Finance

When Does PBR Pay Dividends?

Published: January 3, 2024

Learn all about when PBR pays dividends in the world of finance. Find out the timing and process for dividend distributions from PBR.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where understanding the intricate dynamics of investments can lead to lucrative returns. One essential aspect of investing is assessing a company’s financial health and profitability. One popular metric used by investors to gain insights into a company’s financial strength is the Price-to-Book Ratio (PBR). As finance enthusiasts, we often come across the term PBR and wonder about its implications on investment returns.

In this article, we will delve into the concept of PBR, its relevance to dividend payments, and how it can guide investors in making informed decisions. Whether you are a seasoned investor or a beginner looking to navigate the world of finance, understanding the connection between PBR and dividends is integral to harnessing the potential of your investments.

Before we dive deeper into the relationship between PBR and dividends, let’s take a moment to understand what PBR represents. The Price-to-Book Ratio is a valuation ratio commonly used to compare a company’s market value with its book value.

The book value is derived by subtracting a company’s liabilities from its assets and represents the net worth of the company. On the other hand, the market value is the current value of the company’s stock as determined by the supply and demand dynamics in the stock market.

By dividing the market value per share with the book value per share, we arrive at the PBR. This ratio provides investors with insights into how the market perceives the company’s financial position and growth potential.

Now that we have a basic understanding of PBR, let’s explore the world of dividends. Dividends are the distributions of a company’s earnings to shareholders. Companies typically pay dividends to reward shareholders for their investment and to signal financial stability and profitability.

As an investor, understanding when a company is likely to pay dividends can be a crucial factor in deciding which stocks to invest in. This is where the connection between PBR and dividends becomes vital.

In the next sections, we will explore how PBR indicates a company’s potential to pay dividends, taking into account various factors and real-life case studies. So, let’s deep dive into the world of PBR and dividends and discover the insights it holds for investors.

Understanding PBR (Price-to-Book Ratio)

The Price-to-Book Ratio (PBR) is a financial metric used by investors to assess the relative value of a company’s stock. It provides a measure of how the market values a company’s assets in relation to its book value. Understanding PBR is crucial to gaining insights into a company’s financial health and growth potential.

To calculate PBR, you divide the market value per share by the book value per share. The market value per share represents the current trading price of a company’s stock, while the book value per share represents the net worth of the company, calculated by subtracting liabilities from assets.

A PBR above 1 indicates that the market values the company’s assets more than their book value, suggesting that investors have high expectations for future growth and profitability. Conversely, a PBR below 1 indicates that the company’s assets are valued less than their book value, implying that the market has lower expectations for future growth.

However, it’s important to note that PBR alone cannot provide a complete picture of a company’s financial health. It is just one tool in an investor’s arsenal and should be used in conjunction with other fundamental analysis techniques.

When analyzing PBR, it is essential to compare it with other companies in the same industry or sector. This helps to gauge whether a company’s PBR is relatively higher or lower compared to its peers. A higher PBR may indicate that the company is overvalued, while a lower PBR may suggest that it is undervalued.

Furthermore, PBR can vary across different industries and sectors. Industries with high capital intensity, such as manufacturing or telecommunications, tend to have higher PBRs, reflecting the value of their tangible assets. On the other hand, industries with lower capital requirements, such as technology or software development, may have lower PBRs, as their value is often derived from intangible assets like intellectual property.

While PBR provides insight into a company’s valuation, it cannot predict the future performance or profitability of a company. Therefore, it is crucial to consider other factors, such as revenue growth, earnings, and market trends, alongside PBR to make informed investment decisions.

In the next section, we will explore the world of dividends and how PBR relates to dividend payments. Understanding this connection will help investors determine when a company is likely to pay dividends and how it aligns with their investment goals.

Dividends: A Brief Overview

Dividends are a crucial aspect of investing in stocks. They are distributions of a company’s earnings to its shareholders as a way to share the company’s profits. Dividends serve as a reward for investors who own shares in the company.

