Home>Finance>Why Are Letters Of Credit Used In International Sales Transactions

Finance

Why Are Letters Of Credit Used In International Sales Transactions

Modified: February 21, 2024

Explore the importance of letters of credit in global commerce. Discover how this essential financial tool facilitates secure international sales transactions. Finance your success now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition and Purpose of Letters of Credit

- Advantages of Using Letters of Credit in International Sales Transactions

- Process of Using Letters of Credit

- Parties Involved in a Letter of Credit Transaction

- Types of Letters of Credit

- Common Issues and Challenges in Letter of Credit Transactions

- Alternatives to Letters of Credit

- Conclusion

Introduction

Welcome to the world of international finance, where countries trade goods and services across borders. In this globalized economy, businesses engage in international sales transactions on a daily basis. However, conducting business across borders comes with its own set of challenges and risks. One of the most common concerns for companies involved in international trade is the issue of payment security.

When a buyer and seller are located in different countries, there is inherent uncertainty and mistrust. The seller wants to ensure they will receive payment for their goods or services, while the buyer wants to ensure they will receive the goods or services undamaged and as agreed upon. This is where letters of credit come into play.

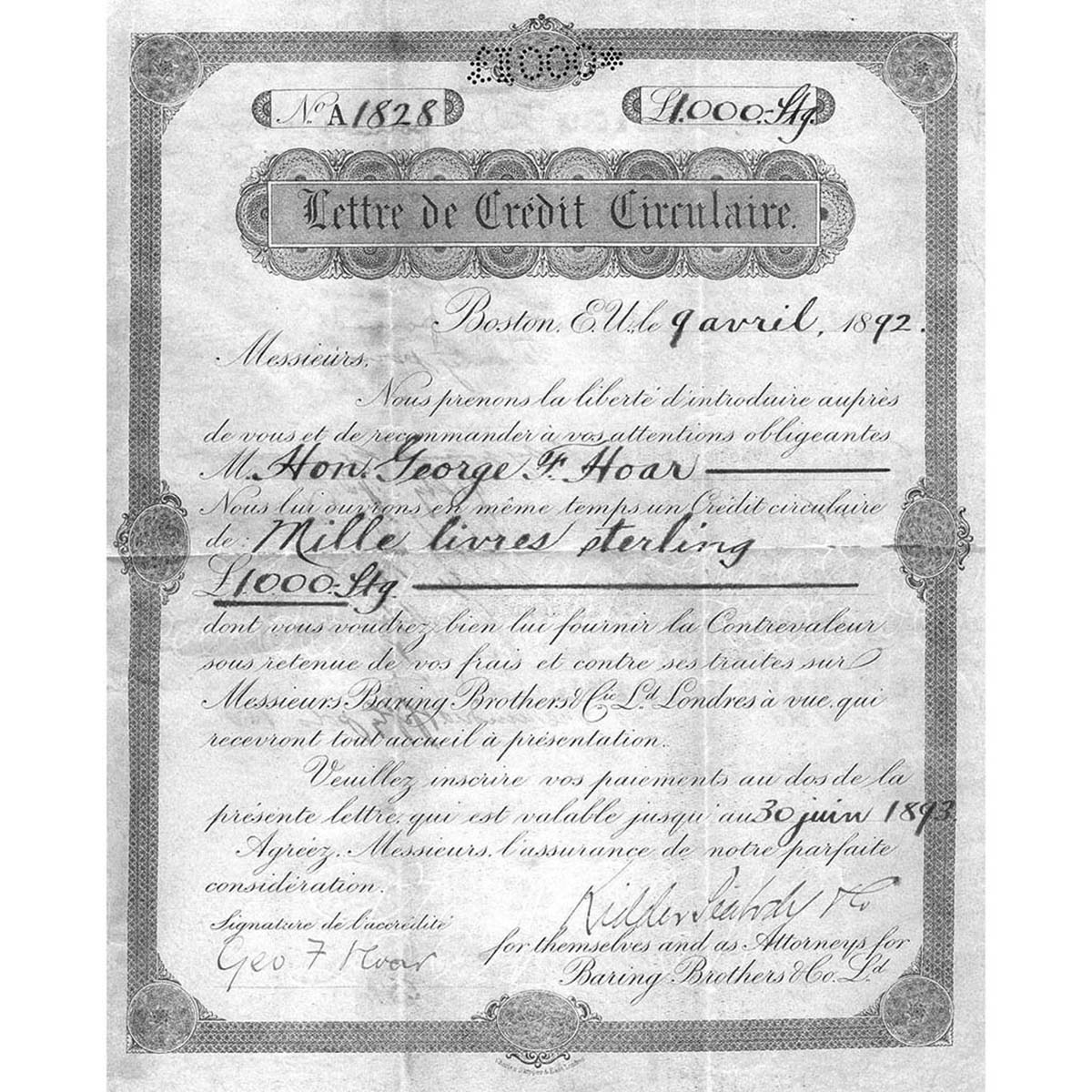

A letter of credit is a financial instrument used in international trade transactions to provide a guarantee of payment to the seller and ensure the delivery of goods to the buyer. It acts as a binding contract between the buyer’s bank (issuing bank), the seller’s bank (confirming bank), and the buyer and seller themselves. The use of letters of credit adds a layer of security and trust to international sales transactions, making them a vital tool in global commerce.

Letters of credit serve multiple purposes, including reducing payment risks, enhancing trust between parties, and facilitating smoother trade transactions. They provide a solid framework for buyers and sellers to conduct business with confidence, even when dealing with unfamiliar or distant trading partners. By understanding the definition, purpose, advantages, and process of using letters of credit, businesses can effectively navigate the complexities of international trade and mitigate potential risks.

Definition and Purpose of Letters of Credit

A letter of credit (LC), also known as a documentary credit, is a document issued by a bank on behalf of a buyer, guaranteeing payment to a seller once specific conditions are met. It serves as a written commitment from the buyer’s bank to the seller, assuring that payment will be made upon satisfactory compliance with the specified terms and conditions outlined in the letter of credit.

The primary purpose of a letter of credit is to minimize the risk associated with international sales transactions. It provides financial security to both the buyer and the seller by acting as an intermediary between them. The letter of credit ensures that the seller will receive payment for their goods or services, while the buyer receives the assurance that payment will only be made once the agreed-upon conditions are met.

