Home>Finance>What Might Be Some Consequences Of Families Not Having Adequate Savings

Finance

What Might Be Some Consequences Of Families Not Having Adequate Savings

Published: January 16, 2024

Discover the potential consequences that families may face when lacking sufficient savings. Explore how finance plays a crucial role in securing a stable future for your loved ones.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In today’s fast-paced and unpredictable world, having adequate savings has become increasingly crucial. Unfortunately, many families are facing the consequences of not having enough saved funds to navigate unexpected expenses or plan for the future. The importance of savings extends beyond just having a financial safety net; it impacts various aspects of individuals’ lives and can have wide-ranging consequences for families.

Financial instability is a significant concern for families without adequate savings. Without a cushion to fall back on, even minor emergencies can quickly turn into financial crises. From unexpected medical bills to car repairs, these sudden expenses can disrupt daily life and cause significant stress.

Another consequence is the increased reliance on debt to meet financial obligations. Without savings, families may resort to using credit cards or taking out loans, which can lead to a never-ending cycle of debt. Heavy debt burdens can restrict financial mobility and limit opportunities for long-term wealth building.

Moreover, limited access to education and healthcare is a direct result of inadequate savings. Without a financial safety net, families may struggle to afford quality education for their children or invest in their own skill development. This lack of access to educational opportunities can perpetuate socio-economic disparities and hinder individuals’ ability to break the cycle of poverty.

Similarly, having insufficient funds for healthcare expenses can lead to delayed or inadequate medical treatment. Preventive care and regular check-ups are essential for maintaining optimal health, but without savings, families may have to forgo necessary medical attention, resulting in compromised well-being and potentially exacerbating long-term health problems.

Furthermore, insufficient savings can lead to inadequate retirement funds. It is important to start saving for retirement early to ensure financial security in old age. Without proper retirement planning, individuals may struggle to maintain their standard of living and rely heavily on government assistance or family support.

The absence of savings can also take a toll on individuals’ mental health and overall well-being. Financial stress and anxiety can lead to increased instances of depression, anxiety disorders, and other mental health issues. The constant worry about money can strain relationships and negatively impact the quality of life for individuals and their families.

In addition to the impact on individuals and families, insufficient savings also make individuals more vulnerable to emergencies. Whether it’s a natural disaster, job loss, or a sudden economic downturn, having a financial safety net can make a significant difference in weathering the storm. Families without adequate savings may struggle to recover from unexpected setbacks and may face significant challenges in rebuilding their lives.

Finally, the consequences of insufficient savings can have a long-term effect on generational wealth. Without savings, families may struggle to pass on assets and provide opportunities for the next generation. Lack of intergenerational wealth transfer can perpetuate socio-economic disparities and limit upward mobility for future generations.

Overall, the consequences of families not having adequate savings are far-reaching. From financial instability to limited access to education and healthcare, the impact can be felt in various aspects of individuals’ lives. It is essential to prioritize savings and financial planning to ensure stability, security, and a better future for families.

Financial Instability

One of the immediate consequences of families not having adequate savings is financial instability. Without a safety net of savings, families are constantly at risk of falling into financial crisis when unexpected expenses arise. Even minor emergencies, such as medical bills or car repairs, can quickly drain their limited resources and leave them struggling to meet basic needs.

Financial instability leads to a constant state of stress and uncertainty. Families may find themselves living paycheck to paycheck, with no room for financial emergencies or future planning. This can create a cycle of constantly playing catch-up, never able to get ahead or build a stable financial foundation.

Moreover, without savings, families may have to rely on high-interest credit cards or take out loans to cover expenses. This results in the accumulation of debt that can quickly become overwhelming and difficult to manage. The burden of debt restricts financial mobility and limits the ability to save for the future or invest in long-term wealth-building opportunities.

Financial instability also affects individuals’ ability to provide for their family’s needs. It may lead to cutting back on essential expenses like nutritious food, medical care, or quality education for children. This not only compromises their immediate well-being but also has long-term consequences for their overall development.

In addition, financial instability can strain relationships and impact mental health. Constant financial stress can lead to arguments, tension, and feelings of inadequacy. Individuals may experience increased anxiety, depression, and other mental health issues as they grapple with the constant worry about money and their family’s financial future.

