Home>Finance>What Category Should Merchant Fees Be In QuickBooks Online?

Finance

What Category Should Merchant Fees Be In QuickBooks Online?

Published: February 24, 2024

Optimize your QuickBooks Online merchant fee categorization for better finance management. Learn the best practices for organizing fees efficiently.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Complexity of Merchant Fees in QuickBooks Online

Merchant fees are a critical aspect of any business that accepts credit card payments. These fees, often charged by payment processors or banks, can significantly impact a company’s bottom line. Managing and categorizing merchant fees properly in QuickBooks Online is essential for accurate financial reporting and analysis. In this article, we will delve into the intricacies of merchant fees, explore the best practices for categorizing them in QuickBooks Online, and provide valuable insights for effectively managing these fees.

As a business owner or financial professional, understanding the nuances of merchant fees is crucial for maintaining financial transparency and making informed decisions. By gaining a comprehensive understanding of how to categorize and manage merchant fees in QuickBooks Online, you can streamline your accounting processes and gain clarity on your company’s financial performance.

Join us as we navigate the complex landscape of merchant fees, unraveling the intricacies of categorization and shedding light on the best practices for seamless management within the QuickBooks Online platform.

Understanding Merchant Fees

Merchant fees encompass a variety of charges incurred by businesses when processing credit card transactions. These fees typically include interchange fees, assessment fees, and payment processor charges. Interchange fees are set by credit card networks such as Visa, Mastercard, and Discover, and are paid by merchants to the card-issuing banks for each transaction. Assessment fees, on the other hand, are collected by the card networks themselves to cover operational costs and generate revenue.

