Home>Finance>American Municipal Bond Assurance Corporation Definition

Finance

American Municipal Bond Assurance Corporation Definition

Published: October 6, 2023

Looking for the definition of American Municipal Bond Assurance Corporation in the world of finance? Find out what this corporation is all about and how it relates to the financial industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Demystifying the American Municipal Bond Assurance Corporation: A Comprehensive Definition

Are you curious about the American Municipal Bond Assurance Corporation (AMBAC) and what it means for your financial journey? Look no further! In this blog post, we’ll dive into the world of AMBAC to provide you with a comprehensive understanding of its purpose, significance, and the role it plays in the world of finance.

Key Takeaways:

- AMBAC is a financial company that specializes in providing bond insurance for municipal issuers.

- Its core mission is to enhance the creditworthiness of municipal bonds, attracting investors and lowering borrowing costs for local government bodies.

So, what exactly is the American Municipal Bond Assurance Corporation?

The American Municipal Bond Assurance Corporation, commonly referred to as AMBAC, is a financial company that specializes in providing bond insurance for municipal issuers. Municipal bonds are issued by state and local governments, as well as other public agencies, to finance various public projects such as infrastructure development, schools, and hospitals.

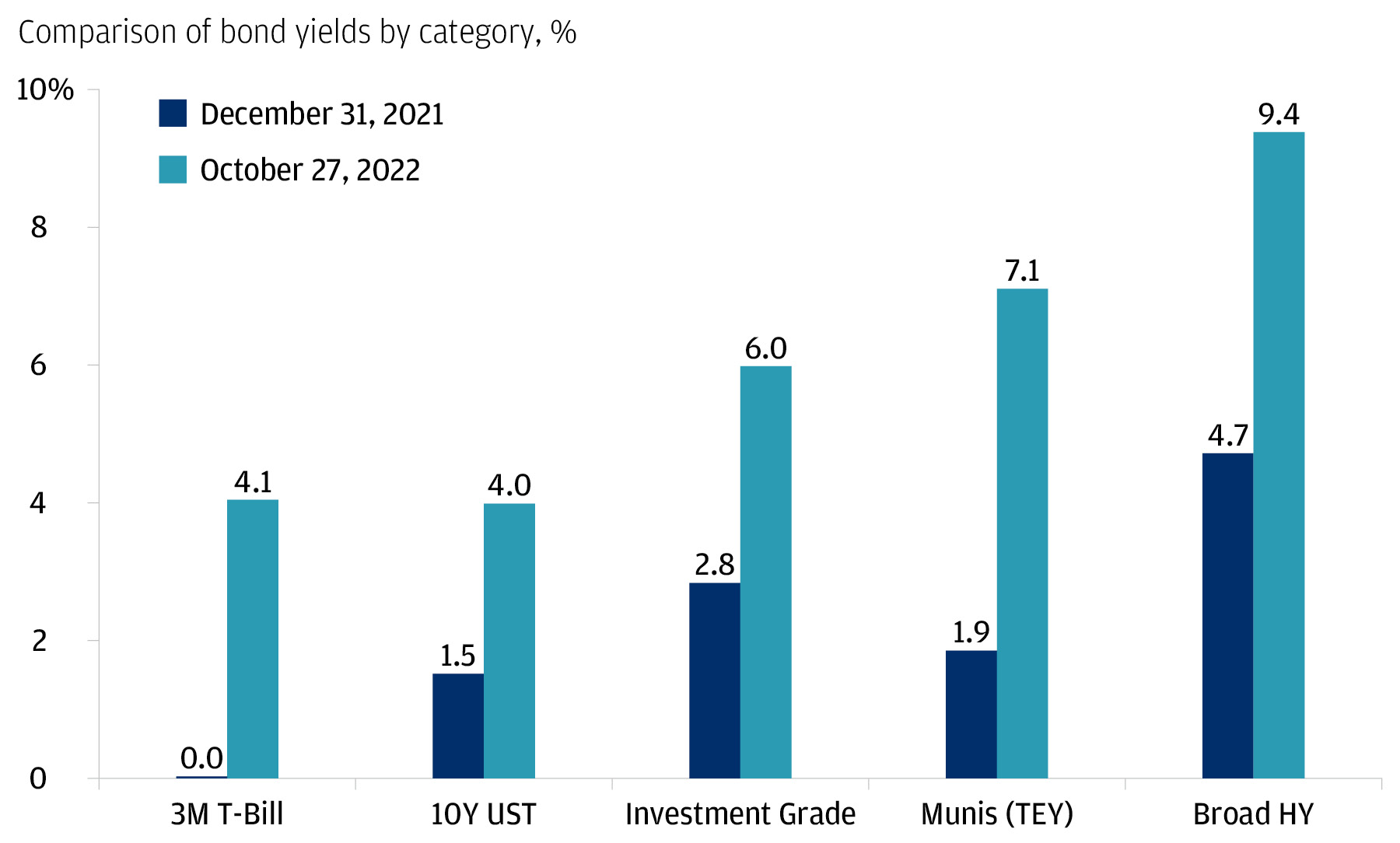

AMBAC’s main purpose is to enhance the creditworthiness of these municipal bonds by guaranteeing the repayment of principal and interest to the bondholders in case of defaults or failures by the issuers. By insuring the bonds, AMBAC effectively reduces the perceived risk associated with investing in municipal bonds, making them more attractive to investors. This increased investor confidence allows municipalities to borrow funds at lower interest rates, resulting in significant cost savings for these local government bodies.

AMBAC achieves its objectives by leveraging its strong financial position and credit ratings. The company carefully assesses the creditworthiness of the municipal issuers before offering bond insurance. This assessment includes analyzing the issuer’s financial health, repayment history, and the specific project being financed. AMBAC only offers insurance to issuers that meet its stringent criteria, ensuring that it maintains a high standard of quality and reduces the risk of defaults.

It’s important to note that AMBAC primarily focuses on guaranteeing municipal bonds rather than investing in them directly. This means that the company doesn’t buy and trade municipal bonds in the financial markets like other investment firms. Instead, it functions as a reliable and trusted partner for municipal issuers, providing them with the necessary insurance to enhance their bonds’ attractiveness to potential investors.

In conclusion, the American Municipal Bond Assurance Corporation plays a crucial role in the world of finance by providing bond insurance for municipal issuers. Its mission is to enhance the creditworthiness of municipal bonds, attract investors, and lower borrowing costs for local government bodies. By understanding the significance of AMBAC, you can make informed decisions when considering municipal bonds as part of your investment portfolio.