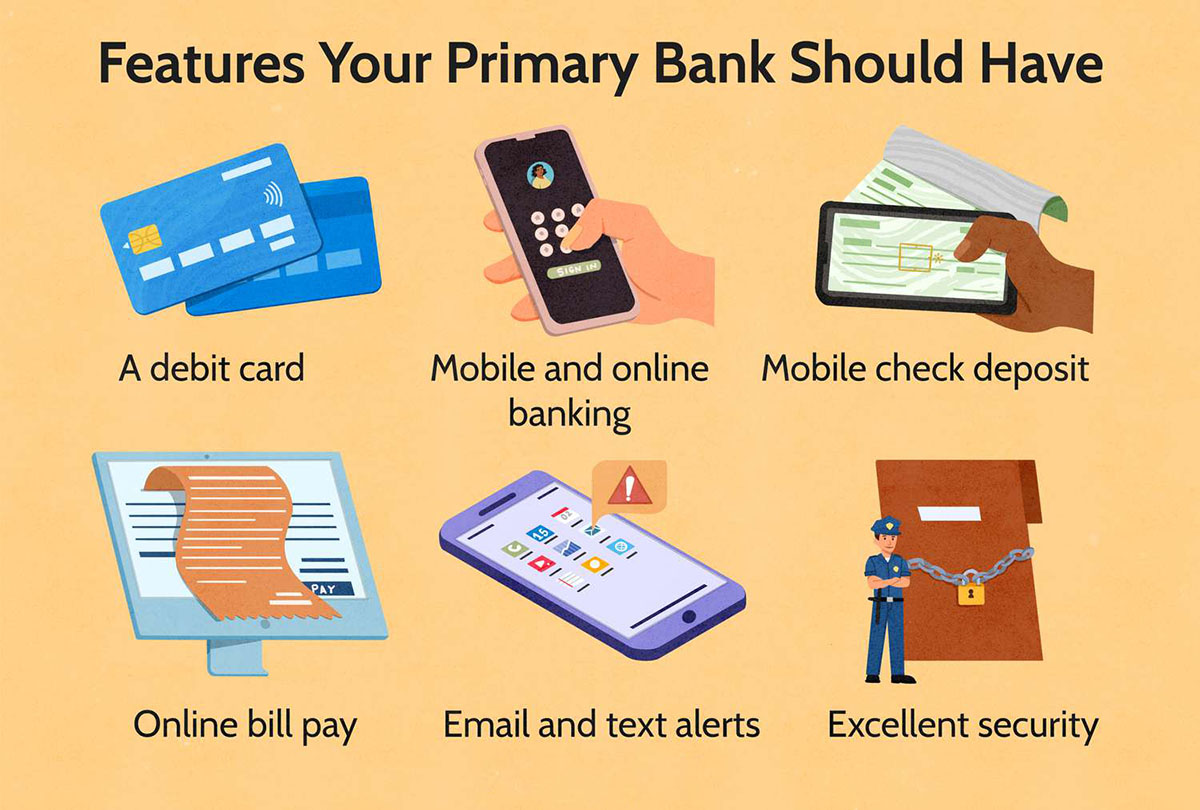

To overcome financial instability, it is crucial for families to prioritize savings and create a budget that allocates a portion of their income towards emergency funds and future planning. Building a financial safety net can provide a sense of security and alleviate the stress and uncertainty that comes with living paycheck to paycheck.

By accumulating savings, families can weather unexpected expenses without resorting to high-interest debt or compromising their basic needs. Savings also offer a sense of freedom and empowerment, allowing individuals to pursue opportunities, invest in education, and plan for a more financially secure future.

Increased Debt

One of the significant consequences of families not having adequate savings is the increased reliance on debt to meet their financial obligations. Without a cushion of savings to fall back on, families may find themselves turning to credit cards, personal loans, or other forms of borrowing to cover their expenses.

Using debt as a means of financing daily expenses can quickly lead to a never-ending cycle of borrowing and repaying. Each new loan or credit card charge adds to the existing debt burden, making it increasingly challenging to break free from the cycle and achieve financial stability.

High-interest rates associated with credit cards and personal loans can make it difficult for families to pay off their debts, as a significant portion of their income goes towards interest payments. This can result in a constant struggle to meet minimum payments, leading to further accumulation of debt and perpetuating the cycle of financial stress.

