Finance

Where Is The IRS Data Retrieval Tool?

Published: November 1, 2023

Discover the whereabouts of the IRS Data Retrieval Tool for Finance. Simplify the process of accessing vital financial information with ease.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The IRS Data Retrieval Tool has long been a valuable resource for individuals and families navigating the complex world of taxes and financial aid applications. This online tool, provided by the Internal Revenue Service (IRS), allows users to electronically transfer their tax information directly into the Free Application for Federal Student Aid (FAFSA) or the Income-Driven Repayment (IDR) application, making the process quicker and more efficient.

For many years, the IRS Data Retrieval Tool has been an essential tool for students and families applying for financial aid for college or university. It has significantly simplified the process of completing the FAFSA by automatically importing tax information directly from the IRS database. This has helped to reduce errors and inconsistencies in reported income, streamline the verification process, and expedite the awarding of financial aid packages.

However, in recent years, there have been several changes and developments regarding the availability and accessibility of the IRS Data Retrieval Tool. These changes have left many individuals wondering where the tool is currently located and how they can access it.

In this article, we will explore the importance of the IRS Data Retrieval Tool, discuss recent changes that have impacted its availability, and provide alternatives for individuals seeking to retrieve their tax information for financial aid purposes.

What is the IRS Data Retrieval Tool?

The IRS Data Retrieval Tool is a secure online tool provided by the Internal Revenue Service (IRS) that allows individuals and families to electronically transfer their tax information directly into the Free Application for Federal Student Aid (FAFSA) or the Income-Driven Repayment (IDR) application. The tool was designed to simplify the process of completing these financial aid applications by automatically populating the income and tax fields with accurate and up-to-date information.

