Home>Finance>Municipal Bond: Definition, Types, Risks, And Tax Benefits

Finance

Municipal Bond: Definition, Types, Risks, And Tax Benefits

Published: December 28, 2023

Learn about municipal bonds including their definition, various types, associated risks, and tax benefits. Explore the world of finance with this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Municipal Bonds: Definition, Types, Risks, and Tax Benefits

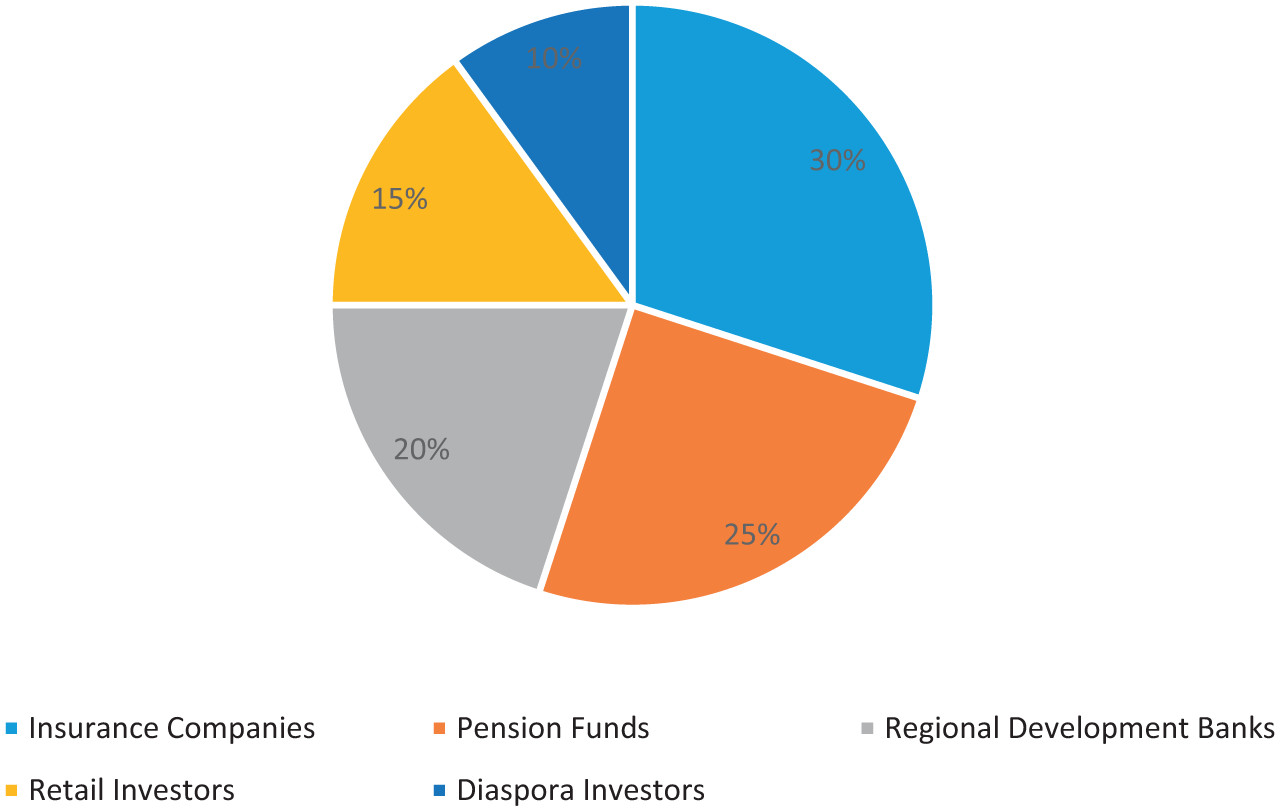

Welcome to our latest blog post in the “Finance” category! In this article, we are going to dive deep into the world of municipal bonds. Municipal bonds, also known as munis, are debt securities issued by state and local governments to finance public projects such as schools, roads, and infrastructure. These bonds play a significant role in financing crucial governmental projects. Wondering how they work and what the benefits and risks are? Let’s find out!

Key Takeaways

- Municipal bonds are debt securities issued by state and local governments.

- They offer tax advantages, and their credit ratings directly affect the interest rates investors receive.

Definition: What are Municipal Bonds?

Municipal bonds are essentially loans made by investors to local governments or public entities. They are used to finance public projects that benefit the community, such as building schools, hospitals, or improving local infrastructure. In exchange for lending money to the government, investors receive interest payments at regular intervals until the bond matures.

Types of Municipal Bonds

Municipal bonds come in various forms, including:

- General Obligation (GO) Bonds: These bonds are backed by the issuer’s taxing authority and full faith and credit. They are considered less risky and typically have lower interest rates.

- Revenue Bonds: These bonds are supported by specific revenue streams, such as tolls, water, or electric services. They are riskier but have the potential for higher yields.

- Industrial Revenue Bonds (IRBs): These bonds are issued to finance projects for private corporations, such as manufacturing facilities. The underlying companies are responsible for repaying them.

- Qualified 501(c)(3) Bonds: These bonds are issued on behalf of nonprofit organizations, such as hospitals and universities. They offer tax-exempt financing to these organizations.

- Housing Bonds: Housing bonds are munis issued to fund affordable housing initiatives. They aim to provide safe and affordable housing options for low- and moderate-income individuals and families.

