Finance

When Does The IRS Start Accepting 2023?

Modified: February 21, 2024

Learn when the IRS starts accepting tax returns for 2023 and get your finances in order. Stay ahead of the game and maximize your deductions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of taxes! Every year, millions of Americans eagerly await the start of tax season, when they can file their tax returns and, perhaps, receive a much-anticipated refund. As we approach 2023, it’s important to stay informed about the key dates and changes in tax laws that may impact your filing process. Whether you’re a seasoned taxpayer or a novice, this article will provide you with a comprehensive overview of what to expect.

Taxes can be complex and overwhelming, but with the right information and a bit of planning, you can navigate this annual financial requirement with ease. The first step is to know when the IRS begins accepting tax returns for the 2023 tax year. Mark this date on your calendar, as it sets the starting point for your tax filing journey.

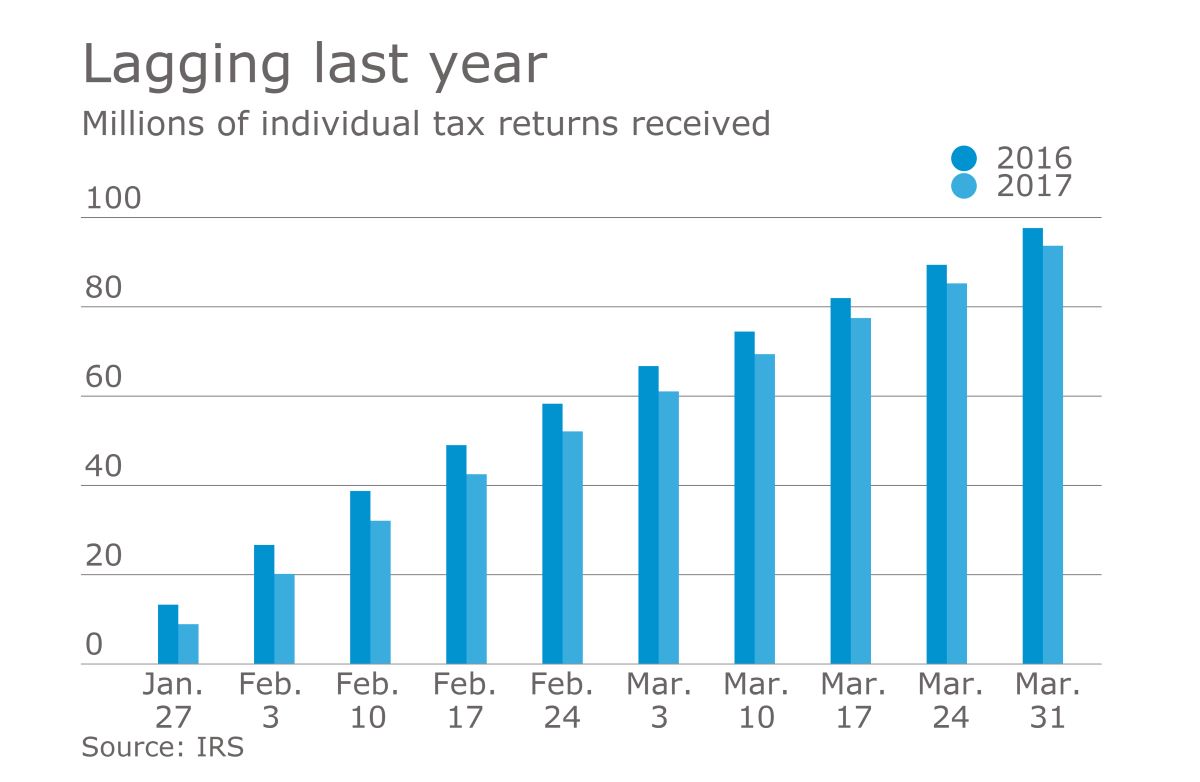

The IRS typically begins accepting tax returns in late January or early February. In recent years, the official start date has been around January 27th. However, it’s important to note that this date can vary from year to year. To ensure that you have the most up-to-date information, it’s advisable to check the IRS website or consult with a tax professional.

While the IRS may start accepting tax returns in late January or early February, it’s worth mentioning that not all tax forms may be available right away. Some more complex forms, such as those related to business income or foreign investments, may have delayed availability. It’s important to stay informed about which forms are ready and when, as this will impact your ability to file your taxes accurately and on time.

