Finance

Which FICO Score Is Used For Auto Loans

Published: March 6, 2024

Learn about the FICO score used for auto loans and how it impacts your financing options. Understand the role of finance in determining your creditworthiness and loan terms.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to financing a vehicle, understanding your credit score is crucial. Lenders utilize various scoring models to assess an individual's creditworthiness, with one of the most prevalent being the FICO score. This three-digit number, ranging from 300 to 850, provides lenders with valuable insights into an individual's credit history and their likelihood of repaying a loan.

In the realm of auto loans, FICO scores play a pivotal role in determining the terms and conditions of the loan, including the interest rate and the amount that can be borrowed. As such, comprehending the significance of FICO scores in the context of auto financing is essential for anyone considering purchasing a vehicle through a loan.

In this comprehensive guide, we will delve into the intricacies of FICO scores and their impact on auto loans. By the end of this article, you will have a clear understanding of how FICO scores influence the auto loan approval process and the key factors that can affect your chances of securing favorable loan terms. So, let's embark on this enlightening journey to unravel the relationship between FICO scores and auto loans.

Understanding FICO Scores

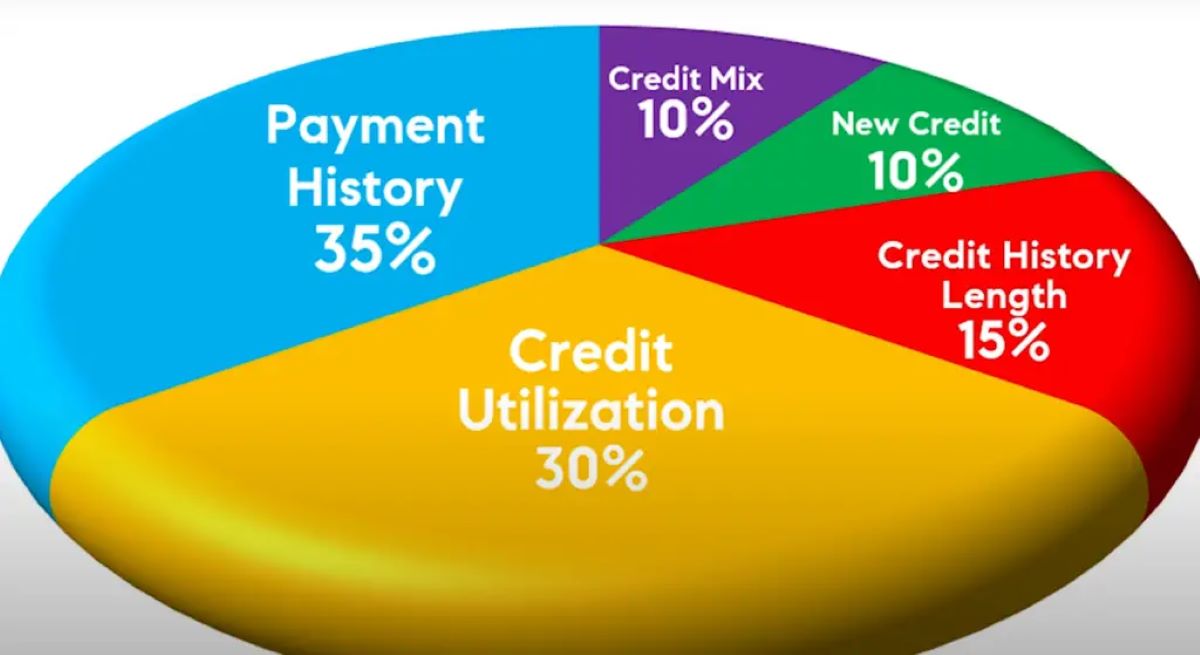

FICO scores are generated based on the information in your credit reports, which are compiled by the three major credit bureaus: Equifax, Experian, and TransUnion. These scores are designed to provide lenders with a quick and reliable assessment of an individual’s credit risk. The factors that contribute to your FICO score include payment history, amounts owed, length of credit history, new credit, and types of credit used.

Payment history holds significant weight in determining your FICO score. It reflects whether you have paid your credit accounts on time, highlighting any instances of delinquency or default. The amounts owed, or credit utilization ratio, also play a crucial role. This factor compares the amount of credit you’re using to the total credit available to you, with lower utilization generally seen as favorable.

The length of your credit history is another key consideration. A longer credit history provides more data for lenders to assess your credit management habits. Additionally, the mix of credit types you have, such as credit cards, installment loans, and mortgages, can impact your score. Finally, the pursuit of new credit, including recent inquiries and the number of recently opened accounts, can influence your FICO score.

Understanding the composition of your FICO score empowers you to take proactive steps to improve it. By maintaining a history of timely payments, keeping credit utilization low, and diversifying your credit portfolio sensibly, you can positively impact your FICO score over time. This, in turn, can enhance your eligibility for favorable auto loan terms.

