Finance

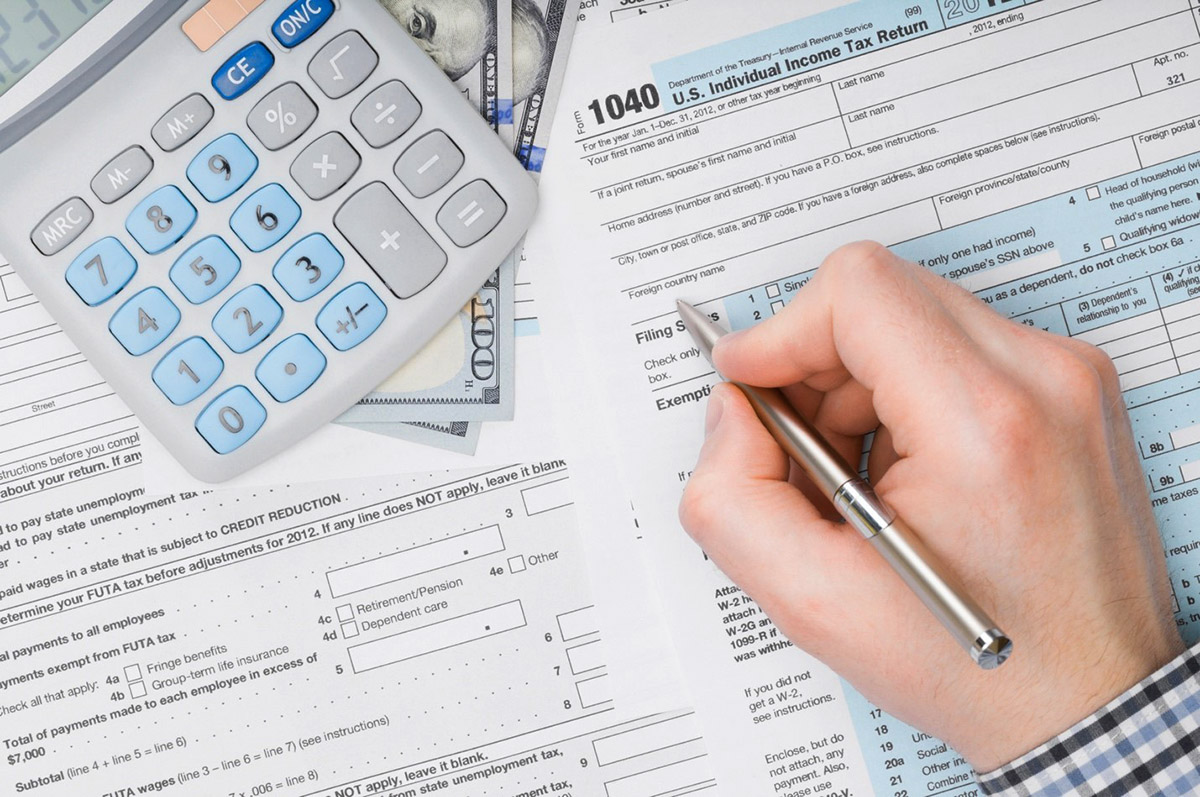

Where To Find Tax Deferred Pension On 1040

Modified: December 30, 2023

Looking for tax deferred pension options? Learn how to find 1040 tax deferred pension options and plan for your financial future with our finance guides.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Tax Deferred Pensions

- Benefits of Tax Deferred Pensions

- Types of Tax Deferred Pensions

- Eligibility for Tax Deferred Pensions

- How to Report Tax Deferred Pensions on Form 1040

- Where to Find Tax Deferred Pension Information on Form 1040

- Common Mistakes to Avoid on Form 1040

- Tips for Maximizing Tax Savings with Tax Deferred Pensions

- Conclusion

Introduction

Welcome to our guide on tax deferred pensions and how to find them on Form 1040. Understanding the ins and outs of tax deferred pensions can be complex, but it’s essential for anyone looking to optimize their finances and save on taxes. In this article, we’ll explore the basics of tax deferred pensions, the benefits they offer, and how to report them correctly on your tax return.

A tax deferred pension is a retirement savings account that allows individuals to contribute pre-tax income, which then grows tax-free until it is withdrawn during retirement. This type of pension offers significant advantages, as it allows individuals to lower their taxable income during their working years, potentially reducing their overall tax liability and providing income in retirement.