Letters of credit are commonly used in international trade transactions where the buyer and seller are located in different countries, and there exists a lack of trust or familiarity between the parties. The document acts as a legally-binding contract that specifies the exact terms, quality standards, and delivery conditions that must be met for payment to occur.

The use of letters of credit benefits both the buyer and the seller. For the seller, it provides a guarantee of payment and reduces the risk of non-payment or payment delays. The seller can have confidence that they will be compensated once they fulfill their obligations under the letter of credit. On the other hand, the buyer benefits from the assurance that payment will only be made once they receive the goods or services as specified in the letter of credit.

Moreover, letters of credit facilitate international trade by creating a standardized and universally accepted method of payment. They provide a level of security and trust that encourages businesses to engage in cross-border transactions, especially with unfamiliar or distant trading partners. The use of letters of credit helps to protect the interests of both parties involved in an international sales transaction, promoting confidence and stability in the global marketplace.

Advantages of Using Letters of Credit in International Sales Transactions

Letters of credit offer several advantages to both buyers and sellers involved in international sales transactions. These advantages contribute to the smooth execution of trade deals and provide a level of security and trust. Let’s explore some of the primary benefits of using letters of credit:

- Payment Security: One of the significant advantages of using a letter of credit is the enhanced payment security it provides. For the seller, the letter of credit serves as a guarantee of payment, ensuring that they will be paid once they fulfill the specified conditions. This reduces the risk of non-payment or payment delays. Similarly, the buyer is assured that payment will only be made once they receive the goods or services as agreed upon.

- Reduced Risk of Fraud: Letters of credit help mitigate the risk of fraud in international transactions. The banks involved in the letter of credit process carefully scrutinize the documents submitted by the seller to ensure they comply with the terms and conditions of the letter of credit. This reduces the likelihood of fraudulent activities and protects the interests of both parties.

- Facilitates Trade Financing: Letters of credit can also act as a form of trade financing. Banks may offer financing options to businesses based on the letter of credit, allowing sellers to access funds before the actual payment is received. This can be especially beneficial for small and medium-sized enterprises who may require immediate cash flow for their operations or production.

- Consistency and Standardization: Letters of credit provide a standardized and universally accepted method of payment in international trade. The terms and conditions outlined in the letter of credit establish a clear framework that both parties must adhere to, ensuring consistency and avoiding misunderstandings and disputes.