Risks Associated with Municipal Bonds

While municipal bonds are generally considered less risky than other types of investments, it’s important to be aware of the potential risks:

- Credit Risk: Municipalities can default on their obligations, resulting in delayed or missed interest payments. It’s crucial to research the credit ratings of the issuers to assess their creditworthiness.

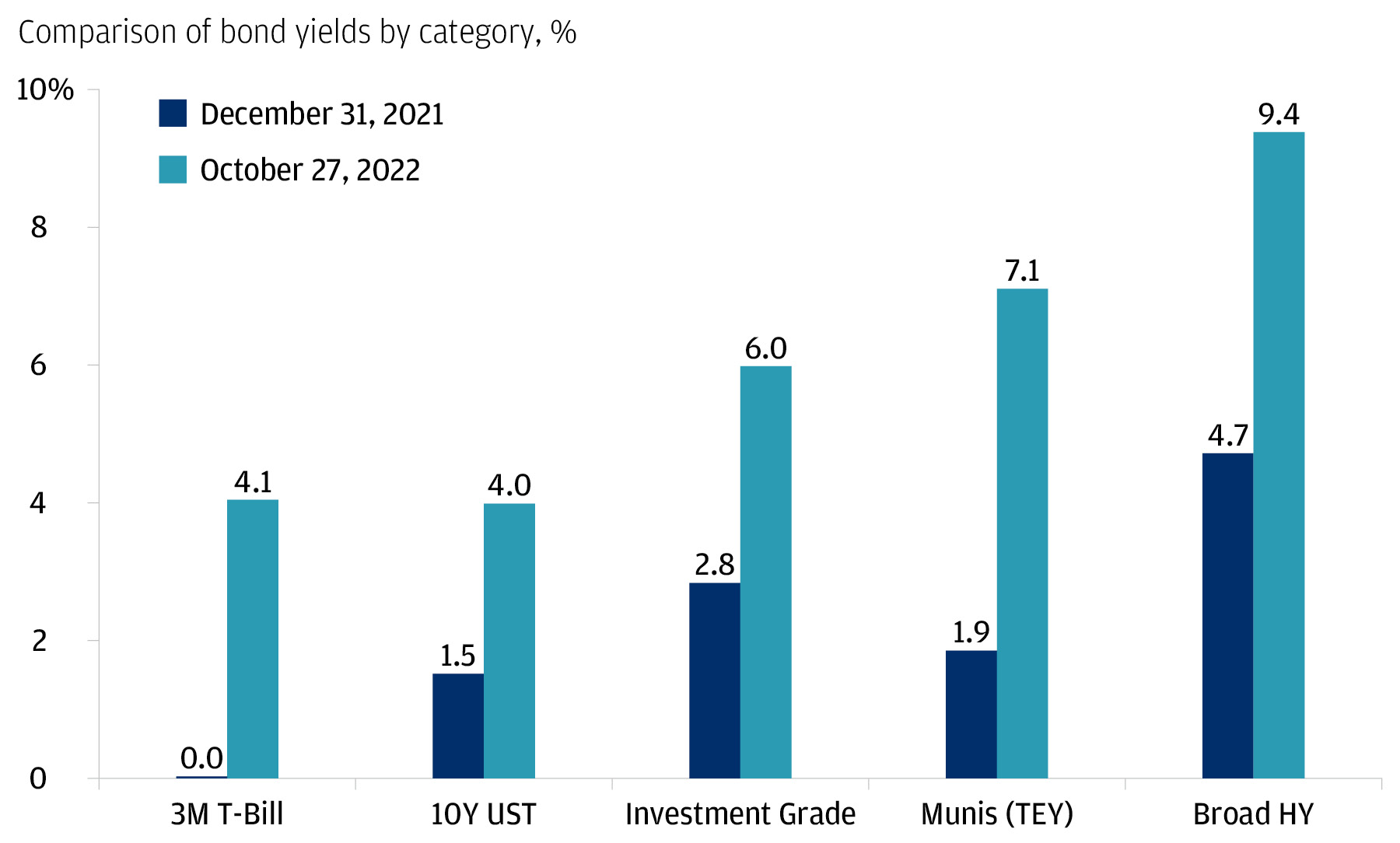

- Interest Rate Risk: Municipal bond prices are inversely related to interest rates. When interest rates rise, bond prices tend to fall.

- Liquidity Risk: Some municipal bonds may have limited trading activity, making them less liquid. In case of unforeseen circumstances, it may be challenging to quickly sell these bonds.

Tax Benefits of Municipal Bonds

Municipal bonds offer unique tax benefits that make them attractive to investors:

- Tax-Exempt Interest: The interest earned from municipal bonds is often exempt from federal income taxes. Depending on your residence and the issuer, the interest may also be exempt from state and local taxes.

- Alternative Minimum Tax (AMT) Exclusion: Some municipal bonds are exempt from AMT, providing additional tax advantages.

Conclusion

Investing in municipal bonds can provide steady income and potential tax advantages. However, it’s crucial to understand the different types of municipal bonds, their associated risks, and the potential tax benefits. Before investing, consult with a financial advisor to determine if municipal bonds align with your investment goals and needs.

We hope this article has given you a deeper understanding of municipal bonds. If you have any questions or would like to learn more, feel free to reach out to us. Happy investing!