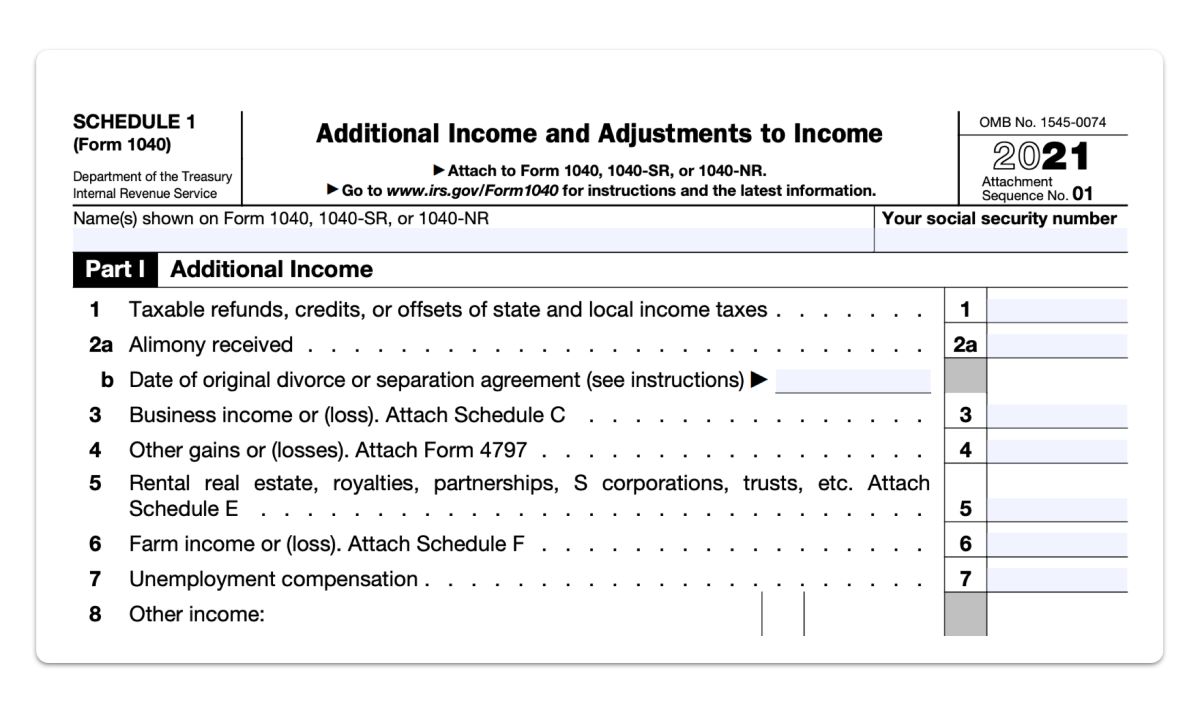

When completing the FAFSA or IDR application, applicants are required to provide information about their income and taxes from the previous year. This information is crucial for determining eligibility for various types of financial aid, such as grants, scholarships, and student loans. In the past, applicants had to manually input their tax information, which was time-consuming and prone to errors.

The IRS Data Retrieval Tool eliminates the need for manual input by allowing applicants to securely access their tax information directly from the IRS database. This not only saves time but also ensures the accuracy and consistency of the reported income on the financial aid applications. By using the tool, applicants can import their tax data with just a few clicks, reducing the chances of errors and increasing the efficiency of the application process.

The IRS Data Retrieval Tool is especially beneficial for low-income students and families who may not have access to professional tax advisors or have complex tax situations. It simplifies the application process and provides a convenient way to transfer tax information without the need for extensive documentation or manual calculations.

It is important to note that the IRS Data Retrieval Tool is available for use with select tax return types, including electronically filed tax returns and the IRS tax return transcript. Individuals who file their taxes through other methods, such as paper filing, may not be able to use the tool and will need to manually enter their tax information.

Overall, the IRS Data Retrieval Tool is a valuable resource for applicants seeking financial aid. It streamlines the application process, reduces errors, and ensures the accuracy and consistency of tax information reported on the FAFSA or IDR application.

The Importance of the IRS Data Retrieval Tool

The IRS Data Retrieval Tool plays a critical role in the financial aid application process and has numerous benefits for students and families. Here are some key reasons why the tool is important:

- Increased Accuracy: One of the main advantages of using the IRS Data Retrieval Tool is the increased accuracy of the financial information provided on the FAFSA or IDR application. By directly importing tax data from the IRS, there is a reduced risk of human error or inconsistency in reporting income. This ensures that the information provided is reliable and aligns with the official tax records.

- Time-Saving: Manual data entry can be a time-consuming task, especially when it comes to inputting tax information line by line. The IRS Data Retrieval Tool eliminates this tedious process by automatically populating the relevant fields with accurate tax data. This saves applicants valuable time, allowing them to complete the application more efficiently and focus on other important aspects of their financial aid journey.

- Reduced Documentation Requirements: Retrieving tax information through the IRS Data Retrieval Tool reduces the need for additional documentation to verify income. In many cases, colleges and universities require applicants to submit additional documentation, such as tax transcripts or copies of tax returns, to validate the income reported on the FAFSA. By using the tool, applicants can meet the verification requirements more easily, avoiding the hassle of gathering and submitting various documents.

- Streamlined Verification Process: The IRS Data Retrieval Tool simplifies the verification process for financial aid administrators. With accurate and verified tax information imported directly from the IRS, there is less need for manual verification of income details. This can expedite the processing of financial aid applications and allow students to receive their awards in a timely manner.

- Improved Access for Low-Income Individuals: The tool is particularly beneficial for low-income individuals and families who may face financial barriers or lack access to professional tax assistance. By automating the retrieval of tax information, the tool helps level the playing field and ensures that all applicants have equal opportunities to access financial aid.

In summary, the IRS Data Retrieval Tool is crucial in simplifying the financial aid application process, increasing accuracy, saving time, reducing documentation requirements, streamlining verification procedures, and providing equitable access to financial aid for individuals from diverse economic backgrounds.