One of the key benefits of a tax deferred pension is the ability to defer taxes on investment earnings. Unlike regular investment accounts where taxes are due each year on dividends, interest, and capital gains, tax deferred pensions allow for tax-free growth. This means that individuals can maximize their investment returns by reinvesting earnings without the burden of immediate taxation.

Another advantage of tax deferred pensions is the ability to potentially lower your tax bracket in retirement. By contributing to a tax deferred pension during your working years, you can reduce your taxable income, which may result in a lower tax bracket when you start withdrawing funds during retirement. This can help stretch your retirement savings further and allow you to maintain your desired lifestyle with potentially less tax liability.

There are various types of tax deferred pensions available, such as Traditional IRAs, 401(k)s, and 403(b)s, each with their own unique rules and contribution limits. Depending on your employment situation and eligibility, you may have access to one or more of these options. It’s important to familiarize yourself with the specific requirements and benefits of each type to make the most informed decisions regarding your retirement savings.

Now that we have a basic understanding of tax deferred pensions, let’s delve deeper into the different types of tax deferred pensions, eligibility requirements, and how to report them correctly on Form 1040.

Understanding Tax Deferred Pensions

Before we explore how to find tax deferred pensions on Form 1040, let’s take a closer look at what exactly tax deferred pensions are and how they work.

A tax deferred pension is a retirement savings account that allows individuals to save for their retirement while deferring taxes on the contributions and investment earnings until withdrawal. It provides a way to grow your retirement funds without the immediate tax burden that comes with other types of investment accounts.

When you contribute to a tax deferred pension, the money is typically deducted from your taxable income for that year. This means you pay less in taxes, potentially saving you money now. The contributions then grow tax-free over time, thanks to the power of compound interest. This tax-free growth allows your retirement savings to grow faster compared to taxable investment accounts.

Keep in mind that while you may be able to lower your current tax liability by contributing to a tax deferred pension, you will eventually have to pay taxes on the money when you start making withdrawals in retirement. However, the advantage is that you may be in a lower tax bracket during your retirement years, which could result in overall tax savings.

It’s worth noting that there are contribution limits for tax deferred pensions, which vary depending on the type of pension account and your age. These limits are set by the Internal Revenue Service (IRS) and are subject to change from year to year. It’s important to stay updated on the current limits to ensure you maximize your contributions while staying within the legal boundaries.

In addition to the tax advantages, tax deferred pensions often come with employer matching contributions in the case of 401(k)s and 403(b)s. This means that your employer may contribute a certain percentage of your salary to your pension account, essentially giving you free money to help boost your retirement savings.

Overall, tax deferred pensions are a powerful tool for saving for retirement while minimizing your current tax liability. By understanding how they work and the potential benefits they offer, you can make informed decisions about how to allocate your financial resources and secure a brighter financial future.

Benefits of Tax Deferred Pensions

Tax deferred pensions offer numerous benefits that can help individuals secure a comfortable retirement and optimize their tax savings. Let’s explore some of the key advantages of tax deferred pensions:

- Tax Savings: One of the primary benefits of tax deferred pensions is the ability to lower your current tax liability. By contributing pre-tax income to your pension account, you effectively reduce your taxable income for the year. This can lead to immediate tax savings, allowing you to keep more of your hard-earned money. Additionally, the investment earnings within the pension account grow tax-free, providing potential long-term tax savings.

- Compound Interest: Tax deferred pensions take advantage of the power of compound interest. When your contributions and investment earnings grow tax-free over time, your account balance can accumulate exponentially. This can result in significant growth and a larger retirement nest egg compared to taxable investment accounts.

- Employer Contributions: Many tax deferred pension options, such as 401(k)s and 403(b)s, offer the opportunity for employer matching contributions. This means that your employer will match a percentage of your salary that you contribute to your pension account. It’s essentially free money that can significantly boost your retirement savings.

- Lowered Tax Bracket in Retirement: Another advantage of tax deferred pensions is the potential to be in a lower tax bracket during your retirement years. By contributing to a tax deferred pension during your working years, you may be able to reduce your taxable income. Consequently, when you start making withdrawals in retirement, you may be subject to a lower tax rate. This can result in overall tax savings and help stretch your retirement funds further.

- Discipline and Long-Term Savings: By contributing to a tax deferred pension, you are effectively putting aside money for your future self. The structure of the pension account encourages long-term savings and can help instill discipline in your financial habits. It’s a powerful way to prioritize your retirement savings and ensure you have the financial resources needed to enjoy a comfortable retirement.

