Finance

Why Did My Auto Insurance Go Up For No Reason?

Published: November 17, 2023

Discover the reasons why your auto insurance premium increased unexpectedly and find helpful tips to manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Auto insurance is a necessary expense that every driver must deal with. While it’s expected that insurance rates can fluctuate over time, it can be frustrating when your auto insurance premiums suddenly increase with no apparent reason. As a policyholder, you may find yourself wondering why your auto insurance rates have gone up, especially if you haven’t had any recent accidents or traffic violations. In this article, we’ll explore the various factors that can impact your auto insurance rates and shed light on why your premiums may have increased unexpectedly.

It’s important to understand that auto insurance companies rely on a multitude of factors, both personal and external, to determine your premiums. These factors can range from changes in your personal circumstances to shifts in the insurance company’s policies, as well as broader market conditions. By examining these factors, we can better understand why your auto insurance rates may have increased and potentially find ways to mitigate or lower the cost.

While it’s true that insurance companies have complex algorithms and calculations to determine rates, it’s worth noting that there isn’t always a clear-cut answer for every individual policyholder. With that said, let’s explore some of the common factors that can impact auto insurance rates.

Factors that Impact Auto Insurance Rates

Auto insurance companies utilize a variety of factors to determine the rates they charge their policyholders. These factors are used to assess the level of risk associated with insuring a particular driver. While the specific weighting and importance of each factor may vary between insurance providers, here are some of the key elements that typically influence auto insurance rates:

