Home>Finance>When Do Oil Futures Contracts Expire This Month?

Finance

When Do Oil Futures Contracts Expire This Month?

Published: December 24, 2023

Stay updated on oil futures contracts expiration dates this month with our finance-focused guide. Discover when to expect contract expirations and plan your trading strategy accordingly.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of oil futures contracts! If you’re new to the world of finance or simply curious about how the oil market works, you’ve come to the right place. Oil futures contracts are an essential component of the global economy, providing a mechanism for buyers and sellers to hedge against price fluctuations and ensure a stable supply of oil.

Understanding oil futures contracts can be a bit daunting at first, but fear not! In this article, we’ll break down the key concepts and dive into the fascinating world of expiration dates for these contracts. So, let’s get started!

An oil futures contract is a legally binding agreement between a buyer and a seller to exchange a specific quantity of crude oil at a predetermined price and at a future date. These contracts are traded on various exchanges, such as the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE).

Now, you might be wondering why we’re specifically discussing the expiration dates of oil futures contracts. Well, the expiration date is a critical aspect of these contracts. It signifies the date by which the buyer must either take physical delivery of the oil or offset their position by entering into an opposite transaction.

Next, we’ll explore the expiration dates of oil futures contracts in detail, including how they are determined, what happens when a contract approaches its expiration, and the specific expiration dates for the current month.

So buckle up as we journey into the world of oil futures contract expiration dates, where the flow of oil and money intertwines with the dynamics of time and market forces.

Understanding Oil Futures Contracts

Before we delve into the intricacies of expiration dates for oil futures contracts, let’s first establish a solid foundation of understanding. Oil futures contracts, as mentioned earlier, are agreements to buy or sell a specific quantity of crude oil at a predetermined price and at a future date.

These contracts serve several important purposes. First, they allow producers, such as oil companies, to lock in prices for their future production, protecting themselves against potential price declines. This provides them with the certainty they need to plan their operations and manage their finances.

On the other side of the equation, oil consumers, such as airlines or manufacturing companies, utilize futures contracts to hedge against the risk of rising oil prices. By entering into a contract, they can secure a predetermined price for future oil purchases, shielding themselves from potential price volatility in the market.

Most oil futures contracts are standardized, meaning they have predetermined quantity and quality specifications. For example, the most actively traded oil futures contracts, such as the West Texas Intermediate (WTI) crude oil contract, typically represent 1,000 barrels of oil.

When a futures contract is first established, there is no exchange of physical oil. Instead, it is a financial transaction between the buyer and the seller. As the contract approaches its expiration date, however, the buyer has two options: either take delivery of the physical oil or offset their position by selling the contract to another market participant.

It’s important to note that the majority of oil futures contracts are closed out before their expiration dates. In fact, only a small percentage of contracts result in physical delivery. Instead, most market participants choose to offset their positions by entering into an opposite transaction, effectively canceling out their obligations.

Now that we have a solid understanding of the basics of oil futures contracts, let’s move on to exploring the crucial aspect of expiration dates. By understanding how these dates are determined and their implications, we can gain valuable insights into the dynamics of the oil market.

Expiration Dates of Oil Futures Contracts

The expiration date of an oil futures contract is the date on which the contract comes to an end, and the buyer must either take delivery of the physical oil or offset their position. These dates are predetermined and vary depending on the specific contract.

