Home>Finance>When Are LTC Premiums Deductible For An Employer?

Finance

When Are LTC Premiums Deductible For An Employer?

Published: December 19, 2023

Learn when long-term care (LTC) premiums are deductible for employers and the potential financial benefits it can provide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Long-Term Care (LTC) is a vital aspect of financial planning, especially as individuals age and face potential health issues. LTC refers to the assistance and support provided to individuals who are unable to perform daily activities due to physical or mental impairments. The cost of long-term care services can be substantial, putting a strain on both individuals and their families.

One way to offset the financial burden of LTC is by securing a long-term care insurance policy. These policies help cover the expenses associated with LTC, including assistance with activities such as bathing, dressing, and eating. In many cases, employers offer LTC coverage as part of their employee benefits package, recognizing the importance of providing support and assistance to their workforce.

For employers who choose to offer LTC insurance to their employees, there may be potential tax benefits associated with the premiums paid. However, it’s crucial to understand the rules and regulations surrounding the deductibility of LTC premiums for employers.

This article aims to provide a comprehensive overview of when LTC premiums are deductible for employers. We will explore the requirements for deductible premiums, the tax treatment for employer-paid premiums, and the limits on deductions. Additionally, we will discuss the tax implications for employees when employer-paid premiums are provided.

Understanding the deductibility of LTC premiums can help employers make informed decisions about offering LTC insurance as part of their employee benefits package. It can also assist employees in understanding the potential tax implications when receiving employer-paid premiums for LTC coverage. Let’s delve into the details.

