Home>Finance>Why Are Municipal Bonds Attractive To Investors

Finance

Why Are Municipal Bonds Attractive To Investors

Published: October 14, 2023

Discover why municipal bonds are attractive to investors in the realm of finance. Explore the benefits of these bond investments in terms of stability and tax advantages.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of municipal bonds, where investors seek stable income streams and tax advantages. Municipal bonds, also known as munis, are debt securities issued by state and local governments or their agencies. These bonds are widely regarded as a safe and attractive investment option due to their tax benefits, low default risk, and potential for diversification. In this article, we will explore why municipal bonds are so appealing to investors and why they should consider adding them to their investment portfolio.

As an investor, it is important to have a diversified portfolio that includes a mix of asset classes. Municipal bonds can play a crucial role in achieving this diversification by providing a steady stream of income while reducing overall risk. Municipal bonds are typically issued to fund public infrastructure projects such as schools, hospitals, roads, and bridges. By investing in these bonds, individuals can contribute to the development and improvement of their local communities.

Moreover, municipal bonds offer significant tax advantages that make them even more appealing. The interest paid on these bonds is usually exempt from federal income taxes and, in some cases, state and local taxes as well. This tax-exempt status enhances the after-tax yield for investors, allowing them to keep more of their investment income. This is particularly advantageous for individuals in higher tax brackets, as it provides an opportunity to reduce their tax liability.

In order to understand the attractiveness of municipal bonds, we must also address the low default risk associated with these investments. Municipalities have a strong incentive to fulfill their debt obligations as defaulting on bonds can have severe consequences, including a negative impact on their credit rating and ability to borrow in the future. Additionally, many states have laws in place that require local governments to budget for and prioritize debt service payments, further mitigating the risk of default.

Furthermore, the stable income stream generated by municipal bonds is another key factor that attracts investors. Unlike stocks or other investments that may be subject to market volatility, municipal bond payments are typically fixed and predictable. This provides investors with a steady and reliable source of income, making municipal bonds appealing to those who rely on consistent cash flow to meet their financial goals.

In the following sections, we will delve deeper into the tax advantages, low default risk, diversification benefits, and various investment options available to investors in the municipal bond market. By understanding these factors, investors can make informed decisions and potentially reap the rewards of investing in this asset class.

