Finance

How To Roll Over Futures Contracts In NT7

Published: December 24, 2023

Learn how to roll over futures contracts in NT7 and stay updated with the latest finance trends.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Futures Contracts

- Importance of Rolling Over Futures Contracts

- Process of Rolling Over Futures Contracts

- Step 1: Reviewing Contract Expiration

- Step 2: Identifying the Next Contract Month

- Step 3: Analyzing Contract Liquidity

- Step 4: Initiating Rollover Process in NT7

- Step 5: Monitoring Rollover Progress

- Step 6: Completing Rollover of Futures Contracts

- Conclusion

Introduction

Welcome to the world of futures trading! If you’re new to this exciting investment arena, or even if you’ve been trading futures for a while, understanding the process of rolling over futures contracts is crucial. In this article, we will delve into the ins and outs of rolling over futures contracts in NT7 (NinjaTrader 7), a popular trading platform used by many traders.

Before we dive into the details, let’s take a moment to understand what futures contracts are. In simple terms, futures contracts are agreements to buy or sell a certain asset or commodity at a predetermined price and date in the future. These contracts enable traders to speculate on the price movement of various financial instruments, including stocks, commodities, and indices. Unlike traditional stock trading, where investors buy and sell shares of a company, futures trading involves trading the contracts themselves.

So, why is it necessary to roll over futures contracts? Well, futures contracts have expiration dates. Once a contract reaches its expiration date, it becomes invalid, and traders must roll over their positions to the next available contract. Rolling over contracts not only allows traders to continue their exposure to the underlying asset but also avoids the risk of physical delivery, which is a requirement in some futures contracts.

The process of rolling over futures contracts involves several steps, and NT7 provides a seamless and efficient platform to execute this task. In the next sections, we will explore the step-by-step process of rolling over futures contracts in NT7, enabling you to confidently navigate this crucial aspect of futures trading.

Whether you’re a seasoned trader or just starting out, understanding the intricacies of rolling over futures contracts is essential for maximizing your success in the futures market. So, without further ado, let’s dive into the world of rolling over futures contracts in NT7!

Understanding Futures Contracts

Before we dive into the process of rolling over futures contracts, let’s take a closer look at what futures contracts are and how they function in the market. Futures contracts are financial agreements that enable traders to speculate on the price movement of various underlying assets. These assets can include commodities, such as oil, gold, or wheat, as well as financial instruments like stock indexes or Treasury bonds.

At its core, a futures contract is a standardized agreement between two parties to buy or sell an asset at a predetermined price on a specific future date. The key difference between futures contracts and other types of trading, such as spot trading, is that futures contracts have a fixed expiration date. This means that the contract has a specified timeframe within which it can be traded.

For example, let’s say you want to trade oil futures. You enter into a futures contract to buy a certain quantity of oil at a specific price, with a delivery date set in the future. As the contract approaches its expiration date, you have two options: either settle the contract by taking physical delivery of the oil or close the contract before expiration by entering into an offsetting trade. Most traders choose to close their positions before expiration rather than taking delivery.

One of the key advantages of futures contracts is their high level of leverage. With a relatively small margin requirement, traders are able to control a significantly larger position. This leverage enables traders to amplify their potential profits, but it also increases the risks involved. It’s crucial to have a solid understanding of the market and risk management strategies before engaging in futures trading.

Another important aspect of futures contracts is the concept of contract months. Each futures contract has different available months for trading, typically referred to as front-month, back-month, or distant-month contracts. As the expiration date of the front-month contract approaches, traders need to roll over their positions to the next available contract.

Now that we have a basic understanding of futures contracts, let’s explore the importance of rolling over these contracts and how it can affect traders’ positions in the market.

Importance of Rolling Over Futures Contracts

Rolling over futures contracts is a critical aspect of futures trading that ensures traders can maintain their exposure to the underlying asset beyond the expiration date of a contract. It is important to understand the significance of rolling over contracts and how it can impact trading positions.