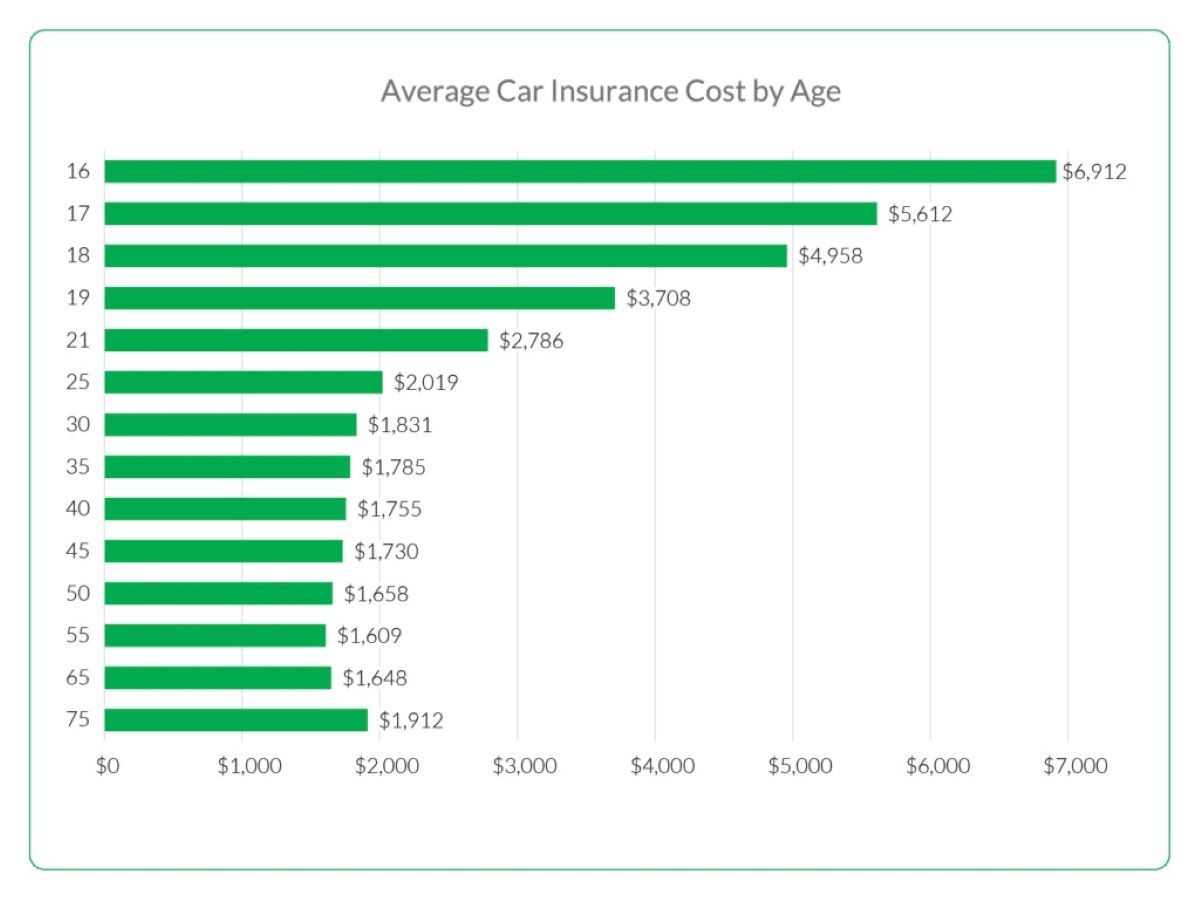

- Age: Young, inexperienced drivers are statistically more likely to be involved in accidents, resulting in higher insurance premiums. Additionally, older drivers may also face increased rates due to potential health-related issues affecting their driving abilities.

- Driving Record: Your driving history plays a significant role in determining your insurance rates. Multiple traffic violations, accidents, or DUI convictions can significantly impact your premiums by signaling a higher risk to the insurance company.

- Vehicle Type and Usage: The make, model, age, and safety features of your vehicle can affect your insurance rates. Generally, vehicles with high safety ratings and lower theft rates will result in lower premiums. Additionally, if you use your vehicle for business purposes or have a long commute, your rates may be higher due to increased time on the road.

- Location: Where you live can impact your insurance rates. Areas with higher traffic congestion or a higher incidence of accidents or theft may result in higher premiums.

- Credit Score: In many states, insurance providers use credit scores as a factor when determining rates. Insurers believe that individuals with higher credit scores are more likely to be responsible drivers and less likely to file claims.

- Insurance History: If you have a history of insurance lapses or previous claims, it can negatively impact your rates. Insurance providers view policyholders with a consistent history of coverage as lower risk.

These are just a few of the many factors that auto insurance companies consider when determining rates. It’s important to note that each insurer may prioritize these factors differently, resulting in variations in premiums.

Now that we have a better understanding of the factors influencing auto insurance rates, let’s explore some reasons why your premiums may have increased unexpectedly.

Changes in Personal Circumstances

One possible reason why your auto insurance rates may have increased unexpectedly is due to changes in your personal circumstances. Insurance companies take into account various personal factors when determining premiums. Here are some common changes that may impact your rates:

- Marital Status: Getting married or divorced can affect your auto insurance rates. Insurance providers generally consider married individuals to be more responsible and less prone to accidents, resulting in lower premiums. On the other hand, divorce may lead to higher rates due to the potential change in driving habits or increased stress.

- Address: Moving to a new location can impact your auto insurance rates. If you’ve moved to an area with higher population density, increased crime rates, or a higher number of accidents, your rates may go up to reflect the higher risk.

- Occupation: Certain occupations may be associated with a higher risk of accidents or require more driving, leading to higher premiums. For example, professions that involve frequent travel or hazardous conditions can result in increased auto insurance rates.

- Annual Mileage: If your driving habits have changed and you’re now driving more miles each year, your insurance company may consider you to be at a higher risk and adjust your rates accordingly.

- Additional Drivers: Adding new drivers to your policy, such as a teenager or a spouse, can increase your auto insurance rates. Younger drivers, in particular, are viewed as a higher risk due to their limited experience.

If any of these personal circumstances have changed for you recently, it could explain the increase in your auto insurance rates. Remember to inform your insurance provider about any changes to ensure that your coverage remains accurate and up-to-date.

Next, we’ll explore how changes in your driving record can impact your auto insurance premiums.