As you begin preparing for the 2023 tax season, it’s also crucial to keep in mind the deadlines for filing your tax return. For most taxpayers, the deadline falls on April 15th. However, if the 15th falls on a weekend or holiday, the deadline is extended to the next business day. It’s essential to mark this date and plan accordingly to avoid any penalties or late filing fees.

Now that we’ve covered the important dates of the 2023 tax season, let’s explore some changes in tax laws that you should be aware of before filing your return. Tax laws are constantly evolving, and staying informed about the latest updates can help you maximize your deductions and minimize your tax liability.

Important Dates for Taxpayers

As a taxpayer, it’s crucial to stay organized and stay ahead of important dates during the tax season. Here are some key dates to keep in mind for the 2023 tax year:

- January 27, 2023: This is the tentative start date for the IRS to begin accepting tax returns. However, it’s always advisable to check the IRS website for any updates or changes to the start date.

- April 15, 2023: This is the deadline for most taxpayers to file their federal income tax returns. If the 15th falls on a weekend or holiday, the deadline is extended to the next business day.

- October 15, 2023: If you need more time to file your tax return, you can request an extension by submitting IRS Form 4868. This will grant you an additional six months to file your return, making the new deadline October 15, 2023. However, it’s important to note that this extension only applies to the filing deadline, not the deadline for paying any taxes owed.

- Estimated Tax Payment Deadlines: If you’re a self-employed individual or receive income that isn’t subject to withholding, you may be required to make quarterly estimated tax payments. The payment due dates for the 2023 tax year are April 15, 2023, June 15, 2023, September 15, 2023, and January 15, 2024.

- Other State Tax Deadlines: While April 15th is the federal tax deadline, it’s important to check the deadlines for state income tax returns. Each state may have its own filing deadline, which could differ from the federal deadline.

It’s crucial to mark these dates on your calendar and plan accordingly to avoid any last-minute rush or penalties for late filing. Remember that timely filing of your tax return is essential to ensure you receive any potential refunds or avoid interest and penalties for late payment of taxes owed.

Changes in Tax Laws for 2023

Each year, tax laws undergo updates and revisions, and 2023 is no exception. It’s important to stay informed about these changes to ensure that you’re taking full advantage of available tax benefits and deductions. Let’s take a look at some key changes in tax laws for 2023:

- Standard Deduction: The standard deduction for the 2023 tax year has increased. For single filers and married individuals filing separately, the standard deduction is $12,950. For married couples filing jointly, the standard deduction is $25,900, and for heads of household, it is $19,400.

- Tax Brackets: Tax brackets have been adjusted for inflation. This means that the income thresholds for each tax bracket have increased slightly for the 2023 tax year. It’s important to review the new tax brackets to determine which one you fall into and plan your tax strategies accordingly.

- Child Tax Credit: The child tax credit has been expanded for 2023. Eligible families can now claim up to $3,000 per child under the age of 17 and up to $3,600 for children under the age of 6. This credit can help offset the cost of raising children and can lead to significant tax savings. It’s important to review the eligibility criteria and ensure that you claim this credit if you qualify.

- Retirement Contributions: The contribution limits for retirement accounts, such as 401(k) and IRA, have been increased for 2023. This allows individuals to save more for retirement while enjoying potential tax savings. It’s important to review the new contribution limits and consider maximizing your retirement contributions to take advantage of these tax benefits.

- Medical Expense Deductions: The threshold for deducting medical expenses has been lowered to 7.5% of adjusted gross income (AGI) for all taxpayers. This means that you can deduct qualifying medical expenses that exceed 7.5% of your AGI. It’s crucial to keep track of your medical expenses and determine if you’re eligible for this deduction.

These are just a few examples of the changes in tax laws for 2023. It’s important to stay informed about other changes that may apply to your specific financial situation. Consider consulting with a tax professional or using tax software to ensure that you’re taking advantage of all available tax benefits and maximizing your potential refunds.

Filing Options for Tax Year 2023

When it comes to filing your taxes for the 2023 tax year, you have several options to choose from. Let’s explore some of the filing options available to taxpayers:

- File Online: One of the most popular and convenient options is to file your taxes online. There are numerous tax preparation software and online platforms available that make the process quick and efficient. These platforms guide you through the necessary steps, help you identify eligible deductions and credits, and ensure accurate calculations. When filing online, you can choose to e-file your return and receive any potential refunds via direct deposit, making the whole process seamless and faster.