- Facilitates International Trade: The use of letters of credit encourages businesses to engage in cross-border transactions, even with unfamiliar or distant trading partners. The financial security and trust gained through letters of credit promote confidence in the global marketplace, facilitating the expansion of international trade.

Overall, letters of credit offer numerous benefits to both buyers and sellers involved in international sales transactions. From payment security and reduced risk of fraud to trade financing options and standardized processes, letters of credit play a vital role in facilitating smooth and secure trade deals in the global economy.

Process of Using Letters of Credit

The process of using letters of credit involves various steps and parties to ensure a smooth and secure international trade transaction. Let’s explore the typical process of using letters of credit:

- Agreement and Issuance: The process begins with the buyer and seller agreeing to use a letter of credit for the transaction. The buyer’s bank, known as the issuing bank, issues the letter of credit on behalf of the buyer. The letter of credit specifies the terms and conditions under which payment will be made.

- Confirmation: In some cases, the letter of credit may also be confirmed by the seller’s bank, known as the confirming bank. The confirming bank ensures the creditworthiness of the issuing bank and acts as an additional guarantee to the seller that payment will be made.

- Shipment and Documentation: Once the letter of credit is established, the seller proceeds with the shipment of the goods or provision of services. The seller must carefully comply with the terms and conditions outlined in the letter of credit. This includes providing the necessary documentation, such as invoices, shipping documents, and certificates of origin.

- Presentation of Documents: The seller submits the required documents to the issuing bank within the specified timeframe as stated in the letter of credit. These documents serve as evidence that the seller has fulfilled their obligations under the terms and conditions of the letter of credit.

- Document Examination: The issuing bank meticulously examines the submitted documents to ensure compliance with the terms and conditions of the letter of credit. The bank reviews the documents to verify their authenticity, accuracy, and conformity with the requirements specified in the letter of credit.

- Payment and Confirmation: If the documents meet the requirements, the issuing bank will make the payment to the seller as stipulated in the letter of credit. The payment is made to the seller’s bank account. In cases where the letter of credit is confirmed, the seller’s bank will make the payment once they receive confirmation from the issuing bank.

- Discrepant Documents: If any discrepancies are found in the submitted documents, the issuing bank may notify the seller so that the documents can be corrected or amended. The letter of credit may allow for a certain period of time for the seller to rectify the discrepancies.

- Finalizing the Transaction: Once the payment is made and the documents are in order, the transaction is considered complete. The buyer receives the goods or services, and the seller receives the payment for their efforts.

The process of using letters of credit ensures that international trade transactions are conducted in a systematic and secure manner. The involvement of banks and the careful inspection of documents provide assurance to both buyers and sellers that their interests are protected and that the terms of the trade deal are met.

Parties Involved in a Letter of Credit Transaction

A letter of credit transaction involves several parties, each with distinct roles and responsibilities. Understanding the key players in a letter of credit transaction is crucial for a smooth and successful international trade deal. Let’s explore the parties involved:

- Buyer: The buyer, also known as the importer or applicant, is the individual or company purchasing the goods or services. The buyer initiates the letter of credit process by requesting their bank to issue a letter of credit on their behalf. The buyer and seller agree to the terms and conditions of the transaction, which are reflected in the letter of credit.

- Seller: The seller, also known as the exporter or beneficiary, is the individual or company selling the goods or services. The seller relies on the letter of credit as a guarantee of payment. They fulfill their obligations under the letter of credit by delivering the agreed-upon goods or services to the buyer according to the specified terms and conditions.

- Issuing Bank: The issuing bank, designated by the buyer, is the financial institution responsible for issuing the letter of credit. The issuing bank acts on behalf of the buyer and provides a guarantee of payment to the seller. They examine the documents submitted by the seller and determine whether they comply with the terms and conditions of the letter of credit.

- Confirming Bank: In some cases, a confirming bank may be involved. The confirming bank is the financial institution that adds its confirmation to the letter of credit. This additional confirmation serves as a guarantee to the seller that payment will be made by the issuing bank. The confirming bank plays a crucial role in reducing the risk for the seller, especially when dealing with unfamiliar or less creditworthy issuing banks.