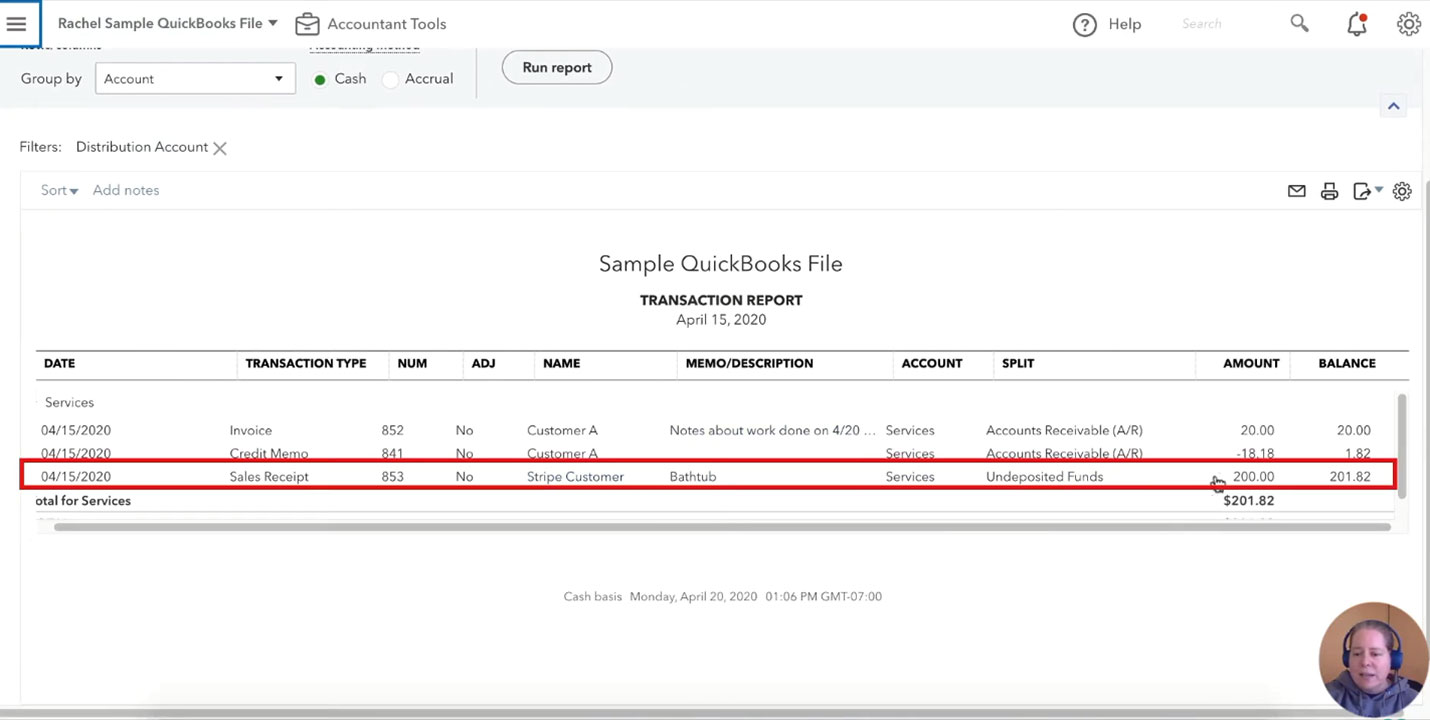

Payment processor charges, also known as service fees, are levied by the entities that facilitate credit card transactions, such as PayPal, Square, or Stripe. These fees may encompass a combination of flat transaction fees and a percentage of the transaction amount. Understanding the breakdown of these fees is crucial for accurately categorizing them in QuickBooks Online and gaining insights into the true cost of processing credit card payments.

Moreover, the structure of merchant fees can vary based on factors such as the type of credit card used, the method of processing (in-person, online, or mobile), and the specific pricing models offered by payment processors. This complexity underscores the importance of carefully analyzing and categorizing merchant fees within the accounting framework of QuickBooks Online.

By comprehensively grasping the components of merchant fees, businesses can make informed decisions regarding their payment processing methods, assess the impact of these fees on their profitability, and optimize their financial strategies accordingly. In the subsequent sections, we will explore the optimal approaches for categorizing and managing merchant fees in QuickBooks Online, empowering businesses to navigate this intricate terrain with confidence and precision.