Recent Changes to the IRS Data Retrieval Tool

In recent years, there have been significant changes to the availability and accessibility of the IRS Data Retrieval Tool. These changes have impacted individuals relying on the tool for retrieving their tax information for financial aid purposes. Let’s explore some of the notable changes:

- Temporary Suspension: In March 2017, the IRS Data Retrieval Tool was temporarily taken offline due to security concerns. The tool was disabled after it was discovered that some personal identifiable information was being exploited by identity thieves. This suspension meant that applicants had to manually enter their tax information on the FAFSA or IDR application, which led to a disruption in the streamlined process.

- Enhanced Security Measures: Following the temporary suspension, the IRS implemented enhanced security measures to protect personal data and prevent unauthorized access. These measures included improved encryption protocols and authentication processes to ensure the integrity and confidentiality of user information.

- Selective Availability: Since the security breach, the IRS Data Retrieval Tool has been made available in a phased manner. Initially, it was reintroduced for users completing the FAFSA for the upcoming academic year. Over time, availability expanded to include other types of financial aid applications, such as IDR applications. The selective availability allowed the IRS to monitor and evaluate the effectiveness of the enhanced security measures.

- Mobile Device Compatibility: In recent years, the IRS has made efforts to improve the accessibility of the Data Retrieval Tool on mobile devices. Recognizing the increasing reliance on smartphones and tablets, the tool has been optimized for mobile use, allowing users to conveniently access their tax information and complete the necessary financial aid applications on their mobile devices.

- IRS Data Retrieval Tool on the FAFSA Mobile App: The IRS Data Retrieval Tool is now available for use through the official FAFSA mobile app. This provides a seamless integration between the FAFSA application and the IRS database, enabling users to import their tax information directly from their mobile devices. The mobile app offers an intuitive and user-friendly interface, making the entire process more convenient and accessible.

It is essential to stay updated on any further changes or updates to the IRS Data Retrieval Tool by visiting the official IRS website or consulting financial aid professionals. As technology and security measures evolve, the IRS continues to prioritize the protection of taxpayer information while striving to provide a user-friendly experience for individuals applying for financial aid.

Why Was the IRS Data Retrieval Tool Removed?

The temporary removal of the IRS Data Retrieval Tool in 2017 was prompted by security concerns. The tool was disabled after it was discovered that some personal identifiable information was being exploited by identity thieves. The IRS took swift action to investigate and address the security vulnerabilities, leading to the temporary suspension of the tool.

Identity thieves were using the tool to access tax and financial information, which posed a significant risk to individuals’ personal data. The IRS decided to take proactive measures to protect taxpayers’ sensitive information and prevent further unauthorized access. By temporarily removing the tool, the IRS could assess the security weaknesses and implement appropriate enhancements to safeguard user data.

The decision to remove the IRS Data Retrieval Tool was not taken lightly, as the tool played a crucial role in simplifying the financial aid application process for millions of students and families. However, protecting sensitive tax information and ensuring data security is of utmost importance.

The IRS took various steps to address the security concerns and fortify the tool against potential threats. Enhanced encryption protocols, authentication processes, and other security measures were implemented to prevent unauthorized access and ensure the confidentiality of user information. The IRS also collaborated with other federal agencies to adopt best practices in data protection and cybersecurity.

The removal of the tool allowed the IRS to evaluate and strengthen the security measures before gradually reintroducing it in a phased manner. This cautious approach ensured that the tool’s functionality could be restored while minimizing the risk of further exploitation or breaches.

It is important to note that while the temporary removal of the IRS Data Retrieval Tool may have caused inconvenience and disruption to applicants, the aim was to mitigate the potential risks associated with identity theft and safeguard individuals’ personal information.

As technology and security threats continue to evolve, the IRS remains committed to maintaining the highest standards of data protection and security. The temporary removal of the IRS Data Retrieval Tool served as a necessary step in safeguarding taxpayer information and ensuring a more secure financial aid application process.