Changes in Driving Record

One of the key factors that insurance companies consider when determining auto insurance rates is your driving record. Any changes in your driving history can have a significant impact on your premiums. Here are some common changes that may affect your rates:

- Accidents: If you’ve been involved in an at-fault accident or multiple accidents, your insurance rates are likely to increase. This is because insurers view individuals with a history of accidents as higher risk.

- Traffic Violations: Any traffic violations, such as speeding tickets or running red lights, can result in higher auto insurance rates. Insurance providers consider individuals with a history of traffic infractions to be more likely to engage in risky driving behaviors.

- DUI or DWI Convictions: Driving under the influence (DUI) or driving while intoxicated (DWI) convictions can have serious consequences on your auto insurance rates. These offenses are viewed as extremely high risk, and insurance companies may raise your premiums significantly or even refuse to insure you altogether.

- License Suspensions: If your driver’s license has been suspended due to violations or a failure to maintain proper documentation, it can lead to higher insurance rates once you regain your license.

It’s essential to understand that changes in your driving record can have a lasting impact on your auto insurance rates. These changes are typically reported to your insurance provider during policy renewals or when you file a claim. It’s crucial to drive responsibly and adhere to traffic laws to maintain a clean driving record and keep your insurance premiums as low as possible.

Now that we’ve explored changes in personal circumstances and driving records, let’s delve into how changes in your insurance company’s policies can affect your auto insurance rates.

Changes in Insurance Company’s Policies

Insurance companies are not static entities, and they regularly adjust their policies and pricing strategies based on various factors. Sometimes, an increase in your auto insurance rates may be due to changes in your insurance company’s policies. Here are a few factors that can impact your rates:

- Underwriting Guidelines: Insurance companies constantly reassess their underwriting guidelines, the criteria they use to evaluate risk. If your insurance company has updated its underwriting guidelines, it may result in higher premiums for certain policyholders.

- Claim Patterns: If your insurance company has experienced a higher number of claims or significant losses in a particular region or demographic, they may respond by raising rates to offset these costs and maintain profitability.

- Market Competition: The competitive landscape of the insurance industry can influence pricing. If your insurance company faces increased competition or experiences financial pressures, they may need to adjust rates to align with the market.

- Rate Increases Across the Board: Sometimes, insurance companies may decide to raise rates for all policyholders across the board due to various factors such as increasing repair costs, inflation, or changes in industry regulations. This can result in higher premiums for all customers, even those with clean driving records.

It’s essential to stay informed about your insurance company’s policies and any changes they make. Be sure to review any notices or communications you receive and reach out to your insurance agent or representative for clarification if needed.

While changes in an insurance company’s policies can be frustrating, it’s important to remember that you have options. If you’re unhappy with the rate increases or changes, you might consider shopping around and obtaining quotes from other insurance providers to see if you could secure a better deal elsewhere.

Now that we have explored personal circumstances, driving records, and insurance company policies, let’s turn our attention to market conditions and external factors that can impact auto insurance rates.

Market Conditions and External Factors

In addition to personal circumstances, driving records, and insurance company policies, there are external factors and market conditions that can contribute to changes in auto insurance rates. These factors are beyond an individual’s control but can still impact premiums. Here are a few examples:

- Economic Conditions: Economic fluctuations can have a trickle-down effect on the insurance industry. During periods of economic downturn, insurance providers may experience higher claim frequencies or financial uncertainties, leading to rate increases to maintain profitability.

- Weather Events: Severe weather events, such as hurricanes or hailstorms, can result in a surge in insurance claims for vehicle damage. Insurance companies may respond by raising rates to offset these increased costs.

- Changing Laws and Regulations: Legislative changes, such as new insurance regulations or requirements, can impact insurance rates. For example, if a state increases the minimum liability coverage limits, it can lead to higher premiums for all policyholders in that state.