Definition of Municipal Bonds

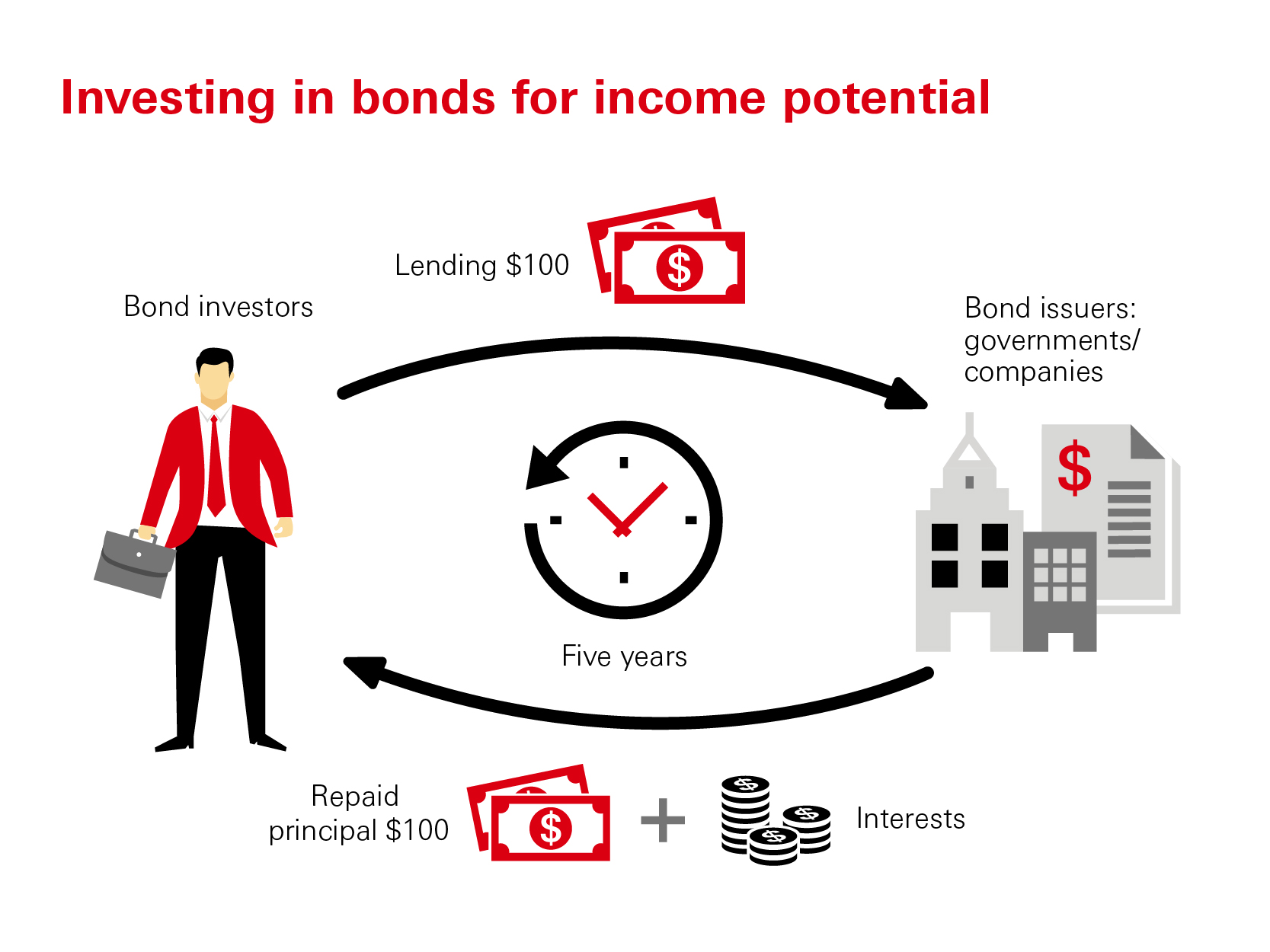

Municipal bonds, often referred to as munis, are debt instruments issued by state and local governments or their agencies to finance public infrastructure projects or other governmental activities. Essentially, investors who purchase municipal bonds are lending money to the municipality in exchange for regular interest payments and the return of their principal investment at maturity.

Unlike corporate bonds, which are issued by private companies, municipal bonds are issued by government entities. These entities can include states, cities, counties, school districts, water districts, and other governmental bodies. Each municipality may issue different types of bonds to fund specific projects or initiatives, such as general obligation bonds, revenue bonds, or special assessment bonds.

General obligation bonds are backed by the full faith and credit of the issuing municipality. This means that the municipality has pledged its taxing power to repay the bondholders. Revenue bonds, on the other hand, are backed by the revenue generated from a specific project or source, such as toll fees, airport fees, or water and sewer system fees. Special assessment bonds are secured by assessments levied on specific properties to fund local improvements, such as street repairs or sewer system upgrades.

When purchasing municipal bonds, investors have the option to choose between taxable and tax-exempt bonds. Taxable municipal bonds do not offer any tax advantages and are subject to federal, state, and local taxes. On the other hand, tax-exempt municipal bonds, also known as tax-free munis, provide significant tax advantages. The interest earned from tax-exempt municipal bonds is generally free from federal income taxes and, in many cases, state and local taxes as well, making them attractive to investors seeking tax-efficient investments.

Municipal bonds are typically issued with a fixed interest rate, meaning that the bondholder will receive a predetermined amount of interest payments at regular intervals throughout the life of the bond. The bond’s maturity date represents the point at which the issuer will repay the bond’s principal amount in full.

In summary, municipal bonds are debt securities issued by state and local governments to finance public projects. They can offer both taxable and tax-exempt options, and the interest payments and principal repayment are typically fixed. Understanding the different types of municipal bonds and their tax implications is essential for investors looking to diversify their portfolios and take advantage of the unique benefits offered by these investments.