One of the primary reasons for rolling over futures contracts is to avoid physical delivery. While some futures contracts do result in the physical delivery of the underlying asset, most traders prefer to close their positions before expiry rather than taking delivery. Rolling over contracts allows traders to seamlessly transition their positions to the next available contract month, eliminating the need for physical delivery and the associated costs and logistical challenges.

Moreover, rolling over futures contracts helps traders avoid potential disruption in their trading strategies. By transitioning from the expiring contract to a new one, traders can maintain their desired exposure to the market without any gaps or interruptions in their trading activities. This continuity is crucial for implementing and executing trading strategies effectively.

Another key benefit of rolling over futures contracts is the ability to capture changes in market sentiment and potentially improve trading outcomes. As contracts approach their expiration, market dynamics and investor sentiment can shift, potentially affecting the pricing and liquidity of the contract. By rolling over to a new contract, traders have the opportunity to adapt to these changing market conditions and optimize their trading strategies accordingly.

Furthermore, rolling over contracts allows traders to manage their risk exposure effectively. By continuously monitoring and adjusting positions, traders can adapt to market volatility and mitigate potential losses. Rolling over to the next contract month enables traders to maintain control over their positions and make informed decisions based on the evolving market conditions.

Finally, rolling over futures contracts promotes efficient capital utilization. Rather than tying up capital in expiring contracts, traders can allocate their resources to new opportunities by rolling over to fresh positions. This flexibility and efficient use of capital can enhance profitability and enable traders to take advantage of emerging trading opportunities.

In summary, rolling over futures contracts is crucial for traders to maintain continuity, avoid physical delivery, adapt to changing market conditions, manage risk exposure, and optimize capital usage. By understanding the importance of rolling over contracts, traders can navigate the futures market with confidence and maximize their trading potential.

Process of Rolling Over Futures Contracts

Now that we understand the importance of rolling over futures contracts, let’s explore the step-by-step process of executing this task in NT7:

Step 1: Reviewing Contract Expiration

The first step in the rollover process is to review the expiration date of your current futures contract. This information can typically be found in the contract specifications or on your trading platform. Take note of the expiration date to ensure you have enough time to initiate the rollover process.

Step 2: Identifying the Next Contract Month

Once you are aware of the impending expiration, identify the next available contract month for the same underlying asset. This information can also be found in the contract specifications or on your trading platform. Select the appropriate contract month based on your trading strategy and desired time horizon.

Step 3: Analyzing Contract Liquidity

Before initiating the rollover process, it is important to assess the liquidity of the new contract you wish to roll over to. Liquidity refers to the ease of buying or selling the contract without impacting its price. Higher liquidity generally translates to tighter bid-ask spreads and smoother order execution. Analyze the liquidity of the new contract to ensure that it meets your trading needs and can support your desired position size.

