Finance

When Is LLC Tax Return Due?

Modified: December 29, 2023

Learn about the deadlines for filing LLC tax returns and stay on top of your finance obligations. Find out when the LLC tax return is due to avoid penalties and ensure compliance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Overview of LLC Tax Return Due Dates

As a business owner, it is crucial to stay on top of your tax obligations. If you operate your business as a Limited Liability Company (LLC), understanding the due dates for filing your tax return is essential. The due dates may vary depending on your LLC’s tax classification and filing status.

There are two main types of LLCs for tax purposes: single-member LLCs and multi-member LLCs. A single-member LLC is owned by one individual, while a multi-member LLC has two or more owners. The IRS treats single-member LLCs as disregarded entities, which means the owner reports their business income and expenses on their personal tax return. In contrast, multi-member LLCs must file a separate tax return.

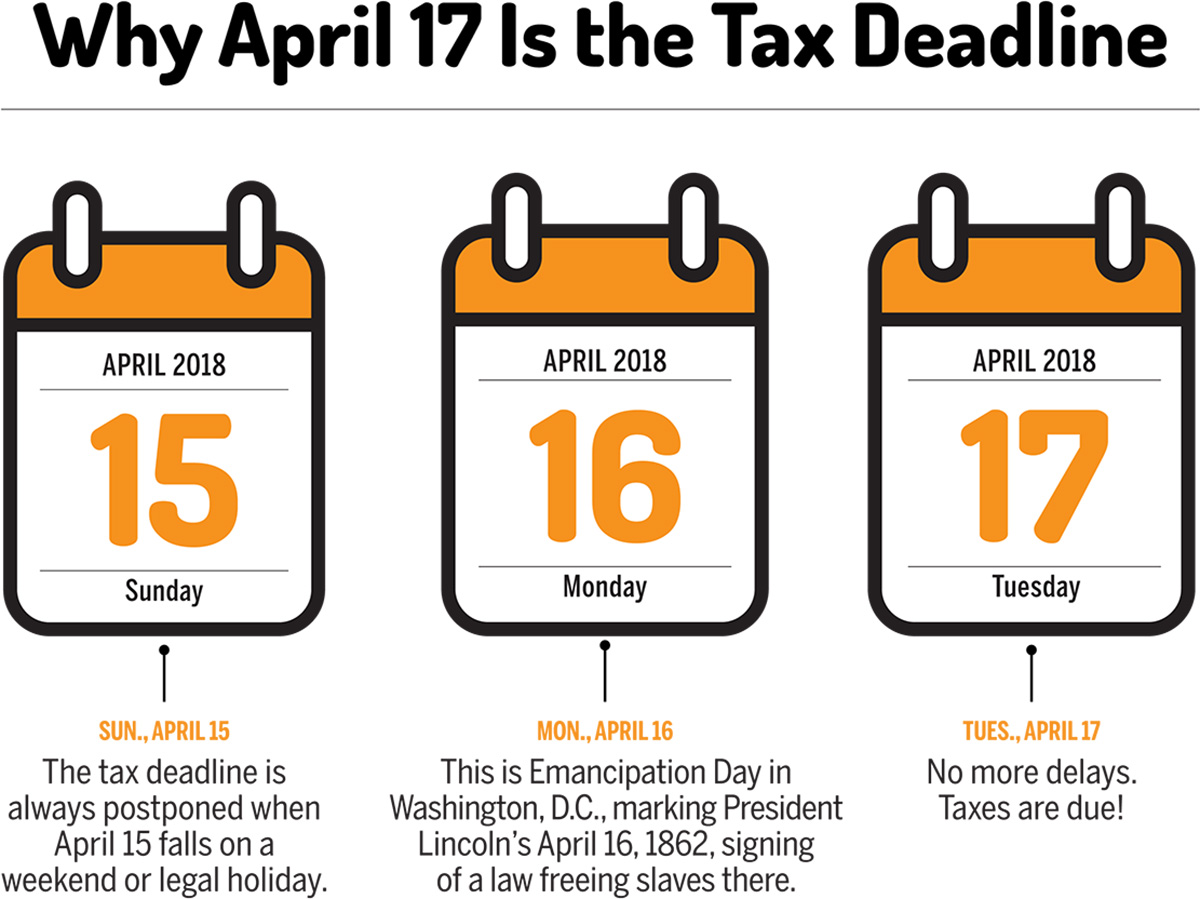

For single-member LLCs, the tax return due date follows the individual tax return due date, which is typically April 15th. However, if the due date falls on a weekend or a holiday, it is pushed to the next business day. It is important to note that the tax return due date for single-member LLCs can be extended six months by filing an extension form.

