for proper reimbursement and tax deductions.

Conclusion

Understanding the IRS per diem rate for 2016 is crucial for both employers and employees when it comes to business travel expenses. Per diem rates provide a standardized approach to reimbursing employees and ensuring proper tax deductions for eligible expenses.

We discussed the definition of per diem and its purpose in simplifying the reimbursement process. Per diem rates are determined by the IRS based on the average costs of meals, lodging, and incidental expenses in different locations. The rates vary for standard areas and high-cost areas, reflecting the variations in living expenses.

Employers can utilize per diem rates as a guideline for reimbursing employees, simplifying the process and ensuring consistency. Employees can benefit from a clear understanding of the amount they can expect for their business travel expenses, helping them manage their finances effectively.

Furthermore, individuals can utilize per diem rates for tax deductions. Whether using actual expenses or the standard rates, having accurate records and staying compliant with IRS regulations is vital.

In conclusion, understanding the IRS per diem rate for 2016 is essential for employers and employees alike. By utilizing per diem rates, employers can ensure fair reimbursement, and employees can stay organized regarding their travel expenses. Additionally, individuals can optimize their tax deductions by adhering to the guidelines set by the IRS.

It’s important to note that per diem rates may change annually, and it’s crucial to stay updated with the latest rates and regulations. Consulting with a tax professional can provide further guidance and ensure compliance with IRS requirements.

By understanding and effectively utilizing per diem rates, employers can streamline their reimbursement process, employees can receive fair compensation for business travel expenses, and individuals can maximize their tax deductions while adhering to IRS regulations.