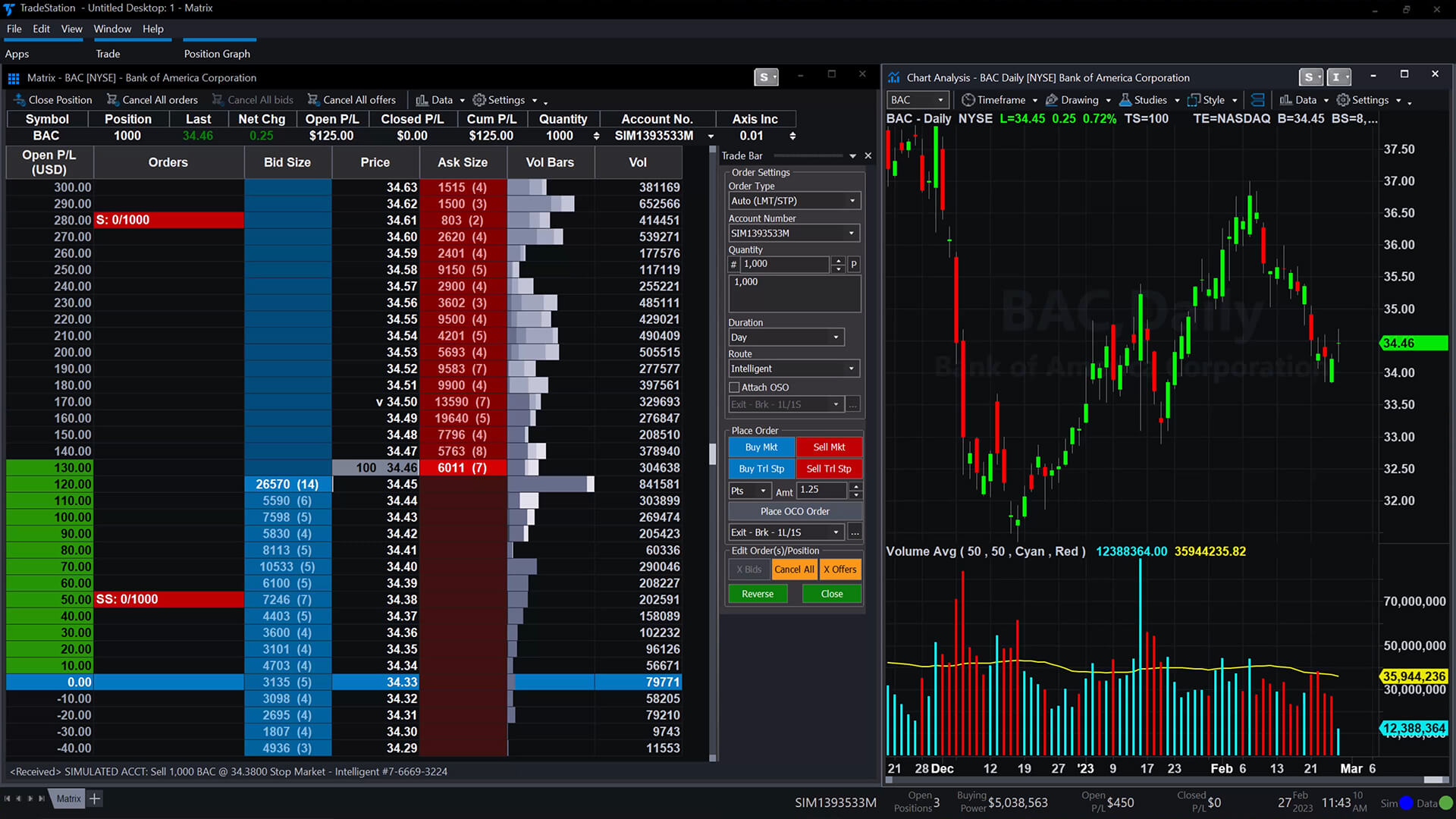

Step 4: Initiating the Rollover Process in NT7

Once you have identified the next contract month and evaluated its liquidity, it’s time to begin the rollover process in NT7. Open the trading platform and navigate to the futures contract you currently hold. Look for the option to roll over the contract or switch to the next available contract month. Follow the provided instructions or consult the platform’s user guide for specific details on how to initiate the rollover process in NT7.

Step 5: Monitoring Rollover Progress

After initiating the rollover process, it is crucial to monitor the progress and ensure that the transition from the old contract to the new one occurs smoothly. Keep an eye on your positions, order execution, and any adjustments required to align with the new contract. If any issues or discrepancies arise, contact your broker or the platform’s customer support for assistance.

Step 6: Completing the Rollover of Futures Contracts

Once the rollover process is complete, you have successfully transitioned your positions to the new contract. Verify that your positions are accurate, and ensure that any stop-loss or take-profit orders are adjusted accordingly. You are now ready to continue trading with the new contract and take advantage of the opportunities provided by the futures market.

By following these steps, you can effectively roll over your futures contracts in NT7 and maintain your exposure to the underlying asset without any disruptions. Remember to stay informed, evaluate liquidity, and monitor the process to ensure a seamless transition.