In addition, increased debt can limit individuals’ financial flexibility and restrict their ability to save for the future. The more money that goes towards paying off debts, the less they have available to invest in long-term wealth-building opportunities or to build a financial safety net.

Furthermore, excessive debt can negatively impact individuals’ credit scores and make it challenging to access affordable credit in the future. This can have far-reaching consequences, as a poor credit history can affect their ability to secure favorable interest rates on mortgages, car loans, and other essential financial products.

Increased debt not only affects the present financial situation but also has long-term implications. When families are burdened with heavy debt, it becomes difficult to save for retirement or invest in education for themselves or their children. This can result in a lack of financial preparedness for retirement and limited opportunities for economic mobility.

Given these challenges, it is crucial for families to prioritize building savings and reducing debt. Utilizing strategies such as debt consolidation, budgeting, and seeking professional financial advice can help individuals regain control over their finances and start on the path towards debt repayment and financial freedom.

By reducing debt and building savings simultaneously, families can break free from the cycle of borrowing and set themselves up for a more secure financial future. It requires discipline, commitment, and a long-term financial plan, but the benefits of financial freedom and reduced stress are well worth the effort.

Limited Access to Education and Healthcare

A lack of adequate savings can have far-reaching consequences when it comes to accessing quality education and healthcare for families. Without financial resources to rely on, families may struggle to provide their children with the necessary educational opportunities or afford proper healthcare when needed.

Education is a vital tool for social and economic mobility, yet the cost of education continues to rise. Families without adequate savings may find it challenging to afford quality education for their children, whether it’s private school tuition, extracurricular activities, or resources needed for a well-rounded education. This can perpetuate existing socio-economic disparities and limit opportunities for children from low-income families to break the cycle of poverty.

Limited access to education can hinder a child’s intellectual development and restrict their chances of academic success. Without the financial means to invest in educational resources, tutoring, or enrichment programs, children may struggle to keep up with their peers, ultimately affecting their long-term educational and career prospects.

Similarly, inadequate savings can significantly impact access to healthcare. Medical expenses can be exorbitant, and without savings to cover these costs, families may have to forgo necessary medical treatment or delay seeking healthcare services. This can have serious consequences on their health and well-being, potentially leading to the progression of illnesses or the development of more severe medical conditions.

Preventive care and regular check-ups are essential for maintaining optimal health. However, without savings, families may not have the means to afford preventive healthcare services, leading to the neglect of necessary screenings, vaccinations, and regular medical examinations. This lack of proactive healthcare can result in undiagnosed or untreated health conditions that could have been prevented or managed with timely intervention.

Inadequate access to education and healthcare can have long-term implications for both individuals and society as a whole. Without educational opportunities, individuals may struggle to acquire the knowledge and skills needed to secure well-paying jobs and contribute to economic growth. Furthermore, limited access to healthcare can lead to increased healthcare disparities and a higher burden on public healthcare systems.

To address these challenges, it is crucial for families to prioritize savings specifically designated for education and healthcare expenses. By setting aside funds for these purposes, families can ensure that their children have access to quality education and that they can afford timely healthcare services when needed. Additionally, exploring financial aid options, scholarships, and community resources can help lessen the financial burden and increase access to educational and healthcare opportunities.

By investing in education and healthcare, families can lay a solid foundation for their children’s future success and well-being. It is not only a responsibility but also an investment in building a brighter and healthier future for the entire family.

Inadequate Retirement Funds

Another significant consequence of families not having adequate savings is the potential for inadequate retirement funds. Retirement planning is essential to ensure financial security in old age, yet many families neglect this aspect due to a lack of savings.

Without sufficient savings, individuals may find themselves unprepared for retirement, unable to maintain their standard of living or cover essential expenses. This can lead to financial stress and anxiety in their golden years, and they may have to rely heavily on government assistance or family support to make ends meet.

Delaying retirement or working longer than the desired age can become a necessity for individuals without savings, as they struggle to accumulate enough funds to live comfortably in retirement. This can have long-term implications on their quality of life, as older individuals may be forced to continue working in physically demanding or low-paying jobs past their desired retirement age.

Inadequate retirement funds can also restrict individuals’ ability to pursue their desired lifestyle during retirement. They may have to make significant sacrifices, such as downsizing their housing, cutting back on leisure activities, or compromising on healthcare, to make their limited savings last.