- Hire a Tax Professional: If you prefer a hands-off approach or have complex tax situations, hiring a tax professional can be beneficial. An experienced tax professional can help ensure that your taxes are prepared accurately and optimize your potential refunds. They have an in-depth understanding of tax laws and can provide personalized advice based on your unique financial circumstances. However, it’s important to note that hiring a tax professional may come with a cost, so it’s essential to inquire about their fees before proceeding.

- Free File Program: The IRS offers a Free File program, which allows eligible taxpayers to use participating tax preparation software for free. This program is available to individuals whose adjusted gross income (AGI) is below a certain threshold. You can visit the IRS website to check if you qualify for the Free File program and find software providers that participate in the program.

- File by Mail: If you prefer the traditional method, you can still choose to file your tax return by mail. However, it’s important to ensure that you have the necessary forms and that they are filled out correctly. Make sure to include any supporting documents and remember to send your return to the appropriate IRS address based on your location.

- Use a VITA Site: The Volunteer Income Tax Assistance (VITA) program offers free tax help to individuals with low-to-moderate income, disabled individuals, non-English speakers, and elderly taxpayers. VITA sites are manned by IRS-certified volunteers who can assist in preparing and filing your tax return. This option can be especially beneficial if you have specific tax questions or need assistance with complex tax situations.

Whether you choose to file online, hire a tax professional, or opt for another method, it’s important to ensure that your tax return is accurate and submitted on time. Consider the complexity of your financial situation, your comfort level with tax preparation, and your budget when selecting the most suitable filing option for the 2023 tax year.

Preparing Your Tax Return for 2023

Preparing your tax return can seem like a daunting task, but with the right approach and organization, it can be a smooth process. Here are some steps to help you prepare your tax return for the 2023 tax year:

- Gather your documents: Start by gathering all the necessary documents, such as your W-2 forms from your employer, 1099 forms for additional income, mortgage interest statements, and any other relevant documents. Having these documents on hand will make the tax preparation process much easier.

- Organize your records: It’s important to keep your financial records organized throughout the year. Gather your receipts, invoices, and any other documentation of expenses or deductions. This will make it easier to calculate accurate amounts and claim applicable deductions or credits.

- Review tax law changes: Familiarize yourself with the changes in tax laws for the 2023 tax year. Stay updated on any new deductions, credits, or changes that may impact your tax return. This will help you optimize your deductions and ensure compliance with the latest regulations.

- Select a tax preparation method: Choose the tax preparation method that suits your needs and preferences. Whether you decide to file your taxes electronically using tax preparation software, seek the assistance of a tax professional, or utilize other resources, make sure it aligns with your comfort level and financial circumstances.

- Maximize deductions and credits: Take advantage of all eligible deductions and credits to minimize your tax liability. Consider deductions such as the mortgage interest deduction, student loan interest deduction, and education-related credits. Ensure that you claim all applicable deductions and credits to maximize your tax savings.

- Double-check your return: Before submitting your tax return, carefully review all the information entered to avoid any errors or omissions. Double-check your calculations and ensure accuracy. Simple mistakes can cause delays or even trigger audits, so thoroughness is key.

- File and keep copies: Once you are confident in the accuracy of your tax return, file it accordingly. If filing electronically, follow the instructions provided by the software. If filing by mail, ensure that you have made copies for your records and mail the return to the appropriate IRS address.

By following these steps, you’ll be well on your way to preparing a complete and accurate tax return for the 2023 tax year. Remember to keep copies of your tax return and supporting documents for future reference. If you have any doubts or questions during the process, don’t hesitate to seek assistance from a tax professional or use IRS resources to ensure a smooth filing experience.

Tips for a Smooth Tax Filing Process

Filing your taxes can sometimes be a stressful and overwhelming task. However, with careful planning and preparation, you can make the process much smoother. Here are some tips to help you have a hassle-free tax filing experience for the 2023 tax year:

- Stay organized: Keep all your tax-related documents organized throughout the year. This includes receipts, invoices, and any other documents supporting your deductions or credits. Having everything in one place will save you time and stress when it’s time to file your taxes.

- Keep track of important dates: Mark key tax-related dates on your calendar, such as the start of tax season, the tax filing deadline, and any estimated tax payment due dates. Staying aware of these dates will help you avoid missing important deadlines and potential penalties.

- Use electronic filing: Consider filing your taxes electronically. E-filing is not only convenient and faster, but it also reduces the risk of errors. Additionally, if you’re eligible for a refund, you can expect to receive it much quicker by choosing direct deposit rather than receiving a paper check.

