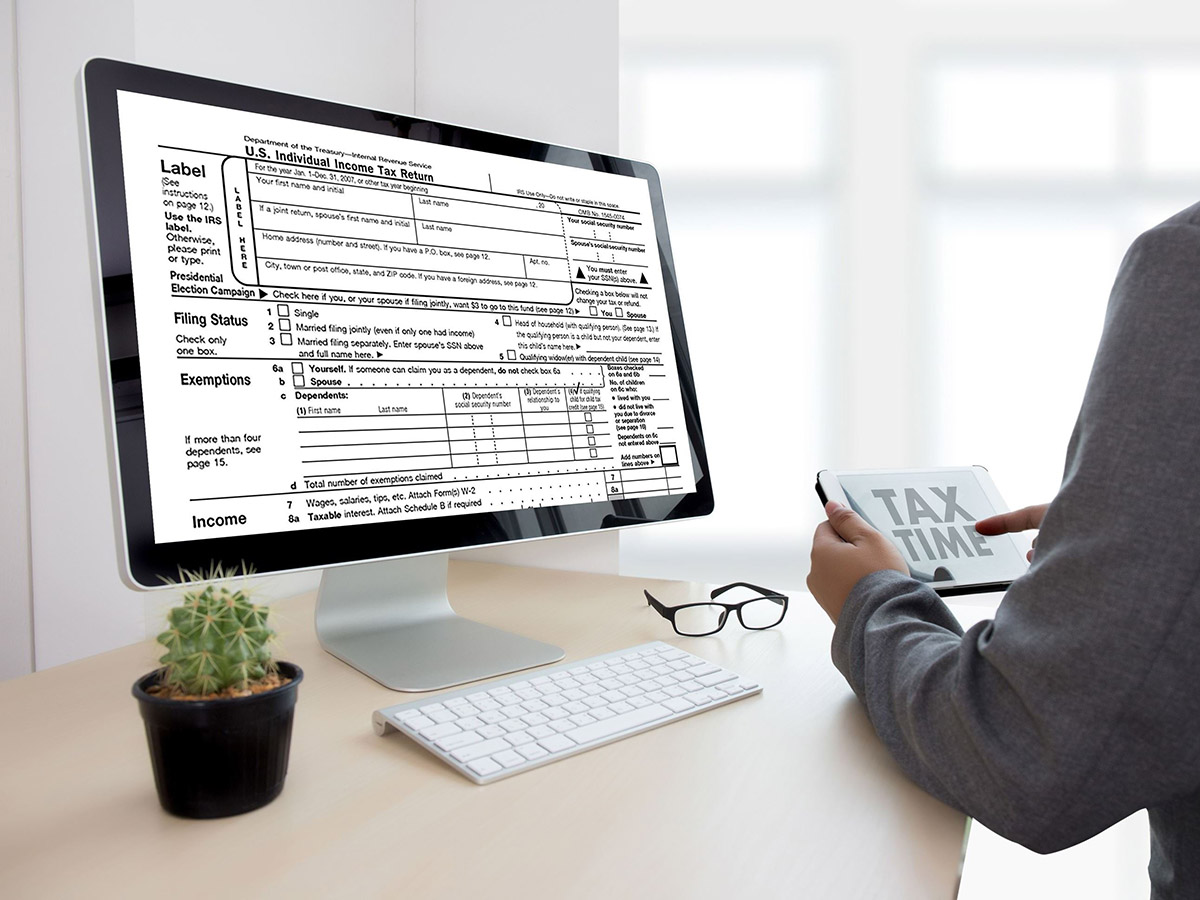

Finance

Where To File A New York State Tax Return

Published: October 29, 2023

Looking to file your New York State tax return? Find out where to file and ensure compliance with state finance requirements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding New York State Tax Returns

- Requirements for Filing a New York State Tax Return

- Where to File a New York State Tax Return

- Filing Methods for New York State Tax Returns

- Online Filing Options for New York State Tax Returns

- Paper Filing Options for New York State Tax Returns

- Where to File an Amended New York State Tax Return

- Conclusion

Introduction

When it comes to filing your state taxes, it’s crucial to understand the process and know where to submit your tax return. New York State has its own unique requirements and filing methods, so it’s important to be well-informed to ensure a smooth and accurate process.

Filing a New York State tax return is necessary if you are a resident of the state, have earned income from New York sources, or have met certain filing thresholds. Whether you are an individual, a business owner, or a part-year resident, understanding the requirements and knowing where to file your tax return is essential to avoid penalties and ensure compliance with state tax laws.