Companies generally pay dividends on a regular basis, such as quarterly, semi-annually, or annually. The amount of dividends paid can vary and is typically determined by the company’s board of directors. It is important to note that not all companies pay dividends, as some may choose to reinvest their profits into the business for growth opportunities.

Dividends are a way for companies to attract and retain investors by providing them with a steady income stream. For investors, dividends can be an important source of passive income, especially for those seeking regular cash flow from their investments.

Dividends can take various forms, including cash dividends and stock dividends. Cash dividends are the most common type, where shareholders receive a cash payment per share owned. Stock dividends, also known as bonus shares, involve the distribution of additional shares to existing shareholders rather than cash.

Companies that consistently pay dividends are often viewed favorably by investors, as they demonstrate financial stability and a commitment to sharing profits. Dividend payments can also be an indicator of a company’s confidence in its future earnings and growth prospects.

While dividends are generally seen as a positive aspect of investing, it’s important to consider certain factors. High dividend yields can be attractive, but they may also indicate that a company is facing financial challenges or that its stock price has declined significantly. Additionally, dividend payments are not guaranteed, and a company may choose to reduce or omit dividends in times of financial hardship or during periods of reinvestment.

Investors should also carefully consider the tax implications of dividend income, as dividend payments are typically subject to taxes at various levels, depending on the investor’s jurisdiction and personal circumstances.

In the next section, we will explore the factors that can influence dividend payments and delve into the connection between PBR and dividends. Understanding these factors will help investors gauge the likelihood of receiving dividends from a company and make informed investment decisions.

Factors Influencing Dividend Payments

Dividend payments are influenced by a variety of factors that reflect a company’s financial health, profitability, and overall business strategy. Understanding these factors can help investors gauge the likelihood and sustainability of dividend payments. Let’s explore some of the key factors that influence dividend payments:

- Earnings and Profitability: A company’s ability to pay dividends is closely tied to its earnings and profitability. Companies with consistent and growing earnings are more likely to pay dividends. Investors often look for companies with a track record of stable and increasing profits to ensure a sustainable dividend payment.

- Free Cash Flow: Free cash flow is a measure of the cash a company generates after deducting capital expenditures. Companies with strong free cash flow are in a better position to pay dividends as they have surplus funds available. Positive free cash flow indicates that a company has enough cash to invest in growth opportunities and still distribute dividends to shareholders.

- Debt Levels: High levels of debt can limit a company’s ability to pay dividends. Companies with significant debt obligations may choose to allocate their cash flow towards debt repayment rather than dividend payments. It is important to assess a company’s debt levels and debt servicing capabilities when evaluating its dividend potential.

- Industry and Sector Trends: Dividend payments can vary across industries and sectors. Industries with stable and mature businesses, such as utilities and consumer staples, tend to have a higher likelihood of paying dividends. On the other hand, growth-oriented industries, such as technology and biotechnology, may prioritize reinvesting profits for expansion rather than distributing dividends.

- Regulatory and Legal Constraints: Dividend payments are subject to regulatory and legal requirements. Companies must comply with regulatory guidelines, tax obligations, and financial stability measures when deciding on dividend payments. These constraints may impact the frequency, amount, or timing of dividend distributions.

- Management Decisions and Shareholder Priorities: Ultimately, the decision to pay dividends rests with a company’s board of directors and management. They assess various factors, including future growth opportunities, investment priorities, and shareholder expectations. Management may prioritize reinvesting profits for expansion or share buybacks over paying dividends if they believe it will benefit the company and shareholders in the long run.

It is important for investors to consider these factors and conduct thorough research before investing in companies with the expectation of receiving dividends. Analyzing a company’s financial statements, earnings reports, and management commentary can provide valuable insights into their dividend policy and payout potential.