Tax Advantages of Municipal Bonds

Municipal bonds provide investors with significant tax advantages, making them a popular choice for those seeking tax-efficient investments. The tax benefits associated with municipal bonds can be summarized in two key advantages: tax-exempt interest and tax reduction opportunities.

One of the primary attractions of municipal bonds is that the interest earned from these bonds is generally exempt from federal income taxes. This means that investors don’t have to include the interest income from municipal bonds when calculating their federal taxable income. This tax-exempt status can be particularly advantageous for individuals in higher tax brackets, as it helps to reduce their overall tax liability. By shielding the interest income, investors can potentially increase their after-tax return on investment.

In addition to federal tax exemptions, many municipal bonds are also exempt from state and local taxes. This depends on the issuing municipality and the state in which the investor resides. Some states offer tax advantages to their residents by exempting the interest income from municipal bonds issued within the state from state income taxes. Similarly, certain municipalities may exempt the interest income from their municipal bonds from local taxes. These tax exemptions at the state and local levels further enhance the tax advantages of municipal bonds and provide additional savings for investors.

It is important to note that not all municipal bonds are tax-exempt. Some bonds, known as taxable municipal bonds, do not provide any tax advantages and are subject to federal, state, and local taxes. These bonds are often issued for specific projects that do not meet the criteria for tax-exempt treatment. Before investing, it is essential to evaluate the tax status of the bond to determine whether it offers any tax advantages.

Beyond the tax-exempt interest, municipal bonds also present opportunities for tax reduction and planning. For investors subject to the alternative minimum tax (AMT), certain types of municipal bonds can be exempt from this additional tax. These bonds, known as AMT-free bonds, are structured to comply with AMT regulations and can be an attractive option for investors seeking to minimize their tax liability.

In addition to AMT benefits, municipal bonds can be strategically used in asset allocation and tax planning. Investors can analyze their overall tax situation and consider adding municipal bonds to their portfolios to achieve a more balanced mix of taxable and tax-exempt investments. By diversifying their holdings with tax-exempt municipal bonds, investors can potentially reduce their overall tax burden and enhance their after-tax returns.

Overall, the tax advantages of municipal bonds make them an attractive investment option for individuals looking to minimize their tax liability and increase their after-tax returns. The tax-exempt interest feature, along with potential state and local tax exemptions and strategic tax planning opportunities, contribute to the appeal of these bonds and make them a valuable addition to an investor’s portfolio.

Stable Income Stream

One of the key attractions of investing in municipal bonds is the stability of the income stream they provide. Unlike other investments that may be subject to market volatility and unpredictable returns, municipal bonds offer investors a dependable and consistent source of income.

When investors purchase municipal bonds, they are essentially lending money to the issuing municipality. In return, they receive regular interest payments from the municipality, usually on a semi-annual basis. These interest payments, known as coupon payments, are predetermined and fixed, providing investors with a predictable income stream.

The stability of the income generated by municipal bonds is beneficial for investors, particularly those who rely on consistent cash flow to meet their financial needs. It can be particularly attractive for retirees or individuals seeking reliable income to cover living expenses, as well as those who prefer a steady income stream to reinvest or save for long-term goals.

Investors can choose from various types of municipal bonds based on their desired income stream. For example, general obligation bonds, backed by the full faith and credit of the issuing municipality, offer a reliable income stream as the bondholders are paid from the government’s general revenue sources, such as taxes and fees.

Revenue bonds, on the other hand, provide income based on the revenue generated by specific projects or assets. These bonds are typically issued to finance projects such as toll roads, airports, or water and sewer systems. The income generated from these projects is used to repay investors, providing a stable income stream directly tied to the performance of the underlying project.

The ability to generate a stable income stream from municipal bonds is further enhanced by the low default risk associated with these investments. Municipalities have a strong incentive to honor their debt obligations, as defaulting on bonds can harm their credit rating and make it difficult to access financing in the future. Additionally, many states have laws in place that require local governments to budget for and prioritize debt service payments, adding an extra layer of security for bondholders.