Step 1: Reviewing Contract Expiration

The first step in the process of rolling over futures contracts is to review the expiration date of your current contract. Every futures contract has a predetermined expiration date, which marks the end of its trading period. It is crucial to be aware of this date to ensure a smooth transition to the next contract.

To find the expiration date of your current futures contract, you can refer to the contract specifications provided by the exchange or your trading platform. The expiration date is typically listed along with other contract details, such as the underlying asset, contract size, and tick size. It is also displayed on the trading platform’s interface, usually next to the contract symbol or name.

When reviewing the contract expiration, pay attention to the specific date and time when the contract expires. Different futures contracts have different expiration times, often taking place during specific trading sessions. It is crucial to note the exact expiration time to ensure you have ample time to initiate the rollover process.

Additionally, it is essential to consider the overall trading volume and liquidity of the contract as it approaches expiration. As a contract nears its expiration date, its trading activity may decrease, resulting in lower liquidity and potentially wider bid-ask spreads. This can impact the execution of trades and introduce additional risks. Therefore, it is prudent to review the trading volume and liquidity of the contract to make informed decisions about rolling over to the next contract.

By thoroughly reviewing the contract expiration details, you can effectively plan the rollover process. Being aware of the expiration date and time allows you to initiate the rollover in a timely manner, ensuring continuity in your trading positions and minimizing any potential disruptions.

Now that you understand the importance of reviewing the contract expiration, let’s move on to the next step: identifying the next available contract month.

Step 2: Identifying the Next Contract Month

After reviewing the expiration date of your current futures contract, the next step in the process of rolling over futures contracts is to identify the next available contract month. Each futures contract has multiple contract months available for trading, typically referred to as front-month, back-month, or distant-month contracts.

To identify the next contract month, you can refer to the contract specifications provided by the exchange or your trading platform. The contract specifications will outline the available contract months for the specific futures contract you are trading. These contract months are typically denoted by a letter or number code that corresponds to a specific month.

For example, let’s say you are trading the crude oil futures contract. The current contract you hold is set to expire in the month of December (denoted as “Z” for crude oil futures). By reviewing the contract specifications, you can determine the next available contract month, which might be January (denoted as “F” for crude oil futures).

In addition to identifying the next contract month, it is also important to consider the liquidity and trading volume of the new contract. Higher liquidity ensures smoother order execution and tighter bid-ask spreads, which can be advantageous for traders. Assessing the liquidity of the new contract is vital to ensure that it can accommodate your desired position size and trading strategy.

Furthermore, it is essential to consider any differences in contract specifications between the current and the new contract month. Certain futures contracts may have variations in contract size, tick size, or other specifics across different contract months. Familiarize yourself with these differences to ensure a seamless transition and avoid any potential trading errors or miscalculations.

By identifying the next contract month, taking into account liquidity and contract specifications, you can proceed to the next step: analyzing contract liquidity.

Step 3: Analyzing Contract Liquidity

Once you have identified the next contract month for rolling over your futures contract, it is crucial to analyze the liquidity of the new contract. Liquidity refers to the ease with which a contract can be bought or sold in the market without significantly impacting its price.

Analyzing contract liquidity is important because it directly affects the execution of trades and the overall trading experience. Contracts with higher liquidity typically have tighter bid-ask spreads and allow for smoother order execution, providing traders with better trading opportunities and reduced slippage.

There are several factors to consider when analyzing contract liquidity:

- Trading Volume: The trading volume of a contract reflects the number of contracts being actively traded in the market. Higher trading volume signifies higher liquidity, as it indicates a greater number of market participants and increased trading activity. Analyze the trading volume of the new contract month to ensure that it meets your trading needs and supports your desired position size.

- Bid-Ask Spreads: The bid-ask spread represents the difference between the highest price a buyer is willing to pay (the bid) and the lowest price a seller is willing to accept (the ask). Contracts with tighter bid-ask spreads offer better pricing efficiency and allow for more favorable trade execution. Compare the bid-ask spreads of the new contract to those of the expiring contract to assess the potential impact on your trading costs.