In the next section, we will explore how the Price-to-Book Ratio (PBR) can indicate a company’s likelihood of paying dividends. Understanding this connection will enable investors to incorporate PBR as a valuable tool in their dividend investing strategy.

When Does PBR Indicate Dividends?

The Price-to-Book Ratio (PBR) can provide investors with valuable insights into a company’s potential to pay dividends. While PBR alone may not directly indicate dividend payments, it can be used in conjunction with other factors to assess the likelihood of receiving dividends. Let’s explore how PBR can be indicative of dividend payments:

1. PBR and Value Investing: Value investors often consider companies with low PBRs as potential dividend-paying stocks. A low PBR suggests that the market values the company’s assets less than their book value, indicating a potential undervaluation. Such undervalued companies may have the potential to generate steady earnings and cash flow, making them more likely candidates for dividend payments.

2. PBR and Return on Equity (ROE): Return on Equity is a measure of a company’s profitability in relation to its shareholders’ equity. Companies with higher ROEs tend to generate more profits per unit of shareholders’ equity and may have a higher propensity to pay dividends. When assessing dividend potential, investors can consider companies with a combination of low PBR and high ROE as potential candidates.

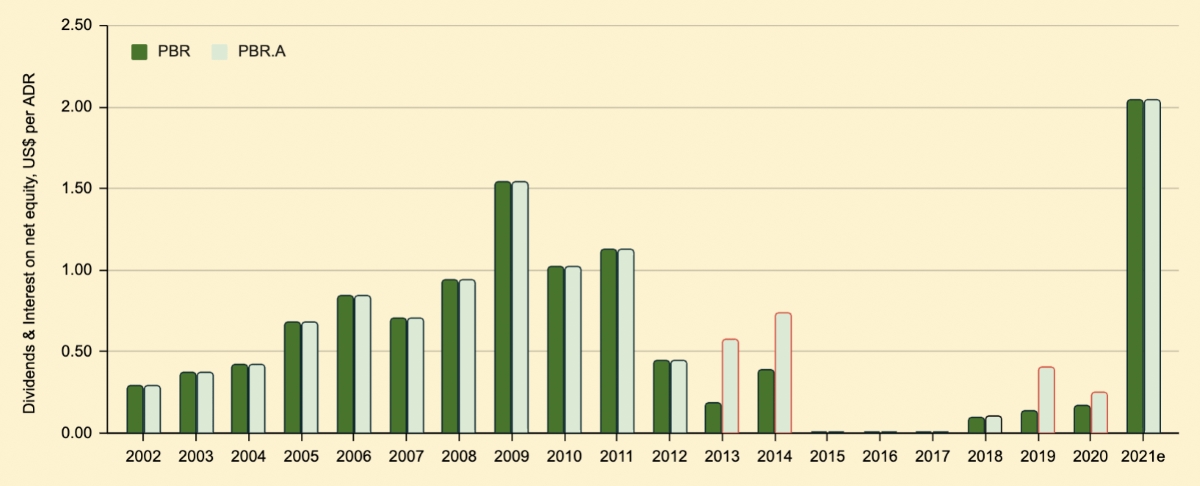

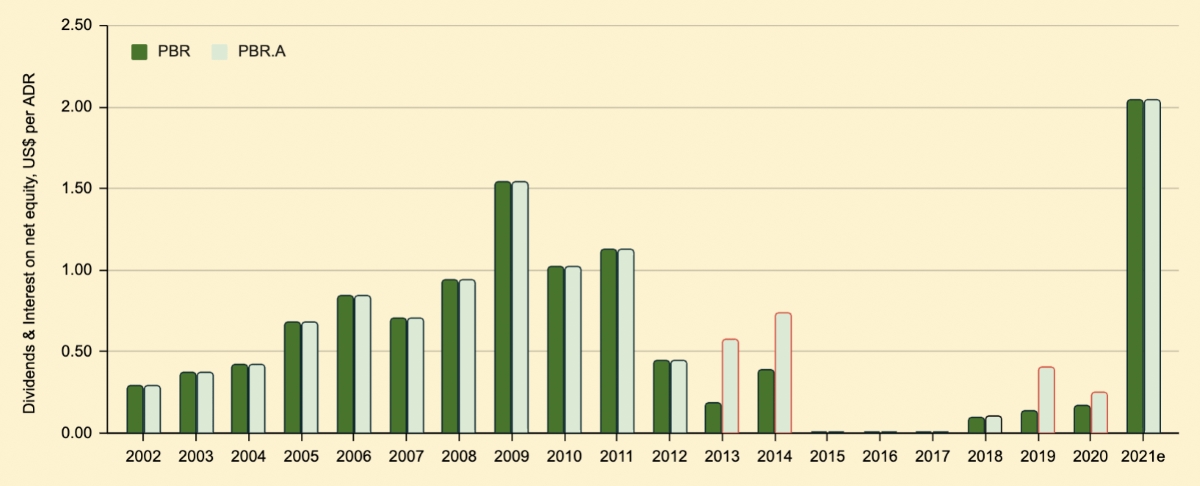

3. Historical Dividend Track Record: Scrutinizing a company’s dividend track record can provide insights into its dividend-paying tendencies. Stocks with a history of consistent dividend payments are more likely to continue the trend. By examining the relationship between PBR and historical dividend payments, investors can gauge the company’s commitment to sharing profits with shareholders.

4. Comparative Analysis: Comparing a company’s PBR with that of its industry peers is another valuable approach. If a company has a relatively low PBR compared to its peers, it may indicate that the market has undervalued the company’s potential to generate profits. This may suggest the possibility of dividend payments as the market catches up with the company’s true value.

5. Financial Stability: A company’s financial stability is a crucial factor in determining its ability to pay dividends. While PBR alone may not indicate financial stability, integrating it with other financial ratios such as debt-to-equity ratio, current ratio, or interest coverage ratio can provide a comprehensive view. Companies with healthy financials are more likely to have the resources to sustain dividend payments.

