Finance

When Do Crude Futures Contracts Roll

Published: December 24, 2023

Learn about the process of rolling crude futures contracts in the finance industry. Discover when and how this crucial transition occurs to navigate the world of commodity trading with confidence.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

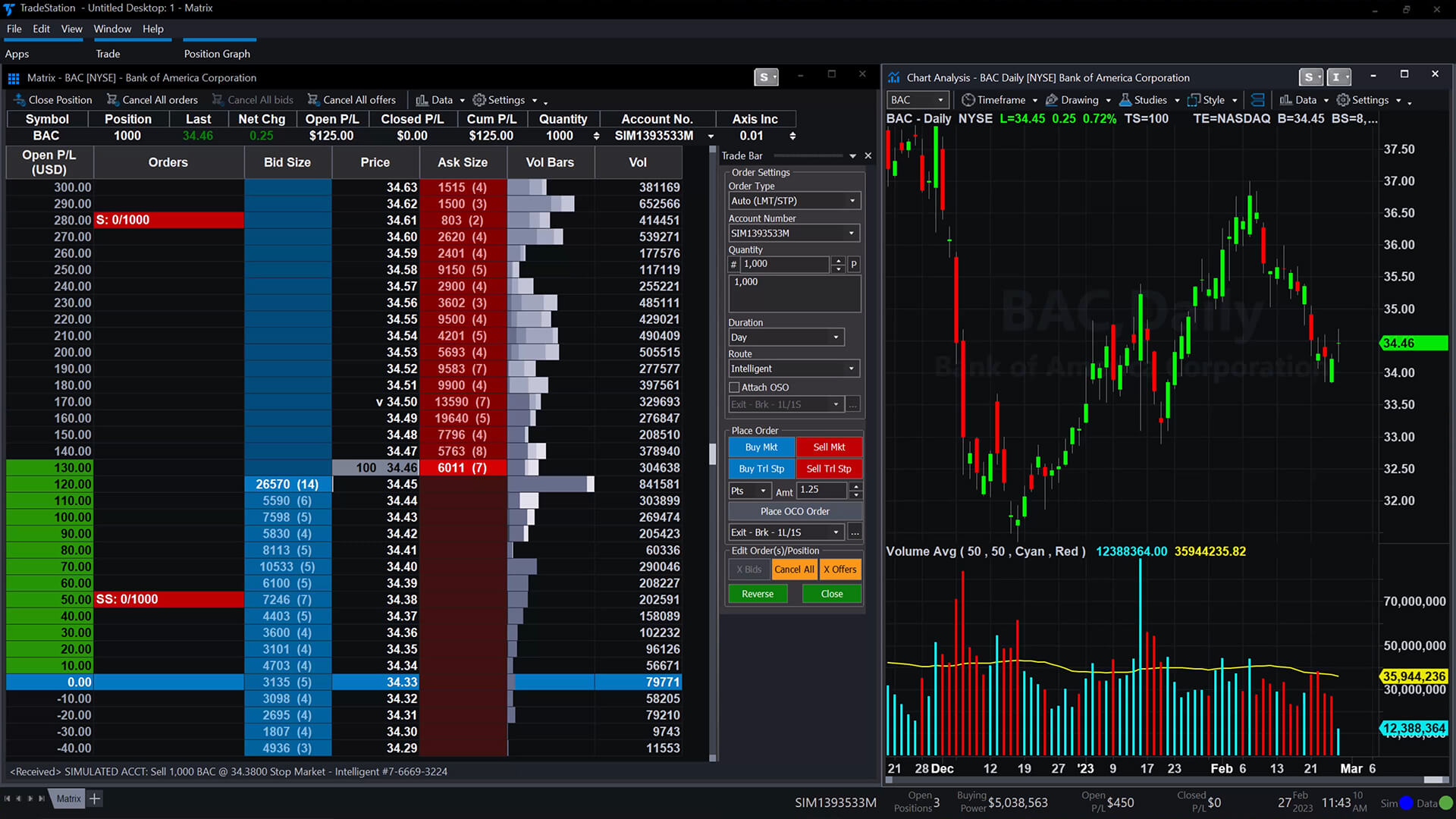

Crude oil is one of the most important commodities in the global economy, serving as a crucial source of energy for various industries. As a result, the trading of crude oil futures contracts has become an essential component of the financial markets. Futures contracts allow investors to speculate on the price of crude oil and hedge against potential price fluctuations.