- Advising Bank: The advising bank, also known as the notifying bank, is the financial institution located in the seller’s country. They receive the letter of credit from the issuing bank and notify the seller of its existence. The advising bank does not provide any payment guarantee but acts as a facilitator by conveying the terms and conditions of the letter of credit to the seller.

- Shipping Carrier: The shipping carrier is responsible for transporting the goods from the seller’s location to the buyer’s location. They ensure the safe and timely delivery of the goods according to the terms specified in the letter of credit.

- Inspection Agencies: Inspection agencies may be involved in the letter of credit transaction to verify the quality, quantity, and condition of the goods being shipped. They provide independent inspection reports that serve as supporting documents during the document examination process.

Each party plays a crucial role in the letter of credit transaction, ensuring the smooth flow of goods, funds, and information. By understanding the responsibilities of each party, businesses can navigate the complexities of international trade and execute successful transactions.

Types of Letters of Credit

Letters of credit come in various forms, each designed to meet specific requirements and circumstances. Understanding the different types of letters of credit can help businesses select the most suitable option for their international trade transactions. Here are some common types of letters of credit:

- Revocable and Irrevocable Letters of Credit: Revocable letters of credit can be modified or canceled by the buyer or the issuing bank without the agreement of the seller. However, they are rarely used because they provide little security for the seller. Irrevocable letters of credit, on the other hand, cannot be modified or canceled without the consent of all parties involved. Irrevocable letters of credit provide greater assurance for the seller.

- Confirmed and Unconfirmed Letters of Credit: A confirmed letter of credit involves a confirming bank, which adds its guarantee of payment to the letter of credit. This provides an additional layer of security for the seller, especially when dealing with unknown or less creditworthy issuing banks. An unconfirmed letter of credit does not involve a confirming bank and relies solely on the creditworthiness of the issuing bank.

- Sight and Time Letters of Credit: Sight letters of credit require the issuing bank to make payment to the seller upon a compliant presentation of the required documents. Time letters of credit, on the other hand, specify a deferred payment date, allowing the buyer a certain period to conduct inspection or verify the goods before making payment.

- Transferable Letters of Credit: Transferable letters of credit enable the seller, known as the first beneficiary, to transfer all or a portion of the credit to one or more second beneficiaries. This allows for intermediary buyers or agents involved in the supply chain to utilize the credit to finance further transactions.

- Standby Letters of Credit: Standby letters of credit act as a financial guarantee and are often used in situations where the primary method of payment fails. They serve as a backup to support the seller in the event of non-payment or other breaches of the contractual agreement.

- Revolving Letters of Credit: Revolving letters of credit are used for multiple shipments over a specified period or within a defined total amount limit. Once the credit is utilized, it automatically replenishes for subsequent shipments. This type of letter of credit provides convenience for recurring trade transactions.

These are just a few examples of the types of letters of credit available. Businesses should carefully consider their specific needs and requirements when selecting the most appropriate type of letter of credit for their international trade transactions. Working closely with their banks and trade partners can help ensure the chosen letter of credit aligns with their business objectives.

Common Issues and Challenges in Letter of Credit Transactions

While letters of credit provide a level of security and trust in international trade transactions, they are not immune to challenges and issues. Various factors can arise that may complicate the smooth execution of a letter of credit transaction. Here are some common issues and challenges in letter of credit transactions:

- Documentary Compliance: Strict compliance with the terms and conditions outlined in the letter of credit is essential. Any discrepancies or non-compliance in the submitted documents can lead to delays in payment or even rejection of the documents. It is crucial for both buyers and sellers to fully understand the requirements and ensure the accuracy of the documents to avoid complications.

- Timing and Time Sensitivity: Timeliness is crucial in letter of credit transactions. Strict adherence to the expiration date, presentation period, and shipping dates is essential. Any delay or deviation from the specified timeline can result in the rejection of the documents and adversely affect the payment process.

- International Regulations and Trade Practices: International trade regulations and practices can pose challenges in letter of credit transactions. Different countries may have varying rules and regulations, which can impact the acceptance and interpretation of the documents presented. Staying updated with the relevant regulations and trade practices is necessary to ensure compliance.

- Disputes and Discrepancies: Disputes and discrepancies between the buyer and seller can arise during the letter of credit transaction. These disputes can be related to the quality of goods, quantity, shipping terms, or any other contractual obligations. Resolving such disputes can be time-consuming and may require negotiation between the parties involved.