Current Status of the IRS Data Retrieval Tool

As of the latest update, the IRS Data Retrieval Tool has been reinstated and is available for use by individuals and families applying for financial aid. Following the temporary suspension in 2017, the IRS took proactive steps to enhance security measures and address the vulnerabilities that were identified.

The IRS Data Retrieval Tool is now operational and can be accessed through the official IRS website, as well as through the Free Application for Federal Student Aid (FAFSA) and Income-Driven Repayment (IDR) applications. Users can securely retrieve their tax information from the IRS database and populate the relevant fields on the financial aid applications.

During the temporary suspension period, the IRS implemented multiple layers of security enhancements to protect sensitive taxpayer data. The tool now utilizes advanced encryption protocols, multi-factor authentication, and other safeguards to prevent unauthorized access and maintain data privacy.

In addition to reinstating the tool, the IRS has also made efforts to improve its accessibility and ease of use. Mobile device compatibility has been implemented, allowing users to access the IRS Data Retrieval Tool and import tax information directly from their smartphones or tablets. This enhances the convenience and flexibility of the tool, as applicants can now complete financial aid applications on the go.

Furthermore, the IRS Data Retrieval Tool is now integrated with the official FAFSA mobile app. This seamless integration provides a user-friendly interface, making it even easier for individuals to retrieve their tax information and complete the FAFSA application process from their mobile devices.

It is important for applicants to regularly check for updates and be aware of any changes to the availability and functionality of the IRS Data Retrieval Tool. The IRS website, along with official financial aid resources and guidance, will provide the most up-to-date information regarding the tool.

By reinstating the IRS Data Retrieval Tool and implementing stronger security measures, the IRS aims to provide a streamlined and secure process for individuals and families to retrieve their tax information for financial aid applications. The availability of the tool ensures that applicants can conveniently and accurately report their income, making it easier for financial aid administrators to determine eligibility and award appropriate assistance.

Alternatives to the IRS Data Retrieval Tool

While the IRS Data Retrieval Tool is a convenient and efficient option for retrieving tax information, there are alternatives available for individuals who are unable to access or use the tool. Here are some alternatives to consider:

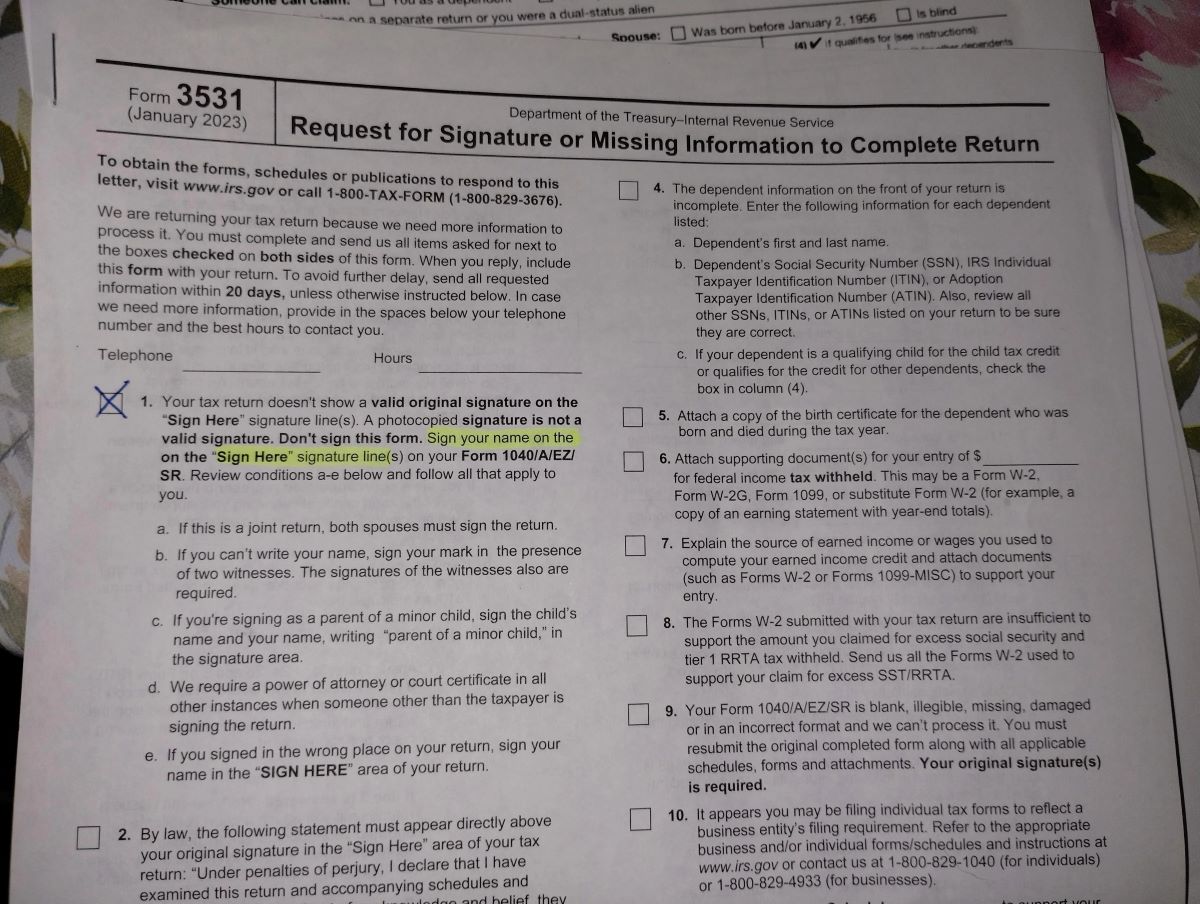

- Manual Entry: If the IRS Data Retrieval Tool is not available or suitable for your situation, you can manually enter your tax information on the Free Application for Federal Student Aid (FAFSA) or Income-Driven Repayment (IDR) application. This involves gathering your tax documents, such as W-2 forms and tax returns, and entering the information accurately into the designated fields. While this method may take more time and effort, it allows you to proceed with the application without relying on data retrieval.