Categorizing Merchant Fees in QuickBooks Online

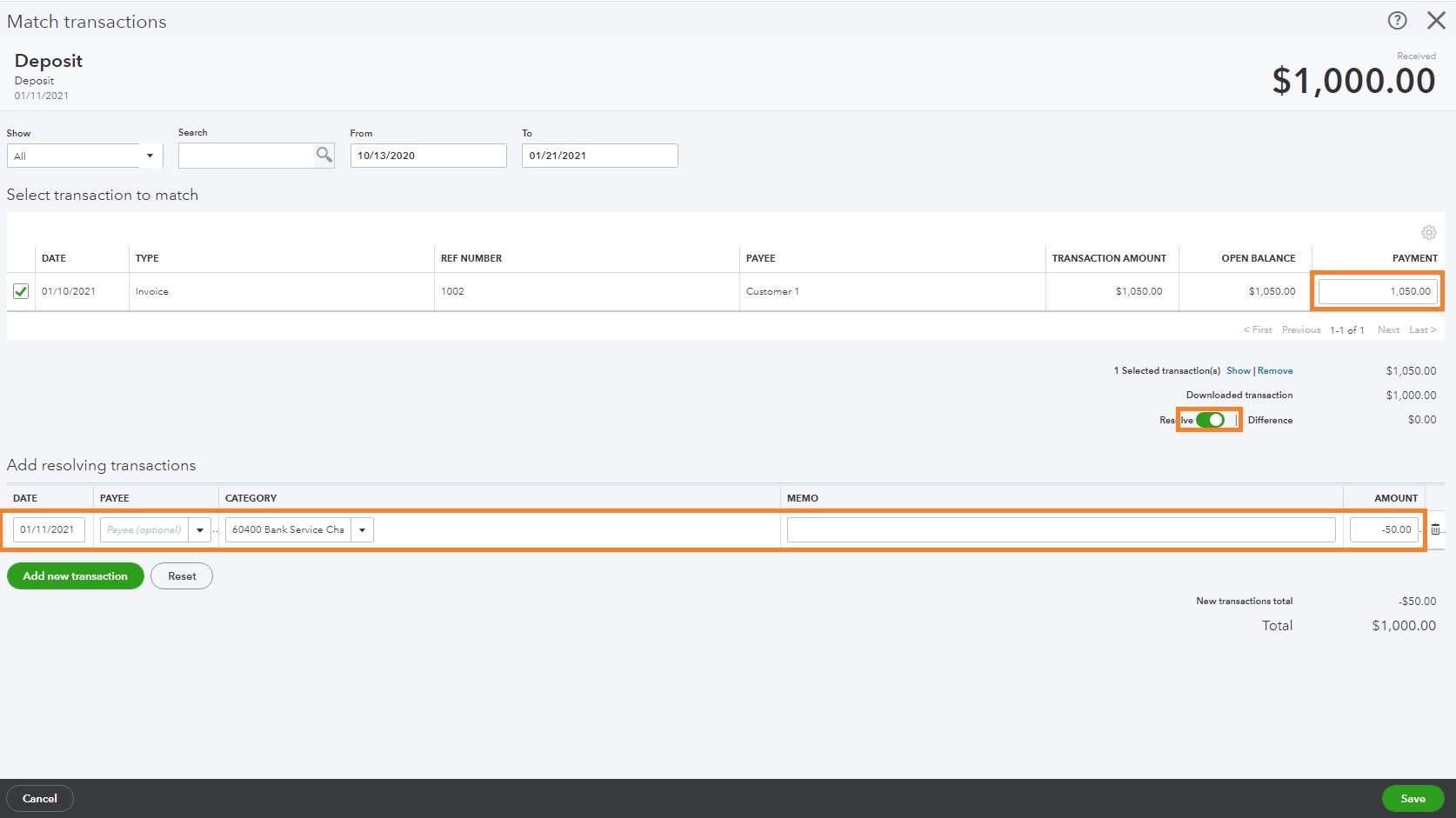

When it comes to accurately categorizing merchant fees in QuickBooks Online, precision is paramount. QuickBooks Online offers a range of predefined accounts and sub-accounts that can be leveraged to categorize merchant fees effectively. One common approach is to create a distinct expense account specifically dedicated to merchant fees. This allows for clear segregation of these expenses, enabling businesses to monitor and analyze their impact on overall financial performance.

Within the merchant fees expense account, sub-accounts can be established to differentiate various types of fees, such as interchange fees, assessment fees, and payment processor charges. This granular categorization provides a detailed breakdown of the different components comprising the overall merchant fees, facilitating comprehensive financial analysis and reporting.

Furthermore, utilizing classes or tracking categories in QuickBooks Online can offer additional insights into how merchant fees affect different aspects of the business. By assigning classes or tracking categories to transactions related to merchant fees, businesses can discern the impact of these fees across different departments, product lines, or locations, enabling more nuanced financial evaluation and strategic decision-making.