These benefits highlight the importance of tax deferred pensions in financial planning. By taking advantage of the tax savings, compound interest, employer contributions, and potential lower tax brackets in retirement, you can set yourself up for a financially secure future.

Types of Tax Deferred Pensions

There are several types of tax deferred pensions available, each with its own set of rules and regulations. Let’s explore some of the most common types:

- Traditional Individual Retirement Accounts (IRAs): Traditional IRAs are one of the most popular tax deferred pension options available to individuals. Contributions made to a Traditional IRA are typically tax-deductible, which means they can lower your taxable income for the year. The earnings within the IRA grow tax-free until withdrawal, and taxes are paid when funds are taken out during retirement.

- Employer-Sponsored 401(k) Plans: 401(k) plans are offered by employers to their employees as a retirement savings vehicle. Contributions to a 401(k) plan are typically deducted from your paycheck before taxes, reducing your current taxable income. Employers often provide matching contributions, which adds to the overall savings. The growth of the investments in the 401(k) account is tax-deferred until withdrawal during retirement.

- 403(b) Plans: 403(b) plans are similar to 401(k) plans, but they are typically offered by non-profit organizations, schools, and certain government entities. They also allow employees to contribute pre-tax income to their retirement savings and benefit from potential employer matching contributions.

- Simplified Employee Pension (SEP) IRAs: SEP IRAs are a type of retirement account that is typically used by self-employed individuals or small business owners. Contributions to a SEP IRA are tax-deductible and grow tax-deferred. The contribution limits for SEP IRAs are generally higher than those for Traditional IRAs.

- 457 Plans: 457 plans are offered by governmental and certain non-governmental employers. They allow employees to contribute pre-tax income to their retirement savings. The earnings within the 457 plan are tax-deferred until withdrawal.

It’s important to note that contribution limits, eligibility requirements, and other specifics can vary for each type of tax deferred pension. Additionally, there may be additional rules and restrictions based on factors such as age, income level, and employment status. It’s crucial to consult with a financial advisor or tax professional to determine which type of tax deferred pension is the most suitable for your specific situation.

Understanding the different types of tax deferred pensions available empowers individuals to make informed decisions about their retirement savings and take advantage of the most appropriate options.

Eligibility for Tax Deferred Pensions

To participate in tax deferred pension plans, you need to meet certain eligibility requirements. Let’s explore the key factors that determine eligibility:

- Employment Status: The eligibility for tax deferred pensions varies based on your employment status. Traditional employees who work for companies offering retirement plans, such as 401(k) or 403(b) plans, are generally eligible to participate. Self-employed individuals, freelancers, and small business owners can set up retirement accounts like SEP IRAs or Simple IRAs for themselves and their employees.

- Age: The age requirements for tax deferred pensions vary depending on the type of retirement account. For example, there is generally no age restriction to contribute to a Traditional IRA, but there are required minimum distributions (RMDs) once you reach age 72. On the other hand, 401(k) and 403(b) plans may have restrictions regarding when you can start contributing and when you can start making withdrawals.

- Income: Some retirement accounts have income limits that determine eligibility. For example, Roth IRAs have income limits that restrict high earners from contributing directly to a Roth IRA. However, there are no income restrictions for contributing to a Traditional IRA or participating in employer-sponsored plans like 401(k)s.

- Participation in Other Retirement Accounts: If you already have a retirement account, such as a pension or another tax deferred pension, it may affect your eligibility to contribute or deduct contributions to other retirement accounts. It’s essential to consult with a financial advisor or tax professional to understand the contribution limits and any overlap or impact on your overall retirement savings strategy.

- Employer Policy: If you are eligible for an employer-sponsored retirement plan, such as a 401(k) or 403(b), your employer’s policy will determine your eligibility. Some employers require employees to meet certain criteria, such as a minimum number of hours worked or a specific waiting period, before becoming eligible to participate in the plan.

It’s important to note that eligibility requirements can change based on updates to tax laws and regulations. It’s advisable to stay informed about any changes that may impact your eligibility for tax deferred pensions.

Additionally, even if you are not eligible for a tax deferred pension, there are other retirement savings options available, such as Roth IRAs or taxable investment accounts. It’s always recommended to seek professional advice to ensure you are maximizing your retirement savings and taking advantage of the most suitable options based on your financial situation and goals.