FICO Scores and Auto Loans

When applying for an auto loan, your FICO score serves as a critical factor in the lender’s decision-making process. It essentially indicates your creditworthiness and the level of risk associated with lending to you. Generally, FICO scores are categorized as follows:

- FICO Score Range: 300-579 – Poor

- FICO Score Range: 580-669 – Fair

- FICO Score Range: 670-739 – Good

- FICO Score Range: 740-799 – Very Good

- FICO Score Range: 800-850 – Exceptional

Borrowers with higher FICO scores are typically offered more favorable terms, including lower interest rates and higher loan amounts, compared to those with lower scores. Lenders perceive individuals with higher scores as less risky, making them more attractive candidates for loans.

For auto loans, having a good or excellent FICO score can potentially save you thousands of dollars over the life of the loan. Lower interest rates translate to lower monthly payments and reduced overall interest expenses. This underscores the significance of maintaining a healthy FICO score when seeking an auto loan.

It’s important to note that while your FICO score is a pivotal factor, lenders also consider other elements when evaluating loan applications. These may include your income, existing debt obligations, the loan amount relative to the vehicle’s value, and the duration of the loan. Additionally, your employment history and stability can also influence the lender’s decision.

Understanding the relationship between your FICO score and auto loans empowers you to make informed decisions when navigating the loan application process. By focusing on improving and maintaining a strong FICO score, you can position yourself for more favorable auto loan terms, ultimately saving money and enhancing your overall financial well-being.

Factors Impacting Auto Loan Approval

When seeking approval for an auto loan, several key factors come into play, influencing the lender’s decision and the terms offered to the borrower. Understanding these factors can help individuals prepare for the loan application process and improve their chances of securing favorable terms.

Credit Score

As previously discussed, the FICO score is a pivotal element in the auto loan approval process. Lenders use this score to gauge an individual’s creditworthiness and assess the risk associated with extending a loan. A higher credit score typically results in more favorable loan terms, while a lower score may lead to higher interest rates or even difficulty in securing a loan.

Income and Employment History

Lenders often consider an applicant’s income and employment history to ensure that they have the financial capacity to repay the loan. A stable job and consistent income can bolster the applicant’s credibility and increase the likelihood of loan approval. Additionally, a higher income may enable the borrower to qualify for a larger loan amount.

Debt-to-Income Ratio

The debt-to-income (DTI) ratio is a crucial metric used by lenders to assess an individual’s ability to manage additional debt. It compares the borrower’s monthly debt payments to their gross monthly income. A lower DTI ratio indicates that the borrower has more disposable income available to meet new financial obligations, making them a more attractive candidate for an auto loan.

Down Payment

The size of the down payment offered by the borrower can significantly impact the loan approval process. A larger down payment not only reduces the amount of money that needs to be financed but also demonstrates the borrower’s commitment and financial stability. This can mitigate the lender’s risk and potentially lead to more favorable loan terms.

Loan Term and Vehicle Age

The duration of the loan and the age of the vehicle being financed can also influence the approval process. Longer loan terms may result in lower monthly payments but could lead to higher overall interest expenses. Additionally, lenders may have restrictions on financing older vehicles, considering them riskier investments.

By comprehending these factors and taking proactive steps to strengthen their financial position, individuals can improve their prospects of securing an auto loan with favorable terms. Whether it involves enhancing their credit score, stabilizing their income, managing existing debt responsibly, or saving for a substantial down payment, these efforts can pave the way for a smoother and more advantageous auto loan approval process.

Conclusion

Understanding the intricate relationship between FICO scores and auto loans is paramount for anyone considering vehicle financing. The FICO score serves as a critical indicator of creditworthiness, influencing the terms and conditions of auto loans. Individuals with higher FICO scores are typically offered more favorable loan terms, including lower interest rates and higher borrowing limits, ultimately leading to significant cost savings over the life of the loan.

While the FICO score is a crucial factor, it is not the sole determinant of auto loan approval. Lenders also consider various other aspects, such as income, employment history, debt-to-income ratio, down payment, loan term, and the age of the vehicle. These factors collectively shape the lender’s decision and the terms extended to the borrower.

Empowered with this knowledge, individuals can take proactive steps to enhance their creditworthiness and financial standing, thereby improving their chances of securing favorable auto loan terms. Whether it involves diligently managing their credit, stabilizing their income, reducing existing debts, or saving for a substantial down payment, these efforts can significantly impact the loan approval process.

In conclusion, a thorough understanding of FICO scores and the factors influencing auto loan approval enables individuals to navigate the loan application process with confidence. By prioritizing financial responsibility and strategically managing their credit profile, individuals can position themselves for more advantageous auto loan terms, ultimately contributing to their long-term financial well-being and driving satisfaction.