Understanding Long-Term Care (LTC) Premiums

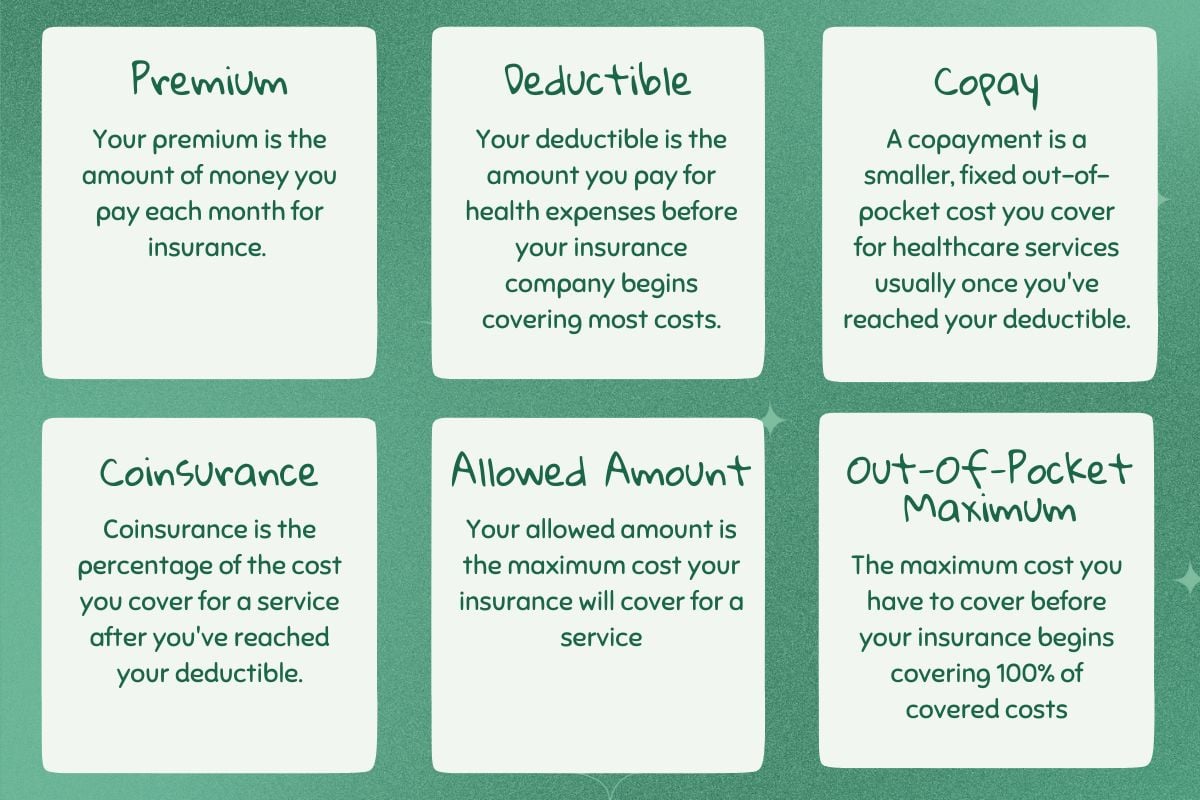

Long-Term Care (LTC) premiums are the regular payments made by individuals or employers to secure LTC insurance coverage. LTC insurance provides financial assistance for the costs associated with long-term care services, such as nursing home care, assisted living facilities, and in-home care. It is designed to help individuals cover the expenses when they are no longer able to perform daily activities independently due to illness, disability, or aging.

These premiums can be paid by individuals as private insurance or offered as an employee benefit by employers. By acquiring LTC insurance, individuals and their families can have peace of mind knowing that they have financial support in the event of needing long-term care services in the future.

LTC premiums are typically based on several factors, including the age and health of the insured individuals, the amount and duration of coverage desired, and any additional riders or features included in the policy. The premiums can vary significantly between insurance providers, so it is essential to carefully research and compare different options before making a decision.

For employers, offering LTC insurance as part of their employee benefits package can be seen as a valuable perk that attracts and retains talent. It demonstrates a commitment to employee well-being and provides an extra layer of financial security for employees and their families.

When considering LTC premiums, it is important to keep in mind that the cost of long-term care services can be substantial. Without insurance coverage, individuals may have to rely on personal savings or government programs to finance their care. By paying LTC premiums, individuals or employers mitigate the financial risks associated with high long-term care costs and ensure that appropriate care and support are available when needed.

Employer Deductibility of LTC Premiums

Employers who provide long-term care (LTC) insurance coverage to their employees may be eligible to deduct the premiums they pay as a business expense. However, there are specific requirements that must be met for LTC premiums to be considered deductible by employers.

Firstly, the LTC insurance policy must be established under a plan that benefits employees, their spouses, dependents, and retired employees. The coverage must not discriminate in favor of highly compensated employees. In other words, the plan must be offered to a broad range of employees, regardless of their income level.

Secondly, the deductions for LTC premiums are subject to limitations based on the age of the insured individuals. The maximum deductible amount increases as the age of the insured individual increases, reflecting the higher cost of LTC coverage for older individuals. It is important for employers to consult the IRS guidelines and tables to determine the maximum deductible amounts based on the age of their employees.

Thirdly, the total amount of premiums paid for LTC insurance, including any employer-paid premiums, cannot exceed the eligible LTC premium amounts set by the IRS. These eligible premium amounts vary depending on the age range of the insured individuals and are adjusted annually for inflation. Employers need to ensure that they do not exceed these maximum eligible amounts when deducting LTC premiums.

Furthermore, employers must properly report the deductible LTC premiums on their tax returns. This typically involves completing Form 1040, Schedule C for sole proprietors, Form 1120 for corporations, or Form 1065 for partnerships. Consultation with a tax professional or accountant is recommended to ensure accurate reporting.

It is important to note that self-employed individuals may also be eligible to deduct LTC premiums for coverage purchased outside of an employer-sponsored plan. However, different rules and limitations may apply in these situations. Consulting with a tax professional is essential to determine the specific deductibility of LTC premiums for self-employed individuals.

By understanding and adhering to the requirements for deductibility, employers can seize the opportunity to provide valuable LTC insurance coverage to their employees while benefiting from the potential tax advantages associated with the premiums paid.