How to Report Tax Deferred Pensions on Form 1040

When it comes to reporting tax deferred pensions on your tax return, the specific steps may vary depending on the type of pension and your individual circumstances. However, here are some general guidelines to help you understand how to report tax deferred pensions on Form 1040:

- Gather the necessary forms: Before you begin filling out Form 1040, make sure you have all the necessary documents, such as your W-2s, 1099-Rs, and any other financial statements related to your tax deferred pension.

- Enter your personal information: Begin by entering your personal information, including your name, Social Security number, and filing status.

- Report your taxable income: On Form 1040, report your taxable income from all sources. This includes income from your job, investments, and any other taxable income you received throughout the year. It’s important to note that tax deferred pension contributions do not count as taxable income for the current year.

- Report your pension distributions: Locate the section on Form 1040 where you report your pension distributions. This is typically found on line 4d of Form 1040. Report the total amount of distributions you received from your tax deferred pension during the tax year.

- Claim any applicable deductions: Depending on your circumstances, you may be eligible for certain deductions related to your tax deferred pension. For example, if you made contributions to a Traditional IRA, you may be able to deduct those contributions on Form 1040. Consult the instructions for Form 1040 or seek professional advice to determine if you qualify for any deductions.

- Complete the rest of Form 1040: Continue filling out the rest of Form 1040, including any additional income, deductions, credits, and taxes owed or refunded. Ensure that you carefully review the instructions and double-check all entries for accuracy.

- File your tax return: Once you have completed Form 1040, sign and date the form, and file it with the appropriate tax authorities. Make sure to keep a copy of your tax return and any supporting documents for your records.

It’s important to note that the instructions and reporting requirements for tax deferred pensions may change from year to year. It’s always a good idea to refer to the most recent instructions for Form 1040 or consult with a tax professional to ensure that you are accurately reporting your tax deferred pension contributions and distributions on your tax return.

Where to Find Tax Deferred Pension Information on Form 1040

When filling out Form 1040, it’s important to know where to find the relevant sections for reporting tax deferred pension information. Here are the key areas where you can locate tax deferred pension information on Form 1040:

- Line 4d: Tax deferred pension distributions are typically reported on line 4d of Form 1040. This line is specifically designated for reporting pensions and annuities. Enter the total amount of distributions you received from your tax deferred pension during the tax year on this line.

- Form 1099-R: You may receive a Form 1099-R from the administrator of your tax deferred pension plan. This form provides information about the distributions you received, including the taxable amount. Use the information from this form to accurately report your pension distributions on line 4d of Form 1040.

- Schedule 1: In some cases, additional documentation may be required when reporting tax deferred pension information. Schedule 1 is an additional form that can be attached to Form 1040, if needed. This form is used to report additional income and adjustments to income, such as deductions related to contributions made to a Traditional IRA. If you qualify for any deductions related to your tax deferred pension, use Schedule 1 to report these deductions accordingly.

It’s essential to carefully review the instructions for Form 1040 and any accompanying schedules to ensure that you are correctly reporting your tax deferred pension information. This will help you avoid any errors or discrepancies that could result in potential issues with your tax return.

If you are unsure about how to locate or report your tax deferred pension information on Form 1040, consider consulting with a tax professional. They can provide guidance based on your specific circumstances and help ensure that you accurately report your pension-related information.

Common Mistakes to Avoid on Form 1040

When filling out Form 1040, it’s important to be aware of common mistakes that can occur. By avoiding these errors, you can ensure that your tax return is accurate, reducing the risk of potential issues or an audit. Here are some common mistakes to avoid when completing Form 1040:

- Incorrect Social Security Number: One of the most crucial pieces of information on your tax return is your Social Security number (SSN). Ensure that you enter your SSN accurately to prevent any processing delays or errors.

- Mathematical Errors: Even though tax software and calculators can help with calculations, it’s still important to double-check your math. Small mistakes can lead to significant discrepancies in your tax liability or refund.

- Incorrect Filing Status: Choosing the correct filing status is vital as it affects your tax rates and eligibility for certain deductions and credits. Make sure you select the appropriate filing status based on your marital status and family situation.

- Omitting Income: Be sure to include all income earned during the tax year. This includes wages, self-employment income, rental income, interest, dividends, and any other sources of income. Failure to report all income can trigger penalties or an audit.

- Missing Deductions or Credits: Take the time to research and understand deductions and credits that you may be eligible for. Often, taxpayers miss out on valuable tax benefits because they are unaware of the available deductions and credits.

- Forgetting to Sign and Date: It may seem trivial, but forgetting to sign and date your tax return can result in your return being considered invalid. Ensure that you sign and date your Form 1040 before submitting it.