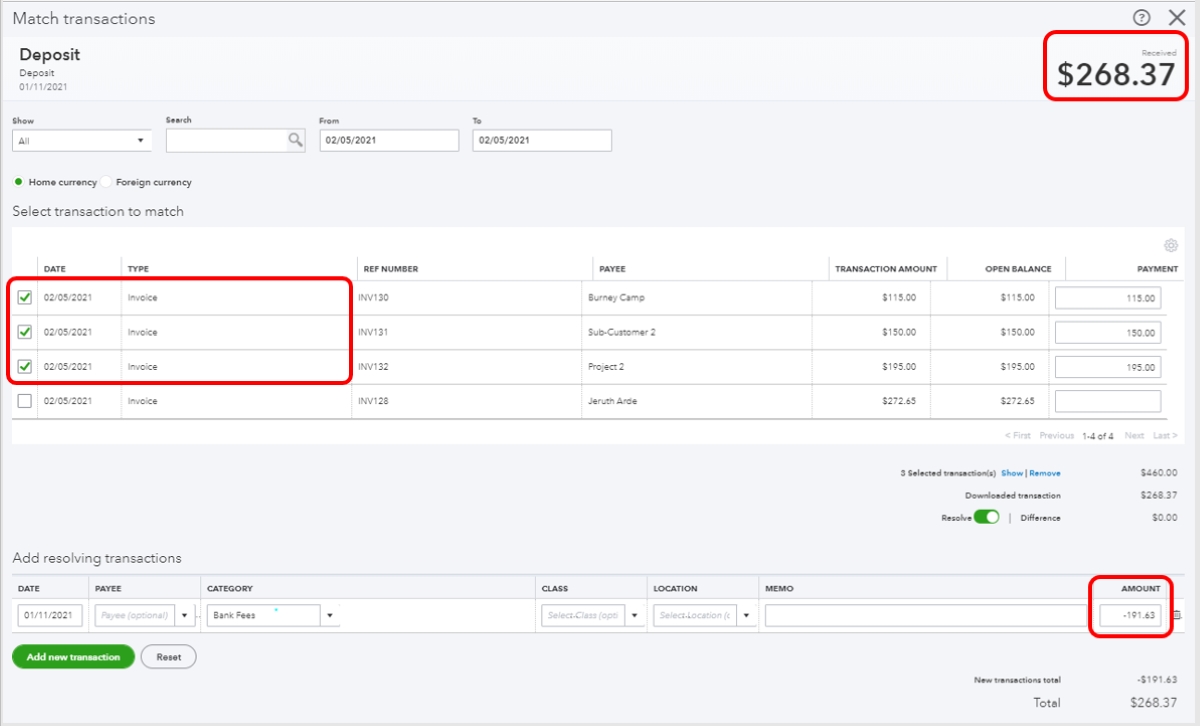

It is essential to reconcile merchant fee transactions with corresponding bank or credit card statements within QuickBooks Online to ensure accuracy and completeness. Reconciling these transactions not only validates the integrity of the financial records but also provides a clear audit trail, enhancing transparency and compliance.

As businesses navigate the dynamic landscape of payment processing, the ability to categorize merchant fees accurately in QuickBooks Online empowers them to gain a comprehensive understanding of their financial dynamics, make informed decisions, and optimize their operational efficiency.

Best Practices for Managing Merchant Fees in QuickBooks Online

Effective management of merchant fees in QuickBooks Online involves implementing best practices that streamline processes and enhance financial visibility. One fundamental practice is to reconcile merchant fee transactions regularly. This entails matching the fees recorded in QuickBooks Online with the corresponding transactions on bank and credit card statements. Reconciliation not only ensures accuracy but also identifies discrepancies that may require resolution.

Another crucial aspect of managing merchant fees is maintaining detailed records of fee components. By capturing and categorizing interchange fees, assessment fees, and payment processor charges separately, businesses can gain a comprehensive understanding of the cost structure associated with credit card transactions. This granularity facilitates informed decision-making and strategic planning.