- Cost of Vehicle Repairs and Medical Treatments: The rising costs of vehicle repairs and medical treatments can impact insurance rates. If repair and medical costs increase, insurance companies may need to adjust rates to cover these expenses in the event of an accident or claim.

- Insurance Fraud: Insurance fraud is a significant concern for insurance providers. Increases in fraudulent claims can result in higher costs for insurers, which may be passed on to policyholders through higher premiums.

It’s important to recognize that these external factors and market conditions can influence auto insurance rates, even if you have a clean driving record and unchanged personal circumstances. While you may not have control over these factors, staying informed and proactive about your insurance coverage can help you navigate any changes more effectively.

Now, let’s explore some tips for lowering your auto insurance premiums and potentially mitigating any increases you may have experienced.

Tips for Lowering Auto Insurance Premiums

If you’re concerned about rising auto insurance premiums or are looking to reduce your insurance costs, there are several strategies you can employ to lower your premiums. Here are some effective tips to consider:

- Shop Around: Don’t settle for the first insurance quote you receive. Take the time to compare rates and coverage options from multiple insurance providers. This can help you find the best deal and potentially save money.

- Bundle Your Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance, with the same provider. Consolidating your insurance needs can lead to significant savings.

- Inquire About Discounts: Ask your insurance company about any available discounts that you may qualify for. Common discounts include safe driver discounts, good student discounts, or discounts for completing a defensive driving course.

- Consider Higher Deductibles: Increasing your deductibles can lower your premiums. However, be sure you can comfortably afford the deductible amount in the event of a claim.

- Improve Your Credit Score: In many states, your credit score can impact your auto insurance rates. Improve your credit score by paying bills on time, reducing debt, and monitoring your credit report for errors.

- Update Your Policy Regularly: Review your policy annually to ensure you’re not paying for unnecessary coverage. Adjust your coverage limits and deductibles based on your current needs.

- Drive Safely: Maintaining a clean driving record can lead to lower insurance rates over time. Obey traffic laws, avoid accidents, and consider enrolling in a defensive driving course to demonstrate your commitment to safe driving.

- Consider Usage-Based Insurance: Some insurance companies offer usage-based insurance programs that assess your premiums based on your driving habits. If you have safe driving habits, this type of program may help lower your rates.

By implementing these tips and taking control of your insurance coverage, you can potentially lower your auto insurance premiums and find ways to mitigate any unexpected increases. Remember to regularly review your policy, stay informed about discounts, and maintain a safe driving record to optimize your insurance costs.

Now, let’s wrap up the article.

Conclusion

Auto insurance rates can increase for a variety of reasons, and it’s important to understand the factors that contribute to these changes. While it can be frustrating to experience an unexpected increase in your premiums, knowing the potential causes can help you navigate the situation more effectively.

We’ve explored how changes in personal circumstances, such as marital status or address, can impact your auto insurance rates. Additionally, changes in your driving record, including accidents or traffic violations, can also lead to higher premiums. We’ve also discussed how adjustments in your insurance company’s policies and external factors, such as market conditions or changes in laws, can affect rates.

However, there are steps you can take to lower your auto insurance premiums. Shopping around for the best rates, bundling policies, and inquiring about available discounts are effective ways to save money. Furthermore, maintaining a safe driving record, selecting higher deductibles, and regularly reviewing and updating your policy can also help lower your premiums.

Remember, insurance rates are not set in stone, and it’s within your control to take proactive measures to manage your premiums. By staying informed, being a responsible driver, and exploring cost-saving options, you can potentially reduce your auto insurance costs and find a policy that suits your needs and budget.

Ultimately, maintaining open communication with your insurance provider, regularly reviewing your coverage, and staying informed about industry trends can help you navigate any changes in your auto insurance rates. By taking proactive steps, you can find ways to mitigate unexpected increases and ensure that you have the coverage you need at a fair price.

We hope that this article has shed light on the factors that can impact auto insurance rates and provided you with valuable tips for lowering your premiums. Remember to stay informed, be proactive, and regularly reassess your coverage to optimize your auto insurance experience.