Home>Finance>Where Can I Find A List Of Merchant Fees In Wave?

Finance

Where Can I Find A List Of Merchant Fees In Wave?

Published: February 24, 2024

Looking for a comprehensive list of merchant fees in Wave? Find all the details you need to manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Navigating the world of finance as a business owner can be a complex and daunting task, especially when it comes to understanding merchant fees. These fees are an integral part of processing payments and can have a significant impact on a company's bottom line. In the realm of financial management, having access to a comprehensive list of merchant fees is crucial for making informed decisions and optimizing cost-efficiency.

In the digital age, where online transactions and electronic payments are the norm, having a clear understanding of merchant fees is paramount. Whether you operate an e-commerce store, a small business, or a thriving enterprise, being well-versed in the intricacies of merchant fees can directly influence your financial strategy and operational effectiveness.

In this article, we will delve into the realm of merchant fees in Wave, a popular financial software platform designed to streamline accounting and payment processing for businesses. We'll explore the significance of understanding merchant fees, the process of accessing the list of merchant fees in Wave, and how to navigate this essential resource effectively. By the end of this article, you'll have a comprehensive understanding of where to find a list of merchant fees in Wave and how to leverage this knowledge to optimize your financial management.

Understanding Merchant Fees in Wave

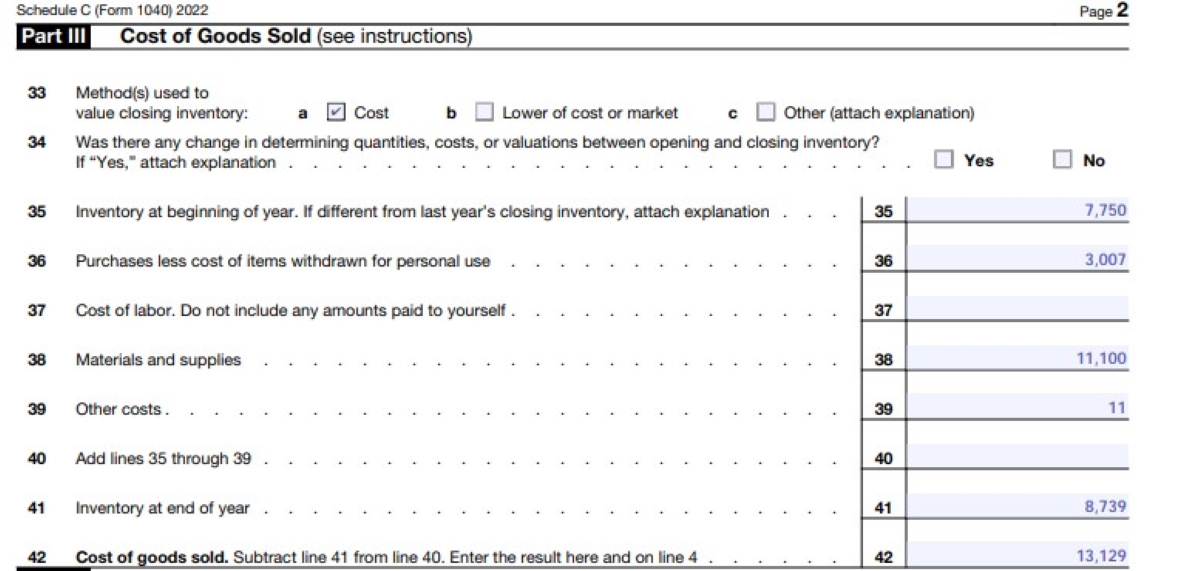

Merchant fees, also known as processing fees, are charges incurred by businesses when processing payments through credit or debit cards. These fees are typically imposed by payment processors or financial institutions and are calculated as a percentage of the transaction amount, along with a flat fee for each transaction. Understanding these fees is essential for businesses, as they directly impact the overall cost of accepting electronic payments and can vary based on factors such as card type, transaction volume, and the chosen payment processor.

In the context of Wave, a comprehensive understanding of merchant fees is crucial for businesses utilizing the platform’s payment processing capabilities. By comprehending the specific fees associated with different types of transactions, businesses can accurately assess the cost implications of processing payments through Wave and make informed decisions regarding their financial operations.

Moreover, understanding merchant fees empowers businesses to evaluate the competitiveness of their payment processing arrangements, identify potential cost-saving opportunities, and optimize their pricing strategies. This knowledge equips business owners and financial managers with the insights needed to negotiate favorable terms with payment processors, thereby minimizing expenses and maximizing profitability.

Additionally, being well-versed in merchant fees enables businesses to transparently communicate the cost of electronic payments to their customers, fostering trust and clarity in financial transactions. By educating themselves about merchant fees, business owners can effectively manage their financial resources, allocate budgets strategically, and enhance the overall financial health of their operations.