When trading crude oil futures, it is important to understand the concept of contract expiration and settlement. Crude futures contracts have a specified expiration date, beyond which they are no longer tradable. Traders need to be aware of the timing of contract expiration and the process of rolling over their positions to a new contract.

In this article, we will explore the ins and outs of crude futures contracts rollover, including the factors that influence the timing of the rollover, trading strategies during the rollover period, and the overall significance of this process in the crude oil trading market.

Understanding Crude Futures Contracts

Before diving into the details of crude futures contracts rollover, it is essential to have a solid understanding of what these contracts are. Crude futures contracts are standardized agreements to buy or sell a specific quantity of crude oil at a predetermined price and date in the future.

These contracts are traded on various commodity exchanges, such as the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE). Each contract represents a specific amount of crude oil, typically measured in barrels. The price of the contract is determined by supply and demand dynamics, as well as other market factors.

As with any futures contract, crude oil futures have an expiration date. This date marks the end of the contract’s validity, after which it can no longer be traded. Traders who wish to maintain their crude oil exposure beyond the expiration date need to rollover their positions to a new contract.

It’s important to note that the expiration date of a crude futures contract does not dictate when the actual physical delivery of the oil will occur. In fact, the majority of futures contracts are settled in cash rather than through physical delivery. While physical delivery is possible, it is not the primary goal for most traders in the futures market.

Crude futures contracts serve two main purposes for market participants. Firstly, they allow producers and consumers of crude oil to manage their price risk. For example, an oil producer can sell futures contracts to lock in a price for their future production, thereby protecting themselves against a potential drop in oil prices. On the other hand, a consumer, such as an airline or a shipping company, can buy futures contracts to protect themselves against a significant increase in oil prices.

Secondly, crude oil futures contracts attract speculators who aim to profit from price movements. These speculators include hedge funds, commodity trading advisors, and individual retail traders. By taking positions in futures contracts, they can benefit from both rising and falling crude oil prices.

Now that we have a solid understanding of what crude futures contracts are, let’s explore the concept of contract expiration and settlement.

Contract Expiration and Settlement

Contract expiration and settlement are fundamental concepts in the world of futures trading. The expiration date of a crude oil futures contract is the date on which it officially terminates. After this date, the contract can no longer be traded.

It’s important to note that the expiration date of a futures contract does not mean that physical delivery of the underlying asset, in this case, crude oil, has to take place. In fact, the majority of futures contracts are cash-settled, meaning that the final settlement is done in cash equivalent to the difference between the contract price and the market price of crude oil at expiration.

For example, let’s say an investor holds a long (buy) position in a crude oil futures contract. As the contract approaches expiration, the investor must decide whether to close out the position or roll it over to the next contract. If the investor chooses to close out the position, they will receive or pay the cash settlement amount on the expiration date.

On the other hand, if the investor decides to roll over the position, they will sell the expiring contract and simultaneously initiate a new position in the next available contract with a later expiration date. This rollover process allows traders to maintain their exposure to crude oil without physically taking delivery of the commodity.

The settlement price of a crude oil futures contract is determined based on the prevailing market price at a specific point in time on the expiration date. This price is usually calculated based on the average of trades executed during a specified period leading up to the expiration.

It’s important for traders to be aware of the settlement process and understand the potential impact it can have on their positions. The settlement price can significantly affect the profitability or loss on a futures trade, especially for those who have not rolled over their positions before expiration.