- Inaccurate Bank Account Information: If you are expecting a refund and opt for direct deposit, double-check your bank account number and routing number to avoid any delays or misdirected funds.

- Not Keeping Copies of Your Tax Return: It’s crucial to keep copies of your tax return and any supporting documents for future reference. This can be helpful in case of an audit or if you need to reference your tax information for other purposes in the future.

Remember, accuracy is key when completing Form 1040. Taking the time to review your tax return, double-checking mathematical calculations, and ensuring that you’ve included all necessary information can help you avoid these common mistakes and ensure a smoother tax filing process.

If you’re uncertain about any aspect of your tax return, consider seeking the assistance of a tax professional who can provide guidance and help ensure that your Form 1040 is completed correctly.

Tips for Maximizing Tax Savings with Tax Deferred Pensions

Tax deferred pensions offer excellent opportunities for maximizing tax savings while saving for retirement. Here are some tips to help you make the most of your tax deferred pension accounts:

- Contribute the maximum amount: Take advantage of the contribution limits for your specific tax deferred pension account. The more you contribute, the more you can potentially reduce your taxable income. Aim to contribute the maximum amount allowed each year to maximize your tax savings and retirement savings.

- Take advantage of employer matching: If your employer offers a matching contribution to your tax deferred pension account, make sure you contribute at least enough to receive the full employer match. Employer matches are essentially free money, and by not taking advantage of them, you are leaving potential savings on the table.

- Consider catch-up contributions: If you are age 50 or older, take advantage of catch-up contributions. These are additional contributions allowed above the regular contribution limits. Catch-up contributions enable you to accelerate your savings and potentially increase your retirement funds while enjoying additional tax benefits.

- Review your investment options: Take the time to review the investment options within your tax deferred pension account. Diversify your investments to spread risk and ensure potential growth. Consider consulting with a financial advisor to help you make informed investment decisions that align with your risk tolerance and long-term goals.

- Consider a Roth conversion: Depending on your circumstances, it may be advantageous to convert some or all of your traditional tax deferred pension funds into a Roth account. Roth conversions involve paying taxes now on the amount converted but can provide tax-free growth and withdrawals in retirement. Consult with a tax professional to determine if a Roth conversion makes sense for you.

- Plan your withdrawals strategically: When you reach retirement age and start withdrawing from your tax deferred pension accounts, be mindful of your tax bracket. Consider withdrawing funds strategically to minimize the tax impact. This may involve spreading out withdrawals over several years or coordinating your pension distributions with other sources of income to manage your tax liability.

- Stay informed: Tax laws and regulations are subject to change. Stay updated on any changes that may impact your tax deferred pension accounts. This includes staying informed about contribution limits, required minimum distributions (RMDs), and any new legislation that may affect retirement savings. Being aware of these changes allows you to make informed decisions and optimize your tax savings.

Remember, tax deferred pensions are valuable tools for saving for retirement and minimizing your current tax liability. By implementing these tips, you can maximize your tax savings and build a solid financial foundation for your future retirement.

Conclusion

Tax deferred pensions provide individuals with a valuable opportunity to save for retirement while enjoying significant tax benefits. By understanding tax deferred pensions and how to navigate Form 1040, you can seize the advantages they offer and optimize your tax savings.

Throughout this guide, we explored the basics of tax deferred pensions, the benefits they provide, and how to report them correctly on Form 1040. We discussed the importance of understanding the different types of tax deferred pensions available, including Traditional IRAs, 401(k)s, and 403(b)s.

It’s crucial to be aware of the eligibility requirements for tax deferred pensions, as they vary based on factors such as employment status, age, and income. Additionally, we outlined common mistakes to avoid when completing Form 1040, such as mathematical errors, omitting income, and incorrect filing status.

To maximize your tax savings with tax deferred pensions, we provided valuable tips, including contributing the maximum amount allowed, taking advantage of employer matching contributions, and strategically planning your withdrawals in retirement.

By implementing these strategies and staying informed about tax laws and regulations, you can make informed decisions regarding your tax deferred pensions and ensure a financially secure retirement.

Remember, every individual’s financial situation is unique, and it’s important to consult with a financial advisor or tax professional to determine the best approach for your specific circumstances.

With careful planning, diligent reporting, and a focus on maximizing tax savings, you can effectively utilize tax deferred pensions to build a solid foundation for your retirement and improve your overall financial well-being.