Accessing the List of Merchant Fees

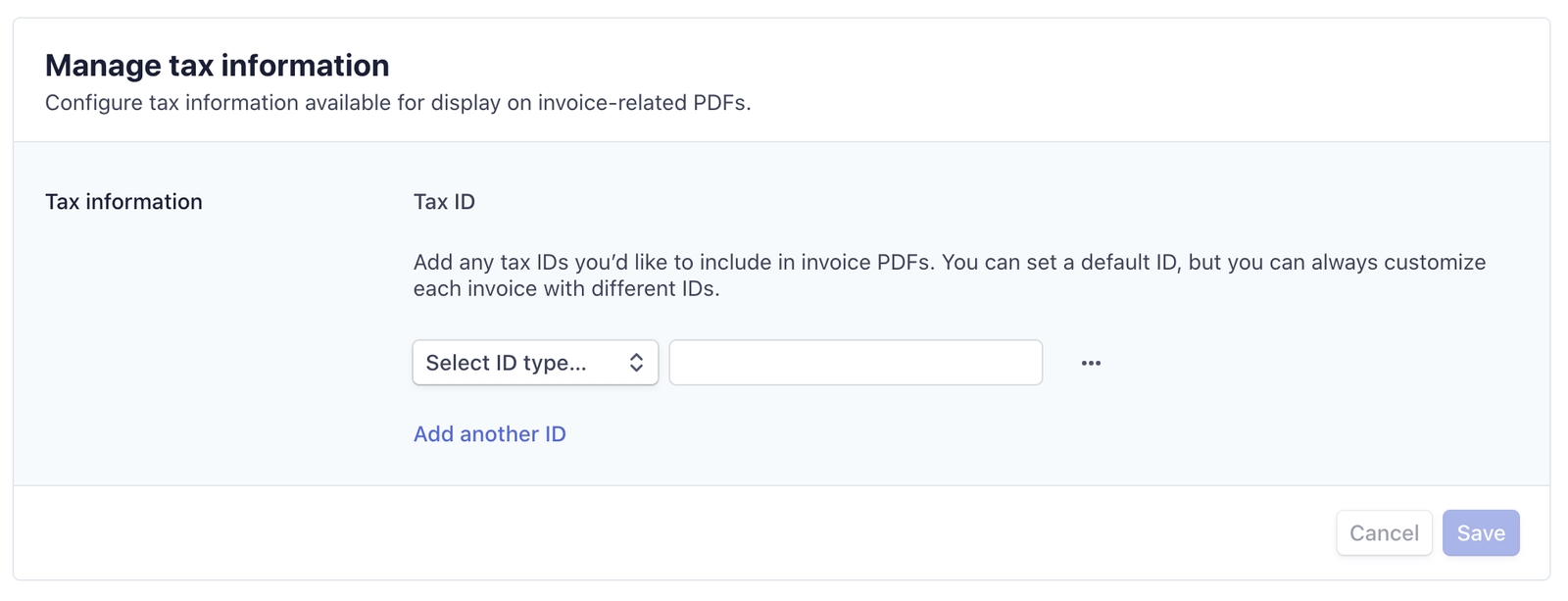

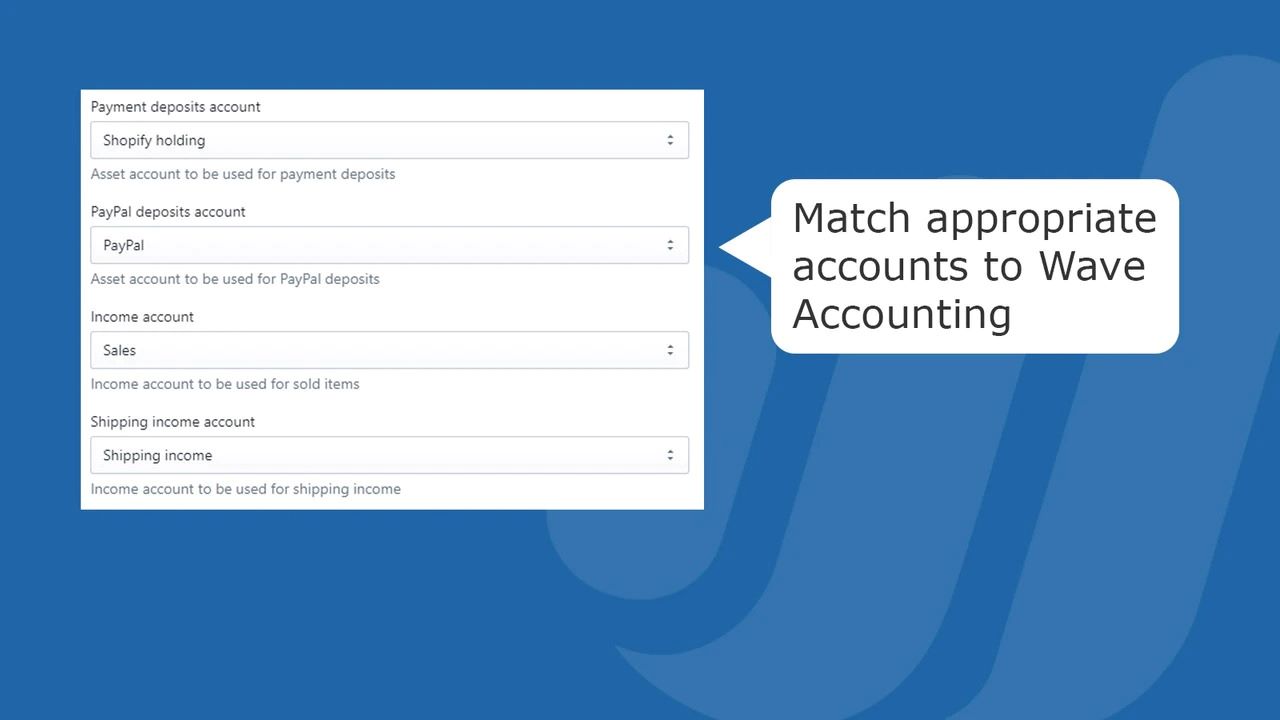

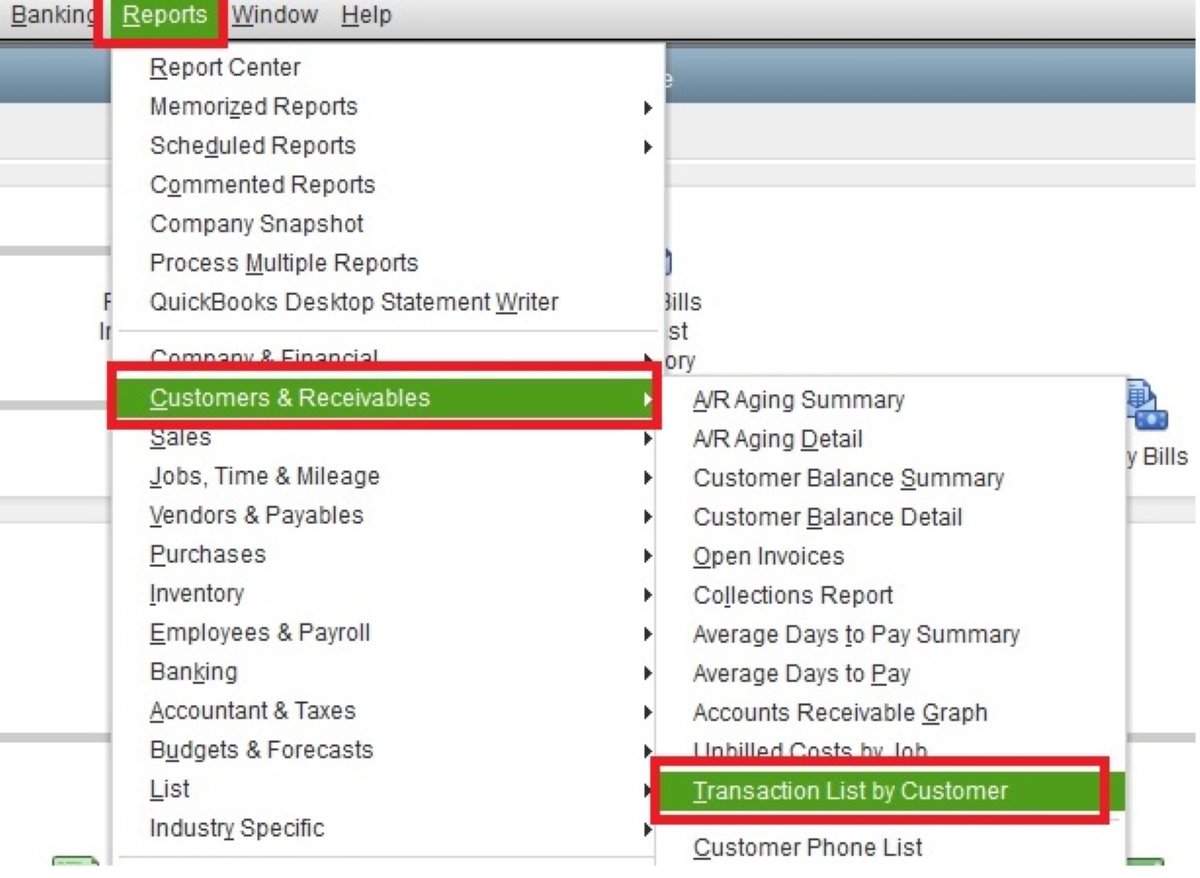

Accessing the list of merchant fees in Wave is a straightforward process that provides businesses with valuable insights into the costs associated with processing payments through the platform. To access this essential resource, users can navigate to their Wave account and access the payment processing or invoicing section, where they can find a dedicated area for managing merchant fees.