On the other hand, multi-member LLCs have a different tax return due date. They are required to file Form 1065, also known as the U.S. Return of Partnership Income. The due date for Form 1065 is the 15th day of the third month after the end of the LLC’s tax year. For example, if your LLC’s tax year ends on December 31st, your tax return would be due on March 15th. As with single-member LLCs, multi-member LLCs can also file for a six-month extension using Form 7004.

It is important to keep in mind that these due dates apply to LLCs that operate on a calendar year basis. However, some LLCs may operate on a fiscal year basis, which means their tax year does not align with the calendar year. In such cases, the tax return due date would be different and based on their fiscal year-end.

When filing your LLC tax return, it is crucial to ensure accuracy and compliance with tax laws. Failing to meet the tax return due date can result in penalties and interest charges. If you are unsure about your LLC’s tax filing status or have any questions, it is advisable to consult with a tax professional or CPA who specializes in business tax matters.

Determining the LLC’s Tax Filing Status

As an LLC owner, it is important to understand your LLC’s tax filing status as it determines how you report your business income and expenses to the IRS. The tax filing status of your LLC depends on the number of owners or members involved in the business.

There are two main types of tax classifications for LLCs: single-member LLCs and multi-member LLCs.

A single-member LLC is owned by one individual, and it is considered a disregarded entity for tax purposes. This means that the IRS doesn’t recognize the single-member LLC as a separate entity, and the owner reports the business income and expenses on their personal tax return, typically using Schedule C.

On the other hand, a multi-member LLC is owned by two or more individuals, and it is treated as a partnership for tax purposes. This means that the multi-member LLC must file a separate tax return using Form 1065, U.S. Return of Partnership Income. The form reports the LLC’s income, deductions, and credits, but does not pay taxes itself. Instead, each member must report their share of the partnership’s income on their personal tax return using Schedule E.

It’s important to determine your LLC’s tax filing status correctly, as misclassifying your LLC could lead to penalties or other consequences. If your LLC has multiple owners but chooses to be treated as a single-member LLC for tax purposes, you need to file Form 8832, Entity Classification Election, with the IRS to elect a different tax classification. Likewise, if your single-member LLC adds additional owners, it will be treated as a multi-member LLC for tax purposes.

If you’re unsure about your LLC’s tax filing status or need assistance in determining it, consulting with a tax professional or CPA who specializes in business taxes can provide valuable guidance. They can help you assess your LLC’s structure, ownership, and activities to ensure accurate and compliant tax reporting.

Understanding your LLC’s tax filing status is crucial for meeting your tax obligations and ensuring compliance with IRS regulations. By correctly determining your LLC’s tax classification, you can accurately report your business income and expenses and avoid potential penalties or audits.

LLC Tax Return Due Date for Single-Member LLCs

If you own a single-member Limited Liability Company (LLC), it’s important to be aware of the tax return due date for your business. As a single-member LLC, the IRS treats your business as a disregarded entity, meaning that you report the income and expenses on your personal tax return using Schedule C.

The tax return due date for single-member LLCs follows the individual tax return deadline, which is usually April 15th. However, if April 15th falls on a weekend or a holiday, the due date is moved to the next business day.

It’s important to note that single-member LLCs have the option to file for a six-month extension if they need more time to prepare and file their tax return. This is done by submitting Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, to the IRS.

By filing for an extension, you will have until October 15th to submit your tax return. It’s worth mentioning that obtaining an extension only extends the time to file the return, not the time to pay any taxes owed. If you owe taxes, it’s recommended to make an estimated tax payment with your extension request to avoid potential penalties for late payment.

In addition to federal taxes, you also need to consider state tax obligations for your single-member LLC. Each state may have different tax return due dates, so it’s important to check with your state’s tax agency for specific deadlines.

Complying with the tax return due date for your single-member LLC is crucial to avoid penalties and interest charges. Late filing penalties can accumulate at a rate of 5% per month, up to a maximum of 25% of the tax owed.