Now that we have a clear understanding of contract expiration and settlement, let’s explore how the rollover process works in crude futures trading.

Roll Over Process

The rollover process in crude oil futures trading refers to the action of closing out an expiring contract and simultaneously entering into a new contract with a later expiration date. This process allows traders to maintain their crude oil exposure without letting their positions expire.

As the expiration date of a futures contract approaches, market participants must decide whether to roll over their positions or close them out. Rollover involves selling the expiring contract and simultaneously buying a new contract with a later expiration date.

The rollover process is crucial because it allows traders to avoid the risk of physical delivery of the underlying commodity. Most traders in the futures market are not interested in taking delivery of the physical crude oil; their primary focus is on profiting from price movements.

When the rollover process occurs, traders need to carefully consider several factors. These factors include the liquidity and volume of the new contract, the cost of rolling over positions, and any potential market impact from the process itself.

One common method of rolling over positions is to execute a simultaneously offsetting buy and sell transaction. This involves selling the current expiring futures contract and simultaneously purchasing the next contract with an extended expiration date.

Another method that traders use is known as the calendar spread strategy. In this approach, traders simultaneously buy and sell contracts with different expiration dates. For example, a trader may sell the front-month contract and buy the next month’s contract at the same time. By doing so, they create a spread position that reflects the price difference between the two contracts.

Traders need to be aware of the potential costs associated with rolling over positions. These costs can include brokerage fees, bid-ask spreads, and any commissions involved. It’s essential to factor in these costs when considering the profitability of the rollover process.

Timing is also critical when it comes to rolling over positions. Traders need to assess the market conditions and choose an appropriate time to execute the rollover. This decision is influenced by factors such as market liquidity, volatility, and any relevant economic or geopolitical events that may impact crude oil prices.

By understanding the rollover process and carefully managing their positions, traders can effectively navigate the expiration and settlement of crude oil futures contracts while maintaining their market exposure.

Factors Influencing Rollover Timing

The timing of rolling over positions in crude oil futures contracts is influenced by a variety of factors. Traders need to assess these factors to determine the optimal timing for executing the rollover. Understanding these influences can help traders make informed decisions and minimize potential risks.

One of the key factors that influence rollover timing is the liquidity and trading volume of the new contract. It is important to choose a contract with sufficient liquidity to ensure smooth execution of the rollover process. Contracts with higher trading volume generally offer tighter bid-ask spreads, reducing the impact of transaction costs. Traders should keep an eye on the trading activity and liquidity of the new contract before initiating the rollover.

Market volatility is another crucial factor that affects rollover timing. Higher volatility can lead to larger price swings, making it more challenging to execute the rollover at the desired price. Traders may prefer to wait for periods of relative stability or lower volatility to minimize the potential risk associated with the rollover process.

Economic factors and geopolitical events can also influence rollover timing. Important economic indicators, such as inventory reports, GDP data, or interest rate decisions, can significantly impact crude oil prices. Similarly, geopolitical events like political tensions or conflicts in major oil-producing regions can cause price fluctuations. Traders should carefully consider these factors and their potential impact on crude oil prices before deciding on the timing of the rollover.

The roll yield, also known as the cost of carry, is an additional factor to consider. The roll yield refers to the potential gain or loss associated with rolling over positions from one contract to another. It is determined by the price difference between the expiring contract and the new contract. Traders may aim to roll over when the roll yield is favorable, meaning that the price of the new contract is lower than the expiring contract, allowing them to potentially profit from the roll yield.

Furthermore, market sentiment and investor positioning can influence rollover timing. Traders need to analyze market trends, sentiment indicators, and the positioning of other market participants to gauge market sentiment accurately. This information can help traders anticipate potential price movements and make informed decisions regarding the timing of the rollover.

Lastly, traders should consider their individual risk tolerance and specific trading strategies. Some traders may prefer to roll over positions closer to the expiration date for short-term trading strategies, while others may opt to initiate the rollover earlier to minimize potential risks and ensure a smooth transition to the new contract.