It’s important to note that PBR is just one metric among many that can help identify potential dividend-paying stocks. Investors should conduct thorough research, consider the company’s overall financial health, examine industry trends, and assess management’s dividend policy before making investment decisions.

In the following section, we will explore real-life case studies and examples to illustrate how PBR can be used to assess dividend potential in various scenarios.

Case Studies and Examples

Examining real-life case studies and examples can provide valuable insights into how the Price-to-Book Ratio (PBR) can indicate a company’s likelihood of paying dividends. Let’s explore a couple of scenarios to illustrate this connection:

Case Study 1: Company A and Company B

Company A operates in the manufacturing industry, while Company B operates in the technology sector. Both companies have similar earnings and profitability. However, when comparing their PBRs, Company A has a lower PBR compared to Company B. This indicates that Company A’s assets are undervalued in relation to its book value, potentially making it an attractive dividend-paying stock. On the other hand, Company B’s higher PBR suggests that investors value its assets more than their book value, indicating a lower likelihood of dividend payments.

Case Study 2: Historical Dividend Track Record

Consider two companies in the consumer goods sector: Company X and Company Y. Company X has a consistently high PBR, indicating that the market values its assets at a premium. Company Y, on the other hand, has a lower PBR, reflecting an undervaluation relative to its book value. When examining their historical dividend track records, it is evident that Company Y has a consistent history of paying dividends, while Company X has not paid dividends in the past. This indicates that Company Y, with its lower PBR, is more likely to continue making dividend payments in the future compared to Company X.

These case studies highlight how assessing PBR in conjunction with other factors and industry trends can provide insights into a company’s dividend potential. It’s important for investors to analyze each case thoroughly, considering the specific characteristics of the industry, the company’s financial stability, and its historical track record.

In practice, conducting thorough research and analysis of a company’s fundamentals, financial statements, and dividend policies can help investors identify potential dividend-paying stocks. Additionally, consulting with financial advisors or utilizing online research platforms can provide further guidance and expertise.