In this article, we will guide you through the process of filing a New York State tax return and provide you with information on where to submit your return based on your specific filing method. So, let’s dive in and explore the ins and outs of filing a New York State tax return.

Understanding New York State Tax Returns

Before diving into the filing process, it’s important to have a basic understanding of New York State tax returns. In New York, the Department of Taxation and Finance is responsible for administering and enforcing the state’s tax laws.

New York State taxes are separate from federal taxes, meaning you will need to file a separate tax return for the state. The state tax return includes information about your income, deductions, credits, and any taxes owed to the state.

It’s important to note that New York State offers different tax brackets and rates compared to the federal tax system. This means that you may be subject to different tax rates for your state income tax compared to your federal income tax.

Additionally, New York State allows for various deductions and credits that may help reduce your taxable income or provide tax breaks. Some common deductions and credits include the standard deduction, itemized deductions, child and dependent care credit, and the earned income tax credit.

When filing your state tax return, you’ll need to report your income from all sources, such as wages, self-employment income, rental income, and investment income. You’ll also need to provide documentation to support your deductions and credits.

Understanding your filing status is also important when completing your New York State tax return. Common filing statuses include single, married filing jointly, married filing separately, and head of household. Your filing status will affect your tax rates and eligibility for certain credits and deductions.

It’s crucial to accurately report your income and deductions on your New York State tax return to avoid penalties and potential audits by the Department of Taxation and Finance. Make sure to keep all relevant documents and records related to your income and deductions to support the information reported on your tax return.

Now that we have a general understanding of New York State tax returns, let’s explore the requirements for filing a New York State tax return.

Requirements for Filing a New York State Tax Return

If you are a resident of New York State, a part-year resident, or have earned income from New York sources, you may be required to file a New York State tax return. Here are some of the key requirements to determine if you need to file:

- Resident status: If you are a resident of New York State for the entire tax year, you are generally required to file a New York State tax return.

- Part-year resident status: If you moved into or out of New York State during the tax year, you may be considered a part-year resident. In this case, you will need to file a New York State tax return to report income earned while you were a resident of the state.

- New York source income: Even if you are not a resident of New York State, you may still be required to file a tax return if you earned income from New York sources. This includes income from employment, rental properties, or any other source within the state.

- Filing thresholds: The filing thresholds vary depending on your filing status and age. For example, if you are single and under 65 years old, you generally need to file a New York State tax return if your federal adjusted gross income is $4,000 or more.

It’s important to note that these requirements are subject to change, so it’s recommended to refer to the official guidelines provided by the New York State Department of Taxation and Finance or consult with a tax professional for specific circumstances.

Additionally, even if you are not required to file a New York State tax return, it may still be beneficial to do so. Filing a tax return can potentially make you eligible for certain tax credits, such as the Earned Income Tax Credit or the Child and Dependent Care Credit, which can help reduce your overall tax liability.

Now that we know the requirements for filing a New York State tax return, let’s explore where you can file your return based on the filing method you choose.

Where to File a New York State Tax Return

When it comes to filing your New York State tax return, the location where you need to submit your return depends on the filing method you choose. Here are the different options available to taxpayers:

- Online filing: One of the most convenient and efficient ways to file your New York State tax return is through the official website of the New York State Department of Taxation and Finance. They offer an online platform called the New York State Income Tax Web File, which allows you to electronically file your tax return and make secure payments electronically. This option is available to most individuals and businesses, and it offers faster processing and confirmation compared to traditional paper filing.

- Tax preparation software: Another popular option is to use tax preparation software, such as TurboTax or H&R Block, which supports electronic filing for New York State tax returns. These software programs guide you through the tax preparation process, ensure accuracy, and electronically file your return on your behalf.

- Authorized e-file providers: If you prefer to have a tax professional assist you with your New York State tax return, you can choose an authorized e-file provider. These providers are authorized by the New York State Department of Taxation and Finance to electronically file tax returns on behalf of their clients.

- Traditional paper filing: If you prefer to file your New York State tax return using a paper form, you can download the necessary forms from the official website of the New York State Department of Taxation and Finance. Once completed, you can mail the forms to the appropriate address based on your filing status and residency. It’s important to double-check the correct mailing address to ensure your tax return is processed accurately and efficiently.

It’s worth noting that regardless of the filing method you choose, you may be required to attach supporting documents, such as W-2 forms, 1099 forms, or any other relevant documentation, to your tax return. Make sure to carefully review the instructions provided by the New York State Department of Taxation and Finance to ensure you include all necessary documentation.