- Banking Risks and Issues: While banks provide an essential role in letter of credit transactions, challenges can arise from their side as well. Issues such as delays in document examination, disputes over discrepancies, or the financial stability of the issuing bank or confirming bank can impact the smooth processing of the letter of credit.

- Document Authenticity and Fraud: Verifying the authenticity of the documents provided by the seller is crucial to prevent fraud. The risk of fraudulent documents or counterfeit goods posing as genuine can be a challenge. Banks and parties involved need to be vigilant and employ strict procedures to detect and prevent fraud.

Dealing with these common issues and challenges in letter of credit transactions requires effective communication, attention to detail, and a thorough understanding of the process. It is advisable for businesses to work closely with their banks and trade partners to address any potential issues and ensure a smooth and successful letter of credit transaction.

Alternatives to Letters of Credit

While letters of credit are widely used and have many benefits, there are alternative methods of payment and risk mitigation in international trade transactions. These alternatives provide businesses with flexibility and options to suit their specific needs. Let’s explore some of the common alternatives to letters of credit:

- Bank Guarantees: Similar to letters of credit, bank guarantees provide a form of financial security for international transactions. Instead of guaranteeing payment, bank guarantees serve as a promise from the bank to fulfill a contractual obligation in the event the buyer or seller fails to do so. Bank guarantees can be tailored to specific requirements and provide an additional layer of assurance for the parties involved.

- Cash in Advance: Cash in advance involves the buyer making payment to the seller before the goods are shipped or the services are provided. This method offers maximum security for the seller, as they receive full payment upfront. However, cash in advance may be a barrier for buyers who may not be willing to make payment without the assurance of receiving the goods or services as agreed.

- Open Account: Open account arrangements involve the buyer and seller agreeing to conduct the transaction with deferred payment terms. Under an open account, the seller ships the goods or provides the services and invoices the buyer, who agrees to make the payment within an agreed-upon timeframe. While open accounts offer flexibility and simplicity, they also involve higher risk for the seller, as there is no immediate guarantee of payment.

- Documentary Collections: Documentary collections involve banks acting as intermediaries to facilitate the payment process. The seller ships the goods and then presents the shipping documents to their bank, which sends the documents to the buyer’s bank along with instructions for payment. The buyer’s bank releases the documents to the buyer after receiving payment or accepting a time draft. Documentary collections provide some level of security while offering more flexibility and lower costs compared to letters of credit.

- Trade Credit Insurance: Trade credit insurance is a policy that businesses can obtain to protect against the risk of non-payment by their buyers. This insurance provides coverage for losses arising from insolvency, bankruptcy, or protracted default. Trade credit insurance can act as an alternative or complement to other payment methods and helps businesses mitigate the risk associated with international transactions.

These alternatives to letters of credit offer businesses different options for managing payment security and risk in international trade transactions. It is important for businesses to carefully assess their requirements, evaluate the associated costs and risks, and choose the most suitable alternative to meet their specific needs and circumstances.

Conclusion

Letters of credit are vital instruments in international trade transactions, providing a level of security and trust for both buyers and sellers. They serve as a binding contract between parties and their banks, ensuring payment to the seller upon compliance with specified terms and conditions. The advantages of using letters of credit are numerous, including payment security, reduced risk of fraud, facilitation of trade financing, consistency, and facilitation of international trade.

However, it is important to acknoledge that there are challenges and alternatives to letters of credit. Common issues in letter of credit transactions include documentary compliance, timing, international regulations, disputes, banking risks, and document authenticity. Businesses may consider alternatives such as bank guarantees, cash in advance, open accounts, documentary collections, and trade credit insurance to tailor their payment security and risk mitigation strategies to their specific needs.

Therefore, businesses engaged in international trade transactions should carefully assess their requirements, understand the complexities of letter of credit transactions, and explore alternative solutions. By doing so, they can effectively manage the risks associated with cross-border trade, foster trust with their trading partners, and ensure the smooth execution of international transactions.

In conclusion, letters of credit play a crucial role in facilitating secure and efficient international trade. They provide a framework for payment security and mitigate risks for both buyers and sellers. However, businesses should also be aware of the challenges that may arise and take into consideration alternative options to adapt to their unique circumstances. By leveraging the benefits of letters of credit and exploring alternative methods, businesses can navigate the complexities of international trade with confidence and achieve successful outcomes.