By analyzing these various factors and considering their interplay, traders can determine the optimal timing for rolling over positions in crude oil futures contracts, maximizing their trading opportunities while minimizing potential risks.

Trading Strategies during Rollover Period

The rollover period in crude oil futures contracts can present unique trading opportunities for market participants. Traders can employ various strategies to take advantage of price movements and optimize their positions during this transitional period. Here are some commonly utilized trading strategies during the rollover period:

- Spread Trading: Spread trading involves simultaneously buying and selling contracts with different expiration dates. By creating a spread position, traders aim to profit from the price difference between the two contracts. For example, a trader may sell the expiring front-month contract and buy the next month’s contract. This strategy allows traders to capture any price discrepancies between the two contracts during the rollover period.

- Calendar Spread Strategy: This strategy focuses on taking positions in contracts with different expiration dates. Traders establish a spread position by simultaneously buying and selling contracts in different months. This strategy aims to capitalize on the price difference between the two contracts as they approach expiration, allowing traders to profit from the convergence or divergence of prices.

- Volatility Trading: During the rollover period, volatility in crude oil prices can increase due to market uncertainties and changing positions of market participants. Traders can take advantage of this volatility by employing volatility trading strategies, such as straddles or strangles. These strategies involve simultaneously buying both call and put options with the same expiration date, allowing traders to profit from significant price swings in either direction.

- Technical Analysis: Technical analysis involves analyzing historical price patterns, trends, and chart indicators to identify potential trading opportunities. Traders can use technical analysis tools, such as moving averages, trendlines, and oscillators, to determine entry and exit points during the rollover period. This strategy helps traders make informed decisions based on price action and market sentiment.

- Fundamental Analysis: Fundamental analysis involves analyzing economic data, geopolitical events, and supply-demand factors that can influence crude oil prices. Traders can monitor important factors, such as inventory reports, production levels, and global oil demand, to make trading decisions during the rollover period. This strategy helps traders assess the underlying fundamentals that can drive price movements.

It is important for traders to consider their risk tolerance, trading style, and market conditions when selecting a trading strategy during the rollover period. Each strategy carries its own advantages and risks, and traders should conduct thorough analysis and backtesting to ensure its suitability.

Moreover, risk management is crucial during the rollover period. Traders should set stop-loss orders, establish profit targets, and closely monitor their positions to protect themselves from potential adverse price movements or unexpected events.

By employing appropriate trading strategies during the rollover period, traders can seize opportunities for profit and effectively manage their positions in crude oil futures contracts.

Conclusion

Rollover timing in crude oil futures contracts is a critical aspect of trading in the commodity markets. Understanding the rollover process and the factors that influence the timing is essential for traders to effectively manage their positions and optimize their trading strategies.

Crude oil futures contracts allow market participants to manage price risk and speculate on price movements without physical delivery of the underlying commodity. As contracts approach their expiration dates, traders must decide whether to roll over their positions to the next contract or close them out.

Factors such as liquidity and trading volume of the new contract, market volatility, economic indicators, geopolitical events, roll yield, and market sentiment all play a role in determining the optimal timing for rolling over positions. Traders need to carefully analyze these factors to make informed decisions.

During the rollover period, traders can employ various strategies, including spread trading, calendar spread strategies, volatility trading, technical analysis, and fundamental analysis. Each strategy offers its own unique advantages and risks, and traders should select the approach that aligns with their risk tolerance and trading style.

Effective risk management is crucial during the rollover period. Traders should utilize stop-loss orders, establish profit targets, and closely monitor their positions to mitigate potential risks and protect their capital.

In conclusion, navigating the rollover period in crude oil futures contracts requires a thorough understanding of the process, careful analysis of market factors, and effective trading strategies. By incorporating these elements into their trading approach, traders can seize opportunities, manage their risk, and optimize their trading performance in the dynamic world of crude oil futures trading.