- Market Depth: Market depth refers to the quantity of contracts available at various price levels in the order book. A deep market indicates a significant number of buy and sell orders at different price levels, providing traders with ample liquidity and improved liquidity. Assess the market depth of the new contract to ensure there is adequate liquidity to support your desired trading volume.

- Open Interest: Open interest measures the number of outstanding contracts that have not been closed or delivered. Higher open interest implies greater market participation and can be an indication of market liquidity. Analyze the open interest of the new contract month to gauge its attractiveness and potential trading activity.

By thoroughly analyzing contract liquidity, you can make informed decisions when rolling over your futures contracts. Look for contracts with sufficient trading volume, tighter bid-ask spreads, deep market depth, and significant open interest. This will help ensure a smooth transition to the new contract month without experiencing liquidity-related issues that could impact your trading experience.

With a clear understanding of contract liquidity, you are now ready to proceed to the next step: initiating the rollover process in NT7.

Step 4: Initiating Rollover Process in NT7

Once you have reviewed the contract expiration, identified the next contract month, and analyzed the liquidity of the new contract, you are ready to initiate the rollover process in NT7 (NinjaTrader 7). NT7 provides a user-friendly platform that streamlines the rollover process for futures contracts. Here’s how you can initiate the rollover process:

- Open NinjaTrader 7: Launch the NT7 trading platform on your computer. If you don’t have it installed, you can download it from the official NinjaTrader website and follow the installation instructions.

- Access the Chart or Order Entry Window: Navigate to the chart or order entry window that displays your current futures contract position.

- Right-click on the Chart or Order Entry Window: Right-click on the active chart or order entry window to access a context menu of options.

- Select “Roll Over” or “Switch Contract”: In the context menu, look for the option that allows you to roll over or switch the futures contract. The specific wording may vary depending on the version of NT7 you are using, but the functionality should be similar.

- Select the Next Contract Month: A dropdown menu or pop-up window should appear, displaying the available contract months for the chosen futures market. Select the next contract month that you identified during the previous steps.

- Confirm the Rollover: After selecting the next contract month, you may be prompted to confirm the rollover action. Ensure that all details are accurate before proceeding.

- Review the Positions: Once the rollover is complete, review your positions to ensure they have transitioned to the new contract month as expected. Cross-check the contract specifications, trading volume, and any other relevant information to confirm a successful rollover.

It is important to note that the specific steps and options for initiating the rollover process in NT7 may differ slightly depending on the version and customization settings of your trading platform. If you are unsure or encounter any difficulties, consult the NT7 user guide or contact NinjaTrader support for assistance.

With the rollover process initiated in NT7, you can now move on to the next step: monitoring the rollover progress.

Step 5: Monitoring Rollover Progress

After initiating the rollover process in NT7, it is important to monitor the progress to ensure a seamless transition from the old contract to the new contract. Monitoring the rollover progress allows you to stay informed about any updates or adjustments that may be required during the transition. Here are some key considerations when monitoring the rollover progress:

- Position Visibility: Keep an eye on your positions to ensure that they are accurately reflected in NT7. Verify that your open positions from the old contract have been successfully rolled over to the new contract month and that your position sizes and entry prices are correct.

- Order Execution: Monitor the execution of any new orders placed on the new contract. Ensure that trades are being filled promptly and at the desired prices. If you experience any issues with order execution, consider adjusting your limit or stop-loss orders if necessary.

- Slippage: Pay attention to any slippage that may occur during the rollover process. Slippage refers to the difference between the expected execution price and the actual execution price. While some slippage is normal in fast-moving markets, excessive slippage may indicate liquidity issues or other trading-related challenges.

- Communication with Brokers: Maintain open communication with your brokers or trading platform support team. If you encounter any difficulties or have questions regarding the rollover process, reach out to them for assistance. They can provide valuable insights and help resolve any issues that may arise.

- Platform Updates: Stay updated with any announcements or notifications from NT7 regarding the rollover process. Platform updates may include information about any technical issues, changes in contract specifications, or other relevant details that could impact your trading.