Requirements for Deductible Premiums

In order for long-term care (LTC) premiums to be considered deductible for employers, certain requirements must be met. These requirements ensure that the coverage and premiums meet the necessary criteria for tax deduction purposes.

Firstly, the LTC insurance plan under which the premiums are paid must be considered a qualified plan. A qualified LTC plan is one that provides coverage for necessary diagnostic, preventive, therapeutic, and rehabilitative services related to an insured individual’s long-term care needs. The plan may also include coverage for personal care services and other support services necessary for an individual’s daily living activities.

Additionally, the LTC insurance plan must satisfy IRS regulations for non-discrimination. This means that the plan must be available to all employees, as well as their spouses, dependents, and retired employees, without discriminating in favor of highly compensated individuals. The non-discrimination rule ensures that the employee benefits are offered fairly and equally to all eligible individuals.

Another requirement for deductible LTC premiums is that the premiums must be paid on behalf of eligible individuals. Eligible individuals typically include employees, their spouses, dependents, and retired employees. It is important to note that premiums paid for LTC coverage for business owners and their spouses may be subject to different rules. Consulting with a tax professional or accountant can provide clarification regarding the eligibility of premiums for business owners.

Furthermore, the amount of premiums paid by the employer must not exceed the maximum eligible premium amounts determined by the IRS. These maximum eligible premium amounts are based on the age of the insured individuals and are adjusted annually for inflation. Employers should consult the IRS guidelines and tables to determine the specific eligible premium amounts based on the age of their employees.

Lastly, employers must ensure that the LTC insurance coverage is provided under a written plan, and the necessary documents and records are maintained. This includes documentation of the plan terms, employee participation, premium payments, and any other relevant information. Having proper records in place ensures compliance with IRS regulations and facilitates accurate reporting of deductible premiums.

By meeting these requirements, employers can ensure that the LTC premiums they pay are eligible for tax deductions, providing them with potential cost savings while offering valuable coverage to their employees.

Tax Treatment for Employer-Paid Premiums

When it comes to employer-paid long-term care (LTC) insurance premiums, the tax treatment differs for both the employer and the employee. Understanding the tax implications is crucial for both parties involved.

For employers, the premiums they pay for LTC insurance coverage are generally tax-deductible as a business expense. This means that the amount they spend on LTC premiums can be subtracted from the company’s taxable income, reducing their overall tax liability. However, there are certain rules and limitations that must be followed for the premiums to be considered deductible. These requirements include offering the coverage to a broad range of employees without discrimination and adhering to the maximum eligible premium amounts determined by the IRS.

It’s important for employers to consult with a tax professional or accountant to ensure accurate reporting and compliance with tax regulations regarding deductions for LTC premiums.

For employees, the tax treatment of employer-paid LTC premiums depends on whether the coverage is provided under a qualified LTC plan or a non-qualified plan.

If the LTC coverage is provided under a qualified plan, the employer-paid premiums are generally excluded from the employee’s taxable income. This means that employees do not have to pay tax on the value of the LTC insurance premiums paid by their employer. In essence, the premium amounts are treated as a tax-free fringe benefit. This tax exclusion provides financial relief for employees as they do not have to include the value of the premiums in their taxable income.

On the other hand, if the LTC coverage is provided under a non-qualified plan, the employer-paid premiums are considered taxable income for employees. In this case, the value of the premiums is added to the employee’s taxable income and subject to income tax. The taxable amount is typically reported on the employee’s Form W-2.

It’s important for employees to review their tax forms and consult with a tax professional to ensure accurate reporting of employer-paid LTC premiums under either a qualified or non-qualified plan.

Understanding the tax treatment for employer-paid LTC premiums is essential for both employers and employees. Employers can benefit from deductible expenses, reducing their tax burden, while employees can potentially enjoy tax-free LTC coverage or be aware of any taxable income associated with non-qualified plans. Consultation with a tax professional can provide clarity on the specific tax treatment for employer-paid LTC premiums in each individual’s situation.