Moreover, inadequate retirement funds can impact the legacy individuals can leave behind for their loved ones. Without savings, families may not have the means to pass on assets or resources to the next generation, thereby limiting opportunities for generational wealth and financial stability.

To address the issue of inadequate retirement funds, it is crucial for individuals to prioritize retirement savings early on in their working lives. By starting to save for retirement as early as possible, individuals can take full advantage of compounding interest and long-term investment growth.

Employer-sponsored retirement plans, such as 401(k) plans or pension schemes, provide an excellent opportunity to contribute towards retirement savings. Additionally, individuals can explore other retirement investment options like Individual Retirement Accounts (IRAs) or invest in diversified portfolios to maximize their long-term returns.

It is also essential for individuals to regularly reassess their retirement savings strategy and adjust it according to their changing financial situation and goals. Seeking the guidance of a financial advisor can be invaluable in creating a personalized retirement savings plan and ensuring that individuals are on track to achieve their retirement objectives.

By building adequate retirement funds, individuals can enjoy financial security and independence in their later years. They can have the freedom to pursue their passions, spend time with loved ones, and enjoy the fruits of their lifelong labor without the constant worry of running out of money.

Higher Stress and Mental Health Issues

Not having adequate savings can significantly contribute to higher stress levels and increase the risk of developing mental health issues for individuals and families. The constant worry about finances and the uncertainty of not having a financial safety net can take a toll on one’s mental well-being.

Financial stress is a prevalent consequence of insufficient savings. The pressure to meet daily expenses, pay off debts, and handle unexpected emergencies without sufficient funds can lead to anxiety, depression, and other mental health conditions. This stress can permeate various aspects of life, straining relationships with family and friends and impacting overall quality of life.

Moreover, individuals without savings may experience feelings of shame, guilt, or self-blame as they perceive themselves as being unable to meet societal or personal expectations. These negative emotions can further exacerbate mental health issues and create a downward spiral of negative thought patterns and self-esteem.

The impact of financial stress on mental health extends beyond the individual level. It can have ripple effects on family dynamics, leading to conflicts and strained relationships. The constant strain of financial insecurity can breed tension, resentment, and feelings of inadequacy among family members.

Additionally, the lack of financial resources to access mental health services can further exacerbate mental health issues. Without savings, individuals might not be able to afford therapy, counseling, or medications, which are crucial for managing and improving mental well-being. This lack of access can perpetuate the cycle of mental health struggles and hinder individuals’ ability to seek the help they need.

Addressing the relationship between financial stress and mental health requires a comprehensive approach. Developing healthy coping mechanisms, such as stress management techniques, mindfulness practices, or engaging in hobbies and activities that promote well-being, can help alleviate some of the psychological effects of financial stress.

Creating a realistic budget and financial plan can also help individuals regain a sense of control over their finances and reduce anxiety. Seeking assistance from financial professionals or non-profit organizations that provide financial counseling can offer guidance and support in managing finances effectively.

Additionally, it is vital to prioritize mental health and seek help when needed. Many communities offer low-cost or free mental health services, and exploring these resources can provide the necessary support for individuals experiencing mental health struggles.

By addressing the underlying stress associated with insufficient savings and prioritizing mental health, individuals can improve their overall well-being and build resilience in the face of financial challenges. Taking proactive steps towards self-care and seeking professional assistance can pave the way for better mental health and a brighter future.

Greater Vulnerability to Emergencies

Families without adequate savings are at a significantly greater risk of experiencing vulnerability and hardship during emergencies. Whether it’s a natural disaster, a sudden health crisis, or an unexpected job loss, the absence of savings can leave individuals and families ill-prepared to weather these challenging situations.

During emergencies, having savings can provide a crucial safety net, offering a financial cushion to cover immediate expenses and sustain individuals and families until they can regain stability. Without savings, individuals may find themselves struggling to meet basic needs like housing, food, and utilities, in addition to managing the additional expenses that emergencies bring.

Financial vulnerability during emergencies can have cascading effects on various aspects of life. For example, individuals may be unable to afford necessary medical treatment or medications during a health crisis, leading to compromised well-being and potentially worsening their condition.

Similarly, families without savings may face difficulties in accessing temporary shelter or finding alternative living arrangements in the aftermath of a natural disaster or unforeseen housing emergency. This lack of resources can prolong the recovery process and make it more challenging to rebuild their lives.