- Consider tax software: Utilize tax preparation software to streamline the process and ensure accuracy. These tools guide you through the necessary steps, help you identify potential deductions and credits, and ensure that your calculations are correct. Many software options also offer support and customer service to assist with any questions or concerns you may have.

- Take advantage of deductions and credits: Familiarize yourself with the available deductions and credits that can help reduce your tax liability. Common deductions include mortgage interest, student loan interest, and medical expenses. Be sure to claim all applicable deductions and credits to maximize your savings.

- Review your return before submitting: Before you submit your tax return, carefully review all the information for accuracy. Double-check your calculations and ensure that all the necessary forms and schedules are included. Even a small error can cause complications, so a thorough review is important.

- Pay attention to state taxes: Remember that tax obligations are not limited to the federal level. Research and understand your state’s tax laws and requirements to ensure that you file your state tax return accurately and meet any additional deadlines.

- Seek professional assistance when needed: If you have a complex tax situation, are unsure about certain deductions or credits, or simply want peace of mind, consider seeking assistance from a qualified tax professional. They can provide personalized advice and ensure that your tax return is prepared accurately.

By following these tips, you can simplify the process of filing your taxes for the 2023 tax year. Remember that adequate preparation and attention to detail are key to a smooth filing experience. Don’t hesitate to seek help if needed and stay organized throughout the process for a stress-free tax season.

Frequently Asked Questions

Here are some commonly asked questions about filing taxes for the 2023 tax year:

- When does the IRS start accepting tax returns for 2023?

- What is the tax filing deadline for the 2023 tax year?

- Are there any changes in tax laws for the 2023 tax year?

- Can I file my taxes online?

- What if I can’t file my taxes by the deadline?

- What if I made a mistake on my tax return?

The IRS typically starts accepting tax returns for the 2023 tax year in late January or early February. However, it’s important to check the IRS website or consult a tax professional for the exact starting date, as it can vary from year to year.

The tax filing deadline for most taxpayers for the 2023 tax year is April 15, 2023. If the 15th falls on a weekend or holiday, the deadline is extended to the next business day.

Yes, tax laws undergo updates and revisions each year. For the 2023 tax year, there may be changes in standard deductions, tax brackets, and deductions or credits. It’s crucial to stay informed about these changes to ensure that you maximize your deductions and remain compliant with the latest regulations.

Yes, you can choose to file your taxes online. There are various tax preparation software and online platforms available that make the process quick and efficient. These platforms guide you through the necessary steps, help you identify eligible deductions and credits, and ensure accurate calculations.

If you’re unable to file your taxes by the deadline, you can request an extension by filing IRS Form 4868. This will grant you an additional six months to file your return; however, it’s important to note that this extension only applies to the filing deadline, not the deadline for paying any taxes owed.

If you discover a mistake on your tax return after filing, you can file an amended return using IRS Form 1040X. This form allows you to correct any errors or omissions. It’s important to file an amended return as soon as possible to avoid any penalties or interest.

These are just a few frequently asked questions about filing taxes for the 2023 tax year. Remember, it’s always best to consult with a tax professional or refer to the IRS website for specific and up-to-date information based on your unique financial situation.

Conclusion

Preparing and filing your taxes may seem overwhelming, but with the right information and approach, you can tackle the process with confidence. As we approach the 2023 tax year, it’s important to stay informed about the key dates, changes in tax laws, and various filing options available to taxpayers.

Mark important dates on your calendar, including the start of tax season and the tax filing deadline, to ensure that you stay on track and avoid any late penalties. Familiarize yourself with the changes in tax laws for the 2023 tax year to take advantage of new deductions, credits, and other tax benefits.

Choose the filing option that best suits your needs, whether it’s filing online, using tax software, seeking professional assistance, or utilizing free resources like the Free File program or VITA sites. Consider maximizing deductions and credits to reduce your tax liability and increase potential refunds.

Stay organized throughout the process by gathering all necessary documents, keeping track of your records, and reviewing your tax return before submitting. In case of any mistakes, be proactive in amending your return to avoid any penalties or interest.

Filing your taxes for the 2023 tax year can be a smooth and successful process if you follow these tips and stay informed. Remember, it’s always advisable to consult with a tax professional or utilize IRS resources for personalized guidance and the most up-to-date information based on your unique financial situation.

By taking the time to understand the tax requirements and properly prepare your tax return, you can ensure compliance, maximize your tax benefits, and experience a stress-free tax season. Don’t hesitate to seek assistance when needed, and always strive for accuracy and timely filing.