It’s advisable to keep accurate records of your business income and expenses throughout the year to streamline the tax filing process. By maintaining organized records and staying informed about important deadlines, you can ensure that your single-member LLC remains in good standing with the IRS and state tax authorities.

If you have any questions or concerns regarding the tax return due date for your single-member LLC, consulting with a tax professional or CPA who specializes in small business taxes can provide valuable guidance and ensure compliance with tax laws.

LLC Tax Return Due Date for Multi-Member LLCs

If you own a multi-member Limited Liability Company (LLC), it’s crucial to be aware of the tax return due date for your business. Unlike single-member LLCs, multi-member LLCs are required to file a separate tax return known as Form 1065, U.S. Return of Partnership Income.

The tax return due date for multi-member LLCs is the 15th day of the third month after the end of the LLC’s tax year. For example, if your LLC’s tax year ends on December 31st, your tax return would be due on March 15th. However, if the due date falls on a weekend or a holiday, the deadline is moved to the next business day.

It’s important to note that multi-member LLCs have the option to request a six-month extension to file their tax return. To do this, you must submit Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, to the IRS before the original due date of the tax return.

With the extension, your multi-member LLC will have until September 15th to file the tax return. Similarly to single-member LLCs, filing for an extension only extends the time to file the return, not the time to pay any taxes owed. Therefore, if your multi-member LLC anticipates owing taxes, it’s advisable to make an estimated tax payment with your extension request.

It’s worth noting that each member of the multi-member LLC will also need to report their share of the partnership’s income on their personal tax return using Schedule E. Personal tax return due dates vary, but they typically align with the individual tax return deadline of April 15th.

In addition to federal taxes, multi-member LLCs also need to fulfill state tax obligations. Each state may have different tax return due dates, so it’s important to consult with your state’s tax agency or a tax professional to ensure compliance with state filing deadlines.

Complying with the tax return due date for your multi-member LLC is essential to avoid penalties and interest charges. Penalties for late filing can accumulate at a rate of 5% per month, up to a maximum of 25% of the tax owed.

By staying organized, keeping accurate records, and staying informed about important tax deadlines, you can ensure that your multi-member LLC remains in good standing with the IRS and state tax authorities.

If you have any questions or concerns regarding the tax return due date for your multi-member LLC, it’s advisable to consult with a tax professional or CPA who specializes in partnership taxes. They can provide guidance specific to your LLC’s situation and help ensure compliance with tax laws.

Special Considerations for Fiscal Year LLCs

While most Limited Liability Companies (LLCs) operate on a calendar year basis, some LLCs choose to adopt a fiscal year. A fiscal year is a 12-month period that does not align with the traditional January 1st to December 31st calendar year. Instead, it may begin on any date and end 12 months later.

If your LLC operates on a fiscal year basis, there are some special considerations to keep in mind regarding the tax return due date:

1. Fiscal Year-End and Due Date: The tax return due date for fiscal year LLCs is generally the 15th day of the third month after the end of the fiscal year. For example, if your LLC’s fiscal year ends on June 30th, your tax return would typically be due on September 15th. However, as with other due dates, if the deadline falls on a weekend or a holiday, it is extended to the next business day.

2. Consistent Fiscal Year: The IRS requires that if your LLC adopts a fiscal year, you must use that same fiscal year consistently for reporting and tax purposes. Changing your fiscal year requires obtaining IRS approval, and there are certain limitations and restrictions on these changes.

3. Election to Adopt Fiscal Year: To adopt a fiscal year for your LLC, you must file Form 1128, Application to Adopt, Change, or Retain a Tax Year, with the IRS. This form notifies the IRS of your LLC’s intent to operate on a fiscal year and provides details about your chosen fiscal year-end.

4. Partnership Allocations: For multi-member LLCs operating on a fiscal year, it’s important to determine how income, deductions, and credits will be allocated between the partners for each fiscal year. Accurate and consistent allocation methods should be established and documented to maintain compliance with partnership tax rules.

5. Estimated Taxes: If your fiscal year LLC expects to owe taxes, it’s important to make estimated tax payments throughout the year to avoid underpayment penalties. Estimated tax payments are generally due in four installments throughout the fiscal year.