Employee Taxability of Employer-Paid Premiums

When it comes to employer-paid long-term care (LTC) insurance premiums, the taxability for employees depends on whether the coverage is provided under a qualified or non-qualified plan.

Under a qualified plan, if an employer pays LTC premiums on behalf of employees, the premiums are generally excluded from the employee’s taxable income. This means that employees do not have to pay income tax on the value of the LTC insurance premiums paid by their employer. The exclusion of these premiums from taxable income provides a significant tax advantage for employees, as it effectively reduces their overall tax liability.

It’s important for employees to understand that while these premiums are excluded from income tax, they may still be subject to Social Security and Medicare taxes. For Social Security and Medicare tax purposes, employer-paid LTC premiums are generally treated as wages and are subject to the applicable payroll taxes.

On the other hand, if the LTC coverage is provided under a non-qualified plan, the employer-paid premiums are considered taxable income for employees. In this situation, the value of the LTC premiums is added to the employee’s taxable income and is subject to federal, state, and local income taxes. The taxable amount is typically reported on the employee’s Form W-2 and must be included on their annual tax return.

It’s crucial for employees to review their tax forms, such as the Form W-2, and consult with a tax professional to ensure accurate reporting of any taxable employer-paid LTC premiums under a non-qualified plan.

It’s worth noting that if employees receive taxable employer-paid LTC premiums, they may be able to deduct those premiums as a medical expense on their personal income tax return, provided they meet certain criteria. Deductibility of LTC premiums as a medical expense is subject to the limitations set by the Internal Revenue Service (IRS) for medical expense deductions.

Employees should consult a tax professional to understand the specific tax implications, deductions, and reporting requirements related to employer-paid LTC premiums in their individual circumstances.

Understanding the taxability of employer-paid LTC premiums is essential for employees in order to accurately report their income and taxes. By being aware of the tax treatment, individuals can better plan and manage their tax liabilities related to LTC coverage provided by their employer.

Limits on Deductions for LTC Premiums

While employers can generally deduct long-term care (LTC) insurance premiums as a business expense, there are limits to the amount that can be deducted. These limits are determined by the age of the insured individuals and are adjusted annually for inflation.

The Internal Revenue Service (IRS) sets maximum eligible premium amounts based on age ranges. As individuals get older, the cost of LTC coverage typically increases, and therefore, the deductible amounts increase as well. The IRS provides tables to determine the maximum eligible premium amounts for each age range.

It’s important for employers to consult these tables to determine the specific deductible amounts based on the ages of their employees. Deducting premiums above the maximum eligible amounts can result in disallowed deductions and potential tax penalties.

Furthermore, the total amount of LTC premiums paid for each employee, including both employer and employee-paid premiums, cannot exceed the eligible premium amounts set by the IRS. If the total premiums paid exceed the eligible amounts, only a portion of the premiums can be deducted, up to the maximum eligible limits.

Employers should also be aware that the maximum eligible premium amounts differentiate between individual coverage and family coverage. For family coverage, the eligible amounts are generally higher to account for the additional individuals covered under the policy.

It’s crucial for employers to accurately track and document the LTC premiums they pay on behalf of employees to ensure compliance with the maximum eligible premium limits. Proper record-keeping facilitates accurate tax reporting, reduces the risk of incorrect deductions, and helps avoid potential IRS audits.

Additionally, employers should be mindful of any state-specific limitations or regulations regarding the deductibility of LTC premiums. Different states may impose their own rules and restrictions, so it’s important to stay informed about state tax laws related to LTC insurance deductions.

Consulting with a tax professional or accountant is highly recommended to ensure compliance with the limits on deductions for LTC premiums. They can provide guidance on accurately calculating and reporting deductible premiums based on the IRS guidelines and any state-specific regulations.