Now that we have explored some case studies and examples, let’s discuss potential drawbacks and limitations associated with relying solely on PBR as an indicator of dividend payments.

Potential Drawbacks and Limitations

While the Price-to-Book Ratio (PBR) can offer valuable insights into a company’s potential to pay dividends, it is important to acknowledge the potential drawbacks and limitations of relying solely on this metric. Let’s explore some of these limitations:

1. Limited Scope: PBR focuses primarily on a company’s financial health and asset valuation. However, it does not provide a comprehensive view of a company’s future earnings, growth prospects, or dividend policies. Therefore, it is essential to consider other fundamental analysis tools and factors when assessing dividend potential.

2. Industry Variations: PBR may vary significantly across different industries and sectors due to variations in capital intensity, business models, and asset structures. Comparing PBR between companies in different industries may not be meaningful, as the factors driving their valuation metrics could differ. It is crucial to compare PBR within the same industry to understand a company’s relative position.

3. Market Sentiment and Timing: PBR is influenced by market sentiment, investor perception, and timing. The market’s perception of a company’s future prospects can impact its valuation and therefore its PBR. Additionally, temporary market fluctuations or economic conditions can temporarily distort PBR ratios, making immediate decisions based solely on PBR challenging.

4. Limitations of Book Value: Book value is a static measure that may not accurately reflect a company’s true value. It does not consider the market’s view of intangible assets such as brand value, intellectual property, or future growth potential. Therefore, relying solely on book value in the calculation of PBR may not provide a complete representation of a company’s intrinsic value.

5. Dividend Policy Shifts: A company’s dividend policy can change over time due to various factors such as shifts in business strategy, financial performance, or market conditions. Past dividend payments or the company’s historical track record are not indicative of future dividend payments. It is essential to stay updated on a company’s dividend policy and regularly assess key financial indicators.

While considering these limitations, it is worth noting that PBR, when used in conjunction with other fundamental analysis tools, can provide valuable insights into a company’s dividend potential. Investors should conduct thorough research, analyze financial statements, and consider other factors such as earnings growth, free cash flow, and industry trends to make well-informed investment decisions.

Now let’s conclude our article by summarizing the key takeaways from our exploration of PBR and its indication of dividend payments.

Conclusion

In conclusion, understanding the Price-to-Book Ratio (PBR) and its connection to dividend payments can provide investors with valuable insights when making investment decisions. While PBR alone may not directly indicate dividend payments, it is an important metric to consider in conjunction with other factors.

PBR offers a measure of a company’s valuation relative to its book value, reflecting market sentiment and growth expectations. Companies with low PBRs may be undervalued and potentially attractive for dividend investors, as they indicate the market’s underappreciation of their asset value and growth potential. Additionally, comparing PBR with industry peers can provide a relative assessment of a company’s potential dividend-paying capability.

Factors such as earnings, profitability, free cash flow, debt levels, and management decisions all influence dividend payments alongside PBR and should be carefully evaluated. It is crucial to conduct comprehensive research and analysis to gain a holistic understanding of a company’s financial health, historical dividend track record, and dividend policy.

While PBR is a valuable tool, it has limitations. Its application may be affected by industry variations, market sentiment, and the limitations of book value. Furthermore, a company’s dividend policy can shift over time, making it essential for investors to stay updated.

Incorporating PBR into investment strategies can help investors identify potential dividend-paying stocks and align their investment goals with companies that have a history of rewarding shareholders. However, it is always important to consider PBR alongside other fundamental analysis tools and to evaluate the overall financial health and growth prospects of a company.

By understanding PBR and its indication of dividend payments, investors can enhance their decision-making process, seeking attractive dividend opportunities while balancing risk and reward. Always remember that thorough research, diversification, and staying informed are keys to successful investing in the dynamic world of finance.