Overall, the stable income stream provided by municipal bonds makes them an attractive option for investors seeking consistent cash flow. Whether it is to cover living expenses, supplement retirement income, or meet other financial goals, the predictability of income payments from municipal bonds can provide investors with peace of mind and financial stability.

Low Default Risk

Another key advantage of investing in municipal bonds is the historically low default risk associated with these investments. Municipal bonds are widely regarded as one of the safest forms of fixed-income securities due to several factors that mitigate the risk of default.

First and foremost, municipalities have a strong incentive to honor their debt obligations. Defaulting on bonds can lead to serious consequences, including a negative impact on the municipality’s credit rating and its ability to borrow in the future. Municipalities rely on the debt markets to finance essential infrastructure projects and maintain public services. Failing to meet their debt obligations could result in higher borrowing costs and hinder their ability to fund critical projects.

Furthermore, many states have laws in place that require local governments to budget for and prioritize debt service payments. These laws establish a legal obligation for municipalities to allocate funds for the timely repayment of their outstanding debt. By mandating the prioritization of debt payments, these laws provide an added layer of security for bondholders and reduce the risk of default.

Additionally, before issuing bonds, municipalities undergo a thorough underwriting process, which involves assessing their financial health and creditworthiness. Independent credit rating agencies assign ratings to municipal bond issuers based on their analysis of the issuer’s ability to repay its debt obligations. Investors can rely on these ratings to evaluate the creditworthiness and default risk of municipal bonds before making investment decisions.

It is important to note that while default risk for municipal bonds is generally low, it is not non-existent. Certain factors can contribute to a higher default risk, such as deteriorating economic conditions, mismanagement of funds, or unexpected events that significantly impact the municipality’s finances. Investors should conduct their due diligence and consider the creditworthiness of the issuer before investing in municipal bonds.

Nevertheless, historical data has demonstrated the overall resilience of municipal bond investments. Default rates on municipal bonds have historically been very low compared to other types of fixed-income securities. This low default risk contributes to the attractiveness of municipal bonds as a safe and reliable investment option.

By considering the low default risk associated with municipal bonds, investors can have confidence in the stability and security of their investment. While it is crucial to assess the creditworthiness of the issuer, the track record of minimal defaults and the legal mechanisms in place to protect bondholders make municipal bonds an appealing choice for those seeking low-risk fixed-income investments.

Diversification Benefits

Diversification is a fundamental principle of investing, and municipal bonds can play a valuable role in achieving a well-diversified investment portfolio. By adding municipal bonds to a diversified portfolio, investors can benefit from reduced risk and potential for enhanced returns.

One of the primary advantages of diversification is the reduction of investment risk. By investing in a variety of asset classes, such as stocks, bonds, and real estate, investors can offset the impact of any individual investment’s poor performance. The inclusion of municipal bonds in a diversified portfolio can further reduce risk by adding an asset class known for its stability and low volatility.