Financial insecurity can also impact individuals’ ability to re-enter the workforce after a sudden job loss. Without savings to support them during the period of unemployment, individuals may face increased stress and anxiety, making it harder to secure new employment.

Furthermore, the absence of savings can limit individuals’ ability to take advantage of opportunities for personal or professional growth during emergencies. For instance, they may be unable to afford retraining programs or additional education that could enhance their skills and improve their employability.

Having savings can also provide peace of mind during emergencies, allowing individuals to focus on recovery and overcome challenges more effectively. It can offer a sense of control and empowerment, knowing that they have resources readily available to navigate unexpected setbacks.

To mitigate the vulnerability to emergencies, it is crucial to prioritize building an emergency fund. Setting aside a portion of income towards savings specifically designated for unforeseen events can alleviate the financial strain and provide a buffer during times of crisis.

Financial experts recommend having an emergency fund that can cover three to six months’ worth of living expenses. This can provide individuals and families with the financial security necessary to navigate unexpected circumstances without resorting to high-interest debt or putting themselves at greater risk.

In addition to savings, having appropriate insurance coverage for emergencies can further safeguard against potential financial hardships. Health insurance, homeowners or renters insurance, and even disability insurance can help protect individuals and families from the financial burden of unexpected events.

By prioritizing savings and having appropriate insurance coverage, individuals and families can minimize the impact of emergencies and enhance their resilience. Financial preparedness allows for quick response, better decision-making, and a smoother recovery process during times of crisis.

Impact on Generational Wealth

The consequences of families not having adequate savings extend beyond the immediate financial challenges they face. Insufficient savings can have a significant impact on generational wealth, limiting opportunities for future generations and perpetuating socio-economic disparities.

Generational wealth encompasses assets, resources, and financial stability that can be passed down from one generation to the next. It provides a foundation for individuals and families to build upon and secure a better future for themselves and their descendants.

Without sufficient savings, families may struggle to pass on assets or provide financial support to the next generation. This lack of intergenerational wealth transfer can limit opportunities for educational advancement, homeownership, and business ownership, which are crucial factors for building long-term financial stability.

Insufficient savings can hinder the ability to invest in education and other opportunities that can unlock economic mobility. Without access to quality education, individuals may face limited career prospects and earn lower incomes, perpetuating the cycle of financial hardship.

In contrast, families with adequate savings can invest in their children’s education, providing them with the tools and resources necessary for success. This financial support can break barriers, open doors, and create opportunities that can lead to upward mobility and the accumulation of wealth.

Moreover, with sufficient savings, families can support their children’s entrepreneurial aspirations or provide the necessary capital to start businesses. Entrepreneurship and business ownership can generate wealth and create a legacy that can be passed down to future generations.

The impact on generational wealth also extends to homeownership. Lack of savings can make it challenging for individuals to afford a home or maintain homeownership, limiting their ability to build equity and generate wealth through property appreciation.

On the other hand, families with savings can use their resources to invest in real estate, buying properties that appreciate over time and contribute to their overall net worth. This allows them to pass down a valuable asset to future generations, further enhancing their financial well-being.

Generational wealth also offers a safety net during difficult times, providing a financial cushion that can help mitigate unexpected setbacks or economic downturns. Families with sufficient savings can weather financial storms more easily, while those without savings may struggle to recover from unexpected emergencies or economic hardships.

To break the cycle of limited generational wealth, it is crucial for families to prioritize savings and long-term financial planning. By building savings and strategically investing in education, homeownership, and business opportunities, families can create a solid foundation for future generations to build upon and enhance their financial well-being.

Additionally, proactive financial education and teaching the importance of savings to younger generations can instill positive financial habits and empower them to prioritize their financial future.

By focusing on building generational wealth, families can create lasting legacies and provide a solid springboard for their children and future descendants to achieve economic stability, pursue their dreams, and contribute to a more equitable society.

Decreased Economic Mobility

The consequences of families not having adequate savings can have a profound impact on economic mobility, limiting individuals’ ability to move up the socio-economic ladder and achieve financial success. Insufficient savings can create barriers that hinder upward mobility and perpetuate socio-economic disparities.

Economic mobility refers to the ability of individuals to improve their financial well-being and move to higher income levels over time. Savings play a crucial role in economic mobility as they provide the necessary resources to invest in opportunities for advancement.