Now that we know where to file a New York State tax return based on the filing method, let’s explore the specific options available for each filing method.

Filing Methods for New York State Tax Returns

When it comes to filing your New York State tax return, you have several options to choose from. Let’s explore the different filing methods available:

- Online filing: Online filing is a popular and convenient method for submitting your New York State tax return. The New York State Department of Taxation and Finance offers an online platform called the New York State Income Tax Web File, which allows you to electronically file your return. This method is available for most individuals and businesses, and it offers benefits such as faster processing, immediate confirmation, and the ability to make secure electronic payments.

- Tax preparation software: Using tax preparation software, such as TurboTax or H&R Block, is another popular option. These software programs guide you through the tax preparation process, ensuring accuracy and helping you maximize your deductions and credits. Most tax preparation software also supports electronic filing for New York State tax returns, making it a seamless process to file your return electronically.

- Authorized e-file providers: If you prefer to have a tax professional assist you with your New York State tax return, you can choose an authorized e-file provider. These providers are authorized by the New York State Department of Taxation and Finance to electronically file tax returns on behalf of their clients. They have the expertise to navigate the complexities of the New York State tax system and ensure that your tax return is filed accurately and on time.

- Traditional paper filing: For those who prefer to file their New York State tax return using a paper form, you can download the necessary forms from the official website of the New York State Department of Taxation and Finance. Once completed, you can mail the forms to the appropriate address based on your filing status and residency. It’s important to note that paper filing may take longer to process compared to electronic filing methods.

Regardless of the filing method you choose, it’s important to accurately report your income, deductions, and credits to avoid penalties or audits. It’s also a good idea to keep copies of all relevant documents and supporting documentation for your records.

Now that we know the different filing methods available for New York State tax returns, let’s explore the online filing options in more detail.

Online Filing Options for New York State Tax Returns

Filing your New York State tax return online offers a convenient and secure way to submit your taxes. The New York State Department of Taxation and Finance provides various online filing options to meet the needs of different taxpayers. Here are some of the online filing options available:

- New York State Income Tax Web File: The New York State Income Tax Web File is the official online platform provided by the Department of Taxation and Finance. It allows individuals and businesses to electronically file their tax returns and make secure electronic payments. This option is available for most types of tax returns, including resident, nonresident, and part-year resident returns. The Income Tax Web File provides step-by-step instructions and helps ensure accurate calculations, making it an efficient and user-friendly option for filing your New York State tax return.

- Free File: The Free File program is a partnership between the New York State Department of Taxation and Finance and tax preparation software companies. It allows eligible taxpayers to prepare and file their New York State tax return for free using participating software. To qualify for Free File, your income must be below a certain threshold, generally around $69,000. This option provides access to additional features and support from the software companies, making it a great option for eligible taxpayers who want assistance in preparing their tax return.

- Voluntary Disclosure and Compliance Program: The Voluntary Disclosure and Compliance Program is designed for taxpayers who have not previously filed their New York State tax returns. The program provides an online option for eligible individuals and businesses to come forward and voluntarily file their delinquent tax returns. This program may waive penalties and reduce interest charges for eligible taxpayers who voluntarily comply with their tax obligations.

- Authorized e-file providers: Authorized e-file providers are trusted professionals who can electronically file your New York State tax return on your behalf. These providers are authorized by the Department of Taxation and Finance and have the expertise to ensure that your tax return is filed accurately and on time. Authorized e-file providers can assist with various types of tax returns, including individual, business, and fiduciary returns.

It’s important to note that each online filing option may have specific eligibility criteria, so it’s essential to review the requirements and guidelines provided by the Department of Taxation and Finance or consult with a tax professional to determine the best option for your specific situation.

Whichever online filing option you choose, make sure to gather all necessary documents, including W-2 forms, 1099 forms, and any other relevant income and deduction documentation. Accurate reporting and timely filing will help ensure a smooth and hassle-free tax filing process.

Now that we’ve explored the online filing options for New York State tax returns, let’s delve into the paper filing options available.

Paper Filing Options for New York State Tax Returns

If you prefer to file your New York State tax return using a paper form, there are options available to accommodate your needs. The Department of Taxation and Finance provides downloadable forms on their official website, which can be filled out manually and submitted via mail. Here are the paper filing options available:

- Individual tax returns: If you are an individual taxpayer, you can download the appropriate paper tax form from the New York State Department of Taxation and Finance website. The main form used for individual tax returns is Form IT-201, “New York State Resident Income Tax Return.” This form is used by residents, part-year residents, and nonresidents who have income from New York State sources. Complete the form accurately, including all required information, and mail it to the address specified on the form.

