Home>Finance>When Does My First Billing Cycle Begin With A Capital One Secured Card?

Finance

When Does My First Billing Cycle Begin With A Capital One Secured Card?

Published: March 1, 2024

Learn when your first billing cycle begins with a Capital One Secured Card. Get the finance information you need to manage your card effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Navigating the world of credit cards can be both exciting and overwhelming, especially when you're considering a secured card to build or rebuild your credit. Capital One offers a popular secured card option that can serve as a valuable tool on your journey to financial stability. Understanding the nuances of how a secured card, such as the Capital One Secured Card, operates is crucial for making informed decisions and maximizing its benefits.

In this article, we'll delve into the specifics of when your first billing cycle begins with a Capital One Secured Card. By shedding light on this aspect, you'll gain a clearer understanding of the financial responsibilities associated with this type of credit card. Whether you're new to the world of credit or looking to make a fresh start, the insights provided here will empower you to manage your secured card effectively and leverage it to improve your credit standing.

Let's embark on a comprehensive exploration of the billing cycle commencement for a Capital One Secured Card, unraveling the factors that influence this crucial milestone and equipping you with the knowledge needed to navigate this aspect of credit management confidently.

Understanding Capital One Secured Card

The Capital One Secured Card is a valuable financial tool designed to help individuals establish or rebuild their credit. Unlike traditional credit cards, a secured card requires a security deposit, which serves as collateral and determines the initial credit limit. This deposit is fully refundable, provided that the cardholder manages the account responsibly and pays their balances on time.

One of the key advantages of the Capital One Secured Card is its accessibility, as it caters to individuals with limited credit history or those working to improve a damaged credit score. By responsibly using the secured card, cardholders can demonstrate their creditworthiness and lay a solid foundation for accessing more favorable credit options in the future.

Capital One reports the cardholder’s payment history to the three major credit bureaus, namely Equifax, Experian, and TransUnion. This reporting practice enables cardholders to build a positive credit history when they make timely payments and maintain low credit utilization. As a result, the secured card can be a stepping stone toward achieving financial goals such as obtaining a mortgage, car loan, or unsecured credit cards with higher credit limits and better terms.

Furthermore, the Capital One Secured Card offers the convenience and security features associated with traditional credit cards, including fraud protection, 24/7 account monitoring, and the ability to make purchases worldwide. With responsible use, cardholders can gradually enhance their credit profile and transition to unsecured credit products, ultimately reducing their reliance on the security deposit.