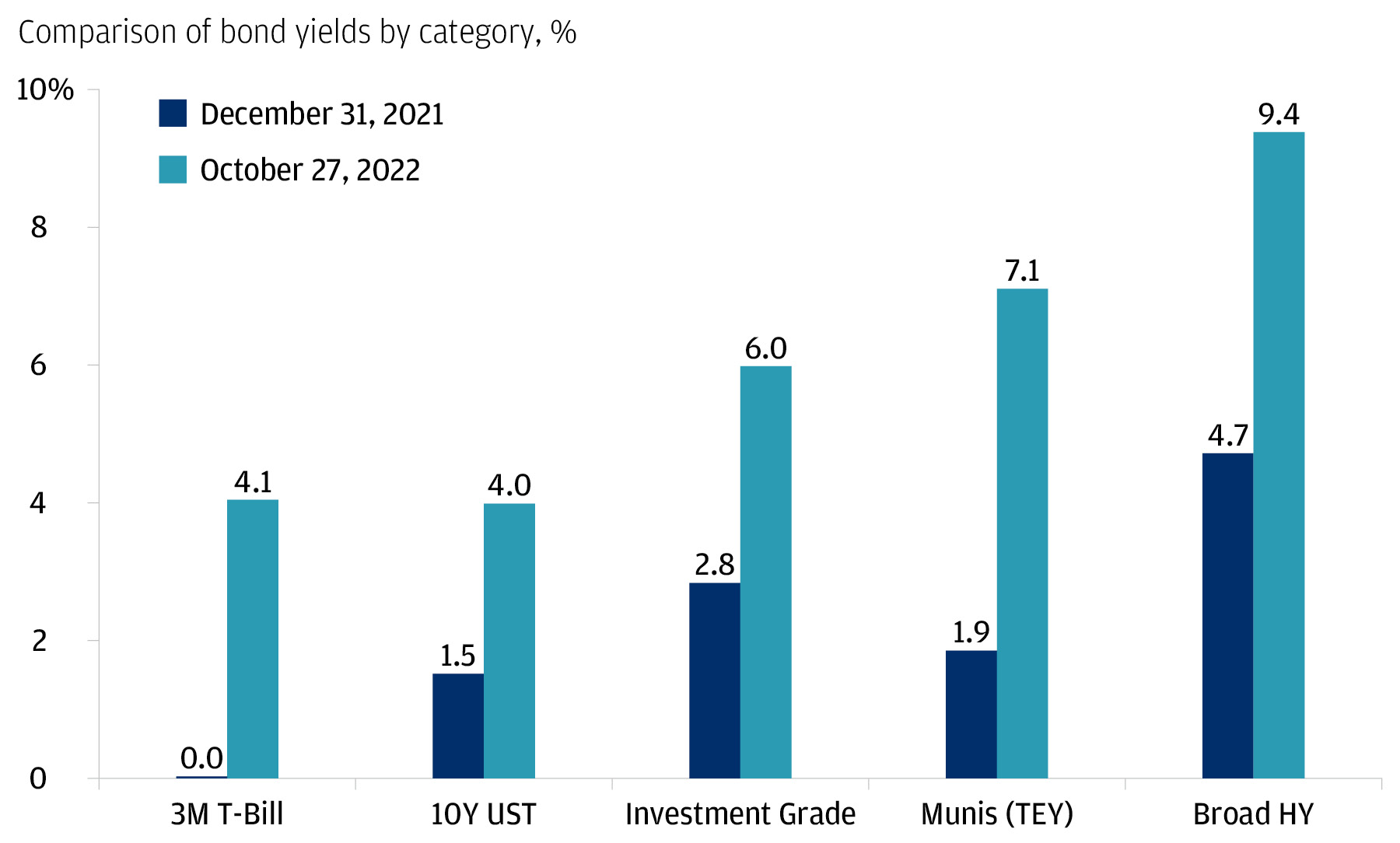

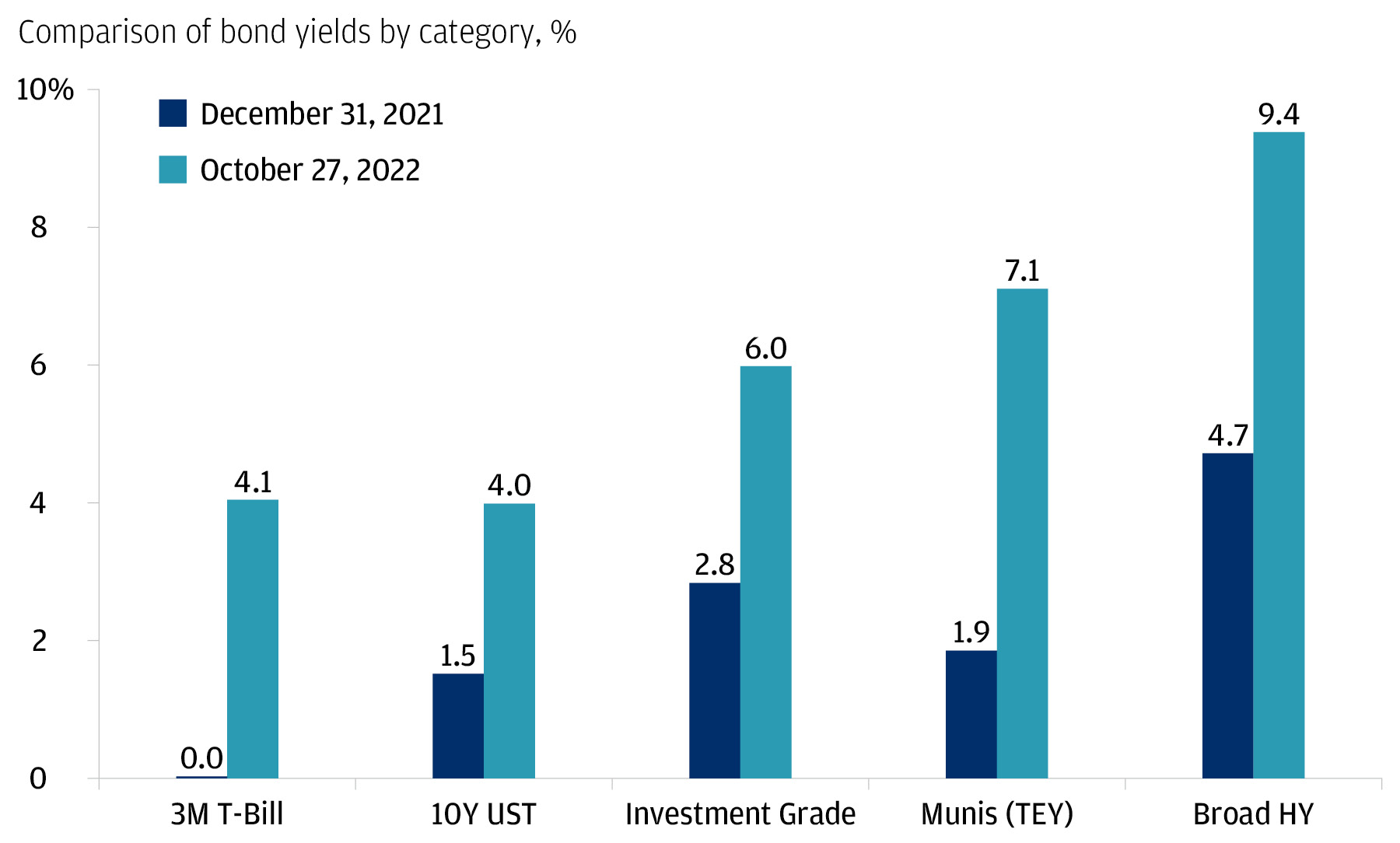

Municipal bonds have historically demonstrated a low correlation with other asset classes, such as stocks and corporate bonds. This means that their performance is less influenced by the ups and downs of the stock market and can be more independent of the overall economic cycle. As a result, investing in municipal bonds can help to diversify a portfolio and provide a cushion against market volatility.

In addition to reducing risk, diversification can also enhance returns. Different asset classes have varying return patterns and react differently to market conditions. By diversifying across asset classes, investors have the potential to capture positive returns from different sectors of the market and optimize their overall portfolio performance.

Municipal bonds can contribute to portfolio performance by providing a steady income stream and potentially enhancing overall returns. As fixed-income investments, municipal bonds offer coupon payments that can supplement returns from other investments, such as stocks. The income generated from municipal bonds can help balance out the volatility and fluctuations in the stock market, leading to a more consistent and reliable overall portfolio return.

Moreover, the tax advantages associated with municipal bonds can further enhance returns, particularly for investors in higher tax brackets. The tax-exempt status of municipal bond interest income allows investors to keep more of their investment earnings, effectively increasing their after-tax returns. This creates an additional boost to the overall performance of a diversified portfolio.

Investors have several options when it comes to diversifying their holdings within the municipal bond market. They can choose different types of municipal bonds, such as general obligation bonds, revenue bonds, or bonds from various geographic regions. They can also select a mix of short-term and long-term bonds, depending on their investment objectives and risk tolerance.