- Business tax returns: If you are a business owner, partnership, or corporation filing a New York State tax return, you will need to download the applicable paper tax forms from the Department of Taxation and Finance website. Forms such as Form IT-204 for partnerships, Form CT-3 for corporations, or Form IT-112-C or IT-112-R for small businesses can be found on the website. Fill out the forms according to the instructions provided and mail them to the appropriate address based on your filing status and business type.

- Fiduciary tax returns: If you are filing a tax return for an estate or trust, you will need to obtain the applicable paper form from the Department of Taxation and Finance website. This includes forms such as the Form IT-205 for fiduciary income tax returns. Carefully complete the form and mail it to the specified address.

- Amended tax returns: If you need to file an amended New York State tax return to correct previously reported information, you can download the appropriate amendment form from the Department of Taxation and Finance website. The main form used for amended returns is Form IT-201-X, “Amended Resident Income Tax Return.” Provide accurate and detailed information about the changes being made, include any required supporting documentation, and mail the amended return to the designated address.

When filing your New York State tax return on paper, it’s essential to carefully review the instructions provided with the form and double-check that you have included all necessary documentation. Make sure to sign and date your tax return before mailing it to ensure it is valid.

Lastly, it’s recommended to keep a copy of your filed tax return, along with any supporting documents, for your records. This will come in handy in case you need to refer to the information in the future or if you are ever subject to an audit.

Now that we’ve explored the paper filing options for New York State tax returns, let’s discuss where to file an amended New York State tax return.

Where to File an Amended New York State Tax Return

If you need to make changes or corrections to a previously filed New York State tax return, you’ll need to file an amended return. Filing an amended return allows you to update any incorrect or incomplete information, such as income, deductions, or tax credits. Here’s where you can file an amended New York State tax return:

- Paper filing: When filing an amended New York State tax return on paper, you will need to download and complete Form IT-201-X, “Amended Resident Income Tax Return,” from the New York State Department of Taxation and Finance website. Make sure to provide accurate and detailed information about the changes being made on the amended return. Attach any required supporting documentation, such as amended federal tax returns or additional schedules, and mail the completed form to the address specified on the form.

- Online filing: If you originally filed your New York State tax return electronically, you may also have the option to file your amended return electronically. The Department of Taxation and Finance offers an online service called “Amend a Return” on their website. Using this service, you can make changes and submit your amended return electronically. However, please note that not all types of amended returns may be eligible for online filing, so it’s advisable to check the specific guidelines and requirements outlined by the Department of Taxation and Finance.

Regardless of the filing method you choose, when submitting an amended return, it’s crucial to include all necessary documentation to support the changes being made. This could include updated W-2 forms, 1099 forms, or any other relevant documentation that substantiates the amendments. Keep copies of all documentation and the amended return for your records.

It’s important to note that processing times for amended returns may take longer compared to regular tax returns. Typically, it can take up to 16 weeks to process an amended return. You can check the status of your amended return using the “Check your Refund” tool on the New York State Department of Taxation and Finance website or by calling their helpline.

Now that we’ve covered where to file an amended New York State tax return, let’s summarize the key points we’ve discussed.

Conclusion

Filing a New York State tax return is an important obligation for residents, part-year residents, and individuals with income from New York sources. Understanding the process and knowing where to submit your tax return can help ensure compliance with state tax laws and avoid penalties.

In this article, we covered the fundamentals of New York State tax returns, including the requirements for filing and the different filing methods available. We explored online filing options such as the New York State Income Tax Web File, tax preparation software, and authorized e-file providers. We also discussed paper filing options for those who prefer a traditional method of filing.

Furthermore, we discussed where to file an amended New York State tax return if you need to make changes or corrections to a previously filed return. Whether through paper filing or online submission, it’s important to provide accurate information and include any necessary supporting documentation when filing an amended return.

Remember to review the guidelines provided by the New York State Department of Taxation and Finance or consult with a tax professional to ensure you meet all the requirements for filing your New York State tax return.

By understanding the filing process and knowing your options, you can ensure a smooth and accurate filing experience, reducing the likelihood of errors or omissions on your tax return.

Now that you’re equipped with the knowledge of where and how to file your New York State tax return, you can confidently navigate the process and fulfill your tax obligations. Take the necessary steps to gather your tax documents, accurately report your income and deductions, and choose the filing method that aligns with your preferences.

Remember, tax filing season can be busy, so be sure to start early and file your return by the deadline to avoid any potential penalties or interest charges.

Good luck with your New York State tax filing, and may your financial journey be a successful one!