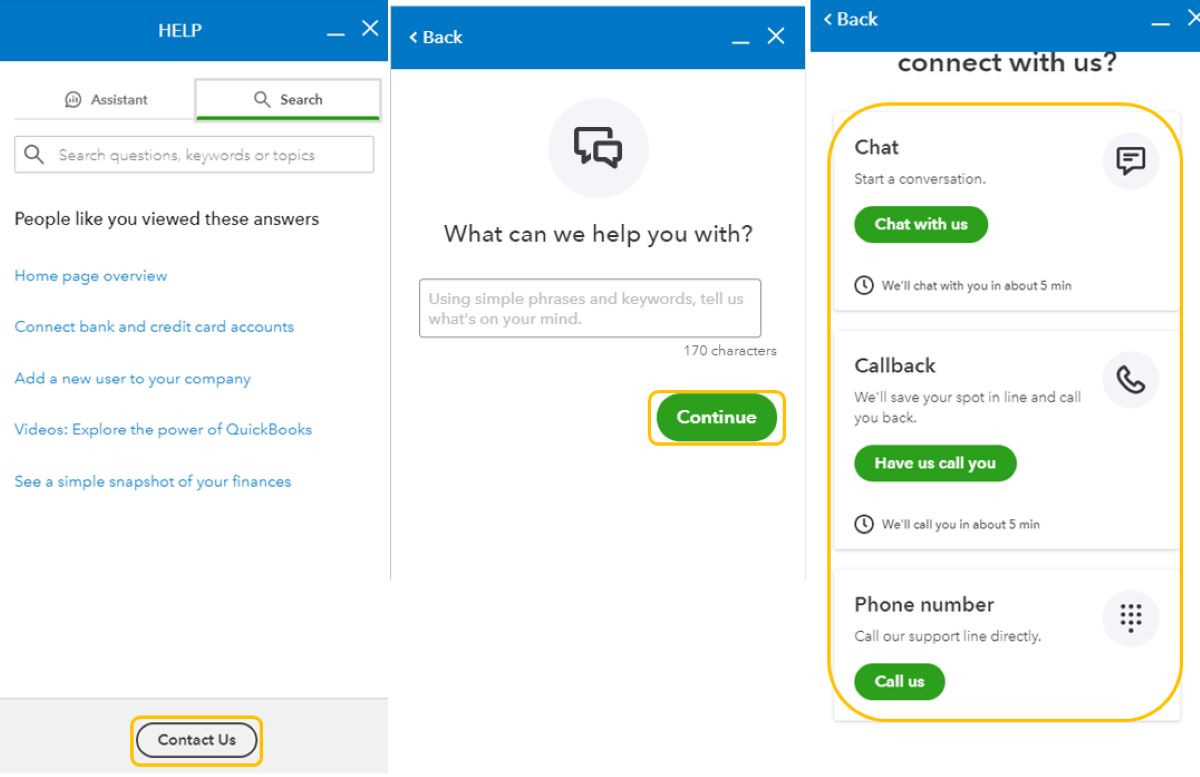

Utilizing automation tools within QuickBooks Online can significantly streamline the management of merchant fees. Automated bank feeds, for instance, enable seamless import of transaction data, simplifying the reconciliation process and reducing manual effort. Additionally, leveraging rule-based categorization can automate the assignment of merchant fee transactions to the appropriate accounts and sub-accounts, enhancing efficiency and accuracy.

Regular analysis of merchant fee data is essential for identifying trends, optimizing payment processing strategies, and managing costs effectively. By generating customized reports in QuickBooks Online that focus specifically on merchant fees, businesses can gain actionable insights into their fee structures, identify opportunities for cost savings, and assess the impact of fees on overall profitability.

Furthermore, staying informed about updates in payment processing regulations, fee structures, and industry trends is integral to effective fee management. By remaining abreast of changes in the payment landscape, businesses can proactively adapt their strategies and ensure compliance while optimizing their financial performance.

Ultimately, by adhering to these best practices and harnessing the capabilities of QuickBooks Online, businesses can navigate the intricacies of merchant fee management with agility and precision, empowering them to optimize their financial operations and drive sustainable growth.

Conclusion

In conclusion, the effective management of merchant fees in QuickBooks Online is integral to maintaining financial clarity, optimizing operational efficiency, and making informed decisions. By comprehensively understanding the components of merchant fees and leveraging the robust categorization capabilities of QuickBooks Online, businesses can gain valuable insights into their payment processing costs and their impact on overall financial performance.

Accurate categorization of merchant fees within QuickBooks Online, including the creation of dedicated expense accounts and sub-accounts, facilitates detailed financial analysis and reporting. This granular approach enables businesses to discern the specific components of merchant fees, empowering them to make strategic adjustments and optimize their payment processing strategies.

Implementing best practices such as regular reconciliation, detailed record-keeping, automation, and proactive analysis further enhances the management of merchant fees in QuickBooks Online. These practices not only streamline processes but also provide valuable visibility into fee structures, enabling businesses to adapt and thrive in the dynamic landscape of payment processing.

As businesses continue to navigate the evolving terrain of payment processing, the ability to effectively manage merchant fees in QuickBooks Online is a cornerstone of financial stewardship. By embracing best practices, leveraging the capabilities of QuickBooks Online, and staying informed about industry developments, businesses can proactively manage their merchant fees, optimize their financial strategies, and drive sustainable growth.

In essence, the seamless management of merchant fees in QuickBooks Online empowers businesses to not only maintain financial transparency but also harness valuable insights to propel their success in an increasingly competitive marketplace.