Ultimately, by diversifying their portfolios with municipal bonds, investors can access the stability and tax advantages of this asset class while reducing overall risk. The low correlation with other asset classes and the potential for enhanced returns make municipal bonds an attractive addition to a well-diversified investment portfolio.

Investment Options in Municipal Bonds

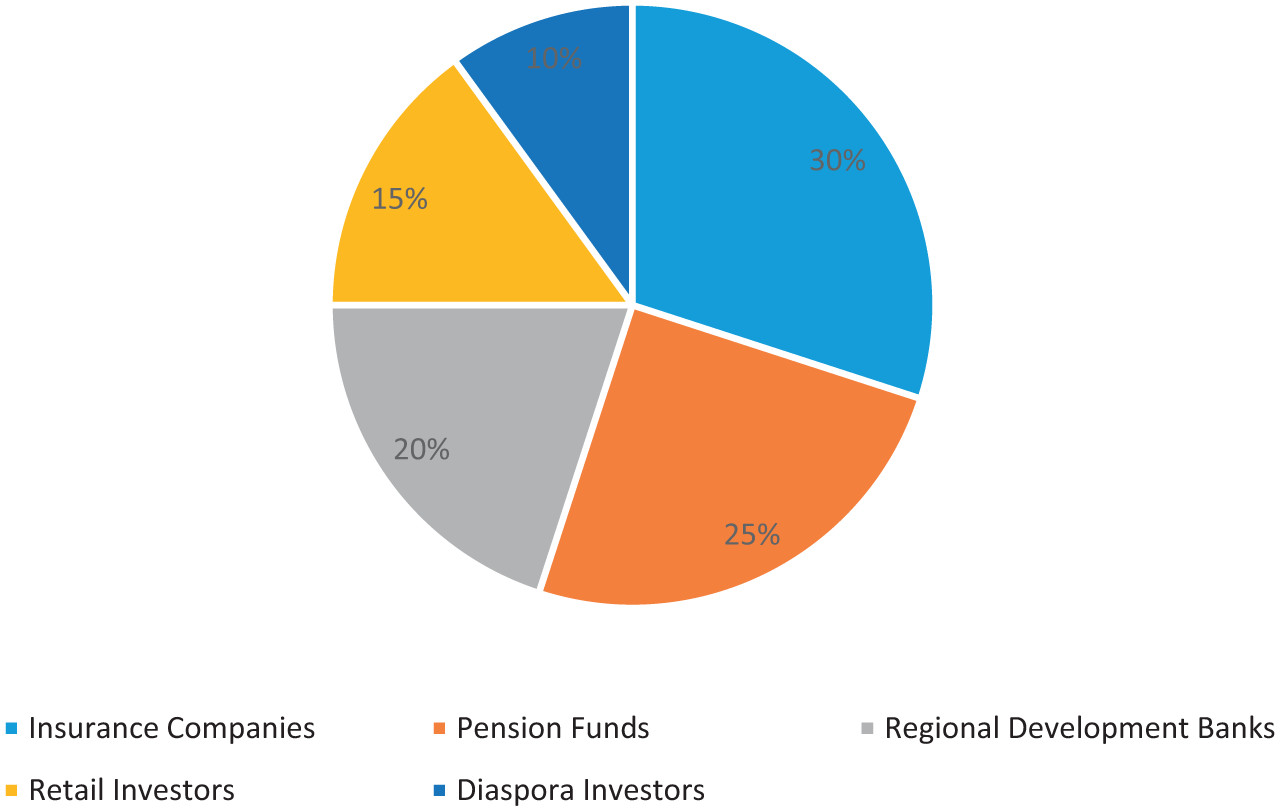

Investors interested in municipal bonds have several options to consider when building their investment strategy. The municipal bond market offers a range of investment options, providing flexibility to match individual risk tolerance, investment goals, and desired level of involvement.

One option for investors is to purchase individual municipal bonds directly from the bond issuer or through a broker. This approach allows investors to select specific bonds based on their preferences, such as maturity date, credit rating, and interest rate. By carefully choosing individual bonds, investors can tailor their portfolio to match their risk appetite and income objectives. However, it’s important to note that investing in individual bonds requires careful research and analysis, as well as a higher level of involvement in monitoring and managing the portfolio.