By carefully monitoring the rollover progress, you can ensure that all positions are transitioned correctly and that your trading activities continue smoothly without any disruptions. Regularly check your positions, orders, and any updates from NT7 to stay informed and address any issues promptly.

Once you have confirmed the successful completion of the rollover process and ensured that your positions are accurately reflected in the new contract, you can proceed to the final step: completing the rollover of futures contracts.

Step 6: Completing Rollover of Futures Contracts

After monitoring the rollover progress and verifying the accuracy of your positions in the new contract, you are now ready to complete the rollover of futures contracts. This final step ensures that your trading activities seamlessly transition to the new contract and allows you to capitalize on the trading opportunities presented by the futures market.

Here are some important considerations for completing the rollover:

- Position Verification: Double-check your current positions to ensure that they match your trading plan and preferences. Confirm that the contract month, quantity, and other relevant details of your positions are accurate in the new contract.

- Stop-Loss and Take-Profit Orders: Review and adjust any stop-loss or take-profit orders that were associated with your previous contract. Make sure that these orders are updated to reflect the new contract month and any changes in your trading strategy.

- Monitor Market Conditions: Stay informed about market conditions, news events, and any upcoming economic announcements that may affect the price movement in the new contract. Adapting your trading strategy to the current market environment is crucial for successful trading.

- Risk Management: Revisit and reassess your risk management strategies in light of the completion of the rollover process. Determine appropriate position sizes, stop-loss levels, and risk-reward ratios to maintain risk control and protect your capital.

- Continued Analysis: Continue analyzing and monitoring the performance of the new contract and make any necessary adjustments to your trading approach. Regularly review technical indicators, news developments, and market trends to make informed trading decisions.

By completing these final steps, you have successfully completed the rollover process of your futures contracts. You can now fully engage in trading activities using the new contract and take advantage of the opportunities presented by the futures market.

Remember, ongoing monitoring and analysis are crucial to your success as a trader. Stay updated on market conditions, adapt your strategies as needed, and ensure that your trading activities align with your goals and risk tolerance.

When the next contract expiration approaches, you can repeat the rollover process to transition to the subsequent contract month, ensuring seamless continuity in your trading positions.

Congratulations on completing the rollover process of your futures contracts in NT7! May your trades be profitable and your trading journey be filled with success.

Conclusion

Rolling over futures contracts is an essential process for traders to maintain their exposure to the underlying asset and avoid the risk of physical delivery. By understanding and following the step-by-step process of rolling over contracts in NT7, you can navigate the futures market with confidence and ensure a seamless transition from one contract month to another.

In this article, we explored the importance of rolling over futures contracts and how it helps traders avoid disruptions in their trading strategies. We discussed the process of reviewing contract expiration, identifying the next contract month, analyzing contract liquidity, initiating the rollover process in NT7, monitoring the rollover progress, and completing the rollover of futures contracts.

By reviewing the contract expiration date, traders can determine the timeline for initiating the rollover process. Identifying the next contract month and analyzing its liquidity enables traders to ensure the smooth transition of their positions. Initiating and monitoring the rollover process in NT7 allows for seamless execution and adjustment if needed. Finally, completing the rollover ensures that traders can fully engage in trading activities with the new contract month.

It is important to stay informed, monitor market conditions, and adapt your trading strategies as needed. Regularly reviewing contract specifications and assessing liquidity are vital for making informed decisions and optimizing trading outcomes. Additionally, maintaining open communication with your broker or trading platform support team can provide valuable assistance throughout the rollover process.

By following these steps and incorporating them into your trading routine, you can effectively roll over futures contracts in NT7 and navigate the futures market with confidence. Continuously enhancing your understanding of futures contracts, market dynamics, and risk management strategies will contribute to your success as a trader.

So, whether you are an experienced trader or new to the world of futures trading, mastering the process of rolling over futures contracts in NT7 is a valuable skill that will help you thrive in the dynamic and exciting futures market.