Billing Cycle Commencement

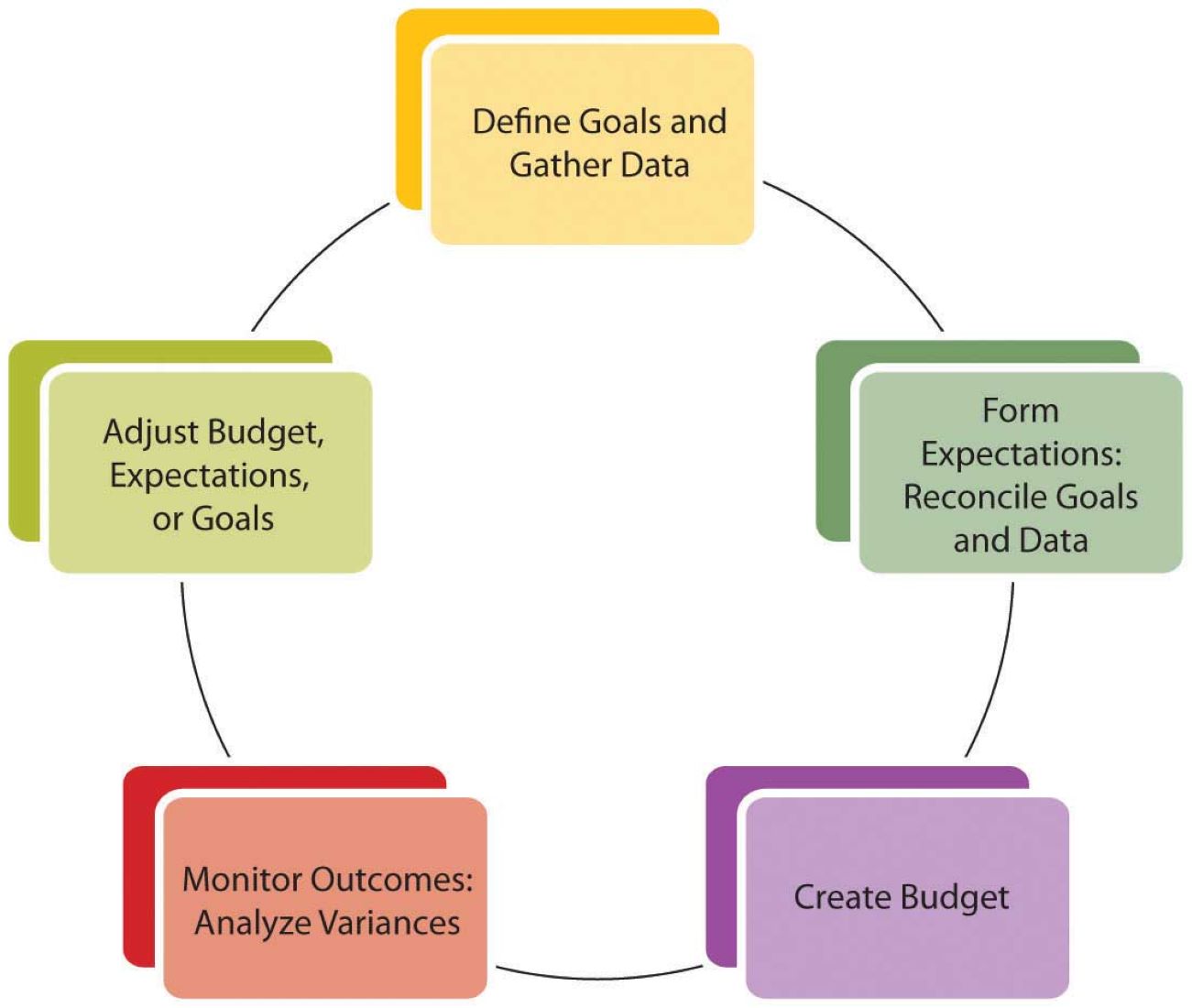

Understanding when your first billing cycle begins with a Capital One Secured Card is essential for managing your finances effectively. The billing cycle, also known as the statement period, is the timeframe during which your credit card transactions are recorded to generate a statement. This statement summarizes your charges, payments, and other account activities for the given period. It is crucial to grasp the billing cycle’s start date, as it directly impacts when your payments are due and when your credit utilization is reported to the credit bureaus.

When you are approved for a Capital One Secured Card, the initial billing cycle typically commences shortly after the account opening and card activation. During this period, any purchases, balance transfers, or cash advances you make with the card will be recorded and reflected in your first statement. It’s important to monitor your spending during this time and ensure that you stay within your credit limit to avoid potential over-limit fees and negative credit implications.

Once the billing cycle concludes, typically after 30 days, Capital One will generate a statement detailing your account activity and the amount due. This statement will include the minimum payment required, the due date, and the total balance. It’s crucial to review this statement carefully to verify the accuracy of the transactions and understand your payment obligations.

As you become familiar with the billing cycle commencement and statement generation process, you can proactively manage your secured card account, make timely payments, and maintain a healthy credit utilization ratio. This proactive approach can contribute to building a positive credit history and improving your credit score over time.

Factors Affecting Billing Cycle Start Date

The commencement of the billing cycle for a Capital One Secured Card is influenced by several factors that determine when your account activity is captured and when your statement is generated. Understanding these factors can help you anticipate the timing of your billing cycle and effectively manage your credit card usage.

- Account Activation: The billing cycle typically begins after you activate your Capital One Secured Card. Upon activation, your card becomes operational, and any transactions you make thereafter will be included in the upcoming billing cycle. It is advisable to activate your card promptly to initiate the billing cycle and start building your credit history.

- Account Opening Date: The date on which your Capital One Secured Card account is opened also plays a pivotal role in determining the billing cycle start date. This date marks the beginning of your cardholder journey and sets the foundation for subsequent billing cycles and statement periods.

- Statement Closing Date: The statement closing date, which occurs at the end of each billing cycle, influences when the next cycle begins. Capital One typically assigns a specific statement closing date to each cardholder, and the subsequent billing cycle commences after this date. Monitoring your statement closing date can help you anticipate when your next billing cycle will start.

- Transaction Timing: The timing of your transactions, such as purchases and payments, can impact the start date of your billing cycle. Transactions made shortly before or after the statement closing date may fall into the next billing cycle, affecting the timing of their inclusion in your statement and the corresponding payment due date.

By considering these factors and staying informed about your account activity, you can gain greater control over your billing cycle and align your credit card usage with your financial goals. Effectively managing the billing cycle start date can contribute to maintaining a positive credit profile and maximizing the benefits of your Capital One Secured Card.

Conclusion

Mastering the dynamics of the billing cycle commencement for your Capital One Secured Card is a foundational step in your financial journey. By comprehending when your first billing cycle begins and the factors that influence it, you can navigate the realm of credit management with confidence and foresight.

With the Capital One Secured Card, you have the opportunity to proactively shape your credit history and demonstrate responsible financial habits. The initial billing cycle sets the stage for your ongoing credit card usage, payment patterns, and credit reporting, making it essential to grasp its significance.

As you embark on this credit-building endeavor, remember that the billing cycle start date is influenced by various factors, including account activation, account opening date, statement closing date, and transaction timing. By staying attuned to these factors, you can anticipate your billing cycle and make informed decisions to optimize your credit utilization and payment practices.

Ultimately, the insights gained from understanding the billing cycle commencement for your Capital One Secured Card empower you to wield this financial tool effectively, bolster your creditworthiness, and work toward achieving your long-term financial aspirations.

Armed with this knowledge, you are poised to embark on a path of financial empowerment, leveraging the Capital One Secured Card to pave the way for a brighter and more secure financial future.