Without sufficient savings, individuals may struggle to access quality education, which is a crucial factor in economic mobility. The cost of higher education continues to rise, and families without savings may not have the financial means to provide their children with the necessary educational opportunities or the ability to invest in their own skill development.

Education is an essential stepping stone to higher-paying jobs and increased earning potential. Limited access to education can perpetuate income inequality and restrict individuals’ ability to break free from the cycle of low-income jobs and limited opportunities for economic advancement.

Inadequate savings can also limit individuals’ ability to invest in themselves, acquire new skills, or pursue career development opportunities. Without the financial resources to attend conferences, workshops, or training sessions, individuals may struggle to stay competitive in the job market and miss out on promotions or higher-paying positions.

In addition, insufficient savings can make it challenging for individuals to accumulate the necessary down payment or obtain loans for homeownership. Homeownership has long been associated with wealth accumulation and can provide a foundation for economic stability and upward mobility. Without savings, individuals may remain stuck in the cycle of renting, which can limit their ability to build equity and generate wealth through property appreciation.

Lack of savings can also impact entrepreneurship and business ownership, which are pathways to economic mobility. Starting a business requires initial capital and financial resources to thrive. Without savings, individuals may struggle to launch their ventures or expand existing businesses, hindering their ability to create jobs, generate income, and build wealth.

Furthermore, inadequate savings can limit individuals’ ability to withstand financial setbacks or unexpected expenses, making them more vulnerable to economic downturns. Without a financial safety net, individuals may be forced to accept lower-paying jobs or remain in unstable employment situations, impairing their chances of upward mobility.

To combat the effects of decreased economic mobility, it is crucial to prioritize savings and develop strategies for long-term financial planning. By setting aside funds specifically designated for educational opportunities, career development, homeownership, and entrepreneurial endeavors, individuals can increase their chances of upward mobility.

Financial education and literacy, along with access to resources and guidance, can empower individuals to make informed financial decisions and navigate their way toward economic mobility. Communities and institutions can play a vital role in providing support systems, mentorship programs, and financial assistance to address the barriers faced by individuals with limited savings.

By focusing on increasing access to education, creating opportunities for skill development, promoting homeownership, and fostering entrepreneurship, we can enhance economic mobility and create a more equitable society. Prioritizing savings and providing the necessary support structures can empower individuals to pursue their dreams and achieve the economic success they deserve.

Conclusion

The consequences of families not having adequate savings are far-reaching and have significant implications for individuals’ lives and society as a whole. From financial instability to limited access to education and healthcare, the effects of insufficient savings can create barriers and perpetuate socio-economic disparities. It is essential for individuals and families to prioritize savings and financial planning to ensure stability, security, and a better future.

Financial instability is a major concern when there are no savings to rely on during unexpected emergencies or sudden expenses. It leads to stress, reliance on debt, and limited access to resources. Inadequate savings can also hinder access to quality education, which is a key driver of socio-economic mobility. It restricts the ability to invest in oneself and create opportunities for long-term success.

Lack of savings also affects access to healthcare, limiting individuals’ ability to afford necessary medical treatment and preventive care. Insufficient retirement funds can lead to financial strain and compromise one’s standard of living in old age. The absence of savings contributes to higher stress levels and an increased risk of mental health issues.

Families without savings are more vulnerable to emergencies, lacking the necessary resources to navigate through difficult times. The impact on generational wealth is profound, limiting the ability to pass on assets and opportunities to future generations. Additionally, inadequate savings can hinder economic mobility, making it difficult to break free from the cycle of poverty and low-income jobs.

To combat the consequences of insufficient savings, individuals and families must prioritize savings and financial planning. This includes building emergency funds, saving for education and healthcare expenses, and creating a solid retirement plan. Seeking financial advice and utilizing resources for financial literacy can help individuals make informed decisions and improve their financial well-being.

Governments, communities, and institutions also have a role to play in creating an environment that supports savings and fosters economic security. This includes providing accessible education, affordable healthcare, and policies that promote financial stability and upward mobility.

By prioritizing savings and financial planning, individuals can improve their financial well-being, create opportunities for themselves and future generations, and contribute to a more equitable society. It is never too late to start saving and take control of one’s financial future. With dedication and discipline, individuals can build a solid foundation for a more secure and prosperous life.