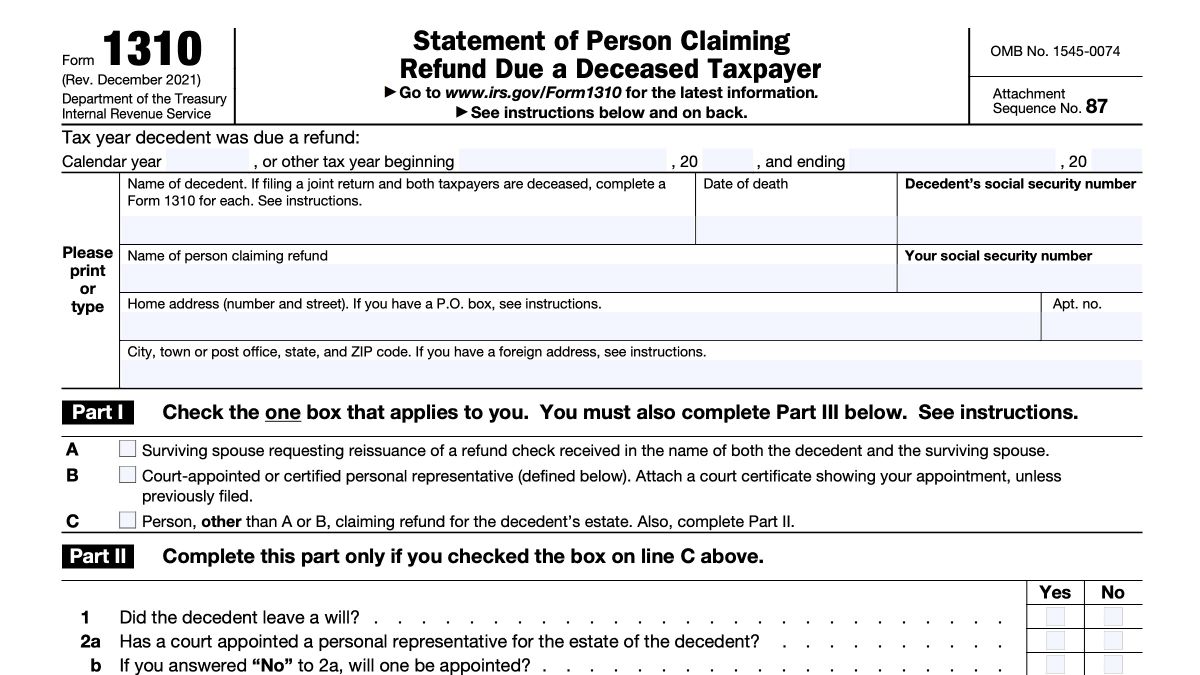

- IRS Tax Return Transcript: Another alternative is to request an IRS tax return transcript. This transcript summarizes your tax return information and can be obtained online through the IRS website or by requesting a physical copy. The tax return transcript provides a detailed overview of your tax information, including income, deductions, and credits. You can refer to the transcript to manually input the necessary details on your financial aid applications.

- Consult a Tax Professional: If you are facing challenges in retrieving your tax information or are unsure about the accuracy of the data, consulting a tax professional can be helpful. A tax professional, such as a certified public accountant (CPA) or tax advisor, can assist you in gathering the necessary tax documents and provide guidance on accurately reporting your income on the FAFSA or IDR application. They can also answer any questions you may have regarding your tax situation.

- Contact your Financial Aid Office: If you are unable to retrieve your tax information through the IRS Data Retrieval Tool or other means, reach out to your college or university’s financial aid office. They may be able to guide you through alternative methods or provide specific instructions on how to proceed with the financial aid application process without the data retrieval tool.

- Ensure Accuracy and Documentation: Regardless of the method used, it is important to ensure the accuracy of the tax information provided on the FAFSA or IDR application. Double-check all values and review your tax documents for any discrepancies. Additionally, keep copies of your tax documents and related paperwork for reference and verification purposes.

While the IRS Data Retrieval Tool streamlines the process of retrieving tax information for financial aid applications, these alternative methods can serve as viable options for individuals who are unable to use the tool or prefer other means of reporting their income.

It is crucial to consider your specific circumstances and consult with financial aid professionals for personalized guidance on the best approach for accurately reporting your tax information for financial aid purposes.

Conclusion

The IRS Data Retrieval Tool has been a valuable resource for individuals and families navigating the financial aid application process. It has provided a convenient and efficient way to retrieve tax information and populate the necessary fields on the Free Application for Federal Student Aid (FAFSA) and Income-Driven Repayment (IDR) applications.

Although the tool faced a temporary suspension due to security concerns, it has since been reinstated with enhanced security measures to protect sensitive taxpayer data. The availability of the tool, along with mobile device compatibility and integration with the FAFSA mobile app, ensures that applicants can easily access and retrieve their tax information for financial aid purposes.

In cases where the IRS Data Retrieval Tool is not accessible or suitable, individuals can resort to alternatives such as manual entry, obtaining an IRS tax return transcript, consulting a tax professional, or seeking guidance from the financial aid office. These alternatives provide options for accurately reporting income and completing the financial aid applications without relying solely on the data retrieval tool.

It is important for applicants to stay updated on any changes or updates to the IRS Data Retrieval Tool and its availability. Regularly checking the official IRS website and consulting financial aid professionals can provide the most up-to-date information and guidance in utilizing the tool effectively.

Overall, the IRS Data Retrieval Tool remains an integral part of the financial aid application process, offering convenience, accuracy, and efficiency for individuals and families. By leveraging this tool or exploring alternative methods, applicants can navigate the financial aid journey with greater ease, ensuring that they receive the assistance they need to pursue their educational goals.