Understanding and adhering to the limits on deductions for LTC premiums allows employers to appropriately determine their deductible expenses while ensuring compliance with tax laws and regulations.

Reporting LTC Premiums on Tax Forms

Proper reporting of long-term care (LTC) premiums on tax forms is essential for employers to accurately claim deductions and for employees to report any taxable income associated with employer-paid LTC premiums. Understanding the reporting requirements ensures compliance with tax regulations and facilitates smooth tax filing processes.

Employers who pay LTC premiums on behalf of their employees need to accurately report these premiums on their tax returns. The specific tax form to use depends on the business structure. For example, sole proprietors generally report business expenses on Schedule C of Form 1040, while corporations use Form 1120, and partnerships use Form 1065.

On the appropriate tax form, employers should report the total amount of LTC premiums they paid during the tax year as a deductible business expense. This amount should match the premiums paid for qualifying employees, their spouses, dependents, and retired employees. Employers should keep detailed records of premium payments, employee participation, and any relevant documentation to support the deduction claim.

In addition to reporting on tax forms, employers are also required to provide employees with Form W-2, which summarizes their total compensation, including any taxable employer-paid LTC premiums. The value of the premiums paid by the employer should be reported in Box 12 of the Form W-2 using the appropriate code. The taxable amount is subject to federal, state, and local income taxes.

Employees receiving employer-paid LTC premiums must report any taxable amounts accurately on their personal tax returns. They should include the value of the premiums as part of their taxable income, typically in the “Other Income” section of the tax form, such as Form 1040.

It’s essential for employees to review their tax forms, such as the Form W-2, to ensure that the reported employer-paid premiums are accurately included in their taxable income. Any discrepancies should be addressed with the employer or a tax professional.

Both employers and employees should consult with a tax professional or accountant to ensure accurate reporting of LTC premiums on tax forms. Professionals can provide guidance in complying with tax regulations, determining deductible amounts, and reporting any taxable income associated with employer-paid premiums.

By accurately reporting LTC premiums on tax forms, employers can effectively claim deductions, and employees can fulfill their tax obligations, ensuring compliance with tax laws and regulations.

Conclusion

Long-term care (LTC) insurance coverage is a valuable component of financial planning, providing individuals with financial protection against the high costs associated with long-term care services. Employers who offer LTC insurance as part of their employee benefits package can provide a significant advantage to their workforce while potentially benefiting from tax deductions.

Understanding the deductibility of LTC premiums for employers is key to taking full advantage of the tax benefits associated with providing this coverage. Employers must ensure that the LTC insurance plan meets certain criteria, such as non-discrimination in favor of highly compensated employees, and adheres to the limits on maximum eligible premium amounts set by the Internal Revenue Service (IRS).

Employees should be aware of the tax implications associated with employer-paid LTC premiums. Depending on whether the coverage is provided under a qualified or non-qualified plan, the premiums may be excluded from taxable income or subject to income tax. Clear reporting and accurate inclusion of taxable amounts in personal tax returns are crucial for employees.

Proper record-keeping and documentation of LTC premiums paid and a comprehensive understanding of the reporting requirements on tax forms are vital for employers. Accurate reporting ensures compliance with tax regulations and facilitates smooth tax filing processes.

Consulting with a tax professional or accountant is highly recommended for both employers and employees. They can provide guidance tailored to specific situations, ensuring compliance, and optimizing tax benefits.

By navigating the intricacies of LTC premiums deductibility and proper reporting, employers can provide valuable LTC coverage to employees while potentially enjoying tax advantages. Employees can benefit from employer-paid premiums and accurately fulfill their tax responsibilities.

In conclusion, understanding the deductibility and tax treatment of LTC premiums is crucial for both employers and employees. Proper compliance and accurate reporting contribute to the smooth functioning of LTC insurance programs and ensure that individuals receive the financial support they need for long-term care services while optimizing potential tax benefits.