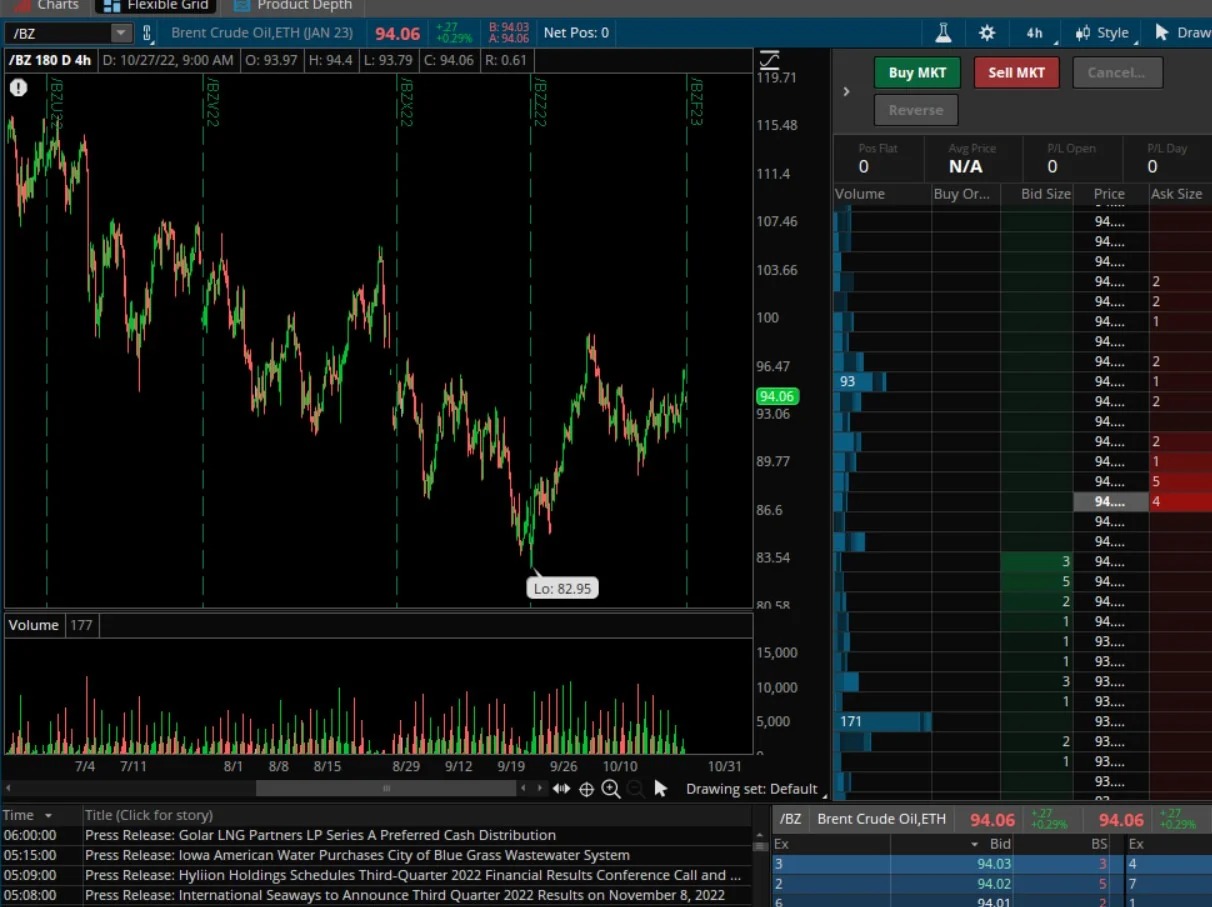

For most oil futures contracts, the expiration date falls on the third Friday of the contract’s designated delivery month. This is true for contracts traded on exchanges like NYMEX and ICE. However, it’s essential to note that not all contracts follow this rule, and different exchanges may have slightly different expiration date conventions.

For example, the WTI crude oil futures contract on the NYMEX typically expires on the trading day preceding the 25th calendar day of the month preceding the delivery month. In simpler terms, the expiration date for the WTI contract is usually in the month before the actual delivery month.

It’s crucial to be aware of the specific expiration date conventions for the oil futures contracts you are trading or monitoring. Market participants must stay informed and be mindful of these dates to ensure they manage their positions effectively.

Now that we understand how expiration dates are determined let’s dive into the expiration dates for the current month. Knowing these dates can provide valuable insights into the market dynamics and help traders and investors make informed decisions.

Expiration Dates in the Current Month

Keeping track of expiration dates for oil futures contracts is crucial for market participants, as it allows them to stay ahead of trading decisions and effectively manage their positions. Let’s take a look at the expiration dates for oil futures contracts in the current month.

It’s important to note that expiration dates can vary for different oil futures contracts and exchanges. Therefore, it’s essential to consult the specific contract specifications and exchange information to get accurate and up-to-date expiration dates.

For example, let’s consider the WTI crude oil futures contract traded on the NYMEX. As mentioned earlier, the expiration date for this contract is typically on the trading day preceding the 25th calendar day of the month preceding the delivery month. So, if we are currently in the month of September, the expiration date for the WTI crude oil futures contract would likely fall in August.