6. Fiscal Year Extensions: If additional time is needed to file your tax return, you can request a six-month extension using Form 7004. The extension will provide you with extra time to complete your fiscal year tax return, moving the due date to the 15th day of the ninth month after the close of the fiscal year.

As with any tax-related matters, it’s advisable to consult with a tax professional or CPA who specializes in business taxes and fiscal year LLCs. They can provide guidance tailored to your specific situation and help ensure compliance with IRS regulations.

By understanding the special considerations for fiscal year LLCs and staying informed about the tax return due date, you can effectively manage your LLC’s tax obligations and avoid penalties or compliance issues.

Filing Extensions and Late Payment Penalties

When it comes to filing your LLC tax return, there may be instances where you need additional time to complete and submit your return. Fortunately, the IRS provides options for filing extensions to give you more time to fulfill your tax obligations. However, it’s important to understand the process of obtaining an extension and the potential penalties for late payment.

For both single-member and multi-member LLCs, you can request a six-month extension to file your tax return. The extension gives you extra time to gather necessary documents, reconcile financial records, and ensure accurate reporting. To request an extension, you must file the appropriate form with the IRS before the original due date of your tax return.

For single-member LLCs, you can file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, which extends the deadline to file your tax return to October 15th.

For multi-member LLCs, you can file Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, which extends the deadline to file Form 1065, U.S. Return of Partnership Income, to the same October 15th deadline.

It’s important to note that while filing an extension allows you more time to submit your tax return, it does not extend the time to pay any taxes owed. If your LLC anticipates owing taxes, it’s recommended to make an estimated tax payment with your extension request to minimize potential penalties for late payment.

Failure to pay your taxes by the original due date can result in penalties and interest charges. The late payment penalty is typically 0.5% of the unpaid tax amount per month, up to a maximum of 25% of the outstanding balance. Interest is also charged on the unpaid tax amount, accruing daily.

If you are unable to pay the full tax amount owed, it is still important to file your tax return by the original due date or extension deadline. By doing so, you can avoid additional failure-to-file penalties, which are generally higher than late payment penalties.

If you require more time to pay your tax obligation, you may qualify for an installment agreement with the IRS. In such cases, you can make monthly payments over an extended period to satisfy your tax liability.

It’s crucial to keep accurate records of your tax filings, extensions, and payment history. By maintaining proper documentation, you can easily track deadlines, demonstrate compliance, and resolve any potential discrepancies with the IRS.

Remember, it’s always a good idea to consult with a tax professional or CPA who specializes in LLC taxes to ensure you understand the requirements, deadlines, and potential penalties associated with filing extensions and paying taxes for your LLC.

Conclusion

Understanding the tax return due dates for your Limited Liability Company (LLC) is crucial for maintaining compliance and avoiding penalties. As a business owner, it’s imperative to know the specific due dates based on your LLC’s tax classification and fiscal year.

For single-member LLCs, the tax return due date follows the individual tax return deadline, typically falling on April 15th. Multi-member LLCs, on the other hand, must file a separate tax return using Form 1065, with the due date being the 15th day of the third month after the end of the LLC’s tax year.

Fiscal year LLCs operate on a 12-month period that doesn’t align with the calendar year. The tax return due date for fiscal year LLCs is generally the 15th day of the third month after the end of the fiscal year.

It’s important to note that extensions are available for both single-member and multi-member LLCs, providing an additional six months to file the tax return. However, it’s essential to remember that an extension only extends the time to file, not the time to pay any taxes owed.

Late payment penalties can apply if taxes are not paid on time. The penalty generally accumulates at a rate of 0.5% per month, with interest also charged on the outstanding tax amount.

To ensure accurate and timely filing, it’s advisable to keep detailed records of your business income and expenses throughout the year. By staying organized and informed, you can streamline the tax filing process and meet your LLC’s tax obligations efficiently.

If you have questions or concerns about your LLC’s tax return due dates or need assistance with tax compliance, consulting with a tax professional or CPA who specializes in small business taxes is highly recommended. They can provide personalized guidance and ensure that you meet all your tax obligations while maximizing deductions and minimizing potential penalties.

In conclusion, staying informed about the tax return due dates for your LLC is crucial for maintaining compliance and avoiding penalties. By fulfilling your tax obligations promptly and accurately, you can focus on growing your business with peace of mind.