Upon accessing the payment processing or invoicing section, users can locate a specific tab or menu option labeled “Merchant Fees” or “Fee Schedule,” which grants them access to a comprehensive list detailing the various fees associated with processing different types of transactions through Wave. This list typically includes details such as the percentage-based fees, flat fees, and any additional charges applicable to specific card types or payment methods.

Furthermore, Wave users can access the list of merchant fees through the platform’s reporting and analytics features, which provide detailed breakdowns of transaction costs and associated fees. By leveraging these reporting tools, businesses can gain a granular understanding of their payment processing expenses and identify opportunities to optimize their cost-efficiency.

It’s important to note that accessing the list of merchant fees in Wave is not only beneficial for understanding the cost structure of payment processing but also for facilitating transparent and informed decision-making. Armed with this knowledge, businesses can assess the financial implications of utilizing Wave’s payment processing services and make informed comparisons with alternative payment solutions, empowering them to make strategic choices that align with their operational and financial objectives.

Navigating the Merchant Fees List

Once users access the merchant fees list in Wave, navigating this comprehensive resource is essential for gaining a clear understanding of the costs associated with payment processing. The list typically presents a breakdown of fees based on various transaction types and payment methods, allowing businesses to discern the specific charges applicable to their operations.

When navigating the merchant fees list, users can expect to encounter detailed information regarding percentage-based fees, flat fees, and any additional charges associated with specific card networks or payment types. This granular breakdown enables businesses to assess the cost implications of processing different types of transactions through Wave and facilitates informed decision-making related to payment acceptance strategies.

Furthermore, the merchant fees list may include insights into interchange fees, which are the charges imposed by card networks such as Visa and Mastercard and are an integral component of the overall cost of processing credit and debit card payments. Understanding interchange fees is crucial for businesses, as they directly impact the cost of accepting card payments and can vary based on factors such as card type, transaction volume, and the nature of the transaction.

As businesses navigate the merchant fees list in Wave, they can leverage the provided information to conduct comparative analyses of payment processing costs across different card networks and transaction types. This comparative approach empowers businesses to identify cost-saving opportunities, optimize their payment acceptance strategies, and negotiate favorable terms with payment processors, ultimately enhancing their financial efficiency.

Moreover, the ability to navigate the merchant fees list equips businesses with the insights needed to communicate transparently with customers regarding the costs associated with electronic payments. By fostering transparency and clarity in financial transactions, businesses can build trust with their customer base and cultivate positive relationships while effectively managing their payment processing expenses.

Conclusion

In conclusion, having a comprehensive understanding of merchant fees in Wave is paramount for businesses seeking to optimize their financial management and payment processing strategies. By delving into the intricacies of merchant fees, businesses can gain valuable insights into the cost structure of processing electronic payments and make informed decisions that align with their operational and financial objectives.

Accessing the list of merchant fees in Wave provides businesses with a transparent view of the expenses associated with payment processing, empowering them to evaluate the competitiveness of their payment acceptance strategies and identify opportunities for cost optimization. Navigating this essential resource allows businesses to discern the specific charges applicable to different transaction types and payment methods, facilitating informed decision-making and strategic planning.

Furthermore, understanding merchant fees equips businesses to communicate transparently with their customers regarding the costs of electronic payments, fostering trust and clarity in financial transactions. This transparency not only enhances customer relationships but also contributes to the overall integrity and professionalism of the business.

Ultimately, leveraging the insights gleaned from the merchant fees list in Wave enables businesses to optimize their payment acceptance strategies, negotiate favorable terms with payment processors, and allocate financial resources strategically. By harnessing this knowledge, businesses can enhance their cost-efficiency, maximize profitability, and cultivate a strong foundation for sustainable financial success.

In the dynamic landscape of business finance, a nuanced understanding of merchant fees is a cornerstone of effective financial management. As businesses navigate the realm of payment processing, leveraging the resources and insights provided by the merchant fees list in Wave empowers them to make informed, strategic decisions that propel their financial health and operational effectiveness.