Another investment option is to invest in mutual funds that specialize in municipal bonds. Municipal bond mutual funds pool money from multiple investors and invest in a diversified portfolio of municipal bonds. This provides investors with instant diversification and professional management of their investments. Mutual funds may offer different strategies, such as investing in bonds from a specific geographic region, bonds of a certain credit quality, or a mix of different types of municipal bonds. This option is suitable for investors who prefer a hands-off approach and want access to the expertise and diversification provided by professional fund managers.

Exchange-traded funds (ETFs) focused on municipal bonds are another investment option. Similar to mutual funds, municipal bond ETFs invest in a portfolio of municipal bonds. However, ETFs are traded on stock exchanges, offering the advantage of intra-day trading flexibility. Investors can buy and sell ETF shares throughout the trading day at market-determined prices, making it easy to adjust their holdings as needed. Municipal bond ETFs provide liquidity and diversification, making them suitable for investors who value ease of trading and want exposure to a broad range of municipal bonds.

To further diversify their municipal bond holdings, investors can also consider investing in closed-end funds (CEFs). CEFs are publicly traded investment companies that issue a fixed number of shares and invest in a portfolio of municipal bonds. Unlike mutual funds and ETFs, CEFs are not actively managed and can trade at a premium or discount to their net asset value (NAV). This investment option may appeal to investors who are comfortable with the potential for price discrepancies between the market price of the CEF and its underlying assets.

Lastly, investors can explore investing in municipal bond unit trusts, which are pre-packaged portfolios of bonds that focus on a specific maturity range or investment objective. Unit trusts offer a fixed portfolio of bonds with a predetermined maturity date. This option can be suitable for investors looking for a predictable income stream and a clear investment horizon.

When considering investment options in municipal bonds, it’s essential for investors to assess their risk tolerance, investment goals, and level of involvement. They should also consider factors such as management fees, potential tax implications, and the overall performance track record of the investment options. Consulting with a financial advisor can provide valuable guidance in selecting the most suitable investment option within the municipal bond market.

Conclusion

Municipal bonds offer attractive benefits to investors, making them a valuable addition to an investment portfolio. From the tax advantages to the stable income stream, low default risk, and diversification benefits, municipal bonds provide a range of advantages that appeal to a wide range of investors.

The tax advantages associated with municipal bonds allow investors to potentially increase their after-tax returns by shielding the interest income from federal, and in some cases, state and local taxes. This tax efficiency can be especially beneficial for individuals in higher tax brackets looking to minimize their tax liability.

The stable income stream provided by municipal bonds is another key advantage. The predetermined interest payments offer investors a reliable and consistent source of income, making municipal bonds appealing to those seeking steady cash flow for retirement or other financial goals.

Furthermore, municipal bonds are known for their historically low default risk. Municipalities have a strong incentive to fulfill their debt obligations, and laws are in place to enforce responsible financial management. This reduced risk of default provides investors with peace of mind and adds a layer of security to their investment portfolios.

Additionally, municipal bonds offer diversification benefits. By investing in municipal bonds, investors can add an asset class with low correlation to traditional stocks and bonds, reducing overall portfolio risk. The potential for enhanced returns and the stability of municipal bonds make them an attractive component of a well-diversified investment strategy.

Investors have several options when it comes to investing in municipal bonds. They can invest in individual bonds, invest in mutual funds or exchange-traded funds specialized in municipal bonds, consider closed-end funds or unit trusts, or a combination of these options. Each choice offers its own set of advantages and considerations, allowing investors to tailor their approach based on their preferences and investment goals.

In conclusion, municipal bonds provide investors with the opportunity for tax-efficient income, stability, low default risk, and diversification. Understanding the advantages of municipal bonds and exploring the available investment options can help investors make informed decisions and potentially benefit from the attractive features of this asset class. As with any investment, it is important to carefully evaluate risks, conduct thorough research, and consider individual financial circumstances before investing in municipal bonds.