To find out the exact expiration dates for the current month, it’s best to refer to the exchange’s website or consult a reliable financial data provider. These sources will provide you with the specific expiration dates and other important contract details to ensure accuracy in your trading decisions.

By staying informed about expiration dates, you can strategically plan your trades and take appropriate actions, whether it’s rolling over your position to the next contract or closing out your position before expiration.

As expiration dates approach, it’s also important to be mindful of the potential impact on market volatility. Traders often actively adjust their positions, which can lead to increased price fluctuations as the expiration date draws nearer. Being aware of this dynamic can help you navigate the market more effectively.

Remember, expiration dates are a key component of the oil futures market, and understanding their implications can help you make informed decisions and manage your positions more effectively.

Factors Influencing Oil Futures Contract Expiration

When it comes to the expiration of oil futures contracts, several factors come into play, influencing market dynamics and participants’ decision-making processes. Let’s explore some of the key factors that can impact the expiration of these contracts.

1. Supply and demand dynamics: The balance between oil supply and demand is a crucial factor influencing the expiration of oil futures contracts. Investors and traders closely monitor global oil production levels, geopolitical events, and economic indicators to gauge the supply-demand outlook. Significant shifts in supply or demand can affect the decision to roll over or close out positions before expiration.

2. Market sentiment and investor behavior: Sentiment in the market plays a significant role in determining the expiration of oil futures contracts. Investor sentiment, influenced by factors such as economic indicators, political events, and market speculation, can impact trading decisions. If market sentiment is bearish, participants may choose to close out positions before expiration, leading to increased volatility.

3. Price movements and volatility: Fluctuations in oil prices and market volatility can influence the decision-making process for expiration of oil futures contracts. Traders and investors closely monitor price trends and volatility levels to make informed decisions about rolling over positions or closing them out before expiration. High volatility may prompt traders to take profits or cut losses before the contract reaches its expiry date.

4. Regulatory requirements: Regulatory rules and requirements can also impact the expiration of oil futures contracts. Regulatory bodies may impose specific guidelines, such as position limits and reporting obligations, that participants must comply with. These requirements can influence trading decisions and the timing of closing out positions before contract expiration.

5. Market liquidity: Liquidity in the oil futures market can affect the expiration of contracts. If the market is illiquid or trading volumes are low, it may be more challenging to execute trades close to the expiration date. Traders may adjust their strategies or close out positions earlier, considering the liquidity conditions in the market.

6. Seasonal factors: Seasonal patterns can also impact the expiration of oil futures contracts. For example, there may be increased demand for heating oil contracts during the winter months, which could influence trading decisions and the timing of position closures before expiration.

It’s essential to understand that these factors are interconnected and can interact in complex ways. Market participants need to consider a combination of these factors to make informed decisions regarding the expiration of oil futures contracts.

By staying informed and monitoring these influencing factors, traders and investors can navigate the expiration process more effectively and adapt to changing market conditions.

Conclusion

Understanding the expiration dates of oil futures contracts is crucial for anyone involved in the oil market or interested in trading oil futures. While expiration dates can vary depending on the specific contract and exchange, they play a critical role in shaping market dynamics and participants’ decision-making processes.

By grasping the fundamentals of oil futures contracts and their expiration dates, traders and investors can effectively manage their positions and make informed trading decisions. It is essential to stay updated on the specific expiration dates for the contracts you are trading or monitoring, as well as the factors that can influence the expiration process.

The balance of supply and demand, market sentiment, price movements, regulatory requirements, market liquidity, and seasonal factors are just some of the key factors that impact the expiration of oil futures contracts. Recognizing and understanding these factors can provide valuable insights into the market and help traders navigate the expiration process more effectively.

Ultimately, expiration dates are a crucial aspect of the oil futures market, serving as a catalyst for decisions regarding physical delivery or position rollover. By staying informed, market participants can optimize their trading strategies and manage their risk exposure efficiently.

So, as you continue to explore the fascinating world of oil futures contracts, remember to pay attention to expiration dates, monitor the influencing factors, and leverage this knowledge to enhance your trading endeavors.

In conclusion, expiration dates are not merely arbitrary dates on the calendar; they are the culmination of contractual obligations and the intersection of market forces. Understanding their significance empowers traders to navigate the ever-changing landscape of the oil market with confidence and precision.